- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 06:00 | United Kingdom | PSNB, bln | August | -25.9 | -35.1 |

| 06:45 | France | Consumer confidence | September | 94 | |

| 08:00 | Eurozone | Private Loans, Y/Y | August | 3% | |

| 08:00 | Eurozone | M3 money supply, adjusted y/y | August | 10.2% | 10.2% |

| 10:00 | United Kingdom | CBI retail sales volume balance | September | -6 | |

| 12:30 | U.S. | Durable goods orders ex defense | August | 9.9% | |

| 12:30 | U.S. | Durable Goods Orders ex Transportation | August | 2.4% | 1.2% |

| 12:30 | U.S. | Durable Goods Orders | August | 11.2% | 1.5% |

| 13:00 | U.S. | FOMC Member Williams Speaks | |||

| 17:00 | U.S. | Baker Hughes Oil Rig Count | September | 179 | |

| 19:10 | U.S. | FOMC Member Williams Speaks |

- We should have negative rates in toolbox because other countries have demonstrated they can do it

- It would be cardinal sin not to look first at whether UK could use it too

The U.S.

Commerce Department announced on Thursday that the sales of new single-family

homes climbed 4.8 percent m-o-m to a seasonally adjusted annual rate of 1,011,

000 units in August. This was the highest level since September 2006.

Economists had

forecast the sales pace of 895,000 last month.

July’s sales

pace was revised up to 965,000 units from the originally reported 901,000

units.

According to

the report, new home sales in the South, the largest area, surged 13.4 percent

m-o-m in August. At the same time, sales in the Northeast rose 5.0 percent m-o-m,

while sales in the Midwest tumbled 21.4 percent m-o-m and sales in the West dropped

1.7 percent m-o-m.

- We are pretty far away from maximum employment and there are headwinds to getting there quickly

- More fiscal support will be needed for low-income individuals, small business as well as state and local governments

- Fed's statement made it clear that Fed would potentially raise interest rates if there are financial imbalance

James Knightley, ING's Chief International Economist, notes that U.S. initial jobless claims remain elevated despite the decent activity backdrop.

"US initial jobless claims rose 4k to 870k for the week of September 19 versus expectations they would drop to 840k. Continuing claims moved down to 12.58mn from 12.75mn, not as good as the 12.28mn consensus. The total number of people claiming unemployment benefits (including pandemic unemployment assistance) dropped to 26.04mn from 29.77mn."

"This latter number is encouraging although we don't have any detail as to why it was such a big drop in the number of people claiming PUA. The total number of benefit claimants remains nearly double the 13.55mn “official” level of unemployment whereby to be “officially” unemployed you have to be actively looking for work."

"Given Covid-19 is far from beaten plus the fact that the supportive impact from the fiscal stimulus is fading, caution remains warranted. There are clearly ongoing strains in the jobs market – remember that the peak in initial claims during the Global Financial Crisis was 665k the week of March 27, 2009 so we are still 200k above that."

"There certainly is the risk of a renewed wave of cases in the US, particularly as the weather becomes more conducive to human transfer, so if renewed containment measures are introduced this will undoubtedly constrain business activity and hurt employment prospects. As such, calls for more fiscal help will only grow, but it is difficult to see a material package being agreed given election-related tensions in Washington."

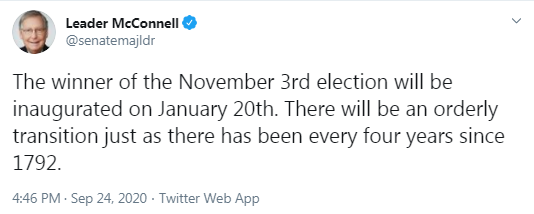

U.S. stock-index futures plunged on Thursday, as investors were discouraged by worse-than-expected weekly jobless claims and worrying comments from the U.S. President Trump about a peaceful transition of power after the November election.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 23,087.82 | -258.67 | -1.11% |

Hang Seng | 23,311.07 | -431.44 | -1.82% |

Shanghai | 3,223.18 | -56.53 | -1.72% |

S&P/ASX | 5,875.90 | -48.00 | -0.81% |

FTSE | 5,855.11 | -44.15 | -0.75% |

CAC | 4,780.27 | -21.99 | -0.46% |

DAX | 12,609.04 | -33.93 | -0.27% |

Crude oil | $39.63 | -0.75% | |

Gold | $1,857.60 | -0.58% |

(company / ticker / price / change ($/%) / volume)

