- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

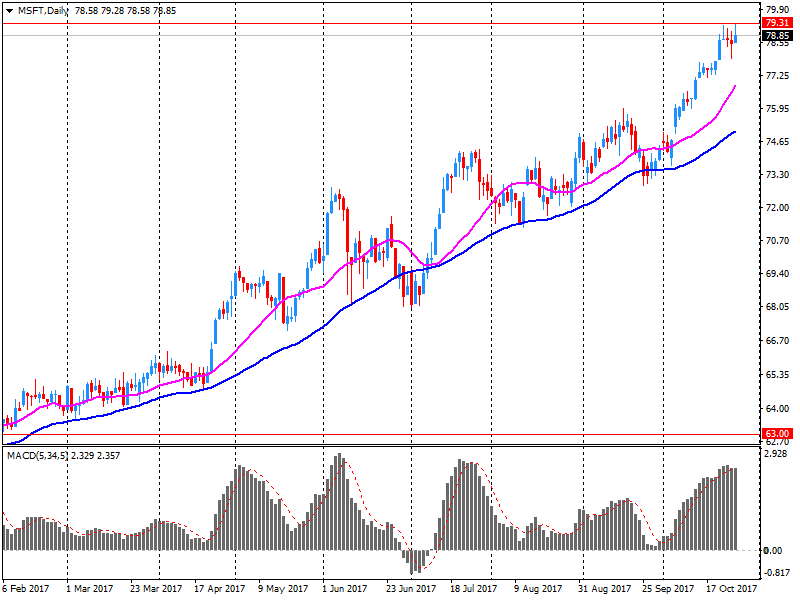

The main US stock indexes rose against the background of strong quarterly data from technological giants. The quarterly reports of Amazon (AMZN), Microsoft (MSFT), Intel (INTC) and Alphabet (GOOG) released earlier were quarterly better than forecasted by analysts.

In addition, the support of the market provided statistical data for the United States. As it became known, US GDP grew by 3% per annum in the third quarter, despite the damage from two hurricanes, according to the Ministry of Commerce. This is higher than the expectations of economists (+ 2.5%), and only slightly below the growth rate of 3.1% in the second quarter. The last time the economy had two consecutive quarters above 3% growth in 2014. The government said it can not say for sure how hurricanes Harvey and Irma reduced growth in the quarter from July to September. Since Puerto Rico is not a state, the impact of Hurricane Maria is not taken into account in GDP calculations.

However, the final results of the studies presented by Thomson-Reuters and the Michigan Institute showed that in October US consumers felt more optimistic about the economy than last month. According to the data, in October the consumer sentiment index rose to 100.7 points compared with the final reading for September 95.1 points and the preliminary value for October 101.1 points. It was predicted that the index will be 100.9 points.

