- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Building Permits, m/m | June | 0.7% | 0.2% |

| 03:00 | Japan | BoJ Interest Rate Decision | -0.1% | -0.1% | |

| 03:00 | Japan | BOJ Outlook Report | |||

| 05:30 | France | GDP, q/q | Quarter II | 0.3% | 0.3% |

| 06:00 | Germany | Gfk Consumer Confidence Survey | August | 9.8 | 9.7 |

| 06:30 | Japan | BOJ Press Conference | |||

| 06:45 | France | Consumer spending | June | 0.4% | 0.2% |

| 07:00 | Switzerland | KOF Leading Indicator | July | 93.6 | 93 |

| 09:00 | Eurozone | Industrial confidence | July | -5.6 | -6.8 |

| 09:00 | Eurozone | Consumer Confidence | July | -7.2 | -6.6 |

| 09:00 | Eurozone | Economic sentiment index | July | 103.3 | 102.7 |

| 09:00 | Eurozone | Business climate indicator | July | 0.17 | 0.1 |

| 12:00 | Germany | CPI, m/m | July | 0.3% | 0.3% |

| 12:00 | Germany | CPI, y/y | July | 1.6% | 1.5% |

| 12:30 | U.S. | PCE price index ex food, energy, Y/Y | June | 1.6% | 1.7% |

| 12:30 | U.S. | PCE price index ex food, energy, m/m | June | 0.2% | 0.2% |

| 12:30 | U.S. | Personal spending | June | 0.4% | 0.3% |

| 12:30 | U.S. | Personal Income, m/m | June | 0.5% | 0.4% |

| 13:00 | U.S. | S&P/Case-Shiller Home Price Indices, y/y | May | 2.5% | 2.4% |

| 14:00 | U.S. | Pending Home Sales (MoM) | June | 1.1% | 0.5% |

| 14:00 | U.S. | Consumer confidence | July | 121.5 | 125 |

| 23:01 | United Kingdom | Gfk Consumer Confidence | July | -13 | -13 |

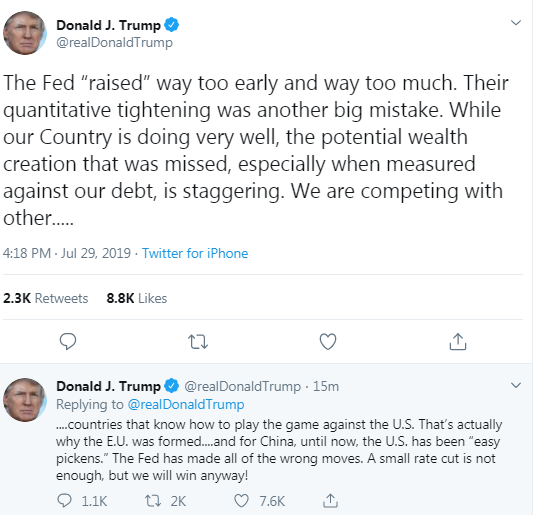

Major US stock indexes ended the session without a single dynamic, as investors could not decide on the direction of movement at the beginning of the trading week, full of important events, such as the announcement of the Fed rate decision, the publication of the July employment report, the trade negotiations between the US and China, and also a new round of corporate reporting.

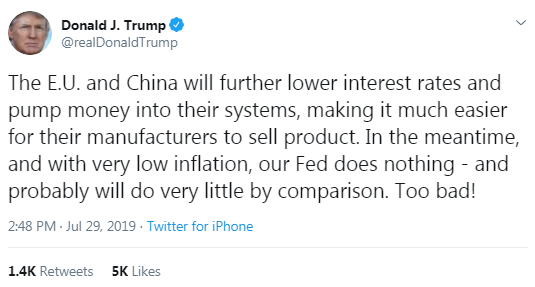

The Fed will announce its decision on interest rates on Wednesday at 18:00 GMT, after which Central Bank Chairman Jerome Powell will discuss the state of the economy during a press conference scheduled for 18:30 GMT. Investors expect the US central bank to cut rates by 25 basis points for the first time since 2008. The Fed, which seeks to keep inflation at 2%, has experienced growth problems in recent months, despite a healthy economy and low unemployment. This may indicate that the current level of interest rates may be too high, even if it is well below historical norms. Some economists and Fed officials believe that rates should be lowered in the face of slowing US GDP growth and darker growth prospects abroad, as trade wars initiated by Washington continue. Investors will closely monitor the Fed's signals of new rate cuts in the coming months. Economists basically expect one to three rate cuts this year.

