- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Net Foreign Bond Investment in Japan declined by ¥-84.5 billion into November 24th compared to a ¥4 billion increase for the previous period, which was revised upwards from the previously-reported ¥2.5 billion net surplus in foreign bond investment.

Foreign Investment in Japanese Stocks into November 24th saw a minor capital inflow of ¥4.2 billion, a notable decline from the previous period's net inflow of ¥285.9 billion.

Market Reaction

The USD/JPY is holding steady near the 147.00 handle after testing into an early Thursday low of 146.84 prior to the data release.

About Japanese Foreign Investment

Securities investment, released by the Ministry of Finance, refers to bonds issued in a domestic market by a foreign entity in the domestic market’s currency. The report is released by the Ministry of Finance, detailing the flows from the public sector excluding the Bank of Japan. The net data shows the difference between capital inflow and outflow. A positive difference indicates net sales of foreign securities by residents (capital inflow), and a negative difference indicates net purchases of foreign securities by residents (capital outflow).

Japanese MoM Industrial Production increased by 1% in October compared to September's 0.5% uptick, beating the market forecast of 0.8%.

Annualized Industrial Production into October also rebounded from the last period's 4.4% decline to print at 0.9%.

Market Reaction

The USD/JPY is holding steady near the 147.00 handle after testing into an early Thursday low of 146.84 prior to the data release.

About Japanese Industrial Production

The Industrial Production released by the Ministry of Economy, Trade and Industry measures outputs of the Japanese factories and mines. Changes in industrial production are widely followed as a major indicator of strength in the manufacturing sector. A high reading is seen as bullish for the JPY, whereas a low reading is seen as bearish.

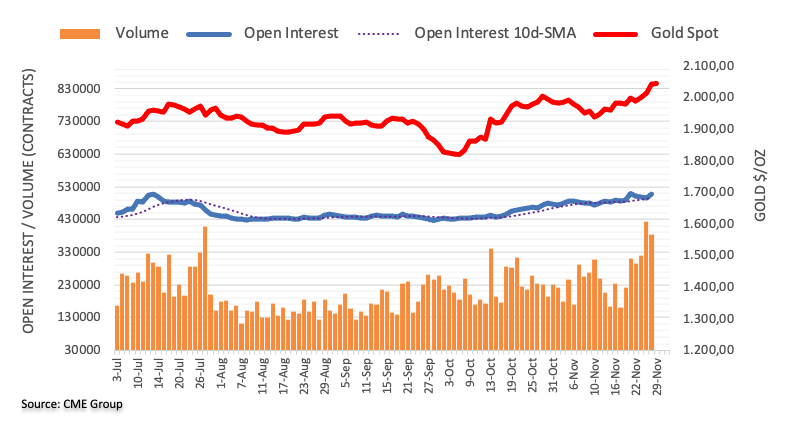

- Gold price gains momentum to $2,045 despite the modest USD recovery.

- Cleveland Fed President Mester said whether further hikes are needed depends on the economy.

- US Gross Domestic Product Annualized for the third quarter (Q3) came in at 5.2% vs 4.9% prior, better than expected.

- China’s NBS PMI and US Core Personal Consumption Expenditure Price Index (PCE) will be crucial data to watch.

Gold price (XAU/USD) holds positive ground for the sixth consecutive day during the early Asian session on Thursday. A modest recovery of the US Dollar (USD) fails to drag the yellow metal lower. Gold price currently trades near $2,045, up 0.04% on the day.

Meanwhile, the US Dollar Index (DXY), a measure of the value of the USD against a weighted basket of currencies used by US trade partners, recovers modestly from the monthly lows to 102.85. The Treasury yields edge lower, with the 10-year yield standing at 4.259%.

Late Wednesday, Cleveland Federal Reserve (Fed) President Loretta Mester said that monetary policy is in a good place to assess incoming information on the economy and financial conditions. Mester did not close the door to more rate hikes but added that whether further hikes are needed depends on the economy.

About the data, the US Gross Domestic Product Annualized for the third quarter (Q3) came in at 5.2% versus 4.9% prior, better than the market expectation of 5.0%. The market is pricing a 25 basis points (bps) rate cut in May 2024 and seems to have abandoned the higher-for-longer rate narrative in the US.

China’s NBS Purchasing Managers Index (PMI) data on Thursday will be crucial figures to watch as it could impact the gold price. It’s worth noting that China is the world's largest gold producer and consumer and the stronger-than-expected data might boost the further upside in the precious metal. Chinese Manufacturing is estimated to grow to 49.7 while Services PMI figures are expected to improve to 51.1. On the US docket, the US weekly Jobless Claims, the Core Personal Consumption Expenditure Price Index (PCE) for October, the Chicago PMI, and Pending Home Sales will be due on Thursday.

- The USD/JPY is testing the 147.00 handle ahead of Japan's latest Retail Sales print.

- Markets are forecasting a slight uptick in annualized Retail Trade in October.

- China's NBS Manufacturing PMIs due early in Asia session, to highlight market action.

The USD/JPY drifted lower in the back half of Wednesday's trading session after hitting an intraday peak just above 147.80. The pair closed out the midweek session near where it started, close to the 147.00 handle.

Japan's Retail Trade figures are due early in the Pacific trading session, and markets are forecasting a slight uptick in retail trade, with annualized Retail Trade in October expected to tick up from 5.8% to 5.9%. Japanese Industrial Production for the month of October is also expected to improve from 0.5% to 0.8%, and markets will be looking for a healthy print in Japanese Large Retailer Sales for October, which last came in at an even 5.0% in September.

Chinese NBS Purchasing Managers' Index (PMI) figures will be the highlight of the early Thursday trading window, and will set the tone for the rest of the early trading day.

Chinese PMIs are both expected to print slight gains, with the Non-Manufacturing PMI forecast to improve from 50.6 to 51.1 in November, while the headline Manufacturing PMI is expected to inch closer back towards expansionary territory, forecast to edge upwards from 49.5 to 49.7.

Later on Thursday will be another reading of the US Core Personal Consumption Expenditure (PCE) Price Index for October, and markets are expecting the Federal Reserve's (Fed) favorite inflation metric to tick down slightly from 0.3% to 0.2% in the MoM figure as inflation continues to ease back in the US domestic economy.

USD/JPY Technical Outlook

The USD/JPY's downside on Wednesday sees the pair close in the red for a fifth straight day, and the pair is continuing to drift lower after seeing a technical rejection from the 50-day Simple Moving Average (SMA) in the last swing high into 149.50.

The pair has been trading steadily lower after failing to claim the 152.00 major handle in early November's trading, and the pair is set to see technical congestion with price action trading on the south side of the 50-day SMA with long-term prices getting technical support from the 200-day SMA near 142.00.

USD/JPY Daily Chart

USD/JPY Technical Levels

- An inverted hammer in the NZD/USD daily chart, could pave the way for a formation of an evening star, a bearish chart pattern.

- If sellers drag prices below the 200-DMA, that could pave the way toward 0.6000.

- Otherwise, buyers keeping the exchange rate above 0.6100, and the pair could edge toward 0.6200 and beyond.

The NZD/USD registered slim gains on Wednesday after reaching a multi-month high of 0.6208 but retreated and closed at around the 0.6150ish area, forming an inverted hammer. Hence, if the pair slides below the November 29 swing low of 0.6126, that could form an evening star that could send the pair drifting lower.

The daily chart portrays the pair upwards, but price action on Wednesday keeps sellers hopeful of pushing the exchange rates lower to test the 200-day moving average (DMA) at 0.6089. That would form an evening star, with downside risks emerging below the latter, like the latest swing low seen at 0.5996, the November 22 low.

Conversely, if NZD/USD stays above 0.6100 and buyers reclaim 0.6200, that would put into play key resistance levels. Firstly, the July 31 daily high at 0.6225, followed by the July 27 swing high at 0.6273 shy of the 0.6300 mark.

NZD/USD Price Analysis – Daily Chart

NZD/USD Technical Levels

- AUD/USD loses ground near 0.6620 on the modest recovery of USD.

- US economy expanded at an annualized rate of 5.2% vs 4.9% prior, better than expected.

- Australian monthly CPI eased 4.9% YoY from 5.6% in the previous reading.

- Chinese PMI and US Core Personal Consumption Expenditure Price Index (PCE) will be the highlight on Thursday.

