- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

On Monday, at 00:30 GMT, Japan will publish the manufacturing PMI for July. At 01:00 GMT, Australia will report inflation data from MI for July, and at 01:30 GMT, the ANZ job number index for July. At 01:45 GMT China will release PMI index for the manufacturing sector from Caixin in July. At 06:30 GMT in Switzerland, the consumer price index for July will be released. Then the focus will be on the manufacturing sector's business activity indices for July: Switzerland will report at 07: 30 GMT, France at 07: 50 GMT, Germany at 07:55 GMT, the Eurozone at 08:00 GMT, Britain at 08:30 GMT, and the US at 13:45 GMT. At 14: 00 GMT, the US will publish the ISM manufacturing index for July and announce changes in the volume of spending in the construction sector for June. At 23:30 GMT, Japan will release the Tokyo region's consumer price index for July.

On Tuesday, at 01:30 GMT, Australia will report changes in the foreign trade balance and retail trade volume for June. At 04:30 GMT in Australia, the RBA's interest rate decision will be announced and the RBA's accompanying statement will be released. At 09:00 GMT, the Euro zone will publish the producer price index for June. At 14:00 GMT, the US will announce a change in the volume of production orders for June. At 22:30 GMT, Australia will release the AIG construction activity index for July. At 22:45 GMT, New Zealand will report changes in the unemployment rate and employment for the 2nd quarter.

On Wednesday, initially, the focus will be on business activity indices in the services sector for July: Japan will report at 00: 30 GMT, China at 01: 45 GMT, France at 07: 50 GMT, Germany at 07: 55 GMT, the Eurozone at 08:00 GMT, and Britain at 08:30 GMT. At 09:00 GMT, the Euro zone will announce changes in retail sales for June. At 12: 00 GMT Bank of Japan Governor Kuroda will deliver a speech. At 12:15 GMT, the US will report a change in the number of employees from ADP for July. At 12:30 GMT, the US and Canada will announce changes in the foreign trade balance for June. At 13:45 GMT USA will release PMI services for July, 14:00 GMT - ISM non-manufacturing index for July. At 14:30 GMT, the US will report changes in oil reserves according to the Ministry of energy.

On Thursday, at 03:00 GMT, New Zealand will announce a change in expected inflation in two years for the 3rd quarter. At 06:00 GMT Germany will report the change in the volume of orders in industry for June. Also at 06: 00 GMT in Britain, the Bank of England interest rate decision will be announced. At 08:30 GMT, Britain will release the PMI for the construction sector for July. At 12: 30 GMT, the US will announce a change in the number of initial applications for unemployment benefits for July. At 23:30 GMT, Japan will announce changes in the level of wages and household spending for June.

On Friday, at 01:30 GMT in Australia, the Reserve Bank of Australia's monetary policy report will be released. At 05:00 GMT, Japan will publish an index of leading economic indicators for June. At 06:00 GMT, Germany will report changes in industrial production and foreign trade balance for June. At 06:45 GMT, France will announce changes in industrial production for June, the number of people employed in the private sector of the economy for the 2nd quarter and the balance of foreign trade for June. At 07:00 GMT, Switzerland will announce changes in the SNB's foreign currency reserves for July. At 07:30 GMT, Britain will release the Halifax house price index for July. At 12: 30 GMT, the US will report changes in the unemployment rate and the number of people employed in the non-agricultural sector for July. Also at 12:30 GMT, Canada will announce changes in the unemployment rate and employment for July. At 14:00 GMT, Canada will release the Ivey business activity index for July. At 17:00 GMT in the US, the Baker Hughes report on the number of active oil drilling rigs will be released. At 19:00 GMT the U.S. will report on the change in the volume of consumer credit for June.

MNI Indicators’

report revealed on Friday that business activity in Chicago expanded this

month, following twelve consecutive months of contraction.

The MNI Chicago

Business Barometer, also known as Chicago purchasing manager's index (PMI) came

in at 51.9 in July, up from 36.6 in June. That was the highest reading since

May 2019. Economists had forecast the index to increase to 43.9.

A reading above

50 indicates improving conditions, while a reading below this level shows

worsening of the situation.

According to

the report, New Orders and Production recorded their largest monthly gains in

July, while Supplier Deliveries fell to the lowest level since January 2020.

FXStreet suggests that US fiscal negotiations should be positive for gold, while the yellow metal may consolidate recent gains in the near-term. All in all, gold is still well supported in the longer-term by low yields, according to HSBC precious metals analysts.

“It is clear that the FOMC continues to view the economic outlook as extraordinarily uncertain, and that the economy’s path will depend heavily on how the COVID-19 pandemic evolves.Ongoing monetary accommodation from the Fed and the extraordinarily uncertain economic outlook can buoy up gold.”

“The Fed said it would extend USD liquidity swap lines for nine central banks through 31 March 2021 to serve as backstop for markets and help facilitate planning by other central banks. The Fed also has standing US dollar liquidity swap lines with the BoC, the BoE, the BoJ, the ECB, and the SNB. To an extent, this helps assure the world of adequate USD supply, and reduce financial stress and uncertainty. This should be gold negative.”

“Gold is benefitting from the uncertainty arising from the wide disagreement between Republicans and Democrats on the make-up of the fiscal stimulus but also from the expectations that a fiscal stimulus agreement will be reached. That said, gold may be consolidating some recent gains in the near-term, especially if a fresh fiscal stimulus proves USD positive, from a cyclical perspective, instead of being USD negative amid fewer ‘safe-haven’ bids.”

“Low or negative real interest rates are key to propelling gold higher. When US real yields are low or even negative, investors have no opportunity cost in owning gold. Besides, negative real US yields are likely an indicator of financial or economic stress, probably boosting ‘safe haven’ demand for gold. Furthermore, when US real yields turn negative, it may be negative for the USD, supporting gold in USD terms. Gold is still well supported in the longer-term by low yields.”

