- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- EUR/USD crossed into new highs for the year as markets sell off the US Dollar.

- Investors are broadly anticipating further signs pointing to a September rate cut.

- US PMI figures still loom ahead alongside the impending kickoff of Jackson Hole.

EUR/USD breached into a fresh 13-month peak on Wednesday, testing north of 1.1150 as the pair continues to grind its way toward 1.1200. Markets are selling off the Greenback across the board as investor confidence in a September rate cut rises to dizzying highs. The Federal Reserve (Fed) is broadly expected to deliver at least a quarter-point rate cut on September 18, with markets hoping for the possibility of a double cut.

According to the Fed’s latest Meeting Minutes, policymakers noted that discussions of when to deliver rate cuts to pleading market participants had already begin in July, further firming up odds of at least a quarter-point trim on September 18. In true market participant fashion, rate markets bolstered their bets of a double cut from the Federal Open Market Committee’s (FOMC) September meeting, with rate traders pricing in nearly 40% odds of a 50 bps trim on September 18.

Pan-European Purchasing Managers Index (PMI) activity survey results are expected early Thursday, with the EU Manufacturing and Services PMIs for August both expected to hold steady, at 45.8 and 51.9, respectively.

US Purchasing Manager Index (PMI) business activity survey results are slated for release on Thursday, as well as the kickoff of the annual Jackson Hole Symposium which is set to run through the weekend. Wednesday will deliver the Federal Reserve’s (Fed) latest Meeting Minutes, but market forces will broadly be looking ahead to Thursday’s outings for reasons to move.

US S&P Global Manufacturing PMI activity expectations are forecast to hold steady at 49.6 in August, while the Services PMI component is expected to tick down a full point to 54.0 from 55.0. The kickoff of the Jackson Hole Symposium is expected to draw plenty of investor attention on Thursday, but Friday’s appearance from Fed Chairman Jerome Powell can be expected to set the overall tone of market sentiment heading into next week.

EUR/USD price forecast

Fiber claimed a fourth straight bullish candle on Wednesday, tipping into 1.1174 for the first time in over a year. The pair has closed in the green for all but one of the last eight straight trading days, with EUR/USD chalking in over 3.5% in gains since the pair’s last swing low into the 1.0800 handle before catching a bullish bounce off of the 200-day Exponential Moving Average (EMA), which is now rising into 1.0825.

With the pair continuing to defy gravity, the way is clear to the 1.1200 handle, with bidding pressure supported by a fresh high-low pattern baked into the daily candlesticks from 2024’s April lows near 1.0600.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

The preliminary reading of Australia's Judo Bank Manufacturing Purchasing Managers Index (PMI) rose to 48.7 in August from 47.5 in July, the latest data published by Judo Bank and S&P Global showed on Thursday.

The Judo Bank Australian Services PMI improved to 52.2 in August from the previous reading of 50.4, while the Composite PMI climbed to 51.4 in August versus 49.9 prior.

Market reaction

At the press time, the AUD/USD pair was up 0.12% on the day to trade at 0.6752.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- GBP/USD breached 1.3100 on Wednesday as the bull march continues.

- The Pound Sterling is enjoying a healthy bid as the US Dollar recedes.

- Jackson Hole, PMI data dump still loom ahead.

GBP/USD briefly tested chart paper on the high side of 1.3100 on Wednesday as Cable continues to push deeper into bull country. The pair is marching into fresh 13-month highs, setting a peak intraday bid of 1.3112, and the Sterling is threatening to cross into its highest prices against the Greenback since April of 2022.

The US Bureau of Labor Statistics announced a steep cut of over 800K jobs to March’s Nonfarm Payrolls (NFP) jobs print, sharply revising previous job growth figures to the low side. The tilt in hiring numbers prompted markets to add to bets of a double cut from the Federal Reserve (Fed) in September. Rate cut bets pinned even higher on Wednesday after the Fed’s latest Meeting Minutes revealed policymakers in the US central bank had already begun discussions about when to begin cutting interest rates as early as July.

UK Purchasing Managers Index (PMI) figures for August are expected to drift upwards slightly on Thursday, with the UK Services PMI component forecast to tick up to 52.8 from 52.5. The Manufacturing section is expected to hold steady at 52.1.

US PMI business activity survey results are also slated for release on Thursday, as well as the kickoff of the annual Jackson Hole Symposium which is set to run through the weekend. Wednesday will deliver the Federal Reserve’s (Fed) latest Meeting Minutes, but market forces will broadly be looking ahead to Thursday’s outings for reasons to move.

US S&P Global Manufacturing PMI activity expectations are forecast to hold steady at 49.6 in August, while the Services PMI component is expected to tick down a full point to 54.0 from 55.0. The kickoff of the Jackson Hole Symposium is expected to draw plenty of investor attention on Thursday, but Friday’s appearance from Fed Chairman Jerome Powell can be expected to set the overall tone of market sentiment heading into next week.

GBP/USD technical outlook

With Cable chalking in a fifth straight gain, GBP/USD is poised for a breach into multi-year highs, provided buyers can maintain pressure long enough to keep prices climbing beyond 2023’s July peak of 1.3142. Odds favor the buyers as GBP/USD has closed in the green for all but one of the last ten consecutive trading days.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- USD/CAD weakens near 1.3585 in Wednesday’s early Asian session.