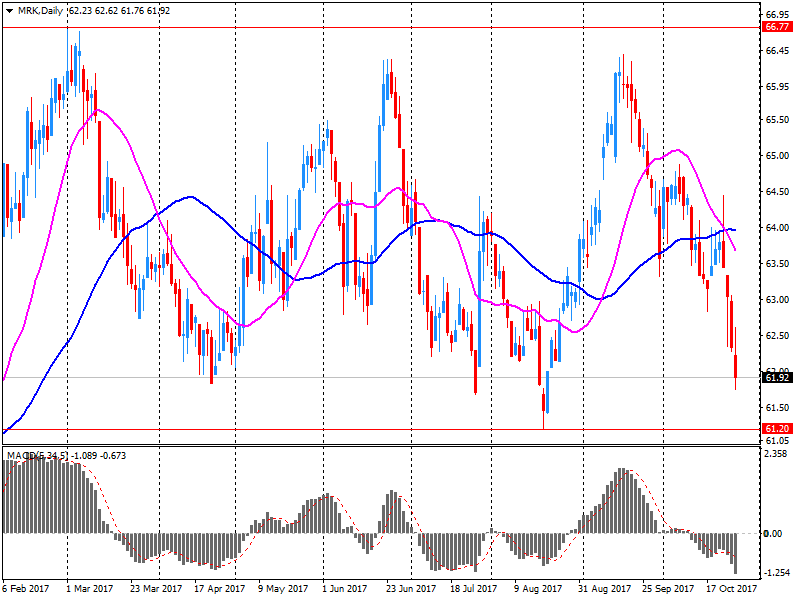

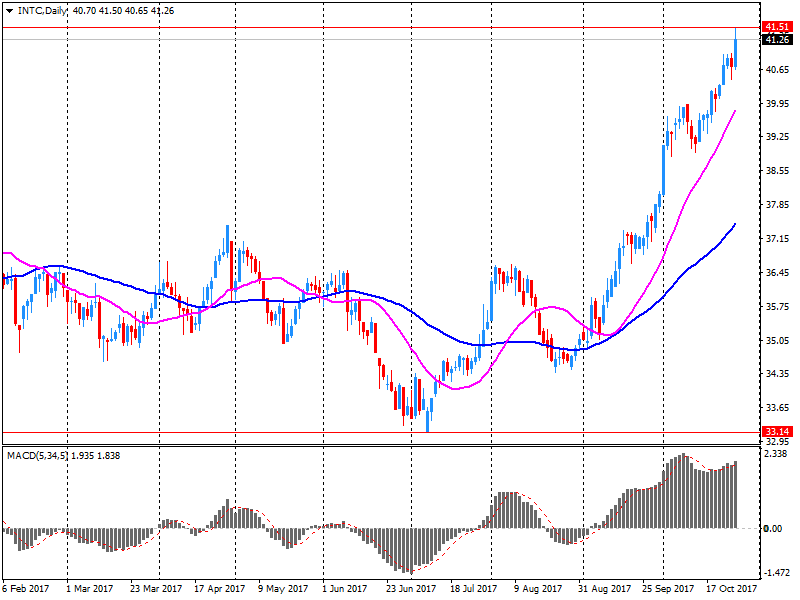

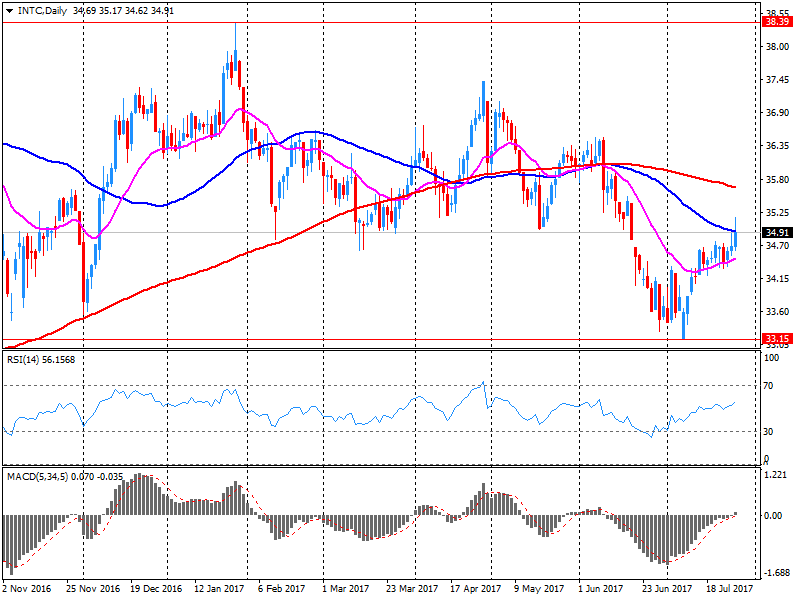

Most components of the DOW index finished trading in the red (18 out of 30). The leader of growth was shares of Intel Corporation (INTC, + 7.59%). Outsider were the shares of Merck & Co., Inc. (MRK, -6.28%).