The final

reading for the July Reuters/Michigan index of consumer sentiment came in at 72.5

compared to a preliminary reading of 73.2 and the June final reading of 78.1.

Economists had

forecast the index to be revised down to 73.0.

According to

the report, the index of the current economic conditions fell 4.9 percent m-o-m

to 82.8 from June’s final reading of 87.1.

Meanwhile, the

index of consumer expectations plunged 8.9 percent m-o-m to 65.9 from June’s

final reading of 72.3.

Richard Curtin,

the Surveys of Consumers chief economist, noted that consumer sentiment sank

further in late July due to the continued resurgence of the coronavirus, and the

expectations measure provided no indication that consumers expect the recession

to end anytime soon. “While the 3rd quarter GDP is likely to improve over the

record setting 2nd quarter plunge, it is unlikely that consumers will conclude

that the recession is anywhere near over,” he added. “The lapse of the special

jobless benefits will directly hurt the most vulnerable and spread even further

by missed rent, mortgage, and other debt payments. Easing off the added jobless

benefit will naturally result with job growth as well as provide for a delayed

and gradual reduction in added benefits so that its eventual absence is much

less disruptive.”

According to ActionForex, analysts at TD Bank Financial Group note that the Canadian economy returned to growth in May as real GDP rose 4.5% month-on-month.

"May’s growth was a fair bit stronger than both Statistics Canada’s initial nowcast of a 3% gain and market expectations of a 3.5% climb. Growth was fairly widespread, as 17 of 20 major sectors reported increased activity."

"Statistics Canada provided an early nowcast for June, forecasting a further 5% climb. This would leave the level of economic activity 10.4% below February’s reading, and implies roughly a 12% drop for the second quarter as a whole, or about -40% annualized."

"That latter figure is perhaps a less useful way of presenting things given the unique nature of the shock – the notion of a ‘run rate’ implied by an annualized figure isn’t as helpful when the trend has already reversed itself (as implied by the May data and June nowcast). Regardless of how you calculate it, the story is the same: COVID-19 hit the Canadian economy like a wrecking ball."

"Output in the goods producing sectors, which had been hardest hit over March and April, rose 8%, but despite the strong performance, the level of activity was still 15% below February’s reading. Construction stood out, up 17.6% as restrictions on activity were eased in Quebec and Ontario. Manufacturing activity rose 7.4%, with transportation equipment in the driver’s seat as auto plants began to re-open from mid-month."

"In contrast, the much larger service sector rose a more modest 3.3%, and was 14.4% below February levels in May. There were some standout performers: retail trade rose 16.4%, driven by motor vehicle and parts dealers, but with 11 of 12 subsectors expanding, the bigger story appears to have been the re-openings as the month progressed."

"As expected, the May GDP data gave us further confirmation that at least in aggregate, the immediate economic impact of the pandemic is now behind us. A solid nowcast for June, and a combination of further re-openings and encouraging early data for July all point to an ongoing recovery from the earlier hit."

"There is no understating the scale of that hit. Even with May and June set to be the strongest two months of growth recorded under the current definition, the economy was still about 10% shy of its pre-pandemic level of activity in early summer. The June forecast and early July indicators augur for a decent pop-back of activity this quarter, but once the initial effect of re-openings fades, we’re likely to enter a more gradual phase of recovery."

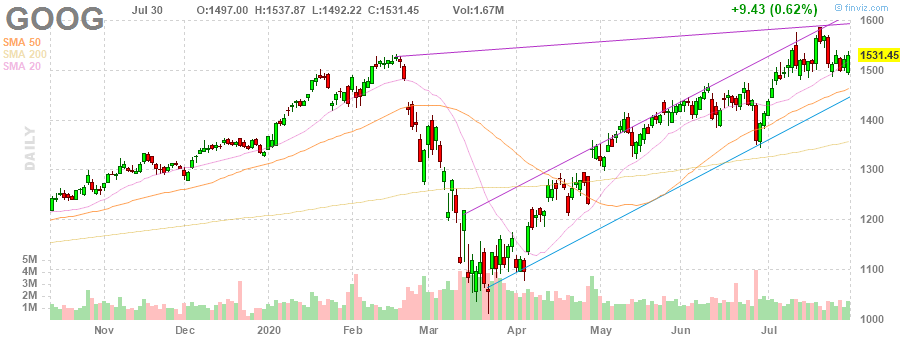

U.S. stock-index futures rose on Friday, following better-than-expected earnings reports from some of the biggest tech companies and market leaders, including Facebook (FB), Amazon (AMZN), Alphabet (GOOG) and Apple (AAPL).

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,710.00 | -629.23 | -2.82% |

Hang Seng | 24,595.35 | -115.24 | -0.47% |

Shanghai | 3,310.01 | +23.18 | +0.71% |

S&P/ASX | 5,927.80 | -123.30 | -2.04% |

FTSE | 5,974.61 | -15.38 | -0.26% |

CAC | 4,863.28 | +10.34 | +0.21% |

DAX | 12,476.71 | +97.06 | +0.78% |

Crude oil | $40.36 | +1.10% | |

Gold | $1,992.60 | +2.59% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 151.75 | -0.37(-0.24%) | 7880 |

