- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

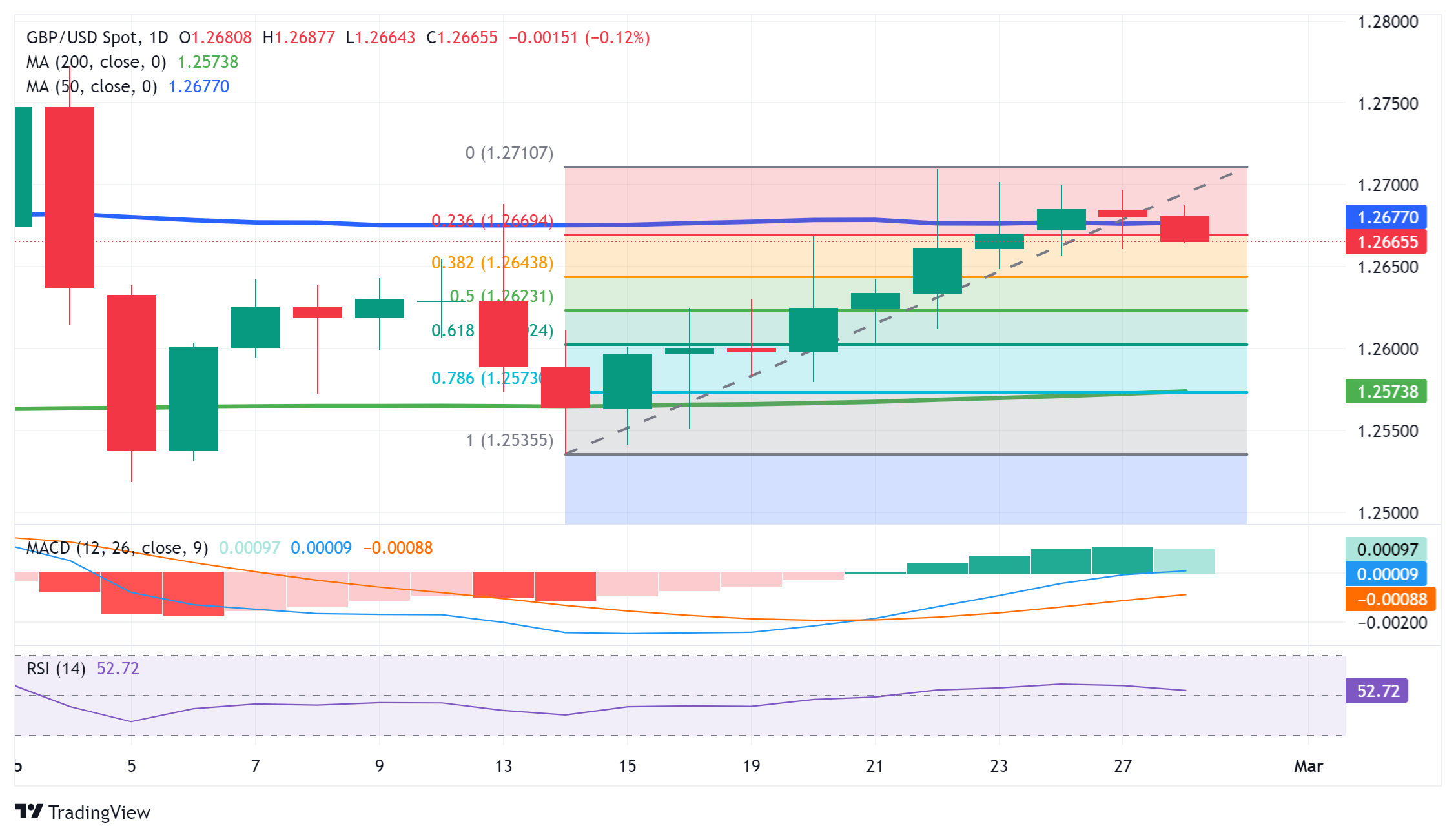

- GBP/USD loses traction near 1.2660 in Thursday’s early Asian session.

- US economic growth was slightly weaker than previously forecast in the fourth quarter of 2023.

- BoE policymakers said they need more incoming data to consider before lowering interest rates.

- The US Core Personal Consumption Expenditures Index (Core PCE) will be in the spotlight on Thursday.

The GBP/USD pair bounces off the multi-day lows near 1.2620 and recovers to 1.2660 during the early Asian session on Thursday. The renewed US Dollar (USD) demand ahead of the key US event weighs on the major pair. Investors await the US January Personal Consumption Expenditures Price Index (PCE) on Thursday for fresh impetus. At press time, GBP/USD is trading at 1.2660, down 0.01% for the day.

The New York Federal Reserve (Fed) President John Williams said on Wednesday that even though there's still some distance to cover in achieving the Fed 2% inflation target, the door is opening to interest rate cuts this year, depending on how the data come in.

The recent inflation data has caused financial markets to push back the timing of the first rate cut, which provides some support for the Greenback. Nonetheless, the US PCE data due later in the day might offer some hints about the inflation trajectory in the United States.

On Wednesday, the US Gross Domestic Product (GDP) for the fourth quarter grew at a 3.2% annualized rate from 3.3% in the previous reading, according to the US Bureau of Economic Analysis (BEA). The figure came in weaker than the estimation of a 3.3% expansion for Q4.

The Bank of England (BoE) policymakers said they need more evidence that inflation will come down to the 2% target before they decide to lower the key lending rates. The BoE expects year-over-year inflation to decline from 4% last month to 2% in the second quarter of this year, but then rise to 3% by the end of 2024 as the disinflationary effect of lower natural gas prices fades.

Looking ahead, traders will keep an eye on the Fed's preferred inflation measure, the Core Personal Consumption Expenditures Index (Core PCE), due on Thursday. Additionally, the UK Nationwide Housing Prices and Consumer Credit will be released later in the day.

- AUD/USD falls 0.73% as RBNZ's cautious rate decision overshadows Australia's inflation report.

- US economic data reveals growth, with GDP at 3.2% YoY, influencing global market sentiment.

- Upcoming Australian Retail Sales expected to show recovery, with market forecasting a 1.5% rise MoM.

The Australian Dollar (AUD) dropped 0.73%, against the US Dollar (USD) on Wednesday/s session, courtesy of a dovish hold by the Reserve Bank of New Zealand (RBNZ), which followed a solid inflation report from Australia. As the Asian session begins, the AUD/USD trades at 0.6496, virtually unchanged.

AUD/USD retreats as investors weigh RBNZ's rate hold and anticipate Australian retail sales data

Wall Street finished with losses, as depicted by the S&P 500, down 0.30%. Economic data from the United States (US) showed the US economy is growing above the trend needed to drive inflation toward the US Federal Reserve's 2% target. the Gross Domestic Product (GDP) for the last quarter of 2023 grew by 3.2% YoY, below estimates of 3.3% and Q3 4.9%.

Besides that, Fed speakers stuck to their cautious stance, with Boston Fed President Susan Collins and New York Fed President John Williams supporting rate cuts later in the year. Collins noted that the road to achieving the inflation target would be “bumpy,” Williams said, “We still have a ways to go on the journey to sustained 2% inflation.”

Aside from this, Australian inflation data adopted a back seat as the RBNZ grabbed the attention with its decision to hold rates at 5.50% while removing hawkish comments from the monetary policy statement. AUD/USD and NZD/USD traders gathered more signals from RBNZ Governor Adrian Orr's Q&A session. He said there were discussions about a rate hike. Still, the strong consensus aimed to keep the current level of tightening, adding that some variables revealed that monetary policy is working.

What to watch?

Ahead of the Asian session, the Aussie’s economic docket will feature Retail Sales data, with the consensus expecting a jump from -2.7% to 1.5% MoM in January.

