- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 12:30 | Canada | Retail Sales YoY | June | 1% | |

| 12:30 | Canada | Retail Sales, m/m | June | -0.1% | -0.1% |

| 12:30 | Canada | Retail Sales ex Autos, m/m | June | -0.3% | 0% |

| 13:00 | Belgium | Business Climate | August | -5.0 | -6.0 |

| 14:00 | U.S. | New Home Sales | July | 0.646 | 0.649 |

| 14:00 | U.S. | Jackson Hole Symposium | |||

| 14:00 | U.S. | Fed Chair Powell Speaks | |||

| 17:00 | U.S. | Baker Hughes Oil Rig Count | August | 770 |

The main US stock indices mainly declined, as the publication of weaker-than-expected data on activity in the manufacturing sector raised new concerns about the state of the economy.

An IHS Markit report showed that the index of business activity in the US manufacturing sector declined in August for the first time in almost a decade, amid fears that a trade conflict between the US and China could lead to a recession. Meanwhile, data on the index of business activity for the service sector indicated a slowdown compared with the previous month.

Investors are eagerly awaiting Fed Chairman Jerome Powell's scheduled Friday speech at a central bank conference in Jackson Hole, Wyoming, which kicked off today. Released on the eve of the minutes of the July meeting of the Central Bank of the United States showed that the views of Fed leaders are deeply divided about the further reduction in rates. In addition, Kansas City Federal Reserve Bank President Esther George (FOMC voting member) said today that she maintains interest rates at current levels, while Philadelphia Federal Reserve President Patrick Harker (non-voting FOMC member) said he currently sees no reason for additional measures. stimulation. Powell’s performance will be closely monitored for clues about the regulator’s monetary policy plans and could have a strong impact on investor sentiment in the short term.

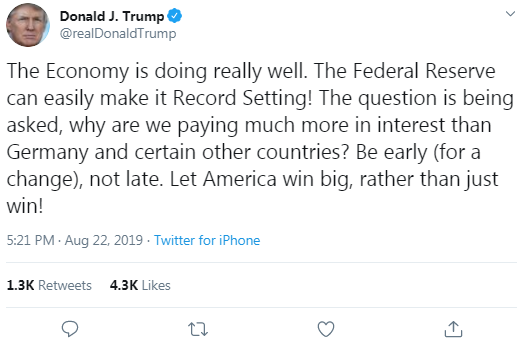

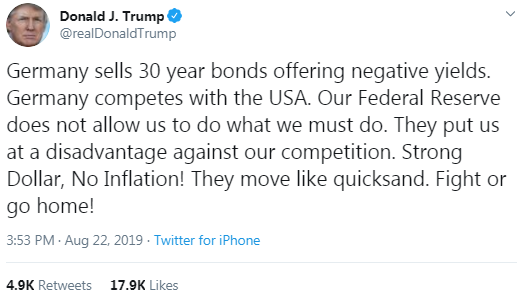

Meanwhile, US President Donald Trump continued to “attack” the US Central Bank, urging him to lower interest rates. Today, trump wrote on Twitter that the Fed puts the United States at a disadvantage in relation to competitors. “A strong dollar, no inflation!” Said the president.

Most DOW components completed trading in positive territory (21 out of 30). The biggest gainers were The Boeing Co. (BA; + 4.71%). Outsiders were shares of UnitedHealth Group Incorporated (UNH; -2.83%).

Most S&P sectors completed trading in the red. The conglomerate sector showed the largest decline (-1.6%). The industrial goods sector grew the most (+ 0.5%).

At the time of closing:

Dow 26,252.24 +49.51 +0.19%

S&P 500 2,922.95 -1.48 -0.05%

Nasdaq 100 7,991.39 -28.82 -0.36%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 12:30 | Canada | Retail Sales YoY | June | 1% | |

| 12:30 | Canada | Retail Sales, m/m | June | -0.1% | -0.1% |

| 12:30 | Canada | Retail Sales ex Autos, m/m | June | -0.3% | 0% |

| 13:00 | Belgium | Business Climate | August | -5.0 | -6.0 |

| 14:00 | U.S. | New Home Sales | July | 0.646 | 0.649 |

| 14:00 | U.S. | Jackson Hole Symposium | |||

| 14:00 | U.S. | Fed Chair Powell Speaks | |||

| 17:00 | U.S. | Baker Hughes Oil Rig Count | August | 770 |

Tim Riddell, the senior market strategist at Westpac, thinks that markets had been primed by Draghi to anticipate both rate cuts and a restart of the ECB’s asset purchase program.

