- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- Gold price loses ground near $1,990 on the firmer US Dollar, higher Treasury yields.

- University of Michigan Consumer Sentiment Index rose to 61.3 in November versus the 60.4 initial reading.

- The FOMC Minutes showed all participants agreed that policy decisions would continue to be based on the totality of incoming information.

- Gold traders will monitor the US S&P Global PMI on Friday.

Gold price (XAU/USD) loses its recovering momentum after retreating from $2,006 during the early Asian session on Thursday. Yellow metal attracted some sellers after the upbeat US consumer sentiment report saw the US Treasury yield and the US Dollar recovering. Markets remain subdued ahead of the Thanksgiving Day holiday in the United States on Thursday. Gold price currently trades around $1,990, up 0.02% on the day.

Meanwhile, the US Dollar Index (DXY), an index of the value of the USD measured against a basket of six world currencies, hovers around 103.88. The US Treasury yields edge higher, with the 10-year yields climbing 4.40%. This, in turn, weighs on the yellow metal as US yields are the opportunity cost of holding non-yielding metals.

The US University of Michigan Consumer Sentiment Index rose to 61.3 in November from an initial reading of 60.4, its fourth consecutive monthly fall. Furthermore, the UoM 1-year inflation expectations rose to 4.5% from the preliminary 4.4%. The 5–10y inflation expectations were steady at 3.2%.

Durable Goods Orders dropped 5.4% MoM in October versus a 4.6% rise prior. In the labor market, the Jobless Claims for the week ending November 17 unexpectedly fell to 209,000, the biggest fall since June while Continuing Claims declined to 1.84M versus 1.862M prior.

On Tuesday, the November Federal Open Market Committee (FOMC) Meeting Minutes showed all participants agreed to proceed carefully and policy decisions at every meeting would continue to be based on the totality of incoming information and economic outlook as well as the balance of risks.

Gold traders will take more cues from the US S&P Global PMI data on Friday for fresh impetus. The Manufacturing PMI is expected to rise to 49.8 while Services PMI is estimated to grow to 50.4. These figures could give a clear direction to the gold price.

- AUD/USD loses traction around 0.6538, up 0.04% on the day.

- Australian Judo Bank Manufacturing PMI for November came in at 47.7 vs. 48.2 prior; Services PMI eased to 46.3 vs. 47.9 prior.

- The University of Michigan Consumer Sentiment Index came in at 61.3 from an initial reading of 60.4.

The AUD/USD pair faces a rejection of 0.6600 and trades around 0.6538 during the early Asian session on Thursday. The downtick of to pair is backed by renewed US Dollar (USD) demand after the US economic reports. Markets remain subdued ahead of the Thanksgiving Day holiday in the United States on Thursday, and trading sessions on Friday will be shortened.

The latest data on Thursday suggested more evidence about the economic slowdown in Australian economic activity in November. The preliminary Australian Judo Bank Manufacturing PMI for November came in at 47.7 compared to the previous month’s 48.2, its worst reading in 42 months. Meanwhile, Judo Bank Services PMI eased to 46.3 versus 47.9 prior, and the Composite PMI hit a 27-month low of 46.4 in November from the previous reading of 47.6. The softer data weighs on the Australian Dollar (AUD) and acts as a headwind for the AUD/USD pair.

On the other hand, the US University of Michigan Consumer Sentiment Index experienced its fourth consecutive monthly decline in November, arriving at 61.3 from an initial reading of 60.4. Additionally, Durable Goods Orders fell 5.4% MoM in October from a 4.6% rise in the previous month. About the labor market data, the weekly Jobless Claims unexpectedly fell to 209K, the biggest fall since June, and declined to 1.84M versus 1.862M prior.

Market volumes were light ahead of the Thanksgiving holiday in the US. Equities extended their rally as the market believe that the Federal Reserve's (Fed) tightening cycle is complete.

Looking ahead, market participants will keep an on the preliminary US S&P Global PMI for November, due on Friday. The Manufacturing PMI and Services PMI readings are expected to rise 49.8 and 50.4, respectively. Traders will take cues from the figures and find trading opportunities around the AUD/USD pair.

- EUR/USD is bullish despite falling to a three-day low.

- The daily chart portrays the formation of a bullish hammer, which could pave the way to challenge 1.1000.

- A bearish resumption would happen if EUR/USD stays below 1.0900.

The Euro (EUR) dropped to a three-day low against the US Dollar (USD), though it remains bullish according to the daily chart, as Wednesday’s price action formed a ‘hammer’ preceded by a downtrend. Although it warrants further upside is expected, the break of crucial resistance levels must be achieved to extend the rally. The EUR/USD trades at 1.0884, down 0.03%.

To cement the uptrend, EUR/USD buyers need to reclaim the 1.0900 figure. Once done, the next resistance level would be the November 21 swing high at 1.0965, followed by the 1.1000 figure. A breach of the latter would expose the August 10 high at 1.1065.

Conversely, if EUR/USD stays below 1.0900 and extends its losses past the November 22 low of 1.0852, that could exacerbate the pair’s drop to challenge the 200-day moving average (DMA) at 1.0808. If buyers surrender the latter, the major would fall toward the 1.0700 mark.

EUR/USD Price Analysis – Daily Chart

EUR/USD Technical Levels

- Australia's PMI indexes broadly print below previous, highlighting Australia's "soft landing" scenario.

- Composite, Business Activity, and Manufacturing PMIs all hit multi-year lows in November.

Australia's Judo Bank Flash Purchasing Managers' Index (PMI) for November showed declines across the board, with the Composite PMI hitting a 27-month low of 46.4 compared to October's 47.6.

Australia's Services PMI Business Activity also declined to 46.3 versus October's 47.9, a 26-month low for the indicator. On the positive side, the Manufacturing PMI Output Index hit a 2-month high of 47.2 compared to the previous month's 45.8, while Australia's Manufacturing PMI is approaching a four-year low after printing at 47.7 versus October's 48.2, its worst reading in 42 months.

According to Warren Hogan, Chief Economic Advisor at Judo Bank: “The Judo Bank Flash PMI provides further evidence that the slowdown in Australian economic activity extended into November. The flash composite output index fell to 46.4 in November from a final reading of 47.6 in October. This is the lowest reading for the composite output index in the 8-year survey history, outside of pandemic lockdowns."

“The November result follows a decline in October and all but confirms that the economy is experiencing a soft landing, consistent with the RBA’s narrow path. It is important to note that we are still seeing no real signs of a hard landing in the survey," added Hogan.

Market Reaction

The Aussie (AUD) is seeing thin trading early in the Thursday market session, trading closely to 0.6540 against the US Dollar (USD) despite the soft reading, and the AUD/USD remains down about 0.25% from Wednesday's opening bids of 0.6557.