AUD/USD Price Analysis: Technical outlook

The AUD/USD pair shifted bearish bias after hovering around a narrow range of 0.6520-0.6580 and failing to crack the 200-day Moving Average (DMA) at 0.6559. that, along with fundamental reasons, pushed the spot price below the 0.6500 figure and extended its losses to a 9-day low. A fall below that area would expose the February 13 low of 0.6442, which, once cleared, could pave the way to test 0.6400. Conversely, if buyers reclaim 0.6500, they must regain the 100-DMA at 0.6533.

- NZD/USD remains under selling pressure near 0.6100 in Thursday’s early Asian session.

- The US economy expanded at a 3.2% annualized rate for the fourth quarter of last year.

- The RBNZ maintained the interest rate steady at 5.5%, as widely expected on Wednesday.

- The US PCE inflation data will be a closely watched event on Thursday.

The NZD/USD pair remains on the defensive around 0.6100 during the early Asian session on Thursday. The downtick of the pair is supported by the dovish shift from the Reserve Bank of New Zealand (RBNZ) following the monetary policy meeting. The attention will shift to the US inflation figures measured by the PCE on Thursday.

Data released from the Commerce Department on Wednesday reported that the US economy grew at a 3.2% annual pace from October through December from a 3.3% initial estimate. The GDP growth rate has now surpassed 2% for six consecutive quarters, despite a forecast that rising interest rates may push the world's largest economy into a recession.

The RBNZ decided to hold the Official Cash Rate (OCR) unchanged at 5.5%, as widely expected in its February monetary policy meeting. However, the Monetary Policy Committee (MPC) stated that the central bank is no longer forecasting additional tightening, though they continue to see OCR risks as tilted to the upside. This, in turn, exerts some selling pressure on the New Zealand Dollar (NZD) and acts as a headwind for the NZD/USD pair.

Moving on, market players will closely watch the US Personal Consumption Expenditures Price Index (PCE) for January on Thursday. Also, the US Personal Income, Personal Spending, Pending Home Sales, and the weekly Initial Jobless Claims are due later in the day and the Fed’s Bostic, Goolsbee, and Mester are due to speak. These events could give a clear direction to the NZD/USD pair.

- The NZD/JPY is currently trading at 91.84, registering a significant drop of 1% in Wednesday's session.

- The RBNZ's dovish hold during the Asian session significantly weakened the NZD.

- The daily RSI indicates a possible shift in momentum, with NZD/JPY buyer strength declining from the overbought territory near 50..

- A short-term advantage for sellers is evident, with hourly RSI values oscillating near oversold territory.

In Wednesday's session, the NZD/JPY dived towards the 91.84 level, recording a notable decline of 1%. The main driver of this movement was the dovish decision from the Reserve Bank of New Zealand (RBNZ) which contributed to the Kiwi being the weakest currency in the session.

The RBNZ held the rates steady at 5.5%, with a revised outlook reducing the likelihood of another 25 bps hike from 75% to 40%. In addition, the bank cut down near-term Gross Domestic Product (GDP) growth projections, slightly adjusting inflation projections downwards. It expects, however, that inflation will return to the 1-3% target band in Q3 2025, implying the persistence of a tighter monetary policy. As a reaction, the combination of projections of a weaker economic activity with expectations of fewer hikes drove the Kiwi’s selloff.

NZD/JPY technical analysis

The daily Relative Strength Index (RSI) recently slid from the overbought territory and took a big hit in Wednesday’s session. This signals a potential turnaround moment, although the pair maintains a positive outlook within the broader technical landscape, as affirmed by its position above the 20,100,200-day Simple Moving Averages (SMAs). At the same time, the MACD histogram indicated a drop in bullish momentum, as marked by the shrinking green bars.

NZD/JPY daily chart

Interestingly, the hourly RSI values are oscillating within the negative territory, pointing to a short-term advantage for the sellers. Simultaneously, the MACD histogram on the hourly chart suggests the return of bullish momentum, as evidenced by the rising green bars. This hourly divergence hints at some level of intraday volatility for the NZD/JPY pair as indicators seem to be correcting oversold conditions.

NZD/JPY hourly chart

Treasurer of Australia Jom Edward Chalmers hit newswires early Thursday, noting that the assumed baseline of a global soft landing isn't a guarantee.

Key highlights

- Austalia's Q4 GDP data likely to be quite weak.

- Global soft landing is assumed to be the default case.

- Soft landing scenario isn't assured, risks still remain.

- Local economic figures in Australia run the same risk.

- Gold steadies at $2,030, buoyed by a dip in US Treasury yields and recent economic growth figures.

- Mixed US economic indicators and Fed statements on policy easing keep gold investors watchful.

- The 50-day SMA caps Gold's gains as Wall Street indices reflect cautious market sentiment.

Gold price remains steady near $2,030 on Wednesday, posting a gain of 0.17% after the US Bureau of Economic Analysis (BEA) revealed the country's economy expanded. A drop in US Treasury bond yields has kept the yellow metal near the current month and weekly highs, capped by the 50-day Simple Moving Average (SMA).

Wall Street treads water with most indices trading in the red. The Gross Domestic Product (GDP) for the last quarter in 2023 expanded a tick lower than the consensus and the preliminary reading, while Retail and Wholesale Inventories came in mixed.

Federal Reserve (Fed) Regional Presidents Susan Collins and John Williams crossed the newswires. They repeated previous remarks regarding easing policy later in the year and emphasized they haven’t reached the 2% goal for core inflation.

Daily digest market movers: Gold climbs on falling US yields

- Boston Fed President Susan Collins said, “I believe it will likely become appropriate to begin easing policy later this year.” She added, “When this happens, a methodical, forward-looking approach to reducing rates gradually should provide the necessary flexibility to manage risks while promoting stable prices and maximum employment.”

- New York Fed President John Williams stated, “While the economy has come a long way toward achieving better balance and reaching our 2% inflation goal, we are not there yet.” Williams added that he would need to assess “the data, the economic outlook and the risks, in evaluating the appropriate path for monetary policy that best achieves our goals.”

- On Tuesday, Federal Reserve Governor Michelle Bowman said she’s in no rush to cut rates, given upside risks to inflation that could stall progress or cause a resurgence in price pressure.

- Bowman said that inflation would decline “slowly,” adding that she will remain “cautious in my approach to considering future changes in the stance of policy.”

- The Gross Domestic Product (GDP) for the final quarter of 2023 was reported at 3.2% YoY, slightly below the preliminary estimate of 3.3%.

- US Retail Sales Inventories rose 0.3% MoM in January, below 0.4% in the previous month's data, while Wholesale Inventories declined -0.1% MoM, missing estimates of 0.1%.

- Previous data releases in the week:

- US Durable Goods Orders dropped -6.1% MoM, more than the -4.5% contraction expected and the -0.3% dip observed in December.

- The S&P/Case Shiller Home Price Index for December rose 6.1% YoY, outpacing estimates of 6% and November’s 5.4% reading.

- US New Home Sales rose by 1.5% from 0.651M to 0.661M, less than the 0.68M expected.

- The Dallas Fed Manufacturing Index for February contracted -11.3, though it improved compared to January’s -27.4 shrinkage, suggesting that business activity is recovering.

- The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, edges up at 103.95 as uncertainty over US economic data has improved the appeal for safe-haven assets.

- The US 10-year Treasury note yield stands at 4.284%, down two basis points (bps).

- Interest rate speculators have priced out a Fed rate cut in March and May. For June, the odds of a 25 basis point rate cut are at 49.7%.

- Investors are pricing in 85 basis points of easing throughout 2024.