The AUD/USD pair loses traction to 0.6620 after retracing from its highest level in almost four months. The downtick of the pair is backed by the recovery of the US Dollar (USD) on diverging Federal Reserve (Fed) official comments on future rate hikes.

The US economic US data have lifted the USD modestly from monthly lows. However, the upside remains capped in the near term as the market is pricing a 25 basis points (bps) rate cut in May 2024 and seems to have abandoned any notion of rates being higher for longer. On Wednesday, the US economy expanded at an annualized rate of 5.2% during the third quarter from the previous reading of 4.9%, above the market consensus of 5.0.

On the Aussie front, the Australian monthly CPI slowed in October, easing from 5.6% to 4.9% YoY. The Reserve Bank of Australia (RBA) Governor Michele Bullock said that current monetary policy is restrictive, with higher rates dampening demand, especially in the context of persistent services inflation.

Market players will keep an eye on China’s PMI data and Australia's Private Credit data on Thursday. That being said, the stronger-than-expected Chinese data could boost the Australian Dollar (AUD) as China is its largest trading partner. Also, the US will release the key figures, including the weekly Jobless Claims, the Core Personal Consumption Expenditure Price Index (PCE) for October, the Chicago PMI, and Pending Home Sales.

- AUD/JPY records a decline for the fourth consecutive day, currently trading at 97.37, a slight drop of 0.05%.

- The Australian Bureau of Statistics reports a slowdown in inflation, with the Consumer Price Index (CPI) rising by 4.9% in October, less than the anticipated 5.2%.

- AUD/JPY traders eye Japanese Industrial Production, Retail Sales and Consumer Confidence.

The AUD/JPY extended its losses for the fourth straight trading day, due to overall Aussie’s Dollar (AUD) weakness, as the latest inflation report showed substantial progress. Hence, traders scale back tightening prospects by the Reserve Bank of Australia (RBA). At the time of writing, the AUD/JPY is trading at 97.37, down 0.05% in early Thursday’s Asian session.

Lower-than-expected inflation data in Australia leads to reduced expectations for RBA tightening, a headwind for AUD/JPY

On Wednesday, the Australian Bureau of Statistics (ABS) revealed the monthly Consumer Price Index (CPI) rose by 4.9% in October, slower than the 5.6% increase in September, below forecasts of 5.2%. Monthly based, CPI slid 0.3%, blamed on lower petrol prices.

Sources cited by Reuters noted, “The lower-than-expected October print is an early Christmas present for households and businesses... That should be enough to save the Reserve Bank Board from having to be the Grinch of Christmas when it meets next week.”

Early in the month, the Reserve Bank of Australia (RBA) decided to lift interest rates from 4.10% to 4.35% due to higher inflation levels. The RBA left the door open for further tightening, if necessary, to achieve its 2 to 3% inflation target.

Money market futures linked to the RBA’s monetary policy see the central bank holding policy steady, though there’s a 50% chance of a rate hike in the first half of 2024.

On the Japanese front, the economic docket would reveal a speech of the Bank of Japan (BoJ) official Nakamura and release of Industrial Production data, Retail Sales, and Consumer Confidence.

AUD/JPY Price Analysis: Technical outlook

The pair has formed a double top, achieving four straight days of losses, with the AUD/JPY drifting more than 100 pips of losses since reaching a weekly high of 98.49. Additionally, last Wednesday's CPI report was the catalyst to push prices below the Tenkan-Sen line at 97.68, which has exacerbated a drop toward 97.39, with sellers targeting the Senkou Span A at 97.04. Further downside risks lie below the November 21 swing low of 96.82, like the Kijun-Sen at 96.41.

- The Aussie has tumbled out of recent consolidation against the Kiwi, closing the gap on 1.0700.

- A hawkish RBNZ is driving the Kiwi higher, sending the AUD/NZD pair back down.

- The Aussie is down three-quarters of a percent against the Kiwi into 1.0750, a five-week low.

The AUD/NZD has declined three-quarters of a percent on Wednesday, heading into the trading day’s close near 1.0750 after backsliding nearly 1.3% peak-to-trough from the day’s peak at 1.0861.

Fueled by a rapid rebalance sparked by a hawkish Reserve Bank of New Zealand (RBNZ), the pair has undergone a dramatic rebalance, shattering the intraday trading pattern and dragging the AUD/NZD out of recent consolidation and into its lowest bids in five weeks.

The Aussie (AUD) has slid straight through the 50- and 200-day Simple Moving Averages (SMA) near the 1.0800 handle, shedding weight against the Kiwi (NZD) to trade on the south side of the last swing low of 1.0780 on the daily candlesticks.

The AUD/NZD is now running directly into a technical support level at 1.0750 that has become familiar in 2023’s back-and-forth momentum swings in the pair, but October’s swing low into 1.0625 has destabilized the technical level somewhat.

On the top end, November’s peak bids just shy of 1.0950 will be the ultimate ceiling on any long-term bullish momentum, while the last swing high into 1.0875 will be the immediate target for bulls to beat.

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Swiss Franc.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.32% | 0.14% | 0.18% | 0.55% | 0.06% | -0.19% | -0.37% | |

| EUR | -0.31% | -0.16% | -0.14% | 0.24% | -0.26% | -0.52% | -0.67% | |

| GBP | -0.15% | 0.16% | 0.04% | 0.39% | -0.11% | -0.37% | -0.51% | |

| CAD | -0.17% | 0.15% | -0.02% | 0.39% | -0.12% | -0.35% | -0.54% | |

| AUD | -0.54% | -0.25% | -0.41% | -0.39% | -0.49% | -0.75% | -0.93% | |

| JPY | -0.07% | 0.24% | 0.09% | 0.12% | 0.51% | -0.25% | -0.41% | |

| NZD | 0.22% | 0.50% | 0.33% | 0.34% | 0.75% | 0.23% | -0.18% | |

| CHF | 0.33% | 0.65% | 0.51% | 0.53% | 0.92% | 0.39% | 0.18% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

AUD/NZD Hourly Chart

AUD/NZD Daily Chart

- NZD/JPY sees a 0.20% uptick, hovering around 90.60 after getting rejected at the cycle high 91.20.

- Indicators on the shorter time frames suggest that the bears are stepping in.

- The bullish trend is intact on a broader scale.

In Wednesday's session, the NZD/JPY is trading at 90.60, modestly higher by 0.20%, retreating from a cycle high of 91.20. The pair's trajectory remains neutral to bullish on the daily chart, as bulls seem to be taking a hiatus after being rebuffed twice at cyclical peaks. On the four-hour chart, indicators suggest that bears are subtly reclaiming influence.

Daily chart indicators reflect a relatively flat yet bullish posture for the NZD/JPY. The Relative Strength Index (RSI) is in positive territory but flat, indicating a minor cooldown in the bullish momentum, perhaps due to the bulls taking a little breather following their pronounced exertions. The Moving Average Convergence Divergence (MACD) histogram echos this sentiment with flat green bars, hinting at sustained but static buying momentum.

Simultaneously, a broader outlook presents an optimistic case. This is captured by the positioning of the pair in relation to its three key Simple Moving Averages (SMAs): the 20-day, 100-day, and 200-day, respectively.

However, switching to the four-hour chart uncovers signs of increasing bearish momentum. Here, the Relative Strength Index (RSI) reveals a negative slope despite being in the positive territory - indicative of the bears ramping up their might. Concurrently, printing read bars, the Moving Average Convergence Divergence (MACD) suggests that the bears are gaining momentum.

Support Levels: 89.85 (20-day SMA), 89.30, 89.00.

Resistance Levels: 91.00, 91.20, 91.30.

NZD/JPY daily chart

-638368920908860697.png)

- The EUR/GBP is dropping into the 0.8640 level on Wednesday as the Euro continues to weaken.

- Eurozone Consumer Confidence held steady while the business outlook declined further.

- Eurozone HICP inflation on the docket for Thursday.

The EUR/GBP is extending its ongoing bearish momentum, slipping into 0.8640 and set for a fifth straight day of declines as the Euro (EUR) continues to give up ground to the Pound Sterling (GBP). The EUR/GBP is only slightly lower on the day, shedding a tenth of a percent in intraday trading, but the pair is set to close in the red for seven of the last eight consecutive trading days.