- “The clear indication now is that ECB are likely to loosen their largely self-imposed limits on purchases with the potential of an “operation switch” to extend duration and credit in order to have greater impact.

- The danger for ECB now is that markets have built up their expectations. This could result in a perceived failure to deliver causing market distress that could undermine confidence and EUR.

- Uncertainty from politics in Italy and Spain should be seen as distractions at present. If Germany can push fiscal stimulus, together with effective ECB policy, there could be a notable lift for regional confidence and EUR. However, EUR rebounds are likely to be limited in the near term. Obstacles for German policy and risks of ECB disappointment may test EUR’s 1.10 support.”

- We are not out of sync with other economies

- Fed needs to do what is appropriate for the US

- Rates cannot get too far away from other global rates

- Fed is roughly where neutral is

- He does not see case for further easing

- We should stay here for a while, see how things play out

- The yield curve inversion is "a signal" but not the only signal. We must look at many

- Labor market is strong, inflation is moving up slowly

The European

Commission reported on Wednesday its flash estimate showed the consumer confidence

indicator for the Eurozone decreased 0.5 points to -7.1 in August from the

previous month.

Economists had

expected the index to fall to -7.0.

Considering the

European Union (EU) as a whole, consumer sentiment also dropped 1.1 points to -7.0.

Despite these declines,

both indicators remain on a broadly horizontal trajectory well above their

respective long-term averages of -10.7 (Eurozone) and -10.0 (EU), the report

said.

Preliminary

data released by IHS Markit on Thursday indicated that the U.S. private sector growth

hit a three-month low in August, as new orders posted the slowest rise for a decade.

According to

the report, the Markit flash manufacturing purchasing manager's index (PMI)

stood at 49.9 in August, down 50.4 in July. The latest reading pointed to the

first contraction in the manufacturing sector since September 2009.

Economists had

expected the reading to increase to at 50.5.

A reading above

50 signals an expansion in activity, while a reading below this level signals a

contraction.

According to

the report, the decline in the headline PMI mainly reflected a much weaker

contribution from new orders, which offset a stabilization in employment and

fractionally faster output growth.

Meanwhile, the

Markit flash services purchasing manager's index (PMI) dropped to 50.9 this

month, from 53 in the prior month. The latest reading pointed to only a

marginal rate of expansion in the service sector.

Economists had

expected the reading to decrease to 52.8.

Overall, IHS

Markit Flash U.S. Composite PMI Output Index came in at 50.9 in August, down from

52.6 in the previous month, signaling only a slight increase in business

activity and the slowest pace of expansion for three months.

Commenting on

the flash PMI data, Tim Moore, Economics Associate Director at IHS Markit noted:

“August’s survey data provides a clear signal that economic growth has

continued to soften in the third quarter. The PMIs for manufacturing and

services remain much weaker than at the beginning of 2019 and collectively

point to annualized GDP growth of around 1.5%. The most concerning aspect of

the latest data is a slowdown in new business growth to its weakest in a decade,

driven by a sharp loss of momentum across the service sector”.

U.S. stock-index futures rose on Thursday as investors looked ahead to the start of an annual gathering of central bankers in in Jackson Hole, Wyoming.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,628.01 | +9.44 | +0.05% |

Hang Seng | 26,048.72 | -221.32 | -0.84% |

Shanghai | 2,883.44 | +3.11 | +0.11% |

S&P/ASX | 6,501.80 | +18.50 | +0.29% |

FTSE | 7,178.55 | -25.42 | -0.35% |

CAC | 5,428.12 | -7.36 | -0.14% |

DAX | 11,829.00 | +26.15 | +0.22% |

Crude oil | $56.34 | +1.19% | |

Gold | $1,506.20 | -0.63% |

- We can work on finding a regime that keeps the Good Friday agreement and also ensures the integrity of the EU single market

(company / ticker / price / change ($/%) / volume)