Almost all sectors of the S & P index recorded an increase. The technological sector grew most (+ 2.1%). The sector of industrial goods decreased only (-0.1%).

At closing:

Dow + 0.14% 23.434.19 +33.33

Nasdaq + 2.20% 6,701.26 +144.49

S & P + 0.81% 2.581.07 +20.67

Consumer sentiment slipped ever so slightly in late October, despite remaining at its highest monthly level since the start of 2004. This is only the second time the Sentiment Index has been above 100.0 since the end of the record 1990's expansion, and its average during the first ten months of 2017 (96.7) has been the highest since 2000 (108.5).

The October gain was reflected in more favorable consumers' assessments of current economic conditions (+4.8) as well as expected economic prospects (+6.1). Personal finances were judged near all-time record favorable levels due to gains in household incomes as well as decade highs in home and stock values. Lingering doubts about the near term strength of the national economy were dispelled as more than half of all respondents expected good times during the year ahead and anticipated the expansion to continue uninterrupted over the next five years.

EURUSD: 1.1500 (EUR 580m) 1.1550 (500m) 1.1600 (560m) 1.1700 (520m) 1.1750(770m)

USDJPY: 112.70-75 (USD 530m) 113.00 (1.3bln) 113.50 (675m) 114.00 (1.42bln) 114.45-50 (1.54bln)

GBPUSD: Ntg of note

AUDUSD: 0.7465 (AUD 500m) 0.7650 (430m) 0.7680 (660m) 0.7725 (280m)

U.S. stock-index futures rose on Friday as strong earnings from technology giants and a better-than-expected quarterly GDP growth boosted investor sentiment.

Global Stocks:

Nikkei 21,739.78 +32.16 +0.15%

Nikkei 22,008.45 +268.67 +1.24%

Hang Seng 28,438.85 +236.47 +0.84%

Shanghai 3,416.42 +8.85 +0.26%

S&P/ASX 5,903.16 -13.14 -0.22%

FTSE 7,502.49 +15.99 +0.21%

CAC 5,497.97 +42.57 +0.78%

DAX 13,228.46 +95.18 +0.72%

Crude $52.40 (-0.46%)

Gold $1,265.40 (-0.33%)

IBM (IBM) initiated with a Buy at Pivotal Research Group; target $180

Microsoft (MSFT) target raised to $94 from $86 at BMO Capital Markets

Microsoft (MSFT) target raised to $88 from $85 at RBC Capital Mkts

Microsoft (MSFT) target raised to $90 from $85 at Stifel

Alphabet A (GOOGL) target raised to $1,125 from $1,050 at RBC Capital Mkts

Alphabet A (GOOGL) target raised to $1,200 from $1,050 at B Riley

Alphabet A (GOOGL) target raised to $1,180 from $1,050 at Oppenheimer

Alphabet A (GOOGL) target raised to $1,150 from $1,075 at Stifel

Intel (INTC) target raised to $47 from $45 at Mizuho Securities

Intel (INTC) target raised to $53 from $46 at B. Riley

Intel (INTC) target raised to $44 from $40 at RBC Capital Mkts

Tesla (TSLA) downgraded to In-line from Outperform at Evercore ISI

Facebook (FB) upgraded to Buy at Monness Crespi & Hardt; target $210

Amazon (AMZN) upgraded to Buy at Monness Crespi & Hardt; target $1250

Amazon (AMZN) upgraded to Outperform from Mkt Perform at Raymond James

Intel (INTC) upgraded to Buy from Neutral at BofA/Merrill

Twitter (TWTR) upgraded to Neutral from Sell at UBS

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 232.95 | 0.01(0.00%) | 3844 |