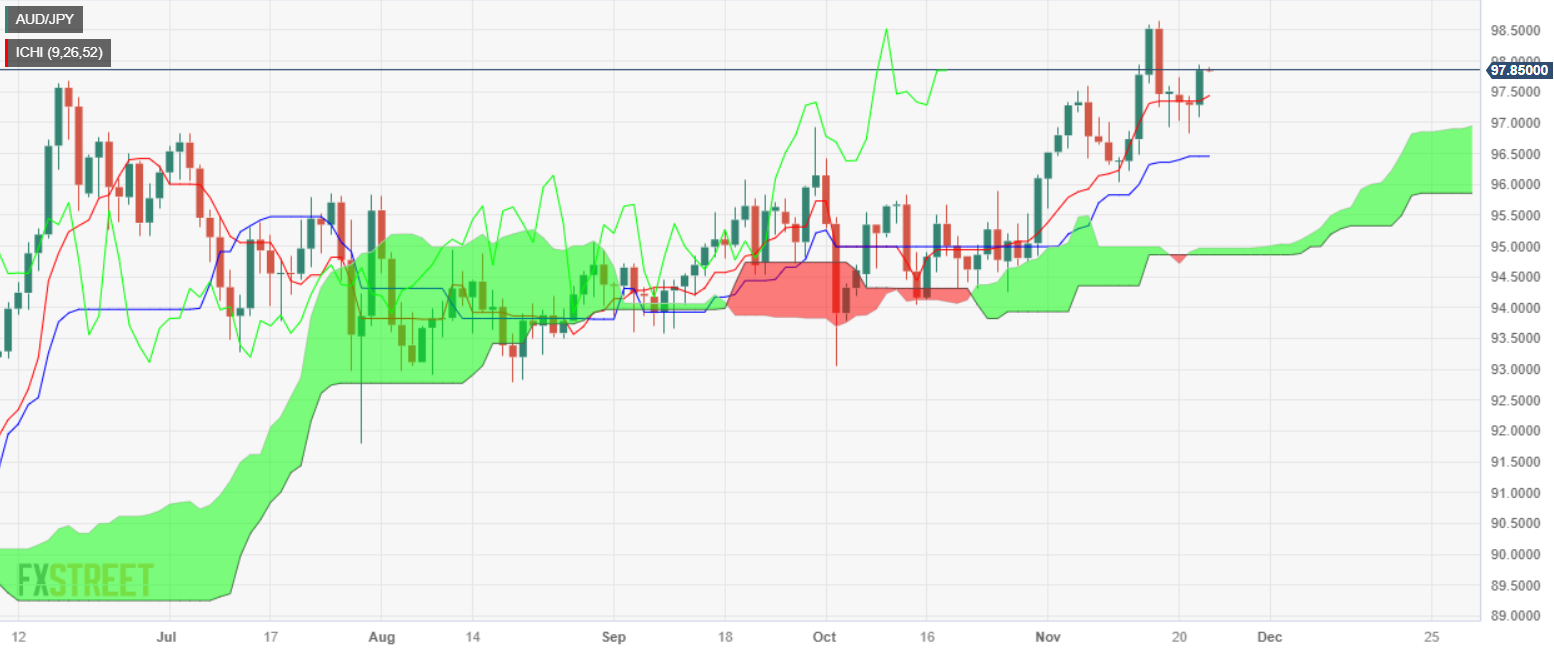

- AUD/JPY remains bullish in the near term after bulls reclaimed the Kijun-Sen, eyeing 98.00.

- If the cross drops below 97.50, the AUD/JPY could challenge 97.00, ahead of dropping below 96.50.

The AUD/JPY rallied more than 0.50% late in the North American session on Wednesday, ahead of the Thanksgiving holiday, which would drain liquidity in the financial markets on Thursday. Therefore, the currency pair is expected to remain within a narrow trading range, exchanging hands at 97.87.

The AUD/JPY daily chart portrays the pair as neutral to upward biased after breaking the Tenkan-Sen at 97.31. The formation of a ‘morning star’ opened the door to test the June 2023 high of 97.67, ahead of challenging the 98.00 figure. A breach of 98.00 and the pair could climb to 99.00.

On the other hand, if the pair slips below the November 21 high of 97.42, AUD/JPY sellers could drag the price towards the 97.00 figure. Once that level is cleared, the next stop would be the Senkou Span A at 96.90 before dropping toward the Kijun-Sen at 96.42.

AUD/JPY Price Analysis – Daily Chart

AUD/JPY Technical Levels

- The GBP/JPY is trading into the high side near the 187.00 handle.

- The Pound Sterling saw light gains on Wednesday, setting a new weekly high.

- Japanese markets to be dark on Thursday in observation of Labor Thanksgiving Day.

The GBP/JPY is trading into the high side near 187.00 heading into Thursday's market session, bolstered by a Japanese Yen (JPY) that is seeing some paring back after several days of gains.

The Pound Sterling (GBP) has recovered some ground against the Yen for this week, setting a new peak just beyond 187.00, but the pair is now cycling just below 187.00.

Thursday markets are set to see unsteady volatility and an overall decline in directional momentum with Japanese markets shuttered for the Labor Thanksgiving holiday, but Yen traders will be returning to the fold on Friday.

The UK sees S&P Global/CIPS Purchasing Manager's Index (PMI) figures for November on Thursday, and investors are hoping for the Composite figure to hold steady at 48.7.

The UK Manufacturing PMI Component is expected to tick upwards slightly from 44.8 to a flat 45.0, while the Services Component is seen holding at October's reading of 49.5.

Japanese National Inflation figures will be landing early Friday, but the release is unlikely to move markets in a meaningful way unless the numbers deviate wildly. Japan's National Consumer Price Index (CPI) inflation reading is usually front-run by the Tokyo CPI release a couple of weeks earlier.

Friday also sees the UK GfK Consumer Confidence survey for November, which is expected to improve, albeit slightly, from -30 to -28 as consumers remain negative about the UK's domestic economy.

GBP/JPY Technical Outlook

The GBP/JPY is trading closely with the 187.00 handle, looking for a topside break after early Wednesday's bull run failed to hold chart territory north of the major figure.

The pair is finding intraday support from the 200-hour Simple Moving Average (SMA), and the key for bidders will be to stop the Guppy from reversing course back into the near-term median prices near the 50-hour SMA at 185.80.

Daily candlesticks have the pair trading on the high side of the 50-day SMA, but it's getting difficult to ignore the Guppy's overbought stance, and the Moving Average Convergence-Divergence (MACD) has been printing a bearish divergence.

GBP/JPY Hourly Chart

GBP/JPY Daily Chart

- The EUR/JPY is currently rallying upwards, standing at 162.90.

- Daily chart indicators show bullish momentum.

- After the break from the bears after a four-day slump, an underlying bullish control is evident.

In Wednesday's session, the EUR/JPY rose to 162.90, up by 0.70%. The pair's current situation on the daily chart leans neutral to bearish, with sellers taking a breather following a four-day losing streak. Nonetheless, stronger bullish momentum is being observed on the four-hour chart.

Buying momentum seems to be the dominating force when considering the daily chart indicators. The pair is positively positioned, showing an upward movement above its 20,100,200-day Simple Moving Averages (SMAs). Additionally, the Relative Strength Index (RSI) trajectory remains positive, highlighting further support for continuing a buying trend. Flat green bars on the Moving Average Convergence Divergence (MACD) complement this, reflecting a largely static yet bullish positioning.

Zooming into the shorter time frame, the four-hour chart extends this bullish narrative. The positive slope and territory of the four-hour RSI indeed affirm that buying momentum dominates. Similarly, the MACD’s flat green bars remain consistent, indicating sustained buying pressure.

It's significant to note that the bears appear to be on a temporary standby, with their selling momentum showing signs of losing steam after a four-day losing streak. This could be indicative of a short-term bullish outlook, thereby reinforcing that the bulls hold the upperhand.

Support Levels: 162.50, 161.30 (20-day SMA), 160.00.

Resistance Levels: 163.00, 163.50, 164.00.

EUR/JPY daily chart

- the USD/CHF is grinding it out in the middle on Wednesday, sticking to 0.8840 region.

- The US Dollar rippled as market sentiment twists on economic headlines.

- US markets heading into a Thanksgiving holiday on Thursday before Friday's PMI reports.

The USD/CHF tested territory on both the low and high sides before settling into the midrange near 0.8840 on Wednesday, with markets testing the boundaries of risk sentiment after mixed US data chewed into risk appetite.

The US Dollar (USD) dipped into the week's familiar low point near 0.8820 as the Swiss Franc (CHF) continues to see ongoing strength on the back of Swiss National Bank (SNB) Franc repatriation. The pair also set a new high for the trading week just shy of 0.8880, but a recovery in market sentiment is sending the USD/CHF right back into the day's opening bids.

The SNB's historic build-up of foreign currency reserves peaked back in 2022 at a massive CHF 950 billion, and the Swiss central bank has been steadily selling off their foreign currency holdings, with the SNB's balance sheet of non-domestic currency reaching a seven-year low of CHF 657 billion as of October.

Despite Switzerland's desire for a softer Franc to help boost domestic production and exporters, the SNB's portfolio drawdown has seen the CHF appreciate notably against the USD, gaining nearly 13% from last November's USD/CHF peak of 1.0144.

Market risk appetite gets hung up on mixed US figures

US Initial Jobless Claims came in much better than expected, dipping to a five-week low at 209K against the market forecast of 225K for the week ending November 17th.

US Treasuries saw a brief spike in yields with the 10-year T-note yield tapping 4.445% before easing back on recovering investor risk appetite.

Investors were briefly driven back after the University of Michigan's (UoM) 5-year Consumer Inflation Expectations showed US consumers remain afraid of elevated inflation. the UoM inflation outlook sees inflation remaining at 3.2% on a 5-year time horizon, which will do little to encourage the Federal Reserve (Fed) into cutting interest rates sooner rather than later.