ALCOA INC. | AA | 13.18 | 0.00(0.00%) | 652 |

ALTRIA GROUP INC. | MO | 41.41 | -0.17(-0.41%) | 6822 |

Amazon.com Inc., NASDAQ | AMZN | 3,220.00 | 168.12(5.51%) | 171716 |

American Express Co | AXP | 93.6 | -1.05(-1.11%) | 9236 |

AMERICAN INTERNATIONAL GROUP | AIG | 32 | 0.22(0.69%) | 4962 |

Apple Inc. | AAPL | 409.75 | 24.99(6.50%) | 1926350 |

AT&T Inc | T | 29.53 | -0.04(-0.14%) | 118413 |

Boeing Co | BA | 161.69 | -0.26(-0.16%) | 137087 |

Caterpillar Inc | CAT | 138.1 | 1.37(1.00%) | 44258 |

Chevron Corp | CVX | 82.92 | -3.35(-3.88%) | 150576 |

Cisco Systems Inc | CSCO | 46.5 | 0.06(0.13%) | 57820 |

Citigroup Inc., NYSE | C | 50.18 | -0.18(-0.36%) | 147075 |

E. I. du Pont de Nemours and Co | DD | 53.7 | -0.06(-0.11%) | 9093 |

Exxon Mobil Corp | XOM | 40.95 | -0.92(-2.20%) | 348889 |

Facebook, Inc. | FB | 251.15 | 16.65(7.10%) | 1003771 |

FedEx Corporation, NYSE | FDX | 172.7 | -0.01(-0.01%) | 3125 |

Ford Motor Co. | F | 6.93 | 0.19(2.82%) | 618061 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13 | 0.06(0.46%) | 26775 |

General Electric Co | GE | 6.3 | 0.04(0.64%) | 668205 |

General Motors Company, NYSE | GM | 25.21 | 0.01(0.04%) | 44437 |

Goldman Sachs | GS | 198.5 | -1.03(-0.52%) | 21571 |

Google Inc. | GOOG | 1,515.01 | -16.44(-1.07%) | 18338 |

Hewlett-Packard Co. | HPQ | 17.36 | 0.12(0.70%) | 27938 |

Home Depot Inc | HD | 264.8 | -1.51(-0.57%) | 14947 |

HONEYWELL INTERNATIONAL INC. | HON | 149.72 | 0.56(0.38%) | 701 |

Intel Corp | INTC | 48.43 | 0.44(0.92%) | 318619 |

International Business Machines Co... | IBM | 122.79 | -0.11(-0.09%) | 14464 |

Johnson & Johnson | JNJ | 147.3 | 0.46(0.31%) | 17569 |

JPMorgan Chase and Co | JPM | 96.55 | -0.47(-0.48%) | 92559 |

McDonald's Corp | MCD | 194.2 | -1.21(-0.62%) | 13481 |

Merck & Co Inc | MRK | 81.3 | 2.31(2.92%) | 157613 |

Microsoft Corp | MSFT | 205 | 1.10(0.54%) | 198467 |

Nike | NKE | 96.3 | -0.52(-0.54%) | 9543 |

Pfizer Inc | PFE | 38.79 | 0.05(0.13%) | 145073 |

Procter & Gamble Co | PG | 129.16 | -2.26(-1.72%) | 22573 |

Starbucks Corporation, NASDAQ | SBUX | 76.48 | -0.16(-0.21%) | 12889 |

Tesla Motors, Inc., NASDAQ | TSLA | 1,520.00 | 32.51(2.19%) | 129655 |

The Coca-Cola Co | KO | 47.53 | -0.16(-0.34%) | 15730 |

Travelers Companies Inc | TRV | 115 | -0.93(-0.80%) | 3988 |

Twitter, Inc., NYSE | TWTR | 37.45 | 0.73(1.99%) | 88417 |

UnitedHealth Group Inc | UNH | 304.99 | -0.24(-0.08%) | 451 |

Verizon Communications Inc | VZ | 57.03 | -0.27(-0.47%) | 12447 |

Visa | V | 193.85 | -0.21(-0.11%) | 23419 |

Wal-Mart Stores Inc | WMT | 129.82 | -0.30(-0.23%) | 26115 |

Walt Disney Co | DIS | 115.5 | -0.16(-0.14%) | 29087 |

Yandex N.V., NASDAQ | YNDX | 56.67 | -0.56(-0.98%) | 4636 |

Apple (AAPL) target raised to $470 from $400 at Cowen

Amazon (AMZN) target raised to $4000 from $3600 at Telsey Advisory Group

Statistics

Canada announced on Friday that the country’s gross domestic product (GDP) grew

4.5 percent m-o-m in May, following no 11.7 percent m-o-m decline in April.

This was above economists’ forecast for a 3.5 percent m-o-m growth and was the largest monthly increase since the series began in 1961.

According to the report, both goods-producing (+8.0 percent m-o-m) and services-producing industries (+3.4 percent m-o-m) rebounded in May, with 17 of 20 industrial sectors recording gains in output. Construction surged 17.6 percent m-o-m in May, while retail trade grew 16.4 percent m-o-m (the largest monthly increase on record), the manufacturing sector rose 7.4 percent m-o-m, wholesale trade increased 6.0 percent m-o-m, the health and social services went up 3.3 percent m-o-m and the transportation and warehousing sector advanced 1.7 percent m-o-m.

The Commerce

Department reported on Friday that consumer spending in the U.S. surged 5.6

percent m-o-m in June after a revised 8.5 percent m-o-m climb in May

(originally an 8.2 percent m-o-m jump). Economists had forecast the reading to

show a 5.5 percent m-o-m gain.

Meanwhile,

consumer income fell 1.1 percent m-o-m in May, following a revised 4.4 percent

m-o-m decline in the previous month (originally a 4.2 percent m-o-m decrease).

Economists had forecast a 0.5 percent m-o-m drop.

The June decline

in personal income was more than accounted for by a decrease in government

social benefits to persons as payments made to individuals from federal

economic recovery programs in response to the COVID-19 pandemic continued, but

at a lower level than in May. Partially offsetting the decline in other

government social benefits were increases in compensation of employees and

proprietors’ income as portions of the economy continued to reopen in June.

Unemployment insurance benefits, based primarily on unemployment claims data

from the Department of Labor’s Employment and Training Administration, also rose

in June.

The personal

consumption expenditures (PCE) price index, excluding the volatile categories

of food and energy, which is the Fed's preferred inflation measure, increased

0.2 percent m-o-m in June, following a revised 0.2 percent m-o-m advance in the

prior month (originally a 0.1 percent m-o-m uptick). Economists had projected

the index would increase 0.2 m-o-m.

