- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

The U.S. Energy Information Administration (EIA) revealed on Friday that crude inventories decreased by 5.474 million barrels in the week ended December 20. Economists had forecast a drop of 1.724 million barrels.

At the same time, gasoline stocks rose by 1.963 million barrels, while analysts had expected an increase of 1.663 million barrels. Distillate stocks fell by 0.152 million barrels, while analysts had forecast a gain of 0.611 million barrels.

Meanwhile, oil production in the U.S. increased by 100,000 barrels a day to 12.900 million barrels a day.

U.S. crude oil imports averaged 6.8 million barrels per day last week, up by 230,000 barrels per day from the previous week.

Analysts at Danske Bank note that China refrained from lowering the policy rate (Loan Prime Rate) this week in a sign that it is reluctant to ease policy further.

- "Efforts are being made to get more credit through to the private sector, which continues to be starved of credit access.

- The State Council, China's cabinet, called on banks to cut financing costs by 0.5 percentage points next year for small and micro businesses. It also instructed five of the country's largest state-owned commercial banks to increase the value of loans made to these companies by at least 20% next year."

Jane Foley, the head of FX strategy at Rabobank, notes that EUR/CHF traded sideways towards the end of 2019 at the bottom end of the range traded over the past two years.

- "A slowing Eurozone economy generally generates demand for the CHF as a safe haven. Although Eurozone data may have stopped worsening for now, downside risks to growth remain and these suggest that the SNB will be wary about the possibility of further gains in the CHF.

- Faced will very weak inflation pressure the SNB can be expected to retain its set of ultra-accommodative monetary policy settings along with a threat to intervene for the foreseeable future. Even so, we expect demand for the safe-haven CHF to increase around mid-2020."

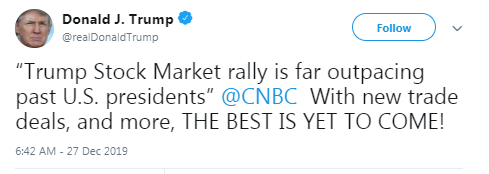

U.S. stock-index futures rose on Friday, touching fresh record highs, as optimism over U.S.-China trade tensions and an improving global economy continued to support investor sentiment going into the new year.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 23,837.72 | -87.20 | -0.36% |

| Hang Seng | 28,225.42 | +361.21 | +1.30% |

| Shanghai | 3,005.04 | -2.32 | -0.08% |

| S&P/ASX | 6,821.70 | +27.50 | +0.40% |

| FTSE | 7,655.31 | +23.07 | +0.30% |

| CAC | 6,052.15 | +22.60 | +0.37% |

| DAX | 13,363.84 | +62.86 | +0.47% |

| Crude oil | $61.82 | | +0.23% |

| Gold | $1,515.80 | | +0.09% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 177.28 | 0.69(0.39%) | 2046 |