Technical analysis: Gold stays firm, fluctuating near the 50-day SMA

Gold is trading sideways as XAU/USD has failed to break above the $2,035 psychological resistance level for the last 12 days. Nevertheless, the upward bias remains intact, and if buyers reclaim the $2,035 level, that could open the door to challenge the psychological $2,050 figure. Key resistance levels up next would be the February 1 high at $2,065.60, ahead of the December 28 high at $2,088.48.

On the flipside, if Gold falls below the February 16 swing low of $2,016.15, XAU/USD would dive toward the October 27 daily high-turned-support at $2,009.42. Once cleared, that will expose key technical support levels like the 100-day SMA at $2,009.42, followed by the 200-day SMA at $1,967.45.

Gold FAQs

Why do people invest in Gold?

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Who buys the most Gold?

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

How is Gold correlated with other assets?

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

What does the price of Gold depend on?

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- EUR/USD drifted below 1.0800 after EU sentiment missed the mark.

- US GDP came in mixed, driving EUR/USD back to baseline.

- US PCE inflation to be the key data release this week.

EUR/USD sagged early Friday after European sentiment indicators came in below expectations, and a lopsided print in US Gross Domestic Product (GDP) figures kept the pair in familiar territory midweek.

Thursday brings plenty of data for investors to chew on with German Retail Sales and Consumer Price Index (CPI) numbers, which will be closely followed by US Personal Consumption Expenditure Price Index (PCE) inflation. Friday will round out the week with pan-European Harmonized Index of Consumer Prices (HICP) inflation, as well as the US ISM Manufacturing Purchasing Managers Index (PMI) for February.

Daily digest market movers: EUR/USD churns near 1.0800 once again on mixed data

- Europe’s Economic Sentiment Indicator fell to 95.4 in February versus the expected 96.7. January printed at 96.1 after a slight revision from 96.2.

- US QOQ Q4 GDP printed at 1.7%, above the forecast of 1.5%.

- Despite the QoQ increase, Q4’s annualized US GDP slipped back to 3.2% versus the forecast of 3.3% after downside revisions to 2023’s first-quarter growth.

- German Retail Sales are expected to recover slightly, forecast to print at -1.5% YoY compared to the previous period’s -1.7%.

- Germany’s YoY CPI is forecast to come in at 2.6%, down from the previous 2.9%.

- February’s Core annualized US PCE is expected to come in at 2.8% YoY versus the previous print of 2.9%.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.09% | 0.21% | 0.35% | 0.80% | 0.14% | 1.26% | 0.03% | |

| EUR | -0.07% | 0.14% | 0.27% | 0.74% | 0.06% | 1.19% | -0.05% | |

| GBP | -0.22% | -0.14% | 0.14% | 0.60% | -0.09% | 1.05% | -0.20% | |

| CAD | -0.35% | -0.28% | -0.14% | 0.45% | -0.22% | 0.91% | -0.30% | |

| AUD | -0.82% | -0.74% | -0.60% | -0.46% | -0.69% | 0.46% | -0.80% | |

| JPY | -0.13% | -0.06% | 0.08% | 0.22% | 0.68% | 1.15% | -0.11% | |

| NZD | -1.27% | -1.20% | -1.08% | -0.93% | -0.46% | -1.20% | -1.29% | |

| CHF | -0.03% | 0.07% | 0.19% | 0.33% | 0.76% | 0.11% | 1.24% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

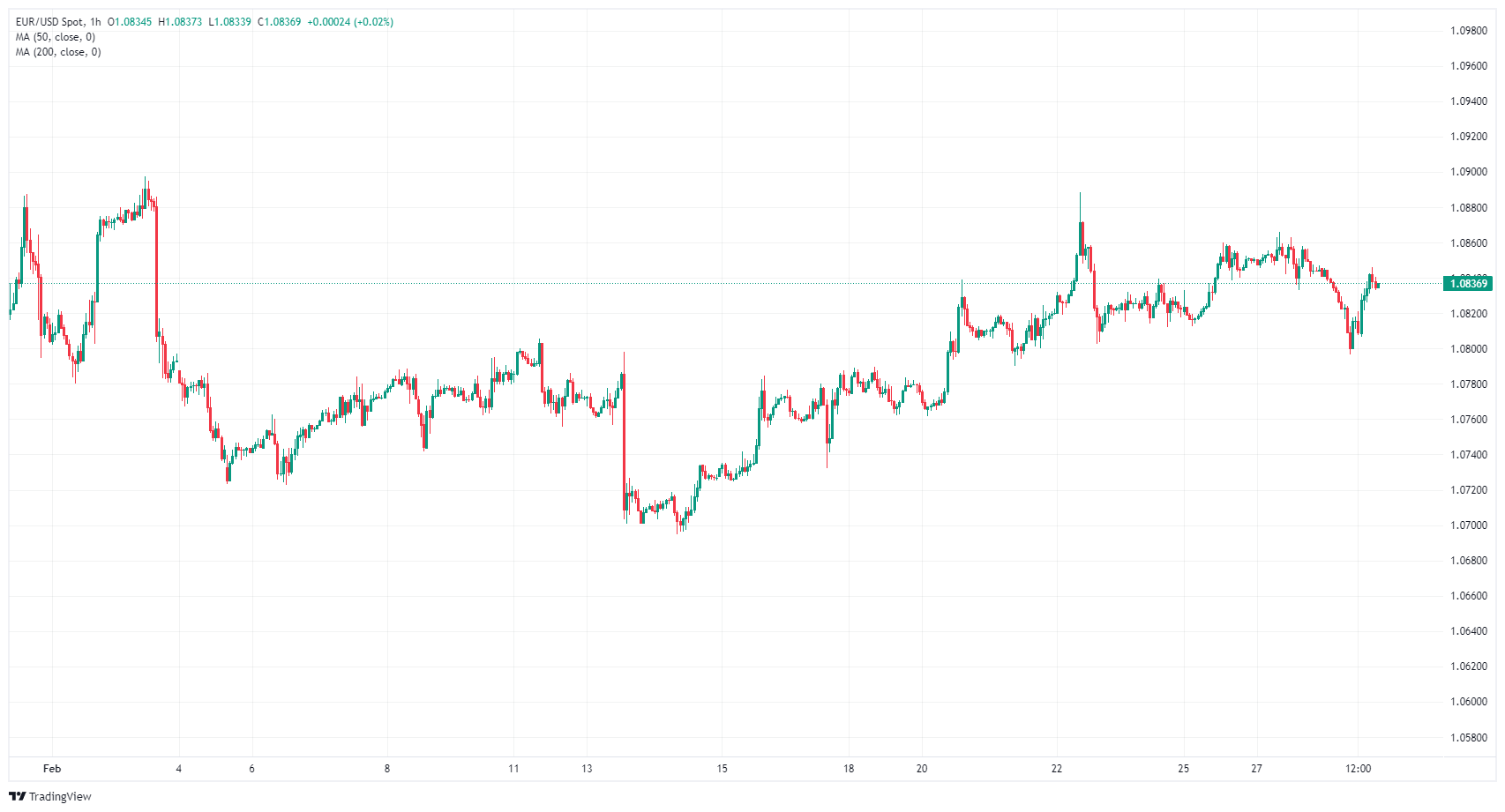

Technical analysis: EUR/USD continues to drift around 1.0800

EUR/USD fell to an intraday low of 1.0796 before recovering into familiar technical churn as the pair cycles 1.0800. The 1.0840 level is the pair’s key sticking point on Wednesday. A heavy supply zone is priced in between 1.0860 and 1.0840.

