- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- US equities closed sharply lower, snapping the post-Fed pivot rally.

- S&P 500 inched within half a percent of all-time highs before a harsh correction.

- Dow abruptly ends a nine-day winning streak.

The Standard & Poor's (S&P) 500 major equity index sharply reversed late Wednesday to close the day down almost 1.5% after coming within half a percent of setting a new all-time high. US equities declined in a harsh pullback on Wednesday after markets pared back a recent rally sparked by the Fed's policy pivot last week.

US stocks rallied on runaway expectations of Federal Reserve (Fed) rate cuts next year after the Fed admitted that the rate hike cycle is truly over, and the Fed dot plot of interest rate expectations shifted to include up to three rate cuts next year for 75 basis points.

Market expectations surged after the Fed met the market halfway, sending the Dow Jones Industrial Average (DJIA) into a new all-time high. Money markets are pricing in over six rate cuts for an eye-watering 150 basis points in rate cuts in 2024, with a 21% chance of a rate cut as soon as March.

Fed pivot sparks rally, but upside momentum meets abrupt end on Wednesday

Fed officials have been taking turns splashing cold water on overactive investor imaginations, and the efforts appear to have paid off late Wednesday, sending equities lower across the board with all major indices declining sharply.

The S&P and the NASDAQ both fell around one and a half percent, shedding 70 and 225.28 points respectively. The S&P slipped back below the $4,700 handle to close the day at $4,698.35 while the NASDAQ wrapped up Wednesday down to $14,777. The DJIA also lost a little over one and a quarter percent to shed 475 points and end the mid-week market session at $37,082.

Markets head into the back half of the trading week with US Gross Domestic Product (GDP) figures slated for Thursday, with Friday set for one last print of high-impact inflation, consumer demand, and economic expectations figures with US Personal Consumption Expenditure (PCE) Price Index, Durable Goods Orders, and December's Michigan Consumer Sentiment Index.

S&P 500 Technical Outlook

The S&P's sharp decline late Wednesday has the major index tumbling towards the 200-hour Simple Moving Average (SMA) just above $4,640, and intraday price action has the S&P 500 trading well above the last meaningful swing low into $4,540.

On the daily candlesticks, The S&P 500 has snapped its recent winning streak and is poised for its first weekly loss since October, having closed in the green for seven consecutive weeks.

The long-term 200-day SMA is drifting higher into the $4,350 neighborhood, and the closest technical support point rests at the 50-day SMA just above $4,450.

S&P 500 Hourly Chart

S&P 500 Daily Chart

S&P 500 Technical Levels

The European Central Bank (ECB) Governing Council member Martins Kazaks said late Wednesday that the central bank needs to keep interest rates at the current level for some time, but the first rate cut could come later than investors are pricing around the mid-2024

Key quotes

“Most likely it looks like in the middle of next year — in June or July,”

“But in the spring at the current moment that’s too early.”

“The pace of rate cuts is really dependent on how the economy really behaves and what happens to the economy.”

Market reaction

The comments above have little to no impact on the Euro. The EUR/USD pair is trading higher at 1.0944, up 0.11% on the day.

ECB FAQs

What is the ECB and how does it influence the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region.

The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

What is Quantitative Easing (QE) and how does it affect the Euro?

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro.

QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

What is Quantitative tightening (QT) and how does it affect the Euro?

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

- AUD/USD drifts higher near 0.6732 despite the firmer USD.

- November’s US Existing Home Sales were better than expected, the December’s CB Consumer Confidence grew by the most since early 2021.

- The RBA meeting minutes showed the central bank opened the door for further tightening amid encouraging signs of falling inflation.

- Market players await US weekly Jobless Claims, Q3 GDP, and the Philly Fed Manufacturing Survey.

The AUD/USD pair trades on a stronger note during the early Asian session on Thursday. The pair snaps its two-day losing streak on the day despite the upbeat US economic data and the modest rebound in the US Dollar (USD). AUD/USD currently trades near 0.6732, up 0.10% on the day.

US Data released on Wednesday came in better than the market expectation. The US Existing Home Sales rose to an annual rate of 3.82M in November, above the market consensus of 3.77M. Meanwhile, CB Consumer Confidence for December grew by the most since early 2021, climbing from 101.0 to 110.07.

On the Aussie front, the minutes of the Reserve Bank of Australia (RBA) showed a hawkish tone. The central bank opened the door for further tightening amid the encouraging signs of falling inflationary pressures across the economy. However, it will depend on the incoming data and the evolving assessment of risks.

Traders will monitor the US weekly Jobless Claims, a new estimate for Gross Domestic Product (GDP) for the third quarter (Q3), and the Philly Fed Manufacturing Survey. On Friday, the attention will shift to November’s Core Personal Consumption Expenditures Price Index (PCE). These figures could give a clear direction to the AUD/USD pair.

- The XAU/USD sees a downward shift to around the $2030 level, highlighting a 0.55% decline.

- US yields show weakness, which may limit the downside for the metal.

- Markets are bracing for Friday's inflation data, which is likely to set the pace of the price dynamics for the short term.

In Wednesday's trading session, the XAU/USD Gold spot price witnessed a strong downward trend, currently trading at approximately $2,030. Buyers seem to be taking a step back to consolidate gains as the price stands at highs since May.

