- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

The final

reading for the April Reuters/Michigan index of consumer sentiment came in at 100

compared to a preliminary reading of 102.4 and the April final reading of 97.2.

That was the highest reading since September 2018.

Economists had

forecast the index to be revised downwardly to 101.5.

According to

the report, the index of the current economic conditions fell to 110.0 from April’s

final reading of 112.3.

Meanwhile, the

index of consumer expectations increased to 93.5 from April’s final reading of 87.4.

The report

notes that confidence significantly eroded in the last two weeks of May due to

unfavorable references to tariffs.

MNI Indicators’

report revealed on Friday that the expansion of business activity in Chicago accelerated

slightly this month.

The MNI Chicago

Business Barometer, also known as Chicago purchasing manager's index (PMI) came

in at 54.2 in May, down from an unrevised 52.6 in April. Economists had

forecast the index to increase to 53.7.

A reading above

50 indicates improving conditions, while a reading below this level shows

worsening of the situation.

According to

the report, two of the five Barometer components rose in May. New Orders

increased for the first time in three months, but the advance was not large

enough to offset last month’s fall. Production picked-up to match its

three-month average but was significantly below its 12-month average.

Meanwhile, Supplier delivery times continued to expand but less so than last month.

Employment fell to the lowest level since October 2017. Order Backlogs slipped

into contraction again, the second such instance this year.

Statistics Canada announced on Friday that the country’s gross domestic product (GDP) grew 0.5 percent m-o-m in March, following a revised 0.2 m-o-m decline in February (originally a drop of 0.1 percent m-o-m).

That was below economists’ forecast for a gain of 0.4 percent m-o-m.

In the first quarter of 2019, the Canadian GDP rose 0.1 percent q-o-q, the same growth rate as the fourth quarter of 2018. That was the lowest quarterly increase in GDP since the second quarter of 2016.

Expressed at an annualized rate, Canada’s GDP increased 0.4 percent in the first quarter, while economists had predicted it would grow 0.7 percent.

According to the report, growth in GDP was driven by a 0.9 percent rise in household spending and an 8.7 percent climb in business investment in machinery and equipment. These increases were moderated by a 1.0percent decline in exports, coupled with a 1.9 percent increase in imports. Additionally, investment in housing continued to decrease, down 1.6 percent in the first quarter.

U.S. stock-index futures rose moderately on Thursday, as investors feared that U.S. President’s surprise threat to set tariffs on all imports from Mexico, amid a worsening trade war with China, could risk sending the world’s largest economy into a recession.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,601.19 | -341.34 | -1.63% |

Hang Seng | 26,901.09 | -213.79 | -0.79% |

Shanghai | 2,898.70 | -7.11 | -0.24% |

S&P/ASX | 6,396.90 | +4.80 | +0.08% |

FTSE | 7,146.39 | -71.77 | -0.99% |

CAC | 5,179.48 | -69.43 | -1.32% |

DAX | 11,700.78 | -201.30 | -1.69% |

Crude oil | $55.31 | -2.26% | |

Gold | $1,301.70 | +0.72% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 159.28 | -1.30(-0.81%) | 5492 |

ALCOA INC. | AA | 21.18 | -0.44(-2.04%) | 5403 |

ALTRIA GROUP INC. | MO | 49.76 | -0.45(-0.90%) | 1359 |

Amazon.com Inc., NASDAQ | AMZN | 1,789.50 | -26.82(-1.48%) | 70596 |

American Express Co | AXP | 115.63 | -1.11(-0.95%) | 679 |

Apple Inc. | AAPL | 176.06 | -2.24(-1.26%) | 205376 |

AT&T Inc | T | 31.12 | -0.74(-2.32%) | 281863 |

Boeing Co | BA | 346.31 | -3.56(-1.02%) | 16965 |

Caterpillar Inc | CAT | 120 | -1.84(-1.51%) | 12374 |

Chevron Corp | CVX | 114.02 | -1.36(-1.18%) | 5763 |

Cisco Systems Inc | CSCO | 52.96 | -0.61(-1.14%) | 21281 |

Citigroup Inc., NYSE | C | 62.5 | -1.11(-1.75%) | 50760 |

Exxon Mobil Corp | XOM | 71.34 | -0.63(-0.88%) | 10917 |

Facebook, Inc. | FB | 180.6 | -2.41(-1.32%) | 60815 |

FedEx Corporation, NYSE | FDX | 154.01 | -4.00(-2.53%) | 6571 |

Ford Motor Co. | F | 9.4 | -0.34(-3.49%) | 414270 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.59 | -0.23(-2.34%) | 98970 |

