- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(raw materials / closing price /% change)

Oil 52.53 +1.21%

Gold 1,277.80 -0.24%

(index / closing price / change items /% change)

Nikkei +108.52 21805.17 +0.50%

TOPIX +11.67 1756.92 +0.67%

Hang Seng -150.91 28154.97 -0.53%

CSI 300 +28.60 3959.40 +0.73%

Euro Stoxx 50 +1.82 3610.69 +0.05%

FTSE 100 +2.09 7526.54 +0.03%

DAX +10.05 13013.19 +0.08%

CAC 40 +7.99 5394.80 +0.15%

DJIA +167.80 23441.76 +0.72%

S&P 500 +4.15 2569.13 +0.16%

NASDAQ +11.60 6598.43 +0.18%

S&P/TSX +49.38 15905.14 +0.31%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1763 +0,12%

GBP/USD $1,3128 -0,52%

USD/CHF Chf0,99082 +0,60%

USD/JPY Y113,91 +0,39%

EUR/JPY Y134,00 +0,51%

GBP/JPY Y149,546 -0,13%

AUD/USD $0,7773 -0,44%

NZD/USD $0,6898 -1,11%

USD/CAD C$1,26761 +0,24%

03:30 Australia CPI, q/q Quarter III 0.2% 0.8%

03:30 Australia CPI, y/y Quarter III 1.9% 2%

03:30 Australia Trimmed Mean CPI q/q Quarter III 0.5% 0.5%

03:30 Australia Trimmed Mean CPI y/y Quarter III 1.8% 2.0%

09:00 Switzerland UBS Consumption Indicator September 1.53

11:00 Germany IFO - Expectations October 107.4 107.3

11:00 Germany IFO - Current Assessment October 123.6 123.5

11:00 Germany IFO - Business Climate October 115.2 115.2

11:30 United Kingdom BBA Mortgage Approvals September 41.807 41.9

11:30 United Kingdom GDP, y/y (Preliminary) Quarter III 1.5% 1.4%

11:30 United Kingdom GDP, q/q (Preliminary) Quarter III 0.3% 0.3%

15:30 U.S. Durable Goods Orders ex Transportation September 0.2% 0.5%

15:30 U.S. Durable Goods Orders September 1.7% 1.0%

15:30 U.S. Durable goods orders ex defense September 2.2%

16:00 U.S. Housing Price Index, m/m August 0.2% 0.4%

17:00 Canada Bank of Canada Rate 1% 1%

17:00 Canada Bank of Canada Monetary Policy Report

17:00 Canada BOC Rate Statement

17:00 U.S. New Home Sales September 560 0.555

17:30 U.S. Crude Oil Inventories October -5.731 -2.500

18:15 Canada BOC Press Conference

Major US stock indices rose on Tuesday, while the Dow Jones index renewed its record high, helped by good reports from the industrial giants 3M (MMM) and Caterpillar (CAT).

In addition, data for October indicated a reliable and accelerated expansion of business activity in the private sector of the United States. The upswing was supported by the fastest growth in the manufacturing sector for eight months, along with yet another reliable growth in output in the services sector. Taking into account seasonal fluctuations, the composite PMI index from IHS Markit increased to 55.7 from 54.8 in September. The last reading reflected the fastest growth in private sector activity since January.

At the same time, the index of production activity from the Federal Reserve Bank of Richmond remained positive in October, although the composite index fell due to a noticeable decline in the supply sub-index, which weakened from 22 to 9. Despite this, the index remained positive for all components, indicating continuing growth. Although most sub-indices fell in October, the employment index increased from 17 to 24, which is the highest level since May 2000.

Oil rose more than 1%, as Saudi Arabia reiterated its intention to strike a balance between supply and demand for oil. Support for prices was also provided by the remaining geopolitical risks for global reserves.

Most components of the DOW index recorded a rise (16 out of 30). The leader of the growth were shares of 3M Company (MMM, + 6.47%). Outsider were shares of International Business Machines Corporation (IBM, -2.40%).

