- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 06:00 | United Kingdom | Retail Sales (MoM) | June | 12% | 8% |

| 06:00 | United Kingdom | Retail Sales (YoY) | June | -13.1% | -6.4% |

| 07:15 | France | Services PMI | July | 50.7 | 52.3 |

| 07:15 | France | Manufacturing PMI | July | 52.3 | 53.2 |

| 07:30 | Germany | Services PMI | July | 47.3 | 50.5 |

| 07:30 | Germany | Manufacturing PMI | July | 45.2 | 48 |

| 08:00 | Eurozone | Manufacturing PMI | July | 47.4 | 50 |

| 08:00 | Eurozone | Services PMI | July | 48.3 | 51 |

| 08:30 | United Kingdom | Purchasing Manager Index Manufacturing | July | 50.1 | 52 |

| 08:30 | United Kingdom | Purchasing Manager Index Services | July | 47.1 | 51.5 |

| 13:00 | Belgium | Business Climate | July | -22.9 | -14 |

| 13:45 | U.S. | Manufacturing PMI | July | 49.8 | 51.5 |

| 13:45 | U.S. | Services PMI | July | 47.9 | 51 |

| 14:00 | U.S. | New Home Sales | June | 0.676 | 0.7 |

| 17:00 | U.S. | Baker Hughes Oil Rig Count | July | 180 |

- Recovery is about transforming the economy to reflect new realities of post-COVID-19 world; government actions will therefore be key in smoothing the transition and promoting change

- Reallocation from “sunset” industries towards new sectors and technologies usually takes time

- Though NGEU is temporary, the potential to activate such tools in future crises is already powerful change to structure of EU

The Conference

Board announced on Thursday its Leading Economic Index (LEI) for the U.S. rose 2.0

percent m-o-m in June to 102.0 (2016 = 100), following a revised 3.2 percent

m-o-m advance in May (originally a 2.8 percent m-o-m gain).

Economists had

forecast an increase of 2.1 percent m-o-m.

“The June

increase in the LEI reflects improvements brought about by the incremental reopening

of the economy, with labor market conditions and stock prices in particular

contributing positively,” noted Ataman Ozyildirim, Senior Director of Economic

Research at The Conference Board. “However, broader financial conditions and

the consumers’ outlook on business conditions still point to a weak economic

outlook. Together with a resurgence of new COVID-19 cases across much of the

nation, the LEI suggests that the US economy will remain in recession territory

in the near term.”

The report also

revealed the Conference Board Coincident Economic Index (CEI) for the U.S. went

up 2.5 percent m-o-m in June to 96.7, following a 1.6 percent m-o-m increase in

May. Meanwhile, its Lagging Economic Index (LAG) for the U.S. declined 2.5

percent m-o-m in June to 110.8, following a 1.2 percent m-o-m drop in May.

The European

Commission (EC) said on Thursday its flash estimate showed the consumer

confidence indicator for the Eurozone fell by 0.3 points to -15.0 in July from

an unrevised -14.7 in the previous month.

Economists had expected the index to improve to -12.0.

Considering the

European Union (EU) as a whole, consumer sentiment was unchanged at -15.6.

Both indicators remained well below their long-term

averages of -11.1 (Eurozone) and -10.5 (EU).

James Knightley, Chief International Economist, notes that a pick-up in jobless claims underlines the economic pain from renewed Covid containment measures in many states.

"Today’s initial jobless claims data have shown another 1.416mn people lodging a new unemployment benefit claim the week of 18 July versus the consensus forecast of 1.3mn. We sensed the risks were skewed to the upside given the reintroduction of Covid containment measures in a number of states following a spike in cases. This has led to renewed shuttering of businesses in the hospitality industry with high frequency jobs data from Homebase (an employee scheduling software provider for small businesses) suggesting employment peaked in late June and has been drifting lower nationally ever since. This is the 18th consecutive week of a reading at or above 1.3mn, underlying the stressed situation in the labour market."

"Continuing claims dropped from 17.3mn to 16.2mn, which is a little more encouraging, but it comes with a week lag on the initial claims numbers and could certainly rise again. That said, for us, the key figure to watch is the number of people claiming benefits under ALL programs, which is up at 31.8mn as of the week of 4 July versus 32mn the week of 27 June (it comes with an additional week lag on continuing claims data). That is because an additional 14mn people receive benefits under the Pandemic Unemployment Assistance and PEUC programs that don’t qualify for state unemployment insurance benefits (only 17.2mn do) - people that left their last job voluntarily, students looking for a first job or people who didn’t work enough time or earn the minimum earnings to be eligible."