In the 12

months through June, the core PCE increased 0.9 percent after a 1.0 percent

surge in the 12 months through May. Economists had forecast an advance of 1.0

percent y-o-y.

Exxon Mobil (XOM) reported Q2 FY 2020 loss of $0.70 per share (versus earnings of $0.61 per share in Q2 FY 2019), worse than analysts’ consensus estimate of -$0.60 per share.

The company’s quarterly revenues amounted to $32.605 bln (-52.8% y/y), missing analysts’ consensus estimate of $38.157 bln.

XOM fell to $40.98 (-2.13%) in pre-market trading.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 06:00 | Germany | Retail sales, real unadjusted, y/y | June | 3.8% | 3% | 5.9% |

| 06:00 | United Kingdom | Nationwide house price index | July | -1.6% | -0.1% | 1.7% |

| 06:00 | United Kingdom | Nationwide house price index, y/y | July | -0.1% | -0.3% | 1.5% |

| 06:00 | Germany | Retail sales, real adjusted | June | 12.7% | -3.3% | -1.6% |

| 06:30 | Switzerland | Retail Sales (MoM) | June | 30.7% | 30.5% | |

| 06:30 | Switzerland | Retail Sales Y/Y | June | 6.2% | 1.1% | |

| 06:45 | France | CPI, y/y | July | 0.2% | 0.3% | 0.8% |

| 06:45 | France | CPI, m/m | July | 0.1% | -0.1% | 0.4% |

| 06:45 | France | Consumer spending | June | 37.4% | 3.2% | 9% |

| 09:00 | Eurozone | Harmonized CPI, Y/Y | July | 0.3% | 0.2% | 0.4% |

| 09:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | July | 0.8% | 0.8% | 1.2% |

| 09:00 | Eurozone | GDP (YoY) | Quarter II | -3.1% | -14.5% | -15% |

| 09:00 | Eurozone | GDP (QoQ) | Quarter II | -3.6% | -12% | -12.1% |

EUR traded mixed against its major rivals in the European session on Friday after official data revealed that the Eurozone's economy contracted by the fastest rate on record in the second quarter and the bloc’s annual inflation unexpectedly edged up in July.

EUR fell against GBP, USD and CAD, rose against JPY and NZD, and was little changed against CHF and AUD.

Eurostat reported on Friday its flash estimate showed that the Eurozone's gross domestic product (GDP) shrank by 12.1 percent q/q in the second quarter of 2020, following a 3.6 percent q/q decline in the first quarter. That was the biggest contraction on record, as lockdowns imposed to contain the spread of the coronavirus pandemic hit activity and global demand. Economists had forecast a 12 percent q/q fall. All major economies in the region posted record declines in GDP in the second quarter. In y/y terms, the Eurozone's economy contracted by a record 15.0 percent compared to economists' expectations of a 14.5 percent decline.

A separate report from Eurostat revealed that the Eurozone's annual inflation edged up unexpectedly to 0.4 percent in July from 0.3 percent in June. Economists had forecast the rate to decline to 0.2 percent. Meanwhile, the annual core inflation, which excludes volatile prices of energy, food, alcohol and tobacco, and at which the ECB looks in its monetary policy decisions, accelerated to 1.2 percent this month from 0.8 percent in the prior month.

FXStreet notes that the S&P 500 Index has yet again held above key support at 3205/3198, which reduces the topping threat somewhat, although economists at Credit Suisse still lean towards a breakdown below this level on balance.

“S&P 500 moved higher on Thursday as the market saw a sharp intraday reversal back higher after yet again holding support from its rising 13-day exponential average, now at 3225 as well as the range lows at 3215/3198. This leaves the market still trapped in its range and whilst we remain of the view the threat of a correction lower remains in place, this threat is somewhat reduced given the market’s ongoing resilience above key supports.”

“We need to see a close below 3225 to see the topping threat increase again, although only below 3205/3198 would finally see this confirmed, with support then seen initially at 3173. Above 3265/66 would instead open the door to a retest of the ‘reversal day’ high and price resistance at 3279/81.”

“Ultimately we need to see above 3279/81 to ease the threat of a corrective setback for an extension of the rally with resistance seen next at 3288 and the more importantly at the top of the February price gap at 3328/38.”

- Easing of lockdown measures must now slow down

- Guidance on returning to work remains unchanged

- Face covering rules will be extended

- Calls for citizens to obey rules to avoid a full national lockdown

Merck (MRK) reported Q2 FY 2020 earnings of $1.37 per share (versus $1.30 per share in Q2 FY 2019), beating analysts’ consensus estimate of $1.05 per share.

The company’s quarterly revenues amounted to $10.872 bln (-7.6% y/y), beating analysts’ consensus estimate of $10.524 bln.

MRK rose to $81.20 (+2.80%) in pre-market trading.

Chevron (CVX) reported Q2 FY 2020 loss of $1.59 per share (versus earnings of $2.27 per share in Q2 FY 2019), worse than analysts’ consensus estimate of -$0.89 per share.

The company’s quarterly revenues amounted to $13.949 bln (-64.1% y/y), missing analysts’ consensus estimate of $21.707 bln.

CVX fell to $84.00 (-2.63%) in pre-market trading.

Caterpillar (CAT) reported Q2 FY 2020 earnings of $1.03 per share (versus $2.83 per share in Q2 FY 2019), beating analysts’ consensus estimate of $0.72 per share.

The company’s quarterly revenues amounted to $9.997 bln (-30.7% y/y), beating analysts’ consensus estimate of $9.397 bln.

CAT rose to $141.00 (+3.12%) in pre-market trading.

Ford Motor (F) reported Q2 FY 2020 loss of $0.35 per share (versus earnings of $0.28 per share in Q2 FY 2019), better than analysts’ consensus estimate of -$1.16 per share.

The company’s quarterly revenues amounted to $16.622 bln (-53.5% y/y), beating analysts’ consensus estimate of $15.629 bln.

F rose to $6.92 (+2.67%) in pre-market trading.