- Firmer expectations of a Fed rate cut in September after the FOMC Minutes have exerted some selling pressure on the USD.

- The recent Canadian CPI supported the case for another rate cut by the BoC.

The USD/CAD pair edges lower to 1.3585 during the early Asian session on Thursday. The Greenback remains under selling pressure as the Minutes of the US Federal Reserve (Fed) opened the door for an interest rate cut at its September meeting,

According to the minutes of the Fed’s July meeting, “the vast majority” of participants observed that, if the data continued to come in about as expected, it would likely be appropriate to cut the interest rate at the next meeting.

Markets are now fully pricing in a September cut, which would be the first reduction since the emergency easing in the early days of the Covid crisis. A full percentage point worth of rate cuts is expected by the end of this year. The growing expectation of a Fed rate cut continues to undermine the US Dollar and US Treasury bond yields.

Elsewhere, the US Bureau of Labor Statistics announced on Wednesday that Nonfarm-Payrolls (NFP) growth revised down by 818,000 from March 2023 to March 2024, fewer than previously estimated.

On the Loonie front, the softer Canadian Consumer Price Index (CPI) inflation reports have triggered the speculation of another rate cut by the Bank of Canada (BoC). Traders continue to fully price in a 25 basis points (bps) cut in September, while an additional 50 bps of easing is priced in for the final two meetings of the year. This, in turn, might weigh on the Canadian Dollar (CAD) and help limit USD/CAD’s losses.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

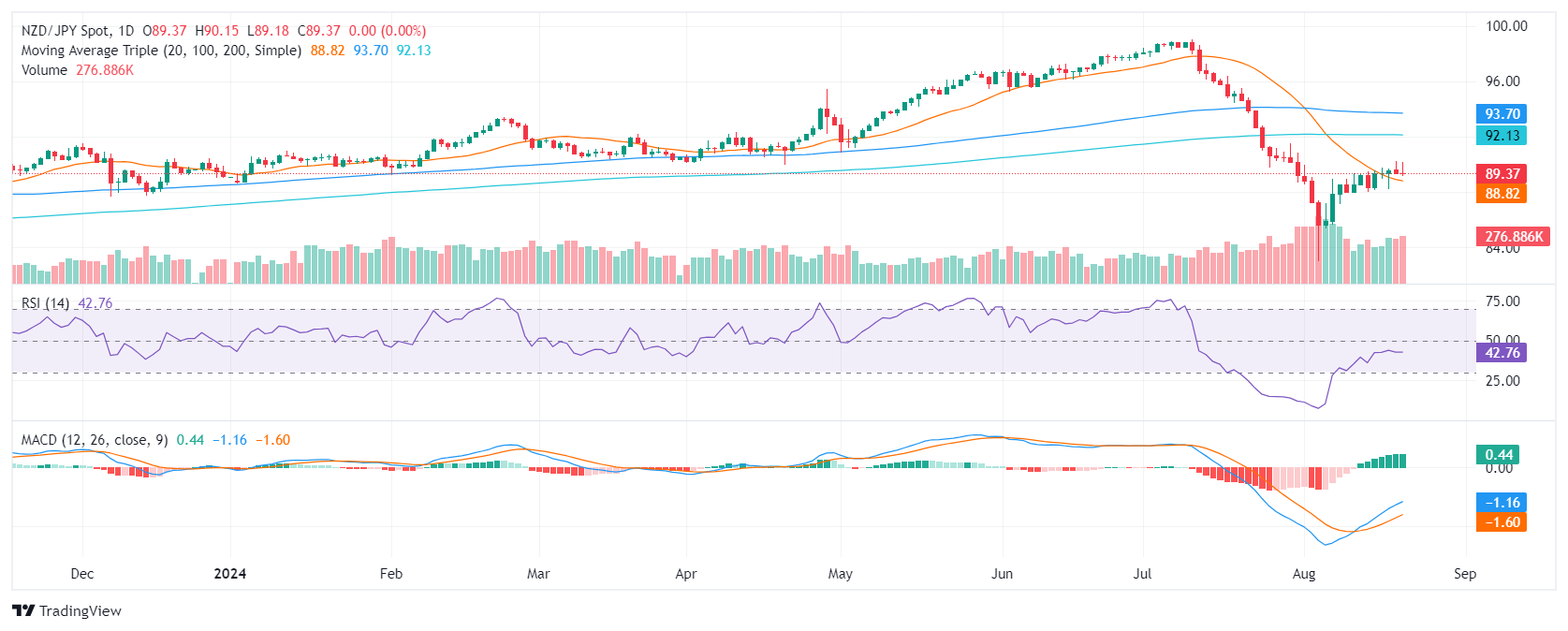

- NZD/JPY was flat on Wednesday, trading at 89.40.

- The RSI remains below 50, indicating a subdued buying pressure.

- The pair is currently trading within a range between the 88.50 and 89.50 support and resistance levels.

