- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 10:00 | United Kingdom | CBI industrial order books balance | July | -15 | -15 |

| 12:20 | United Kingdom | MPC Member Andy Haldane Speaks | |||

| 13:00 | U.S. | Housing Price Index, m/m | May | 0.4% | 0.3% |

| 14:00 | Eurozone | Consumer Confidence | July | -7.2 | -7.2 |

| 14:00 | U.S. | Richmond Fed Manufacturing Index | July | 3 | 5 |

| 14:00 | U.S. | Existing Home Sales | June | 5.34 | 5.34 |

| 22:45 | New Zealand | Trade Balance, mln | June | 264 | 100 |

Major US stock indexes rose slightly, as investors were cautious in anticipation of the publication of a large block of significant corporate reports this week.

About 30% of the S & P 500 companies are due to release their quarterly results this week, including Coca-Cola (KO), United Technologies (UTX) and Visa (V) on Tuesday; Boeing (BA), Caterpillar (CAT) and Facebook (FB) on Wednesday; Amazon (AMZN), Alphabet (GOOG) and Intel (INTC) on Thursday; McDonald's (MCD) on Friday. Investors will analyze the results of companies to assess the impact of the trade war on corporate results, to find out if the results are weak enough to convince the Fed to take decisive action this year. To date, more than 15% of the companies in the S & P 500 index have already published their quarterly results. According to FactSet, of these companies, 78.5% showed higher-than-expected earnings for the last reporting period and 67% reported quarterly earnings that exceeded estimates. After a good start to the corporate reporting season, analysts polled by Refinitiv now predict that the profits of the S & P 500 companies will show an increase of about 1% y / y, whereas they had previously expected a slight decline.

Investors also continue to monitor the trade negotiations between the United States and China. As the South China Morning Post reported today, US trade representatives are likely to visit China next week to meet with Chinese officials for the first time after the G20.

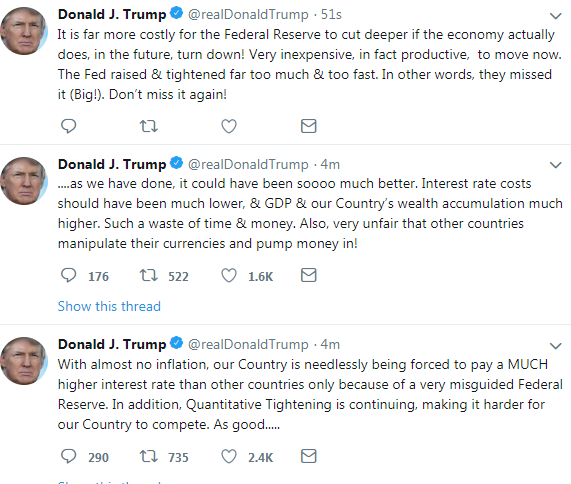

The focus of market participants was also a new portion of Twitter-criticism from US President Trump to the Fed because of “too strong and fast” rate hikes and stricter policies, in which he also advised the Fed to “reduce more” interest rates at the upcoming meeting 30 July 31. In the meantime, expectations of a deeper rate cut have weakened somewhat. According to the FedWatch CME Group tool, market expectations for a rate cut of 25 basis points at the end of this month are 77.5%. Meanwhile, the likelihood of a more significant decrease Nia - by 50 basis points - is estimated at only 22.5% (against 29.2% a week ago).

Most of the components of DOW finished trading in positive territory (16 of 30). Verizon Communications Inc. was an outsider. (VZ; -1.97%). The growth leader was Intel Corporation (INTC; + 2.30%).

Most sectors of the S & P recorded an increase. The sector of conglomerates grew the most (+ 0.7%). The largest decline was shown by the utility sector (-0.5%).