Apple (AAPL) reported Q3 FY 2020 earnings of $2.58 per share (versus $2.18 per share in Q3 FY 2019), beating analysts’ consensus estimate of $2.07 per share.

The company’s quarterly revenues amounted to $59.685 bln (+10.9% y/y), beating analysts’ consensus estimate of $52.555 bln.

The company’s board of directors also approved a four-for-one stock split to make the stock more accessible to a broader base of investors.

AAPL rose to $408.50 (+6.17%) in pre-market trading.

FXStreet notes that USD/CHF is continuously moving lower, with a weekly close below the crucial 2018 and March 2020 lows at 0.9188/83 now looking very likely as the pair trades around 0.9080. Economists at Credit Suisse see the pair sliding toward the 0.90 psychological level.

“USD/CHF continues to extend its move below the crucial 2018 and March 2020 lows at 0.9188/83, further reinforcing the view that we should see a weekly close below this critical inflection point today. This would then suggest a major breakdown and the end of its broad, multi-year range.”

“A close below the 2015 May low at 0.9072 would then see support at 0.9047, before the psychological barrier at 0.9000, where we might see a first attempt to hold. Below here though would then see support at 0.8936, removal of which would see the 50% retracement of the entire 2015/2016 upswing at 0.8875 next, where we would then expect a more important effort to hold. In contrast, as the daily RSI momentum is still in heavily oversold territory we remain on alert for a potential reversal higher or minor setback in the near-term.”

“Resistance is initially seen at 0.9089, then 0.9151, ahead of 0.9183/88, which ideally continues to cap.”

Amazon (AMZN) reported Q2 FY 2020 earnings of $10.30 per share (versus $5.22 per share in Q2 FY 2019), beating analysts’ consensus estimate of $1.62 per share.

The company’s quarterly revenues amounted to $88.912 bln (+40.2% y/y), beating analysts’ consensus estimate of $81.269 bln.

The company also issued upside guidance for Q3, projecting revenues of $87-93 bln versus analysts’ consensus estimate of $86.36 bln and operating income of $2.00-5.00 bln versus analysts’ consensus estimate of $2.90 bln.

AMZN rose to $3,218.01 (+5.44%) in pre-market trading.

According to Hong Kong law, an election can be postponed if the city’s chief executive believes it is likely to be “obstructed, disrupted, undermined or seriously affected by riot or open violence or any danger to public health and safety.” The vote was initially scheduled to take place on September 6.

According to Lam, the central government supported the decision and it was taken to safeguard people’s health.

Alphabet (GOOG) reported Q2 FY 2020 earnings of $10.13 per share (versus $14.21 per share in Q2 FY 2019), beating analysts’ consensus estimate of $8.23 per share.

The company’s quarterly revenues amounted to $38.297 bln (-1.7% y/y), beating analysts’ consensus estimate of $37.342 bln.

GOOG rose to $1,543.06 (+0.76%) in pre-market trading.

Facebook (FB) reported Q2 FY 2020 earnings of $1.80 per share (versus $1.99 per share in Q2 FY 2019), beating analysts’ consensus estimate of $1.38 per share.

The company’s quarterly revenues amounted to $18.690 bln (+10.7% y/y), beating analysts’ consensus estimate of $17.361 bln.

FB rose to $248.20 (+5.84%) in pre-market trading.

Reuters reports that Japan on Friday pushed back its estimated return to a budget surplus by two years, due to the massive increase in spending needed to support the economy during the coronavirus and putting pressure on the nation's massive debt burden.

The country faces the challenge of restoring fiscal health as even as some policymakers call for more spending to deal with the pandemic.

The government has delayed its forecasts for achieving a surplus to the fiscal year starting April 2029 from the previous projection of fiscal 2027 made in January.

In its twice-yearly fiscal and economic projections, the government expected the primary budget, excluding new bond sales and debt servicing, to swing to a surplus of only 300 billion yen ($2.87 billion) in the fiscal year 2029.

The government has so far compiled a combined stimulus spending worth $2.2 trillion to soften the hit from the coronavirus outbreak.

Japan's worsening fiscal health highlights the difficulties for policymakers as they try to boost the economy from a sharp slump due to the pandemic, while fighting to curb the spread of the virus.

The government forecasts real gross domestic product (GDP) to shrink 4.5% for the current fiscal year to March 2021, the fastest contraction since comparable data became available in 1994, and sharply down from its previous 1.4% growth projection made in January.

The economy then is expected to rebound 3.4% for the next fiscal year, according to the estimate.

The latest estimate also showed nominal GDP will grow to 600 trillion yen by fiscal 2023, later than the original target of around 2020.

A panel of seven economists on Thursday declared a tentative end to the economy's second-longest boom and entered "recession" in late 2018, suggesting it was struggling long before its more recent coronavirus slump.

FXStreet reports that the AUD has broken through a number of key levels in search of new-highs as a steady stream of vaccine headlines have balanced the distribution of news flow, acting as a modest tail-wind for the aussie. AUD/USD is trading around the 0.72 level and economists at ANZ Bank expect the pair to move around this level, a test of the 0.75 mark is on the cards though.

“On a domestic front, virus outbreaks across Victoria and New South Wales will challenge the prior view that Australia emerged from COVID-19 in a stronger position relative to peers. Instead, a sustained period of slowdown is now likely, challenging key service sectors in addition to the prolonged hit expected from a lack of migration and tourism.”

“For the RBA, we expect a sustained period of currency overvaluation to draw a pronounced policy response from the central bank, however with fundamental value continuing to drift higher, the RBA will likely have to remain on the sidelines.”

“We maintain our forecast track for AUD/USD near current levels, reflecting a range bound view of the currency and the at-times patchy growth environment expected through 2020. However, we also still expect that the AUD/usd can test as high as 0.75 in this range.”