Most sectors of the S & P index finished trading in positive territory. The industrial goods sector grew most (+ 0.8%). The health sector showed the greatest decline (-0.8%).

At closing:

DJIA + 0.72% 23.442.11 +168.15

Nasdaq + 0.18% 6,598.43 +11.60

S & P + 0.17% 2.569.23 +4.25

October data indicated a robust and accelerated expansion of U.S. private sector business activity. The upturn was supported by the fastest rise in manufacturing production for eight months, alongside another robust increase in service sector output.

The seasonally adjusted IHS Markit Flash U.S. Composite PMI Output Index rose to 55.7 in October, from 54.8 in September. As a result, the latest reading signalled the fastest upturn in private sector output since January.

However, growth of overall new business volumes moderated further from the two-year peak seen in August. This reflected a slowdown in the service sector, as manufacturing firms reported the strongest rise in new work since March.

EURUSD: 1.1800 (EUR 1.55bln) 1.1830 (560m) 1.1850 (985m)

USDJPY: 112.50 (USD 950m) 113.00 (600m) 113.50-55 (900m) 114.00 (880m) 114.50 (620m)

GBPUSD: Ntg of note

AUDUSD: 0.7900 (AUD 380m) 0.7920 (275m) 0.7938 (320m)

U.S. stock-index futures rose as investors assessed a slew of Q3 corporate earnings.

Global Stocks:

Nikkei 21,805.17 +108.52 +0.50%

Hang Seng 28,154.97 -150.91 -0.53%

Shanghai 3,388.25 +7.55 +0.22%

S&P/ASX 5,897.61 +3.65 +0.06%

FTSE 7,521.47 -2.98 -0.04%

CAC 5,407.11 +20.30 +0.38%

DAX 13,039.94 +36.80 +0.28%

Crude $52.27 (+0.71%)

Gold $1,278.70 (-0.17%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 227.2 | 5.65(2.55%) | 13015 |

| Amazon.com Inc., NASDAQ | AMZN | 970.11 | 3.81(0.39%) | 14603 |

| Apple Inc. | AAPL | 156.61 | 0.44(0.28%) | 281994 |

| AT&T Inc | T | 35.29 | 0.04(0.11%) | 23703 |

| Barrick Gold Corporation, NYSE | ABX | 16.08 | -0.07(-0.43%) | 1418 |

| Boeing Co | BA | 263.32 | 1.00(0.38%) | 5007 |

| Caterpillar Inc | CAT | 140.9 | 9.22(7.00%) | 714904 |

| Chevron Corp | CVX | 119 | 0.07(0.06%) | 248 |

| Cisco Systems Inc | CSCO | 34.4 | 0.05(0.15%) | 13983 |

| Citigroup Inc., NYSE | C | 74.15 | 0.62(0.84%) | 21472 |

| Deere & Company, NYSE | DE | 131.45 | 1.86(1.44%) | 2735 |

| Exxon Mobil Corp | XOM | 83.51 | 0.27(0.32%) | 8496 |

| Facebook, Inc. | FB | 172.1 | 0.83(0.48%) | 41705 |

| Ford Motor Co. | F | 12.19 | 0.15(1.25%) | 238219 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.02 | 0.21(1.42%) | 15396 |