Daily candlesticks remain hamstrung on the 200-day Simple Moving Average (SMA) near 1.0830, and the EUR/USD continues to drift into median bids despite a bullish recovery from the last swing low into 1.0700. The pair remains down nearly 3% from December’s peak at 1.1140.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- The AUD/JPY is currently trading at around 97.90, reflecting a decrease of 0.55% in Wednesday's session.

- Although the daily RSI MACD on the AUD/JPY hints at fading momentum, buyers continue establishing their upper hand.

- However, the hourly chart indicators suggest stronger selling activity with the RSI venturing into oversold regions.

In Wednesday's session, the AUD/JPY fell to around 97.90, losing 0.55%. The short-term technical outlook hints towards a shift in command from the bears to the bulls while the overall bullish trend remains positive.

On the daily chart, the Relative Strength Index (RSI) for the AUD/JPY pair remains in positive territory, although with a declining trend. Despite the recent dip in the RSI, considering it still sits above the 50 mark, the buying pressure somewhat outweighs the selling pressure in the prevailing market conditions. However, a continuous downtrend, indicated by the RSI's negative slope since its recent peak, signifies a weakening in the buying momentum.

On the other hand, witnessing decreased green bars in the Moving Average Convergence Divergence (MACD) histogram indicates cues for a potential shift in trend. A falling MACD histogram generally means that the positive momentum is dwindling, indicating the sellers might be set to take control.

AUD/JPY daily chart

On the hourly chart, the RSI fluctuates in the negative territory, signaling increased selling activity. However, presenting a sharp contrast to the daily chart data, the hourly RSI ventures into the oversold area, which often points to a potential price correction in the near term to the upside. Also, the hourly MACD illustrates a weakening bearish momentum as suggested by the decreasing red bars which may suggest that an upward correction may be incoming..

AUD/JPY hourly chart

In retrospect, while the daily data illustrates a bullish trend, the hourly data presents that the bears took control but a slight upward correction shouldn’t be taken off the table for the rest of the session. The pair remains above the key Simple Moving Averages of 20,100 and 200 days, indicating a long-term bullish sentiment, despite short-term bearish glimpses.

The Greenback gathered some fresh upside traction against the backdrop of rising cautiousness prior to the release of US inflation figures measured by the PCE on Thursday. The renewed strengthening of the US Dollar weighed on sentiment and prompted some corrective moves in the risk complex.

Here is what you need to know on Thursday, February 29:

The Greenback regained further balance and prompted the USD Index (DXY) to reclaim the area beyond the 104.00 hurdle despite lower yields. On February 29, all the attention will be on the inflation gauged by the PCE, along with Personal Income, Personal Spending, Pending Home Sales and the usual weekly Initial Jobless Claims. Furthermore, Fed’s Bostic, Goolsbee, and Mester are due to speak.

EUR/USD traded on the defensive for the second straight session, although it managed to bounce off lows near 1.0800. The preliminary Inflation rate tracked by the CPI in the broader euro area takes centre stage on February 29, followed by Germany’s Retail Sales, flash Inflation Rate and the labour market report.

GBP/USD retreated to multi-day lows near 1.2620 on the back of renewed buying interest in the Greenback. Mortgage Approvals and Mortgage Lending are due on February 28.

USD/JPY kept its weekly choppiness well in place above the 150.00 barrier. On February 29, the usual weekly Foreign Bond Investment figures are due, seconded by flash Industrial Production, Retail Sales, Housing Starts and the speech by BoJ’s Hajime.

AUD/USD deflated to two-week lows in the sub-0.6500 region, maintaining its trade below the 200-day SMA. Data-wise, in Oz, comes Housing Credit and advanced Retail Sales on February 29.

Prices of WTI traded in a volatile session after hitting a new 2024 peak around $79.60 per barrel as traders assessed another unexpected build in US inventories, the likelihood of delayed rate cuts by the Fed, and the persistent crisis in the Middle East and the Red Sea, all coupled with speculation of the continuation of supply cuts by the OPEC+.

Prices of Gold clung to their daily gains around the $2,030 region, while Silver prices extended their leg lower, leaving the door open to a potential test of the $22.00 mark per ounce sooner rather than later.

President of New York Federal Reserve (Fed) John Williams noted on Wednesday that the Fed is likely to begin cutting interest rates in 2024, albeit in the latter half of the year.

Key highlights

- Inflation pressures have fallen amid broad-based improvement.

- The path back to 2% inflation is likely uneven.

- Incoming economic data will determine monetary policy.

- Remains fully committed to achieving 2% inflation target.

- Still a ways to go before hitting 2%.

- Current unemployment of 2.7% is around the long-term level.

- Economy and labor market remain strong, imbalances are waning.

- Fed's Williams predicts inflation will hit 2.0-2.25% in 2024, finally hit 2.0% in 2025.

- Sees growth at 1.5% this year, unemployment to peak around 4%.

- Risks exist on both the up and down sides.

- Expected to see more of a decline in Fed reserves, will be paying attention to what point it will be appropriate to revisit Quanititative Tightening (QT).

- Debate over rate cuts is a sign of progress on inflation.

- Too early to tell if Fed is extracting the right signals from housing inflation.

- Fed is likely to cut rates later this year.

- Pandemic aftermath is still affecting economy, but remains optimistic.

- USD/JPY trades slightly up, navigating through intervention concerns and US economic data impact.

- Technical analysis shows potential for uptrend continuation if the 151.00 level is reclaimed by buyers.

- Key support levels identified, with a drop below 150.26 possibly signaling a shift towards 150.00 and lower.

The USD/JPY remains subdued during the North American session, trading at around 150.71, up by 013% on Wednesday. Economic data releases from the United States (US) maintain the pair within familiar levels despite threats by Japanese authorities to step into the Forex markets.

USD/JPY Price Analysis: Technical outlook

As the USD/JPY daily chart depicts, the upward bias remains intact. The Relative Strength Index (RSI) is bullish but flat, an indication of consolidation, at around the current year-to-date (YTD) high of 150.88. If buyers would like to extend the uptrend, they must reclaim the 151.00 figure, so they could challenge last year’s high of 151.91.

Conversely, if sellers’ step into the market and drive the exchange rate below the Tenkan-Sen at 150.26, that would expose the 150.00 figure. Further downside is seen below the Senkou Span A at 149.32, followed by 149.00, and the Kijun-Sen at 148.39.

USD/JPY Price Action – Daily Chart

- DXY index is showing gains, currently standing at 103.90, after hitting a high of 104.20.

- The second estimate of Q4 US GDP came in at 3.2%, lower than expected.

- Expectations of the Fed delaying cuts favor the Greenback.

The US Dollar Index (DXY) is trading around 104.00, experiencing its first significant rise since mid-February after hitting 104.20 earlier in the session. This increase can largely be attributed to a decline in foreign currencies in response to a dovish hold by the Reserve Bank of New Zealand (RBNZ), which seems to be overshadowing soft Q4 Gross Domestic Product (GDP) revisions from the US.

Meanwhile, the US Federal Reserve (Fed) maintains a notably consistent, reluctant stance on cutting rates prematurely, signaling a hawkish bias via its officials. Market sensitivity to this stance has reduced expectations of an imminent rate cut, with odds for March at zero, May at 20%, and June around 50%. This seems to be providing a cushion for the Greenback.

Daily digest market movers: US Dollar gains as markets push back rate cut outlook

- The US reported that the GDP annualized growth rate was revised down to 3.2%, slightly below the consensus of 3.3%.

- To continue placing bets on the next Fed decisions, market participants are now awaiting the release of the Personal Consumption Expenditures (PCE) Price Index due on Thursday.

- Market expectations for the Fed's decisive actions have converged. The market now anticipates only 75 bps of total easing in 2024, down from 150 bps at the start of the year, and this aligns with the Fed’s rate projections.