US markets are set to go dark on Thursday in observation of the Thanksgiving holiday, giving traders a breather before Friday's US Purchasing Managers' Index (PMI) figures.

The US S&P Global Composite PMI for November last came in at 50.7, and both the Services and Manufacturing components are expected to decline slightly. The Services component is expected to slip from 50.0 to a contractionary 49.8, with Manufacturing expected to tick down from 50.6 to 50.4.

USD/CHF Technical Outlook

Wednesday's tit-for-tat chart action sees the USD/CHF treading water near multi-month lows, testing bids last seen back in August.

The pair has so far been unable to make a successful bullish bid into the high side of the 200-day Simple Moving Average (SMA), near the 0.9000 handle.

The near-term technical floor will be at late August's last swing into 0.8750, while Greenback bidders will be looking to get the USD/CHF pushed back above major moving averages before the 50-day SMA can rotate into a bearish cross of the 200-day SMA.

USD/CHF Daily Chart

The preliminary November PMIs are due on Thursday, starting with Australia and then moving to Europe. US markets will be closed due to Thanksgiving Day. The European Central Bank will release the minutes of its latest meeting.

Here is what you need to know on Thursday, November 23:

Data from the US released on Wednesday came in mixed, with Jobless Claims falling more than expected. Initial Claims decline to 209,000 from 233,000, and Continuing Claims pulled back after seeing increases for eight consecutive weeks, declining to 1.84 million. Durable Goods Orders fell 5.4% in October, exceeding the expected 3.1% decline. On the positive side, the University of Michigan Consumer Sentiment Index stood at 61.3 in November, revised up from the preliminary reading of 60.3.

The US Dollar rose after the economic reports, extending its correction and lost momentum, affected by higher equity prices. The US Dollar Index (DXY) rose 0.30%; it reached a peak at 104.20 but closed around 103.90. The US market will remain closed on Thursday (Thanksgiving Day), and Friday will have a shortened trading session.

EUR/USD continues to move with a bearish bias in the short term, with a trendline awaiting at 1.0900 and the next strong support at 1.0830. The preliminary November Eurozone PMIs are due on Thursday, and the European Central Bank (ECB) will release the minutes of its latest meeting. The economic figures will be closely monitored.

GBP/USD bottomed near 1.2450 and then rebounded toward 1.2500 after the US Dollar's momentum faded. There was a modest reaction in the Pound to UK government's presentation of the Autumn Statement, that included a cut in national insurance by 2 percentage points.

USD/JPY rose sharply as the 10-year Treasury yield rebounded from monthly lows, rising from 4.35% to 4.42%. The pair climbed to 149.75, marking a 260-pip rise from Tuesday's lows.

NZD/USD retreated further after approaching the 200-day Simple Moving Average (SMA) but settled above 0.6000. The overall bias remains to the upside.

USD/CAD continues to move sideways, with the risk starting to favor the downside as price faced resistance at the 20-day SMA and fell under 1.3700. A break below 1.3660 would open the doors to further losses.

AUD/USD also lost ground but found support around the 0.6520 area, a relevant technical zone. The upside remains capped by the 200-day SMA, slightly below 0.6600. The Judo Bank PMI is due on Friday.

Gold failed to hold above $2,000 and dropped to $1,986. The main trend is up, but prices need to break $2,010 to open the doors to more gains.

Crude oil prices dropped just 1% in a volatile session influenced by the OPEC+ postponing its meeting. WTI bottomed at $73.80 and then rebounded back to $76.85.

(This story was corrected on November 22 at 20:49 GMT to say that it applies to Thursday, November 23. A previous version of the story said "Here is what you need to know on Friday, November 24".)

Like this article? Help us with some feedback by answering this survey:

- NZD/USD drops after hitting a two-day low in the 0.6020s.

- US inflation expectations rise, boosting Treasury yields a headwind for NZD/USD.

- NZD/USD's near-term trajectory hinges on upcoming Australian PMIs, with potential support above the crucial 0.6000 level.

The NZD/USD registers losses late in the North American session, snap three days of gains, and retreats toward the 0.6020s area after hitting a daily high of 0.6064. At the time of writing, the pair is losing 0.44%, printing a new two-day low.

Kiwi Dollar snaps three-day winning streak, influenced by US economic data

A rise in inflation expectations in the United States (US) was a green light to US Treasury bond yields, which averaged a rise of two basis points amongst the whole yield curve. The University of Michigan revealed that American households expect inflation for the next twelve months to hit 4.5%, up from 4.4%, while for five years stood at 3.2%. Regarding Consumer Sentiment, it improved a tick, though it trailed the previous reading.

Besides that, US unemployment claims for the last week fell compared to previous data, while Durable Goods Orders plunged sharply, suggesting the economy could weaken further, as sought by the US Federal Reserve.

Despite the rise in US bond yields, market participants have fully priced in 90 basis points of Fed rate cuts for the next year. Nevertheless, the release of the latest Fed minutes, witnessed the US central bank is keeping the door open for additional tightening.

On the New Zealand (NZ) front, the lack of economic data left NZD/USD traders leaning towards US Dollar dynamics and Australia and Chinese economic data. Ahead in the calendar, flash PMIs in Australia could lend a lifeline to the Kiwi Dollar (NZD), so the pair could remain above the 0.6000 figure.

NZD/USD Price Analysis: Technical outlook

The daily chart portrays the pair as neutral to upward biased, even though it has failed to conquer the 200-day moving average (DMA) at 0.6093. Once that level is cleared, the NZD/USD could rally toward the next resistance area seen above the 0.6200 figure. On the other hand, if the pair surrenders the 0.6000 figure, further downside is expected, as sellers could challenge the 50-DMA at 0.5926.

- The USD/NOK rallies 0.75% upwards, navigating near the 10.750 level.

- The US Dollar pushes higher on robust Jobless Claims data and raising expectations of inflation revealed by the UoM.

In Wednesday's session, the USD/NOK enjoyed an upward rally, trading near the 10.750 level. The upward movements were fueled by robust Jobless Claims figures from the US and the higher inflation expectations of the University of Michigan (UoM), which spooked investors.

In line with that, according to the University of Michigan inflation expectations increased to 4.5% from the previous report's 4.4% for a one-year period, while it stood at 3.2% for a five-year period. Others showed that the US Department of Labor reported that in the week ending November 18, Initial Jobless Claims totalled 209,000, marking the lowest reading in five weeks.

As a reaction, the expectations of sticky inflation and a robust labour market reminded investors that the Federal Reserve (Fed) left the door open for further tightening, in case needed. As for now, the CME FedWatch tool indicates that the markets are still pricing in a pause in the next Fed meeting in December, and the question that arises is for how long the bank will maintain the rates at restrictive levels.

The next highlight of the week will be November’s preliminary S&P PMIs from the US to be reported on Friday.

USD/NOK levels to watch

The Relative Strength Index (RSI) finds itself in the negative territory, with a positive slope suggesting a buildup in buying momentum. However, the Moving Average Convergence Divergence (MACD) presents decreasing red bars, indicative of the selling pressure gradually easing off but still present.

Considering the pair's positioning with respect to the Simple Moving Averages (SMAs), the picture becomes clearer. It currently holds a position beneath the 20-day SMA, which implies an immediate selling pressure, inhibiting further upward movement in the short term. Yet, the pair's position above the 100 and 200-day SMAs cements the longer-term bullish influence.

Support Levels: 10.677 (100-day SMA), 10.655 (200-day SMA), 10.600.

Resistance Levels: 10.810, 10.830, 10.900.

USD/NOK daily chart

-638362798796723947.png)

- Crude Oil is clawing back after a downside shock fueled by OPEC meeting cancelation.

- OPEC finance minister meeting re-scheduled for November 30th.

- OPEC is expected to focus on production cuts next week.

West Texas Intermediate (WTI) is paring back Wednesday's early losses as investor appetite recovers following a bout of uncertainty surrounding a delayed meeting for the Organization of the Petroleum Exporting Countries (OPEC).

OPEC's finance ministers' meeting for November 26th was canceled and shuffled into next week, now slated for November 30th.

The meeting, where finance ministers from OPEC member states are expected to discuss OPEC's current production quotas, was thrown into turmoil after Saudi Arabia expressed clear dissatisfaction with how many OPEC members have been producing and selling more crude oil than current OPEC caps.