| General Electric Co | GE | 22.04 | -0.28(-1.25%) | 432236 |

| General Motors Company, NYSE | GM | 47 | 1.85(4.10%) | 581368 |

| Goldman Sachs | GS | 243.5 | 1.37(0.57%) | 1796 |

| Google Inc. | GOOG | 971.99 | 3.54(0.37%) | 2056 |

| Hewlett-Packard Co. | HPQ | 22.28 | 0.16(0.72%) | 608 |

| Home Depot Inc | HD | 163.99 | -0.75(-0.46%) | 4100 |

| Intel Corp | INTC | 41.05 | 0.22(0.54%) | 17923 |

| International Business Machines Co... | IBM | 159.9 | 0.35(0.22%) | 911 |

| International Paper Company | IP | 58.75 | 0.50(0.86%) | 372 |

| Johnson & Johnson | JNJ | 143.65 | 0.03(0.02%) | 1445 |

| JPMorgan Chase and Co | JPM | 99.97 | 0.63(0.63%) | 32179 |

| McDonald's Corp | MCD | 165.8 | 2.46(1.51%) | 305272 |

| Merck & Co Inc | MRK | 63.62 | 0.22(0.35%) | 1032 |

| Microsoft Corp | MSFT | 79.05 | 0.22(0.28%) | 9081 |

| Nike | NKE | 53.47 | -0.19(-0.35%) | 1073 |

| Pfizer Inc | PFE | 36.43 | 0.03(0.08%) | 993 |

| Procter & Gamble Co | PG | 87.34 | 0.04(0.05%) | 1121 |

| Starbucks Corporation, NASDAQ | SBUX | 54.5 | 0.23(0.42%) | 625 |

| Tesla Motors, Inc., NASDAQ | TSLA | 339.55 | 2.53(0.75%) | 21692 |