US and Chinese officials will meet in Shanghai this week in an attempt by the two largest economies in the world to conclude a trade deal and end their long-standing trade dispute. While investors last week were optimistic about the news of the meeting of negotiators, people close to the negotiations warned that the desire for a deal from the spring had weakened.

In addition, market participants continued to monitor the company's quarterly reports, as the corporate reporting season gained momentum. About 33% of S & P companies must present their results for the second quarter of this week, including Merck (MRK), Procter & Gamble (PG), Apple (AAPL), General Motors (GM) and many others.

Most of the components of DOW recorded an increase (18 out of 30). The top gainers were Johnson & Johnson (JNJ; + 1.87%). Pfizer Inc. shares turned out to be an outsider. (PFE; -3.70%).

Most sectors of the S & P finished trading in the red. The largest decline was shown by the financial sector (-0.5%). The consumer goods sector grew the most (+ 0.5%).

At the time of closing:

Dow 27,221.41 +28.96 + 0.11%

S & P 500 3,020.97 -4.89 -0.16%

Nasdaq 100 8,293.33 -36.88 -0.44%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Building Permits, m/m | June | 0.7% | 0.2% |

| 03:00 | Japan | BoJ Interest Rate Decision | -0.1% | -0.1% | |

| 03:00 | Japan | BOJ Outlook Report | |||

| 05:30 | France | GDP, q/q | Quarter II | 0.3% | 0.3% |

| 06:00 | Germany | Gfk Consumer Confidence Survey | August | 9.8 | 9.7 |

| 06:30 | Japan | BOJ Press Conference | |||

| 06:45 | France | Consumer spending | June | 0.4% | 0.2% |

| 07:00 | Switzerland | KOF Leading Indicator | July | 93.6 | 93 |

| 09:00 | Eurozone | Industrial confidence | July | -5.6 | -6.8 |

| 09:00 | Eurozone | Consumer Confidence | July | -7.2 | -6.6 |

| 09:00 | Eurozone | Economic sentiment index | July | 103.3 | 102.7 |

| 09:00 | Eurozone | Business climate indicator | July | 0.17 | 0.1 |

| 12:00 | Germany | CPI, m/m | July | 0.3% | 0.3% |

| 12:00 | Germany | CPI, y/y | July | 1.6% | 1.5% |

| 12:30 | U.S. | PCE price index ex food, energy, Y/Y | June | 1.6% | 1.7% |

| 12:30 | U.S. | PCE price index ex food, energy, m/m | June | 0.2% | 0.2% |

| 12:30 | U.S. | Personal spending | June | 0.4% | 0.3% |

| 12:30 | U.S. | Personal Income, m/m | June | 0.5% | 0.4% |

| 13:00 | U.S. | S&P/Case-Shiller Home Price Indices, y/y | May | 2.5% | 2.4% |

| 14:00 | U.S. | Pending Home Sales (MoM) | June | 1.1% | 0.5% |

| 14:00 | U.S. | Consumer confidence | July | 121.5 | 125 |

| 23:01 | United Kingdom | Gfk Consumer Confidence | July | -13 | -13 |

The Federal

Reserve Bank of Dallas reported its general business activity index for

manufacturing in Texas rose to -6.2 in July from an unrevised -12.1 in June.

Economists had

forecast the indicator to increase to -5.0.

According to

the report, the production index, a key measure of state manufacturing

conditions, moved from 8.9 to 9.3, indicating output growth continued at

roughly the same pace as in June. At the same time, the new orders index edged

up to 5.5, while the capacity utilization index inched up to 11.2, and the

shipments index climbed nine points to 10.2. The employment index rose seven

points to 16.0, suggesting robust growth in employment. Expectations regarding

future business conditions improved in July as well, with the index of future

general business activity rising nine points to 6.0 and the index of future

company outlook increasing six points to 9.1.

- We are going to come out on Oct 31, deal or no deal

- With common sense, we can get a deal

- There is a big incentive to get this thing done

- If our partners won't move on the backstop then we have to get ready for no-deal

- Says UK is talking to the Irish government on Brexit today

Danske Bank's analysts suggest that, while Boris Johnson is more pro-Brexit than Theresa May, the arithmetic in the House of Commons does not change, and it will be difficult to force a no-deal Brexit through.

- “Our base case is a further extension but it is not a high conviction call. We need to monitor whether and if the dynamics in British politics change. The uncertainty is whether there will be snap election.