| Amazon.com Inc., NASDAQ | AMZN | 1,884.50 | 15.73(0.84%) | 97669 |

| Apple Inc. | AAPL | 291.65 | 1.74(0.60%) | 418597 |

| AT&T Inc | T | 39.27 | 0.11(0.28%) | 42973 |

| Boeing Co | BA | 331.15 | 1.23(0.37%) | 19972 |

| Citigroup Inc., NYSE | C | 80 | 0.17(0.21%) | 18150 |

| Exxon Mobil Corp | XOM | 70.4 | 0.27(0.39%) | 10820 |

| Facebook, Inc. | FB | 208.83 | 1.04(0.50%) | 63686 |

| FedEx Corporation, NYSE | FDX | 153 | 0.51(0.33%) | 3545 |

| Ford Motor Co. | F | 9.46 | 0.01(0.11%) | 45855 |

| General Electric Co | GE | 11.22 | -0.01(-0.09%) | 63185 |

| Home Depot Inc | HD | 221.02 | 0.20(0.09%) | 2951 |

| Intel Corp | INTC | 59.97 | 0.15(0.25%) | 18794 |

| International Business Machines Co... | IBM | 135.3 | 0.39(0.29%) | 3690 |

| Johnson & Johnson | JNJ | 145.96 | 0.13(0.09%) | 6559 |

| JPMorgan Chase and Co | JPM | 139.16 | 0.12(0.09%) | 5754 |

| McDonald's Corp | MCD | 197.15 | 0.09(0.05%) | 4353 |

| Microsoft Corp | MSFT | 159.41 | 0.74(0.47%) | 66888 |

| Nike | NKE | 101 | 0.29(0.29%) | 6598 |

| Pfizer Inc | PFE | 39.49 | 0.11(0.28%) | 16763 |

| Procter & Gamble Co | PG | 125.52 | 0.30(0.24%) | 4653 |

| Starbucks Corporation, NASDAQ | SBUX | 88.22 | 0.15(0.16%) | 3180 |

| Tesla Motors, Inc., NASDAQ | TSLA | 435.3 | 4.36(1.01%) | 207328 |

| The Coca-Cola Co | KO | 55.15 | 0.13(0.24%) | 10052 |

| Twitter, Inc., NYSE | TWTR | 32.71 | 0.08(0.25%) | 13538 |

| UnitedHealth Group Inc | UNH | 296.25 | 0.60(0.20%) | 1672 |

| Wal-Mart Stores Inc | WMT | 119.81 | 0.29(0.24%) | 4169 |

| Walt Disney Co | DIS | 146.08 | 0.38(0.26%) | 26498 |

| Yandex N.V., NASDAQ | YNDX | 44.2 | 0.47(1.07%) | 2499 |

NIKE (NKE) initiated with an Overweight at Consumer Edge Research; target $110

The data released by the National Institute of Statistics on Friday revealed that Spain's retail sales grew at a steady pace in November, helped by higher demand for personal equipment.

According to the data, retail sales rose a calendar and seasonally-adjusted 2.9 percent y-o-y in November, the same pace as in October.

Among components, food sales increased 1.2 percent y-o-y, while non-food sales surged 4.5 percent y-o-y, driven by a 4.4 percent y-o-y jump in sales of personal equipment.

On an unadjusted basis, retail sales climbed 3 percent y-o-y in November, following a 2.6 percent y-o-y gain in October.

Compared to the previous month, retail sales rose a calendar and seasonally adjusted 0.5 percent in November after a 0.1 percent advance in the previous month. That marked the biggest monthly growth since May.

Analysts at Nordea Markets suggest the solid victory at the UK's general election for the Conservatives and Boris Johnson should pave the way for a divorce deal ratification in January.

- "It appears that the markets have not yet fully priced in the expected difficulties concerning the phase two negotiations about the future trade relationship (even despite some sterling weakness this week).

- We, therefore, see downside risks in the coming quarters for the sterling - partly due to these phase two negotiations, partly due to continued weakness in the economy (especially in the labour market).

- Our lukewarm sterling outlook also seems to be more in line with the option market which is clearly positioned for GBP weakness in 2020. We have EUR/GBP at 0.88 on 3-month horizon."

Piotr Matys, the senior FX strategist at Rabobank, suggests that supported by oil prices, attractive carry trade (despite the CBR cutting rates by 125bps to 6.25%) and optimism about the phase one trade deal the ruble was on track to end 2019 as the best performing EM currency, but it may change in 2020.

- "As a commodity currency, the RUB will be negatively affected if the US falls into recession. Trade truce is unlikely to last and China will lose more momentum.

- Domestic factors will not be supportive as GDP growth will remain sluggish. Strong bipartisan anti-Russian sentiment in the US Congress could culminate in severe economic sanctions being imposed for meddling in the 2016 presidential elections."

Iris Pang, the economist for Greater China at ING, notes that with manufacturing PMI switching back to above 50 in November, industrial profits also showed strength in the manufacturing industry.

- Industrial profits grew by 5.4% year on year in November after a contraction of 9.9%YoY in October, marking the fastest growth in 2019 except in March.

- In terms of the growth rate of profits, ferrous metal mining had a 170.7%YoY year-to-date increase in profits in November.

- From another perspective, if we rank the operating profits of the reported manufacturing industries, the biggest operating profit industry, which is the computer, telecommunication, and electronic equipment industry, earned a profit of CNY 10.2 trillion YTD in November that grew by 4.1%YoY year-to-date.