The NZD/JPY currency pair traded flat on Wednesday around the 89.40 zone. Technical indicators provide contrasting signals, with the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) offering contrasting perspectives.

The RSI, a measure of momentum, has flattened and is currently at 45, below the neutral level of 50. This indicates decreasing buying pressure and suggests that the bulls are losing some of their recent momentum. However, the MACD continues to show flat green bars. Green bars generally indicate upward momentum, but the flatness suggests that the upward thrust is not strong enough at the moment.

Volume has been relatively low, indicating a lack of conviction in the recent price movements. The pair is currently trading within a range between the 88.50 and 89.50 support and resistance levels. The 88.50 is a significant support level that has been held since the beginning of August, while the 90.00 resistance is a barrier that the bulls struggle to tackle. A break below 88.50 could lead to further declines towards 86.00, while a break above 89.50 could push the pair up to 91.00.

NZD/JPY daily chart

.

- NZD/USD failed to extend its gains and consolidated in a narrow range around 0.6160.

- The RSI has fallen back to 64, while the MACD is now showing flat green bars, indicating that the bullish momentum is slowing down.

- A break below 0.6130 could lead to a further decline towards 0.6100.

On Wednesday's session, the NZD/USD retreated to 0.6160 after hitting a high above 0.6200, as it failed to sustain its gains and consolidated in a narrow range around that level.

On the daily chart, the Relative Strength Index (RSI) has fallen back to 64, while the Moving Average Convergence Divergence (MACD) is now showing flat green bars. These indicators suggest that the bullish momentum is slowing down. The volume has been decreasing over the past few sessions, suggesting that the current consolidation is likely to continue.

NZD/USD daily chart

The NZD/USD pair is facing immediate resistance at 0.6170. A consolidation above this level could open the door for a further rally to retest the 0.6200 zone. On the downside, immediate support lies in the range of 0.6130 and 0.6150. A break below 0.6130 could lead to a further decline towards 0.6100.

- USD/JPY steady as Fed minutes hint at easing, lowering US 10-year yields.

- Selling momentum persists; RSI indicates more downside potential.

- Below 145.00 targets 143.61, then 141.69; resistance at 146.00 could extend to 146.92, 149.39.

The USD/JPY trims some of its earlier gains after July’s Federal Reserve’s meeting minutes hinted the US central bank could ease policy as soon as September. Therefore, US Treasury bond yields, particularly the 10-year yield, slumped and weighed on the major due to its positive correlation. At the time of writing, the USD/JPY trades at 145.21, virtually unchanged.

USD/JPY Price Forecast: Technical outlook

After falling to a seven-month low of 141.69, the USD/JPY recovered some ground and hit a two-week high of 149.39 before resuming its ongoing downtrend. Momentum backs sellers as depicted by the Relative Strength Index (RSI).

If USD/JPY drops below 145.00, the August 6 daily low of 143.61 will be exposed. Once cleared, the next support would be 141.69, followed by December’s 28 low of 140.25.

On the other hand, if prices climb above 146.00, this can pave the way for further upside. The next resistance would be the Tenkan-Sen at 146.92, followed by 149.39, ahead of the Kijun-Sen at 149.78.

USD/JPY Price Action – Daily Chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

- The Canadian Dollar rose on Wednesday, buoyed by Greenback weakness.

- Canada reported an upswing in housing prices, bolstering the CAD further.

- Broader markets are pivoting to the start of this year’s Jackson Hole economic summit.

The Canadian Dollar (CAD) found some legroom on Wednesday, rising against key counter-currencies through the US market session and extended a recent win streak against the US Dollar as broad market sentiment pins on the high end with investors anticipating a shift in the Federal Reserve’s (Fed) rate cut stance.

Canada reported a slight upswing in recent housing price figures, prompting a thin bullish bid in the Canadian Dollar. The CAD has eased into a multi-month high against the Greenback, and is clawing back recent losses against other major currencies in recent days.

Daily digest market movers: Canadian Dollar finds the high side on higher housing prices

- The Canadian New Housing Price Index rose 0.1% YoY in July, over and above the previous -0.2% contraction.

- The Canadian Raw Material Price Index also rose in July, accelerating 0.7% versus the forecast -0.9% and improving from the previous month’s -1.4% backslide.

- The US Bureau of Labor Statistics introduced a sharp revision to March’s Nonfarm Payrolls (NFP), cutting the initial print by over 800K jobs.

- The Fed’s latest Meeting Minutes revealed that the US central bank had already begun discussions about when to deliver rate cuts as early as July.

- The out-of-cycle NFP adjustment and dovish Fed print help to drive market bets of a September rate cut even higher.

- Nearly half of all rate traders now expect a double cut for 50 bps from the Fed on September 18.

Canadian Dollar price forecast: USD/CAD bulls set to run out of steam below 1.3600

The Canadian Dollar (CAD) rose one-fifth of one percent against the US Dollar on Wednesday, chalking in a fourth straight gain against the Greenback. The CAD has closed higher against the USD for all but three of the last 14 straight trading days, and has recovered 2.66% bottom-to-top against the Greenback after hitting a 22-month low earlier this month.