- The range of possible outcomes is likely to be 0.86 (if Brexit-related news improves markedly) to 0.91 (against expectation but if we see much weaker data and/or by pricing a higher probability of no-deal Brexit).”

U.S. stock-index futures traded little-changed on Monday, as investors tempered their expectations for this week’s trade talks between Washington and Beijing and prepared for monetary policy decision from the Federal Reserve.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,616.80 | -41.35 | -0.19% |

Hang Seng | 28,106.41 | -291.33 | -1.03% |

Shanghai | 2,941.01 | -3.53 | -0.12% |

S&P/ASX | 6,825.80 | +32.40 | +0.48% |

FTSE | 7,694.53 | +145.47 | +1.93% |

CAC | 5,619.48 | +9.43 | +0.17% |

DAX | 12,438.62 | +18.72 | +0.15% |

Crude oil | $56.27 | +0.12% | |

Gold | $1,420.20 | +0.06% |

According to IMM net speculators’ positioning as at July 23, 2019, net long USD positions increased modestly in the week ending July 23 reflecting the strong performance of greenback, which appreciated against all its G10 peers in July, especially against sterling, note Rabobank's analysts.

- “Bearish sentiment towards the euro intensified ahead of the ECB’s meeting. While the ECB refrained from adjusting its monetary policy last week, President Draghi set the stage for easing in September confirming our expectations for a 10bps deposit rate cut.

- Bearish bets against GBP set another year-to-date high on the back of growing market concerns that the UK could be heading for a hard Brexit under the leadership of newly elected PM Johnson.

- Geopolitical tensions in the Persian Gulf did not increase sufficiently to trigger a major shift in market positioning in JPY and CHF. Bullish bets on CAD increased further, while speculators trimmed their bearish wagers against AUD.”

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 174 | 0.02(0.01%) | 820 |

ALTRIA GROUP INC. | MO | 49.95 | 0.09(0.18%) | 1326 |

Amazon.com Inc., NASDAQ | AMZN | 1,939.20 | -3.85(-0.20%) | 9360 |

Apple Inc. | AAPL | 208.1 | 0.36(0.17%) | 65266 |

AT&T Inc | T | 34.05 | -0.10(-0.29%) | 27325 |

Boeing Co | BA | 345.61 | 0.61(0.18%) | 7309 |

Chevron Corp | CVX | 123.94 | 0.22(0.18%) | 452 |

Cisco Systems Inc | CSCO | 56.88 | 0.35(0.62%) | 6129 |

Citigroup Inc., NYSE | C | 71.95 | -0.21(-0.29%) | 2724 |

Deere & Company, NYSE | DE | 169.55 | -0.84(-0.49%) | 311 |

Facebook, Inc. | FB | 199.25 | -0.50(-0.25%) | 45403 |

Ford Motor Co. | F | 9.53 | -0.04(-0.42%) | 56082 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.63 | 0.07(0.61%) | 750 |

