- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(raw materials / closing price /% change)

Oil 52.82 +1.23%

Gold 1,267.60 -0.89%

(index / closing price / change items /% change)

Nikkei +32.16 21739.78 +0.15%

TOPIX +2.47 1753.90 +0.14%

Hang Seng -100.51 28202.38 -0.36%

CSI 300 +16.63 3993.58 +0.42%

Euro Stoxx 50 +45.74 3637.20 +1.27%

FTSE 100 +39.29 7486.50 +0.53%

DAX +179.87 13133.28 +1.39%

CAC 40 +80.51 5455.40 +1.50%

DJIA +71.40 23400.86 +0.31%

S&P 500 +3.25 2560.40 +0.13%

NASDAQ -7.12 6556.77 -0.11%

S&P/TSX +36.86 15891.63 +0.23%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1653 -1,39%

GBP/USD $1,3151 -0,84%

USD/CHF Chf0,99716 +0,79%

USD/JPY Y114,01 +0,29%

EUR/JPY Y132,86 -1,09%

GBP/JPY Y149,93 -0,56%

AUD/USD $0,7660 -0,57%

NZD/USD $0,6836 -0,77%

USD/CAD C$1,28479 +0,48%

02:30 Japan Tokyo CPI ex Fresh Food, y/y October 0.5% 0.5%

02:30 Japan Tokyo Consumer Price Index, y/y October 0.5% 0.1%

02:30 Japan National Consumer Price Index, y/y September 0.7% 0.7%

02:30 Japan National CPI Ex-Fresh Food, y/y September 0.7% 0.8%

03:30 Australia Producer price index, y/y Quarter III 1.7%

03:30 Australia Producer price index, q / q Quarter III 0.5% 0.4%

09:45 France Consumer confidence October 101 101

10:15 Eurozone ECB's Peter Praet Speaks

15:30 U.S. PCE price index, q/q (Preliminary) Quarter III 0.3% 1.2%

15:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter III 0.90% 1.3%

15:30 U.S. GDP, q/q (Preliminary) Quarter III 3.1% 2.5%

17:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) October 95.1 100.9

20:00 U.S. Baker Hughes Oil Rig Count October 736

The main US stock indexes mainly increased, as the rise in the price of shares in the consumer goods and technology sector made it possible to compensate for the collapse of the shares in the health sector.

The focus was also on the United States. As it became known, the number of Americans applying for unemployment benefits last week increased less than expected, indicating that the labor market continues to toughen after recent hurricane-related disruptions. Initial applications for unemployment benefits increased by 10,000 to 233,000, seasonally adjusted for the week to October 21, the Ministry of Labor said. The latter value was the lowest since March 1973. The four-week moving average of primary hits fell 9,000 to 239,500 last week.

At the same time, the number of contracts for the purchase of housing on the secondary market did not change in September, while activity in annual terms decreased for the fifth time in the last six months, as demand for real estate still exceeded supply. The National Association of Realtors said its forecast domestic sales index, based on contracts signed last month, remained at 106.0. The August index was revised to -2.8 percent from -2.6 percent. Economists predicted that unfinished transactions for the sale of housing last month increased by 0.2 percent.

Most components of the DOW index finished trading in positive territory (24 out of 30). Leader of the growth were shares of NIKE, Inc. (NKE, + 3.31%). Outsider were shares of 3M Company (MMM, -2.02%).

Most sectors of the S & P index recorded an increase. The consumer goods sector grew most (+ 0.7%). The health sector showed the greatest decline (-1.0%).

At closing:

DJIA + 0.31% 23,400.86 +71.40

Nasdaq -0.11% 6,556.77 -7.12

S & P + 0.13% 2.560.40 +3.25

The Pending Home Sales Index, a forward-looking indicator based on contract signings, was at 106.0 in September (unchanged from a downwardly revised August figure). The index is now at its lowest reading since January 2015 (104.7), is 3.5 percent below a year ago, and has fallen on an annual basis in five of the past six months.

Lawrence Yun, NAR chief economist, says the quest to buy a home this fall continues to be a challenging endeavor for many home shoppers. "Demand exceeds supply in most markets, which is keeping price growth high and essentially eliminating any savings buyers would realize from the decline in mortgage rates from earlier this year," he said. "While most of the country, except for the South, did see minor gains in contract signings last month, activity is falling further behind last year's pace because new listings aren't keeping up with what's being sold."