ALCOA INC. | AA | 11.54 | -0.10(-0.82%) | 7471 |

ALTRIA GROUP INC. | MO | 38 | 0.07(0.18%) | 3966 |

Amazon.com Inc., NASDAQ | AMZN | 2,959.50 | -40.36(-1.35%) | 64453 |

American Express Co | AXP | 95.05 | -0.51(-0.53%) | 15821 |

Apple Inc. | AAPL | 105.15 | -1.97(-1.84%) | 1672053 |

AT&T Inc | T | 27.91 | 0.04(0.14%) | 106974 |

Boeing Co | BA | 150.1 | -1.08(-0.71%) | 112429 |

Caterpillar Inc | CAT | 143.73 | -0.65(-0.45%) | 3168 |

Chevron Corp | CVX | 71.57 | -0.38(-0.53%) | 19637 |

Cisco Systems Inc | CSCO | 37.94 | -0.34(-0.89%) | 67914 |

Citigroup Inc., NYSE | C | 41.81 | -0.04(-0.10%) | 68859 |

E. I. du Pont de Nemours and Co | DD | 54.02 | -0.35(-0.64%) | 1448 |

Exxon Mobil Corp | XOM | 34.35 | -0.04(-0.10%) | 81961 |

Facebook, Inc. | FB | 245.85 | -3.17(-1.27%) | 140336 |

FedEx Corporation, NYSE | FDX | 242 | 0.58(0.24%) | 26198 |

Ford Motor Co. | F | 6.6 | -0.04(-0.60%) | 182787 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.6 | -0.17(-1.15%) | 226722 |

General Motors Company, NYSE | GM | 29 | -0.34(-1.16%) | 33319 |

Goldman Sachs | GS | 187.3 | 1.18(0.63%) | 32005 |

Google Inc. | GOOG | 1,400.00 | -15.21(-1.07%) | 10143 |

Hewlett-Packard Co. | HPQ | 18.11 | -0.21(-1.15%) | 1410 |

Home Depot Inc | HD | 265.5 | -1.05(-0.39%) | 3718 |

HONEYWELL INTERNATIONAL INC. | HON | 160 | 1.21(0.76%) | 764 |

Intel Corp | INTC | 48.38 | -0.44(-0.90%) | 114431 |

International Business Machines Co... | IBM | 118.4 | -0.43(-0.36%) | 6357 |

Johnson & Johnson | JNJ | 144.76 | 0.32(0.22%) | 25683 |

JPMorgan Chase and Co | JPM | 92.41 | -0.33(-0.36%) | 37715 |

McDonald's Corp | MCD | 214 | -0.97(-0.45%) | 1720 |

Merck & Co Inc | MRK | 82.06 | -0.57(-0.69%) | 3246 |

Microsoft Corp | MSFT | 198.45 | -2.14(-1.07%) | 225286 |

Nike | NKE | 124.82 | -2.29(-1.80%) | 57170 |

Pfizer Inc | PFE | 35.9 | -0.10(-0.28%) | 24549 |

Starbucks Corporation, NASDAQ | SBUX | 82.5 | -0.49(-0.59%) | 6970 |

Tesla Motors, Inc., NASDAQ | TSLA | 367 | -13.36(-3.51%) | 1330867 |

Travelers Companies Inc | TRV | 107.5 | 0.01(0.01%) | 111 |

Twitter, Inc., NYSE | TWTR | 44.73 | -0.60(-1.32%) | 118942 |

UnitedHealth Group Inc | UNH | 290.5 | -1.64(-0.56%) | 1803 |

Verizon Communications Inc | VZ | 59 | 0.09(0.15%) | 5348 |

Visa | V | 194.5 | -0.87(-0.45%) | 5341 |

Wal-Mart Stores Inc | WMT | 135.05 | -0.94(-0.69%) | 16041 |

Walt Disney Co | DIS | 122.6 | -0.68(-0.55%) | 10750 |

Yandex N.V., NASDAQ | YNDX | 63.2 | -1.60(-2.47%) | 33337 |

Chevron (CVX) initiated with a Buy at MKM Partners; target $121

Chevron (CVX) downgraded to Sector Perform from Sector Outperform at Scotiabank; target $95

Exxon Mobil (XOM) upgraded to Sector Perform from Sector Underperform at Scotiabank; target $45

FedEx (FDX) upgraded to Buy from Hold at Stifel; target raised to $281

Freeport-McMoRan (FCX) upgraded to Overweight from Equal-Weight at Morgan Stanley; target raised to $19

Goldman Sachs (GS) upgraded to Buy from Neutral at UBS; target raised to $245

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment unexpectedly increase last week, as the U.S. labor market continues

its slow recovery from its biggest shock in history, caused by the COVID-19 pandemic.