At the time of closing:

Dow 27,172.65 +18.45 +0.07%

S & P 500 2,985.02 +8.41 +0.28%

Nasdaq 100 8,204.14 +57.65 +0.71%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 10:00 | United Kingdom | CBI industrial order books balance | July | -15 | -15 |

| 12:20 | United Kingdom | MPC Member Andy Haldane Speaks | |||

| 13:00 | U.S. | Housing Price Index, m/m | May | 0.4% | 0.3% |

| 14:00 | Eurozone | Consumer Confidence | July | -7.2 | -7.2 |

| 14:00 | U.S. | Richmond Fed Manufacturing Index | July | 3 | 5 |

| 14:00 | U.S. | Existing Home Sales | June | 5.34 | 5.34 |

| 22:45 | New Zealand | Trade Balance, mln | June | 264 | 100 |

Analysts at TD Securities believe the ECB will kick off another easing cycle at this week's meeting, in words for now but setting up for deeds in September.

- “The ECB has been edging in that direction through 2019, extending its forward guidance in March and again in June. We think that it will have to throw in the towel on calendar-based guidance altogether at this meeting, as focus turns to rate cuts rather than rate hikes.

- At the June meeting, we know that the ECB discussed its options to ease further, given the growing downside risks to growth. And later in the month at the Sintra conference, Draghi said quite clearly that, "In the absence of improvement, such that the sustained return of inflation to our aim is threatened, additional stimulus will be required.

- With no obvious improvement in the macro outlook, we know that further stimulus is coming, it's just a question of what kind and how much. We think that the ECB will spend the summer considering that question, and wait until September and more up-to-date macro forecasts before making any firm decisions.

- So the July meeting may not see that much market reaction in the end if things play out as we expect, but the potential for surprise is much higher than before as the ECB cracks open the toolkit that it thought it had closed when it finished QE at the end of 2018.”

- Adds that EU would be forced to respond to any U.S. tariff on cars

- Says tit-for-tat tariffs would result in lose-lose situation

Analysts at Royal Bank of Canada (RBC) suggest that the markets attention this week will be on US data which is headlined by Friday’s Q2 GDP release.

- “Normally, the first cut of US GDP would have important policy implications, especially in the week ahead of an FOMC meeting. But with markets now fully anticipating a 25 basis point cut on July 31 (and even pricing in some odds of a 50 basis point reduction) it’s hard to envision an upside surprise on GDP that would have the Fed hold rates steady.

- In fact, this report should highlight that a rate cut is less about the state of recent economic data and more about providing insurance against trade tensions and slowing global growth (better embodied in sentiment data and activity indicators abroad).

- Consumer spending was the standout performer in Q2. Last week’s data confirmed US core retail sales grew at an 8% annualized rate in the quarter, the best pace since 2005. This will contribute to household spending rebounding to a 3.8% pace, among the best gains in recent years and sufficient to dispel any concerns about the health of US consumers following a slow start to the year.

- All told, domestic demand is expected to post a 3.4% gain, the strongest in a year.

- Headline GDP growth will be less impressive—we expect a 2.2% annualized increase as inventories swing from Q1 add to Q2 drag (i.e. some of the increase in Q2 spending came out of goods produced in earlier quarters and thus doesn’t count toward Q2 output).Net exports, which provided a nice add in the previous quarter, will have subtracted modestly from growth. The end result should be the opposite of Q1 when headline growth was strong but domestic spending soft. Again, this won’t be a report that explains why the Fed looks set to lower interest rates the following week, though it could lead those looking for a 50 basis point cut to reassess.”

Statistics Canada reported on Monday the wholesale sales fell 1.8 percent m-o-m to CAD63.82 million in May, following a revised 1.6 percent m-o-m increase in April (originally a 1.7 percent m-o-m surge). That was the largest decline in wholesale trade since March 2016.

Economists had

forecast an advance of 0.5 percent m-o-m for May.

According to

the report, lower sales were recorded in five of six subsectors, accounting for

86 percent of total wholesale sales. The motor vehicle and motor vehicle parts

and accessories subsector (-4.3 percent m-o-m) was the leading contributor to May’s

decline, followed by the miscellaneous subsector (-4.3 percent m-o-m).