EURUSD: 1.1700 (EUR 520m) 1.1750 (610m) 1.1800 (330m) 1.1850 (350m) 1.1900 (860m) 1.1950 (1.05bln)

USDJPY:112.50 (USD 550m) 113.00 (1.87bln) 113.50 (650m) 113.60 (1.1bln) 113.70 (320m) 113.80 (300m) 114.00 (890m)

GBPUSD: Ntg of note

EURGBP: 0.8980 (EUR 520m) 0.9050 (590m)

AUDUSD: 0.7750 (AUD 370m)

U.S. stock-index futures were little changed on Thursday amid a batch of corporate earnings and ongoing speculation about the Federal Reserve's next chair.

Global Stocks:

Nikkei 21,739.78 +32.16 +0.15%

Hang Seng 28,202.38 -100.51 -0.36%

Shanghai 3,408.24 +11.35 +0.33%

S&P/ASX 5,916.30 +10.70 +0.18%

FTSE 7,482.62 +35.41 +0.48%

CAC 5,419.20 +44.31 +0.82%

DAX 13,030.96 +77.55 +0.60%

Crude $52.22 (+0.08%)

Gold $1,276.20 (-0.22%)

-

Discussion ranged from broad consensus to large majority

In the week ending October 21, the advance figure for seasonally adjusted initial claims was 233,000, an increase of 10,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 222,000 to 223,000. The 4-week moving average was 239,500, a decrease of 9,000 from the previous week's revised average. The previous week's average was revised up by 250 from 248,250 to 248,500.

Claims taking procedures continue to be severely disrupted in Puerto Rico and the Virgin Islands as a result of power outages and infrastructure damage caused by Hurricanes Irma and Maria.