ALCOA INC. | AA | 18.49 | 0.02(0.11%) | 1156 |

ALTRIA GROUP INC. | MO | 46.12 | -0.13(-0.28%) | 19996 |

Amazon.com Inc., NASDAQ | AMZN | 1,830.00 | 6.46(0.35%) | 22702 |

Apple Inc. | AAPL | 213.44 | 0.80(0.38%) | 126420 |

AT&T Inc | T | 35.2 | 0.04(0.11%) | 19516 |

Boeing Co | BA | 341.4 | 1.41(0.41%) | 8500 |

Caterpillar Inc | CAT | 117.82 | 0.14(0.12%) | 104 |

Chevron Corp | CVX | 118.5 | 0.62(0.53%) | 1294 |

Cisco Systems Inc | CSCO | 48.97 | 0.20(0.41%) | 23262 |

Citigroup Inc., NYSE | C | 63.6 | 0.35(0.55%) | 9008 |

Exxon Mobil Corp | XOM | 69.9 | 0.18(0.26%) | 8198 |

Facebook, Inc. | FB | 184 | 0.45(0.25%) | 27285 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.13 | -0.01(-0.11%) | 3110 |

General Electric Co | GE | 8.13 | -0.03(-0.37%) | 216657 |

Goldman Sachs | GS | 202.1 | 1.42(0.71%) | 5338 |

Google Inc. | GOOG | 1,195.00 | 3.75(0.31%) | 807 |

Hewlett-Packard Co. | HPQ | 19.07 | 0.11(0.58%) | 17537 |

Home Depot Inc | HD | 220.59 | 0.19(0.09%) | 1975 |

Intel Corp | INTC | 47.23 | 0.08(0.17%) | 7052 |

International Business Machines Co... | IBM | 134.76 | 0.51(0.38%) | 2538 |

Johnson & Johnson | JNJ | 132 | 0.47(0.36%) | 1381 |

JPMorgan Chase and Co | JPM | 108.25 | 0.64(0.59%) | 14123 |

McDonald's Corp | MCD | 221.12 | 0.41(0.19%) | 1633 |

Microsoft Corp | MSFT | 139.25 | 0.46(0.33%) | 27288 |

Nike | NKE | 83.19 | 0.45(0.54%) | 2686 |

Pfizer Inc | PFE | 35 | 0.13(0.37%) | 3785 |

Procter & Gamble Co | PG | 119.49 | 0.29(0.24%) | 3403 |

Starbucks Corporation, NASDAQ | SBUX | 96.01 | -0.31(-0.32%) | 2049 |

Tesla Motors, Inc., NASDAQ | TSLA | 227.25 | 6.42(2.91%) | 512628 |

The Coca-Cola Co | KO | 54.17 | 0.07(0.13%) | 3842 |

Twitter, Inc., NYSE | TWTR | 42.82 | 0.02(0.05%) | 21441 |

UnitedHealth Group Inc | UNH | 241 | 0.65(0.27%) | 215 |

Verizon Communications Inc | VZ | 56.58 | -0.01(-0.02%) | 1715 |

Visa | V | 181.69 | 0.75(0.41%) | 3647 |

Walt Disney Co | DIS | 135.77 | 0.01(0.01%) | 1161 |

Yandex N.V., NASDAQ | YNDX | 36.69 | 0.23(0.63%) | 3640 |

Canada’s

wholesale sales rise more than forecast in June

Statistics

Canada reported on Monday the wholesale sales rose 0.6 percent m-o-m to CAD64.15

million in June, following a revised 1.9 percent m-o-m decrease in May

(originally a 1.8 percent m-o-m drop).

Economists had

forecast an advance of 0.3 percent m-o-m for June.

According to

the report, higher sales were recorded in four of seven subsectors, accounting

for 54 percent of total wholesale sales. The

miscellaneous (+3.5 percent m-o-m), and the machinery, equipment and supplies (+1.5

percent m-o-m) subsectors contributed the most to the June advance, while the

motor vehicle and motor vehicle parts and accessories subsector (-1.9 percent

m-o-m) recorded the largest drop. Excluding motor vehicle and parts, wholesale

sales grew 1.1 percent m-o-m in June.

During the

second quarter of 2019, sales rose 1.3 percent, recording the 13th consecutive

quarterly gain.

At the same

time, wholesale inventories increased 1.5 percent m-o-m in June. Inventories

were up in six of seven subsectors, representing about 83 percent of total

wholesale inventories. Inventories surged 3.2 percent in the second quarter, recording

the 12th consecutive quarterly increase.