| ALCOA INC. | AA | 48.5 | -0.65(-1.32%) | 5033 |

| ALTRIA GROUP INC. | MO | 66 | 0.21(0.32%) | 1820 |

| Amazon.com Inc., NASDAQ | AMZN | 1,060.60 | 88.17(9.07%) | 402838 |

| American Express Co | AXP | 95.55 | -0.14(-0.15%) | 1093 |

| Apple Inc. | AAPL | 159.65 | 2.24(1.42%) | 383865 |

| AT&T Inc | T | 33.8 | 0.12(0.36%) | 65091 |

| Barrick Gold Corporation, NYSE | ABX | 14.58 | 0.07(0.48%) | 77994 |

| Boeing Co | BA | 258.85 | -0.42(-0.16%) | 2462 |

| Caterpillar Inc | CAT | 137.5 | 0.56(0.41%) | 3503 |

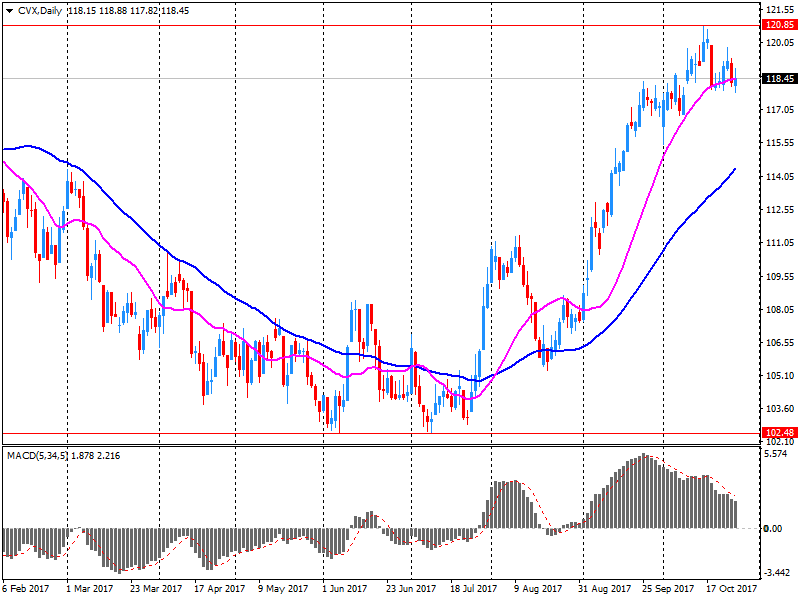

| Chevron Corp | CVX | 117 | -1.44(-1.22%) | 17820 |

| Cisco Systems Inc | CSCO | 34.25 | -0.02(-0.06%) | 27556 |

| Citigroup Inc., NYSE | C | 73.88 | 0.09(0.12%) | 14297 |

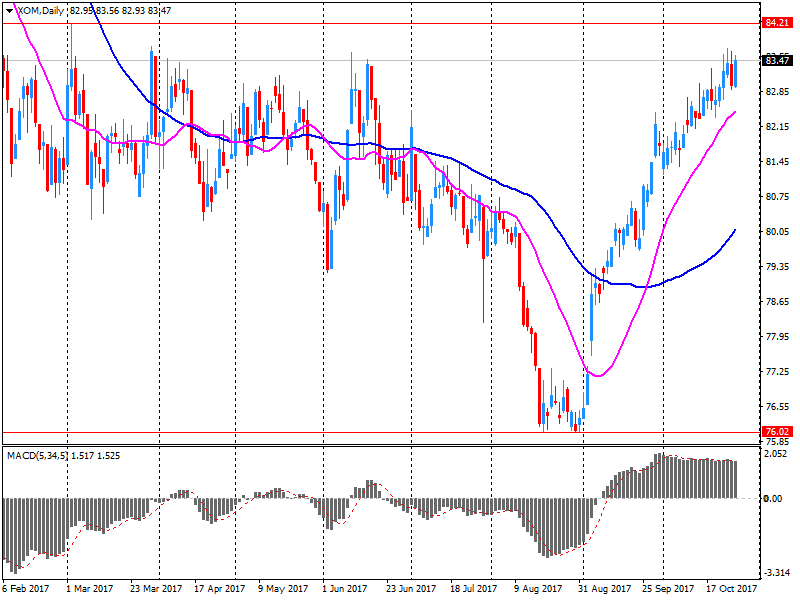

| Exxon Mobil Corp | XOM | 83.98 | 0.51(0.61%) | 80873 |

| Facebook, Inc. | FB | 174.02 | 3.39(1.99%) | 184638 |

| Ford Motor Co. | F | 12.25 | -0.02(-0.16%) | 21081 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.35 | -0.34(-2.31%) | 118824 |