Excluding motor vehicle and parts, wholesale sales dropped 1.3 percent m-o-m in

May.

At the same

time, wholesale inventories increased 1.1 percent m-o-m in May. Inventories

were up in six of seven subsectors, representing about 83 percent of total

wholesale inventories.

U.S. stock-index futures rose moderately on Monday ahead of a busy week of corporate earnings. In addition, investors continued to monitor the latest developments in trade negotiations between the United States and China.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,416.79 | -50.20 | -0.23% |

Hang Seng | 28,371.26 | -394.14 | -1.37% |

Shanghai | 2,886.97 | -37.23 | -1.27% |

S&P/ASX | 6,691.20 | -9.10 | -0.14% |

FTSE | 7,531.98 | +23.28 | +0.31% |

CAC | 5,569.11 | +16.77 | +0.30% |

DAX | 12,324.20 | +64.13 | +0.52% |

Crude oil | $56.35 | +1.29% | |

Gold | $1,427.40 | +0.05% |

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC. | MO | 50.59 | 0.06(0.12%) | 1212 |

Amazon.com Inc., NASDAQ | AMZN | 1,974.00 | 9.48(0.48%) | 33379 |

American Express Co | AXP | 125.06 | 0.24(0.19%) | 4930 |

Apple Inc. | AAPL | 203.81 | 1.22(0.60%) | 193318 |

AT&T Inc | T | 32.89 | 0.10(0.31%) | 33150 |

Boeing Co | BA | 377.46 | 0.10(0.03%) | 17382 |

Caterpillar Inc | CAT | 136.37 | 0.14(0.10%) | 5270 |

Chevron Corp | CVX | 125.09 | 0.05(0.04%) | 236 |

Cisco Systems Inc | CSCO | 57.61 | 0.25(0.44%) | 6435 |

Citigroup Inc., NYSE | C | 70.94 | 0.02(0.03%) | 932 |

Deere & Company, NYSE | DE | 165.49 | -0.12(-0.07%) | 1001 |

Exxon Mobil Corp | XOM | 75.29 | 0.30(0.40%) | 7582 |

Facebook, Inc. | FB | 199.58 | 1.22(0.62%) | 80666 |

FedEx Corporation, NYSE | FDX | 167.7 | 0.57(0.34%) | 1006 |

Ford Motor Co. | F | 10.13 | 0.08(0.80%) | 121887 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.55 | 0.06(0.52%) | 21075 |