USD/CAD pierced below the 1.3600 handle, and has extended a decline below the 200-day Exponential Moving Average (EMA) at 1.3640. The pair is running into oversold territory, but a sharp pullback from April’s technical range prices could see a topside draw in the coming days.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- Gold remains stable above $2,500, buoyed by Fed Minutes suggesting a possible rate cut at the next meeting.

- The US Dollar Index (DXY) falls 0.20% to 101.10, weakening the Greenback and supporting Gold prices.

- Investors focus on upcoming US economic data and Fed Chair Powell's speech at the Jackson Hole Symposium on Friday.

Gold stayed firm above $2,500 for the third straight day after Minutes of the US Federal Reserve (Fed) opened the door for an interest rate cut at the upcoming September meeting, weakening the Greenback. The XAU/USD trades at $2,511, virtually unchanged.

Investors cheered the content of the Fed's July meeting Minutes as Wall Street continued to trade in green territory. The Greenback tumbled sharply over 0.20%, as reflected by the US Dollar Index (DXY), which hovers around 101.10.

The Minutes revealed that most Fed participants said that “it would likely be appropriate to ease policy at the next meeting if data continued to come in as expected,” adding that the progress on inflation and the increase in the unemployment rate opened the door for a quarter or a percentage point rate cut at the July meeting.

Although Fed officials voted unanimously to hold rates unchanged at the July meeting, many officials saw rates as restrictive. Regarding the Fed’s dual mandate, risks have become more balanced, with most policymakers growing more concerned about achieving the maximum employment mandate, while inflation risks have diminished slightly.

In addition, traders will be eyeing a light economic docket, with the release of Initial Jobless Claims, S&P Global PMIs and housing data on Thursday.

On Friday, traders will watch Fed Chair Jerome Powell's speech at the beginning of the Jackson Hole Symposium, hosted by the Kansas City Fed in Wyoming.

Daily digest market movers: Gold price is firm after FOMC Minutes

- Gold prices advanced as US Treasury bond yields slumped. The US 10-year Treasury note is down 1.5 basis points (bps) at 3.792%.

- Following the release of the last FOMC minutes, traders expect 102 basis points of easing, according to the Chicago Board of Trade (CBOT) December 2024 fed funds futures contract.

- US Initial Jobless Claims data for the week ending August 17 are expected to rise to 230K, up from 227K a week before.

- Business activity revealed by S&P Global is expected to show a slight decrease in the Services PMI from 55 to 54. The Manufacturing PMI is foreseen remaining unchanged at 49.6.

- Existing Home Sales are expected to grow from 3.89 million to 3.93 million.

Technical analysis: Gold price to test $2,550 once it clears $2,530

Gold’s daily chart suggests that the yellow metal is expected to rise further if buyers breach the all-time high at $2,531. Momentum suggests that bulls are in charge, as portrayed by the Relative Strength Index (RSI).

Therefore, XAU/USD first resistance would be the $2,550 area, followed by the $2,600 mark. Nevertheless, Gold’s weakness and the non-yielding metal could retrace below the $2,500 figure.

In that outcome, the next support would be the July 17 peak at $2,483, followed by the May 20 high at $2,450. Once cleared, the next stop would be the 50-day Simple Moving Average (SMA) at $2,395.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- AUD/USD experienced a slight drop, adjusting to 0.6745 on Wednesday.

- The persistent hawkish views of the RBA keep backing the Aussie versus its peers.

- Dovish bets on the Fed weaken the USD.

On Wednesday, the AUD/USD is seeing a slight decline as traders digest the nearly 2% rally from the last sessions. The discourse on monetary policy divergence between the Federal Reserve (Fed), considering a less aggressive approach toward interest rates, and the unwavering position of the Reserve Bank of Australia (RBA) remains the mover of the pair, which put the Aussie ahead of the Greenback.

Despite the mixed Australian economic outlook and the RBA's hawkish stance driven by high inflation, markets are projecting only a 25-basis-point easing for 2024, maintaining some support for the Aussie.

Daily digest market movers: Aussie's rally tempered, softer stance by Fed opens the upside

- Softening US labor market data suggests that the Fed may adopt a less aggressive stance, leading to a potential weakening of the USD.

- In addition, the July Federal Open Market Committee (FOMC) Minutes showed that most of the participants were open to a September cut, which adds ammunition to the argument that the Fed will turn dovish at its next meeting.

- On the other hand, the RBA has clearly mentioned that the bank is not considering cuts for the moment, and this divergence is pushing the pair upwards.

- However, incoming data from both countries will continue to guide the pair’s trajectory.

- Markets are seeing high odds of a 100 bps cut by the Fed by year-end, while investors see little probability of a 25 bps cut by the RBA.

AUD/USD technical outlook: AUD/USD uptrend persists but with lower momentum

Technical analysis suggests that the AUD/USD pair has maintained its upward trajectory over the last few sessions. The Relative Strength Index (RSI), which indicates market momentum, has risen near the 70 benchmark. This hints at overbought conditions in recent sessions.

Additionally, the Moving Average Convergence Divergence (MACD) indicator confirms this bullish tone with the rise of green bars, an indication of prevailing bullish sentiment.