Technical analysis: DXY bulls gain some ground, but must conquer 20-day SMA

On the daily chart, the Relative Strength Index (RSI) shows a positive slope in positive territory, indicating buyers have started gaining momentum. Nonetheless, bulls struggle to capture further ground, suggesting a possible exhaustion in their momentum.

The Moving Average Convergence Divergence (MACD) reflects a set of decreasing red bars. This tells us that, despite the buyer's force in the market, there is a palpable selling pressure visible. Looking at the Simple Moving Averages (SMAs), the index is beneath the 20-day and 100-day SMAs, affirming the short-term bearish outlook. Conversely, its position above the 200-day SMA implies that bulls are maintaining their strength in the grander time frames.

In summary, the current technical indicators suggest a precarious balance between buying and selling forces with a short-term bearish bias, which might be starting to wane. However, the long-term view remains bullish, evidenced by the pair's stance above the 200-day SMA.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Mexican Peso declines slightly against the Dollar, traders focus on upcoming Banxico monetary policy insights.

- Market anticipates 75 basis points of rate cuts from Banxico in the first half of 2024, eyeing a shift to 10.50%.

- US economic data and Federal Reserve officials' speeches set the backdrop for MXN's movements against the USD.

Mexican Peso edges lower against the US Dollar on Wednesday, posting modest losses ahead of the Bank of Mexico (Banxico) Q4 2023 report, which would update the view of monetary policy and projections. Data from the United States showed the economy expanded at a slower pace. The USD/MXN exchanges hands at 17.09, up 0.21%.

Mexico’s economic docket is light, except for Banxico’s release. Expectations that the Mexican central bank would ease monetary policy in March remain high with market participants estimating 75 basis points of easing over the next six months. This means the Mexican interest rates, currently standing at 11.25%, would be lowered to 10.50% in the first half of 2024.

Across the border, the US schedule featured the release of Gross Domestic Product (GDP) data for Q4 2023 and Retail and Wholesale Inventories for January. Meanwhile, Federal Reserve (Fed) policymakers will cross the wires, led by regional Fed Presidents Raphael Bostic, Susan Collins and John C. Williams.

Daily digest market movers: Mexican Peso drifts lower ahead of Banxico’s Q4 2023 report

- Mexico’s economy is expected to slow down due to higher interest rates set by Banxico at 11.25%. That’s the main reason that sparked a shift in three of the five governors of the Mexican Central Bank, who are eyeing the first rate cut at the March 21 meeting.

- In that event, the Mexican Peso could depreciate, opening the door for further upside on the USD/MXN pair.

- The latest inflation report in Mexico showed that headline and underlying inflation continued to dip toward Banxico’s goal of 3%, plus or minus 1%, while economic growth exceeded estimates but finished below Q3’s 3.3%.

- Mexico’s economic data released during the week from February 26 to March 1.

- The Balance of Trade for January revealed the country posted a trade deficit of $302 million.

- Mexico’s Consumer Price Index (CPI) in the first half of February was 4.45%, down from 4.9% YoY.

- Mexico’s Core CPI slowed from 4.78% to 4.63% on an annual basis.

- Mexico’s GDP for Q4 2023 exceeded estimates of 2.4% YoY and hit 2.5%, less than Q3 2023 print of 3.3%.

- Economic trade issues between Mexico and the US could depreciate the Mexican currency if the Mexican government fails to resolve its steel and aluminum dispute with the United States. US Trade Representative Katherine Tai warned the US could reimpose tariffs on the commodities.

- Across the border, Gross Domestic Product (GDP) for the last quarter of 2023 missed estimates by a tick, though it came at 3.2% YoY, down from Q3 4.9%.

- US Retail Sales Inventories rose 0.3% MoM in January, below 0.4% in the previous month's data, while Wholesale Inventories declined -0.1% MoM, missing estimates of 0.1%

- In January, US Durable Goods Orders significantly declined to -6.1% MoM, exceeding the anticipated contraction of -4.5% and marking a steeper fall compared to December's -0.3% decrease.

- In December, the S&P/Case-Shiller Home Price Index indicated a monthly decline of -0.3%, a slight acceleration in the contraction pace from November's -0.2%. On an annual basis, home prices rose by 6.1%, surpassing both expectations and the growth rate from the previous month.

- Market players had trimmed the odds for the first 25 basis point (bps) rate cut in June, with odds lying at 49%, down from 53% a day ago, while 39% of investors expected the Fed to keep rates unchanged at the current level of 5.25%-5.50%.

Technical analysis: Mexican Peso trips down as USD/MXN meanders above 50-day SMA

The USD/MXN is trading above the 50-day Simple Moving Average (SMA), which stands at 17.06, after the pair posted three days of losses. Relative Strength Index (RSI) studies are about to turn bullish, which could exacerbate a leg up toward the 17.10 area. Once cleared, traders could target 17.20. Further upside would be expected if buyers reclaim the 200-day SMA at 17.25 and the 100-day SMA at 17.33.

On the flip side, if USD/MXN drops below the 50-day SMA, look for a challenge of the 17.00 mark. A breach of the latter, and the pair would tumble to test yearly lows of 16.78, followed by last year’s low of 16.62.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Boston Federal Reserve (Fed) President Susan Collins still expects the Fed to begin easing later this year, but progress on inflation has slowed and policymakers need to wait for more evidence that the road to 2% remains clear.

Key highlights

- Need to see more evidence that the disinflationary process will continue before carefully normalizing policy.

- More time is needed to discern if the economy is sustainably on the path to stability, while still maintaining a healthy labor market.

- Fed's Collins wants to see continued evidence that wage growth is not contributing to inflation.

- Return to 2% likely requires a moderating of the pace of demand growth.

- Looking for well-anchored inflation expectations and an orderly moderation in labor demand.

- Wants to see continued declines in housing price inflation and non-shelter services inflation.

- The threat of inflation remaining above 2% has receded.

- EIA reported another Crude Oil inventory build.

- The API also reported an increase in barrel counts late Tuesday.

- OPEC officially weighs extending Q1 production caps through Q2.

West Texas Intermediate (WTI) US Crude Oil found further room on the top end on Wednesday, briefly climbing above $79.00 before getting pulled back down by another surprise buildup in US Crude Oil inventories according to the Energy Information Administration (EIA). The EIA’s uptick in barrel counts adds to another reported buildup from the American Petroleum Institute (API) which came through late Tuesday.

According to the EIA, US Crude Stocks Change for the week ended February 23 rose 4.199 million barrels, above the 2.743 million forecast and adding to the previous week’s 3.514 million buildup. This also adds to the API Weekly Crude Oil Stock count for the same period, which added another 8.428 million barrels compared to the previous week’s 7.168 million.

With inventories on the rise, the Organization of the Petroleum Exporting Countries (OPEC) has extended the first quarter’s production caps through June, and the Crude Oil cartel is formally weighing extending pumping reductions through the second quarter. The consortium is trying to bolster Crude prices by stemming the tide of Crude Oil supply getting pumped into markets by non-OPEC countries, specifically the US which recently became the single largest exporter of Crude Oil to Europe.

WTI technical outlook

WTI briefly tested into its highest prices since late November, etching in a daily high of $79.27 before falling back into the low end for Wednesday.

WTI continues to run aground of the 200-day Simple Moving Average (SMA) at $77.67. US Crude Oil is struggling to develop further bullish momentum, but is still up around 9% from the last swing low into $72.00 in early February.

WTI hourly chart

WTI daily chart

- USD/CAD flubs recovery above 1.3600 due to mixed US Q4 GDP.

- Canada sees soured Current Account print that misses expectations.

- Thursday’s Canada GDP to be eclipsed by US PCE.

