- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(raw materials / closing price /% change)

Oil 65.23 -0.58%

Gold 1,346.90 -0.69%

(index / closing price / change items /% change)

Nikkei -271.29 23669.49 -1.13%

TOPIX -16.67 1884.56 -0.88%

Hang Seng -304.24 32654.45 -0.92%

CSI 300 -24.81 4365.08 -0.57%

Euro Stoxx 50 -13.07 3630.15 -0.36%

FTSE 100 -27.59 7615.84 -0.36%

DAX -116.38 13298.36 -0.87%

CAC 40 -13.95 5481.21 -0.25%

DJIA +140.67 26392.79 +0.54%

S&P 500 +1.71 2839.25 +0.06%

NASDAQ -3.89 7411.16 -0.05%

S&P/TSX -80.20 16204.01 -0.49%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2397 -0,08%

GBP/USD $1,4139 -0,67%

USD/CHF Chf0,941 -0,47%

USD/JPY Y109,40 +0,18%

EUR/JPY Y135,62 +0,09%

GBP/JPY Y154,678 -0,50%

AUD/USD $0,8024 -0,51%

NZD/USD $0,7322 -0,21%

USD/CAD C$1,23717 +0,23%

07:45 France Consumer confidence January 105 106

09:00 Eurozone Private Loans, Y/Y December 2.8% 2.9%

09:00 Eurozone M3 money supply, adjusted y/y December 4.9% 4.9%

09:30 United Kingdom GDP, q/q (Preliminary) Quarter IV 0.4% 0.4%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter IV 1.7% 1.4%

10:00 Eurozone ECB's Benoit Coeure Speaks

13:00 U.S. FOMC Member James Bullard Speaks

13:30 Canada Consumer Price Index m / m December 0.3% -0.3%

13:30 Canada Bank of Canada Consumer Price 1.3% 1.5%

13:30 Canada Consumer price index, y/y December 2.1% 1.9%

13:30 U.S. Goods Trade Balance, $ bln. December -69.68 -68.6

13:30 U.S. Durable goods orders ex defense December 1% 0.3%

13:30 U.S. Durable Goods Orders ex Transportation December -0.1% 0.5%

13:30 U.S. Durable Goods Orders December 1.3% 0.8%

13:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter IV 1.3% 1.6%

13:30 U.S. PCE price index, q/q (Preliminary) Quarter IV 1.5% 1.8%

13:30 U.S. GDP, q/q (Preliminary) Quarter IV 3.2% 3%

14:00 United Kingdom BOE Gov Mark Carney Speaks

14:00 Japan BOJ Governor Haruhiko Kuroda Speaks

18:00 U.S. Baker Hughes Oil Rig Count January 747

Major US stock indices showed mixed dynamics, as optimism about solid corporate revenues was partially offset by a sharp strengthening of the US dollar after statements by US President Trump.

The focus was also on the United States. As it became known today, the number of Americans applying for new unemployment benefits rose last week, partially replacing the sharp decline in the previous week and continuing the trend of a gradual increase in applications. Primary claims for unemployment benefits increased by 17,000 to 233,000, seasonally adjusted for the week to January 20. Economists were expecting 240,000 applications.

At the same time, sales of new single-family homes in the US fell more than expected in December, recording the largest decline in almost 1.5 years, probably as a result of the disappearance of the effect of replacing houses damaged by floods in the southern states, destroyed by hurricanes . The Ministry of Commerce reported that sales of new homes fell 9.3% to 725,000 units, taking into account seasonal fluctuations last month. The reduction percentage was the highest since August 2016. The November sales were revised to 689,000 units, which is still the strongest indicator since July 2007, from the previously reported 733,000 units. Economists predicted that sales of new homes would fall by 7.9% to 679,000 units last month.

Most components of the DOW index finished the session in positive territory (17 out of 30). The leader of growth was the shares of The Boeing Company (BA, + 2.48%). Outsider were the shares of Apple Inc. (AAPL, -1.88%).

Most sectors of the S & P recorded a rise. The utilities sector grew most (+ 1.1%). The largest decline was registered in the consumer goods sector (-0.9%).

At closing:

DJIA + 0.54% 26,392.79 +140.67

Nasdaq -0.05% 7,411.16 -3.90

S & P + 0.06% 2,839.25 +1.71

Sales of new single-family houses in December 2017 were at a seasonally adjusted annual rate of 625,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 9.3 percent below the revised November rate of 689,000, but is 14.1 percent above the December 2016 estimate of 548,000. An estimated 608,000 new homes were sold in 2017. This is 8.3 percent (±4.1 percent) above the 2016 figure of 561,000.