| General Electric Co | GE | 21.38 | 0.06(0.28%) | 127384 |

| General Motors Company, NYSE | GM | 45.27 | 0.02(0.04%) | 500 |

| Goldman Sachs | GS | 241.5 | -0.22(-0.09%) | 2463 |

| Google Inc. | GOOG | 1,016.50 | 43.94(4.52%) | 51455 |

| Home Depot Inc | HD | 167.3 | -0.35(-0.21%) | 1797 |

| Intel Corp | INTC | 43.32 | 1.97(4.76%) | 1555872 |

| International Business Machines Co... | IBM | 154.14 | 0.54(0.35%) | 6282 |

| Johnson & Johnson | JNJ | 141.3 | -0.51(-0.36%) | 2176 |

| JPMorgan Chase and Co | JPM | 101.9 | 0.16(0.16%) | 20707 |

| McDonald's Corp | MCD | 164.02 | 0.01(0.01%) | 2505 |

| Merck & Co Inc | MRK | 60.33 | -1.66(-2.68%) | 76180 |

| Microsoft Corp | MSFT | 84.6 | 5.84(7.41%) | 1528725 |

| Nike | NKE | 55.85 | -0.96(-1.69%) | 16993 |

| Pfizer Inc | PFE | 35.64 | -0.10(-0.28%) | 25292 |

| Starbucks Corporation, NASDAQ | SBUX | 54.75 | -0.16(-0.29%) | 6250 |

| Tesla Motors, Inc., NASDAQ | TSLA | 320.67 | -5.50(-1.69%) | 131842 |

| The Coca-Cola Co | KO | 46.12 | -0.11(-0.24%) | 1751 |

| Travelers Companies Inc | TRV | 131.82 | -0.12(-0.09%) | 298 |

| Twitter, Inc., NYSE | TWTR | 20.16 | -0.15(-0.74%) | 288743 |

| United Technologies Corp | UTX | 119.75 | -0.18(-0.15%) | 440 |

| UnitedHealth Group Inc | UNH | 210.78 | 1.63(0.78%) | 3050 |

| Verizon Communications Inc | VZ | 48.59 | -0.30(-0.61%) | 3019 |

| Visa | V | 109.91 | 0.11(0.10%) | 8227 |

| Wal-Mart Stores Inc | WMT | 88.25 | -0.37(-0.42%) | 5379 |

| Walt Disney Co | DIS | 98.54 | -0.02(-0.02%) | 2467 |

| Yandex N.V., NASDAQ | YNDX | 32.61 | -0.07(-0.21%) | 1700 |

Chevron (CVX) reported Q3 FY 2017 earnings of $1.03 per share (versus $0.68 in Q3 FY 2016), beating analysts' consensus estimate of $0.97.

The company's quarterly revenues amounted to $36.205 bln (+20.1% y/y), beating analysts' consensus estimate of $34.057 bln.

CVX fell to $117.00 (-1.22%) in pre-market trading.

Real gross domestic product (GDP) increased at an annual rate of 3.0 percent in the third quarter of 2017, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 3.1 percent.

The increase in real GDP in the third quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, nonresidential fixed investment, exports, and federal government spending. These increases were partly offset by negative contributions from residential

fixed investment and state and local government spending. Imports, which are a subtraction in the

calculation of GDP, decreased.

The deceleration in real GDP growth in the third quarter primarily reflected decelerations in PCE, in nonresidential fixed investment, and in exports that were partly offset by an acceleration in private inventory investment and a downturn in imports.