General Electric Co | GE | 9.34 | -0.13(-1.37%) | 145153 |

General Motors Company, NYSE | GM | 33.25 | -1.57(-4.51%) | 182762 |

Goldman Sachs | GS | 184.1 | -3.27(-1.75%) | 6025 |

Google Inc. | GOOG | 1,106.80 | -11.15(-1.00%) | 6225 |

Home Depot Inc | HD | 189.8 | -1.28(-0.67%) | 2472 |

Intel Corp | INTC | 44.19 | -0.54(-1.21%) | 35443 |

International Business Machines Co... | IBM | 128.15 | -1.42(-1.10%) | 4458 |

International Paper Company | IP | 41.4 | -0.34(-0.81%) | 2230 |

Johnson & Johnson | JNJ | 131.45 | -0.66(-0.50%) | 1205 |

JPMorgan Chase and Co | JPM | 105.44 | -1.62(-1.51%) | 15787 |

McDonald's Corp | MCD | 197.63 | -0.45(-0.23%) | 4033 |

Merck & Co Inc | MRK | 79.12 | -0.56(-0.70%) | 1817 |

Microsoft Corp | MSFT | 124.25 | -1.48(-1.18%) | 71710 |

Nike | NKE | 78.08 | -0.96(-1.21%) | 4076 |

Pfizer Inc | PFE | 41.6 | -0.30(-0.72%) | 3582 |

Procter & Gamble Co | PG | 105 | -0.33(-0.31%) | 14249 |

Starbucks Corporation, NASDAQ | SBUX | 75.5 | -0.67(-0.88%) | 3706 |

Tesla Motors, Inc., NASDAQ | TSLA | 185.59 | -2.63(-1.40%) | 224532 |

The Coca-Cola Co | KO | 49 | -0.25(-0.51%) | 8030 |

Twitter, Inc., NYSE | TWTR | 36.68 | -0.46(-1.24%) | 59326 |

United Technologies Corp | UTX | 126.88 | -1.52(-1.18%) | 516 |

UnitedHealth Group Inc | UNH | 241 | -2.50(-1.03%) | 1610 |

Verizon Communications Inc | VZ | 55.46 | -1.37(-2.41%) | 52935 |

Visa | V | 161.4 | -1.36(-0.84%) | 8895 |

Wal-Mart Stores Inc | WMT | 101.21 | -0.98(-0.96%) | 20811 |

Walt Disney Co | DIS | 131.05 | -1.15(-0.87%) | 12787 |

Yandex N.V., NASDAQ | YNDX | 35.93 | -0.46(-1.26%) | 2602 |

- So far the fundamentals have been quite strong

- Sees inflation expectations anchored around 1.7%

- Latest data shows inflation remains low

- Wage growth is ticking up but slowly

- More noise and rhetoric than action on trade

- Not quite there yet on seeing the need for a Fed policy shift

Germany's

Federal Statistical Office reported on Friday the country’s consumer price

index (CPI) is expected to increase 0.2 percent m-o-m in May, following a 1.0

percent m-o-m advance in the previous month.

On the y-o-y

basis, Germany’s inflation rate is seen to rise 1.4 percent this month after a 2.0

percent gain in April.

Economists had

predicted inflation would increase 0.3 percent m-o-m and 1.6 percent y-o-y in

May.

According to the report, food price growth accelerated to 0.9 percent y-o-y in May from 0.8 percent y-o-y in April, while energy inflation slowed to 4.2 percent y-o-y from 4.6 percent y-o-y. At the same time, services costs climbed 1.2 percent y-o-y following a 2.1 percent y-o-y jump in the previous month.