General Electric Co | GE | 10.08 | 0.04(0.40%) | 99352 |

General Motors Company, NYSE | GM | 39.85 | 0.37(0.94%) | 1735 |

Google Inc. | GOOG | 1,134.62 | 4.52(0.40%) | 4554 |

Home Depot Inc | HD | 213.65 | 0.61(0.29%) | 630 |

Intel Corp | INTC | 50.08 | -0.19(-0.38%) | 25785 |

International Business Machines Co... | IBM | 149.81 | 0.13(0.09%) | 10741 |

Johnson & Johnson | JNJ | 130.7 | 0.39(0.30%) | 3856 |

JPMorgan Chase and Co | JPM | 113.28 | -0.26(-0.23%) | 7718 |

McDonald's Corp | MCD | 213.1 | -0.77(-0.36%) | 10841 |

Merck & Co Inc | MRK | 81.37 | -0.02(-0.02%) | 157 |

Microsoft Corp | MSFT | 137.12 | 0.50(0.37%) | 148756 |

Procter & Gamble Co | PG | 115.25 | 0.24(0.21%) | 1384 |

Starbucks Corporation, NASDAQ | SBUX | 90.45 | 0.15(0.17%) | 448 |

Tesla Motors, Inc., NASDAQ | TSLA | 258.5 | 0.32(0.12%) | 147745 |

The Coca-Cola Co | KO | 51.49 | 0.10(0.19%) | 4712 |

Twitter, Inc., NYSE | TWTR | 36.95 | 0.18(0.49%) | 38538 |

United Technologies Corp | UTX | 133.44 | 1.05(0.79%) | 1809 |

UnitedHealth Group Inc | UNH | 257.5 | 0.85(0.33%) | 1203 |

Verizon Communications Inc | VZ | 56.7 | 0.11(0.19%) | 5167 |

Visa | V | 179.92 | 0.68(0.38%) | 5585 |

Wal-Mart Stores Inc | WMT | 114.25 | 0.35(0.31%) | 1053 |

Walt Disney Co | DIS | 141.3 | 1.45(1.04%) | 56204 |

Yandex N.V., NASDAQ | YNDX | 39.56 | 0.56(1.44%) | 14773 |

Apple (AAPL) target raised to $247 from $231 at Morgan Stanley

Micron Technology (MU) upgraded to Buy from Neutral at Goldman; target raised to $56

Uber (UBER) initiated with a Hold at HSBC Securities; target $49

Advanced Micro (AMD) initiated with a Neutral at Atlantic Equities; target $28

Intel (INTC) initiated with an Underweight at Atlantic Equities; target $38

The Chicago

Federal Reserve announced on Monday the Chicago Fed national activity index

(CFNAI), a weighted average of 85 different economic indicators, came in at

-0.02 in June, up slightly from a revised -0.03 in May (originally -0.05),

pointing to a marginal improvement in economic growth in June.

Economists had

forecast the index to come in at 0.10 in June.

At the same

time, the index’s three-month moving average was unchanged at -0.11 in June.

According to

the report, one of the four broad categories of indicators that make up the

index increased from May, and two of the four categories made negative

contributions to the index in June.

Production-related

indicators made a neutral contribution to the CFNAI in June, down from +0.08 in

May. Meanwhile, the contribution of the sales, orders, and inventories category

to the CFNAI dropped to -0.03 in last month from +0.02 in May, and the personal

consumption and housing category contributed -0.05 in June, unchanged from May.

The contribution of the employment-related indicators to the headline indicator

improved to +0.06 in June, up from -0.08 in May.

According to the South China Morning Post (SCMP), the U.S. delegation led by trade representative Robert Lighthizer and Treasury Secretary Steven Mnuchin are set to meet Vice-Premier Liu He.

"The initial arrangements for the meeting in Beijing, according to the source who declined to be identified, came after the United States announced that it would offer exemptions to 110 Chinese products, including medical equipment and key electronic components, from import tariffs. In a goodwill gesture of their own, China also said that several companies would buy American agricultural products having already applied for exemptions from the tariffs imposed by Beijing."

July 23

Before the Open:

Coca-Cola (KO). Consensus EPS $0.62, Consensus Revenues $9821.35 mln

Travelers (TRV). Consensus EPS $2.30, Consensus Revenues $7029.57 mln

United Tech (UTX). Consensus EPS $2.05, Consensus Revenues $19583.30 mln

After the Close:

Snap (SNAP). Consensus EPS -$0.10, Consensus Revenues $358.05 mln

Visa (V). Consensus EPS $1.32, Consensus Revenues $5697.26 mln

July 24

Before the Open:

AT&T (T). Consensus EPS $0.89, Consensus Revenues $44969.46 mln

Boeing (BA). Consensus EPS $1.90, Consensus Revenues $19234.93 mln

Caterpillar (CAT). Consensus EPS $3.11, Consensus Revenues $14474.27 mln

Freeport-McMoRan (FCX). Consensus EPS -$0.05, Consensus Revenues $3538.24 mln

United Micro (UMC). Consensus EPS $0.10, Consensus Revenues $36057.38 mln

After the Close:

Facebook (FB). Consensus EPS $1.86, Consensus Revenues $16495.11 mln

Ford Motor (F). Consensus EPS $0.31, Consensus Revenues $35207.39 mln

Tesla (TSLA). Consensus EPS -$0.40, Consensus Revenues $6440.98 mln

July 25

Before the Open:

3M (MMM). Consensus EPS $2.07, Consensus Revenues $8104.90 mln

Comcast (CMCSA). Consensus EPS $0.75, Consensus Revenues $27124.57 mln

Int'l Paper (IP). Consensus EPS $1.01, Consensus Revenues $5774.87 mln

After the Close:

Alphabet (GOOG). Consensus EPS $11.37, Consensus Revenues $38209.42 mln

Amazon (AMZN). Consensus EPS $5.49, Consensus Revenues $62551.58 mln

Intel (INTC). Consensus EPS $0.90, Consensus Revenues $15684.60 mln

Starbucks (SBUX). Consensus EPS $0.73, Consensus Revenues $6661.76 mln

July 26

Before the Open:

McDonald's (MCD). Consensus EPS $2.05, Consensus Revenues $5332.36 mln

Twitter (TWTR). Consensus EPS $0.19, Consensus Revenues $828.10 mln

Yandex N.V. (YNDX). Consensus EPS RUB25.83, Consensus Revenues RUB40378.55 mln

Commenting on Iran's seizure of a British oil tanker, says it is up to UK to take care of their own ships

TD Securities' analysts note that the data released on Friday revealed that the U.S. consumer sentiment improved marginally in July, rising to 98.4 from 98.2 before.

- “The gain was entirely the result of an improvement in the expectations component, which more than offset a modest decline in the current conditions component. More important to the Fed, inflation expectations for the 5-10y horizon jumped to the top end of the recent range (since mid-2016) at 2.6% while 1y expectations ticked down a tenth to 2.6% in July.

- This is a one-month development so we wouldn't read too much into it (we will also get the final read in a couple of weeks) but this would surely bring some relief to some Fed officials for now.”

Analysts at Danske Bank believe that it is a matter of when and how rather than if ECB will ease monetary policy as after Draghi's dovish Sintra speech, lack of improvement in growth and inflation, and comments from ECB GC members, the case for further easing has strengthened.

- “We expect the ECB to tweak forward guidance at the July meeting, setting the scene for a comprehensive easing package to be unveiled in September (depo rate cut, tiering, QE restart and forward guidance). We could already see the ECB tasking committees to examine the easing package including tiering (again).

- FI Markets may be disappointed at the July meeting for lacking details on new stimuli. However, we would expect any FI sell-off to be short-lived as focus turns to the expected easing at the September meeting. For FX, we expect the September meeting to be more pivotal than the July meeting.

- Economic data has remained lacklustre, and hence in a first step, we expect the Governing Council (GC) to adjust the forward guidance at the 25 July meeting to include a reference to further easing similar to the wording "at present or lower levels" that was used up until June 2017. This should set the scene for a deposit rate cut, which we expect to be announced at the September meeting (we expect a 20bp rate cut), paired with a restart of the QE programme and extended forward guidance.

- While a preference for further stimulus has been well signalled by various ECB members in recent weeks, for example, Coeuré and Rehn, much debate continues to center on the timing and design of the exact policy measures. We cannot rule out measures coming already at the July meeting, but overall find it premature.”

Analysts at TD Securities (TDS) provide a quick glance on what to expect from Monday’s Canadian Wholesale Sales report, set to be released at 12:30 GMT.

- “We look for wholesale sales to rise by 0.4% in May following consecutive >1% gains in March/April, helped by a large increase in manufacturing shipments and strong imports.”

Deutsche Bank's analysts note that Monday is going to be a very quiet day for data with only the June Chicago Fed national activity index in the US due for release.

- “Tuesday: Data releases include final June machine tool orders in Japan, July CBI survey data in the UK, July consumer confidence for the Euro Area and the May FHFA house price index, July Richmond Fed survey and June existing home sales data all in the US. Companies reporting earnings include Harley Davidson, Coca-Cola, United Technologies and Visa. The next UK PM is expected to be announced while the IMF will release the latest World Economic Outlook.