Current-dollar GDP increased 5.2 percent, or $245.5 billion, in the third quarter to a level of $19,495.5 billion. In the second quarter, current-dollar GDP increased 4.1 percent, or $192.3 billion.

The price index for gross domestic purchases increased 1.8 percent in the third quarter, compared with an increase of 0.9 percent in the second quarter. The PCE price index increased 1.5 percent, compared with an increase of 0.3 percent. Excluding food and energy prices, the PCE price index increased 1.3 percent, compared with an increase of 0.9 percent

Merck (MRK) reported Q3 FY 2017 earnings of $1.11 per share (versus $1.07 in Q3 FY 2016), beating analysts' consensus estimate of $1.03.

The company's quarterly revenues amounted to $10.325 bln (-2.0% y/y), missing analysts' consensus estimate of $10.545 bln.

MRK fell to $60.92 (-1.73%) in pre-market trading.

Microsoft (MSFT) reported Q1 FY 2018 earnings of $0.84 per share (versus $0.76 in Q1 FY 2017), beating analysts' consensus estimate of $0.72.

The company's quarterly revenues amounted to $24.500 bln (+11.7% y/y), beating analysts' consensus estimate of $23.566 bln.

MSFT rose to $83.50 (+6.02%) in pre-market trading.

Intel (INTC) reported Q3 FY 2017 earnings of $0.94 per share (versus $0.80 in Q3 FY 2016), beating analysts' consensus estimate of $0.80.

The company's quarterly revenues amounted to $16.149 bln (+2.4% y/y), beating analysts' consensus estimate of $15.725 bln.

INTC rose to $42.65 (+3.14%) in pre-market trading.

Amazon (AMZN) reported Q3 FY 2017 earnings of $0.52 per share (versus $0.52 in Q3 FY 2016), beating analysts' consensus estimate of -$0.01.

The company's quarterly revenues amounted to $43.744 bln (+33.7% y/y), beating analysts' consensus estimate of $42.260 bln.

AMZN rose to $1,049.00 (+7.87%) in pre-market trading.

Alphabet (GOOG) reported Q3 FY 2017 earnings of $9.57 per share (versus $9.06 in Q3 FY 2016), beating analysts' consensus estimate of $8.40.

The company's quarterly revenues amounted to $27.772 bln (+23.7% y/y), beating analysts' consensus estimate of $27.169 bln.

GOOG rose to $1,007.00 (+3.54%) in pre-market trading.

-

Inflation is projected to be close to 3% by late 2017; going forward, as the temporary factors run their course, it will approach 4%

-

Monetary conditions lay the groundwork for inflation holding close to 4% and not constraining economic growth

-

Key rate decisions will be based on its assessment on the balance of risks for inflation significantly and persistently deviating in either direction from the target

-

Medium-term risks of inflation overshooting the target dominate over the risks of its persistent downward deviation

-

Number of factors bear the risk of inflation deviating from the target both upwards and downwards

EUR/USD: 1.1750 (765m), 1.1700 (510m), 1.1600 (555m), 1.1550 (485m), 1.1500 (570m)

USD/JPY: 114.75 (500m), 114.42 -114.50 (1.53 b), 114.00 (1.42b), 113.50 (675m), 113.00 (1.29b), 112.70/75 (520m)

AUD/USD: 0.7725 (275m), 0.7680 (660m), 0.7650 (425m), 0.7465 (500m )

-

2018 gpd growth at 1.9 pct vs 1.8 pct 3 months ago, 2019 growth seen at 1.7 pct vs 1.6 pct

-

Unemployment seen at 8.6 pct in 2018, 8.2 pct in 2019, both 0.2 percentage point down from last forecast

-

2022 inflation at 1.9 pct vs 1.8 pct seen 3 months ago; 2018 and 2019 forecasts unchanged

EUR/USD

Resistance levels (open interest**, contracts)

$1.1780 (1541)

$1.1751 (1290)

$1.1702 (273)