The Commerce Department announced on Friday that consumer spending in the U.S. rose 0.3 percent m-o-m in April, following a revised 1.1 percent m-o-m surge in March (originally a 0.9 percent m-o-m increase). Economists had forecast the reading to show a 0.2 percent m-o-m growth.

Meanwhile, consumer income climbed 0.5 percent m-o-m in April after an unrevised 0.1 percent m-o-m gain in the previous month. That was the biggest monthly advance since December 2018.

The April increase in personal income primarily reflected gains in personal interest income, wages and salaries, and government social benefits to persons, the report said.

The personal consumption expenditures (PCE) price index, excluding the volatile categories of food and energy, which is the Fed's preferred inflation measure, rose 0.2 percent m-o-m in April, following a 0.1 percent m-o-m advance in the prior month. Economists had projected the index would increase 0.2 percent m-o-m.

In the 12 months through April, the core PCE increased 1.6 percent, accelerating from a revised 1.5 percent gain in the 12 months through March (originally a 1.6 percent advance). Economists had forecast a gain of 1.6 percent y-o-y.

- U.S. remains hopeful that China will step forward in trade negotiations

- Trump has forged a good relationship with Xi

Iris Pang, the economist for Greater China at ING, notes that China's official manufacturing PMI for May fell into contraction territory. May's reading came in at 49.4, which suggests that manufacturing activity in May actually shrank.

- The most eye-catching sub-index is the "new orders index", which measures domestic manufacturing activity. This came down drastically from 51.4 in April to 49.8 in May.

- We believe that the contraction in new orders means domestic manufacturing activity has been affected by both the trade war and the technology war. From the trade war, export-related domestic activity, like packaging materials, are affected by fewer exports. And, the damage on China’s telecommunication companies has slowed down their production in China as they foresee slower sales globally.

- We believe that a contraction trend in manufacturing activity has formed as the manufacturing PMI has now fallen 3 months in a row and now even enters contraction territory.

- Our concern is not just on products affected by the tariffs, which we believe could have a longer impact on both the Chinese and US economy unless trade negotiations resume.

- We also worry about technology companies' production. It is still too soon to evaluate the technology war's impact on domestic manufacturing activity. The technology war is brewing even faster in May 2019, and could continue for the rest of the year. We expect the technology war to put pressure on manufacturing activity for the whole of 2019.

- As manufacturing activity has started to contract, the central government will push local infrastructure projects to speed up their progress.

- Stimulus measures should help manufacturing activity to return to growth and a PMI above 50.

- In any case, the central government is not going to use the yuan as a weapon to fight the trade war and the technology war.

- Instead, we believe that the Chinese government will help exporters to develop other markets, e.g. domestic markets for high-end goods and use the Belt and Road initiative to support demand for lower-end goods.

Analysts at TD Securities are expecting a solid 0.2% m/m gain in the U.S. core PCE prices for April, which should translate into a steady 1.6% y/y inflation rate with rounding.

- “Risks are skewed to a softer print, in our view. We look for muted consumer spending after an outsized 0.9% m/m jump in March. The choppiness in the spending data should fade as tight financial conditions and delayed tax refunds recede from view.

- Chicago PMI and the final print of University of Michigan Consumer Sentiment will round out the calendar; the market looks for Chicago PMI to rebound to 54.0 after falling by 5 points in April, while consumer confidence is expected to edge lower to 101.5 in May from 102.4 in the preliminary release.”

- President Trump remains focused on the economy, jobs and growth

- We will disclose details of the list in the near future

According to analysts at ANZ, it’s going to be a big next week for the Australian economy, with an RBA rate cut expected and key economic data due out (current account, retail sales and GDP being the highlights).

“The RBA Governor is speaking in Sydney on Tuesday evening. We and the market will be shocked if the RBA doesn’t cut in June. Of more interest will be any clues it might provide about action beyond that. If the post-board meeting statement doesn’t provide any clues, attention will switch to the Governor’s speech that evening. As for the data, we expect the smallest current account deficit relative to GDP since the 1970s. Retail sales look likely to be flat for the month of April, but we expect Q1 GDP to be better than the second half of last year and in line with what the RBA expects.”