"Given the lags versus initial claims and the renewed containment measures and the data from Homebase we could certainly see the total number of benefits claims increase again in the next couple of weeks."

- Republicans still working on new formula for expanded unemployment benefits

- Looking at unemployment benefits that are 70% wage replacement

FXStreet notes that USD/CNY has been trading in a tight range around 7 in the past week and analysts at Westpac expect the pair to consolidate around this level with a downward bias as flows are supportive of CNY.

“US-China tensions continue to be a risk factor, but only when retaliation comes in the form of trade will there be a material impact on the broader economy.”

“We expect FX flows from the goods account to more than cover the outflows via trade in services deficits, with likely slower recovery in service trade than goods trade. We also expect continued bond inflow as a catch-up in index inclusion-induced flows.”

“USD/CNY faces resistance at 7.03/74, while the support sits at 6.97/92.”

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 158.99 | 0.28(0.18%) | 224 |

ALCOA INC. | AA | 13.09 | 0.02(0.15%) | 1434 |

ALTRIA GROUP INC. | MO | 41.5 | 0.16(0.39%) | 1702 |

Amazon.com Inc., NASDAQ | AMZN | 3,100.31 | 0.40(0.01%) | 54003 |

American Express Co | AXP | 97 | 0.46(0.48%) | 1126 |

AMERICAN INTERNATIONAL GROUP | AIG | 32.22 | 0.03(0.09%) | 325 |

Apple Inc. | AAPL | 388.5 | -0.59(-0.15%) | 212477 |

AT&T Inc | T | 30.38 | 0.22(0.73%) | 737354 |

Boeing Co | BA | 179.45 | -0.34(-0.19%) | 76707 |

Chevron Corp | CVX | 91.1 | 0.06(0.07%) | 13831 |

Cisco Systems Inc | CSCO | 46.91 | 0.01(0.02%) | 16143 |

Citigroup Inc., NYSE | C | 51.7 | 0.04(0.08%) | 38898 |

Exxon Mobil Corp | XOM | 43.65 | 0.04(0.09%) | 33776 |

Facebook, Inc. | FB | 239.95 | 0.08(0.03%) | 72582 |

FedEx Corporation, NYSE | FDX | 165.5 | 0.36(0.22%) | 6145 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.7 | 0.08(0.59%) | 58060 |

Ford Motor Co. | F | 6.88 | 0.04(0.58%) | 225517 |

General Motors Company, NYSE | GM | 26.4 | 0.10(0.38%) | 15335 |

Goldman Sachs | GS | 206.03 | 0.03(0.01%) | 19673 |

Google Inc. | GOOG | 1,572.86 | 4.37(0.28%) | 3512 |

Hewlett-Packard Co. | HPQ | 17.72 | -0.01(-0.06%) | 2246 |

Home Depot Inc | HD | 265.74 | 0.57(0.22%) | 14380 |

Intel Corp | INTC | 61.15 | 0.10(0.16%) | 53431 |

International Business Machines Co... | IBM | 128.8 | 0.13(0.10%) | 12700 |

Johnson & Johnson | JNJ | 149.5 | -0.51(-0.34%) | 7406 |

McDonald's Corp | MCD | 198.55 | -0.07(-0.04%) | 17336 |

Merck & Co Inc | MRK | 78.88 | 0.10(0.13%) | 1519 |

Microsoft Corp | MSFT | 208 | -3.75(-1.77%) | 966319 |

Nike | NKE | 98.5 | -0.41(-0.41%) | 8699 |

Pfizer Inc | PFE | 39.18 | 0.62(1.61%) | 949427 |

Procter & Gamble Co | PG | 125.72 | 0.37(0.30%) | 8580 |

Starbucks Corporation, NASDAQ | SBUX | 77.33 | 0.09(0.12%) | 8574 |

Tesla Motors, Inc., NASDAQ | TSLA | 1,655.00 | 62.67(3.94%) | 553601 |

The Coca-Cola Co | KO | 48.49 | 0.01(0.02%) | 22604 |

Travelers Companies Inc | TRV | 122.5 | 0.26(0.21%) | 737 |

Twitter, Inc., NYSE | TWTR | 38.81 | 1.87(5.06%) | 4008178 |

UnitedHealth Group Inc | UNH | 307 | 0.29(0.09%) | 12196 |

Verizon Communications Inc | VZ | 55.9 | 0.15(0.27%) | 5010 |

Visa | V | 198.51 | -0.35(-0.18%) | 8238 |

Wal-Mart Stores Inc | WMT | 133.2 | 0.54(0.41%) | 4900 |

Walt Disney Co | DIS | 118.9 | -0.13(-0.11%) | 21527 |

Yandex N.V., NASDAQ | YNDX | 56.07 | -0.46(-0.81%) | 7038 |

- White House does not want to extend the extra $600/week in unemployment benefits due to disincentive for people to return to work

- He would like unemployment to be capped at 70% of wages

- He thinks he will come to an agreement with Democrats

- Administration will put in more relief loans money in stimulus

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment was higher than expected last week as the U.S. continues to

grapple with the economic impacts of the coronavirus pandemic.