Price at time of writing this review: $1.1626

Support levels (open interest**, contracts):

$1.1578 (5634)

$1.1538 (4758)

$1.1494 (2852)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 114294 contracts (according to data from October, 26) with the maximum number of contracts with strike price $1,2000 (9750);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3237 (1241)

$1.3205 (1365)

$1.3184 (1050)

Price at time of writing this review: $1.3108

Support levels (open interest**, contracts):

$1.3088 (2668)

$1.3056 (2029)

$1.3020 (2104)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 42620 contracts, with the maximum number of contracts with strike price $1,3200 (3838);

- Overall open interest on the PUT options with the expiration date November, 3 is 37112 contracts, with the maximum number of contracts with strike price $1,3000 (3292);

- The ratio of PUT/CALL was 0.87 versus 0.87 from the previous trading day according to data from October, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Overall consumer prices in Japan climbed 0.7 percent on year in September, the Ministry of Internal Affairs and Communications cited by rttnews.

That was in line with expectations and unchanged from the August reading.

Core inflation also advanced an annual 0.7 percent - again matching forecasts and steady from the previous month.

Fuel prices led the increase, up 6.0 percent on year, along with medical care (1.8 percent), food (1.0 percent), education (0.4 percent and recreation (0.2 percent).

Clothing prices were down an annual 0.3 percent, along with housing and furniture (both -0.2 percent).

Overall and core CPI both were flat on a monthly basis.

Final demand (excl. Exports):

-

Rose 0.2% in the september quarter 2017.

-

Mainly due to rises in the prices received for electricity, gas and water supply (+4.9%), heavy and civil engineering construction (+0.7%) and building construction (+0.3%).

-

Partly offset by falls in the prices received for other agriculture (-11.6%), electronic equipment manufacturing (-4.5%) and meat and meat product manufacturing (-6.0%).

-

Rose 1.6% through the year to the september quarter 2017.

Intermediate demand:

-

Rose 0.6% in the september quarter 2017.

-

Mainly due to rises in the prices received for electricity, gas and water supply (+3.3%), architectural, engineering and technical services (+2.1%) and real estate services (+2.3%).

-

Partly offset by falls in the prices received for textile, leather, clothing and footwear manufacturing (-1.8%) computer and electronic equipment manufacturing (-5.9%) and meat and meat product manufacturing (-5.6%).

-

Rose 2.5% through the year to the september quarter 2017.

As reported by the Federal Statistical Office (Destatis), the index of import prices increased by 3.0% in September 2017 compared with the corresponding month of the preceding year. In August 2017 and in July 2017 the annual rates of change were +2.1% and +1.9%, respectively. From August 2017 to September 2017 the index rose by 0.9%.

The index of import prices, excluding crude oil and mineral oil products, increased by 2.1% compared with the level of a year earlier.

The index of export prices increased by 1.7% in September 2017 compared with the corresponding month of the preceding year. In August 2017 and in July 2017 the annual rates of change were +1.5%, each. From August 2017 to September 2017 the export price index rose by 0.2%.

Spanish stocks finished off session highs Thursday after the leader of the Catalan region failed to call anticipated snap elections. Catalan President Carles Puigdemont said he wouldn't call early elections because there was no guarantee the central government in Madrid would halt its move toward stripping Catalonia of autonomous rule, local reports said.

U.S. stocks ended mostly higher on Thursday as a fusillade of better-than-expected corporate results helped to reinvigorate Wall Street buying appetite a day after the S&P 500 and the Dow posted their biggest drops in more than seven weeks.

Asia-Pacific equities rose broadly on Friday, buoyed by strength in U.S. corporate earnings and the prospect of continuing stimulus in Europe. Ahead of the start of Asian trading, three of the world's biggest companies - Google parent Alphabet Inc., Amazon.com Inc. and Microsoft Corp. - reported booming quarterly growth, sending shares of the three tech giants surging in after-hours trade.

© 2000-2024. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.