US Crude Oil stocks numbers also surged on Wednesday, with the Energy Information Administration's (EIA) Crude Oil Stocks Change revealing an unexpected building of 8.701 million barrels into the week ending November 17th.

The surprise buildup is significantly higher than the expected 0.9 million buildup and adds significantly to the previous week's 3.6 million addition.

WTI Technical Outlook

Crude Oil has been no stranger to sudden chart drops in recent history, and the WTI's Wednesday decline sent US Crude Oil briefly back below $74.00/barrel before paring away most of the day's losses to rechallenge the $77.00 level.

Despite Wednesday's late-day recovery, WTI remains under fierce selling pressure, trading on the low side of the 200-day Simple Moving Average (SMA). The immediate low for WTI sits at a five-month low near $72.00, while the immediate ceiling will be last week's peak just below $88.00.

WTI Hourly Chart

WTI Daily Chart

- Silver price loses some territory for the second time in the week, down more than 0.50%.

- High US Treasury bond yields and XAG/USD’s failure to climb above $24.00 would pave the way for a pullback.

- If XAG/USD retraces past the 200-DMA, sellers target $22.70.

Silver price reversed its course on Wednesday, registering decent losses of more than 0.40% as US Treasury bond yields advance due to American households’ upward reviewed inflation expectations for one year. Consequently, the US 10-year Treasury bond yield rose, a headwind for the grey metal, which trades at $23.57 after reaching a high of $23.94.

From a daily chart standpoint, the XAG/USD is neutral to upward biased, though, for the last three days, buyers had failed to crack the two-month high reached on November 17 at $24.14. Once that level is surrendered, the next stop would be the August 30 high at $25.00, followed by the July 19 at $25.23.

On the other hand, XAG/USD’s failure at $24.00 for the fifth time could open the door for further losses. The first support would be the 200-day moving average (DMA) at $23.30, followed by the 20-DMA at $23.03. A breach of the latter, Silver would continue diving toward the 50-DMA at $22.71.

XAG/USD Price Analysis – Daily Chart

XAG/USD Technical Levels

- The Aussie is on the low side, but tussling with the US Dollar on Wednesday.

- Market sentiment soured on US data releases, dragging the AUD into lower bids.

- Aussie PMI figures due in the early Thursday market session.

The AUD/USD is wobbling on Wednesday, grinding around the 0.6540 level as market sentiment pushes and pulls the US Dollar (USD), leaving the Aussie (AUD) hung up in the middle of the tug-of-war.

Reserve Bank of Australia (RBA) Governor Michele Bullock hit newswires early Wednesday, highlighting that inflation remains a challenge for Australia, with price pressures consistently on the high side. The RBA is struggling to reign in inflation with policy measures without hampering the Australian domestic economy.

RBA’s Bullock: More substantial monetary policy tightening is right response

On the US data side, US Initial Jobless Claims came in below expectations, printing at a five-week low of 209K versus the expected 225K. Continuing Jobless Claims also declined to 1.84 million.

US weekly Initial Jobless Claims decline to 209K vs. 225K expected

Overall market volatility is on the high side for the mid-week as investors grapple with the rate cycle outlook. USD consumers are bracing for long-running inflation to overshoot the Federal Reserve's (Fed) target of 2%, according to the University of Michigan's (UoM) 5-year Consumer Inflation Expectations Survey for November. The UoM's consumer inflation outlook sees 5-year inflation at 3.2%, above the Fed's target band, and investors are having to once again readjust their outlook on when they can expect the Fed to begin cutting rates.

AUD/USD Technical Outlook

The AUD/USD kicked Wednesday trading off with a dip into 0.6527 before rallying back towards the day's high bids near 0.6570, and the pair is struggling near the 0.6540 level heading towards Wednesday's market close.

Yesterday's swing high into 0.6589 and subsequent decline sees a technical rejection from the 200-day Simple Moving Average (SMA) firming on the charts, and the next stage for sellers will be to drag the AUD/USD back down into the last swing low near 0.6350.

AUD/USD Daily Chart

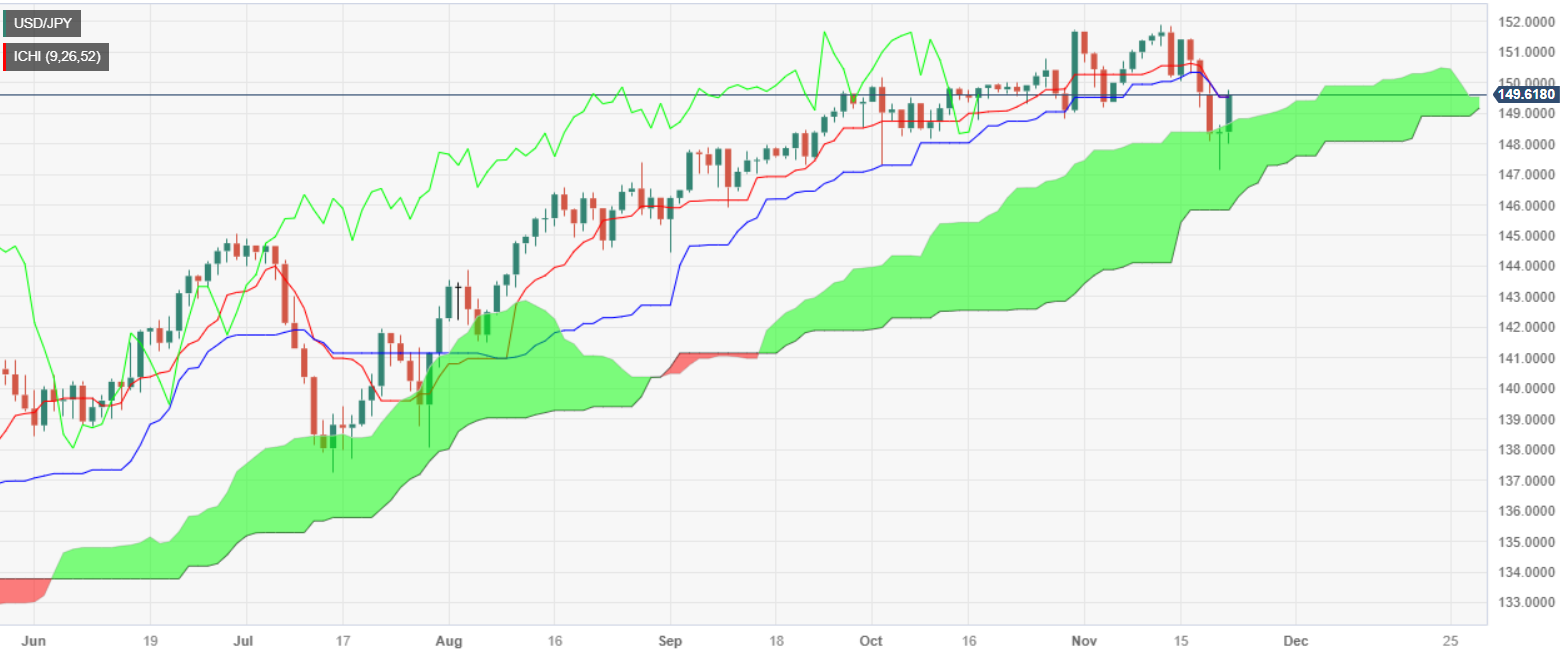

- USD/JPY rallies more than 0.80%, driven by a spike in US 10-year Treasury bond yields.

- US economic data shows mixed signals with lower-than-expected jobless claims and a significant drop in Durable Goods Orders.

- Japan's revised economic outlook and continued dovish Bank of Japan stance contrasts with US inflation expectations to underpin the USD/JPY.

The USD/JPY rebounds from daily lows of 148.01 and rallies more than 0.81% boosted by a jump in the US 10-year Treasury bond yield. At the time of writing, the major exchanges hands at 149.54 and tests a key technical resistance level eyeing the 150.00 figure.

The pair rebounds sharply, fueled by US bond yields and economic indicators, despite mixed consumer sentiment

Key US economic data was revealed today, beginning with the US Initial Jobless Claims for the last week rising less than expected, coming at 209K, below forecasts of 225K, and two weeks ago 233K. At the same time, Durable Goods Orders plunged -5.4% in October, below an expected contraction of -3.1%. Market participants ignored the data, though consumer sentiment moved the needle.