U.S. weekly

jobless claims decrease more than expected

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment benefits fell last week, pointing to a firm labor market

conditions despite concerns the economy is on a path toward recession.

According to

the report, the initial claims for unemployment benefits decreased by 12,000 to

a seasonally adjusted 209,000 for the week ended August 17.

Economists had

expected 216,000 new claims last week.

Claims for the

prior week were revised upwardly to 221,000 from the initial estimate of 220,000.

Meanwhile, the

four-week moving average of claims went up 500 to 214,500 last week.

- It's not the time for accommodation, labour market remains strong

- Businesses are still reporting issues finding workers, we are seeing higher wages

- We are at rate equilibrium now

- Economy absorbed downside risk

- Survey data have indicated a slowdown in global activity in the second quarter of 2019, particularly in manufacturing

- Global trade has remained subdued on the back of a weakening of both global investment and durable goods consumption growth, as well as ongoing trade tensions

- Since the June monetary policy meeting, the euro exchange rate has depreciated slightly, both in bilateral terms against the US dollar and in nominal effective terms

- Incoming information since the June meeting points to subdued growth in the second and third quarters of the year and indicates that risks to the outlook remained tilted to the downside

- Business surveys since mid-June suggest an ongoing slowdown in output growth, with the gap between weak manufacturing and generally stronger services activity widening somewhat further

- The trade outlook has remained surrounded by uncertainty and there is no clear sign of stabilisation

- The financial conditions have eased since the June meeting, largely on account of market expectations of further monetary policy easing

- A mechanical update of the short-term HICP outlook suggests a somewhat lower path

- Survey-based measures of longer-term inflation expectations in the euro area had declined

- There is now an increased likelihood that the economic slowdown or “soft patch” that has emerged last year would be more protracted than had previously been anticipated

- Available “soft” indicators at present point to slower growth in the third quarter of 2019, raising more general doubts regarding the expected recovery in the second half of the year

- A policy package – such as the combination of rate cuts and asset purchases – more effective than a sequence of selective actions

- Thinks we can get a deal

- Encouraged by talks in Berlin yesterday

- We can find a way forward

- It is vital for trust in politics to deliver on the referendum

- A great deal of work has already been done to ensure a smooth transition on October 31

- We want to do all the necessary work on both sides to prepare for Brexit

- Under no circumstances will UK government institute checks or controls at Irish border

- No-deal is not the choice of EU

- Have always respected the UK's decision to leave

- However, have to also protect the European project

- Backstop is the protector of stability in Ireland

- Backstop is indispensable guarantee of stability

- We need visibility in 30 days on backstop

- No one will wait until October 31 for a good solution

- The coming month must be useful, but can’t change the Withdrawal Agreement

Analysts at TD Securities note that this morning's flash PMIs for Eurozone were all a bit better than expected.

- “While the details for the French PMI were reasonably upbeat, in line with the improvement in the headlines (mfg 51.0 vs mkt 49.5 and services 53.3 vs mkt 52.5), the details of the German report were quite downbeat even though the headlines improved (mfg 43.6 vs mkt 43.0 and services 54.4 vs mkt 54.0).

- Markit noted that job creation slipped to a 5y low, while new orders fell further into contraction territory expectations turned net negative for the first time since 2014. Markit also added that the survey didn't do anything to dispel the threat of another contraction in GDP in Q3, especially given the deterioration in forward-looking indicators.”

Imre Speizer, an analyst at Westpac, sees the NZD/USD continues to grind lower, with 0.6350 their target for the week ahead.

- “Longer term, we see scope for it to fall to the mid-0.62s.

- The main negative factor is yield spreads, with the RBNZ’s new-found boldness and likelihood of another cut in November keeping spreads depressed.

- But trade wars are taking a toll also, both via the sentiment channel as well as via export commodity prices. China is NZ’s largest buyer of dairy products, and we suspect the 9% fall in prices since May is partly related to China’s trade war-related slowdown.

- The main risk to our bearish view is the Fed lowers its rate by more than the 75bp we expect this year (or signals such).”

The

Confederation of British Industry (CBI) reported on Thursday its latest survey

of retailers showed retail sales volume balance dropped to -49 in August from

-16 in July. It was the lowest reading since December 2008.