The median sales price of new houses sold in December 2017 was $335,400. The average sales price was $398,900.

U.S. stock-index futures rose on Thursday as investors assessed corporate earnings.

Global Stocks:

Nikkei 23,669.49 -271.29 -1.13%

Hang Seng 32,654.45 -304.24 -0.92%

Shanghai 3,548.30 -11.16 -0.31%

S&P/ASX 6,050.00 -4.70 -0.08%

FTSE 7,658.64 +15.21 +0.20%

CAC 5,520.92 +25.76 +0.47%

DAX 13,439.45 +24.71 +0.18%

Crude $66.45 (+1.28%)

Gold $1,358.30 (+0.15%)

-

Don't target fx rates

-

Issue is whether fx movements have impact on inflation path

-

Too early to assess whether pass-through has taken place

-

Cause of forex, rate change is heightened mkt sensitivity to perceived changes in ECB comms

-

Says stock is metric, not flow for pspp

-

Reinvestments sometimes distributed over three months

(company / ticker / price / change ($/%) / volume)

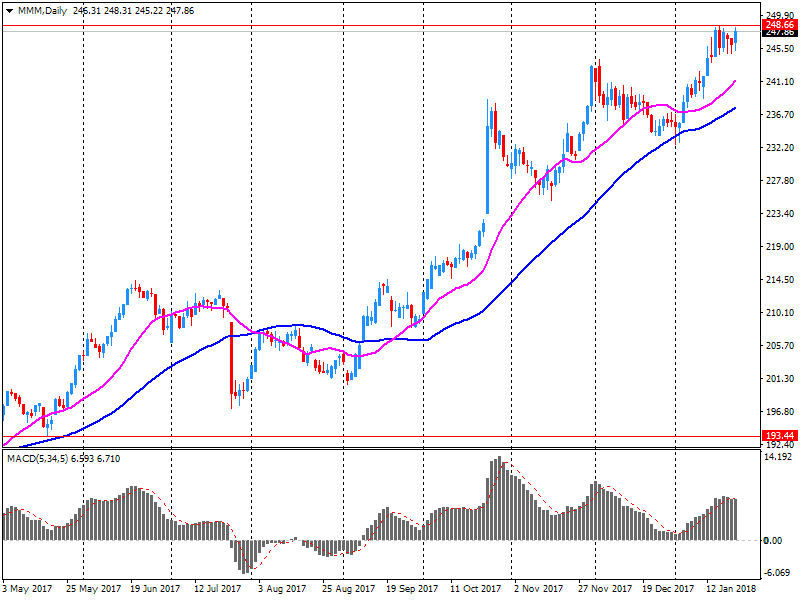

| 3M Co | MMM | 255.5 | 7.81(3.15%) | 33227 |

| ALCOA INC. | AA | 53.47 | 0.17(0.32%) | 772 |