| The Coca-Cola Co | KO | 46.29 | -0.03(-0.06%) | 544 |

| Twitter, Inc., NYSE | TWTR | 17.4 | 0.03(0.17%) | 8039 |

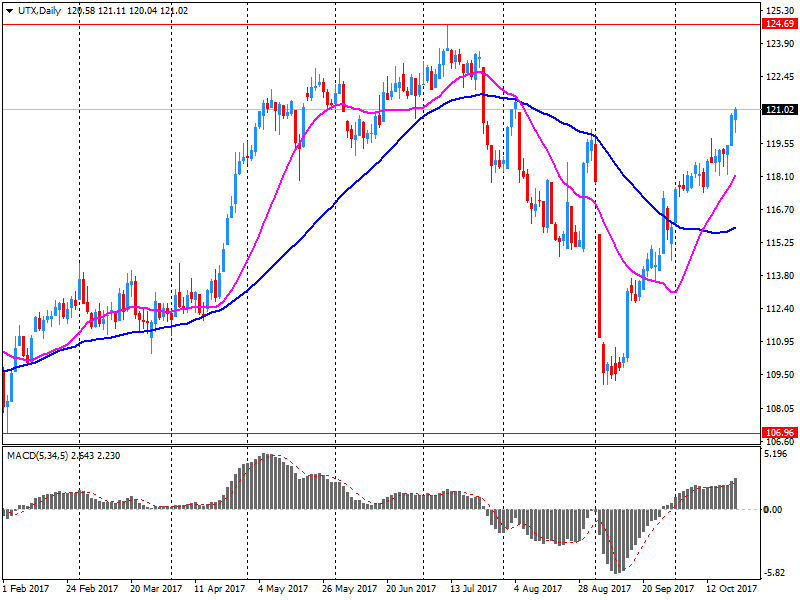

| United Technologies Corp | UTX | 121.1 | 0.21(0.17%) | 12718 |

| Verizon Communications Inc | VZ | 49.1 | 0.11(0.22%) | 7435 |

| Visa | V | 107.88 | 0.35(0.33%) | 4375 |

| Wal-Mart Stores Inc | WMT | 88.93 | 0.28(0.32%) | 2553 |

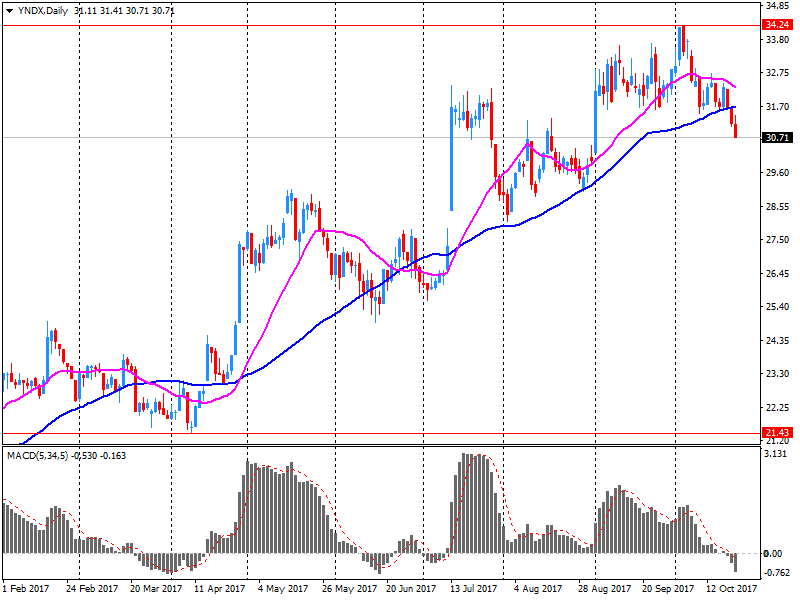

| Yandex N.V., NASDAQ | YNDX | 31.91 | 1.14(3.70%) | 270138 |

Int'l Paper (IP) initiated with a Equal Weight rating at Stephens

American Express (AXP) upgraded to Neutral from Underweight at Atlantic Equities

General Electric (GE) downgraded to Underperform at Oppenheimer

General Electric (GE) downgraded to Hold at Stifel; target lowered to $22

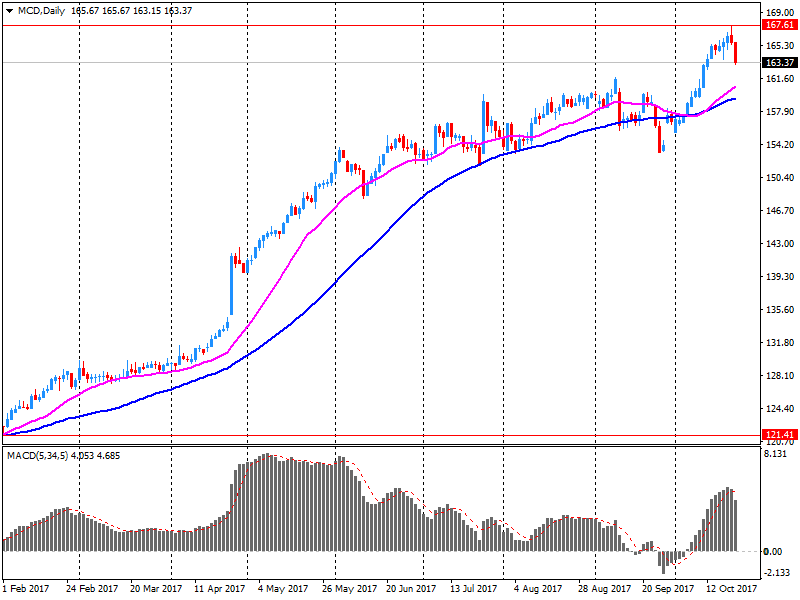

McDonald's (MCD) reported Q3 FY 2017 earnings of $1.76 per share (versus $1.62 in Q3 FY 2016), missing analysts' consensus estimate of $1.77.

The company's quarterly revenues amounted to $5.755 bln (-10.4% y/y), generally in-line with analysts' consensus estimate of $5.749 bln.

MCD rose to $164.10 (+0.47%) in pre-market trading.