Looking ahead, the pair is likely to encounter resistance around the 0.6750 level. For any significant push through this level, traders should monitor volume and RSI closely. Supports are seen within the 0.6700-0.6650 zone.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Further decline saw the Greenback recede to levels last traded in late December 2023 in the sub-101.00 zone, as bets for a rate cut in September were boosted by the FOMC Minutes of the July gathering.

Here is what you need to know on Thursday, August 22:

The USD Index (DXY) retreated to the 100.90 zone against the backdrop of extra losses in US yields across the curve and firmer expectations of a rate cut in September. The Jackson Hole Symposium kicks in on August 22, while on the US docket are expected the usual weekly Initial Jobless Claims, the Chicago Fed National Activity Index, Existing Home Sales, and the advanced S&P Global Manufacturing and Services PMIs for the month of August.

EUR/USD accelerated its bullish impulse and hit new YTD peaks past 1.1170, always in response to the pronounced sell-off in the US Dollar. On August 22, the ECB will publish its Meeting Accounts, along with the release of preliminary HCOB Manufacturing and Services PMIs for the current month in both Germany and the broader euro area and the flash Consumer Confidence gauge in the bloc tracked by the European Commission.

Following its risky peers, GBP/USD reached fresh 2024 tops north of the 1.3100 barrier amidst the exacerbated selling pressure in the Greenback. The advanced S&P Global Manufacturing and Services PMIs for the month of August will be unveiled on August 22, seconded by the CBI Industrial Trends Orders.

USD/JPY added to the weekly leg lower and broke below the 145.00 support with certain conviction following lower yields and the sharp retracement in the Dollar. The preliminary Jibun Bank Manufacturing and Services PMIs are due on August 22, seconded by weekly Foreign Bond Investment figures.

Further gains saw AUD/USD clinch multi-day peaks near 0.6760 on the back of the continuation of the downward bias in the US Dollar. The flash Judo Bank Manufacturing and Services PMIs are expected on August 22.

Recession fears and omnipresent demand concerns coming from the sluggish Chinese economy weighed further on traders and dragged WTI prices to nearly seven-month lows around $71.50 per barrel.

Gold prices rose marginally, although enough to keep the trade above the key $2,500 mark per ounce troy. Silver left behind Tuesday’s irresolute day and advanced past the $29.00 mark per ounce.

- EUR/USD drove further into fresh highs for the year on Wednesday.

- FOMC looks more likely to lean into September rate cuts after Meeting Minutes release.

- EU, US PMI figures still loom ahead on Thursday, as well as Jackson Hole.

EUR/USD pushed further into the high end on Wednesday, breaching 1.1150 and finding fresh 13-month highs on approach to 1.1200 as Fiber bids surges on broad Greenback weakness. The US Dollar is softer across the board in the midweek market session as investors continue to pile into bets that the Federal Reserve (Fed) will be forced to kick off a rate-cutting cycle in September.

Read more: Fed Minutes to give insight on policymakers’ views

According to the Fed’s latest Meeting Minutes, policymakers noted that discussions of when to deliver rate cuts to pleading market participants had already begin in July, further firming up odds of at least a quarter-point trim on September 18. In true market participant fashion, rate markets bolstered their bets of a double cut from the Federal Open Market Committee’s (FOMC) September meeting, with rate traders pricing in nearly 40% odds of a 50 bps trim on September 18.

Pan-European Purchasing Managers Index (PMI) activity survey results are expected early Thursday, with the EU Manufacturing and Services PMIs for August both expected to hold steady, at 45.8 and 51.9, respectively.

US Purchasing Manager Index (PMI) business activity survey results are slated for release on Thursday, as well as the kickoff of the annual Jackson Hole Symposium which is set to run through the weekend. Wednesday will deliver the Federal Reserve’s (Fed) latest Meeting Minutes, but market forces will broadly be looking ahead to Thursday’s outings for reasons to move.

US S&P Global Manufacturing PMI activity expectations are forecast to hold steady at 49.6 in August, while the Services PMI component is expected to tick down a full point to 54.0 from 55.0. The kickoff of the Jackson Hole Symposium is expected to draw plenty of investor attention on Thursday, but Friday’s appearance from Fed Chairman Jerome Powell can be expected to set the overall tone of market sentiment heading into next week.

EUR/USD price forecast

Fiber found yet another peak bid for 2024 on Wednesday as bulls race toward 1.1200. EUR/USD is up over 3% in August alone, and the pair is poised for it’s best single-week performance since November of 2022.

Bullish momentum has broken the price action mold, with the pair up nearly 3.7% and climbing fast from the last swing low into 1.0777 at the beginning of August. The pair launched off of a technical floor at the 200-day Exponential Moving Average (EMA) which is currently rising into 1.0825.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Gold remains stable at around $2,500 after FOMC minutes suggest potential easing if economic data aligns.

- Fed officials express growing confidence in inflation control, eyeing a 25 bps cut at the next meeting.

- US Dollar weakens, DXY down 0.30%, with 10-year Treasury yields falling to 3.769%, supporting gold prices.