In November, the University of Michigan (UoM) consumer sentiment rose to 61.3, above estimates of 60.5, but missed the prior reading. American households' inflation expectations, climbed for the one-year outlook, reaching 4.5% compared to the previous reading of 4.4%, and for a five-year outlook, prices are projected to rise to 3.2%.

The US Dollar Index (DXY), which tracks the performance of six currencies vs. the Greenback, rose sharply by 0.49% and sits at 104.10, underpinned by higher US Treasury bond yields, as a reaction to the UoM inflation expectations poll.

On the Japanese front, Japanese authorities downward revised the economic outlook for the first time in 10 months. The revision came after Japan printed a contraction in the third quarter as demand waned. Therefore, the Bank of Japan’s (BoJ) dovish stance would likely continue well into 2024, despite expressions that foresee the BoJ would end its negative interest rate policy in April of next year, according to former BoJ executive Kazuo Momma.

USD/JPY Price Analysis: Technical outlook

From a technical perspective, the USD/JPY shifted to a neutral-upward bias as price action witnessed a break of the Ichimoku Cloud (Kumo), opening the door for further gains. However, buyers must reclaim the Tenkan-Sen at 149.53 so they can challenge the 150.00 figure mark. On the other hand, failure to crack the confluence of the Tenkan and Kijun-Sen would pave the way for a downward correction, toward 149.00, with sellers eyeing a drop inside the Kumo to test November’s 21 low of 147.15.

- The DXY Index rose to 103.90, up by 0.30%.

- US weekly Initial Jobless Claims came in better than expected, but Durable Goods Orders from October were disappointing.

- US yields are higher, favouring the Greenback’s advance.

On Wednesday, the US Dollar found momentum after the report of positive weekly Initial Jobless Claims from the US, which flashed further warning among investors regarding further tightening from the Federal Reserve (Fed).

The labor market in the United States is showing signs of resilience, and despite the evidence of inflation, it might make Fed officials consider further tightening, which seems to be spooking investors.

Daily Digest Market Movers: US Dollar finds a lift on better-than-expected Initial Jobless Claims

- The US Dollar DXY Index trades neutrally around 103.50.

- Initial Jobless Claims in the US for the week ending November 18 were lower than expected at 209,000, marking the lowest level in five weeks.

- Durable Goods Orders in the US dropped by 5.4%, exceeding the forecasted 3.1% contraction, following a previous month's increase of 4.6%.

- Despite the decline in Durable Goods Orders, the US Dollar strengthened against other currencies, with the DXY index climbing to 104.10, showing a 0.50% rise.

- The Federal Open Market Committee's November Minutes revealed that officials were concerned about inflation and needed to see more evidence to be convinced that inflation is coming down.

- The 2, 5 and 10-year rates increased to 4.96%, 4.46% and 4.43%. Still, markets are confident that the Federal Reserve won’t hike in November and are betting on rate cuts sooner than expected in May 2024. A sizable minority is even betting on a rate cut in March.

Technical Analysis: US Dollar bulls see some light, bears still show dominance

The technical landscape of the DXY daily chart delivers a mix of bullish and bearish signals. The Relative Strength Index (RSI) standing flat near oversold conditions indicates a potential weakening of the selling momentum. This could suggest an imminent reversal, a classic sign that buying pressure could soon resurface. Contrarily, the flat red bars of the Moving Average Convergence Divergence (MACD) hint at a short-term bearish bias, suggesting that sellers might be in control of the immediate market. Yet, it is important to bear in mind that the index’s continuous flat nature could turn either way.

Furthermore, the DXY's position below the 20 and 100-day Simple Moving Averages (SMAs) can be perceived as a bearish signal. However, it currently sits above the 200-day SMA, suggesting that bulls hold the fort on a broader time frame with the underlying trend remaining upward.

Support levels: 103.60 (200-day SMA), 103.30, 103.15.

Resistance levels: 104.00, 104.20 (100-day SMA),104.50.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Bundesbank President Joachim Nagel said on Wednesday that interest rates in the Eurozone are close to their peak. He explained that economic data will determine whether more tightening is needed.

Regarding inflation, Nigel mentioned it is on track to move towards the ECB target while speaking at an even in Milan.

Market reaction

The EUR/USD is falling on Wednesday; it trimmed losses during the last two hours, rising from near 1.0850 to 1.0880.

- Spot Gold is bidding lower, testing back beneath the $2,000 key handle.

- XAU/USD is trimming back some gains as investors weigh their options post-US data.

- Gold remains well-bid, but $2,000 is proving to be a challenging level.

XAU/USD tipped back into a daily high above the $2,000 mark, at $2,006.48, but the key handle is proving a difficult target to nail down.

Gold is bidding back towards the downside as investor sentiment rolls over on the day and exposure goes uneven.

US Treasury yields saw another spike on Wednesday, with the 10-year T-note briefly climbing back into 4.445% before slipping back to 4.42%.

US investor sentiment is going mixed on the day after US Initial Jobless Claims unexpectedly dipped to a five-week low of 209K versus the forecast 225K, revealing some ongoing tightness in the labor market.

Meanwhile, the University of Michigan Consumer Inflation Expectations showed that US consumers still see an elevated inflation outlook, with consumers expecting inflation to remain around 3.2% over the next five years.

With price growth being something of a self-fulfilling prophecy, elevated consumer inflation expectations means the Federal Reserve (Fed) is less likely to accelerate the path towards rate cuts, much to the chagrin of investors who have broadly been increasing bets on a sooner rather than later rate cut cycle.

XAU/USD Technical Outlook

Gold's snap decline in intraday Wednesday trading sees the XAU/USD slipping back from the $2,000 handle to challenge $1,990, descending into the 50-hour Simple Moving Average (SMA).

Despite the Wednesday backslide, Gold remains elevated, with XAU/USD up over 3% from the last swing low into the 200-day SMA near $1,931. $2,000 is proving to be a bit of a technical cap, and Spot Gold's near-term trading range will be defined by whether or not the 200-day SMA can again support any declines into $1,940.

XAU/USD Hourly Chart

XAU/USD Daily Chart

- The Canadian Dollar is falling back on Wednesday as market sentiment sours on multiple fronts.

- US data is depleting risk appetite, coupled with deflating Crude Oil bids.

- USD/CAD hits a new high for the week as the US Dollar bids higher.

The Canadian Dollar (CAD) is seeing declines across the board on Wednesday, getting dragged down as Crude Oil sells off and broader markets step back into the US Dollar (USD) following a slew of US economic data that points to interest rates remaining higher for longer than markets anticipated at the start of the week.

Loonie traders will be looking ahead to Friday’s Retail Sales figures from Canada, but the figures are likely to be overshadowed by US Purchasing Managers’ Index (PMI) figures due shortly after.

US markets are also expected to see some volume on Wednesday as investors gather up their order books in anticipation of Thursday’s Thanksgiving holiday.

Daily Digest Market Movers: Canadian Dollar driven lower as Crude Oil declines and US Dollar flows reverse

- CAD sees fresh lows for the week, falling back on declining market sentiment.

- Crude Oil markets are firmly lower for the week, WTI falls below $75/barrel.

- The Organization of Petroleum Exporting Countries delayed a critical meeting on production cuts until next Thursday.

- Saudi Arabia is reportedly dissatisfied with member states’ unwillingness to stick to reduced production quotas.

- The meeting is for OPEC member state finance ministry staff and specifically focuses on production cut plans.

- Record non-OPEC production and ongoing demand concerns from China are increasing expectations of additional OPEC production cuts.

- US Initial Jobless Claims declined to a five-week low of 209K against the 225K forecast, highlighting still tight labor conditions in the US.

- The University of Michigan Consumer Inflation Expectations for November showed US consumers broadly expect long-term inflation to remain above the Federal Reserve’s (Fed) 2% target as consumers see 3.2% inflation.

- Inflation expectations tend to drive realized inflation, and elevated expectations mean the Fed was right to maintain a hawkish approach.

- Investors hoping for an accelerated path for rate cuts will be left out in the cold by elevated price growth expectations.