According to

the report, the initial claims for unemployment benefits totaled 1,416,000 for

the week ended July 18. That brought the number of job losses over the past

eighteen weeks (since the U.S. went into coronavirus lockdown in mid-March) to

nearly 52.7 million.

Economists had

expected 1,300,000 new claims last week.

Claims for the

prior week were revised upwardly to 1,307,000 from the initial estimate of 1,300,000.

Meanwhile, the

four-week moving average of claims fell to 1,360,250 from an upwardly revised

1,376,750 in the previous week.

Continuing

claims decreased to 16,197,000 million from a downwardly revised 17,304,000 in

the previous week.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 06:00 | Germany | Gfk Consumer Confidence Survey | August | -9.4 | -5 | -0.3 |

| 10:00 | United Kingdom | CBI industrial order books balance | July | -58 | -38 | -46 |

| 12:30 | U.S. | Continuing Jobless Claims | July | 17304 | 17067 | 16197 |

| 12:30 | U.S. | Initial Jobless Claims | July | 1307 | 1300 | 1416 |

GBP declined against its major rivals in the European session on Thursday, as market participants assessed the latest comments of the EU and UK chief negotiators, which reaffirmed that an agreement won't be reached in post-Brexit trade deal talks this month.

The UK's chief negotiator David Frost noted that "considerable gaps" remain in most difficult areas (the so-called level playing field and on fisheries), but an agreement can still be reached in September. Meanwhile, the EU's chief Brexit negotiator Michel Barnier said that the bloc is "still far away in negotiations" with the UK. "We have no visibility on the UK intention on its future domestic subsidy control system, time for answers is quickly running out," he stated. However, Barnier also stressed that neither the UK nor the EU has considered abandoning talks.

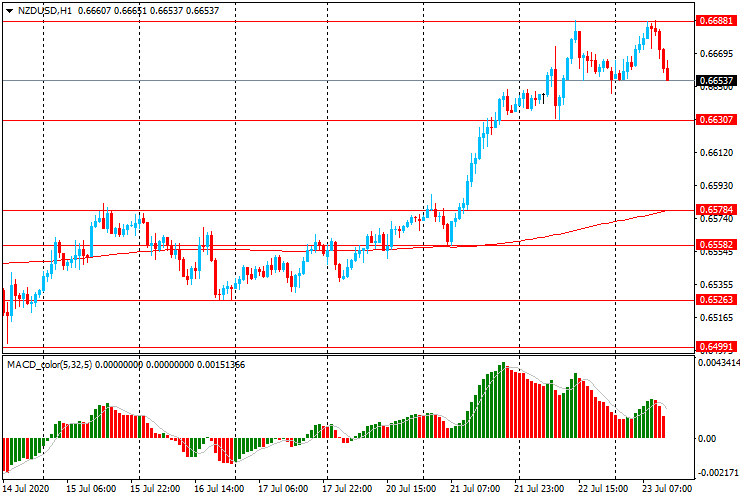

Today, the NZD/USD pair is trading in the range of $0.6655-90 - near the highs since the beginning of January. The pair failed to break through yesterday's high ($0.6690). NZD/USD rose above the moving average of MA (200) H1 ($0.6580), and on the four - hour chart-above MA (200) H4 ($0.6510).

⦁ Resistance levels are at: $0.6690-0.6710, $0.6755, $0.6785

⦁ Support levels are at: $0.6630, $0.6560-80, $0.6525

The publication of analysis is a marketing communication and does not constitute recommendation, investment advice or research by TeleTrade. Analysis is not prepared in accordance with legal requirements promoting independent investment research. It is intended solely for informational and educational purposes and shall not be understood as an offer or solicitation to buy or sell financial instruments. Indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

FXStreet reports that economists at Rabobank note that there has been an upward bias in EUR/GBP since the middle of February and, therefore, still see the pair trading at 0.92 on a three-month view. They recommend buying the cross on dips.

“The failure of the UK government to provide reassurances on the outlook for trade and the impact of the UK’s high covid-19 death toll on confidence provides a grim backdrop for the UK economy.”

“Given that the UK maintains a current account deficit, this could trigger additional downside pressure. We view the pound to be a very vulnerable currency.”