According to

the report, the initial claims for unemployment benefits totaled 870,000 for

the week ended September 19.

Economists had

expected 840,000 new claims last week.

Claims for the

prior week were revised upwardly to 866,000 from the initial estimate of 860,000.

Meanwhile, the

four-week moving average of claims fell to 878,250 from an upwardly revised 913,500

in the previous week.

Continuing

claims dropped to 12,580,000 million from an upwardly revised 12,747,000 in the

previous week.

Charlotte de Montpellier, ING's economist, notes that the Swiss central bank didn't change its monetary policy today and the key rate is still at -0.75% and the franc is still described as "highly valued".

"Since the June meeting, the Swiss franc has depreciated against the euro but appreciated against the dollar. The central bank, therefore, remains in the same position, indicating that it "remains willing to intervene more strongly in the foreign exchange market". This implies that it still intends to use foreign exchange market intervention as the primary instrument of its monetary policy in the coming months."

"Interestingly, the central bank announced it will now publish data on the volume of its foreign exchange market interventions on a quarterly basis instead of just annually. This will therefore provide a clearer picture of the situation. It cannot be ruled out that this decision is linked to the fact that Switzerland is on the US authorities watch list for currency manipulation, and this additional transparency is intended to allay US fears."

"The interesting element of the September meeting is the upward revision of the outlook for GDP and inflation; although this was clearly expected... The SNB now believes GDP will contract by around 5% in 2020, compared to -6% at the June meeting."

"For inflation, the SNB is revising its outlook slightly upwards by forecasting -0.6% for 2020, 0.1% for 2021 and 0.2% for 2022 (compared with -0.7%, -0.2% and 0.2% respectively in June)."

"It is also interesting to note that the Swiss central bank does not even communicate about a possible revision of its monetary policy strategy like the Federal Reserve has done."

"Clearly, the SNB is not there yet or does not wish to communicate about this (let's not forget that the SNB has always preferred surprise decisions in the past). Nevertheless, it is possible that the SNB may have to undertake such an exercise in the coming years."

"Ultimately, as it has done for some time now, the SNB seems to be waiting for better times to see what should be done."

- We are seeing creative and imaginative proposals from Chancellor Sunak

- Sunak has been realistic about prospects of economy; things will be tough

- The main goal is to support jobs, but we need to change how we do this

- As the economy reopens, it is fundamentally wrong to keep furlough scheme

- Under new jobs support scheme, government will directly support wages of people in work

- This will help companies employ people on shorter hours, instead of laying them off

- The scheme will support viable jobs

- Employees must work at least a third of normal hours

- Government will increase wages to cover two thirds of lost pay

- The scheme will run for about 6 months

- Self-employed grant will be extended on similar terms as jobs support scheme

- Introduces 'pay-as-you-grow' scheme

- Bounce back loans extended from 6 years to 10 years

- Businesses can choose to make interest-only payments now

- To extended deadline of all loan schemes until the end of the year

FXStreet reports that FX Strategists at UOB Group now see USD/CNH attempting a move to the 6.8600 region in the near-term.

24-hour view: “While our view for USD to move higher was correct, our expectation that ‘any advance was likely limited to a test of 6.8100’ was not. USD surged past 6.8100 and hit a high of 6.8285 before closing on a strong note at 6.8260 (+0.60%), its biggest 1-day gain in 2 months. While overbought, the advance has room to break above the major 6.8300 resistance. That said, the next resistance at 6.8430 is likely out of reach. Support is at 6.8100 followed by 6.8000.”

Next 1-3 weeks: “Two days ago (22 Sep, spot at 6.7900), we highlighted that the ‘month-long negative phase has run its course’. We held view that the ‘rebound in USD has room to extend higher but any advance is viewed as part of a broad 6.7500/6.8300 range’. While our view was not wrong, the pace by which USD approaches 6.8300 was faster than expected... The price actions suggest that the rebound could extend further towards 6.8600.”