- Wednesday: The July flash PMIs in Japan, Europe and the US will be the main data focus. Away from that July confidence indicators are due in France, June M3 money supply data due for the Euro Area and June new home sales data due in the US. Earnings highlights include Boeing, Caterpillar, Ford, Facebook and AT&T. Former Special Counsel Mueller will testify before the House Judiciary and Intelligence committees on Russian election interference.

- Thursday: The ECB monetary policy meeting will likely be the focal point of the day. As for data, in Europe we get the July IFO survey in Germany and CBI survey data in the UK. In the US the preliminary June durable and capital goods orders data is due in the US along with June wholesale inventories, July Kansas Fed survey and latest jobless claims data. As for earnings, Amazon, Google and Intel will report.

- Friday: The focus of the data will be the advanced Q2 GDP revisions in the US. Prior to this the only data due in Europe is the July consumer confidence print in France. Earnings releases are also due from McDonald's and Twitter.”

According to Ned Rumpeltin, european Head of FX Strategy at TD Securities (TDS), a significant shift is underway in G10 FX markets and after several months of grinding higher against other major currencies, we think the USD is shifting to a weaker footing.

“The EUR may not be a leader in this process, but its size and importance mean it will be an essential component of a weaker USD trend. Our initial focus has been on recent shifts in monetary policy expectations. This is not the whole story, however. We see other forces at work that should help push EURUSD higher in the months ahead. Specifically, the euro area’s underlying capital flows situation continues to improve. Importantly, net portfolio flows are becoming less of a drag on the currency as the ECB has halted its asset purchases. Global investors remain net sellers of the region’s debt markets but this has eased significantly since the start of the year.”

Some Chinese companies are seeking new purchases of U.S. agricultural products, China's official Xinhua news agency said, citing authorities, as Beijing and Washington look for ways to end a protracted trade war.

U.S. President Donald Trump and Chinese President Xi Jinping agreed at last month's G20 summit in Osaka to restart trade talks that stalled in May. Trump said at the time he would not impose new tariffs and U.S. officials said China agreed to make agricultural purchases. But Trump said on July 11 that China was not living up to promises to buy U.S. farm goods.

Chinese businesses have made inquiries with U.S. exporters to buy crops and agricultural products and applied for the lifting of tariffs, Xinhua said, citing Chinese authorities.

China's Customs Tariff Commission will arrange for experts to appraise the Chinese companies' tariff exclusion applications, Xinhua said.

The negative stance on the cross is seen unchanged while below the 122.15/21 area, where coincide the 55-day SMA and the short-term resistance line, suggested Karen Jones, Team Head FICC Technical Analysis at Commerzbank.

“EUR/JPY slid lower last week and maintains a negative bias while we are below the 55 day ma and the 3 month downtrend at 122.15/21. It should head down to the 119.91 78.6% Fibonacci retracement. This is the last defence for the 117.85 January spike low. Resistance is offered initially by the 55 day ma and downtrend at 122.15/21 and then 123.34/75 May 21, June and current July highs”.

NIESR says that there is a 25% chance that the UK is already experiencing a technical recession

Sees odds of a no-deal Brexit at 40%

Sees a possibility of a severe downturn in the case of a disorderly, no-deal Brexit

But current forecast assumes a no-deal Brexit is avoided

Sees 2019 GDP growth at 1.2%, 2020 GDP growth at 1.1% under that assumption

The European Commission is drawing up a multibillion pound aid package for Ireland to offset the economic damage of a no-deal Brexit, The Times reported on Monday

The bloc would "spend whatever was necessary" to support the Irish government through any disruption of trade, The Times said, citing a senior EU diplomat.

The report did not specify the exact the amount of the aid package. Britain is currently due to leave the European Union on October 31.

The Research Team at Danske Bank notes that the UK PM Election takes center stage this week, with the voting results due to be announced on Tuesday.

“After a month of heated debates, the race to replace Theresa May as Britain's new prime minister will culminate today. Opinion polls continue to point to Brexit hardliner Boris Johnson as the frontrunner. While the vote counting starts today, the new prime minister will be announced tomorrow. Over the weekend, UK Chancellor of the Exchequer Philip Hammond has already threatened to resign should Johnson win the leadership in opposition to his no-deal Brexit strategy.’’