-

Reinvestments guidance not related to interest rates

-

Didn't discuss alternative scenarios

-

Atmposphere was positive

-

All council members emphasized better conditions, growth momentum

-

Did not discuss composition of app

-

Core inflation yet to show convincing signs of sustained upward trend

-

Domestic cost pressures still subdued

-

Inflation is expected to continue to rise gradually over medium term

-

From jan, ECB will publish monthly redemptions of each component

-

Ample degree of monetary stimulus still necessary

-

Continued monetary support provided by additional net asset purchases

-

Economic outlook conditional on continued ECB support

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 238 | 0.32(0.13%) | 887 |

| ALCOA INC. | AA | 50 | 0.48(0.97%) | 126 |

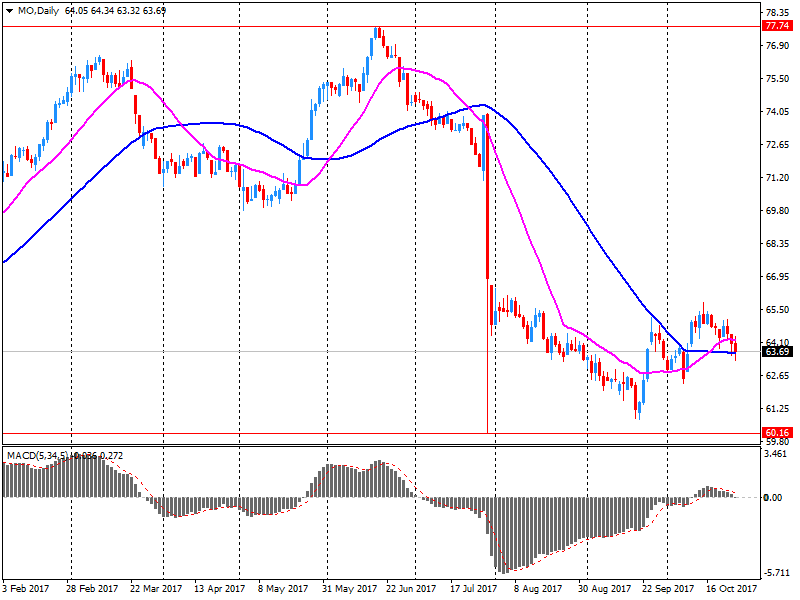

| ALTRIA GROUP INC. | MO | 63.35 | -0.44(-0.69%) | 13853 |

| Amazon.com Inc., NASDAQ | AMZN | 979.11 | 6.20(0.64%) | 17812 |

| Apple Inc. | AAPL | 157.2 | 0.79(0.51%) | 134639 |

| AT&T Inc | T | 33.7 | 0.21(0.63%) | 122337 |

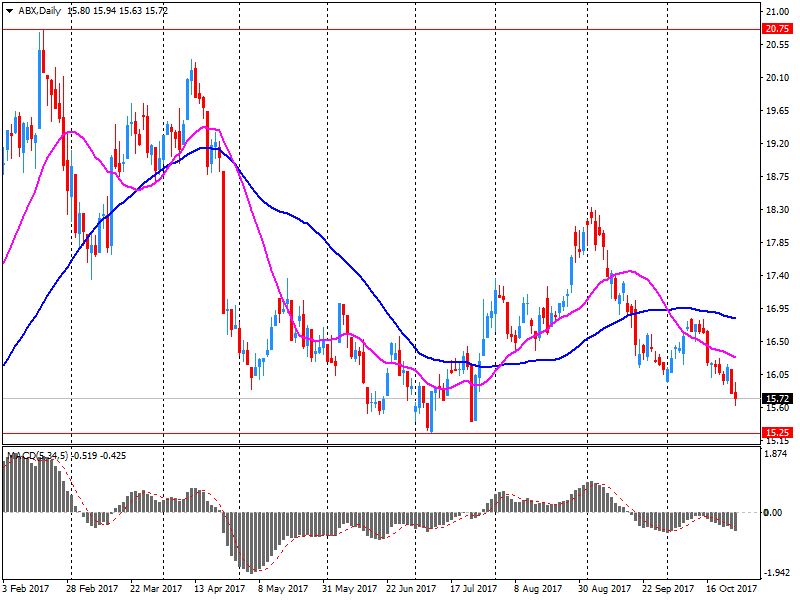

| Barrick Gold Corporation, NYSE | ABX | 15.51 | -0.24(-1.52%) | 98487 |

| Boeing Co | BA | 259.95 | 1.53(0.59%) | 6361 |

| Caterpillar Inc | CAT | 138 | 1.16(0.85%) | 652 |

| Cisco Systems Inc | CSCO | 34.37 | 0.07(0.20%) | 26225 |

| Citigroup Inc., NYSE | C | 73.8 | 0.18(0.24%) | 5613 |

| Facebook, Inc. | FB | 171.48 | 0.88(0.52%) | 39123 |

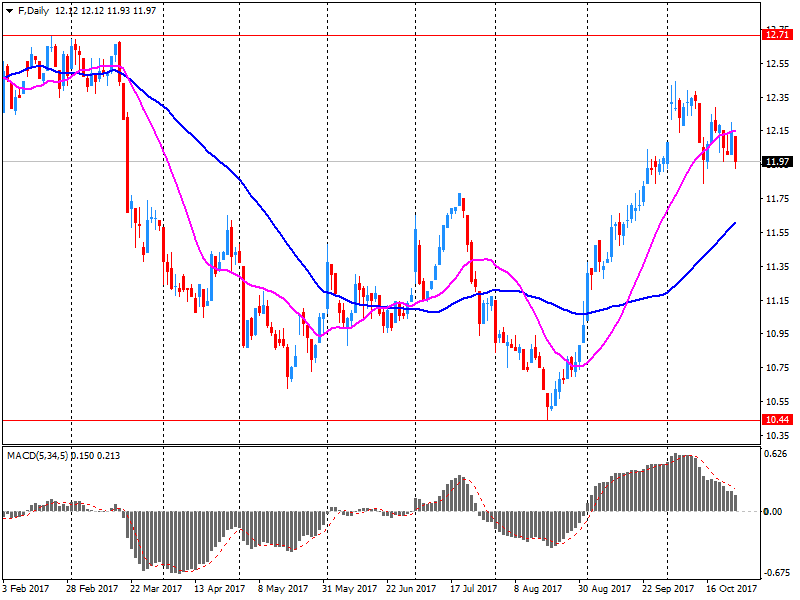

| Ford Motor Co. | F | 12.29 | 0.25(2.08%) | 595604 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.74 | 0.04(0.27%) | 16397 |