Economist had

forecast the reading to come in at -11.

The report revealed that orders placed on suppliers also fell at the quickest rate since

December 2008 (-57) and are expected to decline again in September, albeit at a

slower pace (-29). Meanwhile, retailers expect the sharpest deterioration in

business conditions since February 2009 in the coming months.

According to

the report, retail sales volumes dropped across most sectors, including in

grocers, clothing and hardware & DIY. Non-store retailing was the only

sector that saw a rise in sales.

Anna Leach, CBI

Deputy Chief Economist, noted: “Sentiment is crumbling among retailers, and

unexpectedly weak sales have led to a large overhang of stocks. With investment

intentions for the year ahead and employment down, retailers expect a chilly

few months ahead. It is unsurprising that business confidence has deteriorated

sharply, with a potential no-deal Brexit on the horizon. But retailers are also

buckling under the cumulative burden of costs, including an outdated business

rates system and the apprenticeship levy. Businesses will be looking for

government action at the Budget in the coming months to alleviate some of these

pressures.”

Analysts at TD Securities notes that the July FOMC minutes suggested there was a bit more disagreement among FOMC members than the two dissents suggested.

“Overall, the Fed stuck to the "midcycle adjustment" and "optionality" themes, and provided 3 reasons for delivering the July rate cut: 1) decelerating activity; 2) risk management; and 3) low inflation.”

Sean Callow, analyst at Westpac, suggests that AUD seems to have quite a few factors in its favour.

“RBA minutes this week left the door open to lower rates “if the accumulation of additional evidence” supported further easing. This makes a 3 Sep cut even less likely, with pricing down to 10% and a move by Oct (our base case) 60%. Moreover, substantial short A$ spec positioning implies considerable bad news on US-China trade relations is already in the price. Fed chair Powell’s speech at Jackson Hole should set the path for AUD/USD early in the week. The dovish tone that would be consistent with our Fed call (-75bp by end-2019) could help AUD/USD re-test recent highs around 0.6820. But overall the s/t view vs US$ is neutral, while trying longs on crosses e.g. NZD, EUR and GBP.”

According to ANZ analysts, the FOMC minutes for the July meeting came and went with little fanfare.

“Most officials viewed the July rate cut as a mid-cycle adjustment in response to the evolution of the economic outlook. There was also discussion around wanting to avoid looking like they were on a path to more cuts. That said, two officials would have preferred to cut 50bps. Guidance from here remains data dependant, with minutes noting policy needs to be guided by incoming information, and avoid any appearance of following a pre-set course. Since the July meeting, Trump has announced an additional 10% tariff on imports from China, so it’s fair to say the world has changed a bit. Markets now look towards Powell’s Jackson Hole speech (2am Saturday NZT).”

Tim Riddell, senior market strategist at Westpac, suggests that the US yield curve inversion has heightened markets’ angst over US recession risks.

“Bloomberg and NY Fed (1yr ahead) recession indices, which both incorporate yield curves, show the sharp rise in those risks. Though there were pockets when individual indices rose without a recession, this was rarely the case when both indices rose. The 30-31 July FOMC minutes did not show any urgency or deepening concern though there was a notable increase in divergent views and desire to maintain flexibility. The iteration of the mid-cycle nature of their easing, despite increased external concerns, may keep curve inversion in play and therefore the market’s sense of potential recession. Further yield curve concerns may be a feature of the Kansas Fed Symposium. Trump’s recent comments on unfavourably low/negative rates overseas could lead to further trade tariff tactics being deployed. The combination of such events could continue to favour USD overall even if there might be a rush towards safe haven currencies.”

Italy’s President Sergio Mattarella wants political parties to reach a deal to form a new coalition government in the next few days if they want to avoid snap elections, a source close to him said on Thursday.

The president has started consultations to find a new government after the ruling coalition collapsed and Prime Minister Giuseppe Conte resigned this week.

On Thursday, Mattarella will meet delegations from the centre-left Democratic Party (PD) and the anti-establishment 5-Star Movement, which could forge a new ruling coalition.

The president wants clear signals of a possible deal on Thursday and to see major developments by early next week, the source said.

Some investors fear that if interior Minister Matteo Salvini uses elections to form a League-led government as prime minister, he will ramp up spending and set the heavily indebted nation on a collision course with the European Union.