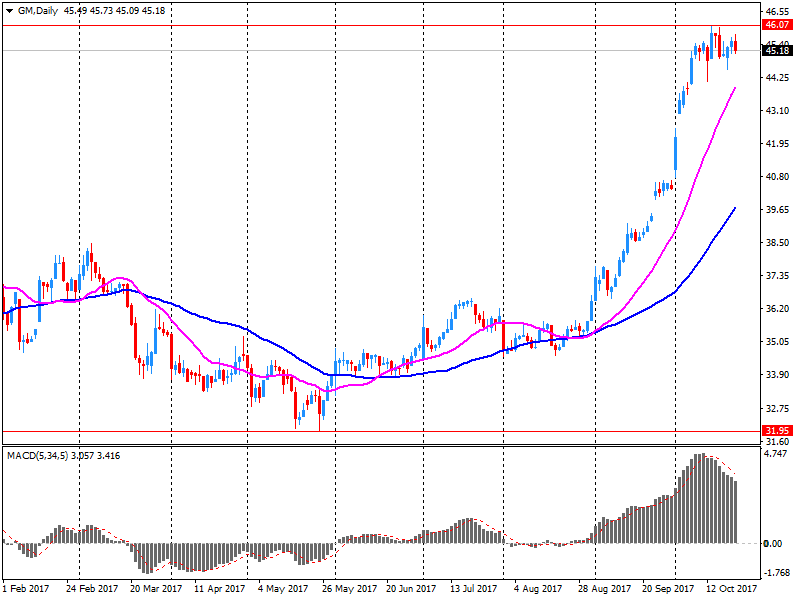

General Motors (GM) reported Q3 FY 2017 earnings of $1.32 per share (versus $1.72 in Q3 FY 2016), beating analysts' consensus estimate of $1.11.

The company's quarterly revenues amounted to $30.475 bln (-16.6% y/y), beating analysts' consensus estimate of $29.927 bln.

The company reaffirmed guidance for FY2017, projecting EPS at middle of $6.00-6.50 (versus analysts' consensus estimate of $6.16), and revenues generally in-line with 2016. It also announced plans to return $7 bln in buybacks and dividends.

GM rose to $46.99 (+4.08%) in pre-market trading.

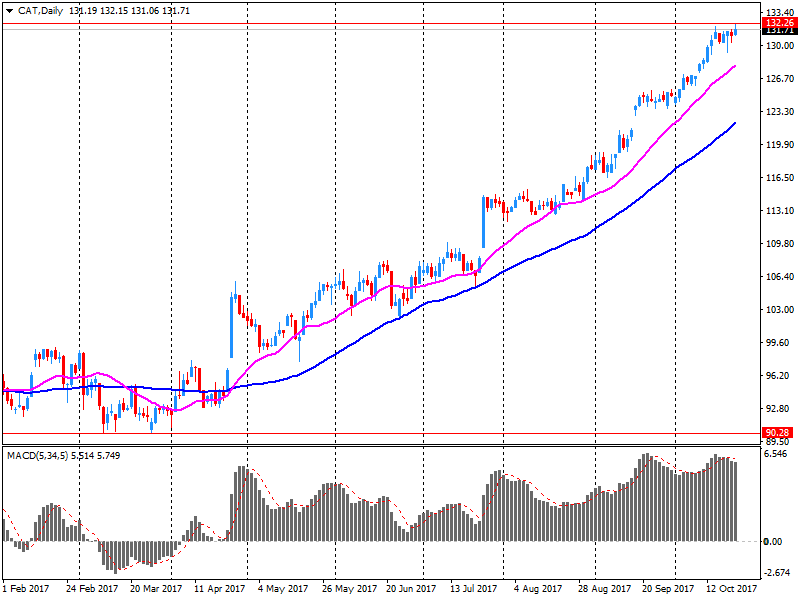

Caterpillar (CAT) reported Q3 FY 2017 earnings of $1.95 per share (versus $0.85 in Q3 FY 2016), beating analysts' consensus estimate of $1.27.

The company's quarterly revenues amounted to $11.413 bln (+24.6% y/y), beating analysts' consensus estimate of $10.691 bln.

The company raised guidance for FY2017 EPS to $6.25 (versus analysts' consensus estimate of $5.24, up from $5.00; FY2017 revenues guidance to $44 bln (versus analysts' consensus estimate of $42.97 bln), up from $42-44 bln.

CAT rose to $140.61 (+6.78%) in pre-market trading.