According to preliminary estimates from Istat, in May 2019 the Italian consumer price index for the whole nation (NIC) increased by 0.1% on monthly basis and by 0.9% with respect to May 2018, down from +1.1% in the previous month.

The slowdown of the growth on annual basis of All items index was mainly due to prices of Services related to transport (from +2.8% to +1.6%), of Non-regulated energy products (from +3.7% to +2.4%) and, to a lesser extent, of Services related to recreation, including repair and personal care (from +1.6% to +1.1%).

The core inflation excluding energy and unprocessed food was +0.5% (down from +0.6% in April 2019) and inflation excluding energy was +0.6% (down from +0.7%).

In May 2019, according to preliminary estimates, the Italian harmonized index of consumer prices (HICP) increased by 0.1% on monthly basis and by 0.9% with respect to May 2018, down from +1.1% in the previous month.

Analysts at Wells Fargo, expected a reading of 0.8% (annualized, quarter-over-quarter), in line with market consensus.

“Q4 GDP rose just 0.4% quarter-over-quarter annualized, while final domestic demand was even softer, contracting at a 1.5% pace. While employment growth has been sturdy so far in 2019, retail sales data point to still subdued consumer spending in Q1, while mixed manufacturing sales also hint at only modest improvement in investment spending. That said, higher oil prices could impart a modest positive impulse on Canada’s economic growth. The consensus is for Q1 GDP growth to rise to 0.8% quarter-over-quarter annualized, more than the 0.3% pace forecast from the Bank of Canada in its latest Monetary Policy Report.”

Axel Rudolph, analyst at Commerzbank, believes that the USD/MXN cross has the September 2016 and December 2017 highs at 19.9048/19.9234 in its sights.

“Further up the early and mid-December lows can be spotted at 19.9874/20.0091. Still further up the November and December peaks can be made out at 20.6353/20.6574. Minor resistance en route can be encountered at the 19.8097 December 20 low. Slips should find support between February and late March highs at 19.4780/22. Further support comes in along the 200 day moving average at 19.3447.”

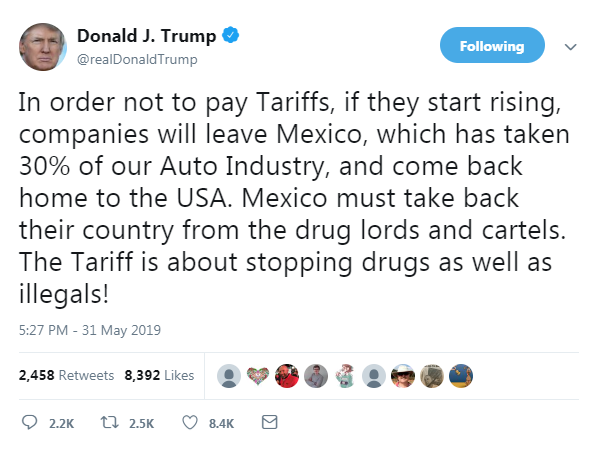

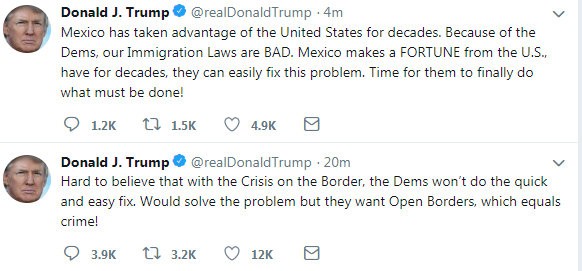

The rally of the USD/MXN was caused by news from the USA. White House said Thursday that the U.S. will impose a 5% tariff on all Mexican imports from June 10 — and duties of up to 25% will be added in the coming months if Mexico does not take action to “reduce or eliminate the number of illegal aliens” crossing into the U.S.

According to the report from Bank of England, consumer credit increased by £0.9 billion in April, in line with the monthly average increase since July 2018. Within consumer credit, net borrowing for other loans and advances increased to £0.7 billion, whilst credit card lending fell slightly to £0.2 billion.