The Barclays Research Team now believes that the UK will likely leave the European Union (EU) without a deal. Therefore, it sees the UK economy facing a recession and the Bank of England (BOE) cutting the interest rates next year.

“In the light of recent political developments, particularly the policy statements of the new administration we change our central working assumption from expecting the agreement of a withdrawal deal by the end of the year, to the UK departing the EU without a deal, either on 31 October, or shortly thereafter, if, for example a snap election has been called that delays the current 31 October deadline. In contrast to Theresa May's administration, we believe that the government is committed to no-deal if necessary, and possibly has greater room to deliver it. We consequently expect the country to enter a shallow recession in 2020 and the Bank of England to cut rates by 50bp by mid-2020, despite some initial jump in inflation on the back of the attendant currency depreciation. We believe the risks to our forecasts are tilted to the downside: a deeper recession could take hold should the expected disruption and confidence effects of a no-deal out turn be larger than expected.”

According to latest PMI data from IHS Markit, the recent soft patch in the eurozone economy continued into August, with activity rising modestly amid a marginal increase in new business. The recent pattern of services growth compensating for a downturn in manufacturing was repeated midway through the third quarter. August did see a drop off in confidence among companies in the single currency area, with firms becoming more wary of hiring additional staff as a result.

The Eurozone Composite PMI ticked up to 51.8 in August, up from July’s three-month low of 51.5 but still one of the weakest readings for six years.

Although narrowing slightly from the previous month, there remained a wide divergence in performance between the manufacturing and service sectors. Services activity continued to increase at a solid pace, with growth recorded in Germany, France and across the rest of the euro area. In contrast, manufacturing output was down for the seventh month running, albeit to a lesser extent than in July. While France was able to eke out production growth, falls were seen in Germany and outside of the ‘big-2’.

Flash Eurozone Services PMI Activity Index rose to 53.4 from 53.2 in July, to 2-month high.

Flash Eurozone Manufacturing PMI rose to 47.0 from 46.5 in July, to 2-month high.

According to the flash report from IHS Markit, the German economy continued to underperform in August. Growth of service sector business activity was again countered by a marked fall in goods production, while overall job creation slipped to a five-year low. Worryingly for the outlook, total new orders sank deeper into contraction territory and firms’ expectations towards future output turned negative for the first time since late 2014. Elsewhere, PMI data pointed to a further softening of inflationary pressures, driven by further falls in both manufacturing input costs and output charges.

At 51.4 in August, the Flash Germany Composite Output Index – which is based on approximately 85% of usual monthly replies – was up slightly from 50.9 in July, but still pointed to one of the weakest performances over the past six years. Robust growth of service sector business activity (Flash Services PMI down to 54.4 from 54.5 in July, to 7-month low) kept the headline index above the 50.0 no-change mark, although it was a slower (but still marked) decrease in manufacturing output that was behind the slightly improved reading. As such, August also saw the Flash Germany Manufacturing PMI tick up from 43.2 in July to 43.6.

Japanese Economy Minister Toshimitsu Motegi said there were still gaps that needed to be filled before Tokyo and Washington could agree on a bilateral trade deal and that negotiations with his U.S. counterpart were “very tough.”

“Issues that need to be sorted out in ministerial-level talks have been narrowed down quite a bit,” Motegi told reporters after his meeting with U.S. Trade Representative Robert Lighthizer

“We agreed to speed up discussions and work on the remaining issues for an early achievement of results,” he said.

The talks aims to lay the groundwork for a possible meeting between Japanese Prime Minister Shinzo Abe and U.S. President Donald Trump, to be held on the sidelines of this weekend’s G7 summit in France.

Separate trade talks with China and Europe have made little headway and Trump is keen to clinch an early deal with Japan that would open up its politically sensitive agriculture sector, as well as curbing Japan’s U.S.-bound auto exports.

Japan, on the other hand, wants the United States to cut tariffs on imports of car parts and industrial goods - something Washington is reluctant to do.

EUR/USD remains under pressure and could extend the move lower to yearly lows in the 1.1020/30 band, according to FX Strategists at UOB Group.

24-hour view: “EUR traded in a quiet manner yesterday as it registered a tight range of 28 pips (the 1.1079/1.1107 range was narrower than our expected 1.1075/1.1125). Indicators are mostly ‘flat’ and the current consolidation phase could persist for today. In other words, EUR is expected to continue to trade sideways, likely between 1.1070 and 1.1115”.