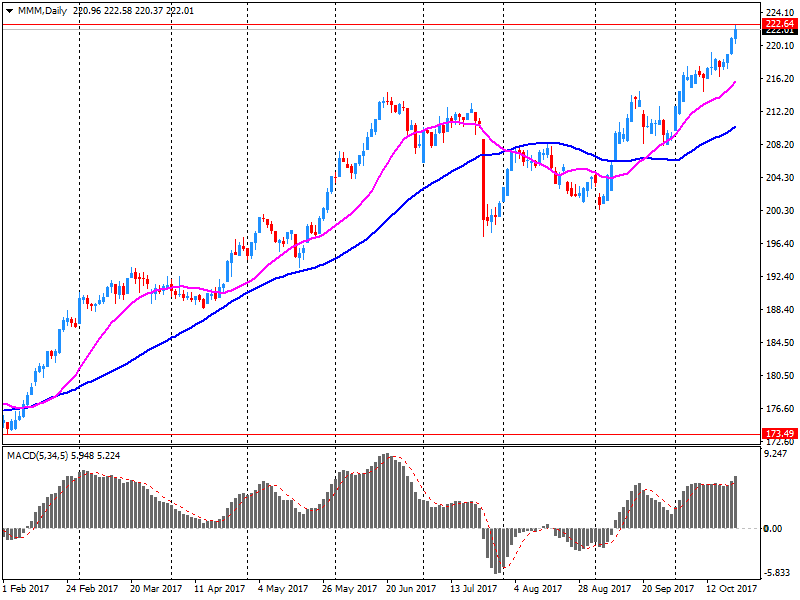

3M (MMM) reported Q3 FY 2017 earnings of $2.33 per share (versus $2.15 in Q3 FY 2016), beating analysts' consensus estimate of $2.21.

The company's quarterly revenues amounted to $8.172 bln (+6.0% y/y), beating analysts' consensus estimate of $7.927 bln.

The company also issued raised guidance for FY2017 EPS of $9.00-9.10 from $8.80-9.05, versus analysts' consensus estimate of $8.96.

MMM rose to $229.39 (+3.54%) in pre-market trading.

Yandex N.V. (YNDX) reported Q3 FY 2017 earnings of RUB7.16 per share (versus RUB11.64 in Q3 FY 2016), missing analysts' consensus estimate of RUB9.21.

The company's quarterly revenues amounted to RUB23.438 bln (+21.5% y/y), in-line with analysts' consensus estimate.

The company also issued upside guidance for FY2017, projecting revenues of +22%-23% y/y to $92.63-93.38 bln versus analysts' consensus estimate of $93.08 bln.

YNDX rose to $31.40 (+2.05%) in pre-market trading.

United Tech (UTX) reported Q3 FY 2017 earnings of $1.73 per share (versus $1.76 in Q3 FY 2016), beating analysts' consensus estimate of $1.69.

The company's quarterly revenues amounted to $15.062 bln (+4.9% y/y), generally in-line with analysts' consensus estimate of $14.994 bln.

The company also raised its guidance for FY2017 EPS to $6.58-6.63 from $6.45-6.50 (versus analysts' consensus estimate of $6.57) and FY2017 revenues to $59.0-59.5 bln from $58.5-59.5 bln (versus analysts' consensus estimate of $59.4 bln).

UTX rose to $122.20 (+1.08%) in pre-market trading.

EUR/USD: 1.1800(1.55 b), 1.1830(553 m), 1.1850(987 m), 1.2000(908 m)

USD/JPY: 110.40-50(650 m), 112.50(946 m), 112.95-113.00(602 m), 113.50-55(895 m), 113.95-114.00(879 m), 114.50(620 m)

USD/CHF: 0.9840(405 m)

AUD/USD: 0.7900(376 m), 0.7920(271 m), 0.7938(322 m)

NZD/USD: 0.7100(558 m), 0.7125(359 m)

USD/CAD: 1.2550(491 m)

EUR/GBP: 0.8950(722 m)

EUR/JPY: 133.00(300 m), 133.80(643 m)

AUD/JPY: 86.75(400 m)

The recent strong growth of the euro area economy was maintained at the start of the final quarter of the year, driven by another marked improvement in new orders. Rising workloads encouraged firms to take on extra staff at the sharpest pace in over a decade.