Market participants continue to be on edge as they await the release of the US Personal Consumption Expenditures (PCE) figures from November, much favored by the Federal Reserve as a key indicator of inflation, due on Friday. The outcome may have an impact on the metals price as it could confirm the markets bet on sooner rate cuts by the Fed in 2024.

Meanwhile, due to the Fed’s dovish shifts, US yields are weak, providing a cushion to the yellow metal as falling US Treasury bond yields tend to ease the opportunity cost of holding non-yielding metals. The 2-year rate is hovering at 4.40%, while the 5 and 10-year yields are at 3.85% and 3.84% (low since July) respectively.

XAU/USD levels to watch

The daily Relative Strength Index (RSI), despite its negative slope, remains in positive territory while the Moving Average Convergence Divergence (MACD) histogram lays out red bars which reaffirm an underlying buying pressure; however, their flat nature implies a pause in momentum.

Zooming out, the Simple Moving Averages (SMAs) further implicate a bullish stance. Specifically, the pair is notably above the 20,100 and 200-day SMA, suggesting that the buyers still dominate the larger time frames.

Support Levels: $2,020 (20-day SMA), $2,000, $1,980.

Resistance Levels: $2,040, $2,050, $2,070.

XAU/USD daily chart

-638387067166213396.png)

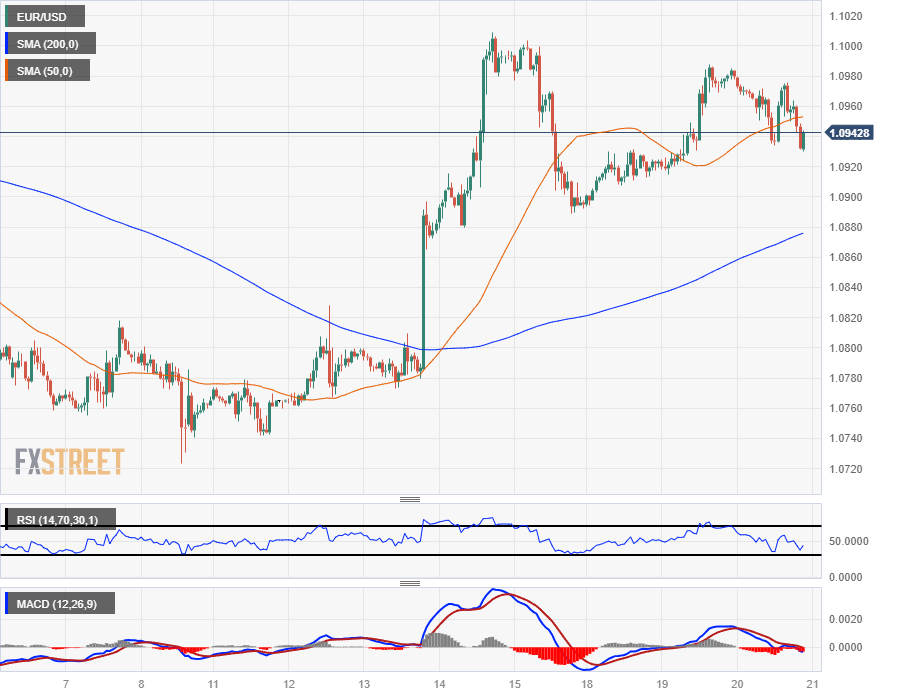

- EUR/USD consolidated on Wednesday, slipping from 1.0980 to 1.0930.

- Markets saw a steady risk bid that kept the USD pinned until a late-day break.

- Up next: Thursday US GDP.

The EUR/USD drifted lower on Wednesday, falling back into 1.0930 late in the day after slipping from the day’s opening bids near 1.0980 with the pair capped just beneath the 1.1000 handle.

Markets broadly went risk-on after US Consumer Confidence and US Existing Sales revealed better-than-expected figures in both indicators. Risk assets gained some ground and the US Dollar (USD) slipped slightly as markets gear up for the holiday wrap-up.

US consumers are more upbeat about the US economy in December, with the US Consumer Confidence Index rising to 110.7 versus November’s 101.0, which was revised down from 102.0.

Read More: US CB Consumer Confidence Index improves to 110.7 in December

US Existing Home Sales also improved by 0.8% in November, rebounding from October’s -4.1%.

Eurozone Consumer Confidence for December also improved, but remained firmly lower compared to consumers’ faith in the US economy. Eurozone December Consumer Confidence rose to -15.1, still in negative territory but cautiously optimistic, recovering from November’s -16.9, and rebounding over the market’s median forecast of -16.4.

Coming up on Thursday will be US Gross Domestic Product (GDP), and markets are expecting US GDP in the third quarter to hold steady at 5.2%.

EUR/USD Technical Outlook

The EUR/USD is firmly planted within the week’s trading range, caught between 1.0980 and 1.0930. Intraday action has been drawing tight this week as investors gear up for the holiday break, pushing the Euro into the midrange against the US Dollar.

Daily candlesticks have the EUR/USD pinned into the top end just below the 1.1000 handle, with prices getting back on the north side of the 200-day Simple Moving Average (SMA) near 1.0850.

EUR/USD Hourly Chart

EUR/USD Daily Chart

EUR/USD Technical Levels

It will be a quiet Asian session in terms of economic data. New Zealand will report Credit Card spending. Later in the day, the UK will release public borrowing data for November. Reports from the US include the weekly Jobless Claims, a new estimate for Q3 GDP, and the Philly Fed. In Canada, Retail Sales are due.