Next 1-3 weeks: “EUR dipped briefly yesterday but rebounded after testing Monday’s (19 Aug) low of 1.1065 (overnight low of 1.1064). The price action offers no fresh clues and for now, we continue to hold the view that there is scope for EUR to retest the early August low of 1.1025. As indicated on Monday (19 Aug, spot at 1.1095), it is unclear at this stage whether there is enough momentum to break the crucial 1.1000 level (even though after the lackluster price action over the past two days, the prospect for a break of this level is not high). That said, EUR is expected to stay under pressure unless it can move above 1.1160 (no change in ‘key resistance’ level)”.

Major Chinese state-owned banks were seen supporting the yuan in the forwards markets on Thursday after it fell to fresh 11-year lows, two traders with knowledge of the matter said.

The banks were receiving dollar liquidity in the forwards market before selling the greenback in the onshore spot market, traders said.

One of them said the state banks were seen selling dollars at around 7.07 yuan to the dollar in the spot market to prevent sharper losses in the local unit.

The onshore yuan traded at 7.0735 per dollar as of 06:20 GMT, down from the previous late night close of 7.0633. It had earlier slid to 7.0752, the weakest since March 2008

Analysts at TD Securities are looking for Germany's manufacturing PMI to fall another 1pt lower in August to 42.2 (market 43.0), which would be a new post-GFC low, as the trough during the Eurozone crisis was 43.0 in July 2012 (the month of Draghi's "whatever it takes" moment).

“The services sector in general should hold up better, as it's less exposed to the downside from global trade tensions. We look for the French services PMI to slip to 51.8 (mkt 52.5). We also have the ECB minutes at 11:30 GMT today, which may give us some further colour around the ECB's policy discussions at last month's meeting. However, in the July Q&A, Draghi did say that the Governing Council did not discuss rate cuts or other specifics (size of rate cut, PSPP limits) at that meeting, so we're unlikely to get as much detail as we would like.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1214 (2611)

$1.1177 (2111)

$1.1150 (856)

Price at time of writing this review: $1.1083

Support levels (open interest**, contracts):

$1.1058 (4536)

$1.1026 (4105)

$1.0986 (7381)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date September, 6 is 105574 contracts (according to data from August, 21) with the maximum number of contracts with strike price $1,1400 (8875);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2261 (1167)

$1.2208 (953)

$1.2175 (194)

Price at time of writing this review: $1.2122

Support levels (open interest**, contracts):

$1.2092 (1538)

$1.2076 (967)

$1.2029 (2073)

Comments:

- Overall open interest on the CALL options with the expiration date September, 6 is 30067 contracts, with the maximum number of contracts with strike price $1,2750 (4128);

- Overall open interest on the PUT options with the expiration date September, 6 is 24568 contracts, with the maximum number of contracts with strike price $1,2100 (2073);

- The ratio of PUT/CALL was 0.82 versus 0.81 from the previous trading day according to data from August, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 59.92 | 0.44 |

| WTI | 55.73 | -0.5 |

| Silver | 17.09 | -0.23 |

| Gold | 1502.22 | -0.34 |

| Palladium | 1469.13 | -1.18 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -58.65 | 20618.57 | -0.28 |

| Hang Seng | 38.5 | 26270.04 | 0.15 |

| KOSPI | 4.4 | 1964.65 | 0.22 |

| ASX 200 | -61.7 | 6483.3 | -0.94 |

| FTSE 100 | 78.97 | 7203.97 | 1.11 |

| DAX | 151.67 | 11802.85 | 1.3 |

| Dow Jones | 240.29 | 26202.73 | 0.93 |

| S&P 500 | 23.92 | 2924.43 | 0.82 |

| NASDAQ Composite | 71.65 | 8020.21 | 0.9 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67828 | 0.12 |

| EURJPY | 118.168 | 0.27 |

| EURUSD | 1.10873 | -0.09 |

| GBPJPY | 129.274 | 0.02 |

| GBPUSD | 1.21279 | -0.31 |

| NZDUSD | 0.64022 | -0.13 |

| USDCAD | 1.32853 | -0.24 |

| USDCHF | 0.9819 | 0.46 |

| USDJPY | 106.578 | 0.32 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.