Canadian Dollar price this week

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies this week. Canadian Dollar was the strongest against the Euro.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.33% | -0.07% | 0.11% | -0.34% | -0.21% | -0.29% | -0.10% | |

| EUR | -0.33% | -0.42% | -0.21% | -0.68% | -0.53% | -0.60% | -0.41% | |

| GBP | 0.08% | 0.41% | 0.20% | -0.25% | -0.11% | -0.19% | -0.01% | |

| CAD | -0.11% | 0.21% | -0.19% | -0.45% | -0.31% | -0.40% | -0.21% | |

| AUD | 0.33% | 0.66% | 0.27% | 0.45% | 0.13% | 0.05% | 0.27% | |

| JPY | 0.20% | 0.54% | -0.11% | 0.31% | -0.18% | -0.06% | 0.13% | |

| NZD | 0.28% | 0.61% | 0.21% | 0.40% | -0.05% | 0.08% | 0.18% | |

| CHF | 0.08% | 0.41% | 0.00% | 0.20% | -0.28% | -0.13% | -0.20% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Canadian Dollar tests new low for the week, Loonie traders looking for a mid-day recovery

The Canadian Dollar (CAD) saw fresh declines against the US Dollar (USD) on Wednesday, driving to a new low for the week and sending the USD/CAD into 1.3765.

The Loonie is now experiencing a mild recovery, dragging the USD/CAD back down below 1.3750, but further intraday downside for the Dollar-Loonie pair will require overcoming resistance-turned-support from the 200-hour Simple Moving Average (SMA) at 1.3740.

The USD/CAD continues to trade toward the high side of the rising trendline from 1.3100, and the 50-day SMA is providing technical support for any bearish moves into 1.3640.

USD/CAD Hourly Chart

USD/CAD Daily Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- GBP/USD drops more than 0.50%, reacting to US data indicating ongoing inflation struggles and a cooling job market.

- US University of Michigan report shows increased short-term inflation expectations, while consumer sentiment dips below expectations.

- UK's Autumn Statement focuses on debt reduction and inflation control, with modest GDP growth projections, weighed on the Pound Sterling.

The GBP/USD tumbles during the mid-North American session after economic data from the United States (US) suggested the battle against inflation is not done while the economy continues to decelerate, as sought by the US Federal Reserve (Fed). At the time of writing, the pair is trading at 1.2456, losing 0.63%.

Sterling falls as US inflation expectations rise and UK Chancellor's Autumn Statement reveals cautious growth projections

A report by the University of Michigan (UoM) witnessed that inflation expectations in the US rose for one year to 4.5% from 4.4% in the previous report, while it stood at 3.2% for a five-year period. Regarding consumer sentiment, Americans remain pessimistic as the index dropped from 63.8 to 61.3 but exceeded forecasts.

Additional data from the US showed that unemployment claims fell last week compared to two weeks ago, suggesting the jobs market is cooling. At the same time, the US Census Bureau showed that Durable Goods Orders plummeted as demand for business equipment slowed.

The US Dollar Index (DXY), which tracks the performance of six currencies vs. the Greenback, rose sharply by 0.49% and sits at 104.10, underpinned by higher US Treasury bond yields, as a reaction to the UoM inflation expectations poll.

Across the pond, Jeremy Hunt, the UK Chancellor of the Exchequer, revealed its Autumn Statement. He stated, “We will reduce debt, cut taxes, and reward work.” He emphasized that it would work alongside the Bank of England to get inflation to its 2% target, which, according to the Office for Budget Responsibility (OBR) would be attained in 2025.

The Office for Budget Responsibility (OBR) says the combined impact of these measures will reduce inflation and raise GDP. Nevertheless, Hunt added that Gross Domestic Product (GDP) is expected to grow by merely 0.7%, compared with the 1.8% forecast in the previous projection in March from the OBR.

GBP/USD Price Analysis: Technical outlook

The GBP/USD remains bullish according to the daily chart, though is about to test key support seen at the 200-day moving average (DMA) at 1.2448, which once cleared, could open the door for further losses. The next support would be the 1.2400 figure, followed by the November 17, the latest cycle low at 1.2374. A decisive break would put into play the 50-DMA at 1.2256. On the flip side, if buyers reclaim 1.2500, they could remain hopeful of higher prices, with the first resistance level at 1.2559, the November 21 high.

- The EUR/USD is positioned at around the 1.0865 level, registering a decline of nearly 0.40%.

- The US Dollar rides on positive jobless claims figures, shedding light on a resilient labor market.

- Durable Godds from October, on the other hand, came in weaker than expected.

In Wednesday's session, the Euro slipped against the US Dollar, with the pair trading around the 1.0865 mark. The downfall was triggered by the report of strong weekly Jobless Claims figures, which reminded investors that the Federal Reserve (Fed) might take it as a threat to the battle against inflation.

In line with that, the US Department of Labor's weekly data, revealed that Initial Jobless Claims for the week ending November 18 came in at 209,000 lower than the expected 225,00, tallying its lowest reading in five weeks. On the negative side, the US Census Bureau reported that Durable Goods Orders in the United States fell by 5.4% after its previous month's increase of 4.6% and was worse than the anticipated contraction of 3.1%.

Despite the negative Orders figures, the US Dollar is trading strongly against its rivals, and the DXY index rose towards 104.10, seeing 0.50% gains. Investors may have gotten spooked after the strong labour market figures as the Federal Open Market Committee (FOMC) minutes from the November meeting reported on Wednesday that officials weren’t satisfied with the progress made on inflation. In line with that, all data points threatening the bank’s job may resume the hawkish bets on the Fed.

EUR/USD levels to watch

Despite the Relative Strength Index (RSI) showing a negative slope yet remaining in positive territory, it indicates a significant selling momentum on the horizon. In addition, decreasing green bars for the Moving Average Convergence Divergence (MACD) further support this sentiment, signalling a potential bearish crossover as the bears strengthen their grasp.

Moreover, as the bears have been steadily gaining ground, it may threaten the position of the pair above the 20, 100, and 200-day Simple Moving Averages (SMAs). The next support stands around 1.0800 (200-day SMA) and at 1.0790 (100-day SMA). On the upside, the 1.0900, 1.09030 and 1.0960 stand as resistances.

EUR/USD daily chart

-638362663463096580.png)

US growth has outperformed expectations and is carrying solid momentum into 2024. Economists at ANZ Bank outline their baseline growth view for next year.

US growth to slow as soft landing expected in 2024

We expect the US economy will experience a soft landing in 2024 as its lows in response to the Federal Reserve’s aggressive tightening, the labour market slows and the contribution from fiscal policy wanes.

We forecast that GDP will rise by an average of 1.1% next year, down from an estimated 2.4% in 2023. We cannot rule out a period of mildly negative growth at some stage, but that is consistent with a soft landing.

We do not expect next year’s presidential election will have a material impact on growth or policy settings. The Fed is independent and will continue to set policy as it sees fit. We expect rate cuts to start in Q3.

- Mexican Peso edges higher as USD/MXN pair tumbles on its way toward the 17.00 figure.

- Mexico's retail sales growth slowed to 2.3% in September, missing forecasts with consumers feeling higher interest rates set by Banxico.

- Mexico’s key economic releases ahead include November inflation data and Q3 GDP.

Mexican Peso (MXN) climbs against the US Dollar (USD) and prints a minuscule daily gain of 0.08%. The USD/MXN pair trimmed some of Tuesday’s gains and trades below the 17.20 area after hitting a daily high of 17.24.

Mexico’s Retail Sales grew by 2.3% YoY in September, slowing down from 3.2% in August and missing estimates of 3.6% expansion. The data begins to evidence the impact of higher interest rates set by the Bank of Mexico (Banxico), currently at 11.25%. Meanwhile, a preliminary data release from the National Statistics Agency (INEGI) showed that economic activity contracted in October, for the first time since June 2022, compared to September.

Ahead in the docket on Thursday, the November mid-month inflation rates are expected to climb in the headline, contrarily to the core, which is foreseen to decline somewhat. On Friday, Mexico will reveal the Gross Domestic Product (GDP) for Q3, which would offer USD/MXN traders fresh impetus ahead of the end of the week.

Daily digest movers: Mexican Peso could weaken as traders await Mexico’s Q3 GDP and economic activity release

- INEGI estimates the economy shrank 0.1% MoM in October, though annually based, it expanded by 2.9%, according to the agency Timely Indicator of Economic Activity (IOAE).

- A Citibanamex poll suggests that 25 of 32 economists polled expect Banxico's first rate cut in the first half of 2024.