Here is what you need to know on Thursday, December 21:

The US Dollar rose on Wednesday, supported by US economic data and a slight deterioration in market sentiment. The Santa Claus rally took a pause, with Wall Street’s main indexes about to end a five-day positive streak. Treasury yields reached fresh lows. The 10-year yield dropped to 3.86%, reaching the lowest level since July 27.

Data from the US on Tuesday surpassed expectations, with Existing Home Sales rising to an annual rate of 3.82 million, above the market consensus of 3.77 million, thus ending a five-month negative streak. Additionally, CB Consumer Confidence improved from 101.0 to 110.07.

Analysts at Wells Fargo on Existing Home Sales:

Although the 3.82 million unit pace of sales registered during the month is still sluggish by historical standards, November's modest uptick is the latest sign that housing activity is starting to bounce off the mat as financing costs move lower.

On Thursday, important economic reports are due, including the weekly Jobless Claims, the Philly Fed, and a new estimation of Q3 GDP growth. On Friday, the Core Personal Consumption Expenditure (Core PCE) is due.

Eurostat reported an improvement in Consumer Confidence in December. European Central Bank (ECB) officials continued to warn that interest rates need to remain at the current level for some time, contrary to market expectations of early rate cuts in 2024. EUR/USD lost ground, but held above the 20-day Simple Moving Average (SMA). The pair is consolidating around 1.0950, showing no clear signs in the short term.

The Pound was among the worst performers after a softer-than-expected inflation reading from the UK. GBP/USD dropped towards the 20-day SMA, standing at 1.2640. The UK will report Public Borrowing data for November.

USD/JPY closed flat around 143.70, stabilizing after volatile days. The Yen remains supported by lower government bond yields.

USD/CAD hit fresh four-month lows at 1.3310 before rebounding towards 1.3350. Canada will report Retail Sales on Thursday, expected to show a 0.8% increase in October.

NZD/USD reached a five-month high slightly below 0.6300 but then turned downside, reaching 0.6250. New Zealand will report Credit Card Spending on Thursday.

Metals exhibited divergent performances. Silver rose, reaching weekly highs at $24.45 but then lost momentum, retracing to $24.15. Gold, on the other hand, declined and fell to the $2,030 support area.

Like this article? Help us with some feedback by answering this survey:

- The USD/JPY is hovering around the 143.80 level with marginal gains recorded.

- The dovish stance from Bank of Japan and it lack of guidance weakens JPY in markets.

- PCE data on Friday from the US will likely set the pace for the upcoming sessions

The USD/JPY pair edged higher in Wednesday's session, trading around the 143.80 level, as the markets remained directionless due to the absence of Bank of Japan's pivot clues. To the downside, the Federal Reserve's dovish clarity may fuel some downside in case the Personal Consumption Expenditures (PCE) November figures come lower than expected on Friday.

In addition, Japan's weaker economy, which mirrors continual JGB yield declines, signaling that the Bank of Japan's rate hike is still on hold, makes the JPY lose interest among investors. On the US side, its economy is holding strong, while the Fed hinted at more rate cuts than expected for 2024, which leaves the US Dollar in a challenging situation. However, as long as inflation continues to edge downwards and give markets the chance to bet on earlier rate cuts, it could pave the way for additional downside.

Presently, US bond yields are in decline. The 2-year rate declined to 4.40%, while the 5-year and 10-year yields are lower at 3.89% each. This current trend could weigh on the USD as yields and currency tend to have an inverse relationship.

For Friday, investors will eye November's PCE figures from the US, with the headline and core figures expected to have decelerated to 2.8% YoY and 3.3% YoY.

USD/JPY levels to watch

Reflecting largely on the daily chart, the immediate short-term bias seems skewed to the upside. Specifically, the Relative Strength Index (RSI) slope is positively inclined and in the positive territory, suggesting that buying pressure has been gradually increasing, further supported by the Moving Average Convergence Divergence (MACD), which lays out decreasing red bars. However, it is crucial to understand that the current bullish momentum has not yet become sufficiently convincing.

The pair's interaction with Simple Moving Averages (SMAs) brings in a different perspective. With the pair trading below the 20 and 100-day SMAs, bearish influences hold sway over the shorter time frames. However, the tug-of-war between bulls and bears is not entirely skewed. This is evinced by the pair being above the 200-day SMA, suggesting that the bulls aren't out of the game on the broader scale.

Support Levels: 143.50, 143.00, 142.00.

Resistance Levels: 145.00, 145.80 (20-day SMA), 147.00.

USD/JPY daily chart

-638386988628895333.png)

- USD/CAD is backsliding in thin pre-holiday markets.

- The Canadian Dollar is finding support from rebounding Crude Oil bids.

- BoC rhetoric about the need for higher rates disappears from latest meeting minutes.

The USD/CAD is getting pushed lower as broader markets see a healthy risk bid that is forcing down the US Dollar (USD) and a bump in Crude Oil bids is propping up the Canadian Dollar (CAD) while the Bank of Canada (BoC) sees lower odds of inflation risks making a reappearance.

BoC minutes: Members concluded that recent data pointed in the right direction

The BoC’s latest Summary of Deliberations revealed that, prior to the Bank of Canada’s December 6 rate call, policymakers felt that higher rates are less likely moving forward as inflationary risks remain subdued. The current trajectory of inflation, while pointing steadily downward, still sees some potential risks, specifically from shelter prices and rents still running hot, helping to keep inflation overall above the BoC’s targets.