The

Confederation of British Industry (CBI) reported on Thursday its latest survey

of retailers showed retail sales volume balance stood at 11 in the year to September,

up significantly from -6 in August. That was the highest reading since April

2019. Grocers were the primary driver of the expansion, with the overwhelming

majority reporting rising sales volumes.

Economist had

forecast the reading to decrease to -10.

However, retail

sales volumes are expected to remain flat in October (0).

The report also

revealed that orders placed on suppliers dropped for the 11th straight month

(balance of -14, from -27) and are expected to decline again in the year to

October (-3). Meanwhile, stock levels in relation to expected sales eased to their

lowest balance since March (balance of +11, from +19) and are expected to ease

further next month (+2).

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 07:30 | Switzerland | SNB Interest Rate Decision | -0.75% | -0.75% | ||

| 08:00 | Eurozone | ECB Economic Bulletin | ||||

| 08:00 | Germany | IFO - Current Assessment | September | 87.9 | 89.2 | |

| 08:00 | Germany | IFO - Expectations | September | 97.5 | 97.7 | |

| 08:00 | Germany | IFO - Business Climate | September | 92.6 | 93.4 | |

| 10:00 | United Kingdom | CBI retail sales volume balance | September | -6 | -10 | 11 |

GBP firmed against its major rivals in the European session on Thursday as investors awaited the UK's finance minister Rishi Sunak to unveil a new round of measures to bolster the country's economy, hit hard by COVID-19 pandemic and restrictions to contain it. Sunak is expected to present a new wage support scheme in a speech around 10:45 GMT.

The Bank of England's (BoE) governor Andrew Bailey is also set to speak today (due at 14:00 GMT). Investors will scrutinize his remarks for clues whether the British central bank intends to cut interest rates below zero. Earlier this week, Bailey acknowledged that the BoE’s officials had looked very hard at the scope to cut rates further, including negative interest rates, but this did not imply that the Bank would necessarily use negative rates.

FXStreet reports that economist at UOB Group Lee Sue Ann reviewed the latest interest rate decision by the RBNZ.

“The September meeting culminated with the Reserve Bank of New Zealand (RBNZ) keeping its Overnight Cash Rate (OCR) unchanged at 0.25%, as expected, in accordance with the guidance issued on 16 March. It also agreed to continue with its Large Scale Asset Programme (LSAP) at NZD100bn.”

“The accompanying press release, however, outlined further measures that can be deployed if needed, including a Funding for Lending Programme (FLP), a negative OCR, and purchases of foreign assets.”

“We think it is looking more likely that the RBNZ will cut the OCR, but we will only be revising our forecasts following the November meeting. In terms of timeline, at this juncture, the RBNZ looks likely to cut the OCR by 50bps at the 14 April 2021 meeting, alongside a FLP, pausing thereafter. Moving in February or April should not really matter in terms of policy effectiveness, since the move will have been well-signaled in advance, which we believe the RBNZ will indicate (and commit to) latest by the 24 February meeting. Moreover, the RBNZ has pledged to keeping the OCR unchanged until March 2021, and has made no promises – or even forecasts – beyond that point.

- FX market is functioning well

- We have no particular target level for the krone

FXStreet reports that FX Strategists at UOB Group suggested that the kiwi dollar could drop further to the sub-0.6500 area vs. the greenback in the next weeks.

24-hour view: “NZD plummeted to an overnight low of 0.6536 before ending the day on a weak note at 0.6651 (-1.25%). The weakness exceeded our expectation... While deep in oversold territory, the current weakness is yet to show sign of stabilizing. That said, the pace of any further weakness is likely to be slower and the next major support at 0.6490 is unlikely to come under threat (0.6520 is already quite a strong level).”

Next 1-3 weeks: “There is not much to add to our update from yesterday (23 Sep, spot at 0.6610). We highlighted that ‘the negative phase has more room to run’ and added, ‘the next support is at 0.6545 followed by 0.6490’. NZD dropped below 0.6545 (overnight low of 0.6536) and the outlook remains weak. From here, the focus is at 0.6490. On the upside, the ‘strong resistance’ level has moved lower to 0.6650 from 0.6720.”

- Current situation slightly less negative than expected three months ago

- Economic recovery remains fragile

- Brexit, U.S.-China tensions, monetary policy environment remains challenging

- Interventions have had impact against upward pressure of the franc

- More details on FX transactions is a response to bigger international interest*

- Monetary policy situation remains more or less the same

* SNB announced earlier today that it would be publishing more detailed data on its money and foreign exchange market operations from 30 September 2020.

ifo Institute announced

on Thursday its survey of about 9,000 businesses revealed that sentiment among

German companies continued to improve in September.