“Since the 2016 Brexit referendum EUR/GBP has spent relatively little time above the 0.90 level. That said, currently we would favour buying dips. We retain our three-month forecast of EUR/GBP 0.92.”

Freeport-McMoRan (FCX) reported Q2 FY 2020 earnings of $0.03 per share (versus -$0.04 per share in Q2 FY 2019), beating analysts’ consensus estimate of -$0.03 per share.

The company’s quarterly revenues amounted to $3.054 bln (-13.9% y/y), generally in line with analysts’ consensus estimate of $3.057 bln.

FCX rose to $13.70 (+0.59%) in pre-market trading.

AT&T (T) reported Q2 FY 2020 earnings of $0.83 per share (versus $0.89 per share in Q2 FY 2019), beating analysts’ consensus estimate of $0.80 per share.

The company’s quarterly revenues amounted to $40.950 bln (-8.9% y/y), generally in line with analysts’ consensus estimate of $40.868 bln.

T rose to $30.60 (+1.46%) in pre-market trading.

- Substantial areas of disagreement with EU remain

- Considerable gaps remain in most difficult areas, that is, the so-called level playing field and on fisheries

- We will continue to seek an agreement

- But must face possibility that one will not be reached

- My assessment is that an agreement can still be reached in September

- I am concerned about the economy "getting stuck" and only recovering slowly

- That may see an undershoot on inflation target

- Path of recovery crucially depends on fear of the virus

- Also depends on the fear - or realisation - of unemployment

- There was no progress on level playing field, fisheries

- The past few weeks, UK has not shown readiness to find solutions

- We are still far away in negotiations with UK

Twitter (TWTR) reported Q2 FY 2020 loss of $0.16 per share (versus earnings of $0.05 per share in Q2 FY 2019), worse than analysts’ consensus estimate of -$0.01 per share.

The company’s quarterly revenues amounted to $0.683 bln (-18.8% y/y), missing analysts’ consensus estimate of $0.708 bln.

Twitter’s average monetizable daily active users (mDAU) were 186 mln for Q2, compared to 139 mln in the same period of the previous year and compared to 166 mln in the previous quarter.

TWTR rose to $38.93 (+5.39%) in pre-market trading.

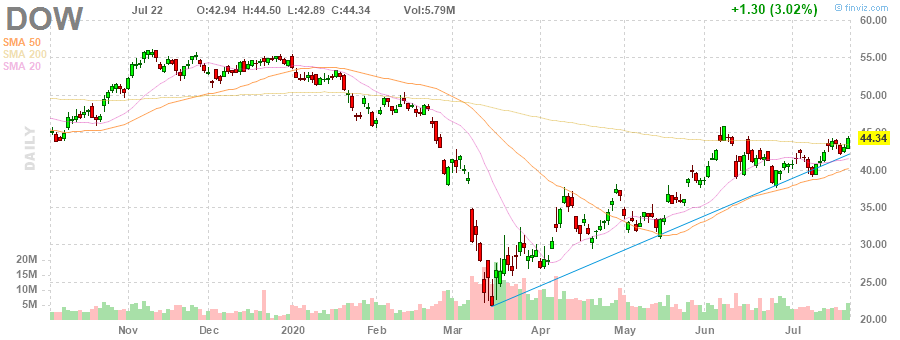

Dow (DOW) reported Q2 FY 2020 loss of $0.26 per share (versus earnings of $0.86 per share in Q2 FY 2019), slightly worse than analysts’ consensus estimate of -$0.25 per share.

The company’s quarterly revenues amounted to $8.354 bln (-24.2% y/y), beating analysts’ consensus estimate of $7.948 bln.

DOW rose to $45.04 (+1.58%) in pre-market trading.

FXStreet reports that the Credit Suisse analyst team notes that S&P 500 while above 3248 can keep the immediate risk higher with resistance still seen initially at 3288, and eventually at the top of the February gap at 3328/38.

“The S&P 500 stays a little sluggish near-term but with the market holding high-level support at 3248 as well as its break above key resistance from the 3233 June high, albeit on low volume, we continue to give the upside the benefit of the doubt still.”

“Resistance is seen next at 3279/81, ahead of 3318 and then the top of the February gap at 3328/38, which we look to prove a tougher barrier. Should strength directly extend, we think this can clear the way for a move back to the 3394 high.”

“Support at 3248 ideally holds to keep the immediate risk higher. A break can see a fall back to 3233/31, potentially 3215, with more important support seen at the price/gap and 13-day average support at 3207/3198. Only a close below here would be seen raising the prospect of a more concerted correction lower.”