General Electric Co | GE | 10.5 | -0.01(-0.10%) | 29411 |

Goldman Sachs | GS | 222 | -0.14(-0.06%) | 611 |

Google Inc. | GOOG | 1,246.00 | -4.41(-0.35%) | 6805 |

Intel Corp | INTC | 51.35 | -0.24(-0.47%) | 36612 |

International Business Machines Co... | IBM | 151.2 | -0.16(-0.11%) | 713 |

Johnson & Johnson | JNJ | 131.14 | 0.41(0.31%) | 1190 |

JPMorgan Chase and Co | JPM | 116.03 | -0.19(-0.16%) | 1440 |

McDonald's Corp | MCD | 216.05 | 0.47(0.22%) | 11512 |

Merck & Co Inc | MRK | 82 | 0.57(0.70%) | 20983 |

Microsoft Corp | MSFT | 141.67 | 0.33(0.23%) | 40333 |

Nike | NKE | 87.75 | 0.21(0.24%) | 2102 |

Pfizer Inc | PFE | 41.47 | -1.62(-3.76%) | 1522828 |

Procter & Gamble Co | PG | 115.1 | 0.37(0.32%) | 1579 |

Starbucks Corporation, NASDAQ | SBUX | 98.15 | -0.96(-0.97%) | 90974 |

Tesla Motors, Inc., NASDAQ | TSLA | 225.3 | -2.74(-1.20%) | 88185 |

The Coca-Cola Co | KO | 54.28 | 0.11(0.20%) | 4791 |

Twitter, Inc., NYSE | TWTR | 41.22 | -0.30(-0.72%) | 93913 |

Verizon Communications Inc | VZ | 57 | -0.08(-0.14%) | 588 |

Visa | V | 184.15 | 0.46(0.25%) | 13301 |

Wal-Mart Stores Inc | WMT | 113.35 | 0.33(0.29%) | 609 |

Walt Disney Co | DIS | 145.05 | 0.40(0.28%) | 6912 |

Yandex N.V., NASDAQ | YNDX | 38.27 | 1.23(3.32%) | 264490 |

McDonald's (MCD) initiated with a Buy at Goldman; target $250

Starbucks (SBUX) initiated with a Buy at Goldman; target $110

Coca-Cola (KO) initiated with an Overweight at Atlantic Equities; target $62

Starbucks (SBUX) downgraded to Neutral from Outperform at Robert W. Baird; target $98

Starbucks (SBUX) downgraded to Neutral from Overweight at JP Morgan; target $91

UPS (UPS) downgraded to Hold from Buy at Stifel

Dow (DOW) downgraded to Neutral from Buy at Citigroup; target lowered to $50

Dow (DOW) downgraded to Neutral from Positive at Susquehanna; target lowered to $53

Analysts at TD Securities suggest that the BoE’s MPC will likely retain its hiking bias, which is seen as increasingly implausible by markets, and will be largely ignored.

- “Our base case sees the MPC continuing to include the reference to rate hikes "at a gradual pace and to a limited extent," although we do see a non-negligible risk of that phrase being dropped, given the growing odds of a disorderly Brexit and the slowdown we've seen in both domestic and global growth. Even so, we think that any half-hearted pushback against current market pricing will be largely ignored by markets, given the extreme level of skepticism that the BoE will be raising rates anytime soon. Even before the election of PM Johnson and his harder tone on Brexit, we had already removed any BoE rate hikes from our forecast profile through to at least the end of 2020.

- The BoE already shifted its nowcast at the June meeting to look for flat GDP growth in Q2, and could go as far as forecasting a negative print (indeed Vlieghe has said he expects this). The sharp turn lower in the June PMIs (plus what we expect to be a further decline in the July manufacturing PMI published on the morning of the BoE's decision) will leave the BoE concerned about Q3 growth as well. Add to that continuing trade tensions and a clear dovish shift from both the Fed and ECB, and there should be plenty of ammunition for market participants to grasp onto if they're looking for an excuse to price in further BoE easing.

- The MPC has also lost its hawkish tail for the time being, with neither Haldane nor Saunders angsting for rate hikes right away. Haldane said recently that the case for holding rates until the road becomes clearer is strong, while Saunders said that the economy right now is clearly not overheating. Neither one sounds all that close to cutting rates either, but they both seem to be a bit further away from voting for rate hikes than they have been in the past.”

Pfizer (PFE) reported Q2 FY 2019 earnings of $0.80 per share (versus $0.77 in Q2 FY 2018), beating analysts’ consensus estimate of $0.75.

The company’s quarterly revenues amounted to $13.264 bln (-1.5% y/y), missing analysts’ consensus estimate of $13.430 bln.

The company also lowered guidance for FY 2019: it projected EPS of $2.76-2.86 (prior $2.83-2.93) versus analysts’ consensus estimate of $2.91 and revenues of $50.5-52.5 bln (prior $52-54 bln) versus analysts’ consensus estimate of $53.45 bln.

PFE fell to $42.15 (-2.18%) in pre-market trading.

July 29

Before the Open:

Pfizer (PFE). Consensus EPS $0.75, Consensus Revenues $13430.05 mln

July 30

Before the Open:

Altria (MO). Consensus EPS $1.10, Consensus Revenues $5078.34 mln

MasterCard (MA). Consensus EPS $1.83, Consensus Revenues $4082.71 mln

Merck (MRK). Consensus EPS $1.16, Consensus Revenues $10942.58 mln

Procter & Gamble (PG). Consensus EPS $1.05, Consensus Revenues $16865.38 mln

After the Close:

Advanced Micro (AMD). Consensus EPS $0.08, Consensus Revenues $1523.41 mln

Apple (AAPL). Consensus EPS $2.10, Consensus Revenues $53379.47 mln

Baidu (BIDU). Consensus EPS $0.97, Consensus Revenues $3746.80 mln

July 31

Before the Open:

General Electric (GE). Consensus EPS $0.12, Consensus Revenues $28832.79 mln

August 1

Before the Open:

DuPont (DD). Consensus EPS $0.82, Consensus Revenues $5631.25 mln

General Motors (GM). Consensus EPS $1.45, Consensus Revenues $36025.23 mln

Verizon (VZ). Consensus EPS $1.20, Consensus Revenues $32420.40 mln

August 2

Before the Open:

Chevron (CVX). Consensus EPS $1.84, Consensus Revenues $40545.21 mln

Exxon Mobil (XOM). Consensus EPS $0.76, Consensus Revenues $65373.12 mln

Analysts at Westpac note that this week’s FOMC outcome will be the key to directional impetus this week, and they see a 25bp rate cut as perhaps sparking a slight disappointment trade, but the medium-term effects will be minimal.

- “Focusing on the 10yr bond yield, we have been in a broad-sideways range for a number of weeks and it is difficult to foresee what combination of rate cuts and guidance will see the recent range breached significantly. Obviously a 50bp rate cut would do the trick, but even then an extended rally would need to be supported by the belief that the Fed was signaling a deeper global and domestic growth slowdown, such that the market was convinced that magnitude of the rate cut was less pre-emptive and more dovish in term of the forward outlook for the economy.

- Downside surprises have slowed in recent weeks, while the Atlanta GDP Now appears to have also bottomed, so we would be surprised if a more bearish economy outlook than was already in the price could evolve.

- From a positioning point of view CFTC data shows that speculative positioning remains short. Indeed current positioning is just of the most short the 10yr futures the specs have been since Q3 2018. Whether that will limit any sell-offs this week is up for debate, however, we think it is more evidence that the current US 10yr range remains intact.”

- Johnson is clear that he wants to meet with EU leaders

- But not to be repeatedly told that withdrawal agreement cannot be reopened

- Hopes that EU leaders will change their mind on the withdrawal agreement

- Government's central focus is preparing for that

- Backstop must be removed to prevent no-deal Brexit

The European Systemic Risk Board (ESRB) said on Friday the commercial property showed signs of overvaluation in most European Union (EU) countries as yield-starved investors pile into bricks and mortar.

“Most of the countries for which commercial real estate (CRE) price data are available have registered CRE price increases and signs of overvaluation, while bank credit for CRE has been muted,” the ESRB, headed by ECB President Mario Draghi, warned in its annual report.

It also added the price rise had been fueled by a search for yield, driven down in some cases to below zero by years of ultra-low interest rates and massive bond purchases by the ECB.

“High investor demand and the search for higher yields, which have been a major source of the CRE price increase, particularly in prime markets, have potentially made investors vulnerable to a repricing of risk premia,” the ERSB said, without citing any specific figures to back its argument.

Analysts at TD Securities suggest that the Bank of Japan (BoJ) could be moving towards strengthening its forward guidance, following a likely Fed rate cut, but they think the Japanese regulator will be more patient than other major central banks.

- “The BoJ has sounded more dovish of late, highlighting downside risks from weaker external demand while keeping their options open to further easing should the economy lose momentum. So far that has not been the case, with data over recent weeks such as industrial production, holding up well although there has been some softening in the Tankan.”

Claire Reade, who spent eight years negotiating with China as a senior figure in the Office of the United States Trade Representative (USTR), told the South China Morning Post that dramatic collapse in the U.S.-China talks in May suggested that Chinese negotiators did not have full political backing for the concessions they proposed to reach a deal to end the trade war.

China was reported to have made last minute, large-scale edits to a near-150 page trade agreement draft, which scuppered the prospects for a deal after 11 rounds of negotiations.

The changes suggested that Chinese negotiators never “really connected with all the people who needed to be connected to in order to make the deal”, said a veteran U.S. trade official.

Reade also added that unexpected changes mean there “is going to be a premium on being very careful and conservative” in future talks on the Chinese side.

“It is very normal for a piece of text to be proposed and the other side to then redline it back, but you don't have text that's been in place for months and all of a sudden come back striking-out what has been agreed. That's not normal - something happened,” she explained.

Face-to-face talks are set to resume in Shanghai on Tuesday and Wednesday for the first time since May.

