- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

The main US stock indexes mostly declined, reacting to weak economic data. The minutes of the Fed meeting were also in focus. Meanwhile, trading activity was lowered on the background of the forthcoming Thanksgiving Day on Thursday.

Data showed that orders for durable goods fell by 1.2% in October, which is much worse than forecast (+ 0.3%). With the exception of transport, orders increased by 0.4%. Investment in business fell by 0.5% on the basis of a carefully monitored measure, known as orders for basic capital goods. However, the number of Americans applying for new unemployment benefits fell last week, which is the last signal that the labor market is on a solid foundation at the end of the year. Initial claims for unemployment benefits fell by 13,000 to 239,000, seasonally adjusted in the week to November 18, the Ministry of Labor said. Economists had expected 240,000 new applications.

As for the minutes of the Fed meeting, it was reported that the leaders at the last meeting expected an increase in the rate "in the short term" due to the improvement of the economic situation, while many noted that their decision would depend on whether inflation would accelerate. The document also indicated that the Central Bank executives admitted that the annual inflation rate could remain below the target level of 2% longer than expected. Most of the participants in the meeting still believed that the growth in demand for labor would lead to an acceleration of inflation in the medium term. However, the leaders discussed the likely reasons for the slowdown in prices, which, in their view, include the weakening of the link between the labor market and the rate of price growth, and the likely further growth in employment.

Most components of the DOW index finished trading in the red (21 out of 30). Outsider were shares of 3M Company (MMM, -1.09%). Leader of growth were shares of Verizon Communications Inc. (VZ, + 2.09%).

Most sectors of the S & P index recorded an increase. The conglomerate sector grew most (+ 1.4%). The largest decline was shown in the financial sector (-0.1%).

At closing:

DJIA -0.27% 23,526.18 -64.65

Nasdaq + 0.07% 6,867.36 +4.88

S & P -0.08% 2,597.08 -1.95

On 4-hour time frame chart we can see that price is now close to the upside trend line.

In this scenario, we can consider long or short entries.

However, it depends of the price how it behaves in this area.

So, we might consider a bullish movement if the price rejects the trend line (wicks touching the trend line)

Besides that, if the price breaks the trend line, then we can expect a depreciation of the Nikkei 225 to the previous relative minimums.

At 457.1 million barrels, U.S. crude oil inventories are in the upper half of the average range for this time of year.

Total motor gasoline inventories remained unchanged last week, and are in the middle of the average range. Finished gasoline inventories increased, while blending components inventories decreased last week. Distillate fuel inventories increased by 0.3 million barrels last week but are in the lower half of the average range for this time of year. Propane/propylene inventories decreased by 1.0 million barrels last week, and are in the lower half of the average range. Total commercial petroleum inventories remained unchanged last week.

Consumer sentiment narrowed its loss from mid-month, although it was still slightly below last month's decade peak. Overall, the Sentiment Index has remained largely unchanged since the start of the year at the highest levels since 2004. What has changed recently is the degree of certainty with which consumers hold their economic expectations. In contrast to the media buzz about approaching cyclical peaks and an aging expansion, with the implication of greater uncertainty about future economic trends, consumers have voiced greater certainty about their expectations for income, employment, and inflation. Inflation expectations have shown the smallest dispersion on record, and increased certainty about future income and job prospects has become a key factor that has supported discretionary purchases.

U.S. stock-index futures were slightly higher on Wednesday, as investors assessed a bundle of economic data and earnings reports, while awaiting the release of the minutes from the Federal Reserve's latest policy meeting. Growing oil prices provided support to the market.

Global Stocks:

Nikkei 22,523.15 +106.67 +0.48%

Hang Seng 30,003.49 +185.42 +0.62%

Shanghai 3,430.55 +20.05 +0.59%

S&P/ASX 5,986.41 +22.89 +0.38%

FTSE 7,449.04 +37.70 +0.51%

CAC 5,382.39 +16.24 +0.30%

DAX 13,156.43 -11.11 -0.08%

Crude $57.81 (+1.72%)