Thursday brings the latest Eurozone Harmonized Index of Consumer Prices (HICP) inflation, and investors are looking for a continued cooldown in Eurozone inflation. The YoY Core November HICP is forecast to come in at 3.9% versus the previous reading of 4.2%, and the headline annualized HICP inflation is expected to decline from 2.9% to 2.2% for the year into November.

Eurozone Unemployment Rate for October is also slated for release, and is expected to hold steady at 6.5%, in-line with September's print.

EUR/GBP Technical Outlook

The EUR/GBP is dropping away from the 200-day Simple Moving Average (SMA) after making a clean break of the moving average from 0.8680, and the pair is dipping into fresh lows for November heading into the end of the month.

The pair has slid through moving average congestion with the 50-day SMA confirming a bullish crossover of the 200-day SMA, but with the pair bidding steadily lower price action might see a bearish rotation in the 50-day SMA.

Low bids are running into technical support from the rising trendline drawn from August's swing lows into 0.8520.

EUR/GBP Daily Chart

EUR/GBP Technical Levels

The highlight of the Asian session will be China's PMIs. Japan will release Industrial Production, Retail Trade, Consumer Confidence, and Housing Starts. Australia's Private Credit data is also due. Later in the day, Eurostat will release Eurozone CPI. Key US data, including the Core PCE and the weekly Jobless Claims, will be released, which could have a critical impact on the Dollar.

Here is what you need to know on Thursday, November 30:

The US Dollar Index (DXY) rose modestly, recovering from monthly lows. The DXY was unable to hold above 103.00. It remains under pressure, but it offers some signs of stabilization, helped by US economic data. The US economy expanded at an annualized rate of 5.2% during the third quarter, above the previous estimate of 4.9%.

On Thursday, the US will report critical data, including the weekly Jobless Claims and, more importantly, the Core Personal Consumption Expenditure Price Index for October. The latter is expected to show further slowing in consumer inflation, with the annual rate of the Core PCE decreasing from 3.4% to 3%. Later, more data is due with the Chicago PMI and Pending Home Sales.

US yields continue to edge lower, while German and even UK bond yields dropped further. The divergence supported the Greenback but the upside was limited amid risk appetite.

EUR/USD dropped after rising for four consecutive days, unable to hold above 1.1000. The pair found support around 1.0960, and the risk remains tilted to the upside. The Euro did not benefit from German and Spain inflation data, which slowed more than expected.

Analysts at Commerzbank on German inflation:

The decline in November is primarily due to a significantly lower core inflation rate, while the contribution from energy and food was limited. In the next two months, the inflation rate is likely to be slightly higher again due to a number of special effects. In the somewhat longer term, the decisive factor will be the extent to which companies are able to pass on their higher wage costs to their customers. We assume that this effect will stabilize the core inflation rate well above the ECB target in the coming year.

More inflation data is due on Thursday with the Eurozone Consumer Price Index. The annual rate is expected to show an increase of 3.9%, below the 4.2% recorded in October. However, a reading below market consensus should not be a surprise. Germany will report Retail Sales for October and the Unemployment Rate for November.

GBP/USD finished flat just below 1.2700 after hitting three-month highs at 1.2732. The Pound also rose against the Euro, with EUR/GBP falling below 0.8650. The Swiss Franc outperformed on Wednesday.

USD/JPY dropped sharply, reaching 146.68, the lowest level in two months, before rebounding towards 147.30. Data due from Japan on Thursday includes Industrial Production, Retail Sales, Housing Starts, and Consumer Confidence.

Of importance for Antipodean currencies and overall sentiment, China will release the NBS PMIs, which are expected to show an improvement in both the Manufacturing and Non-Manufacturing indices.

USD/CAD rebounded at the 100-Simple Moving Average (SMA) and climbed back to 1.3600. The bias is towards the upside, but the pair is trading around a strong support level. Canada will report Q3 GDP data and September's Monthly Growth figures on Thursday.

Analysts at TD Securities on Canada GDP:

We look for a flat print on Q3 GDP, reflecting another muted performance for households and a large drag from residential investment, which is well below BoC projections for +0.8% and should reinforce expectations that the Bank is done tightening. Industry-level GDP should prove slightly more upbeat with a 0.1% increase but this will be paired with another soft flash estimate for October to anchor Q4 growth below 1%.

AUD/USD rose to its highest level in almost four months and then pulled back as the US dollar recovered strength. The pair held above 0.6600. Australia will report Private Sector Credit for October on Thursday.

NZD/USD posted its highest daily close since late July at 0.6150 but ended far from the top. Following the Reserve Bank of New Zealand's hawkish hold, the pair peaked above 0.6200. The retreat casts doubt about more gains in the short term. On Thursday, New Zealand will release Building Permits data, and the ANZ Business Confidence report is also due.

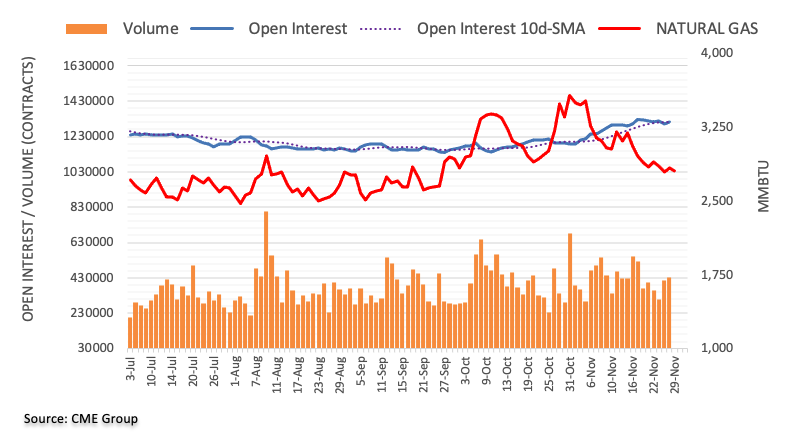

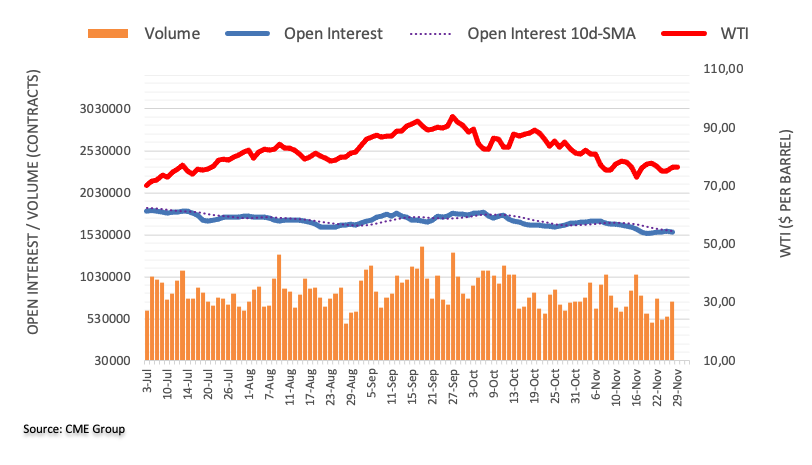

Crude oil prices rose 1.75% in a volatile session. The WTI barrel closed near daily highs, slightly below $78.00, amid speculation about the outcome of Thursday's meeting of the Organization of Petroleum Exporting Countries and its allies (OPEC+).

Gold posted modest daily highs but failed to break above $2,050 despite the decline in government bond yields. Silver ended flat around $25.00.

Like this article? Help us with some feedback by answering this survey:

- The USD/CHF is navigating towards the 0.8700 level, seeing a 0.45% loss.

- The pair tallied a 4-day losing streak, and indicators flash oversold conditions.

- Thomas Barkin from the Fed warned markets about further tightening and stubborn inflation.

- US Q3 GDP was revised upwards, but the Fed's Beige book remarked a slowdown in the US economic activity.

The USD/CHF pair has seen further losses in Wednesday's session, currently trading around 0.8730, its lowest since August. Such downward movement has been largely driven by a broad US weakness amid declines in the US Treasury yields. On the data front, the US revised its Q3 Gross Domestic Product (GDP) to 5.2%, and the Federal Reserve’s (Fed) beige book signalled that the American economy slowed up to November 18.