Gold price remains steady at around $2,500 after the Federal Reserve revealed its latest meeting monetary policy minutes, which hinted the US central bank could cut interest rates. At the time of writing, XAU/USD has trimmed its earlier losses, and its virtually unchanged.

XAU/USD holds firm as FOMC hints at rate cuts, trimming earlier losses

The Federal Open Market Committee (FOMC) minutes showed that most participants said, “it would likely be appropriate to ease policy at the next meeting if data continued to come in as expected.” Furthermore, the minutes added that the recent progress on inflation and the increase in the unemployment rate warranted a 25-basis point (bps) rate cut at the July meeting.

The minutes showed that officials are gaining confidence that inflation is moving toward the 2% goal and that risks to the employment goal have increased.

The golden metal reacted upwards on the release, while the Greenback’s sustaind losses of over 0.30%, as the US Dollar Index (DXY) sits at 100.99. In the meantime, US Treasury bond yields are falling, with the US 10-year Treasury note yield down four basis points to 3.769%.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- GBP/USD extends its uptrend after bouncing off the 50-DMA at 1.2809, with RSI indicating strong bullish momentum.

- A break above 1.3100 targets the 2023 peak at 1.3142, with further gains possible toward 1.3200.

- If the pair retreats, support lies at the July 17 high of 1.3044, followed by the psychological 1.3000 level and August 13 high at 1.2872.

The GBP/USD advanced steadily for the fifth straight day and is eyeing the 1.3100 figure after data from the US Bureau of Labor Statistics (BLS) revealed that the US economy added 800K fewer Americans to the workforce. At the time of writing, the pair trades at 1.308 and gains 0.42%.

GBP/USD Price Forecast: Technical outlook

The GBP/USD uptrend remains intact after bouncing off the 50-day moving average (DMA) at 1.2809 on August 15. The Relative Strength Index (RSI) shows momentum favoring buyers, though the pair could consolidate soon as the RSI approaches overbought levels.

If GBP/USD climbs above 1.3100, the next stop would be the t 2023 peak at 1.3142. On further strength, the next stop would be 1.3200.

Conversely, if GBP/USD retreats below the July 17 high of 1.3044, that would pave the way for a pullback. The psychological 1.3000 figure would be the next support, followed by the August 13 high at 1.2872.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.21% | -0.46% | -0.16% | -0.20% | 0.02% | -0.12% | -0.40% | |

| EUR | 0.21% | -0.26% | 0.03% | 0.00% | 0.26% | 0.08% | -0.19% | |

| GBP | 0.46% | 0.26% | 0.32% | 0.29% | 0.49% | 0.35% | 0.09% | |

| JPY | 0.16% | -0.03% | -0.32% | -0.04% | 0.20% | 0.00% | -0.22% | |

| CAD | 0.20% | -0.01% | -0.29% | 0.04% | 0.24% | 0.06% | -0.21% | |

| AUD | -0.02% | -0.26% | -0.49% | -0.20% | -0.24% | -0.18% | -0.41% | |

| NZD | 0.12% | -0.08% | -0.35% | -0.00% | -0.06% | 0.18% | -0.25% | |

| CHF | 0.40% | 0.19% | -0.09% | 0.22% | 0.21% | 0.41% | 0.25% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

- Dow Jones continues to churn just below 41,000.00.

- Equities continue to look for further signs of rate cuts from Fed.

- NFP payroll adjustments have bolstered bets of 100 bps in 2024.

The Dow Jones Industrial Average is churning in the midrange on Wednesday as markets buckle down for the wait to the kickoff of this year’s annual Jackson Hole Economic Summit on Thursday. Markets continue to look for firmer signs of the Federal Reserve (Fed) getting pushed into a rate cutting cycle in September, with bets on the rise of a 100 bps rate trim on September 18.

According to the CME’s FedWatch Tool, rate markets kicked up their bets of a double rate cut from the Fed in September after the Bureau of Labor Statistics (BLS) reported a steep downside revision to Nonfarm Payroll (NFP) figures initially released in March. The BLS knocked over 800K jobs off of the March jobs report retroactively, sending rate trader bets of a 100 bps initial cut on September 18 up to roughly a third, with the remainder of the rate markets still expecting at least a 25 bps trim.

Dow Jones news

Despite testing middling waters, most of the Dow Jones is finding gains on Wednesday, with less than a third of the equity board declining during the midweek market session. American Express Co. (AXP) is down 3.3% to $244.62 per share, while 3M Co. (MMM) climbed around 1.5% to test $130.00 per share.

Read more: American Express suffers as Bank of America downgrades AXP on slower growth

Dow Jones price forecast

The Dow Jones is set to price in another middling day on Wednesday, and is poised to pop a spinning top candlestick after chalking in one of the index’s best weeks of the year. This week’s price action snapped a five-day winning streak, but bidding pressure continues to simmer as a pullback has yet to materialize.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- DXY index falls to its lowest level since January.

- Markets continue to aggressively bet on a dovish Fed.

- Powell’s words on Friday at the Jackson Hole Symposium will guide the markets.

The US Dollar (USD), as measured by the US Dollar Index (DXY), exhibits no signs of recovery and declined near 101.15 during Wednesday's trading session. This is due to intense dovish bets on the Federal Reserve (Fed) and with US Treasury yields continuing to struggle.