- The poll shows “a great dispersion” for interest rates next year, between 8.0% and 10.25%, revealed Citibanamex.

- Headline annual inflation is expected at 4% and core at 4.06%, both readings for the next year, while the USD/MXN exchange rate is seen at 19.00, up from 18.95, toward the end of 2024

- The latest US Federal Reserve (Fed) minutes showed the Fed would proceed “cautiously” in setting monetary policy and left the door open to additional tightening if warranted by data.

- US Initial Jobless Claims missed estimates, while Durable Goods Orders plunged sharply, suggesting the economy continues to decelerate.

- Data published last week showed prices paid by consumers and producers in the US dipped, increasing investors' speculations that the Fed’s tightening cycle has ended.

- The swap market suggests traders expect 100 basis points of rate cuts by the Fed in 2024.

- The latest inflation report in Mexico, published on November 9, showed prices grew by 4.26% YoY in October, below forecasts of 4.28% and prior rate of 4.45%. On a monthly basis, inflation came at 0.39%, slightly above the 0.38% consensus and September’s 0.44%.

- Banxico revised its inflation projections from 3.50% to 3.87% for 2024, which remains above the central bank’s 3.00% target (plus or minus 1%).

Technical Analysis: Mexican Peso remains bullish if USD/MXN stays below 17.34

The USD/MXN bearish bias remains intact, and despite forming a ‘tweezers bottom’ two candlestick chart pattern, buyers' failure to lift prices toward the 100-day Simple Moving Average (SMA) at 17.34 opened the door to a pullback. However, if USD/MXN reclaims the latter, further upside is seen, with the next resistance at the 20-day SMA at 17.55, ahead of the 200-day SMA at 17.61.

Nevertheless, the most likely scenario would be the pair dropping toward the November 21 low of 17.06, ahead of sliding toward the 17.00 figure. Once sellers regain that level, the USD/MXN bearish bias would be cemented, and expect another test of the year-to-date (YTD) low of 16.62.

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Since 2020, EUR/JPY has rallied close to 40%. Economists at ING analyze the pair’s outlook.

EUR/JPY has a modest positive correlation with global equity markets

EUR/JPY has a modest positive correlation with global equity markets. If a more traditional business cycle emerges where equities turn lower headed into a US recession (equities normally turn six months before a recession) and bonds rally, then EUR/JPY should come lower in line with our forecasts. If, however, lower US rates lead to both bonds and equities rallying then we are probably underestimating the performance of EUR/JPY.

On the bond side as well, we will be interested to watch developments in the eurozone yield. The current inverted yield curves in Europe make it too expensive for Japanese investors to FX hedge European bond portfolios. Bullish steepening of European curves would see FX hedge ratios increase and EUR/JPY finally.

Following the last FOMC minutes release on Tuesday, economists at Rabobank do not believe that recent data are likely to spur the Fed into action.

The urgency of an additional hike does not seem large

The minutes of the FOMC meeting on October 31-November 1 confirm the Committee’s data dependence and intention to proceed carefully.

We should not attach too much value anymore to the remaining hike that is implied in the September dot plot. What’s more, the recent decline in yields has partially been caused by softer economic and inflation data, so the urgency of an additional hike does not seem large.

Since the FOMC believes that a soft landing is in sight, it would be foolish to risk it by hiking further than necessary. If we were to see stronger economic and inflation data before the December meeting, longer-term rates are likely to rebound and substitute for a rate hike. Therefore we do not expect further hikes.

We expect the Fed to remain on hold until the middle of next year. By then we expect the FOMC to be ready to cut rates as rising unemployment (note that unemployment has quietly risen from 3.4% to 3.9% this year), most likely accompanied by a recession, will give the Committee confidence that inflation is on the right path.

Gold price reacts to geopolitical risks. Strategists at ANZ Bank analyze the yellow metal’s outlook.

Central banks’ Gold purchases rose

Gold is benefitting from the tailwinds of heightened geopolitical risk, a weaker US Dollar and retreating US Treasury bond yields. Investment flows are recovering in response.

Central bank Gold purchases are strong and likely to reach 1,050t in 2023. Demand for physical Gold looks healthy too, with India’s imports rising 60% YoY in October.

See: Gold offers a potentially effective hedge against a deterioration in geopolitical conflicts – UBS

2024 should be a decisive year for the S&P 500. Economists at Société Générale analyze the index outlook for the next year.

S&P 500 Index seen at 4,750 by end-2024

The S&P 500 should be in ‘buy-the-dip’ territory, as leading indicators for profits continue to improve. Yet, the journey to the end of the year should be far from smooth, as we expect a mild recession in the middle of the year, a credit market sell-off in 2Q and ongoing quantitative tightening.

The S&P 500 should provide positive returns in 2024 and we keep our end-2024 target that we launched last quarter unchanged at 4,750.

- Initial Jobless Claims in the US decreased by 24K in the week ending November 18.

- Continuing Jobless Claims declined to 1.84 million in the week ending November 11.

- US Dollar Index advances to 103.70 after Claims and Durable Goods Orders.

Initial Jobless Claims totaled 209,000 in the week ending November 18, the weekly data published by the US Department of Labor (DOL) showed on Thursday. It is the lowest reading in five weeks. This follows the previous week's print of 233,000 (revised from 231,000) and came in better than the market expectation of 225,000.

Continuing claims decreased by 22,000 in the week ending November 11 to 1.84 million. It is the first decline after rising for eight consecutive weeks.

Market reaction

Alongside the Jobless Claims, the Durable Goods Orders were released. The US Dollar Index rose modestly, reaching levels above 103.70.

- Durable Goods Orders in the US contracted at a faster pace than expected in October.

- US Dollar Index continue to fluctuate in a tight range above 103.50.

Durable Goods Orders in the United States declined by 5.4%, or $16 billion, to $279.4 billion in October, the Census Bureau reported on Wednesday. This reading followed the 4.6% increase recorded in September and came in worse than the market expectation for a contraction of 3.1%.

"Excluding transportation, new orders were virtually unchanged," the press release read. "Excluding defense, new orders decreased 6.7%. Transportation equipment, also down three of the last four months, drove the decrease, $16.0 billion, or 14.8%, to $92.1 billion."

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen rising 0.1% on the day at 103.70.

- US data due on Wednesday includes Jobless Claims and Durable Goods Orders.

- The US Dollar Index retreats from daily highs as yields slide.

- The EUR/USD faces resistance at 1.0920 and has significant support at 1.0880.

The EUR/USD rebounded and is back above 1.0900, trading flat for the day ahead of key US economic data. The pair reached its lowest level in three days during the European session at 1.0881 but started to rise as the US Dollar weakened.

The focus is on US data scheduled for Wednesday. Initial Jobless Claims are expected to show a decline to 225,000 from last week's 231,000. Durable Goods Orders in October are forecasted to decrease by 3.1% after a 4.7% surge in September. Later in the day, the final November University of Michigan consumer sentiment will also be reported.

The outcome of these data releases could impact the US Dollar. So far on Wednesday, the Dollar Index (DXY) is trading marginally higher, hovering around 103.60, after approaching 104.00. The Greenback lost strength as Treasury Yields moved lower. However, the subsequent direction will likely be influenced by incoming US data.

The EUR/USD is hovering above the 20-day Simple Moving Average (SMA) on the four-hour chart, which stands at 1.0915, near a horizontal resistance level seen at 1.0920. If the Euro rises above it, it could gain momentum. On the contrary, the immediate short-term support is seen around 1.0880. Below that, there is an interim support at 1.0850, followed by the strong level at 1.0830.

Over the past month, EUR/GBP has moderately risen. Economists at Danske Bank analyze the pair’s outlook.

GBP headwinds to persist

We expect the UK economy to perform relatively worse than the Euro area and the conclusion of the Bank of England hiking cycle to weigh on GBP.

Near-term, we expect the cross to range trade on the back of little divergence in either the growth or monetary policy for the rest of the year.

We target the EUR/GBP pair at 0.89 in 12M.

The Office for Budget Responsibility (OBR) published its latest "economic and fiscal outlook” on the economy, with the key insights found below.

Headline debt predicted to be 94% of GDP by end of forecast.

We meet our fiscal rule to have underlying debt falling as percent of GDP by final year of forecast with double headroom.