According to the report from Eurostat, in July 2020, a month in which COVID-19 containment measures continued to be lifted, Euro area annual inflation is expected to be 0.4%, up from 0.3% in June. Economists had expected a 0.2% increase. Meanwhile, the core figure rises to +1.2% in the reported month when compared to +0.8% expectations and +0.8% previous.

Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in July (2.0%, compared with 3.2% in June), followed by non-energy industrial goods (1.7%, compared with 0.2% in June), services (0.9%, compared with 1.2% in June) and energy (-8.3%, compared with -9.3% in June).

According to the report from Eurostat, in the second quarter 2020, still marked by COVID-19 containment measures in most Member States, seasonally adjusted GDP decreased by 12.1% in the euro area and by 11.9% in the EU, compared with the previous quarter. These were by far the sharpest declines observed since time series started in 1995. Economists had expected a 12.0% decrease in the euro area. In the first quarter of 2020 GDP had decreased by 3.6% in the euro area and by 3.2% in the EU.

These preliminary GDP flash estimates are based on data sources that are incomplete and subject to further revisions under the COVID 19 containment measures. The next estimates for the second quarter of 2020 will be released on 14 August 2020.

Compared with the same quarter of the previous year, seasonally adjusted GDP decreased by 15.0% in the euro area and by 14.4% in the EU in the second quarter of 2020, after -3.1% and -2.5% respectively in the previous quarter. These were also by far the sharpest declines since time series started in 1995. Economists had expected a 14.5% decrease in the euro area.

Among the Member States, for which data are available for the second quarter 2020, Spain (-18.5%) recorded the highest decline compared to the previous quarter, followed by Portugal (-14.1%) and France (-13.8%). Lithuania (-5.1%) recorded the lowest decline.

Reuters reports that Italy’s economy shrank 12.4% in the second quarter from the previous three months, preliminary data showed on Friday, as activity nosedived during the coronavirus pandemic, but the fall was less severe than many analysts had predicted.

The quarterly slump in gross domestic product (GDP) in the euro zone’s third largest economy was “unprecedented”, national statistics bureau ISTAT said.

On a year-on-year basis, second quarter GDP tumbled 17.3%, ISTAT said. Analysts polled by Reuters had predicted a 15.0% contraction quarter-on-quarter and an 18.7% drop year-on-year.

All segments of the economy suffered, ISTAT said, without giving details.

ISTAT also revised down its readings for the first three months of 2020 to give a quarterly drop of 5.4% and a 5.5% fall against the same period a year ago. These were previously given as 5.3% and 5.4% respectively.

Italy has been one of the countries hardest hit in Europe by Covid-19, registering more than 35,000 deaths since the contagion came to light in late February. Looking to halt the spread, the government introduced rigid restrictions on trade and travel on March 9, forcing most businesses to close. The lockdown was only gradually eased from May 4 and much of the economy is still hurting.

Italy’s official forecast is for a full-year GDP contraction of 8% this year, although Economy Minister Roberto Gualtieri has said this will probably have to be revised lower. The Bank of Italy has estimated negative growth of 9.5% and the European Commission has predicted the economy will contract 11.2% — the sharpest fall within the 27-nation bloc.

FXStreet reports that EUR/JPY is trading around the 1.24 level and though Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, sees the pair marching higher toward the 200-week ma at 124.80 she cannot rule out a pullback to the 122.18 mark.

“EUR/JPY is consolidating above the 122.88 January high and attention remains on the June high at 124.43 and the 200-week ma at 124.80.”

“The pair is in a very tight range but we remain unable to rule out a pullback towards the three-month uptrend at 122.18 prior to recovery. This guards the current July low at 120.28.”

“The 200-week ma at 124.80 guards the 2014-2020 resistance line at 127.90.”

Bloomberg reports that Spain’s economy suffered a bigger blow than expected in the second quarter, burdening it with the prospect of a long recovery that’s become even tougher because of additional headwinds facing the tourism industry.

The record 18.5% drop in output -- led by plunges in consumer spending and investment -- is the deepest reported so far in Europe, where restrictions to control the coronavirus battered businesses and households. Economists had anticipated a 16.6% contraction.

The virus fallout has been widespread across the euro area, where figures on Friday are expected to show a double-digit slump. France said earlier its economy shrank almost 14%, following a record 10% decline in Germany.

But Spain’s figures put the spotlight on southern European countries that suffered the most from the pandemic after entering the crisis with already-strained public finances. Europe’s fourth-largest economy had one of the continent’s earliest and deadliest outbreaks of the coronavirus, along with Italy, and the government responded with a strict lockdown.

The Spanish economy is heavily reliant on tourism, a sector that’s been slammed by the pandemic. A bad summer season took a turn for the worse when the U.K. announced last weekend that holidaymakers returning from Spain would have to quarantine because of an uptick in coronavirus cases in regions such as Catalonia.

Nearly every industry contracted in the second quarter, with the exception of government spending, agriculture and financial and insurance activities, which grew slightly. The hardest-hit sectors were retail, transport, restaurants and bars, which together plunged 40.4%.

The Spanish economy has been particularly affected by the crisis because of the relatively small size of its companies, which leaves them more vulnerable and less capable of effectively responding to the shock. Business associations expect tens of thousands of small and medium-sized companies to go bankrupt before the end of the year.

Reuters reports that the British public's expectations for inflation over the coming year picked up in July to one of the highest levels since 2013, a survey from City and YouGov showed on Friday.

Year-ahead inflation expectations rose to 3.2% in July from 3.0% in June, matching the levels of March and April.

Expectations for five to 10 years ahead rose to a one-year high of 3.3%, up from 3.2%.

The figures were based on a YouGov poll of 2,010 people conducted on July 27 and 28.

FXStreet reports that the US dollar is in fierce focus as the currency weakens across the G10. The narrative around this trade has been easy to see: low US rates, rising political tension in the US and struggles to form consensus around the next round of much needed fiscal stimulus. Add to this a rollover in the US’s growth pulse as closures hit confidence, and the recipe for weakness is complete. While economists at ANZ Bank agree there is some risk that the USD will weaken a bit more this year, they think talk of its death is premature.