| General Electric Co | GE | 21.54 | 0.04(0.19%) | 103674 |

| General Motors Company, NYSE | GM | 45.22 | 0.10(0.22%) | 14257 |

| Goldman Sachs | GS | 242.52 | 0.81(0.34%) | 1280 |

| Google Inc. | GOOG | 980.2 | 6.87(0.71%) | 8092 |

| Intel Corp | INTC | 40.95 | 0.17(0.42%) | 19444 |

| International Business Machines Co... | IBM | 154.1 | 0.60(0.39%) | 6262 |

| Johnson & Johnson | JNJ | 142.3 | -0.06(-0.04%) | 1972 |

| JPMorgan Chase and Co | JPM | 101.25 | 0.23(0.23%) | 5422 |

| McDonald's Corp | MCD | 164.49 | 0.91(0.56%) | 548 |

| Microsoft Corp | MSFT | 78.93 | 0.30(0.38%) | 75819 |

| Nike | NKE | 54.8 | -0.14(-0.25%) | 11908 |

| Pfizer Inc | PFE | 36.23 | 0.07(0.19%) | 134858 |

| Procter & Gamble Co | PG | 86.6 | -0.26(-0.30%) | 1947 |

| Starbucks Corporation, NASDAQ | SBUX | 54.52 | 0.36(0.66%) | 13268 |

| Tesla Motors, Inc., NASDAQ | TSLA | 328.2 | 2.36(0.72%) | 24948 |

| The Coca-Cola Co | KO | 46.15 | 0.10(0.22%) | 2505 |

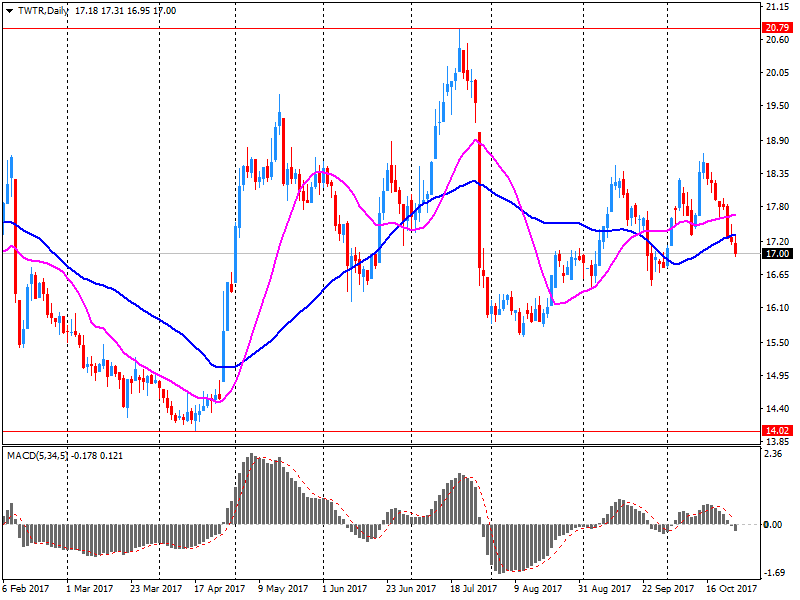

| Twitter, Inc., NYSE | TWTR | 19.07 | 1.93(11.26%) | 5771861 |

| Verizon Communications Inc | VZ | 49.01 | 0.37(0.76%) | 1268 |

| Visa | V | 110.38 | 0.89(0.81%) | 5406 |

| Wal-Mart Stores Inc | WMT | 88.4 | -0.08(-0.09%) | 2467 |

Barrick Gold (ABX) downgraded to Neutral from Outperform at Credit Suisse

Twitter (TWTR) reported Q3 FY 2017 earnings of $0.10 per share (versus $0.13 in Q3 FY 2016), beating analysts' consensus estimate of $0.06.

The company's quarterly revenues amounted to $0.590 bln (-4.2% y/y), generally in-line with analysts' consensus estimate of $0.586 bln.

TWTR rose to $19.20 (+12.02%) in pre-market trading.

Ford Motor (F) reported Q3 FY 2017 earnings of $0.43 per share (versus $0.26 in Q3 FY 2016), beating analysts' consensus estimate of $0.33.

The company's quarterly revenues amounted to $33.646 bln (+0.9% y/y), beating analysts' consensus estimate of $32.805 bln.