Analysts at Westpac provided their take on the upcoming FOMC outcome, which by far will be the most important driver of market momentum and the key to directional impetus this week

“While some market participants continue to argue the case for a 50bp cut, Westpac instead sees a 25bp cut. Market pricing has converged on a similar view following recent comments by officials and after the agreement on the debt ceiling and government spending through to 2021, along with the view the fact that the ECB did not act last week despite Draghi noting that the outlook in Europe was "getting worse and worse. So the question for us as we begin the week is to assess risk rewards under our central scenario and other likely outcomes. Post-cut price action will depend largely on the combination of cuts and language used by the Fed, but our base case is that a 25bp rate cut will need to be accompanied by dovish guidance for it to sustain current 10yr UST yields or push them lower. Indeed, the fact that there are still credible forecasters holding onto the 50bp rate cut view suggests that risk rewards are skewed slightly toward higher yields on the announcement.”

Growth will continue next year but need to pay attention to risks

If risks to the economy materialises, will act without hesitation

Labour market is good and domestic demand is still seen in Japan

Bert Colijn, Senior Economist, Eurozone at ING Bank expects a bunch of bazookas likely to be unveiled at the European Central Bank (ECB) September monetary policy meeting.

“Interest rate cuts and more QE, that's what we can expect from Mario Draghi's last European Central Bank meeting in September. Expect a package of easing measures from the European Central Bank. The ECB anticipate that the rates are now remaining on hold or becoming lower. ECB is likely to cut interests soon.”

Japan's government slashed its economic growth forecast for this year largely due to weaker exports. But the forecast, which serves as a basis for compiling the state budget and the government's fiscal policy, was still nearly twice as high as private-sector projections.

The economy is now expected to expand 0.9% in price-adjusted real terms in the fiscal year ending in March 2020, according to the Cabinet Office's projections. That marked a downgrade from the government's previous forecast of 1.3% growth. The government estimated 1.2% growth for the following fiscal year starting April 2020.

The downgrade largely stemmed from a slowdown in exports, which the government expects to grow just 0.5%, compared to 3.0% in the previous assessment in January. This would make export growth for the current fiscal year the slowest since fiscal 2012, when they contracted with 1.7%, according to a Cabinet Office official. But the government saw the weakening exports being offset by robust corporate investment and private spending.

Karen Jones, Team Head FICC Technical Analysis Research, noted the leg lower in AUD/USD could test the 0.6865/55 band.

“AUD/USD sold off last week from a very tough band of resistance, namely .7065/8. This is the location of the 200 day ma and the 8 month downtrend. The market has eroded the 55 day ma at .6955, and near term uptrend and hence starts this week on the defensive. We look for losses to the support at .6865/55 the 17th May low and 2019 uptrend. This protects the mid June low at .6832. Below .6832 will target the .6738 January 2019 low and .6725, the 2016-2019 support line (connects the lows)”.

According to the report from Bank of England, the annual growth rate of consumer credit continued to slow in June, falling to 5.5%. Annual growth has fallen steadily since its peak in late 2016, and particularly over the past year reflecting a fall in the average monthly net flow of consumer credit. Since July last year, the net flow has averaged £1.0 billion per month, compared with £1.5 billion per month in the year to June 2018.

Net mortgage borrowing by households was £3.7 billion, close to the average of the previous three years. This followed a slightly weaker net flow of £2.9 billion in May. The annual growth rate of mortgage lending remained stable at 3.1%, around the level that it has been at since 2016.

Mortgage approvals for house purchase (an indicator of future lending) increased by around 800 in June to 66,400 and the number of approvals for remortgaging rose slightly to 47,000. Notwithstanding these small rises, mortgage approvals remained within the narrow ranges seen over the past three years.

Borrowing from banks increased by £2.5 billion in June. During the first half of 2019, borrowing has been stronger than the same period in 2018, and the annual growth rate has, therefore, risen. For non-financial businesses, the growth rate rose to 4.4%. Within this, the growth rate of borrowing by large business rose to 6.4%; and the growth of SME borrowing rose to 0.8%, its highest since August 2017.

In opinion of Karen Jones, Team Head FICC Technical Analysis Research, EUR/USD could re-test the 1.1240 region on a close above the 1.1176/81 area.

“EUR/USD last week sold off to, tested and reversed from 1.1110/06, the April and May lows, last week. We would consider a close above 1.1176/81 (mid June low and March low) enough of a trigger to signal recovery to the 55 day ma lies 1.1242 and highs last week at 1.1285. But while capped here it will remain on the defensive. Below 1.1100 will introduce scope to the 1.0974 2018-2019 support line, which in turn guards the 78.6% retracement at 1.0814/78.6% retracement. Initial resistance lies at 1.1285, the 11th July high and this guards the more important 55 week ma at 1.1372”.