- The trade war continued to damage export-related manufacturing activities. As long as the 'phase-one' deal is not signed, the tariffs imposed on China's export to the US will not be rolled back. But, even if the 'phase - one' deal is signed, the rollback of tariffs, according to the media, will be just 7.5% on $120 billion goods, which is too small to stop damages on overall Chinese exports.

- The good news may be that China will lower provisional import taxes that are lower than the most-favoured-nation tariff rates for more than 850 goods starting from 1 January 2020, according to the Customs Tariff Commission of the State Council.

- China will also carry out the fifth reduction in the most-favoured-nation tariff rates for 176 information technology profits from 1 July 2020 according to the same source.

- The most widely reported benefit of these tariff cuts are a reduction of imported food costs and the opening up of the Chinese consumer market to foreign companies. But, we also see that these two policies will reduce manufacturers' import costs, and therefore enhance their profitability in 2020. "

Analysts at Nordea Markets are expecting the Bank of England (BoE) to be on hold in 2020.

- "We do not buy into Boris Johnson's "promise" that a ratified divorce deal in itself should result in an investment boom, which could prompt a rate hike. Instead, we expect the BoE to take a wait-and-see approach, as they await the economic impact from the clarity around the divorce deal as well as how the phase two negotiations unfold.

- Some market participants have speculated in an upcoming rate cut from the BoE in the past six months or so. In our view, however, a cut in at least January can almost completely be ruled out due to timing obstacles (January meeting is on the day before the exit day, 31 January).

- Longer out, the BoE will also probably find some comfort in a modest growth rebound in Q1, and when looking at the last few years' reaction function of the BoE related to Brexit uncertainty, they have usually preferred to be patient rather than acting precautionary.

- The big "if" and possible game-changer besides Brexit, is though who will replace Governor Carney at the end of January. As evident after the 2016 referendum, Carney has not rushed the BoE into any big changes, but a new Governor could take a more precautionary approach (i.e. cut rates) as, for example, the Fed has done in 2019."

- Says ECB is unlikely to be in a position to lift interest rates back into positive territory in 2020

- Concerns will grow again next December when Britain's transition period for its withdrawal from EU is due to end

- There is little time for negotiations on future relations, and the outcome of the negotiations is open

Céline Choulet, an analyst at BNP Paribas, notes that in the last three months, the U.S. Federal Reserve has injected more than USD 360 billion of central bank money through repurchase agreement operations (repo) and outright purchases of T-bills.

- "It will ramp up its intervention further between now and 31 December, to remove the risk of losing control of short-term rates again because of the specific needs of market participants as they approach their financial yearend.

- By the year-end, if the volume of demand for repo transactions reaches the total amount offered by the Fed, USD 650 bn of central bank money will have been injected.

- However, even that huge amount of support could prove insufficient. That is due in particular to the planned increase in the Treasury's account with the Fed, the leverage constraints of broker-dealers and the G-SIB capital surcharge."

Analysts at TD Securities note the focus for sterling remains very much on the evolving UK political landscape.

- "Investors enjoyed a brief post-election honeymoon when the risk of a no-deal crash out was considered all but eliminated. These hopes have diminished, although we note that the end-2020 potential cliff edge remains far off in the distance.

- Looking forward, we are not convinced that cable's correction from its brief foray above 1.3500 is yet complete. From a purely technical standpoint, we think spot could see a clear break below 1.3050 that takes out this now-important support. If realized, we think this would be driven mostly by positioning factors as we approach year-end as shorter-term participants dial back further on sterling allocations. At the same time, we note that the structural shorts - at least those evidenced in IMM data - have been all but eliminated. This, in our view, tilts the balance in favour of shorter-term sterling sellers overall.

- With an eye on potential resistance in the 1.3225/35 area, we think the first target of a further move lower in cable may be found at the 1.2985 pre-election "melt-up" level. Below this, we note the 55-dma currently comes in at 1.2887, which also closely corresponds with support seen in late-Novemer.

- On a longer-term basis, however, we think sterling is starting to look more attractive from a strategic perspective. We continue to target a move up to 1.40 in cable over the next twelve months."