The headline IHS Markit Eurozone PMI posted 55.9 in October, according to the preliminary 'flash' estimate (based on approximately 85% of final replies), down from 56.7 in September

Germany's private sector economy maintained strong growth momentum at the start of the fourth quarter, with inflows of new orders increasing at the fastest rate for six-and-a-half years in October, according to flash PMI survey data from IHS Markit.

Overall business activity rose sharply, albeit at a slightly slower rate than in September, while the pace of job creation accelerated to a five-month high. The survey meanwhile showed a further pick-up in inflation pressures, as average prices charged for goods and services rose at one of the fastest rates seen since mid-2011.

The IHS Markit Flash Germany Composite Output Index was at 56.9 in October, down slightly from September's 77-month high of 57.7, but nonetheless registering one of the highest readings seen since 2011.

-

Corporate credit standards eased in Germany, tightened in Spain and were unchanged in France, Italy and the Netherlands in q3

-

Credit standards broadly unchanged for corporates in q3 but eased for mortgages, consumer credit

-

Demand for corporate loans, consumer credit, mortgages to rise further in q4

-

Banks reported improved access to retail and wholesale funding in q3, see further improvement in q4

Flash France Composite Output Index at 57.5 in October (77-month high).

Services Activity Index rises to 57.4 in October (57.0 in September), 7-month high.

Manufacturing Output Index rises to 58.1 (57.6 in September), 78-month high.

Manufacturing PMI increases to 56.7 (56.1 in September) 78-month high.

According to latest flash data, the resurgence in the French private sector showed no sign of abating at the start of the fourth quarter. Indeed, the rate of growth accelerated from September with the IHS Markit Flash France Composite Output Index, which is based on around 85% of usual monthly survey replies, posting 57.5, up from 57.1 in September and a near-six-and-a-half-year high.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1890 (3367)

$1.1831 (1321)

$1.1796 (406)

Price at time of writing this review: $1.1760

Support levels (open interest**, contracts):

$1.1715 (2963)

$1.1691 (3000)

$1.1662 (4926)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 101590 contracts (according to data from October, 23) with the maximum number of contracts with strike price $1,2000 (6678);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3352 (3314)

$1.3297 (3975)

$1.3262 (2367)

Price at time of writing this review: $1.3209

Support levels (open interest**, contracts):

$1.3169 (2155)

$1.3124 (1671)

$1.3093 (2274)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 39840 contracts, with the maximum number of contracts with strike price $1,3200 (3975);

- Overall open interest on the PUT options with the expiration date November, 3 is 35516 contracts, with the maximum number of contracts with strike price $1,3000 (3178);

- The ratio of PUT/CALL was 0.89 versus 0.88 from the previous trading day according to data from October, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Flash Manufacturing Output Index at 52.6 (53.2 in September)

-

Business confidence softens to 11-month low

Commenting on the Japanese Manufacturing PMI survey data, Joe Hayes, Economist at IHS Markit, which compiles the survey, said: "Although still improving solidly, the Japanese manufacturing sector appeared to lose some momentum in October, as growth eased from September's fourmonth high. Softer expansions were seen for both output and new orders. Meanwhile, firms continued to largely absorb cost pressures, with output price inflation only marginal again in October. "Signs of slowing growth coincided with faltering optimism, as the level of positive sentiment fell to an 11- month low."

Spanish stocks fell Monday as the political standoff between Madrid and the Catalan region wore on, but a drop in the euro appeared to provide a lift to other European markets. The Stoxx Europe 600 index SXXP, +0.16% ended 0.2% higher at 390.74, for a second straight session of gains.

The S&P 500 and the Dow snapped a six-day winning streak on Monday as investors weighed prospects for tax cuts while parsing the latest corporate earnings for clues on where stocks are headed in the near term.

Japan's benchmark Nikkei 225 Index NIK, +0.14% was pushing Tuesday toward a 16th consecutive rise, having posted a 0.17% gain to the 21,733.10 level. The yen, meanwhile, rebounded against the U.S. dollar USDJPY, -0.06% overnight and gained a bit in the Asian session.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.