USD/CAD saw an early Wednesday rally above the 1.3600 handle pull back into recent congestion after US Gross Domestic Product (GDP) figures were mixed on release. Markets will be pivoting to focus on Thursday’s US Personal Consumption Expenditure Price Index (PCE) as the Federal Reserve’s (Fed) inflation metric of choice.

Canada saw a worse-than-expected print in the fourth quarter Current Account, but the figure still recovered from the previous decline. Canadian Q4 GDP is also slated for Thursday, but it is set to be entirely overshadowed by the US PCE inflation update.

Daily digest market movers: USD/CAD sours but still on the high side

- Canada’s Q4 Current Account came in at -1.62 billion, missing the forecast recovery of -1.25 billion but still improved on the previous quarter’s -4.74 billion, which was revised lower from -3.22 billion.

- US Q4 GDP accelerated QoQ to 1.7% from the previous 1.5%.

- Annualized Q4 US GDP ticked lower to 3.2% from the steady forecast of 3.3% after late revisions to Q1 GDP dragged the yearly average lower.

- Read more: US Q4 GDP growth revised lower to 3.2% from 3.3%.

- Early US PCE numbers came in slightly higher than expected, with QoQ Core PCE for Q4 rising to 2.1% from the forecasted flat print at 2.0%, and PCE Prices ticked up to 1.8% from the expected flat print at 1.7%.

- Markets will be pivoting to Thursday’s US PCE Price Index, scheduled for 13:30 GMT.

- US Core PCE Preview: Forecasts from nine major banks, a hot reading.

- Core PCE Price Index for the year ended January is forecast to tick down to 2.8% from the previous 2.9%.

- Q4’s Canadian GDP Annualized is expected to rebound to 0.8% from the previous -1.1%.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.08% | 0.21% | 0.24% | 0.74% | 0.19% | 1.31% | 0.09% | |

| EUR | -0.06% | 0.15% | 0.17% | 0.69% | 0.12% | 1.25% | 0.03% | |

| GBP | -0.21% | -0.15% | 0.03% | 0.54% | -0.03% | 1.11% | -0.12% | |

| CAD | -0.24% | -0.18% | -0.05% | 0.51% | -0.05% | 1.05% | -0.12% | |

| AUD | -0.76% | -0.70% | -0.55% | -0.52% | -0.58% | 0.57% | -0.66% | |

| JPY | -0.18% | -0.15% | 0.02% | 0.06% | 0.57% | 1.15% | -0.09% | |

| NZD | -1.33% | -1.28% | -1.14% | -1.10% | -0.58% | -1.16% | -1.25% | |

| CHF | -0.09% | -0.03% | 0.12% | 0.15% | 0.63% | 0.09% | 1.23% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: USD/CAD hesitates on the top end after testing 1.3600

USD/CAD rallied on Wednesday, briefly crossing the 1.3600 handle before paring back into recent technical levels. The pair found a fresh ten-week high at 1.3606, but 1.3580 remains a tricky barrier to break.

Daily candlesticks continue to etch out a rough pattern of higher highs as momentum runs aground of the 200-day Simple Moving Average (SMA) at 1.3478. Despite near-term congestion, USD/CAD has closed in the green for all but one of the last eight consecutive weeks.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

The Fed’s preferred inflation gauge, the Core Personal Consumption Expenditure (PCE), will be released by the US Bureau of Economic Analysis (BEA) on Thursday, February 29 at 13:30 GMT and as we get closer to the release time, here are the forecasts of economists and researchers of nine major banks.

Core PCE price index is expected to have grown by 0.4% on a month-on-month basis in January against a 0.2% increase in December. If so, it would be the largest gain since last January. Annually, the underlying inflation data is forecast to have fallen a tick to 2.8%. Meanwhile, headline PCE is expected to fall two ticks to 2.4% YoY.

Commerzbank

We forecast a core rate of 0.4% MoM, i.e. an annualised rate of around 5%. This would be a significant setback for those expecting a rapid return of inflation to the Fed's 2% target. Some special effects may have played a role here, so a smaller increase is to be expected in February. However, January's data will reinforce our view that, on balance, inflation is falling only slowly and should eventually stabilise above the Fed's target.

ING

The core (ex-food & energy) personal consumer expenditure deflator is set to post a 0.4% MoM increase. We need to see MoM prints consistently below 0.2% MoM to be confident that inflation will return to the 2% YoY target over time, and we have been making excellent progress with six out of the past seven months seeing inflation come in sub 0.2%. However, the January PPI and CPI reports suggest that key components within the PCE deflator will post outsized increases this month with insurance, medical and portfolio management fees boosting inflation. Much of this isn’t especially driven by fundamental demand and supply factors – insurance is caused by higher crime relating to more expensive assets while strong equity market gains have boosted portfolio fees – but it presents a major stumbling block regarding the prospect of interest rate cuts. We are hopeful that February will post better numbers.

Deutsche Bank

We expect core PCE to show +0.36% MoM growth in January. This would make it the highest since last January. The fact that last January was 0.51% means that rolling out base effects should help the YoY rate edge down a tenth to 2.8%. However, it's the monthly print that will be all important.

TDS

Robust increases in Jan CPI/PPI data will likely result in a solid 0.36% MoM jump for the core PCE – its largest increase since 23Q1. The PCE's supercore likely also surged 0.55%, while we project the headline PCE to rise by a less solid 0.28% MoM. Firm inflation supports the Fed's desire to be patient before cutting rates.

NBF

The annual core PCE deflator may have progressed 0.4% MoM in January, a result which should translate into a one-tick decline of the 12-month rate to 2.8%. Although still above the Fed, this would still be the lowest rate observed in 34 months.

SocGen

The Fed may favour the PCE deflator over the CPI as an inflation measure, but confidence that inflation is moderating and can sustain the desired 2% pace will require all the inflation evidence to offer consistent views. The latest CPI for January shook confidence to the extent that CPI-core inflation was no longer converging upon the lower PCE inflation trend. It could be a one-month piece of noise. Unfortunately, we are expecting the PCE to be more elevated versus recent months as well. Not only were the CPI components that feed directly into the PCE up but healthcare costs and financial costs available in the PPI were also up. The risk may be on the core PCE, where we estimate a 0.4% MoM increase, but that is a rounded figure, and our estimate is closer to 0.36%. Rounding down versus rounding up could be the key to how markets react to the immediate release.

CIBC

We expect core PCE numbers to be a hot one with a 0.4% MoM reading based on the CPI and PPI data. Markets should not be too surprised with a hot core PCE reading given it’s the consensus view so we don’t expect much overreaction. Most Fed speakers have emphasized that cuts are not imminent and the pace of easing is going to be gradual.

Citi

Surprising strength in services prices across the board in both CPI and PPI data lead Cus to forecast similar strength in core PCE inflation in January, with a 0.38% MoM increase and the YoY reading moderating only slightly to 2.8%. This would also imply the 6-month annualized pace rises to 2.4% from 1.9%. Details of core PCE should also echo strength in services prices, with core services excluding shelter rising 0.55%, the strongest monthly pace since March 2022. On the other hand, goods prices should decline in core PCE, but less so than in core CPI.

Wells Fargo

We look for the headline deflator to slip to a year-ago rate of 2.4% and the core measure to fall further to 2.8%. However, the hot January CPI and PPI data suggest firmer monthly prints for both the headline and core (0.3% and 0.4%, respectively), driven by broad-based strength in services. We expect services less energy, food and housing to rise 0.6% in January, lifting the three-month annualized rate to 4.2%. Given services remain key to getting inflation on a sustained trajectory lower, it will likely prevent imminent rate cuts from the Fed.

Next week brings the UK budget. The budget has the potential to impact the Pound Sterling (GBP) – which is currently the second best performing G10 currency in 2024 after the US Dollar, economists at Rabobank say.