Gold $1,285.00 (+0.26%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 233.02 | 0.11(0.05%) | 734 |

| ALCOA INC. | AA | 41.7 | 0.31(0.75%) | 1111 |

| Amazon.com Inc., NASDAQ | AMZN | 1,143.35 | 3.86(0.34%) | 18073 |

| Apple Inc. | AAPL | 173.5 | 0.36(0.21%) | 125141 |

| AT&T Inc | T | 34.47 | 0.14(0.41%) | 10107 |

| Barrick Gold Corporation, NYSE | ABX | 14 | 0.08(0.57%) | 6475 |

| Caterpillar Inc | CAT | 138.55 | 0.95(0.69%) | 8447 |

| Chevron Corp | CVX | 115.76 | 0.59(0.51%) | 1069 |

| Cisco Systems Inc | CSCO | 36.74 | 0.09(0.25%) | 5632 |

| Citigroup Inc., NYSE | C | 72.45 | 0.07(0.10%) | 1019 |

| Deere & Company, NYSE | DE | 146.25 | 7.02(5.04%) | 298289 |

| Exxon Mobil Corp | XOM | 81.2 | 0.33(0.41%) | 4996 |

| Facebook, Inc. | FB | 181.84 | -0.02(-0.01%) | 55826 |

| Ford Motor Co. | F | 12.13 | 0.01(0.08%) | 9004 |

| General Electric Co | GE | 17.86 | 0.03(0.17%) | 30491 |

| General Motors Company, NYSE | GM | 45.05 | 0.08(0.18%) | 5050 |

| Goldman Sachs | GS | 239 | 0.98(0.41%) | 140 |

| Google Inc. | GOOG | 1,035.11 | 0.62(0.06%) | 720 |

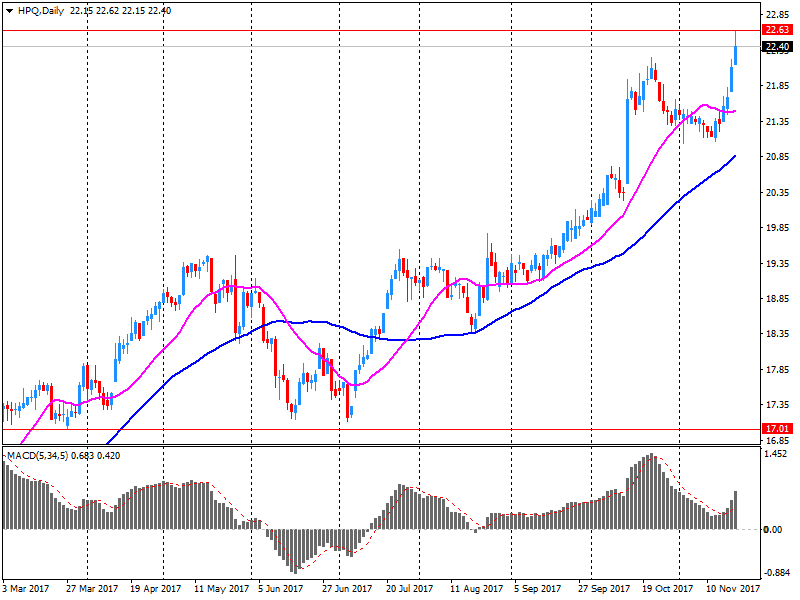

| Hewlett-Packard Co. | HPQ | 21.29 | -1.17(-5.21%) | 70088 |

| Home Depot Inc | HD | 173 | 0.14(0.08%) | 1213 |

| Intel Corp | INTC | 44.97 | 0.03(0.07%) | 56961 |

| International Business Machines Co... | IBM | 152 | 0.05(0.03%) | 1082 |

| JPMorgan Chase and Co | JPM | 98.88 | -0.05(-0.05%) | 110 |

| McDonald's Corp | MCD | 168.7 | 0.40(0.24%) | 4169 |

| Merck & Co Inc | MRK | 54.4 | 0.13(0.24%) | 1821 |

| Microsoft Corp | MSFT | 83.87 | 0.15(0.18%) | 14975 |

| Tesla Motors, Inc., NASDAQ | TSLA | 317.5 | -0.31(-0.10%) | 23844 |

| Verizon Communications Inc | VZ | 46.3 | 0.12(0.26%) | 28675 |

| Visa | V | 111.71 | 0.26(0.23%) | 2269 |

| Wal-Mart Stores Inc | WMT | 96.78 | 0.26(0.27%) | 2046 |

EURUSD: 1.1500-02 (EUR 1.2bln) 1.1650 (600m) 1.1700 (690m) 1.1750 (975m) 1.1775(360m) 1.1800-05 (1.12bln) 1.1825-30 (1.18bln) 1.1845 (385m) 1.1900-05 (1.57bln)