According to the

report, ifo Business Climate Index increased to 93.4 in September from a

revised 92.5 in August (originally 92.6). That was the highest reading since

February.

Economists had

forecast the indicator to come in at 93.8.

The current

situation sub-index climbed to 89.2 this month from 87.9 in August, as the companies

once again assessed their current situation as better than in the previous

month. Meanwhile the gauge measuring companies' expectations for the coming

months rose to 97.7 from 97.2, reflecting anticipations of further recovery of

the business.

On the sector

level, the business sentiment improved in manufacturing, trade and construction, but it

worsened in the service sector, due to less optimistic expectations.

The Swiss

National Bank (SNB) decided

to leave its policy rate unchanged at -0.75 percent at its September meeting,

as widely expected.

In its monetary policy assessment, the SNB noted:

- In view of the fact that the Swiss franc is still highly valued, it remains willing to intervene more strongly in the foreign exchange market, while taking overall exchange rate situation into consideration;

- It continues to supply the banking system with generous amounts of liquidity via COVID-19 refinancing facility (CRF); it is also active on the repo market as needed;

- Expansionary monetary policy is necessary to ensure appropriate monetary conditions in Switzerland and to stabilize economic activity and price developments;

- Inflation outlook is subject to unusually high uncertainty. Forecast for the current year remains negative (-0.6%). The inflation rate is likely to edge back into positive territory in 2021 (0.1%) and increase slightly further in 2022 (0.2%);

- Economic activity in Switzerland has picked up significantly since May due to the relaxation of health policy measures and to fiscal and monetary policy support. This should be reflected in strong rise in GDP in Q3, and the positive development is likely to continue in 2021;

- However, it is anticipated that, as abroad, the recovery will only be partial for the time being;

- Switzerland's GDP is set to shrink by around 5% in 2020, its strongest decline since the crisis in mid-1970s.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 07:30 | Switzerland | SNB Interest Rate Decision | -0.75% | -0.75% |

USD traded mixed against other major currencies in the Asian session on Thursday as risk appetite waned after the European and the U.S. PMI surveys revealed on Wednesday a slowdown in business activity in these regions due to a setback in the services sector. It rose against AUD, NZD and CAD, fell against JPY and CHF, and changed little against EUR and GBP.

The U.S. Dollar Index (DXY), measuring the U.S. currency's value relative to a basket of foreign currencies, edged down 0.06% to 94.34.

Recall, the flash manufacturing PMI readings for September showed expanding activity in Germany, the UK, and France, while activity in the services sector contracted in Germany and France, impacted by fresh coronavirus restrictions, imposed to fight rising numbers of coronavirus cases.

As for the U.S., manufacturing PMI pointed to the strongest expansion in factory activity since January 2019 in September, while services PMI pointed to a deceleration in the pace of activity growth at service providers.

This raised concerns that the new round of measures to curb a resurgence in coronavirus cases might put the economic recovery into jeopardy.

FXStreet reports that analysts at UOB suggest that in light of the recent price action, Cable could recede to the mid-1.2600s region in the next weeks.

24-hour view: “GBP dropped to a low of 1.2676 yesterday before rebounding to close little changed at 1.2726 (-0.06%). The price actions were in line with our expectations... For today, GBP could drift downwards but any weakness is viewed as part of lower trading range of 1.2650/1.2760 (a sustained decline below 1.2650 is not expected).”

Next 1-3 weeks: “Yesterday (22 Sep, spot at 1.2820), we expected GBP ‘to trade with a downward bias towards 1.2730’ and we highlighted that GBP ‘has to close below this level before further weakness can be expected’. GBP subsequently dropped to 1.2711 before closing at 1.2734. While GBP did not close below 1.2730, downward momentum has improved considerably. In other words, GBP is likely to weaken further. The next support is at 1.2650.”

FXStreet reports that analysts at Morgan Stanley offered a bearish outlook on iron-ore prices over the next 12 months in their latest client note.

“Shipments from Vale increasing and demand from China (steel output) easing.”

“China demand eases during the country's winter with slowing construction.”

“Seen Iron-ore prices at 100$/ton in Q4 and dropping to $81 in 2021.”