EUR/GBP to edge lower to 0.8500 on a three-month view

The market is likely prepared for a moderate amount of fiscal loosening next week. Press reports suggest that this may include fresh changes to National Insurance, rather than income tax. Even a low level of fiscal stimulus would likely reinforce the consensus view that the BoE would likely be in a rush to cut interest rates.

Of particular interest to the market could be any supply-side reforms that could increase incentives to work or regulation changes that could enhance incentives to invest. While any increase in the labour pool would be anti-inflationary, such policies would be pro-growth and are thus likely to be seen as GBP-friendly.

Assuming that budgetary prudence is adhered to by Chancellor Hunt and maintained in the pledges of the opposition, we expect EUR/GBP to edge lower to 0.8500 on a three-month view before moving down to 0.8400 on a six-month view.

- EUR/USD declines amid signs of US economic resilience, despite slight GDP adjustment to 3.2% YoY.

- Fed's inflation measure, PCE, anticipated to show deceleration, potentially impacting rate cut expectations.

- Eurozone economic sentiment dips, highlighting stagnation as traders await critical Eurozone inflation figures.

The Euro stumbles for the second straight day against the US Dollar as investors assess recent data from the United States, revealing the economy remains strong. At the time of writing, the EUR/USD edges lower 0.12% and exchanges hands at 1.0830.

EUR/USD falls as US GDP shows economy losses momentum, inflation data in focus

The US Bureau of Economic Analysis (BEA) reported the second estimate of the Gross Domestic Product (GDP) for the last quarter of 2023, coming a tenth lower at 3.2% YoY compared to the 3.3% preliminary reading. Although the economy remains robust, recent data suggests the economy is losing momentum, as Retail Sales and Durable Goods Orders declined in January.

EUR/USD traders’ eyes are laser-focused on the release of the inflation figures for January. The Federal Reserve’s (Fed) preferred gauge for inflation is the Personal Consumption Expenditure (PCE). The consensus sees the PCE at 2.4% YoY and the Core PCE at 2.8%, with both cases slowing compared to December’s data.

If the data eases, look for a more aggressive re-pricing of rate cut expectations by the swaps market, which converged towards the Fed’s projections of three rate cuts towards the end of 2024.

Across the pond, the Eurozone economy is stagnating, as Economic Sentiment fell again in February, from 96.1 to 95.4, below estimates of an improvement to 96.7. According to ING analysts, “The eurozone economy has been stagnant since late 2022, and surveys have shown that there is no meaningful improvement happening in the first quarter.” In the meantime, traders would be eyeing the release of the latest inflation data from the Eurozone, with estimates for the Harmonized Index of Consumer Prices (HICP) at 2.5%, while core HICP at 2.9%.

EUR/USD Price Analysis: Technical outlook

From a technical perspective, the EUR/USD is trading sideways, though in the last couple of days, achieved remained above the 200-day moving average (DMA), which lies at 1.0827. A daily close above that level could pave the way to test the 50-DMA at 1.0878 before testing 1.0900. On the flip side, a daily close below the aforementioned level could pave the way to test the 1.0800 mark.

Economists at HSBC see modest downside risks for the Euro (EUR) and the Pound Sterling (GBP).

The ECB and BoE are likely to pivot more explicitly towards policy easing in the months ahead

We expect the start of the rate-cut cycles in 2024 to be mildly negative for both EUR and GBP, even if markets have currently priced in rate cuts, as they had been in previous cycles.

We expect the first rate cut from the Fed and the ECB in June, while August is more likely for the BoE. Neither the ECB nor the BoE is likely to deliver idiosyncratic rate cuts, but both could end up with a more dovish cycle than the Fed, weighing on their currencies.

At the same time, the global economy is expected to slow this year, so risk sentiment is unlikely to improve significantly. As such, support for both currencies is set to be limited.

Given the circumstances, we expect both the EUR and GBP to weaken modestly against the USD in 2024.

The Reserve Bank of New Zealand (RBNZ) held its Official Cash Rate (OCR) unchanged. Economists at Danske Bank analyze NZD/USD outlook after the decision.

RBNZ holds rates steady

The Reserve Bank of New Zealand (RBNZ) held monetary policy unchanged. In contrast to other G10 central banks eyeing the start of their respective rate cutting cycles, markets have speculated on an additional rate hike from the RBNZ, but the tone of today's announcement was clearly to the dovish side, suggesting that the current level of policy rate is seen as sufficiently restrictive.

We expect NZD/USD to decline further over the coming year, with a 12M target at 0.5700.

The FOMC has kept rates on hold since its last rate hike in July. Economists at ABN Amro still expect the Fed to start cutting rates from June.

Upper bound of the FFR to reach 4.25% by end-2024, and 3% by mid-2025

We expect the Fed to start cutting rates in June, with the risk somewhat tilted to earlier cuts.

Even with rate cuts starting next year, monetary policy is expected to remain restrictive throughout 2024 and even into 2025.

We expect the upper bound of the fed funds rate to reach 4.25% by end-2024, and 3% by mid-2025.

The Fed also looks set to wind down its quantitative tightening somewhat sooner than previously expected, though this will be well-telegraphed and gradual.

The US Dollar Index (DXY) recovers above 104.00. Economists at Scotiabank analyze Greenback’s outlook.

Spreads have moved only marginally in the USD’s favour over the past month

Although markets continue to reprice Fed rate cut risks in the coming months (Fed swaps imply only 75 bps of easing through the end of the year now, about half of what was priced in at the start of February), this is not an obvious driver of USD gains because implied rate cuts by other central banks have been slashed as well.

Spreads have moved only marginally (5-6 bps for 2Y spreads) in the USD’s favour over the past month and the DXY is still trading above my estimated fair value (based on DXY-weighted yield differentials) which sits at 103.04 today.

There may be little potential for USD gains to develop further, in other words.

- US GDP growth for Q4 is revised lower to 3.2% from 3.3%.

- US Dollar Index stays in positive territory above 104.00.

The United States' Gross Domestic Product (GDP) grew at an annual rate of 3.2% in the fourth quarter, the US Bureau of Economic Analysis (BEA) said in its second estimate on Wednesday. The BEA reported in its advanced estimate the real GDP growth was 3.3%.

"The update primarily reflected a downward revision to private inventory investment that was partly offset by upward revisions to state and local government spending and consumer spending," the BEA explained in the press release.

Market reaction

The US Dollar Index (DXY) edged slightly lower with the immediate reaction and was last seen rising 0.26% on the day at 104.07.

EUR/USD looks soft again in the low 1.0800s. Economists at Scotiabank analyze the pair’s outlook.

Support below the 1.0800 figure should firm up in the 1.0770/1.0790 zone

EURUSD’s loss of minor support around 1.0850 added to the negative undertone for price action on the short-term chart.

EUR losses have steadied around the 1.0800 level but the rebound in price, so far, has been limited.

A rebound back through 1.0835 resistance intraday will ease bearish pressure on the EUR and put a move back up to the mid/upper 1.0800s on the cards.

EUR support below the figure should firm up in the 1.0770/1.0790 zone.

USD/CAD is retesting the mid-February high at 1.3590. Economists at Scotiabank analyze the pair’s outlook.

Loonie likely to remain soft for now

The Canadian Dollar is likely to remain soft for now, with little fundamental incentive for the CAD to strengthen, given the recent widening in US/Canada interest rate differentials.

Solid gains on the day have reinvigorated short-term trend strength oscillators in the USD’s favour but the overall trend in spot through February remains flat and the USD will need to push on through 1.3585/1.3590 to see gains develop just a little more through to the low/mid 1.3600s.

Support is 1.3540/1.3550.