The annual growth rate of consumer credit continued slowing, reaching 5.9% in April. It is now five percentage points below its peak in November 2016 and the lowest since June 2014.

Net mortgage lending was £4.3 billion in April, slightly higher than the average of £3.8 billion seen over the previous six months.

UK businesses raised £5.7 billion of net finance in April, driven by borrowing from banks and bond markets.

According to the report from Istat, in the first quarter of 2019 the seasonally and calendar adjusted, chained volume measure of Gross Domestic Product (GDP) increased by 0.1% to the previous quarter and decreased by 0.1% in comparison with the first quarter of 2018. Economists had expected increase by 0.2% to the previous quarter and increase by 0.1% y/y.

Compared to previous quarter, final consumption expenditure increased by 0.2%, gross fixed capital formation by 0.6% and exports by 0.2%. By contrast imports fell by 1.5%.

With respect to the first quarter of 2018, final consumption expenditure increased by 0.2%, gross fixed capital formation by 2.6%, imports by 1.8%, and exports by +3.5%.

The carry-over annual GDP growth for 2019 is null.

Bank of Italy said, in May €-coin indicator rose slightly to 0.20 (from 0.18 in April), following six consecutive decreases. The indicator benefited from the favourable performance of car registrations and retail sales, as well as from the moderate recovery in business and consumer confidence; conversely, the contribution of industrial activity remains weak.

The €-coin indicator developed by the Bank of Italy provides a summary index of the current economic situation in the euro area. The indicator is an estimate of quarterly GDP growth shorn of the most erratic components (seasonal variations, measurement errors and short-run volatility). €-coin is published monthly by the Bank of Italy and CEPR.

Analysts at Standard Chartered suggest that their global heatmap is showing some signs of growth bottoming out and early ‘green shoots’ of stabilisation appear to be emerging, but it may be too soon to sound the all clear, given significant uncertainties (such as heightened US-China trade tensions and Brexit) remain in the global environment.

“We see no good reason to expect a sudden improvement, as most risks are to the downside. Global growth remains soft, but appears to be bottoming out. Our GDP trackers (constructed from high-frequency data) indicate that Q1-2019/April growth in 14 of 22 economies are tracking weaker than their four-quarter average, down from 21 of 22 economies previously. Notably, China’s GDP tracker indicates that its growth is tracking faster than the past four-quarter average. However, we remain cautious. Export weakness remains. 17 of 22 economies are seeing slower export growth than the past six-month average, with export growth in 11 economies declining.”

A widely followed former American diplomat questioned whether President Donald Trump was adopting the right strategy by threatening Mexico with a new tariff because of immigration issues.

Trump announced Thursday that his country plans to impose a 5% tariff on all Mexican imports from June 10. In a statement, he attributed that unexpected move to a “border crisis”.

John Negroponte questioned whether Trump’s move would have the desired effect. “I think it’s both bad politically and bad economically and I don’t think it’s really going to help solve the immigration problem, either, which is what Mr. Trump said he’s trying to attack,” said Negroponte, current vice chairman of consultancy McLarty Associates and formerly U.S. ambassador to Honduras, Mexico, the Philippines, the United Nations, and Iraq.

Mexico, for its part, has said it would not respond well to economic threats. In a letter addressed to Trump, Mexican President Andrés Manuel López Obrador said he did not want confrontation, and that leaders have a responsibility to seek peaceful solutions to controversies. “President Trump: Social problems cannot be resolved with taxes or coercive measures,” the Mexican leader wrote.

Negroponte told he agreed with that sentiment. Still, he said, perhaps now is the time that Washington and Mexico City can come together on the issue.

According to the provisional data from Federal Statistical Office (FSO), real turnover in the retail sector also adjusted for sales days and holidays fell by 0.7% in April 2019 compared with the previous year. Real growth takes inflation into consideration. Economists had expected a 0.8% decrease. Compared with the previous month, real, seasonally adjusted retail trade turnover registered an increase of 0.2%.

Adjusted for sales days and holidays, the retail sector excluding service stations showed a 0.2% decrease in nominal turnover in April 2019 compared with April 2018 (in real terms –0.6%). Retail sales of food, drinks and tobacco registered an increase in nominal turnover of 1.9% (in real terms +0.9%), whereas the non-food sector registered a nominal negative of 2.1% (in real terms –2.0%).