Japanese Prime Minister Shinzo Abe said on Monday that he would take all possible steps flexibly and without hesitation when downside risks to the economy emerge.

Speaking after his ruling coalition maintained a solid majority in Sunday's upper house elections, Abe pledged to continue to make economy his top priority.

Abe also said he would take measures fully to support private consumption when the national sales tax rises to 10% from the current 8% in October.

The S&P 500 Index is now trading near its fair value, with limited further upside after its 19% climb so far this year, according to Goldman Sachs Group Inc.

“The path forward for index ROE (return on equity) is likely to be challenging, although lower interest rates and lower tax rates may provide support,” Goldman strategists including David Kostin wrote in a note to clients. Negative revisions to 2020 earnings-per-share forecasts and “policy uncertainty” will limit upside potential, they wrote.

Benchmark American equity gauges reached record highs this month as investors bet that Fed interest-rate cuts will ensure that the economy avoids a major downturn. Traders are fully pricing a quarter-point cut at the July 30-31 Federal Open Market Committee meeting.

Goldman Sachs lowered its year-on-year oil demand forecast for 2019 citing disappointing global economic activity, which was further weighed down by milder weather, fuel power demand destruction and historical downward revisions, suggesting lower oil demand growth in 2018.

The bank revised down its 2019 oil demand growth forecast to 1.275 million barrels per day (mb/d), from 1.45 mb/d at the beginning of the year. However, this is still above the consensus estimates at about 1.05 mb/d for 2019, bank added.

"All else constant, we estimate that an upward revision of consensus 2019 oil demand growth expectations to our 1.275 mb/d forecast would rally Brent prices by $6 per barrel," it said.

Goldman forecast 2020 oil demand growth at 1.45 mb/d on a gradual acceleration in global economic growth as well as a demand boost from International Maritime Organization's new fuel rules for ships from the start of 2020.

According to Karen Jones, Team Head FICC Technical Analysis at Commerzbank, USD/CHF could have topped in the 0.9967/81 band.

“USD/CHF our view remains neutral to negative as the market remains dominated by the 2 month downtrend at .9893 today. The market recently failed at its 50% retracement at .9967 and the 200 day ma at .9981. This is tough resistance and we suspect that the market has topped here. We look for further losses to .9695, the 25th June low. Above the 200 moving average lies the mid-June high at 1.0014. Longer term we target .9211/.9188, the 2018 low”.

The U.S. will likely emerge the winner in a “cold currency war” that’s heating up, according to Joachim Fels, global economic advisor at Pimco.

“If there is a winner in this ‘cold currency war,’ it’s going to be the U.S. in the sense that the dollar is more likely to weaken than strengthen from here,” said Fels told.

He said a cold war on the currency front refers to a conflict not fought with outright central bank intervention in the foreign exchange markets, but with interest rate cuts, negative interest rates (like those in Europe and Japan), quantitative easing and yield curve control.

In the case of the U.S., “presidential tweets” also factor into the mix, Fels added.

He noted that in early 2017, shortly after his election, U.S. President Donald Trump spoke to Treasury Secretary Steven Mnuchin about the need for a softer dollar. Subsequently, the greenback ended up weaker for the entire year.

“The same could happen again, especially as the Fed obviously has more room to cut interest rates than the ECB or the Bank of Japan,” he Fels. added.

“Clearly, we are getting back into the situation where everybody would like to see a weaker currency. Nobody, no central bank, really wants a stronger currency and that’s why it’s a cold currency war,” he said.

Germany's manufacturing industry and exports are suffering from a slowing global economy, the finance ministry said in its monthly report, warning that weak order numbers suggested the industrial slowdown could be lengthy.

But the domestic demand picture seemed healthier, with employment levels still growing as companies took on new staff, if at a slower pace, though the ministry expected the pace to slacken still further there as well.