“Many are seeing that the multi-year breakdown in the USD has begun and a longer-term bear market is about to take hold. We are less sure about that but see scope for weakness in the near-term.”

“The broader secular turn is likely to need more ingredients, a more certain global growth environment, a more viable alternative to the USD as an invoicing currency and a safe asset market that is deeper and more liquid than the treasury market. The latter two conditions are a way off. The US treasury market is larger than all others, with nearly 40% of all debt securities on issue. The EU is a distant second, with just 20% of securities outstanding.”

“On the demand front, the US consumer market remains globally critical. Together with a deep capital market in which to park profits and working capital and the free convertibility, the USD is likely to remain the invoicing currency of choice for most trades.”

“The growth hurdle, though, is lower. We think the trajectory of global growth will be the strongest driver of the USD in coming months. The question is whether we can trigger a virtuous cycle between the USD and global growth. Over the remainder of 2020, we give this better than even odds, but beyond that, reading this as the beginning of a multi-year depreciation in the USD looks premature given the number of identifiable exogenous shocks that exist.”

“The pandemic’s impact, the escalation of US-China tensions and the scale of current (unsustainable) fiscal support all challenge this narrative. So we think the road ahead may see some weakness, but it is way too soon to call for the end of the USD’s reign.”

We should envisage support continuing beyond 2020

We really have to maintain attractive conditions until the middle of next year at least

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 01:00 | China | Non-Manufacturing PMI | July | 54.4 | 54.2 | |

| 01:00 | China | Manufacturing PMI | July | 50.9 | 50.7 | 51.1 |

| 01:30 | Australia | Producer price index, y/y | Quarter II | 1.3% | -0.4% | |

| 01:30 | Australia | Producer price index, q / q | Quarter II | 0.2% | -1.2% | |

| 01:30 | Australia | Private Sector Credit, y/y | June | 3.2% | 2.9% | |

| 01:30 | Australia | Private Sector Credit, m/m | June | -0.1% | -0.2% | |

| 05:00 | Japan | Housing Starts, y/y | June | -12.3% | -13.7% | -12.8% |

| 05:00 | Japan | Consumer Confidence | July | 28.4 | 29.5 | |

| 05:30 | France | GDP, q/q | Quarter II | -5.9% | -15.3% | -13.8% |

| 06:00 | Germany | Retail sales, real unadjusted, y/y | June | 3.8% | 3% | 5.9% |

| 06:00 | United Kingdom | Nationwide house price index | July | -1.6% | -0.1% | 1.7% |

| 06:00 | United Kingdom | Nationwide house price index, y/y | July | -0.1% | -0.3% | 1.5% |

| 06:00 | Germany | Retail sales, real adjusted | June | 12.7% | -3.3% | -1.6% |

| 06:30 | Switzerland | Retail Sales (MoM) | June | 30.7% | 30.5% | |

| 06:30 | Switzerland | Retail Sales Y/Y | June | 6.2% | 1.1% | |

| 06:45 | France | CPI, y/y | July | 0.2% | 0.3% | 0.8% |

| 06:45 | France | CPI, m/m | July | 0.1% | -0.1% | 0.4% |

| 06:45 | France | Consumer spending | June | 37.4% | 3.2% | 9% |

During today's Asian trading, the US dollar declined against the main world currencies amid renewed concerns about the prospects for the recovery of the us economy.

The ICE Dollar index, which shows the value of the US dollar against six major world currencies, fell 0.42% from the previous day, and is now trading near two-year lows.

Demand for the US currency fell due to doubts about the rapid recovery of the US economy and the ability of the authorities to bring the coronavirus pandemic under control.

The country's GDP in April-June collapsed by 32.9% in terms of annual rates after a decline of 5% in the 1st quarter, according to preliminary data. This is a record drop during the publication of such information, which began almost immediately after the Second world war. Analysts on average predicted a more significant decline: by 34.1%.

US President Donald trump suggested yesterday that it might be better to postpone the presidential election in November 2020, so as not to resort to voting by mail due to the threat of coronavirus.

However, neither Republicans nor Democrats in the US Congress support the idea of postponing the presidential elections and insist on holding them in November, as planned.

Meanwhile, the US still ranks first in the world in the number of cases of COVID-19 infection. At the moment, more than 4.63 million cases of infection have been registered in the country, and more than 155 thousand people have died.

According to the report from INSEE, in June 2020, household consumption expenditure on goods exceeded its February level (+2.3% in volume compared to February) after declining strongly during the lockdown period. This increase was mainly driven by manufactured good consumption (+5.8% compared to February). However, energy spending remained lower than in February (–1.8%). Food consumption, after going beyond its February level during the lockdown, almost returns to it in June (+0.2%).

Over the whole second quarter of 2020, household consumption on goods fell sharply (–7.1% after –6.8% in the first quarter).

According to the report from INSEE, over a year, the Consumer Price Index (CPI) should rise by 0.8% in July 2020, after +0.2% in the previous month. Economists had expected a 0.3% increase. This rise in inflation should result from a rebound in manufactured products, linked to the postponed summer sales, and a smaller fall in energy prices. Contrariwise, the prices of food, and to a lesser extent services and tobacco, would slow down.

Over one month, consumer prices should rise by 0.4%, after +0.1% in the previous month. Economists had expected a 0.1% decrease. Service prices should accelerate seasonally during this summer period, and tobacco prices should rise after being stable last month. Contrariwise, food prices should fall further and energy prices would slow down. Finally, prices of manufactured products should stabilize after falling last month.

Year on year, the Harmonised Index of Consumer Prices should accelerate, to +0.9%, after +0.2% in June. Over one month, it should increase by 0.4%, after +0.1% in the previous month.

eFXdata reports that the output of this month-end fixing model point to USD selling across the board into London Fix on Friday July 31, according to data from Credit Agricole CIB Research

"Global equity markets were broadly firmer on the month while the USD has underperformed across the board. Overall, the moves in equity markets, when adjusted for market capitalisation and FX performance this month, suggest that month-end portfolio-rebalancing flows are likely to keep the USD on the back foot," CACIB notes.