The BoC dropped language about some policymakers seeing a need for higher rates, which was present at the October 26 rate call, suggesting an underlying shift in BoC expectations, though the Canadian central bank remains willing to hike rates even further if inflationary pressures reappear in the data.

Crude Oil markets caught a bounce on Wednesday with markets continuing to be concerned over rebel attacks on container ships in the Yemen region, which could destabilize Crude Oil supply routes between Asia and Europe. West Texas Intermediate (WTI) US Crude Oil is back over $74 per barrel, helping to bolster the Canadian Dollar into one of the best-performing currencies of the major bloc.

US Existing Home Sales rose unexpectedly in November with 3.82 million housing units changing hands for the month, rebounding from October’s 13-year low of 3.79 million, handily beating the market forecast of a further decline to 3.77 million.

Read More: US Existing Home Sales rise 0.8% in November

The rest of the trading week, which will see declining trade volumes as investors wrap up for the holidays, will close out with Canadian Retail Sales and US Annualized Gross Domestic Product (GDP) on Thursday, with Canadian Gross Domestic Product and US Personal Consumption Expenditure (PCE) Price Index numbers on Friday.

USD/CAD Technical Outlook

The USD/CAD is looking to establish a foothold just above the 1.3300 handle in Wednesday trading, planting itself and looking for a rebound from 1.3320 after last week’s backslide that took the pair down from the 1.3600 region.

The 200-hour Simple Moving Average (SMA) is falling into 1.3460 as the moving average struggles to keep up with recent declines, capping off any near-term bullish momentum above the 1.3400 handle.

The USD/CAD has dropped away from the 200-day SMA on the daily candlesticks, trading into its lowest bids since early August.

USD/CAD Hourly Chart

USD/CAD Daily Chart

USD/CAD Technical Levels

- GBP/USD is waffling on the day, selling off across the board.

- UK November CPI inflation eased back more than expected.

- GBP finds some relief in easing US Dollar bids.

The GBP/USD is capped below 1.2680 after a below-expectations print of UK Consumer Price Index (CPI) inflation sent the Pound Sterling (GBP) lower against the US Dollar (USD), dragging the pair down through the 1.2270 handle and pinging 1.2630.

The Pound Sterling was easily the single worst performer of the major currency bloc on Wednesday, declining against all the other major currencies and shedding around half a percent following a half-hearted recovery from the day’s lows to get hung up just below 1.2680.

The UK’s latest CPI print missed market expectations early Wednesday. CPI inflation in November increased by 5.1% over the previous year, coming in below the market’s expected 5.6% versus October’s annualized 5.7% print.

Monthly CPI inflation declined unexpectedly, printing at -0.2% versus the market’s forecast of 0.1%, compared to October’s MoM flat read of 0.0%.

US Existing Home Sales improved in November, helping to bolster broad-market risk appetite and push the US Dollar back down, propping up the Pound Sterling and arresting the day’s declines in the GBP/USD. Existing Home Sales in the US showed 3.82 million pre-existing homes changed hands, above the 3.77 million forecast and rebounding from the 3.79 million print from October.

US Consumer Confidence also improved, showing consumers are cautiously optimistic about the economic outlook through December. The index of consumer economic expectations rose to 110.7 from November’s 101.0 (revised down slightly from 102.0).

The back half of the trading week will wrap up with US Gross Domestic Product (GDP) growth figures on Thursday, expected to hold steady at 5.2% in the third quarter, followed by Friday’s US Personal Consumption Expenditure (PCE) Price Index, as well as third-quarter UK GDP & Retail Sales.

UK GDP for the third quarter is forecast to hold flat at 0.0%, while UK Retail Sales in November are expected to have improved from -0.3% to 0.4%.

US PCE figures are expected to hold steady at 0.2% MoM in November.

GBP/USD Technical Outlook

The Pound Sterling’s decline against the US Dollar saw the GBP/USD decline into the 200-hour Simple Moving Average (SMA) near 1.2635, and a limited rebound sees the pair constrained in the midrange between the 200-hour SMA and the 50-hour SMA near 1.2690.

The GBP/USD is still on the top side of the 200-day SMA on the daily candlesticks, but a lack of bullish momentum is seeing the pair sag from recent highs into the 1.2800 handle, and a pullback risks a bearish extension back into low territory near the 50-day SMA at the 1.2400 handle.

GBP/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Technical Levels

The Bank of Canada released the Summary of Deliberations of the December 6 meeting when they delivered a "dovish" hold. According to the document, the Governing Council agreed that the likelihood of monetary policy being sufficiently restrictive had increased.

The minutes showed that the Governing Council acknowledged that monetary policy could not solve the structural shortage of supply in the housing sector. They expressed concerns that shelter inflation could remain elevated, making it difficult for inflation to return to the 2% target.

After the release of the document, the Canadian Dollar weakened, with USD/CAD trading at its lowest level since early August, slightly above 1.3300.

Key takeaways from the BoC minutes:

Governing Council members also expressed concern that shelter price inflation could remain elevated and that this could make it more difficult to return inflation to 2%.

Governing Council agreed to maintain the policy rate at 5%. Past monetary policy actions had cooled the economy and continued to relieve price pressures.

As they did at the previous meeting in October, members reflected on whether monetary policy was sufficiently restrictive to restore price stability.