Tesla (TSLA) reported Q2 FY 2020 earnings of $2.18 per share (versus -$1.12 per share in Q2 FY 2019), better than analysts’ consensus estimate of -$0.16 per share.

The company’s quarterly revenues amounted to $6.036 bln (-4.9% y/y), beating analysts’ consensus estimate of $5.310 bln.

TSLA rose to $1,679.78 (+5.49%) in pre-market trading.

The latest

survey by the Confederation of British Industry (CBI) revealed on Thursday the

UK manufacturers' order books improved slightly in July.

According to the report, the CBI's monthly factory order book balance increased to -46 in July from -58 in the previous month. This pointed to the smallest decline in factory orders since March. Economists had forecast the reading to come in at -38.

The CBI also

reported that output in the quarter to June fell at the steepest rate since 1975

(to -59 from -57 in June), but is expected to begin to recover in the next

three months (+15). Meanwhile, average domestic prices in the quarter to July

(-24) dropped at their fastest pace since January 2002, while average export

prices (-28) declined at their quickest since July 2000. However, firms expect

domestic prices to pick up slightly (+4) next quarter, while export prices are

anticipated to decrease at a slower pace (-10).

“Manufacturers

continue to face extreme hardship due to the COVID-19 crisis. Output volumes

continued to decline at a record pace, while total orders have fallen at their fastest

rate since October 1980”, noted Rain Newton-Smith, CBI Chief Economist. “There

are tentative signs of gradual recovery on the horizon, with firms expecting

output and orders to begin to pick up in the next three months. But demand

still remains deeply depressed.”

FXStreet reports that Credit Suisse note that USD/CAD maintains a bear ‘wedge’ continuation pattern as extends the downmove today, breaking below the price support and pivotal 78.6% retracement of the June correction higher at 1.3402/3398. Next support is seen at 1.3365/57, then more importantly at 1.3331/17.

“With daily MACD momentum also crossing lower, we stay biased lower and a close below the aforementioned 1.3402/3398 would see next support at the more important 2020 low and retracement support at 1.3331/17, where we would expect to see fresh buyers at first.”

“Big picture, the ‘measured wedge objective’ is seen much lower at 1.3206, just shy of a more important support area at 1.3202/3191.”

”Resistance is seen initially at 1.3427, then 1.3486/91, ahead of the 200-day average at 1.3515, which ideally now caps. Above here could see a move back to 1.3539.”

Microsoft (MSFT) reported Q4 FY 2020 earnings of $1.46 per share (versus $1.37 per share in Q4 FY 2019), beating analysts’ consensus estimate of $1.38 per share.

The company’s quarterly revenues amounted to $38.033bln (+12.8% y/y), beating analysts’ consensus estimate of $36.547 bln.

MSFT fell to $208.02 (-1.76%) in pre-market trading.

FXStreet reports that according to FX Strategists at UOB Group, NZD/USD is now targeting the 0.6700 region in the near-term.

24-hour view: “While our view for NZD to strengthen yesterday was correct, our expectation that ‘0.6670 could be out of reach’ was not quite right as NZD popped to a high of 0.6689 before easing off. The combination of overbought conditions and sign of slowing momentum suggests NZD is likely to consolidate and trade sideways. Expected range for today, 0.6630/0.6690.”

Next 1-3 weeks: “After trading between 0.6500 and 0.6600 since early this month, NZD took off suddenly and soared to a high of 0.6650. The break-out of the consolidation range has room to run further and the level to focus on is at 0.6700. Overall, compared to other major currency pairs, the momentum in NZD against USD is not as strong but is expected to improve unless NZD moves below 0.6565.”

Reuters reports that an agreement by European Union leaders to assign new revenue streams to finance the recovery package is a huge, historic step for the 27-nation bloc, the head of the European Commission Ursula von der Leyen told the European Parliament on Thursday.

EU leaders agreed on Tuesday after a four-day summit to impose a tax on non-recycled plastic and pass the money on to the EU and to have a tax on digital services and on goods important into the EU from countries with lower CO2 emission standards, among others.

"The big winner of this summit are the new own resources" von der Leyen said in presenting the summit agreement to parliamentarians, who will have to approve it over the coming months.

"We have now a unanimous agreement on the need for new own resources. And this is a huge and historic step forward for our union, which both the Commission and the parliament have long been pushing for," she said.

Von der Leyen also stressed that the disbursement of cash from the 750 billion euro recovery package to EU countries was linked to governments observing the rule of law.

The link, albeit not clearly formulated in the conclusions of the summit, is a means of pressure on Poland and Hungary to heed EU calls for them not to undermine the independence of the courts, non-governmental organisations and media.