OBR forecasts 2023/24 underlying public debt to GDP ratio of 91.6% (March forecast 92.4%).

OBR forecasts 2024/25 underlying public debt to GDP ratio of 92.7% (March forecast 93.7%).

OBR shows borrowing to be lower this year and next.

OBR forecasts show 2023/24 budget deficit of 4.5% of GDP (march forecast 5.1% of GDP).

OBR forecasts show 2024/25 budget deficit of 3% of GDP (march forecast 3.2% of GDP).

OBR forecasts show 2025/26 budget deficit of 2.2% of GDP (march forecast 2.8% of GDP).

OBR forecasts show 2027/28 budget deficit of 1.6% of GDP (March forecast 1.7% of GDP).

OBR forecasts show 2028/29 budget deficit of 1.1% of GDP.

OBR forecasts show 2023 GDP growth of 0.6% (March forecast -0.2%).

PBR forecasts show 2024 GDP growth of 0.7% (March forecast 1.8%).

OBR forecasts show 2025 GDP growth of 1.4 (March forecast 2.5%).

OBR forecasts show 2026 GDP growth of 1.9% (March forecast 2.1%).

OBR forecasts show 2027 GDP growth of 2% (March forecast 1.9%).

OBR forecasts show 2028 GDP growth of 1.7%.

Market reaction

GBP/USD is shrugging off the above forecasts, currently trading flat at 1.2535.

Economists at Commerzbank expect the EUR/CHF pair to enjoy modest gains next year.

Scope for a stronger Franc again in 2025

We see a moderate depreciation of the Franc against the Euro next year.

The EUR should benefit from the fact that market expectations regarding interest rate cuts in the Eurozone are likely to prove premature. At the same time, inflation in Switzerland is likely to remain at low levels next year, meaning that the SNB should allow the Franc to depreciate to some extent.

By 2025, however, we see scope for a stronger Franc again. This is because inflation is likely to remain low in Switzerland, while it should be above the ECB target in the Eurozone.

UK Finance Minister Jeremy Hunt announced the Autumn Forecast Statement on Wednesday, stating that “we will reduce debt, cut taxes, reward work in this statement.”

Additional quotes

We will cut business taxes.

The Office for Budget Responsibility (OBR) says combined impact of these measures will reduce inflation and raise GDP.

OBR says inflation will fall to 2% target in 2025.

We will back BoE to do whatever it takes to get inflation back to target.

Working-age welfare benefits to be uprated by 6.7% Sept inflation rate.

We will increase support for housing costs through local housing allowance.

I have decided to freeze all alcohol duties until Aug. 1 next year.

We will raise pensions by full triple lock commitment.

From April 2024 will increase state pensions by 8.5%.

We will increase support for housing costs through local housing allowance.

We will spend GBP104 bln on cost of living pressures.

Market reaction

The Budget update seems to have little to no impact on the Pound Sterling, leaving GBP/USD modestly flat at 1.2535, as of writing.

- The Greenback trades in the green against every major G20 peer.

- Traders are seeing US yields halt their decline as the Fed dampens hopes for a quick rate cut.

- The US Dollar Index flirts with a jump to 104.00.

The US Dollar (USD) trades stronger on Wednesday ahead of the Thanksgiving festivities on Thursday. The publication of the Fed Minutes from their recent rate decision revealed that the whole board agrees that cuts are not in the plan for the upcoming meetings. This pours cold water on the market bets that cuts might be very close, even in December.

As if the devil is at play in this turnaround for the US Dollar, the calendar could help the US Dollar Index (DXY) increase even further. Next to Durable Goods and Jobless Claims data, the consumer inflation expectations data from the University of Michigan could confirm that the Fed is correct in not letting loose too quickly. Although it is the final reading, any upward revision will be good for some more US Dollar strength later this Wednesday.

Daily digest: Not going quietly without a fight

A very full calendar this Wednesday ahead of the Thanksgiving festivities on Thursday.

- Data releases kick off at 12:00 GMT, with the Mortgage Bankers Association (MBA) Mortgage Applications for last week. Previous was at 2.8%.

- At 13:30 GMT, a very eventful moment with a lot of data points due to come out:

- Durable Goods Orders are expected to head from 4.6% to -3.1% for October.

- Durable Goods Orders without Transportation are expected to head from 0.4% to 0.1%.

- Initial Jobless Claims for last week are expected to decline from 231,000 to 225,000.

- Continuing Jobless Claims are expected to head from 1,865,000 to 1,875,000.

- Next focal point will be at 15:00 GMT with the University of Michigan numbers.

- The Consumer Sentiment Index is expected to head from 60.4 to 60.5.

- The 5-year Inflation expectations are expected to stay stable at 3.2%.

- Bear in mind that these are final readings for the month of November.

- Equities are mildly in the green as stock markets were not seeing any help from rather disappointing Nvidia earnings. The Sam Altman saga with Microsoft and AI is not helping either. Mild positive numbers are being noticed across Asia and Europe, with US futures flat ahead of the US opening bell.

- The CME Group’s FedWatch Tool shows that markets are pricing in a 94.8% chance that the Federal Reserve will keep interest rates unchanged at its meeting in December. A juicy sidenote is that now 5.2% even thinks a hike might be at hand.

- The benchmark 10-year US Treasury Note yield trades at 4.40%, and is off the lows from 4.38% earlier.

US Dollar Index technical analysis: off the lows

The US Dollar is snapping the game plan that should have brought the US Dollar Index below 103.00 for this week. Help came from the US Federal Reserve Minutes, which showed that all board members were unanimous that cuts are nowhere near an option. Markets got spooked and are seeing ample amounts of flow back into the Greenback, with the US Dollar Index trying to head back above the 200-day Simple Moving Average at xxxx.

The DXY is back above the 200-day SMA near 103.62, and will need to have a daily close above it in order to consolidate the region. Look for a further recovery bounce towards the 100-day SMA near 104.20. Should the DXY be able to close and open above it later this week, look for a return to the 55-day SMA near 105.71 with 105.12 ahead of it as resistance.

The 200-day SMA will try to play its role again as a crucial pivotal supportive level against any downturn. Should the index snap this level again later this week, the psychological 100.00 level comes into play. With a very slim economic calendar after this Wednesday and several US market participants off the desk for the holidays throughout the rest of this week, there is room for a potential big downturn.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Economists at ING analyze EUR/SEK outlook for the next year.

Riksbank to pick inflation battle over growth

We expect one more hike by the Riksbank before year-end. This should be the last one of the cycle, but we see policymakers continue to prioritise the inflation battle over growth concerns. Orthodox and unorthodox attempts to keep supporting the Krona will remain part of the script, and we cannot exclude an expansion of the FX hedging programme in 2024.

Fed cuts should favour a rotation to activity currencies including SEK, and allow it to cash in on respectable carry and undervaluation.

We see EUR/SEK around 11.00 in the second half of 2024.

European Central Bank (ECB) Vice President Luis de Guindos said on Wednesday, “central bank will not prejudge further movements in the policy rate.”

Additional quotes

Haven't seen extreme moves in bond spreads.

It's premature to discuss rate cuts.

ECB is data-dependent and policy communication is very clear.

Markets' soft-landing hopes may be a bit optimistic.

Market reaction

EUR/USD is unfazed by the above comments, still holding its range around 1.0900, as of writing.

The Canadian Dollar has underperformed alongside the US Dollar this month. Economists at MUFG Bank analyze Loonie’s outlook.

Room for further BoC cuts to be priced into next year

Despite the relative resilience of the US economy, the US rate market is still pricing in around 0.2 points of further cuts than the BoC by the end of next year. With the Canadian rate market currently pricing in around 75 bps of cuts, it leaves room for further BoC cuts to be priced into next year which should remain a weight on Canadian Dollar performance going forward.

As a result, we expect USD/CAD to continue to trade in the high 1.3000’s.

- WTI Oil is facing a firm downturn in the coming trading day.

- The US Dollar rallies on the publication of the Fed Minutes.

- Oil is at risk of dropping back to $74 as more bearish elements emerge.

Oil prices are not selling off as massively as expected, although a case is building for at least some further correction in Crude prices. The recent repricing is likely after a ceasefire between Israel and Palestine and the overnight numbers from the American Petroleum Institute revealed a very substantial build in US stockpiles. These key elements are enough to send Oil prices lower this Wednesday.