They noted that recent data, including in the National Accounts, the Labour Force Survey and the October CPI, indicated that monetary policy was working as expected to slow economic activity and ease inflationary pressures. However, inflation remained too high, and they needed to see a further and sustained decline in core inflation.

Members agreed that the likelihood that monetary policy was sufficiently restrictive to achieve the inflation target had increased. But they also agreed that risks to the inflation outlook remained, and it may still be necessary to increase the policy rate to secure further disinflation and restore price stability.

- The DXY Index recovered towards the 102.30 area, seeing 0.20% daily gains.

- Medium-tier US housing data failed to trigger a significant reaction on the USD.

- Middle East tensions led to Greenback demand.

The US Dollar (USD) broke ground trading on an upbeat 102.30 with 0.20% daily gains. Middle East tensions drove demand for the Greenback but the Federal Reserve's (Fed) dovish stance may limit the bull’s momentum.

The Federal Reserve's stance showed a surprising dovishness in last week’s decision, indicating no rate hikes in 2024 and plans for a 75 bps of easing due to the cooling inflation levels. However, the bank’s decision expectations may remain sensitive to incoming data. The Q3 Gross Domestic Product (GDP) is due on Thursday, and on Friday, the US will release November’s Personal Consumption Expenditures (CPE) Price Index, the Fed’s preferred gauge of inflation.

Daily digest market movers: US Dollar edges higher in quiet pre-holiday session

- The National Association of Realtors (NAR) reported a modest increase in US Existing Home Sales in November by 0.8%, slightly defying expectations.

- Upcoming economic reports include the headline and core US Personal Consumption Expenditures (PCE) Price Index, which are expected to have decreased in November.

- US bond yields currently show a declining trend. Rates for the 2-year yield stand at 4.41%, the 5-year yield at 3.91%, and the 10-year yield at 3.90%.

- The CME FedWatch Tool demonstrates that markets are anticipating rate cuts in March 2024.

DXY Technical Analysis: Bearish control loosens on DXY Index

The indicators on the daily chart reflect a significant bearish control over the market; however, there are also hints of potential dwindling bearish momentum. The Relative Strength Index (RSI) is in negative territory yet is displaying a positive slope. This may suggest that selling momentum is starting to wane, and buyers may be slowly stepping in.

The Moving Average Convergence Divergence (MACD) shows flat red bars, indicating that though the selling pressure maintains its presence, it's not strengthening.

The Simple Moving Averages (SMAs) suggest that the overall course is downward, with the index perched below its 20,100 and 200-day SMAs. Despite this, the bears seem to be taking a breather after pushing the index to multi-month lows, possibly providing additional space for buyers to step in.

Support levels: 101.80,101.50, 101.30.

Resistance levels: 103.30 (20-day SMA), 103.50 (200-day SMA), 104.00.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- The Mexican Peso is middling on Wednesday but keeping close to the top end.

- Mexico's October Retail Sales came in better than expected.

- US Dollar flows helping to prop up MXN despite a dovish Banxico.

The Mexican Peso (MXN) is holding in place, pinned into recent highs against the US Dollar (USD) as broad-market selling pressure keeps the Greenback in place and gives the Peso a chance to cover more ground even as a dovish Banco de Mexico (Banxico) weighs the potential for rate cuts as soon as 2024’s first quarter.

Despite both the Federal Reserve (Fed) and Banxico adopting “data dependant” stances, Mexico’s central bank is far more dovish than its US counterpart. Banxico Governor Victoria Rodriguez Ceja noted recently that Mexico’s interest rate, currently at its highest in over 15 years, could start seeing cuts as soon as 2024’s first quarter.

Banxico held its main rate at 11.25% at its December policy meeting for a sixth straight hold call, after a 15-rate hike run since first raising rates in June of 2021.

Daily digest market movers: Mexican Peso holds on the high side as markets target Greenback underbelly

- Mexico Retail Sales beat the street, rising 3.4% for the year through October versus the forecast 2.0%.

- Over the month, Mexico Retail Sales in October similarly vaulted over the forecast 0.0% to print a 0.8% gain.

- Existing US Home Sales Change showed a 0.8% improvement in November.

- US Existing Home Sales jumped from a 13-year low on a unit basis, climbing from 3.79 million to 3.82 million in November, compared to the median market expectation of a continued decline to 3.77 million.

- US Consumer Confidence also rose to 110.7 in December, compared to November’s 101.0 (revised lower from 102.0).

- Overall market tone is keeping risk appetite pinned into ‘risk on’ territory, pushing down the US Dollar and giving the MXN a slight boost.

- Thursday to see another update on Mexico´s half-month inflation in December.

- 1st half-month Mexico Inflation is forecast to pull back from 0.63% to 0.4%.

- Core Inflation for the 1st half-month is expected to see an increase to 0.48% versus the previous 0.2%.

- Thursday’s US Gross Domestic Product (GDP) print for the third quarter will dominate the calendar headlines. US third quarter GDP is forecast to be confirmed at 5.2%.

Technical Outlook: Mexican Peso holds on the top end amidst market holiday slowdown

The Mexican Peso is sticking in place against the US Dollar through the mid-week market session, with the USD/MXN testing the waters between 17.10 and 17.00. The 17.00 price level remains a major barrier, keeping the pair propped up and limiting MXN gains in the near term.

The Peso has gained nearly 3% against the US Dollar since falling from 17.56 after a rejection from the 200-day Simple Moving Average (SMA) earlier in the month.