Regarding expectations on the Fed, Barkin's recent statements regarding the potential for another interest rate hike and doubts about achieving the desired inflation rate of 2% have unsettled the markets, dampening the excitement that followed the last US Consumer Price Index (CPI). The markets had previously been betting on the Federal Reserve nearing the end of its tightening cycle, which has significantly weakened the USD.

That being said, the bank still remains data-dependant, and before the December meeting, it will receive an additional Consumer Price Index (CPI) and a jobs report. On Thursday, the US will report on the Core Personal Consumption Expenditures (PCE) index from October, which investors will closely watch to continue placing their bets on the next Fed moves.

In the meantime, the US government bond yields erased some losses but are still weak. The 2-year rate stands at 4.64%, its lowest since July, and the 5 and 10-year yields are seen at 4.21% and 4.27%, respectively, at their lowest since September.

USD/CHF levels to watch

The indicators on the daily chart reflect bearish momentum for the USD/CHF. The Relative Strength Index (RSI) displays oversold conditions, which traditionally signals a bear-dominated market, although could mean a reversal in the short term. This is reinforced by the asset's positioning below the 20, 100, and 200-day Simple Moving Averages (SMAs), further supporting the idea that the bears are firmly in control in the longer-term perspective. Concurrently, the Moving Average Convergence Divergence's (MACD) rising red bars signal increased near-term selling momentum.

Support Levels: 0.8700, 0.8680, 0.8650.

Resistance Levels: 0.8800, 0.8850, 0.8890 (100-day SMA).

USD/CHF daily chart

-638368852376308971.png)

- GBP/JPY daily chart depicts the formation of double top chart pattern.

- If the pair drops below the Kijun-Sen, expect further downside toward 180.76, due to double top’s confirmation.

- Buyers maintaining the exchange rate above 187.00, could increase the odds of challenging the YTD high.

The GBP/JPY drop extended to three straight days, as it printed losses of 0.09% late in the New York session, with the pair exchanging hands near its opening price at around 187.07.

Even though the GBP/JPY is trading with a negative bias, it has failed to extend its losses below the 187.00 figure, which could have exposed the Tenkan-Sen level at 186.55. A breach of the latter would likely resume the ongoing downtrend, with sellers eyeing the Senkou Span A at 185.63, followed by the Kijun-Sen support at 184.71.

Given the fact that a ‘double top’ chart pattern is pending further confirmation, a daily close below the abovementioned Kijun-Sen level would validate the pattern, which is targeting the October 30 swing low of 180.76.

On the other hand, keeping the spot price above the Tenkan-Sen and the 187.00 mark could put into play a test of the year-to-date (YTD) high seen at 188.65.

GBP/JPY Price Analysis – Daily Chart

GBP/JPY Technical Levels

- WTI Crude Oil climbs over 1%, trading around $77.65, rebounding from a low of $75.74.

- The rise in Oil prices is influenced by a delayed OPEC+ meeting, sparking speculations of further production cuts.

- Expectations of extended production cuts by Saudi Arabia and Russia into the first quarter of 2024 also drive higher Oil prices.

The US Crude Oil benchmark, also known as West Texas Intermediate (WTI), advances more than 1% on Wednesday as attention turned to a delayed OPEC+ meeting. That, alongside a softer US Dollar (USD) due to dovish remarks by Fed’s Governor Christopher Waller, a former “hawk,” weighed on the buck. At the time of writing, WTI is trading at $77.65 after bouncing off daily lows of $75.74.

West Texas Intermediate (WTI) sees an uptick as market anticipates OPEC+ decisions and reacts to a dovish US Federal Reserve stance

Oil is trading positively even though the US weekly inventory report showed increased Crude Oil inventories. In the meantime, the US Dollar Index (DXY) is dropping 0.07%, exchanging hands at 102.66, unable to gather traction after the US economy grew faster than expected.

In the meantime, the OPEC+ delayed meeting keeps investors nervous on speculations for further crude Oil production cuts. The producer group noted that Oil supply cuts and a rollover of existing curbs is possible.

Sources cited by Reuters noted that "Prices are going to remain volatile until we get greater clarity out of OPEC."

The rise in Oil prices is due to expectations that Saudi Arabia and Russia will extend their production cuts of 1.3 million barrels to the first quarter of 2024. The US Energy Information Administration (EIA) reported a surprise build in US crude Oil and distillate fuel stocks last week, indicating weak demand.

A storm in the Black Sea is another factor underpinning WTI price, with supply expected to take a toll of up to 2 million barrels per day (bpd) unable to be delivered due to weather conditions.

Kazakhstan's largest Oilfields are cutting combined daily Oil output by 56% from November 27, the Kazakh energy ministry said.

WTI Technical Levels

- The EUR/USD is cycling the 1.0990 level as Euro bidders lack the conviction to decisively reclaim 1.1000.

- Markets are still over leaning into risk-on territory, but weak points remain.

- Fedspeak and better-than-expected US GDP figures are cooling market hopes of accelerated Fed rate cuts.

The EUR/USD captured the 1.1000 major handle on Tuesday, but Euro (EUR) bidders couldn't maintain bullish momentum against the US Dollar (USD), and the pair fell back below the major handle to churn between 1.0990 and 1.0960 in Wednesday's trading session.

Wednesday's US Gross Domestic Product (GDP) growth print came in above expectations with real GDP growth printing at an annualized 5.2% against the forecast 5.0%, extending over the previous print of 4.9%.

EUR/USD set to grind around familiar levels ahead of European HICP

Thursday sees Eurozone Harmonized Index of Consumer Prices (HICP) for November, followed by the US' Personal Consumption Expenditure (PCE) Price Index figures for October.

Eurozone HICP and US PCE are both expected to show a slow decline in headline inflation, with the MoM November HICP forecast to print at 3.9% compared to October's 4.2%, while the US Core October PCE is forecast to come in at 0.2% versus the previous 0.3%. Annualized US PCE inflation is expected to print at 3.5% for the year into October compared to the previous period's 3.7%.

EUR/USD Technical Outlook

The EUR/USD has been on a steady climb ever since the Euro crashed through the 200-day Simple Moving Average (SMA) near 1.0800, and the pair is running into technical resistance from the 1.1000 handle.

With the 50-day SMA still drifting on the low side of the 200-day SMA, a bullish crossover of the two moving averages will go a long way towards providing technical support for a sustained move higher, though the EUR/USD may need to fall back into the 1.0850 region to kick that off.

The Euro has climbed over 5% against the US Dollar since October's swing low into 1.0450, and the EUR/USD is holding in the green for the year, but 2023's mid-year peak at 1.1275 is weighing on the long-term trend as the pair gets weighed down near 1.1000 with technical indicators leaning into overbought territory.

EUR/USD Daily Chart

EUR/USD Technical Levels

According to Federal Reserve’s Beige Book, “economic activity slowed since the previous report”. The report was prepared based on information collected before November 18.

The Beige Book mentioned that demand for labor continued to ease and price increases largely moderated.

Key takeaways from the Beige Book:

Economic activity was flat or down slightly on balance, as prices held mostly steady and labor demand slowed. Retail results were mixed but neutral on average, and restaurant sales fell slightly.

Manufacturers reported modest recent revenue declines, and a few experienced sharp reductions in demand from a year earlier. Staffing services contacts enjoyed modest gains in revenues but noted a slowdown in hiring plans among their clients.

Residential home sales were flat at very low levels, and sales were not expected to rebound until interest rates fell. Commercial real estate activity slowed modestly, and the outlook for office properties was increasingly dim. Outside of real estate, contacts on balance were cautiously optimistic for at least stable activity moving forward.

Employment appeared stable on balance, but hiring activity and hiring plans were dialed back noticeably in some sectors. Wage growth was moderate on average and eased further overall.

Prices were stable on average across First District contacts.

Market reaction

The US Dollar trimmed gains modestly after the report, and equity prices in Wall Street hit fresh daily highs. The US Dollar Index erased gains and is hovering around 102.65, after losing strength during the American session.

- Spot Gold is caught in the middle as buyers and sellers play tug-of-war on Wednesday.

- Intraday price action holding on the high end after Tuesday's afternoon rally.

- XAU/USD is looking to catch a foothold on the $2,050 level.