Bloomberg reports that China’s economy will grow 2.5% this year according to UBS Group AG, which raised its forecast from 1.5% due to the recovery in domestic consumption and strong investment.

The economy will expand 5.5% this quarter from a year earlier, and 6% in the final three months of 2020, the bank said in a new report from Chief China Economist Wang Tao and others. The biggest downside risk to that rebound would be a resurgence of the coronavirus outbreak at home and abroad, they wrote.

U.S.-China tensions, coupled with the prospects for supply chain decoupling and weak company profits, are likely to drag on corporate sentiment and trade, UBS cautioned, but overall, macro-policy will remain supportive in the second half.

The surprising strength of Chinese exports in the second quarter prompted the economists to increase their estimate for trade in the rest of the year, and they also revised up the inflation forecast to 2.5% for 2020 from 2.4% earlier, due to recent floods in the south and a stronger recovery. The property sector is expected to show more resilience, thanks to the economic recovery and effects of easier credit, according to the report.

Oxford Economics also upgraded its full-year GDP forecast to 2.5% from 2% this week on a strong rebound in the second quarter, while flagging risks ahead including policy makers’ worries about frothy equity markets, renewed export restrictions due to virus cases and escalating China U.S. trade tensions. Data from the second quarter may also have overestimated the strength of the rebound, they said.

Reuters reports that the French economy is on course to rebound by 8% next year and should return to pre-crisis levels by 2022, French Finance Minister Bruno Le Maire said on Thursday.

Le Maire told the National Assembly recent economic data had been "satisfying but too fragile" for now to change forecasts for an economic contraction this year of 11%, the worst since modern records began.

"I won't resign myself to a -11% recession. If we step up the measures that we have already decided and make sure they are implemented well, we can do better than -11% in 2020," Le Maire said to open a debate on the public finances.

The government has committed more than 460 billion euros ($533 billion) in public funds to supporting the economy. Most will come in the form of state-guaranteed loans and tax breaks to help companies cope with a slump in business.

Le Maire is drafting a recovery plan worth more than 100 billion euros to be presented on Aug. 24, aimed at bringing the euro zone's second-biggest economy back to pre-crisis levels.

Le Maire said that while he forecast a rebound in growth of 8% next year, the outlook was particularly difficult to project and depended in part on the depth of the recession this year.

"My objective is that we are able from 2022 to return to a level of growth and national wealth comparable to that before the crisis," Le Maire told lawmakers.

FXStreet reports that Bart Melek, head of commodity strategy at TD Securities, analyzes the last inventory data and concludes that with the moderating demand the WTI crude should drift lower. Nonetheless, he expects the black gold to trade near $44 in the end.

“Crude inventories are up a much larger-than-expected 4.89 million bbls (consensus was calling for a draw of 2.2 million). Imports jumped 374k b/d, with exports growing 450k b/d and production was up a modest 100k b/d. Implied demand for crude fell a disappointing 1.3 million bpd.”

“With OPEC+ committing to increase supply to match growing demand, demand slumping likely to the spread of COVID in part of the US and higher inventories, WTI crude could well drift lower from the current $41.47/bbl.”

“With US production not showing additional reductions yet and the rate of demand growth likely improving in the US in the coming weeks, now that authorities have started to seriously encourage measures such as the use of masks to limit COVID spread, prices should move back to the top of the trading range. I expect WTI to trade in a range between $38-42/bbl, in the near-term and then move closer to $44/bbl.”

According to the report from INSEE, in July 2020, the business climate has continued its recovery started in May. The indicator that synthesizes it, calculated from the responses of business managers from the main market sectors, has gained 7 points. At 85, the business climate is however still significantly below its long-term average (100), and a fortiori below its relatively high pre-lockdown level (105).

This clear rise in the overall synthetic indicator is explained both by the pursuit of the improvement in the balances of opinion on business outlook in most of the sectors and by the beginning of the recovery in the balances of opinion on the activity of the last three months.

In July 2020, the employment climate has continued to recover sharply from the April low. At 77, it has gained 10 points compared to June, but it still remains far below its pre-lockdown level.

The sectoral business climate for June 2020 in industry and in services, as well as the employment climate, have been revised upwards by one point. Those revisions are mainly explained by the inclusion of late responses from companies.

FXStreet reports that FX Strategists at UOB Group believe the rebound in USD/CNH is seen facing a tough hurdle in the 7.040 region.