Intraday action has been capped under the 200-hour SMA descending into 17.25, and near-term momentum is leaning firmly bearish with the 50-hour SMA slipping into 17.10, squeezing the day’s price action into a right range just above 17.02.

USD/MXN Hourly Chart

USD/MXN Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The XAG/USD approaches the $24.30 level, showing a 1% rally.

- The benchmark 10-year yield dropped to its lowest level since July, favoring the metal's advance.

- US PCE data on Friday will further guide investors on the next Fed moves.

In Wednesday's session, XAG/USD is seeing a rally, currently trading at a level of $24.30, favored by the dovish shift in the Federal Reserve (Fed) and the fall to fresh lows of the US 10-year yield. Positive home sales from November from the US failed to trigger movements on the US Dollar.

In that sense, The US Housing sector saw a minor bounce in Existing Home Sales, according to the November report from the National Association of Realtors (NAR), with the estimated housing values increasing by 0.8% from its previous -4.1%.

What's driving the metal are the US Treasury yields, which are currently on a downtrend. The 2-year rate declined to 4.38%, while the 5- and 10-year rates are at 3.9% each. The benchmark rate declined earlier in the session to 3.87%, its lowest since July and drop in yields lessens the opportunity cost of holding non-yielding metals, hence favoring the price.

The downhill seen in yields is fueled by the dovish hints last week from the Federal Reserve (Fed), whose officials forecast three rate cuts in 2023. The easing bets may be exacerbated on Friday when the US releases November's Personal Consumption Expenditures figures (PCE), the Fed's preferred inflation gauge, which is expected to have decelerated with the headline and core figures seen coming in at 3.3% and 2.8% YoY.

XAG/USD levels to watch

The daily chart suggests that the pair has a moderately bullish bias over the medium term. The Relative Strength Index (RSI) currently resides in positive territory while, the Moving Average Convergence Divergence (MACD) shows larger green bars, a clear sign that the upward momentum is picking up and favors the buyers. It also underscores the strength of the bullish presence.

On a broader scale, the pair's position above the 20, 100, and 200-day Simple Moving Averages (SMAs) suggests that the overall trend favors the bullish side.

Support Levels: $24.10 (20-day SMA), $23.60 (200-day SMA), $23.00.

Resistance Levels: $24.50, $25.00, $25.30.

XAG/USD daily chart

-638386860906733952.png)

USD/CAD has staged a substantial fall in the last few weeks. Economists at Danske Bank analyze the pair’s outlook.

BoC to keep policy rates unchanged until Q1 2024

We regard USD/CAD as a low-beta version of USD/NOK and maintain a bullish view on USD/CAD on a 3-12M horizon. That said, in the near-term risks are for a further setback to the broad USD given weakness in US figures and as markets price in the first rate cut for March. This is likely to benefit CAD albeit not by as much as other cyclically sensitive currencies.

We expect the Bank of Canada to keep policy rates unchanged until Q1 2024 where we pencil in the first rate cut. We generally regard relative rates as neutral for USD/CAD but note how CFTC IMM positioning indicators suggest that markets remain long USD/CAD which on balance limits the topside.

A persistent move lower in the cross would likely require a stronger global growth backdrop than what we pencil in or a very ‘hard landing’ requiring a sharp easing of global monetary conditions, including a weaker USD.

After the Dollar rebounded at the end of last week and stabilised on Monday, renewed selling took hold on Tuesday. Economists at MUFG Bank analyze Greenback’s outlook.

Upside surprise in US PCE required to give the Fed’s push-back attempts a bit more credibility

The US PCE inflation data on Friday remains the key piece of data and really the final key data of the year and an upside surprise is required to give the Fed’s push-back attempts a bit more credibility.

If an upside surprise does not materialise, it will be difficult for the Fed to thwart expectations of a March rate cut which will reinforce the Dollar selling momentum, possibly through the quiet holiday period and into the start of 2024.

- Eurozone Consumer Confidence Indicator rose to -15.1 in December.

- EUR/USD remains around 1.0965 after data, modestly lower for the day.

Consumer sentiment in the Euro area improved in December with the Consumer Confidence Indicator edging higher to -15.1 from -16.4 in November, the European Commission reported on Wednesday. This reading came in better than the market expectation of -16.4. For the EU, the Consumer Confidence Indicator rose by 1.5 percentage points to -16.0.

Market reaction

The EUR/USD is falling modestly on Wednesday, and is trading around 1.0960 after the data. During the American session, the pair trimmed losses on the back of the weaker US Dollar.

- US CB Consumer Confidence Index rose sharply in December.

- US Dollar Index stays in tight daily range above 102.00.

Consumer sentiment in the US improved in December, with the Conference Board's Consumer Confidence Index rising to 110.7 from 101.0 in November (revised from 102.0).

Further details of the publication revealed that the Present Situation Index rose to 148.5 from 136.5 and the Consumer Expectations Index advanced to 85.6 from 77.4.

Finally, the one-year consumer inflation rate expectation edged lower to 5.6%.

Market reaction

The US Dollar Index edged slightly higher after the data and was last seen rising 0.1% on the day at 102.25.

- Existing Home Sales in the US recovered in November.

- US Dollar Index stays modestly higher around 102.20.

Existing Home Sales in the US rose 0.8% in November to a seasonally adjusted annual rate of 3.82 million, better than the 3.77 million of market consensus. It is the first increase after a five-month drop. Compared to a year ago, sales are down 7.3%.