According to provisional data Federal Statistical Office (Destatis), turnover in retail trade in June 2020 was in real and nominal terms adjusted for calendar and seasonal variations 1.6% lower than in May 2020. Economists had expected a 3.3% decrease.

In comparison to February 2020, the month before the outbreak of Covid-19 in Germany, the turnover in June 2020 was 1.4% higher.

In June 2020, the turnover in retail rose by 5.9% (real) and 6.8% (nominal) compared to the same month previous year. While June 2019 with 24 days of sale had one day less than June 2020.

Retail sales of food, beverages and tobacco were in real terms 2.3% and 5.7% nominal terms higher in June 2020 than in June 2019. Turnover in retail sale in non-specialised stores with food, beverages or tobacco were in real terms 3.1% and nominal terms 6.4% higher than in the same month last year. By contrast, the retail sale of food, beverages and tobacco in specialised stores had in real terms 4.0% and in nominal terms 0.1% a lower turnover.

In the non-food retail sector, sales in June 2020 rose in real terms by 8.4% and nominal terms by 8.3% compared with the same month previous year. The largest increase in turnover compared with the previous year's month in real terms by +30.7% and +30.6% in nominal terms was achieved by the internet and mail order business. Change rates of this magnitude are unusual even in this very dynamic sector and are therefore largely attributable to a special influence of the corona pandemic. Trade in furniture, household appliances and building materials also increased significantly, with a real plus of 14.6%. Trade in textiles, clothing, shoes and leather goods and the retail trade in various types of goods (e.g. department stores), on the other hand, did not yet return to the previous year's level, with real growth of -16.0% and -11.1% respectively over the previous year.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 43.17 | -1.12 |

| Silver | 23.47 | -3.26 |

| Gold | 1957.252 | -0.68 |

| Palladium | 2083.76 | -4 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -57.88 | 22339.23 | -0.26 |

| Hang Seng | -172.55 | 24710.59 | -0.69 |

| KOSPI | 3.85 | 2267.01 | 0.17 |

| ASX 200 | 44.7 | 6051.1 | 0.74 |

| FTSE 100 | -141.47 | 5989.99 | -2.31 |

| DAX | -442.61 | 12379.65 | -3.45 |

| CAC 40 | -105.8 | 4852.94 | -2.13 |

| Dow Jones | -225.92 | 26313.65 | -0.85 |

| S&P 500 | -12.22 | 3246.22 | -0.38 |

| NASDAQ Composite | 44.87 | 10587.81 | 0.43 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:00 | China | Non-Manufacturing PMI | July | 54.4 | |

| 01:00 | China | Manufacturing PMI | July | 50.9 | 50.7 |

| 01:30 | Australia | Private Sector Credit, y/y | June | 3.2% | |

| 01:30 | Australia | Private Sector Credit, m/m | June | -0.1% | |

| 01:30 | Australia | Producer price index, y/y | Quarter II | 1.3% | |

| 01:30 | Australia | Producer price index, q / q | Quarter II | 0.2% | |

| 05:00 | Japan | Housing Starts, y/y | June | -12.3% | -13.7% |

| 05:00 | Japan | Consumer Confidence | July | 28.4 | |

| 05:30 | France | GDP, q/q | Quarter II | -5.3% | -15.2% |

| 06:00 | Germany | Retail sales, real unadjusted, y/y | June | 3.8% | 3% |

| 06:00 | Germany | Retail sales, real adjusted | June | 13.9% | -3.3% |

| 06:30 | Switzerland | Retail Sales (MoM) | June | 30.7% | |

| 06:30 | Switzerland | Retail Sales Y/Y | June | 6.6% | |

| 06:45 | France | CPI, y/y | July | 0.2% | 0.3% |

| 06:45 | France | CPI, m/m | July | 0.1% | -0.1% |

| 06:45 | France | Consumer spending | June | 36.6% | 5.1% |

| 09:00 | Eurozone | Harmonized CPI, Y/Y | July | 0.3% | 0.2% |

| 09:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | July | 0.8% | 0.8% |

| 09:00 | Eurozone | GDP (YoY) | Quarter II | -3.1% | -14.5% |

| 09:00 | Eurozone | GDP (QoQ) | Quarter II | -3.6% | -12% |

| 12:30 | Canada | Industrial Product Price Index, y/y | June | -4.9% | |

| 12:30 | Canada | Industrial Product Price Index, m/m | June | 1.2% | 0.5% |

| 12:30 | U.S. | Personal spending | June | 8.2% | 5.5% |

| 12:30 | Canada | GDP (m/m) | May | -11.6% | 3.5% |

| 12:30 | U.S. | Employment Cost Index | Quarter II | 0.8% | 0.6% |

| 12:30 | U.S. | PCE price index ex food, energy, Y/Y | June | 1% | 1% |

| 12:30 | U.S. | PCE price index ex food, energy, m/m | June | 0.1% | 0.2% |

| 12:30 | U.S. | Personal Income, m/m | June | -4.2% | -0.5% |

| 13:45 | U.S. | Chicago Purchasing Managers' Index | July | 36.6 | 43.9 |

| 14:00 | U.S. | Reuters/Michigan Consumer Sentiment Index | July | 78.1 | 73 |

| 17:00 | U.S. | Baker Hughes Oil Rig Count | July | 181 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71862 | -0.03 |

| EURJPY | 124.073 | 0.3 |

| EURUSD | 1.18405 | 0.42 |

| GBPJPY | 137.123 | 0.56 |

| GBPUSD | 1.30887 | 0.71 |

| NZDUSD | 0.66871 | 0.27 |

| USDCAD | 1.3427 | 0.71 |

| USDCHF | 0.90893 | -0.34 |

| USDJPY | 104.768 | -0.15 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.