24-hour view: “Yesterday, we highlighted that USD ‘could dip below 6.9650 but the major support at 6.9500 is unlikely to come into the picture’. USD subsequently dipped to 6.9645 before rocketing (on the back of news) and closed higher by +0.63% (7.0167). While the rapid rise appears to be running ahead of itself, there is likely enough momentum to carry USD higher to 7.0250, possibly as high as 7.0300. On the downside, 6.9900 is expected to be strong enough to hold for today (minor support is at 7.0000).”

Next 1-3 weeks: “We have expected USD to weaken since early this and in our latest update yesterday (22 Jul, spot at 6.9720), we indicated that ‘the odds for a move to 6.9500 have increased’. USD subsequently eked out a fresh low of 6.9645 before staging a dramatic reversal that sent it to a high of 7.0174. The break of our ‘strong resistance’ level at 6.9920 indicates that USD is no more under pressure. The current USD strength is viewed as part of a corrective rebound but at this stage, any advance is expected to face solid resistance at 7.0400. On the downside, the ‘strong support’ level is at 6.9750.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 06:00 | Germany | Gfk Consumer Confidence Survey | August | -9.4 | -5 | -0.3 |

During today's Asian trading, the dollar fell against the euro and pound, and stabilized against the yen. The market remains concerned about the growing number of coronavirus infections in the world and the aggravation of tensions between the United States and China. At the same time, hopes remain for a COVID-19 vaccine and a new incentive package in the US.

US President Donald Trump has said that he may not be limited to closing the Chinese Consulate in Houston. "Can we close more Chinese diplomatic missions? Of course, this is quite possible, " he said at a White House briefing.

The Chinese Embassy in the United States called the decision of the American authorities to close the Chinese Consulate General in Houston a political provocation and violation of international laws.

Meanwhile, Republicans in the US Senate are ready to present their proposal for a fifth package of financial assistance in connection with the coronavirus pandemic, having settled differences with the White house. A group of senior Republican senators on Wednesday concluded a meeting with US Treasury Secretary Steven Mnuchin and White House chief of staff Mark Meadows, with participants saying that the parties have settled unresolved issues.

The ICE Dollar index, which shows the value of the dollar against six major world currencies, fell by 0.18% compared to the previous day.

CNBC reports that economist Stephen Roach warns V-shaped recovery mania on Wall Street is leading investors astray.

According to Roach, the U.S. is on a collision course with a second dramatic downturn.

“The odds of a relapse, not just the virus but in the economy itself — the so-called dreaded double-dip, is very real,” the former Morgan Stanley Asia chairman told CNBC.

He notes recessions are historically double-dip. Roach anticipates this contraction will follow the same pattern despite its unusual origin.

“This behavioral capitulation on the demand side of the U.S. economy is going to continue to create a lot of problems for businesses, business hirings, [and] potential corporate bankruptcies in the second half of this year,” he said.

Roach, who’s one of the world’s leading experts on Asia, predicted in January the coronavirus outbreak would eclipse the SARS impact in 2003 and could shock the global economy, including here at home.

Using China as a model, Roach believes U.S. consumer demand will face a difficult recovery despite reopenings.

“Both economies were able to bring production back quickly, but they’re struggling to bring consumer demand back especially for face to face services where individuals are fearful of getting re-infected,” he said.

He calls a new U.S. virus aid package “essential” in this climate. However, he contends the long-term consequences will be detrimental.

“Our savings and current account dynamic is starting to look terrible,” noted Roach, who believes the budget deficit will explode before our very eyes.

Besides listing inflation as a serious consequence, Roach is still sounding the alarm on a dollar crash.Last month, he warned it will fall 35% over this year and 2021. The greenback is down more than 5% over the past three months. “The dollar is in the early stages of what’s going to be a protracted downturn,” Roach said.

Reuters reports that the Italian government approved 25 billion euros ($28.93 billion) of extra spending late on Wednesday, the third major cash injection to try to support its battered economy since the start of the country's coronavirus outbreak.

The new stimulus will involve additional borrowing and drive the 2020 budget deficit to 11.9% of national output, versus a goal of 10.4% set in April and a figure of 1.6% reported in 2019, the lowest in 12 years.

Rome sees its public debt rising to 157.6% of GDP this year.

"It is essential to continue to support the productive system and the income of citizens," the prime minister's office said in a statement after the cabinet approved the move at a meeting that ended around midnight.

The package will help tide over Italy while it awaits more than 200 billion euros in grants and cheap loans from the European Union's Recovery Fund, which EU leaders approved this week.

The government has said it will present the measures in an emergency decree early in August, following a parliamentary vote on July 29 to authorise the deficit hike.

Part of the extra spending would be used to allow people to pay taxes in installments, rather than a single payment now due in September, Economy Minister Roberto Gualtieri told parliament earlier on Wednesday.