"The median existing-home sales price rose 4.0% from November 2022 to $387,600 – the fifth consecutive month of year-over-year price increases", the report mentioned.

Market reaction

After trimming daily gains during the last two hours, the US Dollar Index (DXY) is hovering around 102.20 modestly higher for the day. US Treasury yields remain at monthly lows, with the 10-year under 3.90%.

EUR/USD has received support on the back of a dovish Fed and the ECB delivering push-back on rate cut expectations. Economists at Danske Bank analyze the pair’s outlook.

Good opportunities for USD weakness in the near term

We maintain the strategic case for a lower EUR/USD based on the relative terms of trade, real rates (growth prospects), and relative unit labour costs. Hence, we continue to expect a downward trajectory over the next 3-12M.

In the near term, we still see good opportunities for USD weakness. The considerable easing of financial conditions over the past month, in conjunction with bearish USD year-end seasonality, could provide some support to EUR/USD over the next couple of months.

Forecast: 1.11 (1M), 1.10 (3M), 1.07 (6M), 1.05 (12M)

Gold price rose more than 20% to a record high of $2,135 in 2023. Strategists at ANZ Bank analyze the yellow metal’s outlook for the next year.

Upside to be capped for Gold in the near term

Going into 2024, we expect Gold price to average above $2,000.

While we hold a positive stance for Gold, the latest price rally looks overdone. Steady rates till H1 2024 and falling inflation will see real rates rising by 50-100 bps, which will be negative for Gold investments. Therefore, we believe the upside to be capped for Gold in the near term.

Our long-term bullish view for gold hinges on three drivers: First, the Fed will start cutting interest rates, which will reduce the opportunity cost of non-yielding Gold. Second, economic, political and geoplitical risks are expected to remain heightened in 2024. The upcoming US elections will increase policy uncertainty, while prospects of slowing economic growth might encourage investors to diversify their portfolios by adding Gold. Third, central bank purchases sustain even after two years of strong buying. We estimate central bank buying to be in the range of 800-850t, but there could be an upside risk to this number.

- AUD/USD struggles for a direction as investors shift focus towards the US core PCE price index data.

- Broader market mood is quite upbeat as rate cut expectations by the Fed deepen.

- A breakout of the symmetrical triangle chart pattern has strengthened the Australian Dollar.

The AUD/USD pair trades sideways inside Tuesday’s trading range of 0.6700-0.6775 in the early New York session. The Aussie asset struggles for a direction as investors shift focus towards the United States core Personal Consumption Expenditure price index (PCE) data for November, which will be published on Friday.

The S&P500 opens on a negative note as profit-booking has kicked in. The overall market mood is quite upbeat as investors lean towards deepening rate cut expectations by the Federal reserve (Fed) in 2024. The US Dollar Index (DXY) faces selling pressure after a pullback move to near 102.50.

On the Australian Dollar front, the Reserve Bank of Australia (RBA) is expected to keep interest rates restrictive for longer as inflation in the Australian region is more than doubled the required rate of 2%.

AUD/USD has continued its winning streak after a breakout of the Symmetrical Triangle chart pattern formed on a daily scale. A breakout of the aforementioned chart pattern results in wider bullish ticks and heavy volume. The asset is expected to extend upside towards the immediate resistance of 0.6900.

Upward-sloping 20-day Exponential Moving Average (EMA) around 0.6630 continues to provide support to the Australian Dollar bulls.

The Relative Strength Index (RSI) (14) shifts into the bullish range of 60.00-80.00, which indicates that the bullish momentum has been triggered.

Going forward, a decisive break above the intraday high of 0.6770 would expose the asset to July 20 high at 0.6846, followed by July 13 high around 0.6900.

On the flip side, downside bets would trigger if the asset breaks below December 7 low at 0.6525. Slippage below the same would drag the asset towards the psychological support of 0.6500 and November 17 low at 0.6452.

AUD/USD daily chart

The USD is trading mixed on the day as FX markets consolidate broadly. Economists at Scotiabank analyze Greenback’s outlook.

Focus on yields and month-end

Softer interest rates remain a significant headwind for the USD.

With the holidays approaching, month-end flows may be a factor for markets a little earlier than usual; strong gains for US equity markets this month suggest that passive hedge rebalancing flows will run against the USD, adding to downside pressure in the short run.

DXY technical signals reflect a moderation in the broad USD decline but price action implies a consolidation ahead of another push lower rather than any sign of a rebound.

Firm resistance is at 102.65 on the index. Support is 102.15, with further USD losses likely to accumulate below there.

EUR/USD is drifting back somewhat after gains stalled just under 1.10 on Tuesday. Economists at Scotiabank analyze the pair’s outlook.

Scope for losses is limited

Market bets – currently – that the Fed is more likely to blink first among the major central banks looking to ease next year continue to drive sentiment support in favour of the EUR.

Weakness below minor support at 1.0945 may see spot ease a little more in the near term but underlying trend momentum remains EUR-bullish and scope for losses is limited.

Firmer support should develop around 1.09. Resistance is 1.1015/1.1020.

- The Euro hesitates at 0.8660 as concerns about the eurozone economy grow.

- Weak Construction data and fears of a recession in Germany are weighing on the pair.

- Softer than expected UK CPI data is holding down the Sterling.

The Euro recovery from last week's lows has been halted at the 0.8660 area on Wednesday´s European morning session with the common currency weighed by mounting concerns about the Region's economy.