Excluding service stations, the retail sector showed a seasonally adjusted increase in nominal turnover of 0.2% compared with the previous month (in real terms +0.2%). Retail sales of food, drinks and tobacco registered a plus of 1.1% (in real terms +1.0%). The non-food sector showed a minus of 0.2% (in real terms 0.0%).

According to the report from Nationwide Building Society, annual house price growth slowed to 0.6% in May from 0.9% in April. Economists had expected a 1.2% increase. Prices fall 0.2% month-on-month, after taking account of seasonal factors. Experts predicted that prices will not change after rising 0.3% in April.

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: “Annual house price growth remained below 1% for the sixth month in a row in May, at 0.6%. Survey data suggests that new buyer enquiries and consumer confidence have remained subdued in recent months. Nevertheless, indicators of housing market activity, such as the number of property transactions and the number of mortgages approved for house purchase, have remained broadly stable".

“Housing market trends are likely to continue to mirror developments in the broader economy. While healthy labour market conditions and low borrowing costs will provide underlying support, uncertainty is likely to continue to act as a drag on sentiment and activity, with price growth and transaction levels remaining close to current levels over the coming months".

According to provisional results of the Federal Statistical Office (Destatis), the real (price-adjusted) turnover of the retail enterprises in Germany was 4.0% and the nominal (not price-adjusted) turnover 4.8% higher in April 2019 compared with April 2018. The number of sales days was 24 in each of these two months.

The timing of Easter had a positive effect on the year-on-year development of turnover in April 2019. In 2018, the Easter business largely fell in March, while turnover decreased in April. In 2019, however, the Easter business largely fell in April.

In the period from January to April 2019, German retail turnover was up a real 2.2%, and a nominal 3.0%, on the same period of the previous year.

In April 2019, the calendar and seasonally adjusted turnover declined a real 2.0%, and a nominal 1.5%, compared with March 2019.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1303 (4716)

$1.1256 (2997)

$1.1214 (1592)

Price at time of writing this review: $1.1130

Support levels (open interest**, contracts):

$1.1117 (4093)

$1.1085 (3668)

$1.1044 (3831)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date June, 7 is 122514 contracts (according to data from May, 30) with the maximum number of contracts with strike price $1,1500 (9016);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2902 (546)

$1.2805 (382)

$1.2716 (841)

Price at time of writing this review: $1.2611

Support levels (open interest**, contracts):

$1.2588 (1768)

$1.2563 (2153)

$1.2489 (1033)

Comments:

- Overall open interest on the CALL options with the expiration date June, 7 is 40574 contracts, with the maximum number of contracts with strike price $1,3450 (3277);

- Overall open interest on the PUT options with the expiration date June, 7 is 40894 contracts, with the maximum number of contracts with strike price $1,2700 (4004);

- The ratio of PUT/CALL was 1.01 versus 0.99 from the previous trading day according to data from May, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -60.84 | 20942.53 | -0.29 |

| Hang Seng | -120.83 | 27114.88 | -0.44 |

| KOSPI | 15.48 | 2038.8 | 0.77 |

| ASX 200 | -47.9 | 6392.1 | -0.74 |

| FTSE 100 | 32.86 | 7218.16 | 0.46 |

| DAX | 64.27 | 11902.08 | 0.54 |

| Dow Jones | 43.47 | 25169.88 | 0.17 |

| S&P 500 | 5.84 | 2788.86 | 0.21 |

| NASDAQ Composite | 20.41 | 7567.72 | 0.27 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.69094 | -0.09 |

| EURJPY | 121.96 | -0.01 |

| EURUSD | 1.11284 | -0.06 |

| GBPJPY | 138.133 | -0.16 |

| GBPUSD | 1.26056 | -0.19 |

| NZDUSD | 0.65065 | -0.1 |

| USDCAD | 1.34992 | -0.1 |

| USDCHF | 1.00774 | 0.04 |

| USDJPY | 109.582 | 0.04 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.