Gold prices are continuing to drift into the upside, holding on the high side of $2,040 on Wednesday. Gold hit its highest bids in six months.

The XAU/USD briefly ticked over $2,050 in the early Wednesday session before slipping back into $2,035, and Spot Gold is now testing back towards $2,050 heading into the back segment of the day's trading session. The day's bullish target will be setting fresh daily highs above $2,052.

An upside beat for US Gross Domestic Product (GDP) growth figures is mixing with surprisingly hawkish Fedspeak from Federal Reserve (Fed) Bank of Richmond President Tom Barkin, who noted that rate hikes might not be entirely off the table if inflation resumes climbing.

US Real GDP grows, Fedspeak sends mixed messages

US quarterly GDP growth clocked in at 5.2% for the third quarter, beating the market forecast of 5.0% and climbing over the previous quarter's 4.9% showing.

Next up on the economic calendar will be Thursday's US Personal Consumption Expenditure (PCE) Price Index for the month of October.

Wall Street is expecting PCE inflation, the Fed's favored method of measuring price growth, to print a slight downtick with investors hoping that inflation continues to cool at a steady pace in the US.

MoM PCE inflation is expected to come in at 0.2% vs 0.3%, while the annualized period into October is expected to print at 3.56% versus September's 3.7%.

Federal Reserve Bank of Richmond President Tom Barkin stated on Wednesday that he is unwilling to take further rate hikes off the table once and for all, noting that he believes inflation will remain stubborn for longer than markets are currently pricing in.

Richmond Fed President Barkin remains skeptical that US inflation will be returning to 2% anytime soon without active involvement from the Fed.

XAU/USD Technical Outlook

Spot Gold continues to bid into the high end, staring straight down the mouth of 2023's highs around $2,080, and the pair is drifting higher as markets continue to push up the XAU/USD after decisively reclaiming the $2,000 handle on Monday.

Gold continues to rally after catching a rebound from the 200-day Simple Moving Average (SMA) near $1,940, and upside price action is seeing a squeeze in the moving averages, with the 50-day SMA set for a bullish crossover of the 200-day SMA as long as topside momentum holds.

XAU/USD Daily Chart

XAU/USD Technical Levels

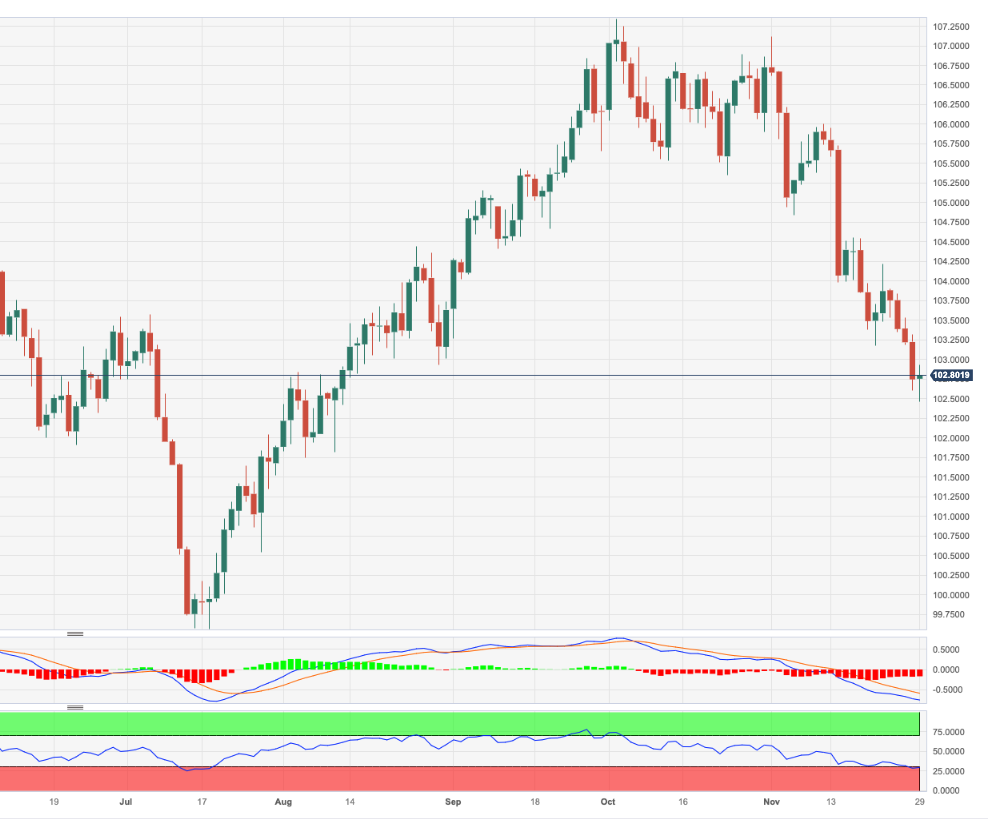

- The DXY Index is bearing a slight uptick, lingering nearing three-month lows.

- US annualized Q3 GDP estimate was revised upward to 5.2%.

- Markets await October Core PCE inflation on Thursday.

The US Dollar (USD) Index (DXY) is seeing modest growth, trading at 102.85 on Wednesday. The DXY found traction due to robust revisions in Gross Domestic Product (GDP) figures for Q3 arriving before Thursday's Personal Consumption Expenditures (PCE) inflation data for October. The Greenback is also getting interest on the back of hawkish words from Federal Reserve’s (Fed) Thomas Barkin, who did not rule out another hike this cycle.

Despite the mixed labour market and cooling inflation, Fed officials aren't excluding the possibility of further policy tightening, thereby adopting a slightly hawkish stance. This seems to be an attempt to prevent any potential inflation slips and reflects the delicate balance the central bank is trying to maintain. That being said, it will come down to the incoming data, and Thursday’s PCE figures from October will have an impact on expectations for coming Fed decisions.

Daily Market Movers: US Dollar rises on strong GDP revisions and hawkish words from Thomas Barkin

- Amid optimism of a soft landing, the US Dollar trades with mild gains today. The driving factors are the revised Q3 GDP data.

- The GDP was revised to 5.2%, surpassing the consensus estimate of 5% and the previous estimate of 4.9%.

- Elsewhere, Thomas Barkin from the Fed stated that he is not confident that inflation is on track to reach the bank’s 2% target, and he didn’t rule out another rate hike.

- Meanwhile, US Treasury yields are currently dipping but trimmed some of the daily declines. The 2-year, 5-year and 10-year yields stand at 4.65%, 4.21% and 4.27%, respectively.

- Markets await Thursday’s Core PCE figures from October, the Fed’s preferred inflation gauge, which is expected to have decelerated to 3.5% YoY from 3.7% in September.

- Meanwhile, the CME FedWatch Tool suggests that the Fed won’t hike in the December meeting, and the markets are foreseeing rate cuts beginning in May 2024.

Technical Analysis: US Dollar under bearish pressure, RSI in oversold territory

Indicators on the daily chart are painting a bearish picture for the US Dollar. The Relative Strength Index (RSI) position suggests an overwhelming selling momentum standing flat at 30. Concurrently, the Moving Average Convergence Divergence (MACD) histogram displays a descending trajectory indicative of ongoing bearishness. The bear control is further affirmed by the currency's position in relation to the Simple Moving Averages (SMAs).

On a broader scale, the asset is trading beneath the 20, 100 and 200-day SMAs, underlining the prevailing strength of the bears. In this challenging scenario, buying momentum is noticeably struggling. These technical signals derived from the RSI, MACD and SMAs collectively point toward continued bearish dominance for the US Dollar in the immediate term.

Support levels: 102.50, 102.30, 102.00.

Resistance levels: 103.60 (200-day SMA), 104.00, 104.20 (100-day SMA)

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- US economy growth for Q3 was reported at 5.2%, above forecasts, indicating robust investment but reduced household spending.

- Federal Reserve officials are divided on future monetary policy, with some suggesting a more dovish approach.

- GBP/USD pair's outlook remains bullish in light of recent comments from Fed Governor Christopher Waller, suggesting the possibility of rate cuts.

The British Pound (GBP) clings to minimal gains vs. the Greenback (USD) in the mid-North American session after data from the United States (US) showed the economy remains resilient and growing above trend. Nevertheless, some Federal Reserve (Fed) officials remained dovish, while investors began to price in a dovish Fed. The GBP/USD is trading at 1.2703, slightly above the 1.2700 figure.