| Amazon.com Inc., NASDAQ | AMZN | 1,370.00 | 12.49(0.92%) | 49029 |

| American Express Co | AXP | 99.5 | 0.20(0.20%) | 681 |

| Apple Inc. | AAPL | 174.77 | 0.55(0.32%) | 127730 |

| AT&T Inc | T | 37.1 | 0.08(0.22%) | 12815 |

| Barrick Gold Corporation, NYSE | ABX | 15.2 | 0.15(1.00%) | 35172 |

| Boeing Co | BA | 336.35 | 1.66(0.50%) | 10210 |

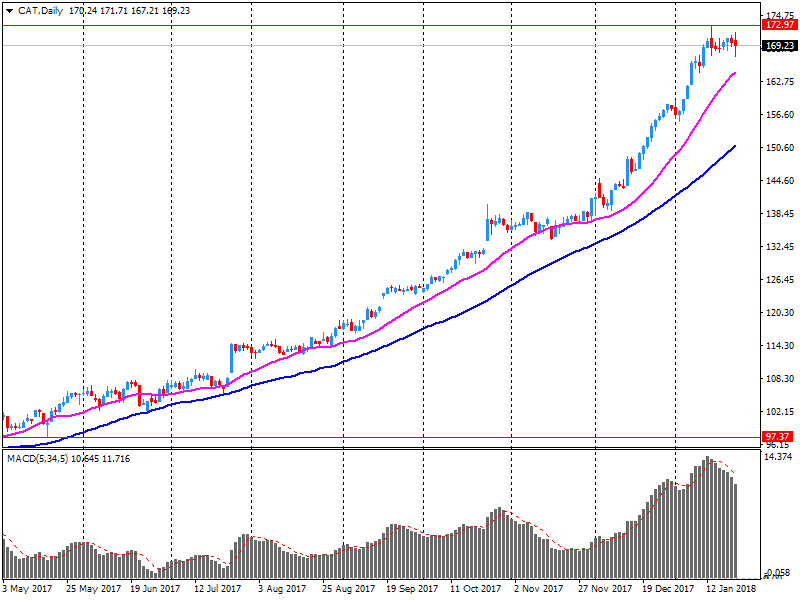

| Caterpillar Inc | CAT | 174.65 | 6.31(3.75%) | 476858 |

| Cisco Systems Inc | CSCO | 42.36 | 0.19(0.45%) | 4510 |

| Citigroup Inc., NYSE | C | 79.98 | 0.53(0.67%) | 10054 |

| Deere & Company, NYSE | DE | 171.9 | 2.30(1.36%) | 6185 |

| Exxon Mobil Corp | XOM | 88.61 | 0.08(0.09%) | 1495 |

| Facebook, Inc. | FB | 188 | 1.45(0.78%) | 82917 |

| FedEx Corporation, NYSE | FDX | 270.99 | 0.58(0.21%) | 300 |

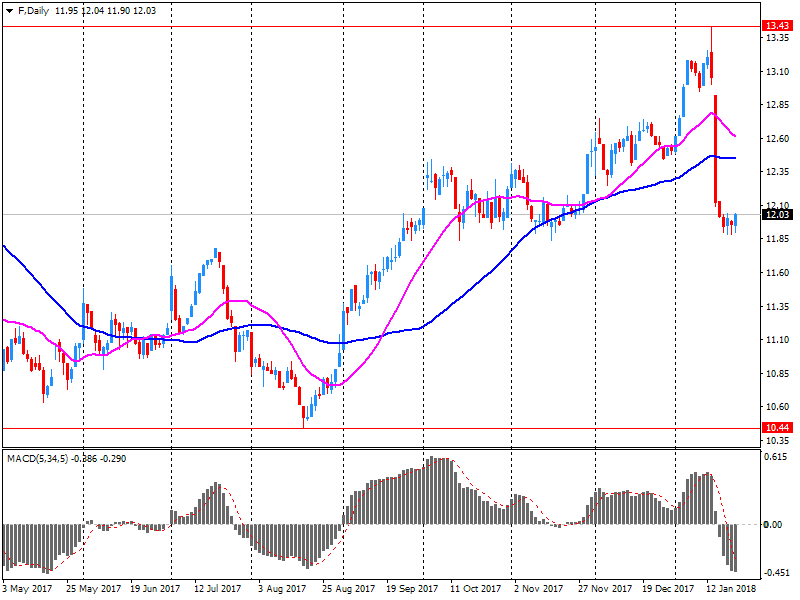

| Ford Motor Co. | F | 11.92 | -0.13(-1.08%) | 197291 |

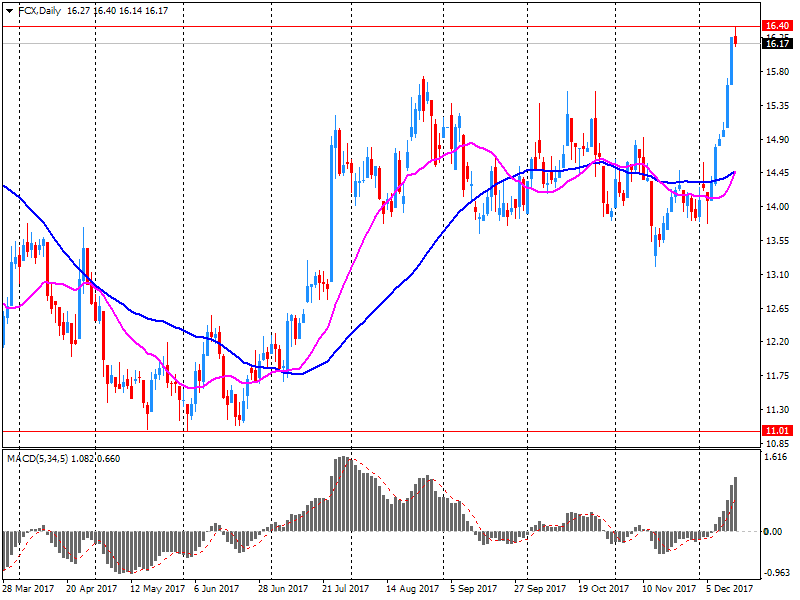

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 20.55 | 0.95(4.85%) | 273237 |