USDJPY: 112.00 (USD1.4bln) 112.70-80 (585m) 113.00 (680m) 113.15 (310m)

GBPUSD: 1.2900 (GBP 495m) 1.3250 (280m)

EURGBP: 0.8900 (EUR 390m)

AUDUSD: 0.7600 (AUD 555m) 0.7730-40 (1.2bln) 0.8080 (1.53bln)

USDCAD: 1.2545-50 (USD 1.0bln) 1.2780 (980m)

EURJPY: 130.25 (EUR 400m)

AUDNZD: 1.1220-25 (AUD 400m) 1.1300 (865m)

In the week ending November 18, the advance figure for seasonally adjusted initial claims was 239,000, a decrease of 13,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 249,000 to 252,000. The 4-week moving average was 239,750, an increase of 1,250 from the previous week's revised average. The previous week's average was revised up by 750 from 237,750 to 238,500.

New orders for manufactured durable goods in October decreased $2.8 billion or 1.2 percent to $236.0 billion, the U.S. Census Bureau announced today. This decrease, down following two consecutive monthly increases, followed a 2.2 percent September increase. Excluding transportation, new orders increased 0.4 percent. Excluding defense, new orders decreased 0.8 percent. Transportation equipment, also down following two consecutive monthly increases, drove the decrease, $3.5 billion or 4.3 percent to $77.1 billion. Shipments of manufactured durable goods in October, up five of the last six months, increased $0.3 billion or 0.1 percent to $241.0 billion. This followed a 1.0 percent September increase. Primary metals, up three of the last four months, led the increase, $0.3 billion or 1.5 percent to $19.9 billion.

Hewlett Packard Enterprise (HPE) reported Q4 FY 2017 earnings of $0.29 per share (versus $0.61 in Q4 FY 2016), beating analysts' consensus estimate of $0.28.

The company's quarterly revenues amounted to $7.660 bln (+4.6% y/y), missing analysts' consensus estimate of $7.779 bln.

The company also issued downside guidance for Q1 FY 2018, projecting EPS of $0.20-0.24 versus analysts' consensus estimate of $0.27.

HPE fell to $13.39 (-5.1%) in pre-market trading.

HP (HPQ) reported Q4 FY 2017 earnings of $0.44 per share (versus $0.36 in Q4 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $13.927 bln (+11.3% y/y), beating analysts' consensus estimate of $13.365 bln.

HPQ fell to $21.33 (-5.03%) in pre-market trading.

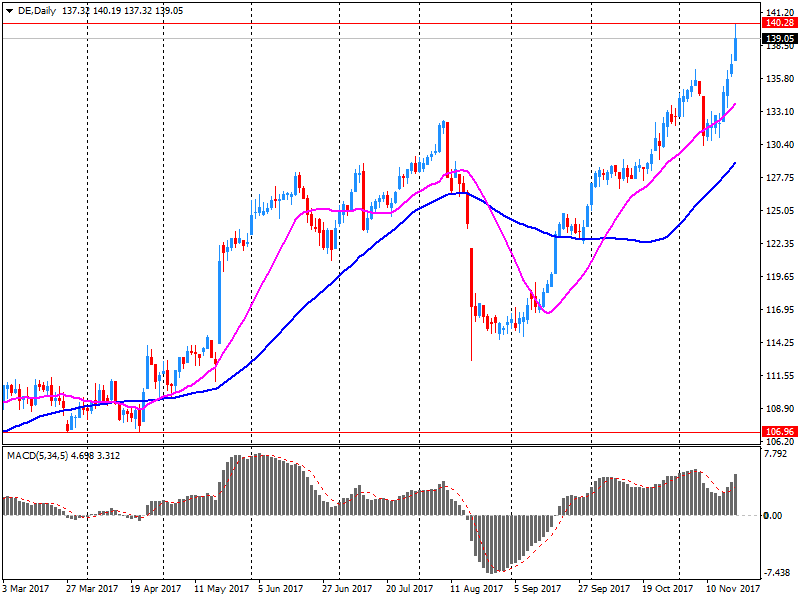

Deere (DE) reported Q4 FY 2017 earnings of $1.57 per share (versus $0.90 in Q4 FY 2016), beating analysts' consensus estimate of $1.44.