China's fourth-quarter economic growth may have been "the weakest of 2019" - but it still showed an improvement compared to the previous quarter and to the same period a year ago, a business survey showed.

Manufacturing and services saw the strongest revenue improvement compared to the the previous quarter, though profit was "muted," according to research firm China Beige Book's quarterly review of the world's second-largest economy, which was based on a survey of more than 3,300 Chinese businesses.

Three important results emerged from the survey.

First, there are signs that cash flows have deteriorated quickly. "It is easy to discount a seemingly unceasing trend of worsening cash flow, since it in some ways is a feature of the system. But even by Chinese standards, Q4 late payables and deliverables soared-to the worst levels we've recorded," the report said.

Secondly, new orders continue to fall even though companies are reporting higher revenue in the fourth quarter. "Demand may not hold up," the report said, adding that "firms may not yet have understood the message their customers are sending."

Finally, the economy saw record levels of corporate borrowing in the fourth quarter, the survey showed. "Loan applications nationally shot to an all-time high, while rejections sank to an all-time low," according to the China Beige Book. "For the first time since 2012 we saw each of our four core sectors-Manufacturing, Retail, Services, and Property-report over 30% of firms borrowing."

According to the report from State Administration of Foreign Exchange, China's current account surplus widened in the third quarter while capital and financial account turned to deficit.

Current account surplus stood at $49.2 billion in the third quarter, up from $46.2 billion in the second quarter, official data showed.

China's capital and financial account recorded $9.8 billion deficit in the third quarter. In April to June period, the capital and financial account had a $21.4 billion surplus.

Jane Foley, head of FX strategy at Rabobank, notes that EUR/CHF traded sideways towards the end of 2019 at the bottom end of the range traded over the past two years.

"A slowing Eurozone economy generally generates demand for the CHF as a safe haven. Although Eurozone data may have stopped worsening for now, downside risks to growth remain and these suggest that the SNB will be wary about the possibility of further gains in the CHF. Faced will very weak inflation pressure the SNB can be expected to retain its set of ultra-accommodative monetary policy settings along with a threat to intervene for the foreseeable future. Even so we expect demand for the safe haven CHF to increase around mid 2020."

British real wages are expected to climb early in 2020 to levels not seen since before the financial crisis over a decade ago, a think-tank forecast on Friday.

Pay data adjusted for inflation will be strong at the start of the new year despite economic growth remaining sluggish, raising concerns that the turnaround may not be sustainable, the Resolution Foundation said in its earnings outlook.

Growth in the world's fifth-biggest economy has slowed since voters decided in June 2016 that Britain should leave the European Union.

The labour market, however, has fared well in 2019, with the unemployment rate recently falling back to its lowest level since early 1975.

"The big question for 2020 is whether (the labour market) can continue its strong run, or whether it will reach a tipping point and reconnect with weaker growth performance," the Resolution Foundation said.

The foundation said falling vacancies and rising youth unemployment were worrying signs for the market, while earnings were at risk from staggering productivity and weaker nominal wage growth.

Christian Lawrence, senior market strategist at Rabobank, explains that USD/CAD pair has been range trading over the past six months which helps explain why implied volatility fell to record lows at the end of November.

"We often highlight oil and interest rate differentials as the main driver of USD/CAD. That said, in line with our expectations this has broken down as the USD continued to strengthen despite falling US rates. We expect USD/CAD to break out to the upside, but it is fair to say we have been surprised at CAD's resilience. To our mind, however, it is only a matter of time before data deteriorates and the market rep."

-

Global real GDP growth (excluding the euro area) weakened during the first half of 2019, but signs of stabilisation started to emerge towards the end of the year.

-

Since the Governing Council meeting in September 2019 euro area long-term risk-free rates have increased and the forward curve of the euro overnight index average (EONIA) has shifted upwards, with markets currently expecting no further cut in the deposit facility rate.