Pound Sterling remains underpinned by expectations for more than 100 bps of rate cuts by the Fed in 2024

Before Wall Street opened, a report by the US Bureau of Economic Analysis (BEA) revealed the US economy grew faster than the 5.0% expected, rising by 5.2% in Q3, above the second quarter's 2.1%. The data showed investment picked up while households cut expenses, which could pave the way for a slower reading in the next quarter. Even though the country grows above trend, Fed policymakers split views of policy sufficiently restrictive or keeping the door open for rate increases.

Atlanta Fed President Raphael Bostic said he sees slower growth and declining inflation pressures within the current monetary policy stance. Meanwhile, Richmond Fed President Thomas Barkin expressed skepticism about inflation, reaching the Fed's target and keeping the option of higher interest rates open.

Across the Atlantic, the Pound Sterling failed to gain traction after UK consumer credit data showed that British increased the pace of borrowing by the most in five years, along with hawkish comments of the Bank of England’s (BoE) Governor Andrew Bailey, who said the “will do what it takes” to get inflation to its 2% target.

Given the backdrop, the GBP/USD must likely remain bullish after yesterday’s remarks of Fed Governor Christopher Waller, who opened the door for rate cuts. Since then, money market interest rate futures foresee 115 bps of rate cuts by the Fed next year, higher than yesterday morning’s 85 bps. That said, if the major stays above 1.2700, a challenge of 1.2800 is on the cards.

GBP/USD Price Analysis: Technical outlook

After printing a multi-month high at 1.2733, the GBP/USD retreated below the 1.2700 figure, opening the door for a pullback. As of writing, the pair is forming a ‘doji,’ suggesting indecision amongst traders. Furthermore, a daily close below 1.2690 could exacerbate a pullback to the November 28 low of 1.2606, ahead of the 1.2600 figure. A bullish scenario is seen if buyers lift the exchange rate above 1.2700 and achieve a daily close above that level. The following critical resistance level to test will be 1.2733, followed by the 1.2800 mark.

- The USD/JPY is recovering back into Wednesday's opening bids after US GDP beats the street.

- US GDP growth accelerated in the third quarter, Japan Retail Trade figures in the barrel.

- Fedspeak is pulling markets in multiple directions after a hawkish showing from Fed's Barkin.

The USD/JPY is pulling back towards the day's early bids near 147.50 as the US Dollar gets a choppy boost from better-than-expected US Gross Domestic Product (GDP) growth figures and a hawkish appearance from Federal Reserve (Fed) officials to balance out Tuesday's hawkish Fedpeak.

Wednesday gives way to early Thursday markets, where Japan will be releasing its latest Retail Trade and Large Retailer Sales numbers for October.

US GDP grew more than expected in the third quarter, printing at 5.2% versus the expected QoQ print of 5.0%, climbing up and over the previous quarter's 4.9%.

Adding to USD-bullish factors, the Fed's Richmond President Tom Barkin hit markets with hawkish statements that take some of the wind out of Tuesday's dovish comments from Fed policymakers.

Fed’s Barkin: Not willing to take another interest rate hike off the table

The Fed's Barkin believes that inflation will remain more stubborn than markets are expecting looking forward, and Barkin can't rule out even further rate hikes if price growth continues to plague the US.

Coming up early on Thursday, Japan's latest retail sales figures will come in for a landing. Market forecasts see Japanese Retail Trade for the year into October finding a slight improvement from 5.8% to 5.9%.

Monthly Retail Trade saw a -0.1% print in September, while Large Retailer Sales for October saw a flat 5% print.

USD/JPY Technical Outlook

The USD/JPY is seeing a light rebound after dipping below 147.00 in Wednesday's trading session, but upside momentum remains limited and it's getting difficult to ignore the fact that the US Dollar is down nearly 3.5% from multi-year peaks set in November just below the 152.00 major handle.

The pair is set to see a technical ceiling from the 50-day Simple Moving Average (SMA) near the 150.00 major handle, while long-term downside momentum will be set to run aground on the 200-day SMA near 142.50.

USD/JPY Daily Chart

USD/JPY Technical Levels

- Canadian Dollar is seeing mixed results but drops against US Dollar on Wednesday.

- Canada Current Account posts smaller rebound than expected.

- US GDP outpaces expectations, weighing on Tuesday’s Fed pivot expectations.

The Canadian Dollar (CAD) is mixed against the other major currencies on Wednesday and paring back recent gains against the US Dollar (USD). The Loonie has fallen back three-tenths of a percent against the Greenback on the day.

Canada’s trade balance rebounded in the third quarter but still missed expectations with the Canadian Current Account printing a CAD $-3.22 billion decline. The second quarter’s print was revised even lower to $-7.32 billion.

Daily Digest Market Movers: Canadian Dollar draws back against Greenback as markets twist

- Canadian Current Account was expected to post a billion CAD gain but shrunk by an additional $3.22 billion on Wednesday.

- The previous print also got revised lower from $-6.63 billion, steepening the CAD’s trade imbalance.

- US Gross Domestic Product (GDP) growth beat the market to post an accelerated 5.2% for the third quarter, beating the forecast for 5.0% and the second quarter’s 4.9% growth.

- US Personal Consumption Expenditure (PCE) Prices for the third quarter missed expectations, and mixed data results are clouding the USD’s outlook.

- PCE Prices ticked lower to 2.8%, markets were expecting a hold at the second quarter’s print of 2.9%.

- Fedspeak is back on the offering on Wednesday after Tuesday’s comments sparked a broad-market bid.

- The President of the Federal Reserve (Fed) Bank of Richmond hit newswires in the US market session, striking a notably more hawkish tone than Fed Governor Christopher Wallace on Tuesday.

- President Barkin remains skeptical that 2% inflation can be achieved from here without additional tightening or at least maintaining the Fed’s “higher for longer” stance.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the Swiss Franc.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.37% | 0.30% | 0.34% | 0.76% | 0.20% | 0.09% | -0.18% | |

| EUR | -0.36% | -0.05% | -0.03% | 0.37% | -0.17% | -0.29% | -0.55% | |

| GBP | -0.31% | 0.05% | 0.04% | 0.44% | -0.12% | -0.25% | -0.48% | |

| CAD | -0.33% | 0.04% | -0.03% | 0.44% | -0.14% | -0.24% | -0.53% | |

| AUD | -0.76% | -0.38% | -0.44% | -0.43% | -0.55% | -0.65% | -0.92% | |

| JPY | -0.20% | 0.18% | 0.11% | 0.14% | 0.58% | -0.09% | -0.37% | |

| NZD | -0.06% | 0.27% | 0.22% | 0.25% | 0.68% | 0.11% | -0.27% | |

| CHF | 0.17% | 0.54% | 0.48% | 0.51% | 0.94% | 0.37% | 0.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Canadian Dollar falls back against Greenback, USD/CAD claws back recent losses, looks to price in floor from 1.3550

The Canadian Dollar (CAD) is paring away recent gains against the US Dollar (USD), sending the USD/CAD back a third of a percent from Wednesday’s low bids near 1.3550.

The USD/CAD still has some room to fall before coming into contact with the 200-day Simple Moving Average (SMA) near 1.3520, but an extended rebound will see a technical ceiling from the 50-day SMA just below 1.3700.

The pair is still seeing some pull from the rising trendline drawn from July’s lows near 1.3100, and the USD/CAD’s recent decline through the technical barrier sees the Loonie beginning to run out of bearish chart space with technical indicators leaning toward the oversold side.

The Relative Strength Index (RSI) is approaching oversold conditions, while the Moving Average Convergence-Divergence (MACD) indicator has the fast signal line declining below the midline, a sign that selling pressure could run out of steam in the near future.

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- The AUD/USD pair is currently trading at 0.6621, showing a decline of 0.39%.

- The US economy's growth rate in Q3 was reported at 5.2%, surpassing the expected 5% and marking the fastest growth in nearly two years.

- AUD/USD traders eye the release of US Core PCE figures, along with employment data.

The Australian Dollar (AUD) extended its earlier losses against the US Dollar (USD) on Wednesday after the US economy in the third quarter, grew at a faster pace than expected, suggesting the US Federal Reserve’s job is not done. That, along with a softer Australia’s inflation reading, weighed on the AUD/USD, which trades at 0.6621, down by 0.39%.