The company's quarterly revenues amounted to $7.094 bln (+25.6% y/y), beating analysts' consensus estimate of $6.911 bln.

DE rose to $145.79 (+4.71%) in pre-market trading.

-

Romania did not take effective action reduce its budget deficit, should cut structural gap in 2018 by at least 0.8 pct/gdp

-

Wants to close excessive budget deficit procedure against Britain

-

EU countries must step up efforts to fight aggressive tax planning

-

2018 draft budgets of Estonia, Ireland, Cyprus, Malta, Slovakia are broadly in line with EU rules

-

2018 draft budgets of Belgium, Italy, Austria, Portugal and Slovenia pose a risk of non-compliance with EU budget rules

-

Italy's high government debt is a reason for concern, not falling as EU rules require

-

Budget deficit at less than 2 pct in 2017

EUR/USD: 1.1500-02(1.2 b), 1.1650(600 m), 1.1700(688 m), 1.1750(971 m), 1.1775(357 m), 1.1800-05(1.12 b), 1.1825-30(1.18 b), 1.1845(382 m), 1.1900(1.57 b)

GBP/USD: 1.2900(492 m), 1.3250(279 m)

USD/JPY: 112.00(1.4 b), 112.70-80(585 m), 113.00(680 m), 113.15(309 m)

AUD/USD: 0.7600(555 m), 0.7730-40(1.2 b), 0.8080(1.53 b)

USD/CAD: 1.2545-50(996 m), 1.2780(980 m)

EUR/GBP: 0.8900(387 m)

EUR/JPY: 130.25(400 m)

-

Inflation is close to target

-

Says we will continue gradual reduction of key rate

-

We do not plan to revise 4-pct inflation target

-

Russia's financial system is stable

-

We have almost finished exit from all anti-crisis measures, will exit special instruments in coming years

EUR/USD

Resistance levels (open interest**, contracts)

$1.1843 (5959)

$1.1816 (3073)

$1.1781 (3830)

Price at time of writing this review: $1.1754

Support levels (open interest**, contracts):

$1.1716 (2264)

$1.1693 (3463)

$1.1664 (5982)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 8 is 157608 contracts (according to data from November, 21) with the maximum number of contracts with strike price $1,1500 (8419);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3328 (2791)

$1.3307 (3315)

$1.3277 (1344)

Price at time of writing this review: $1.3249

Support levels (open interest**, contracts):

$1.3190 (1023)

$1.3167 (1105)

$1.3138 (1351)

Comments:

- Overall open interest on the CALL options with the expiration date December, 8 is 41946 contracts, with the maximum number of contracts with strike price $1,3200 (3315);

- Overall open interest on the PUT options with the expiration date December, 8 is 40493 contracts, with the maximum number of contracts with strike price $1,3000 (4011);

- The ratio of PUT/CALL was 0.97 versus 0.98 from the previous trading day according to data from November, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Reaffirmed commitment to moving forward in all areas of talks in order to conclude negotiations as soon as possible

-

Inflation below target; appropriate to gradually raise rates

-

'reasonably close' to inflation, employment goals; 4.1 pct unemployment at or below goal

-

Raising rates key to dealing with potential future negative shock

-

Inflation expectations have not drifted down too much

-

Wants to avoid 'boom and bust' U.S. economy

-

Raising rates too slowly risks tightening labor market too much

European stocks closed higher Tuesday, aided by gains for airline easyJet PLC and car maker Volkswagen AG, as investors appeared to set aside concerns about the possibility of a new election in Germany. Equity markets in the region rose as major U.S. stock gauges rallied, with a leap in technology shares pushing the Nasdaq Composite Index COMP, +1.06% to an all-time high.

U.S. stock-market indexes ended at records and near session highs on Tuesday, finding support on another round of strong earnings, with technology shares leading the way. Investors focused on a number of corporate earnings and positive economic data. Trading volumes were expected to thin out this week as investors prepare for the long weekend following Thanksgiving holiday.

Global stocks extended their rally early Wednesday in Asia, with technology shares fueling the gains. The region saw broad advances, with Hong Kong's stock benchmark topping 30,000 for the first time in a decade, as the Hang Seng Index HSI, +0.90% continued its push toward late 2007's intraday record of 31,958.41.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.