According to the flash estimate issued by the INE, the annual inflation of the CPI in July 2019 was 0.5%. This indicator provides a preview of the CPI that, if confirmed, would imply an increase of one tenths in the annual rate, since in June this change was 0.4%. Economists had expected a 0.6% increase. This behaviour highlights the decrease in the prices of food and no alcoholic drinks, which have decreased this month less than in July 2018.

In turn, the annual variation of the flash estimate of the HICP in May stands at 0.7%. If confirmed, the annual rate of the HICP would increase one tenths with respect to the previous month.

According to the flash estimate of the CPI, consumer prices registered a variation of -0.6% as compared with June. In turn, the monthly change of the HICP flash estimate in July stood at -1.1%.

Tom Kenny, Senior Economist at Australia and New Zealand Banking Group (ANZ) notes that in the face of softer inflationary pressures and slowing Japanese economic growth, the Bank of Japan (BOJ) is unlikely to make any changes to its current expansionary monetary policy.

“The Bank of Japan (BoJ) faces a triple dilemma: inflation is still far from its goal; other major central banks are easing, and its current framework is counterproductive when growth is slowing and yields are falling. Despite mounting pressure to do something, we do not expect any notable policy announcement this week. A key dynamic for BoJ policymakers is the JPY. Any notable policy action from the central bank is likely to be triggered by a stronger currency. For now, we expect the BoJ to be watchful of global FX moves.”

Says that the EU is being stubborn

We want a deal with the EU

If they continue to be stubborn, then we must prepare for a no-deal Brexit

We are turbo-charging no-deal Brexit preparations

Says that "the undemocratic backstop must go"

There will be a daily government committee looking at no-deal Brexit planning

Says that Javid will set out further funds to prepare for leaving the EU

Sterling makes fresh two-year lows as Raab reiterates hard line on Brexit negotiations.

The Rabobank Research Team offers a brief preview of the key events to watch out for in the week ahead.

Fed: If they cut 25bp and appear calm, markets might still be disappointed; and if they cut 50bp markets could actually be spooked. As such, perhaps 25bp and language showing that despite the data the Fed profess to look at being just fine, lots more cuts are possible will prove the right recipe.

BOJ: Yes, they have been “stealth tightening” by not monetizing quite as many JGBs, but can they reverse and plunge towards de facto MMT, despite protestations that this isn’t what they are doing? Yes, they can - because everyone else is about to do the same, and Japan runs a trade surplus so can get away with it.

Then post Fed it’s the BOE, under new management at the national level, where preparations for Hard Brexit are accelerating rapidly. Indeed, for BoJo, what is his real decision: Hard Brexit, or the appearance of Hard Brexit in order to precipitate a softer Brexit? Put that in your pie chart and smoke it, BOE economists: rates to rise, or fall sharply as a result?

The next round of US-China trade talks in Shanghai, where USTR Lighthizer and Treasury Secretary Mnuchin will put forward the view “we’d like to go back to where we were last May, where we did not have an agreement but we seemed to be about 90% of the way there,” according to White House economic advisor Larry Kudlow.

Former Federal Reserve Chair Janet Yellen said she supports a 25-basis-point cut in the central bank’s benchmark interest rate, as the global economy weakens and inflation in the U.S. is lower.

“The global economy has weakened. I think partly it’s weakened because of conflicts over trade and the uncertainty that’s caused for businesses,” Yellen said.

The U.S. central bank is widely expected to cut interest rates by a quarter point on Wednesday for the first time in more than a decade.

Inflation in the U.S. also remains low — too low, according to Yellen. “The U.S. isn’t an island,” she added. “We’re part of the global economy. What happens in the rest of the world — in Europe, in Asia — affects the U.S. And it’s also true that U.S. monetary policy affects conditions all around the globe.”

Wednesday’s expected rate cut is seen as a pre-emptive move amid growing concerns over global growth outlook and the impact of the ongoing trade war between Beijing and Washington.

Yellen explained the country’s focus should be on maintaining the conditions for a strong U.S. economy that can stay on an expansion path.

Karen Jones, Team Head FICC Technical Analysis Research, noted the very near term outlook on Cable stays neutral to negative while below 1.2515.