Australian Dollar falls against the US Dollar, though would remains bullish above 0.6600

The US Bureau of Economic Analysis (BEA) revealed the economy grew at 5.2% in Q3, exceeding forecasts of 5%, and the fastest rhythm in almost two years. The data showed that business investment picked up while household consumption eased, indicating that the services segment might slow down in the near term. Even though the reading was positive and sponsored a leg-down in the pair, consumers continued to feel the pain of higher interest rates.

Despite the data, investors had priced in more than 115 bps of rate cuts by the Fed in 2024. This is reflected by the fall in US Treasury bond yields, with the 10-year benchmark note sitting at 4.27%, its lowest level since September 14. In the meantime, the US Dollar Index (DXY) trades solid with gains of more than 0.15%, up at 102.93.

Over in Australia, the Consumer Price Index (CPI) for October dipped to 4.9% from 5.6% in October, sponsored by lower prices in goods, petrol, holiday and travel costs. Traders were expected CPI at 5.2%, which were caught off guard, sending the AUD/USD sliding, as investors expect a less hawkish Reserve Bank of Australia (RBA), which lifted rates 25 bps earlier this month, to 4.35%.

Ahead in the calendar, the US calendar will feature the Fed’s preferred gauge for inflation, the Core Personal Consumption Expenditures (PCE) price index, along with employment data on Thursday. The Aussie’s docket will feature Building Permits and Housing Credit data.

AUD/USD Price Analysis: Technical outlook

After reaching a four-month high, the AUD/USD forms a two-candlestick ‘dark cloud cover’ chart pattern, suggesting the pair could drop further. Although downside risks remain, sellers must drag prices below the 0.6600 figure and the 200-day moving average (DMA) at 0.6580. Once those levels are breached, the next demand area would be the 0.6500 mark. On the other hand, if buyers keep the exchange rate above 0.6600, that could set the stage for a rally toward 0.6700.

- The XAG/USD hovers around the $25.00 level after retreating from May highs around $25.25

- Hawkish words from Fed's Barkin made US yields recover somewhat. Still, they stand at multi-month lows.

- All ayes are on Thursday’s PCE figures from the US from October.

In Wednesday's session, the Silver spot price XAG/USD trimmed daily gains, stabilising at $25.00 after reaching a multi-month high of $25.25 earlier in the session. The retracement was largely influenced by the hawkish words of the Federal Reserve (Fed) Thomas Barkin, which seemed to have spooked markets. Market focus is still on Thursday’s October Core Personal Consumption Expenditures (PCE) figures.

In line with that, Barkin stated that he is not ruling out the possibility of another interest rate hike and remains sceptical about achieving the target inflation rate of 2%. He also mentioned that inflation will be more stubborn than expected, which seems to limit the hype after the last Consumer Price Index (CPI) from the US, which made markets bet on the Fed approaching the end of its tightening cycle.

In the meantime, the US government bond yields erased some losses but are still weak. The 2-year rate stands at 4.65%, its lowest since July, and the 5 and 10-year yields are seen at 4.21% and 4.27%, respectively, at their lowest since September. That being said, as long as the US yields continue to edge lower, the grey metal may see further upside. For Thursday’s session, the US will report October’s PCE figures, the Fed’s preferred gauge of inflation, which may affect the bond markets as they will model the expectations of the bank’s next steps.

XAG/USD levels to watch

The indicators on the daily chart are a positive outlook for the metal, but a correction may be on the horizon. On the one hand, the Relative Strength Index (RSI) position, which indicates overbought conditions and seems to be flattening, suggests that selling pressure could soon rise as the market temperature comes down from heated levels. This ties in with the recent behaviour of the bulls, who seem to take a breather after steering the currency pair to highs since early May.

The Moving Average Convergence Divergence (MACD), on the other hand, with its rising green bars, points to an increasing buying momentum. This indicates that there is a strong bullish sentiment at play, lifting upward pressure. This perception is also supported by the pair's positioning over the Simple Moving Averages (SMAs), more specifically, the 20, 100, and 200-day SMAs.

Support Levels: $24.90, $24.50, $24.30.

Resistance Levels: $25.50, $25.70, $26.00.

XAG/USD daily chart

-638368717605334516.png)

Economists at Wells Fargo see potential for pronounced US Dollar depreciation as 2024 progresses across a wide range of economic scenarios.

US Dollar closing in on turning lower

While US economic outperformance could support the Greenback into early next year, we expect broad US Dollar depreciation as 2024 progresses.

Progress on the inflation front means Fed rate cut risks are tilted toward sooner rather than later, which should limit Greenback gains.

A hard landing or US recession next year would see interest rate and growth trends swing against the US currency. A soft US landing, combined with inflation progress and lower US yields, could support broader financial market sentiment, which would also weigh on the ‘safe-haven’ support for the USD.

As the global monetary policy cycle turns to easing, broad US Dollar depreciation is looking increasing likely across a wide range of scenarios.

The Fed’s preferred inflation gauge, the Core Personal Consumption Expenditure (PCE), will be released by the US Bureau of Economic Analysis (BEA) on Thursday, November 30 at 13:30 GMT and as we get closer to the release time, here are the forecasts of economists and researchers of seven major banks.

Headline PCE is expected at 3.1% year-on-year vs. the prior release of 3.4%, while core PCE is expected to decline two ticks to 3.5% YoY. If so, headline would be the lowest since the first quarter of 2021 but still well above the Fed’s 2% target.

Commerzbank

Prices are likely to have risen by 0.1% in October compared with September and by 0.2% excluding energy and food (core rate). The PCE deflator would therefore also indicate that inflationary pressures are easing. However, the YoY rates of 3.0% and 3.5% (core rate) would still be well above the central bank's target of 2%.

ING

Data flow includes the Fed’s favoured measure of inflation, which we expect to show a 0.2% MoM rate of price increases. This is broadly in line with what the central bank wants to see and, if repeated over time, would bring the annual rate of inflation as measured by the core personal consumer expenditure deflator back to 2%.

SocGen

Our PCE deflator forecast is just 0.0% and in line with the previously reported CPI for October.

NBF

The annual core PCE deflator, for its part, may have progressed 0.2% MoM in October, a result which should translate into a 2-tick decline of the 12-month rate to 3.5%. Although still high, this would still be the lowest rate observed in 30 months.

Citi

We expect a 0.17% MoM increase in core PCE inflation in October based on elements of softer-than-expected 0.23% core CPI and October PPI with a decline in lodging away from home (hotel prices) and key shelter prices, namely owners’ equivalent rent, moderating further. This will provide less of a boost to PCE inflation compared to September. Overall, we expect a softer 0.14% increase in core services prices excluding housing after a stronger 0.42% increase in September while ‘super core’ inflation could be somewhat stronger in November and may rebound in December.

TDS

Weaker than expected core CPI inflation at 0.2% MoM augurs well for core PCE prices in October. Indeed, we forecast a similar increase for the latter at 0.2% MoM, which should be reflected on a new decline in the YoY rate to 3.6% from 3.7% in September — its lowest YoY pace since April 2021. Slowing momentum should also be expressed in moderating core PCE services ex-housing inflation which likely printed 0.2% MoM, down from 0.4% in September. We also look for the headline PCE index to advance 0.1% MoM and 3.3% YoY in October.

CIBC

PCE deflator will be flat in month-over-month terms. With the earlier October retail, labour and CPI reports providing many clues, and the Fed in a more patient stance, we don’t expect any material surprises and relatively low market sensitivity to the release.

- Mexican Peso advance is capped by the Greenback as the economy in the United States (US) remains solid.

- The OECD predicts a slowdown in Mexico’s economy, largely due to a cooling US economy impacting Mexican exports.

- Fed Waller’s dovish remarks limit the USD/MXN advance, as traders anticipate over 100 bps rate cuts from Fed in 2024.

Mexican Peso (MXN) retreats against the US Dollar (USD) in an early trading session on Wednesday after the US Department of Commerce revealed the economy in the United States (US) is growing above trend, which could warrant further action by the US Federal Reserve’s (Fed). Consequently, the USD/MXN bounces off its daily lows and trades near the highs of the 17.15/17.20 range, up 0.12% on the day.