The US economic outlook continues to project growth above trend, providing ample indication that the market may be overly optimistic about quick and aggressive rate cuts.

Daily digest market movers: US Dollar weak in anticipation of FOMC minutes and Jackson Hole Symposium

- The release of the FOMC Minutes from the July 30-31 meeting remains the focal market mover today.

- The Fed specified in its statement that it will not consider a rate reduction until it gains greater confidence in sustainable inflation movement toward the 2% target.

- Additionally, the Fed has raised concerns about the state of the labor market.

- These remarks set the stage for a cautious tone from Powell at the Jackson Hole meeting this Friday, suggesting a possible 25 bps cut in September.

DXY T]technical outlook: Bearish dominance persists, index at yearly lows

The DXY technical outlook remains predominantly bearish. Current analysis shows that the index broke the sideways trading regime in the 102.50-103.30 band and fell to a yearly low, which offers a good case for sellers.

The DXY index remains under significantly bearish domination as indicated by the oversold status of the Relative Strength Index (RSI) and the rising red bars shown by the Moving Average Convergence Divergence (MACD).

Support Levels: 101.00, 100.80, 100.50 Resistance Levels: 101.50, 101.80, 102.00

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Mexican Peso weakens after INEGI reports sharp declines in June Retail Sales with inflation concerns looming.

- US Dollar strengthens following downward revision of Nonfarm Payrolls by 800K.

- Fitch warns of rising debt risks for Mexico’s next administration with potential impacts on sovereign rating amid judicial reform controversy.

The Mexican Peso depreciated over 1.20% against the US Dollar in early trading on Wednesday as traders digested Mexico’s dismal Retail Sales report and awaited the release of a revision of US employment figures. The USD/MXN trades at 19.21 after bouncing off a daily low of 18.92.

Wall Street traded in the green, portraying optimism among investors. The Greenback advanced as the Bureau of Labor Statistics (BLS) revised the Nonfarm Payrolls (NFP) figures downward by 800K.

Meanwhile, on Tuesday, the Instituto Nacional de Estadistica Geografia e Informatica (INEGI) revealed that Retail Sales in June plunged in monthly and annual figures. In addition to this data, August’s mid-month inflation data is expected to tick up in core figures, while the headline is foreseen edging lower.

In the meantime, Fitch’s rating said that Mexico’s upcoming administration will face a growing debt above 51% of the Gross Domestic Product (GDP), which could affect the country’s sovereign rating.

The agency noted, “The fiscal strategy and governance reforms of the Sheinbaum government will be key factors for Mexico's rating.”

Fitch analysts added that judiciary reform “would negatively affect Mexico’s overall institutional profile, but the severity of their impact could become clearer once approved and implemented.”

Meanwhile, unions representing Mexico’s judicial workers launched an indefinite nationwide strike last Monday against President Andres Manuel Lopez Obrador's proposed judiciary reform.

According to Reuters, “The unions criticized the reform push in a statement as rushed and a danger to the "only counterweight" to the ruling Morena party's dominance of both the presidency and Congress.”

Juana Fuentes, the national director of Mexico’s Association of Federal Judges and Magistrates, which organized the strike vote on Tuesday, said, “If this bill passes, we will be creating a regime of absolute power concentrated in one single person.”

In addition, USD/MXN traders will be eyeing the release of the latest Federal Reserve (Fed) monetary policy meeting.

Daily digest market movers: Mexican Peso weakens as data hints at economic slowdown

- Mexico’s Retail Sales for June dived -3.9% YoY, below expectations for a contraction of -1.7%. Every month, sales plunged -0.5%, below estimates of a 0.2% increase.

- Mid-month inflation in August is expected to drop from 5.61% YoY to 5.31%, while core figures are estimated to rise from 4.02% to 4.06%.

- Meanwhile, Mexico’s economy is expected to grow by 2.2% YoY, according to the Gross Domestic Product (GDP) final figures for the second quarter, which is against preliminary readings of 1.65%.

- The USD/MXN is also driven by interest rate differentials between the two countries. Although the spread has narrowed as the Bank of Mexico (Banxico) lowered rates at the August meeting, traders estimate the Fed will cut rates by at least 98 basis points, according to the CBOT fed funds rate December 2024 futures contract.

Technical analysis: Mexican Peso extends losses as USD/MXN climbs above 19.20

The USD/MXN uptrend remains intact and might continue, but stir resistance lies ahead. Momentum favors buyers with the Relative Strength Index (RSI) remaining bullish.

If the exotic pair extends its gains, the first resistance it would face would be 19.50. A breach of the latter will expose the psychological 20.00 figure, ahead of the year-to-date (YTD) high of 20.22.

On the flip side, on USD/MXN, there is further weakness. Peso’s buyers could drive the pair beneath the psychological 19.00 figure. Once cleared, the next stop would be the latest cycle low of 18.59, hit on August 19.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The EUR/GBP declined towards reaching 0.852 and bears threatened the 0.8500 area.

- Bearish indicators signal the potential for a downside move.