“GBP/USD remains on the defensive while contained by 2 month downtrend at 1.2515 today. This maintains an overall neutral to negative bias very near term and we would allow for a test of the 1.2339 2 month support line (connects the lows). This may again hold as there is a distinct lack of downside momentum. Below 1.2366/39 (April 2017 low) we have very little support until the 1.2108, the 78.6% retracement of the entire move up from the 2016 low. What is interesting is that we have a 13 count on the weekly chart, however there remains scope for a further sell off - TD support lies at 1.2184. Above the downtrend this would introduce scope to the 55 day ma at 1.2616 and the June high at 1.2784”.

The UK private sector activity continued to fall in three months to July but at a slightly slower pace, the monthly growth indicator from the Confederation of British Industry showed.

The balance of firms posting growth came in at -9 percent. This was the ninth straight rolling quarter of either flat or falling volumes.

Services activity logged a slower decline amid a marked decrease in both distribution and manufacturing volumes.

Nonetheless, private sector growth is forecast to pick up, with a balance of 9 percent expecting an improvement in the three months to October.

"A new Prime Minister marks a fresh start and early signals matter. Business is looking for a Brexit deal that unlocks confidence; clear signals the UK remains open to the world; and a willingness to work together with business on issues ranging from climate change to digital connectivity." Annie Gascoyne, CBI director of economic policy, said.

Analysts at Danske Bank presents key economic events due on the cards in the day ahead, as the Big Fed week takes off.

“While the data front still looks thin today, a crucial week for markets takes off. This week, the Fed can either hold back or push markets closer to an H2 cyclical recovery. In the positive outcome, we see plenty of potential upside left in the CAD, AUD, NZD and Scandies against the USD. EUR/USD is also set to benefit but likely with a lower beta. Preliminary EU harmonized inflation data for July from Spain is due out today. Bloomberg consensus expects a sharp deceleration to -1.2% m/m from -0.1% m/m previously. The Dallas Fed manufacturing outlook level of general business activity for July is due to be published today. The index is likely to rebound from the current three-year low level as trade war escalation has stopped for now. Previously, businesses in Texas pointed to tariffs, and specifically trade talks with China, as a contributing factor to the prevailing uncertainty.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1266 (3206)

$1.1232 (1533)

$1.1206 (407)

Price at time of writing this review: $1.1126

Support levels (open interest**, contracts):

$1.1080 (4643)

$1.1040 (2723)

$1.0995 (889)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 9 is 74513 contracts (according to data from July, 26) with the maximum number of contracts with strike price $1,1100 (4643);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2569 (839)

$1.2530 (1074)

$1.2497 (330)

Price at time of writing this review: $1.2365

Support levels (open interest**, contracts):

$1.2343 (2070)

$1.2312 (801)

$1.2276 (607)

Comments:

- Overall open interest on the CALL options with the expiration date August, 9 is 16178 contracts, with the maximum number of contracts with strike price $1,3000 (2051);

- Overall open interest on the PUT options with the expiration date August, 9 is 18446 contracts, with the maximum number of contracts with strike price $1,2450 (2418);

- The ratio of PUT/CALL was 1.14 versus 1.09 from the previous trading day according to data from July, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 63.15 | 0.3 |

| WTI | 56.17 | 0.45 |

| Silver | 16.36 | -0.18 |

| Gold | 1418.352 | 0.29 |

| Palladium | 1526.39 | -0.1 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -98.4 | 21658.15 | -0.45 |

| Hang Seng | -196.56 | 28397.74 | -0.69 |

| KOSPI | -8.22 | 2066.26 | -0.4 |

| ASX 200 | -24.6 | 6793.4 | -0.36 |

| FTSE 100 | 60.01 | 7549.06 | 0.8 |

| DAX | 57.8 | 12419.9 | 0.47 |

| CAC 40 | 32 | 5610.05 | 0.57 |

| Dow Jones | 51.47 | 27192.45 | 0.19 |

| S&P 500 | 22.19 | 3025.86 | 0.74 |

| NASDAQ Composite | 91.67 | 8330.21 | 1.11 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.69087 | -0.63 |

| EURJPY | 120.915 | -0.14 |

| EURUSD | 1.11253 | -0.19 |

| GBPJPY | 134.545 | -0.54 |

| GBPUSD | 1.23812 | -0.58 |

| NZDUSD | 0.66323 | -0.42 |

| USDCAD | 1.31644 | 0.05 |

| USDCHF | 0.99327 | 0.27 |

| USDJPY | 108.664 | 0.04 |

© 2000-2024. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.