- The US Dollar trades in the green across the board.

- Market sentiment turns into risk-off, with equities in the red in both Asia and Europe.

- The US Dollar Index recovers above 104.00, posting a fresh five-day high.

The US Dollar (USD) is recovering on Wednesday to a five-day high driven by safe-haven inflows. Markets got shaken by a mix of elements coming from China and New Zealand. In China, additional measures were issued to support the housing, leisure and gaming sector, although stimulus was far less than what markets were expecting.

On the economic front, markets had to digest a surprisingly dovish stance from the Reserve Bank of New Zealand (RBNZ), which limited the odds of future rate hikes. In the US calendar, all eyes will be on the second reading for the US Gross Domestic Product (GDP) for the fourth quarter, although not much movement is expected. Rather, some volatility can be expected near the European close as no less than three Fed speakers will take the stage within a one-hour timeframe.

Daily digest market movers: Risk off sets the scene

- Ahead of the US session, some European Central Bank (ECB) comments from ECB's Peter Kazimir, who said that disinflation is taking place much quicker than expected, and that there is no reason to rush for a rate cut, with June as best guess from the ECB member.

- The Mortgage Bankers Association (MBA) has released its Mortgage Applications Index for this week. Last week there was a decline of 10.6%, with this week another 5.6% decline.

- At 13:30 GMT, the second reading of the US Gross Domestic Product (GDP) for the fourth quarter will be released:

- Headline GDP is expected to grow at an annualized rate of 3.3%, unchanged from the first estimate.

- Core Personal Consumption Expenditures is also set to remain unchanged from the previous estimate at 2%.

- The quarterly Personal Consumption Expenditures Price Index is expected to remain unchanged at 1.7%.

- Between 17:00 and 17:45 GMT, three US Federal Reserve officials are due to take the stage.

- At 17:00 GMT, Atlanta Fed President Raphael Bostic will speak first.

- Near 17:15 GMT, Boston Fed President Susan Collins will follow.

- At 17:45 GMT, New York Fed President John Williams will take the stage.

- Equities are in the red across the board. Especially the Chinese equities, with both major indices down over 1% after disappointing supportive measures for the construction, leisure and gaming sector. European and US equities are all in the red, though less than 0.50%.

- According to the CME Group’s FedWatch Tool, expectations for a Fed pause in the March 20 meeting are at 99.5%, while chances of a rate cut stand at 0.5%.

- The benchmark 10-year US Treasury Note trades around 4.29%, and is not far off this week’s peak at 4.32%.

US Dollar Index Technical Analysis: Risk remains for another leg lower

The US Dollar Index (DXY) has brushed off over five days of losses, setting a new five-day high on Wednesday. The move comes with the risk-off inflows after both Chinese stimulus measures and a dovish Reserve Bank of New Zealand rate decision disappointed markets. Do bear in mind that month-end flows are often negative for the US Dollar, so current gains possibly will be given up by Thursday.

To the upside, the 100-day Simple Moving Average (SMA) near 104.00 is being tested as its resistance got broken, though could still shape into a bull trap. Should the US Dollar be able to cross 104.60, 105.12 is the next key level to keep an eye on. One step beyond there comes 105.88, the high from November 2023. Ultimately, 107.20 – the high of 2023 – could even come back into scope, but that would be when markets reprice the timing of a Fed rate cut again, possibly delaying it to the last quarter of 2024.

Looking down, the 200-day Simple Moving Average at 103.74 has been broken twice recently, making it a weak support. The 200-day SMA should not let go that easily, so a small retreat back to that level could be more than granted. Ultimately, it will lose its force with the ongoing selling pressure and could fall to 103.16, the 55-day SMA, before testing 103.00.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

GBP/USD slides in line with peers but rebound from low looks constructive, economists at Scotiabank say.

Support is 1.2580/1.2590

Sterling has succumbed to the stronger USD tone, in line with its major currency peers. There are no obvious fundamental drivers for Sterling’s slide, beyond the shift into the USD amid weaker risk assets. The GBP has found firm support around the daily low, however, and may be staging one of the stronger rebounds among its peers as the North American session gets underway.

Intraday chart patterns reflect a low/reversal (bullish outside range) developed on the hourly chart in response to Cable’s drop to 1.2622 a little earlier.

GBP gains through 1.2665/1.2670 on the session should help deepen the rebound to 1.2700+.

Support is 1.2580/1.2590.

Is it time to normalize the BoJ's monetary policy? Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank, analyzes how the end of ultra-expansionary monetary policy could impact the Japanese Yen (JPY).

If the BoJ begins to exit in three weeks, JPY may initially benefit

For the Yen, an end to ultra-expansionary monetary policy is a double-edged sword: on the one hand, it means slightly higher JPY carry, but on the other hand, no higher carry in the long run.

In my view, this means that if the BoJ does indeed begin to exit in three weeks, this may initially have a positive effect on the JPY. However, this effect would be limited. At the same time, the chances of at least real (i.e. inflation-adjusted) positive real interest rates would decline.

- Natural Gas prices are flat halfway through the European session but with upside potential.

- Traders see the risk of overcrowded demand for cheap European Gas contracts.

- The US Dollar Index rallies above 104.00 and sets a three-day high.

Natural Gas (XNG/USD) is trading back above $1.80 after a two-day winning streak. Traders are seeing more room for some upside with the European Gas trading market becoming very crowded. Due to the recent multi-year low in prices, several foreign traders are making their way into the European Gas trading market, with Asia being very active in buying up contracts.

The US Dollar (USD) is delivering a gut-punch to the markets by stretching to a three-day high in the European trading session. Ahead of the second reading of the US Gross Domestic Product (GDP), the Greenback is making its way back up against most major peers. Risk-off sentiment in Asia was the main trigger for the start of the US Dollar strength this Wednesday.

Natural Gas is trading at $1.84 per MMBtu at the time of writing.

Natural Gas market movers: Europe’s LNG markets get crowded

- Recent declines in European Gas prices have spurred other parts of the world into buying. This could push prices higher in Europe, and spillover into global Gas prices.

- China’s Gas imports are expected to climb by 8.2% this year. Buyers are buying more Gas than needed, especially at current cheap prices.

- Turkey’s Natural Gas imports have declined by 8% in 2023, with Russia being the biggest supplier.

- This Wednesday morning EU President Ursula Von Der Leyen proposed to start using the frozen Russian assets for Ukrainian support.

Natural Gas Technical Analysis: European Gas market getting crowded

Natural Gas in Europe is set to face a hot summer with more and more market participants entering the bloc’s Gas trading market. All new additions are buyers, mainly from Asia, interested in the European Gas market with at the moment multi-year low prices and the guaranteed price cap the EU has put in place to protect households from rising Gas prices after Russia decreased its supplies to Europe. Although Europe looks well equipped to refuel ahead of the next heating season, the risk of some volatile spikes could be on the horizon over the summer period.

On the upside, Natural Gas is facing some pivotal technical levels to get back to. The next step is $1.99, – the level which, when broken on the way down, saw an accelerated decline. After that, the green line at $2.13 comes into view, with the triple bottoms from 2023. If Natural Gas sees sudden demand pick up, $2.40 could come into play.

On the downside, $1.64 and $1.53 (the low of 2020) are targets to look out for. Another leg lower could come if global growth starts to shrink and there is less demand. Add to that equation both the US and Canada trying to free up more volume of Natural Gas mining, and the scale could quickly tip into an oversupplied market with more downside prices at hand.

XNG/USD (Daily Chart)

Natural Gas FAQs

What fundamental factors drive the price of Natural Gas?

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

What are the main macroeconomic releases that impact on Natural Gas Prices?

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

How does the US Dollar influence Natural Gas prices?

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.