| General Electric Co | GE | 16.58 | 0.14(0.85%) | 288290 |

| General Motors Company, NYSE | GM | 44.13 | -0.03(-0.07%) | 3914 |

| Goldman Sachs | GS | 266.9 | 1.22(0.46%) | 4486 |

| Google Inc. | GOOG | 1,174.88 | 10.64(0.91%) | 9232 |

| Hewlett-Packard Co. | HPQ | 23.7 | 0.04(0.17%) | 2673 |

| Home Depot Inc | HD | 206.85 | 0.63(0.31%) | 1234 |

| HONEYWELL INTERNATIONAL INC. | HON | 161.87 | 1.90(1.19%) | 939 |

| Intel Corp | INTC | 45.88 | 0.37(0.81%) | 56288 |

| International Business Machines Co... | IBM | 166 | 0.63(0.38%) | 3458 |

| Johnson & Johnson | JNJ | 142.5 | 0.43(0.30%) | 6874 |

| JPMorgan Chase and Co | JPM | 116.35 | 0.68(0.59%) | 13552 |

| McDonald's Corp | MCD | 176.6 | 0.48(0.27%) | 750 |

| Merck & Co Inc | MRK | 61.49 | 0.31(0.51%) | 854 |

| Microsoft Corp | MSFT | 92.58 | 0.76(0.83%) | 36849 |

| Nike | NKE | 68.03 | 0.03(0.04%) | 929 |

| Pfizer Inc | PFE | 37.08 | 0.15(0.41%) | 4145 |

| Procter & Gamble Co | PG | 88.66 | 0.35(0.40%) | 10374 |

| Starbucks Corporation, NASDAQ | SBUX | 61.07 | 0.24(0.39%) | 8008 |

| Tesla Motors, Inc., NASDAQ | TSLA | 348.11 | 2.22(0.64%) | 20781 |

| The Coca-Cola Co | KO | 47.85 | 0.02(0.04%) | 649 |

| Twitter, Inc., NYSE | TWTR | 22.62 | 0.25(1.12%) | 61746 |

| United Technologies Corp | UTX | 135.43 | -0.25(-0.18%) | 1608 |

| UnitedHealth Group Inc | UNH | 245.95 | 1.10(0.45%) | 659 |

| Verizon Communications Inc | VZ | 54.39 | 0.17(0.31%) | 334 |

| Visa | V | 124.8 | 0.25(0.20%) | 4129 |

| Wal-Mart Stores Inc | WMT | 106 | 0.21(0.20%) | 2449 |

| Yandex N.V., NASDAQ | YNDX | 38.39 | 0.52(1.37%) | 2450 |

Home Depot (HD) target raised to $230 from $209 at Stifel

Amazon (AMZN) target raised to $1800 from $1500 at DA Davidson

Alphabet A (GOOGL) target raised to $1250 from $1175 at Goldman

-

Underlying inflation subdued

-

Downside risks relate to global factors, forex

-

Support provided by bond buys, stock, reinvestment, guidance on rates

-

Underlying inflation to rise gradually over medium term

-

Recent forex vol is source of uncertainty

-

Ample degree of monetary stimulus necessary for underlying inflation

-

Domestic price pressures muted, yet to show convincing upward trend

-

Information confirms robust pace of economic expansion

-

Economy accelerated more than expected

In the week ending January 20, the advance figure for seasonally adjusted initial claims was 233,000, an increase of 17,000 from the previous week's revised level. The previous week's level was revised down by 4,000 from 220,000 to 216,000. The 4-week moving average was 240,000, a decrease of 3,500 from the previous week's revised average. The previous week's average was revised down by 1,000 from 244,500 to 243,500.

Ford Motor (F) reported Q4 FY 2017 earnings of $0.39 per share (versus $0.30 in Q4 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $38.500 bln (+6.9% y/y), beating analysts' consensus estimate of $36.946 bln.

F fell to $11.94 (-0.91%) in pre-market trading.

"At today's meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively. The Governing Council expects the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases".

Freeport-McMoRan (FCX) reported Q4 FY 2017 earnings of $0.51 per share (versus $0.25 in Q4 FY 2016), beating analysts' consensus estimate of $0.50.

The company's quarterly revenues amounted to $5.041 bln (+15.2% y/y), beating analysts' consensus estimate of $4.887 bln.

FCX rose to $20.35 (+3.83%) in pre-market trading.

Caterpillar (CAT) reported Q4 FY 2017 earnings of $2.16 per share (versus $0.83 in Q4 FY 2016), beating analysts' consensus estimate of $1.78.

The company's quarterly revenues amounted to $12.896 bln (+34.7% y/y), beating analysts' consensus estimate of $12.005 bln.

The company also issued upside guidance for FY 2018, projecting EPS of $8.25-9.25 versus analysts' consensus estimate of $8.29.