Mexico’s economic docket remains light. On Thursday, October’s unemployment rate is expected to be 2.8%, a tick lower than in September. Meanwhile, the Organization for Economic Co-operation and Development (OECD) released the 2024 economic outlook for Mexico, in which the economy is expected to expand at a slower pace of 2.5%, down from a 3.4% growth rate registered in 2023. The report cites the moderation of the US economy, which would likely dampen Mexico’s exports. The OECD suggests the Bank of Mexico (Banxico) monetary policy must remain restrictive, as inflation is estimated to dip to 3.9% and 3.2% in 2024 and 2025, respectively.

Across the border, the US economy grew faster than expected, the US Bureau of Economic Analysis (BEA) reported, sponsoring a leg-up in the US Dollar Index (DXY), which tracks the performance of the Greenback versus six currencies. The DXY climbs 0.23%, up at 102.95, a headwind for the USD/MXN.

Daily digest movers: Mexican Peso weakens as the USD/MXN rises to 17.15 following US data

- The US Gross Domestic Product (GDP) for Q3 rose by 5.2% QoQ, exceeding estimates of 5%.

- The US Advancement Goods Trade Balance registered a deficit of $89.8 billion in October, widening $3.5 billion from the $86.3 deficit in September.

- On Tuesday, Fed Governor Christopher Waller, a former hawk, commented that there are good economic arguments that rates could be lowered if inflation continues falling for several months.

- A day after Fed Waller's comments showed interest rates, traders expect 115 basis points of rate cuts by the US central bank in 2024.

- On November 27, Banxico’s Deputy Governor, Jonathan Heath, commented that core prices must come down more, adding that one or two rate cuts may come next year, but “very gradually” and “with great caution.”

- On November 24, a report revealed the economy in Mexico grew as expected in the third quarter on an annual and quarterly basis, suggesting the Bank of Mexico would likely stick to its hawkish stance, even though it opened the door for some easing.

- Mexico's annual inflation increased from 4.31% to 4.32%, while core continued to ease from 5.33% to 5.31%, according to data on November 23.

- The financial markets' narrative that the US Federal Reserve (Fed) is done hiking rates has kept the Greenback on the backfoot, but today, it has found some relief.

- Data published earlier this month showed prices paid by consumers and producers in the US dipped, increasing investors' speculations that the Fed’s tightening cycle has ended.

- A Citibanamex poll suggests that 25 of 32 economists expect Banxico's first rate cut in the first half of 2024.

- The poll shows “a great dispersion” for interest rates next year, between 8.0% and 10.25%, revealed Citibanamex.

- The same survey revealed that economists foresee headline annual inflation at 4.00% and core at 4.06%, both readings for the next year, while the USD/MXN exchange rate is seen at 19.00, up from 18.95, toward the end of 2024

Technical Analysis: Mexican Peso loses strength though the USD/MXN bias remains bearish below the 200-day SMA

Even though the USD/MXN reached a new week high of 17.22, buyers barely cling to minuscule gains. The 20-day Simple Moving Average (SMA) is about to cross below the 100-day SMA, both at around 17.34, signaling the downtrend is gaining steam. If the pair drops below 17.05, the next support would be the 17.00 figure, ahead of challenging the year-to-date (YTD) low of 16.62.

Conversely, if buyers achieve a daily close above the November 21 high at 17.26, that would put into play a test of the confluence of the 20 and 100-day SMAs at 17.34. Further upside is seen at the 200-day SMA at 17.58.

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Tom Barkin, President of the Federal Reserve (Fed) Bank of Richmond, said on Wednesday that he is unwilling to take another interest rate hike off the table. He believes that inflation will be more stubborn than what they would like. In an interview on CNBC, he considered that talks about rate cuts are premature.

Barkin said he is sceptical about being on track for a 2% inflation. He warned that many service prices are still going up, driven by wages.

Market reaction

The US Dollar holds modest daily gains, recovering from monthly lows. The DXY is up by 0.15%, at 102.90.

- The New Zealand Dollar surges higher following the RBNZ policy meeting on Wednesday.

- Although the RBNZ left interest rates unchanged, commentary from Governor Orr suggested the possibility of further rate hikes.

- NZD/USD pushed to a new peak above 0.6200 following the meeting, extending its short-term uptrend.

The New Zealand Dollar (NZD) trades higher on Wednesday after rallying following the Reserve Bank of New Zealand (RBNZ) meeting in the early hours. Although the RBNZ left the Official Cash Rate unchanged, the Kiwi rose after RBNZ Governor Adrian Orr said he would not rule out further interest rate hikes if inflation remained elevated. The prospect of higher interest rates is bullish for currencies as it attracts higher capital inflows.

Daily digest market movers: New Zealand Dollar surges after RBNZ meeting

- The New Zealand Dollar rallies after the RBNZ Governor mentions the possibility interest rates could rise even higher in the future, depending on the outlook for inflation.

- The bank left the Official Cash Rate (OCR) at 5.50% at the meeting, however, as markets had expected.

- The hawkish tone of press conference after the meeting surprised many investors as New Zealand data – though still elevated – has come out below expectations recently, suggesting, if anything, interest rates are at risk of being cut.

- Official data from Statistics New Zealand (Stats NZ) showed that the Consumer Price Index (CPI) in the 12 months to September rose 5.6%, lower than expectations of 5.9% and the prior quarter’s reading of 6.0%. On a quarterly basis, New Zealand’s inflation increased to 1.8% but fell short of expectations of 2.0%.

- New Zealand's Unemployment Rate climbed to 3.9% in the September quarter, compared with 3.6% last quarter.

- The new center right-wing coalition government has plans to change the RBNZ’s dual mandate, which combines maintaining price stability with full employment. They want to scrap the employment part and for the RBNZ to focus on price stability.

- Preliminary talks between the new government and RBNZ officials were characterized as being “constructive” by Orr, suggesting the bank may be open to changing to a single mandate.

- Such a move would enable the RBNZ to be more single-minded about bringing inflation down using higher interest rates and regardless of the impact on the economy and labor market, it thus could be viewed as a hawkish development and bullish for NZD.

New Zealand Dollar technical analysis: NZD/USD peaks above 0.6200

NZD/USD – the number of US Dollars that can be bought with one New Zealand Dollar – peaks above 0.6200 after rallying following the RBNZ policy meeting. Although it has pulled back down since, the pair remains in a short and medium-term bullish trend, which continues to bias longs over shorts.

The MACD momentum indicator is rising in line with price suggesting the short and medium-term uptrend is healthy.

-638368673502594067.png)

New Zealand Dollar vs US Dollar: Daily Chart

Last night’s post-RBNZ surge means a possible bullish inverse head and shoulders (H&S) pattern which formed at the autumn lows has almost reached its conservative price target of 0.6215.

The pair may be in the process of forming a bearish shooting star Japanese candlestick pattern on Wednesday. If the candlestick retains its shape at the end of the day and is followed by a strong bearish candle on Thursday, it could signal a short-term bearish correction.

A break above the current 0.6208 highs, however, would add impetus to the short and medium-term uptrend. The next major resistance level is then at 0.6238, where the 100-week Simple Moving Average (SMA) resides followed by 0.6274, the July 27 highs.

-638368673994987303.png)

New Zealand Dollar vs US Dollar: 4-hour Chart

A possible bearish ending wedge price pattern, which formed on the 4-hour chart, failed to signal a move lower as price actually broke out to the upside extending the uptrend. Whilst this could mark an exhaustion move more downside would be required to confirm.

A possible tweezer top Japanese candlestick reversal pattern may have formed at the highs (circled). This is a short-term bearish signal. The pair is already finding support from the upper boundary line of the wedge at 0.6140. If it pulls back any lower, it could find support at the lower boundary line, at 0.6080.

The long-term trend is still overall bearish, suggesting a risk of a recapitulation remains.

New Zealand Dollar FAQs

What key factors drive the New Zealand Dollar?

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

How do decisions of the RBNZ impact the New Zealand Dollar?

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

How does economic data influence the value of the New Zealand Dollar?

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

How does broader risk sentiment impact the New Zealand Dollar?

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Over the past five days, the Pound is the second best performing G10 currency after the NZD. Economists at Rabobank analyze GBP outlook.

GBP to find a little additional support in the coming months