- We've been working on a winter plan for the economy since the summer, in case the cases started to rise again

- There could be - if necessary - well-targeted closures

- Today, the situation in Italy is certainly better than in other European countries

- We are better prepared - even as health system - to face possible resurgence of the spread of the virus

FXStreet reports that FX Strategists at UOB Group noted that EUR/USD risks a move to 1.1630 ahead of 1.1600 in the next weeks.

24-hour view: “We highlighted yesterday that EUR ‘could weaken further but oversold conditions suggest a sustained decline below 1.1660 is unlikely’. We noted that the next support is at 1.1630. The subsequent weakness exceeded our expectation as EUR dropped to a low of 1.1649 before closing on a soft note at 1.1659 (-0.40%). Downward momentum is showing some signs of slowing but there appears to be room for EUR to dip below the major support at 1.1630.”

Next 1-3 weeks: “We noted yesterday (22 Sep, spot at 1.1765) that the ‘rapid improvement in downward momentum suggests EUR could weaken further towards the next major support at 1.1695’. While our view was correct, we did expect 1.1695 to come into the picture so soon (EUR dropped to an overnight low of 1.1690). Downward momentum has improved further and the risk is still on the downside. From here, the next support is at 1.1630 followed by 1.1600.”

Statistics New

Zealand reported on Thursday that the country’s trade balance recorded a

deficit of NZD353 million in August compared to an upwardly revised NZD447 million

surplus in the previous month (originally a NZD282 million surplus) and a NZD1.642

billion gap in the same month of the previous year.

According to

the report, goods exports rose 8.6 percent y-o-y to NZD4.4 billion last month,

with the increase being led by higher sales of aircraft and parts (+785 percent

y-o-y) and kiwifruit (+48 percent y-o-y). Meanwhile, goods imports tumbled 16

percent y-o-y to NZD4.8 billion last month. Vehicles and parts (-37 percent

y-o-y) led the decline in import values. Decreases were also recorded in petroleum

and products (- 36 percent y-o-y) and mechanical machinery and equipment (-14

percent y-o-y).

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 41.31 | -0.72 |

| Silver | 22.73 | -6.77 |

| Gold | 1862.479 | -1.99 |

| Palladium | 2221.01 | 0.06 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -13.81 | 23346.49 | -0.06 |

| Hang Seng | 25.66 | 23742.51 | 0.11 |

| KOSPI | 0.65 | 2333.24 | 0.03 |

| ASX 200 | 139.8 | 5923.9 | 2.42 |

| FTSE 100 | 69.8 | 5899.26 | 1.2 |

| DAX | 48.58 | 12642.97 | 0.39 |

| CAC 40 | 29.42 | 4802.26 | 0.62 |

| Dow Jones | -525.05 | 26763.13 | -1.92 |

| S&P 500 | -78.65 | 3236.92 | -2.37 |

| NASDAQ Composite | -330.65 | 10632.99 | -3.02 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 07:30 | Switzerland | SNB Interest Rate Decision | -0.75% | ||

| 08:00 | Eurozone | ECB Economic Bulletin | |||

| 08:00 | Germany | IFO - Current Assessment | September | 87.9 | |

| 08:00 | Germany | IFO - Expectations | September | 97.5 | |

| 08:00 | Germany | IFO - Business Climate | September | 92.6 | |

| 10:00 | United Kingdom | CBI retail sales volume balance | September | -6 | -10 |

| 12:30 | U.S. | Continuing Jobless Claims | September | 12628 | 12339 |

| 12:30 | U.S. | Initial Jobless Claims | September | 860 | 843 |

| 13:00 | Belgium | Business Climate | September | -12 | -11 |

| 14:00 | U.S. | New Home Sales | August | 0.901 | 0.89 |

| 14:00 | United Kingdom | BOE Gov Bailey Speaks | |||

| 14:00 | U.S. | Fed Chair Powell Testimony | |||

| 17:00 | U.S. | FOMC Member Charles Evans Speaks | |||

| 18:00 | U.S. | FOMC Member Williams Speaks |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.7072 | -1.31 |

| EURJPY | 122.805 | -0.01 |

| EURUSD | 1.16574 | -0.41 |

| GBPJPY | 133.976 | 0.28 |

| GBPUSD | 1.27212 | -0.1 |

| NZDUSD | 0.65506 | -1.16 |

| USDCAD | 1.33767 | 0.57 |

| USDCHF | 0.92318 | 0.46 |

| USDJPY | 105.31 | 0.37 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.