- The 0.8500 (20 and 100-day SMA crossover) level remains a critical support to watch.

In Wednesday's session, the EUR/GBP resumed its losses, to settle at 0.8520. Technical indicators paint a mixed picture but the sellers appear to be threatening with breaking the 0.8500 support.

The Relative Strength Index (RSI) has fallen to 55, suggesting a decrease in buying pressure, while the Moving Average Convergence Divergence (MACD) is forming rising red bars, indicating growing bearish momentum. Volume patterns have been mixed, with a flat trend in recent sessions.

In summary, the EUR/GBP pair is facing a potential bearish trend, with selling pressure likely to persist. A break below the key 0.8500 support would reinforce the bearish bias and open up the possibility for further downside. On the positive side, the bullish crossover between the 20 and 100-day Simple Moving Averages (SMA) provides strong support

EUR/GBP daily chart

When Platinum Group Metals are on the front foot, analysts are watching Palladium, TDS Senior Commodity Strategist Daniel Ghali notes.

Short positions may start to unwind

“Recall, there are scenarios where the large net short position held by CTAs could be nearly completely unwound should prices continue to rise in a big uptape. These risks to algo positions are particularly acute in Palladium, as we also note that discretionary traders have reaccumulated their epic net short position over the last months.”

“In this context, a squeeze on CTA positioning could morph into a squeeze on discretionary positions, even as we acknowledge that discretionary traders have thus far managed to withstand pain in similar episodes over the last months.”

The US Bureau of Labor Statistics announced on Wednesday that the preliminary estimate of the benchmark revision indicates an adjustment to March 2024 total Nonfarm employment of -818,000 (-0.5%).

"The final benchmark revision will be issued in February 2025 with the publication of the January 2025 Employment Situation news release," the BLS noted in its press release.

Market reaction

This announcement doesn't seem to be having a noticeable impact on the US Dollar's (USD) valuation against its major rivals. At the time of press, the USD Index was up 0.15% on a daily basis at 101.53.

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation. A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work. The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower. NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa. Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold. Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components. At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary. The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

High deficits, slowing growth, fears of sticky inflation, currency devaluation, and an imminent cutting cycle worldwide are all reasons to explain the current spike in Gold prices. But traders might be going too far, TDS Senior Commodity Strategist Daniel Ghali notes.

Downside risks have grown got Gold

“What if we argued these narratives had already attracted significant inflows into Gold markets? Our gauge of macro fund positioning in Gold has scarcely been higher than it is today. In fact, it is statistically consistent with 370bps of Fed cuts.”

“Commodity Trading Advisors (CTAs) are 'max long', and Shanghai trader positioning has reverted to record highs. Few visible shorts remain in the market. Positioning cues are flashing red in Gold markets. And while the fundamental narratives that drive Gold are bullish, narratives ultimately chase prices.”

“Downside risks have grown, and while positioning tells us nothing about timing, Jackson Hole and the next nonfarm payrolls report appear to be consequential catalysts for a possible washout in positioning.”

- Silver price trades sideways below $30.00 with FOMC minutes in focus.

- The US Dollar and bond yields remain in a bearish trajectory on Fed rate-cut optimism.

- Fed Powell’s speech at the JH symposium will be the key event this week.

Silver price (XAG/USD) trades in a tight range below the psychological resistance of $30.00, with investors focusing on the Federal Open Market Committee (FOMC) minutes for the July monetary policy, which will be published at 18:00 GMT.

Investors await the FOMC minutes release as it will provide fresh cues about the interest rate path this year. In the July meeting, the Fed left interest rates unchanged in the range of 5.25%-5.50% but assured that policymakers are prepared to adjust the monetary policy stance in case risks emerge that could delay the attainment of banks’ goals, such as inflation at 2% along with the maintenance of full employment.

Ahead of the FOMC minutes, the US Dollar (USD) exhibits a subdued performance and remains near seven-month lows. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, hovers near 101.40. 10-year US Treasury yields decline to near 3.80%. Lower yields on interest-bearing assets reduce the opportunity cost of holding an investment in non-yielding assets, such as Silver.

This week, the US Dollar is expected to remain volatile as Fed Chair Jerome Powell is scheduled to speak at the Jackson Hole (JH) Symposium on Friday. Fed Powell would indicate how much the central bank could cut interest rates this year.

Silver technical analysis

Silver price delivers a bullish reversal as a decisive break above August 2 high of $29.20 has faltered the lower high lower low formation on a four-hour timeframe. An upward-sloping 20-period Exponential Moving Average (EMA) near $29.20 is expected to act as a cushion for Silver price bulls.

The 14-period Relative Strength Index (RSI) falls to near 60.00, suggesting that the bullish momentum has concluded for now. However, the bullish bias remains intact.

Silver four-hour chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

CTA buying activity in base metals is grinding to a halt, with our estimates suggesting that algos are already likely back on the offer in Aluminium this session, TDS Senior Commodity Strategist Daniel Ghali notes.

Shanghai traders are still adding to their net length in Aluminium

“Under the hood, however, a recovery in demand sentiment embedded within the commodities complex is simultaneously occurring alongside a rise in supply risk premia embedded within the base metals complex.”