The extra funds will conditionally extend financing for temporary layoff schemes for a further 18 weeks, a government source said. Companies hit hardest in the first half of 2020 will be entitled to extend the scheme so as long as they do not cut back their workforce.

According to the report from market research group GfK, German consumers are gradually putting the coronavirus shock of earlier this year behind them. While economic expectations have once again gained slightly, income expectations and the propensity to buy have seen a significant increase for the third consecutive time. As a result, GfK has forecast a figure of -0.3 points for August 2020, 9 points higher than its level in July of this year (revised to -9.4 points).

A V-shaped trend is currently emerging for the consumer climate in Germany: A sharp decline in consumer sentiment immediately followed by a rapid recovery. The consumer climate has risen significantly for the third consecutive period, gaining almost 23 points since its low this past spring.

"There is no doubt that the reduction in value-added tax has contributed to the extremely positive progress. It is clear that consumers are looking to make major purchases earlier than planned, which will help boost spending this year, " explains Rolf Bürkl, GfK Consumer Expert. "Whether this will have a lasting impact is, however, debatable. Retailers and manufacturers must be prepared for the fact that the propensity to consume could decline once more when the standard VAT rate comes into effect in January 2021."

Propensity to buy gaining 23.1 points in July to reach 42.5 – just four points lower than at the same time last year. Income expectations rose for the third consecutive period in July. The indicator gained twelve points and now stands at 18.6. However, this is still around 32 points lower when compared to the same period last year. The economic outlook of German consumers also improved in July. However, the indicator gained just 2.1 points, a far more modest increase than those seen for income expectations and propensity to buy. The indicator currently stands at 10.6 points. The last time a higher value was recorded was in December 2018 at 10.8 points.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1662 (1336)

$1.1637 (1273)

$1.1618 (986)

Price at time of writing this review: $1.1584

Support levels (open interest**, contracts):

$1.1521 (128)

$1.1496 (36)

$1.1465 (136)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 7 is 51293 contracts (according to data from July, 22) with the maximum number of contracts with strike price $1,1400 (4036);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2859 (1951)

$1.2808 (1906)

$1.2775 (1418)

Price at time of writing this review: $1.2747

Support levels (open interest**, contracts):

$1.2721 (141)

$1.2682 (67)

$1.2602 (196)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 19958 contracts, with the maximum number of contracts with strike price $1,3000 (2736);

- Overall open interest on the PUT options with the expiration date August, 7 is 19834 contracts, with the maximum number of contracts with strike price $1,2400 (1519);

- The ratio of PUT/CALL was 0.99 versus 0.99 from the previous trading day according to data from July, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 44.19 | 0.78 |

| Silver | 23.01 | 8.28 |

| Gold | 1871.132 | 1.63 |

| Palladium | 2150.04 | 0.43 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -132.61 | 22751.61 | -0.58 |

| Hang Seng | -577.72 | 25057.94 | -2.25 |

| KOSPI | -0.17 | 2228.66 | -0.01 |

| ASX 200 | -81.2 | 6075.1 | -1.32 |

| FTSE 100 | -62.63 | 6207.1 | -1 |

| DAX | -67.58 | 13104.25 | -0.51 |

| CAC 40 | -67.16 | 5037.12 | -1.32 |

| Dow Jones | 165.44 | 27005.84 | 0.62 |

| S&P 500 | 18.72 | 3276.02 | 0.57 |

| NASDAQ Composite | 25.77 | 10706.13 | 0.24 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 06:00 | Germany | Gfk Consumer Confidence Survey | August | -9.6 | -5 |

| 10:00 | United Kingdom | CBI industrial order books balance | July | -58 | -38 |

| 12:30 | U.S. | Continuing Jobless Claims | July | 17338 | 17067 |

| 12:30 | U.S. | Initial Jobless Claims | July | 1300 | 1300 |

| 14:00 | Eurozone | Consumer Confidence | July | -14.7 | -12 |

| 14:00 | U.S. | Leading Indicators | June | 2.8% | 2.1% |

| 22:45 | New Zealand | Trade Balance, mln | June | 1253 | |

| 23:01 | United Kingdom | Gfk Consumer Confidence | July | -30 | -26 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71358 | 0.07 |

| EURJPY | 123.965 | 0.67 |

| EURUSD | 1.15696 | 0.33 |

| GBPJPY | 136.323 | 0.38 |

| GBPUSD | 1.27258 | 0.05 |

| NZDUSD | 0.66545 | 0.23 |

| USDCAD | 1.34134 | -0.31 |

| USDCHF | 0.929 | -0.36 |

| USDJPY | 107.123 | 0.33 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.