-

Euro area real GDP growth was confirmed at 0.2%, quarter on quarter, in the third quarter of 2019, unchanged from the previous quarter

-

This assessment is broadly reflected in the December 2019 Eurosystem staff macroeconomic projections for the euro area

-

According to Eurostat's flash estimate, euro area annual HICP inflation increased from 0.7% in October 2019 to 1.0% in November, reflecting mainly higher services and food price inflation.

-

This assessment is also broadly reflected in the December 2019 Eurosystem staff macroeconomic projections for the euro area, which foresee annual HICP inflation at 1.2% in 2019, 1.1% in 2020, 1.4% in 2021 and 1.6% in 2022.

-

In October 2019 the annual growth of broad money remained robust, while lending to the private sector continued its gradual recovery.

-

The aggregate fiscal stance for the euro area is expected to remain mildly expansionary in 2020, thus providing support to economic activity.

-

While global growth (excluding the euro area) weakened during the first half of the year, signs of stabilisation started to emerge towards the year-end.

-

Survey-based indicators suggest that the stabilisation of global activity has continued in the fourth quarter

-

Global financial conditions have eased further.

-

Looking ahead, only a mild pick-up in global growth is projected, reflecting a deceleration of growth in advanced economies and China, which is offset by a moderate recovery in EMEs.

-

Economic activity is expected to remain resilient in the United States in the near term, and to decelerate in the medium term.

-

In China, economic activity remains on a gradually slowing trajectory.

-

Global trade has declined significantly in the course of 2019 amid recurring escalations of trade tensions and slowing industrial activity.

-

Recent developments in the US trade policy stance provide mixed signals about a potential dissipation of trade tensions.

-

Global imports are projected to increase gradually over the medium term, and to expand at a more subdued pace than global activity.

-

The balance of risks to global activity remains tilted to the downside, but risks have become somewhat less pronounced.

Jane Foley, head of FX strategy at Rabobank, suggests that the shine came off the better than expected release of New Zealand Q3 GDP very quickly when the sharp downward revision to the Q2 number was taken into account.

"The sharp bounce in consumer confidence and credit card spending into the end of 2019 suggests that the RBNZ's pre-emptive rate cuts in 2019 are having a supportive impact. Looking ahead another bout of trade tensions between the US and China would likely be sufficient to reignite the risk of further rate cuts next year. So, while NZD/USD looks set to start 2020 on a firmer footing, there is scope of another move lower later in the year."

The Bank of Japan has nearly exhausted its policy ammunition to boost the economy as deepening negative interest rates, seen as the most likely step if it were to expand stimulus, will do more harm than good, former BOJ Deputy Governor Toshiro Mutoh said.

Under a policy dubbed yield curve control (YCC), the BOJ guides short-term interest rates at -0.1% and long-term rates around 0% via huge asset buying to hit its 2% inflation target.

Mutoh, who retains influence on economic policy due to his close ties with incumbent financial bureaucrats, said it made sense for the BOJ to maintain its massive stimulus as inflation remained distant from its target.

But he questioned BOJ Governor Haruhiko Kuroda's argument that the central bank could take short-term rates deeper into negative territory if the economy needed more stimulus.

"There are too many demerits to deepening negative rates. Even if the BOJ judged that it needs to ease, the tools available are limited. It would be hard for the BOJ to do anything more that would have a positive impact on the economy," said Mutoh, currently honorary chairman at private think tank Daiwa Institute of Research.

China's biggest risk lies in keeping the local market closed to foreigners, a government research fellow said.

Trade tensions with the U.S. have put pressure on China to respond to long-standing complaints that key local industries are off-limits to foreign companies, and that domestic players have an unfair advantage in China's state-controlled economy. Authorities rushed to pass a new foreign investment law in March. About six months later, regulators announced that foreign companies can take full ownership in key parts of the financial industry at least a year earlier than expected. The new measures roll out Jan. 1, which is also the effective date of the foreign investment law.

"Regarding the risk of opening up to the outside, I think not opening up is the greatest risk," Zhao Jinping, a fellow at the Development Research Center under the State Council, told.

Zhao noted a worrisome backdrop of economic uncertainty worldwide and fears of a split in global technological systems between China and the U.S. Increased protectionism against Chinese companies also poses a big risk for their development, Zhao added.