The company also raised guidance for FY2017 EPS to $1.75-1.85 from $1.65-1.85 versus analysts' consensus estimate of $1.74.

F rose to $12.25 (+1.74%) in pre-market trading.

Barrick Gold (ABX) reported Q3 FY 2017 earnings of $0.16 per share (versus $0.24 in Q3 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $1.933 bln (-15.8% y/y), missing analysts' consensus estimate of $2.020 bln.

ABX fell to $15.56 (-1.21%) in pre-market trading.

Altria (MO) reported Q3 FY 2017 earnings of $0.90 per share (versus $0.82 in Q3 FY 2016), beating analysts' consensus estimate of $0.87.

The company's quarterly revenues amounted to $5.100 bln (-1.8% y/y), missing analysts' consensus estimate of $5.217 bln.

The company also issued in-line guidance for FY2017, projecting EPS of $3.26-3.32 versus analysts' consensus estimate of $3.27.

MO rose to $63.94 (+0.24%) in pre-market trading.

The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively.

The Governing Council continues to expect the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases.

The survey of 106 firms, of which 49 were retailers, showed that in the year to October, retail sales fell at the quickest rate since March 2009 - the height of the financial crisis. Overall, sales for the time of year were considered to be slightly below seasonal norms. Meanwhile, orders placed on suppliers also dropped at the fastest rate since March 2009.

Looking ahead to the next month, retailers expect sales volumes to stabilise in the year to November, but orders are expected to see a further decline, albeit at a slower pace.

In April 2017, median gross weekly earnings for full-time employees in the UK were £550, up 2.2% from £539 in 2016.

The 2.2% growth seen this year is the joint highest since the economic downturn in 2008 (matching that seen in 2013 and 2016). Similarly the median gross weekly earnings for part-time employees also increased, from £177 in 2016 to £182 in 2017 (2.9%).

Adjusted for inflation, full-time workers' weekly earnings decreased by 0.4% compared with 2016. This is the first time since 2014 that there has been a fall in this measure and reflects a higher level of inflation in April 2017 (2.6%) compared with recent years, for example, in April 2016 inflation was 0.7%.

EUR/USD 1.1950 1.05bn, 1.1900 850mn, 1.1850 380m, 1.1800 330m, 1.1745/50 610m, 1.1700 510m

USD/JPY 113.95/00 885m, 113.80 300m, 113.70 315m, 113.60 - 113.61 1.09bn, 113.50 645m, 113.00/05 1.86bn, 112.50 540m

AUD/USD 0.7750 365m

"In Monetary Policy Report 3/17, published on 21 September 2017, the Executive Board's assessment was that there was a continued need for an expansionary monetary policy. Capacity utilisation in the Norwegian economy was assessed to be below a normal level, and inflation was expected to remain below 2.5 percent in the coming years. The Executive Board's assessment of the outlook and the balance of risks suggested that the key policy rate would remain at 0.5 percent in the period ahead.

The Executive Board's assessment is that developments so far have been broadly in line with the picture presented in the September Report. New information does not provide a basis for changing the Bank's assessment of growth in the Norwegian economy. The improvement in the labour market appears to be continuing. Inflation has been slightly lower than projected, while the krone exchange rate is somewhat weaker than projected".

"The outlook and the balance of risks for the Norwegian economy do not appear to have changed substantially since the September Report. The Executive Board therefore decided to keep the key policy rate unchanged at this meeting", says Governor Øystein Olsen.

-

The annual growth rate of the broad monetary aggregate M3 stood at 5.1% in September 2017, after 5.0% in August 2017.

-

The annual growth rate of the narrower aggregate M1, which includes currency in circulation and overnight deposits, increased to 9.7% in September, from 9.5% in August.

-

The annual growth rate of adjusted loans to households stood at 2.7% in September, unchanged from the previous month.

-

The annual growth rate of adjusted loans to non-financial corporations stood at 2.5% in September, compared with 2.4% in August.

The number of employed persons increases by 235,900 people in the third quarter of 2017 compared to the previous quarter (1.25%) and stands at 19,049,200. In terms seasonally adjusted, the quarterly variation is 0.75%. Employment has grown in 521,700 people in the last 12 months.