"Leading indicators as well as shrinking order books point to a lasting period of economic weakness in the industrial sector," the report said.

The report reflects the impression given by a host of indicators recently that the decade-long boom in Europe's largest economy has come to an end, as factors like Brexit and the risk of a trade war weigh on Germany's exporters.

The next UK Prime Minister should restore confidence and take action to bring the economy back on track, the Confederation of British Industry said in its Business Manifesto.

Carolyn Fairbairn, the CBI's Director General called for a clear direction for the UK and to build a long-term vision that drives in investment and back business as a foundation of a growing, inclusive economy.

Brexit has stalled progress on the UK economy for three years. A Brexit deal remains a top priority for business, but a broader vision is needed, the lobby noted.

"Early signals matter. The UK is a fantastic place to do business but we must be honest - the reputation of our country has taken a dent in recent times," Fairbairn said.

"Our new Prime Minister has a real chance to inject a new lease of life into the UK economy and show the world we are open for investment."

Karen Jones, Team Head FICC Technical Analysis at Commerzbank, suggested the positive outlook in EUR/USD should remain intact while above the 1.1181/76 band.

“EUR/USD is really making a meal of trying to get through interim resistance at 1.1285 and again sold off on Friday. Provided dips lower hold over the March and mid-June lows at 1.1181/76 an upside bias will be preserved. We should then see a recovery towards the 200 day moving average and early June high at 1.1315/48. This guards the more important 1.1344/1.1412 55 week ma and recent high. Above the 1.1412 June high we look for resumption of the up move and a test of the 1.1570 2019 high. Slightly longer term we target 1.1815/54, the highs from June and September 2018”.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1346 (1102)

$1.1319 (730)

$1.1287 (241)

Price at time of writing this review: $1.1215

Support levels (open interest**, contracts):

$1.1171 (2812)

$1.1134 (3208)

$1.1091 (3612)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 9 is 65022 contracts (according to data from July, 19) with the maximum number of contracts with strike price $1,1100 (3612);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2682 (1742)

$1.2618 (844)

$1.2576 (346)

Price at time of writing this review: $1.2501

Support levels (open interest**, contracts):

$1.2438 (2244)

$1.2406 (2438)

$1.2370 (2024)

Comments:

- Overall open interest on the CALL options with the expiration date August, 9 is 16312 contracts, with the maximum number of contracts with strike price $1,3000 (2053);

- Overall open interest on the PUT options with the expiration date August, 9 is 16762 contracts, with the maximum number of contracts with strike price $1,2450 (2438);

- The ratio of PUT/CALL was 1.03 versus 1.02 from the previous trading day according to data from July, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 62.6 | 0.71 |

| WTI | 55.85 | 0.25 |

| Silver | 16.18 | -0.86 |

| Gold | 1424.824 | -1.44 |

| Palladium | 1504.48 | -1.56 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 420.75 | 21466.99 | 2 |

| Hang Seng | 303.74 | 28765.4 | 1.07 |

| KOSPI | 27.81 | 2094.36 | 1.35 |

| ASX 200 | 51.2 | 6700.3 | 0.77 |

| FTSE 100 | 15.61 | 7508.7 | 0.21 |

| DAX | 32.22 | 12260.07 | 0.26 |

| CAC 40 | 1.79 | 5552.34 | 0.03 |

| Dow Jones | -68.77 | 27154.2 | -0.25 |

| S&P 500 | -18.5 | 2976.61 | -0.62 |

| NASDAQ Composite | -60.75 | 8146.49 | -0.74 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.70383 | -0.5 |

| EURJPY | 120.845 | -0.1 |

| EURUSD | 1.12191 | -0.51 |

| GBPJPY | 134.625 | 0.04 |

| GBPUSD | 1.24978 | -0.38 |

| NZDUSD | 0.67595 | -0.35 |

| USDCAD | 1.30575 | 0.22 |

| USDCHF | 0.98158 | 0.04 |

| USDJPY | 107.685 | 0.39 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.