According to Jane Foley, head of FX strategy at Rabobank, the BoJ's relative optimism about domestic consumption combined with some additional fiscal support from the Japanese government suggests that monetary policy settings are likely on hold for now.

"On the margin this could lend some support to the JPY, though the relative level of risk appetite is likely to be a bigger driver for the currency in the coming months. Positive news regarding a Phase 1 trade deal between the US and China could keep USD/JPY at the top end of its range in early 2020. However, we see trade tensions and growth fears re-emerging and this is set to weigh on USD/JPY later in the year."

Profits at China's industrial firms grew at the fastest pace in eight months in November, but broad weakness in domestic demand remains a risk for company earnings next year.

Industrial profits in November rose 5.4% from a year earlier to 593.9 billion yuan, snapping three months of decline, as production and sales quickened, data from the National Bureau of Statistics (NBS) showed. That compared with a 9.9% drop in October.

For January-November, industrial firms notched profits of 5.61 trillion yuan, down 2.1% from a year earlier, but slightly better than a 2.9% fall in the first 10 months.

The expansion was mostly due to quickening production and sales, while factory-gate prices contracted at a slower pace, said Zhu Hong, an official with the statistics bureau in a statement released alongside the data.

But he cautioned that the rebound may not be an indication of a sustained recovery. "Although the profit growth turned to positive in November, we have to see that the current downward pressure on the economy is still big, and the volatility and uncertainty of profit growth still exist due to multiple factors such as market demand and industrial prices."

Jane Foley, head of FX strategy at Rabobank, suggests that given its geographical position and its trade links, the AUD is often traded as a proxy for Chinese growth.

"Although a Phase 1 trade deal between the US and China is thus positive for the AUD, the risks associated with its implementation and the potential that a phase 2 deal may never be signed are not. Slowing economic growth in Australia and the determination of the government to return a budget surplus suggest that there is the risk of further rate cuts from the RBA in 2020 and, when rates reached a floor of 0.25%, QE is likely to be invoked. While there may be some initial respite for the AUD, we see risk of renewed downside pressure on AUD/USD during 2020."

EUR/USD

Resistance levels (open interest**, contracts)

$1.1207 (5369)

$1.1178 (2559)

$1.1168 (3731)

Price at time of writing this review: $1.1118

Support levels (open interest**, contracts):

$1.1049 (5225)

$1.0999 (3035)

$1.0950 (2659)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 3 is 54426 contracts (according to data from December, 26) with the maximum number of contracts with strike price $1,1200 (5369);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3210 (3119)

$1.3167 (843)

$1.3128 (1417)

Price at time of writing this review: $1.3000

Support levels (open interest**, contracts):

$1.2888 (1654)

$1.2843 (1388)

$1.2795 (2286)

Comments:

- Overall open interest on the CALL options with the expiration date January, 3 is 24201 contracts, with the maximum number of contracts with strike price $1,3500 (3272);

- Overall open interest on the PUT options with the expiration date January, 3 is 27731 contracts, with the maximum number of contracts with strike price $1,2800 (2286);

- The ratio of PUT/CALL was 1.15 versus 1.15 from the previous trading day according to data from December, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 67.38 | 0.84 |

| WTI | 61.66 | 1.05 |

| Silver | 17.87 | 0.56 |

| Gold | 1510.997 | 0.71 |

| Palladium | 1898.83 | 0.75 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 142.05 | 23924.92 | 0.6 |

| KOSPI | 7.85 | 2197.93 | 0.36 |

| Dow Jones | 105.94 | 28621.39 | 0.37 |

| S&P 500 | 16.53 | 3239.91 | 0.51 |

| NASDAQ Composite | 69.51 | 9022.39 | 0.78 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.69455 | 0.31 |

| EURJPY | 121.657 | 0.29 |

| EURUSD | 1.10957 | 0.08 |

| GBPJPY | 142.469 | 0.37 |

| GBPUSD | 1.29951 | 0.17 |

| NZDUSD | 0.66698 | 0.37 |

| USDCAD | 1.3109 | -0.36 |

| USDCHF | 0.98121 | 0.11 |

| USDJPY | 109.639 | 0.19 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.