The annual rate is 2.82%. - The occupation in the public sector increases this quarter by 58,300 and in the sector private it does in 177,600. In the last 12 months employment has increased in 463,500 people in the private sector and 58,200 in the public. - The total number of employees rises this quarter at 216,400.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1942 (3288)

$1.1887 (3016)

$1.1849 (381)

Price at time of writing this review: $1.1824

Support levels (open interest**, contracts):

$1.1778 (2484)

$1.1753 (3411)

$1.1721 (3247)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 110576 contracts (according to data from October, 25) with the maximum number of contracts with strike price $1,2000 (10174);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3363 (3418)

$1.3320 (3867)

$1.3296 (2407)

Price at time of writing this review: $1.3253

Support levels (open interest**, contracts):

$1.3211 (2178)

$1.3185 (886)

$1.3154 (1738)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 41781 contracts, with the maximum number of contracts with strike price $1,3200 (3867);

- Overall open interest on the PUT options with the expiration date November, 3 is 36506 contracts, with the maximum number of contracts with strike price $1,3000 (3139);

- The ratio of PUT/CALL was 0.87 versus 0.88 from the previous trading day according to data from October, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Milk powder, butter, and cheese leads exports rise:

-

Goods exports rose $313 million (9.0 percent) to $3.8 billion.

-

Milk powder, butter, and cheese had the largest rise of any export commodity group in September 2017, up $175 million (28 percent) to $791 million.

-

Milk fats including butter led the rise in milk powder, butter, and cheese, up $62 million (43 percent) to $207 million, with quantity down 22 percent.

-

Milk powder rose $58 million (20 percent) in value, with quantity down 15 percent.

-

Milk and cream rose $44 million (118 percent) in value, and 41 percent in quantity.

-

Fruit exports fell $69 million (30 percent) in value, and 38 percent in quantity.

-

The fall in fruit exports was due to kiwifruit, down in both value ($70 million) and quantity (42 percent). However, for the September 2017 year, the value of kiwifruit exports rose $69 million (4.1 percent) from the previous year. The quantity of kiwifruit exports fell 2.0 percent over the same period.

The monthly trade balance was a deficit of $1.1 billion (30 percent of exports).

The average monthly deficit in September over the last five years was $980 million (28 percent of exports).

The Import Price Index fell 1.6% in the September quarter 2017. This follows a fall in the June quarter 2017 of 0.1%.

The fall was driven by lower prices paid for Telecommunication and sound recording equipment (-7.8%), Petroleum, petroleum products and related materials (-2.0%) and Office and automatic data processing machines (-4.7%).

Through the year to the September quarter 2017, the Import Price Index fell 0.4%, driven by Telecommunications and sound recording equipment (-15.9%).

The Export Price Index fell 3.0% in the September quarter 2017. This follows a fall in the June quarter 2017 of 5.7%

The fall was driven by lower prices received for Coal, coke and briquettes (-7.4%), Metalliferous ores and metal scrap (-1.5%) and Gas, natural and manufactured (-4.0%).

Through the year to the September quarter 2017, the Export Price Index rose 14.2%, driven by Coal, coke and briquettes (62.1%).

Consumer mood in the first survey since the German federal elections is not sending clear signals. Both economic expectations and propensity to buy are on the rise in Germany. In contrast, income expectations fell for the second time in a row. GfK forecasts a slight decrease in consumer climate for November of 0.1 points in comparison to the previous month to 10.7 points.

Even in late fall, consumers estimate that the German economy is clearly continuing to grow. Economic expectations are rising sharply in October, with August's setback a distant memory. Additionally, propensity to buy more than makes up for last month's struggles. However, income expectations fell for the second time in a row but are still at a very good level.

U.K. stocks closed lower Wednesday after a stronger-than-expected reading on British economic growth drove the pound up against the U.S. dollar and the euro. The FTSE 100 index UKX, -1.05% fell 1.1% to end at 7,447.21. On Tuesday, the London benchmark rose less than 0.1%, notching a third straight gain. It was also the third session in a row that stocks closed with a move smaller than 0.1%.

The S&P 500 and the Dow on Wednesday posted their biggest one-day declines in more than seven weeks on a string of disappointing earnings, even as the stock market pared early losses.

A global stock pullback moved into Asia on Thursday, with most markets down modestly following similar-sized declines overnight in Europe and the U.S., pausing what has been a big month of gains for many indexes.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.