CAT rose to $173.50 (+3.07%) in pre-market trading.

3M (MMM) reported Q4 FY 2017 earnings of $2.10 per share (versus $1.88 in Q4 FY 2016), beating analysts' consensus estimate of $2.03.

The company's quarterly revenues amounted to $7.990 bln (+9.0% y/y), beating analysts' consensus estimate of $7.845 bln.

The company issued upside guidance for FY 2018, projecting EPS of $10.20-10.70 versus its prior guidance of $9.60-10.00 and analysts' consensus estimate of $9.90.

It also raised dividend by 16% y/y to $1.36/share for Q1 FY 2018.

MMM rose to $254.02 (+2.56%) in pre-market trading.

-

U.S has most open trade and investment market in the world

-

Says international trade growing even faster than economic growth

-

Rules of the game on trade have to be clear, fair, enforced

-

Calls for fair rules on international trade

-

Says 'any measure' that could try to slow down trade would slow down growth

Sentiment among German businesses was very strong going into the year. The ifo Business Climate Index rose to 117.6 points in January from 117.2 points in December. This was due to far better assessments of the current business situation, with the sub-indicator hitting a record high. Business expectations for the next six months, by contrast, were slightly scaled back, but remain at a high level. The German economy made a dynamic start to the year.

In manufacturing the index rose to a new record high. This also applies to assessments of the current business situation, which were better than ever. Fewer manufacturers, however, expect to see any further short-term improvement in their very good business situation. Capacity utilisation rose by 0.6 percentage points to 87.9 percent, significantly above its long-term average of 83.7 percent.

-

Japan's approach on cryptocurrency regulation is to curb excessive risk-taking without discouraging innovation

-

Imposing global, across-the-board regulation on cryptocurrency trading won't be easy

-

Very clearly supportive of UK on Brexit

-

Wants to see a successful transition on Brexit that is good for UK and markets

-

Had good discussion with BoE's Carney on Brexit

Weaker than expected inflation at the end of 2017 will see the Reserve Bank delay interest rate hikes for at least six months, ANZ is tipping.

Statistics New Zealand said on Thursday that the consumer price index (CPI) lifted by 0.1 per cent in the final three months of 2017, below the 0.4 per cent rise economists were expecting.

A sharp rise in petrol at the end of 2017 boosted the transport component of inflation, while construction prices also rose. However food prices dropped, as did a range of retail goods, including new cars, clothing and appliances, Stats NZ said.

The increase was lower than the rise at the end of 2016, meaning annual inflation dropped to 1.6 per cent, the lowest in annual rate in 12 months. At the end of September, inflation was 1.9 per cent.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2496 (1659)

$1.2481 (3691)

$1.2462 (4122)

Price at time of writing this review: $1.2417

Support levels (open interest**, contracts):

$1.2329 (374)

$1.2299 (777)

$1.2264 (1982)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 127928 contracts (according to data from January, 24) with the maximum number of contracts with strike price $1,1850 (7038);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4368 (138)

$1.4344 (1133)

$1.4323 (746)

Price at time of writing this review: $1.4256

Support levels (open interest**, contracts):

$1.4145 (12)

$1.4098 (84)

$1.4036 (176)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 42199 contracts, with the maximum number of contracts with strike price $1,3600 (3473);

- Overall open interest on the PUT options with the expiration date February, 9 is 35630 contracts, with the maximum number of contracts with strike price $1,3400 (3057);

- The ratio of PUT/CALL was 0.84 versus 0.88 from the previous trading day according to data from January, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Both economic and income expectations, as well as propensity to buy, are on the increase in January. GfK forecasts an increase in consumer climate for February 2018 of 0.2 points compared to the previous month to 11.0 points

Consumers in Germany are making an extremely optimistic start to 2018. They see the German economy as experiencing a clear economic boom. Economic expectations have clearly risen accordingly, climbing to a new seven-year high. Income expectations and the propensity to buy are also showing moderate growth. They have improved slightly on what was already a very high level.

European stocks broke a four-session winning streak on Wednesday, yanked lower by a rally in the euro after U.S. Treasury Secretary Steven Mnuchin cheered the recent slide in the dollar. Utility companies were among biggest decliners after a profit warning from industry major Suez SA.

U.S. stocks retreated from record territory Wednesday as technology names came under pressure, but the Dow managed to buck the trend to close higher on the back of a few blue-chip financial shares.

Asian stocks retreated from record highs on Thursday as investors mulled rhetoric from Trump administration officials on trade and the dollar that roiled the foreign-exchange market. The U.S. currency extended its decline to a three-year low.

© 2000-2024. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.