Earlier today, Eurostat released that Eurozone Construction Output contracted by 1% in October. These figures come after the downbeat IFO business sentiment index seen on Monday and last week’s contracting Services and Manufacturing PMIs.

In this context the Federation of German Industries (BDI) has warned that the German economy is heading for recession, increasing negative pressure on the Euro.

In the UK, Consumer inflation data released earlier on Wednesday has shown a larger-than-expected decline in November. This eases pressure on the BoE to keep hiking rates and is limiting Sterling´s recovery.

EUR/GBP Technical analysis

The technical picture shows the pair hesitating right below the 50% Fibonacci retracement of the late November - early December sell-off, with the near-term positive bias still intact.

Immediate support lies at 0.8630/40, which closes the path towards 0.8600 and the December 11 low at 0.8550. Above 0.8660, the next targets are 0.8690 and 0.8725.

Technical levels to watch

USD/CAD test support in low 1.33s. Economists at Scotiabank analyze the pair’s outlook.

Firm resistance at 1.3350/1.3360

The BoC’s Summary of Deliberations for the December 6th policy decision is released today. The last summary of the policy-making discussion noted that policymakers ‘needed to see downward momentum in core inflation to be confident that monetary policy was sufficiently restrictive’ to get inflation back on target. A somewhat hawkish-sounding run through of the BoC’s latest thinking might give the CAD a bit more support.

The charts suggest firm resistance at 1.3350/1.3360, with stronger resistance at 1.3400/1.3450.

Support is 1.3330/1.3335 and 1.3280.

- USD/JPY falls gradually to near 143.50 as rate cut expectations from the Fed deepen.

- Fed policymakers fear that resilience in the US economy could make price pressures sticky.

- The absence of dialogue on exiting ultra-loose policy by the BoJ forced investors to dump the Japanese Yen.

The USD/JPY pair corrects to near 143.50 amid expectations that the Federal Reserve (Fed) will start lowering borrowing interest rates earlier than projected by policymakers. The major faces a sell-off as Fed policymakers are failing to downplay rate cut expectations despite warnings that the achievement of price stability is the foremost priority.

S&P500 futures have added some losses in the European session, portraying a risk-off mood while the broader appeal is still bullish. The US Dollar Index (DXY) rebounds to near 102.40 but the pullback move could be considered as a selling opportunity by the market participants.

The USD Index is expected to remain broadly on backfoot despite the Fed has not declared an outright victory over inflation. Fear that resilience in the United States economy could make price pressures sticky is forcing Fed policymakers to maintain a restrictive stance on interest rates.

Going forward, investors will focus on the US core Personal Consumption Expenditure price index (PCE) for November, which will be published on Friday. Further softening of Fed’s preferred inflation tool is highly likely due to higher interest rates by the Fed.

Meanwhile, the Japanese Yen is performing better against the US Dollar despite an unchanged interest rate policy by the Bank of Japan (BoJ). The BoJ kept interest rates unchanged as expected but refrained from discussions about exiting the ultra-loose policy.

GBP/USD is the big mover today, trading lower near 1.2650. Economists at Scotiabank analyze the pair’s outlook.

Return to the mid-1.27s likely on a break past 1.2680

Short-term price signals suggest some loss of momentum for Cable today although spot is holding a consolidation range, with longer-term signals still positively aligned for the Pound.

Intraday support is 1.2650 and 1.2630. Loss of support through the latter point could see weakness extend to the mid/upper 1.25s.

Resistance is 1.2680, with the return to the mid-1.27s likely above there.

USD/CAD has declined toward the 1.33 level. Economists at Scotiabank analyze the pair’s outlook.

Positioning remains a potential driver of additional CAD gains

Spreads look set to continue compressing in the CAD’s favour in the weeks ahead which suggests the CAD can continue to push higher.

Last week’s CFTC data showed that a very large net CAD short position among speculative, real money and hedge fund traders remains intact. Short covering could still give the CAD a shove higher in the coming weeks.

Seasonal trends leave the door open for a short, sharp move lower in USD/CAD right into the last days of the calendar year (perhaps before a consolidation in Q1).

Broader USD weakness plus late year liquidity and volatility issues leave the door open for USD/CAD weakness to stretch further in the short run.

- The US Dollar trades mixed ahead of more US housing data.

- Markets are not fleeing to safe havens on the back of Red Sea geopolitical tensions.

- The US Dollar Index is torn between risk-on mood and Fed speakers pushing back on rate cut bets.

The US Dollar (USD) trades sideways on Wednesday, a mixed trading day on the quote board. Markets are ignoring the geopolitical risk and inflationary pressures that might come on the back of the rerouting of vessels forced by recent attacks in the Red Sea. . Meanwhile, in the commodity space, Oil is soaring and OPEC+ is having a field day. The US Dollar Index is stuck just above 102.00, with the potential to move more sharply later this week on key US data.

On the economic front, there are not many top-tier numbers in the run-up to Thursday’s US Gross Domestic Product (GDP) data and Friday’s Personal Consumption Expenditures (PCE) Price Index. US Existing Home Sales might have some weight after the mixed data from Tuesday, which showed an increase in Housing Starts but a decline in Building Permits.

Daily digest Market Movers: No bets to be made anymore

- Colorado state has banned former US President Donald Trump from being on voting ballots in the upcoming Presidential elections. The State’s top court ruled that Trump was guilty of his role in the January 6 breach of Congress, which disqualifies him from running. This sentence can be upheld or reversed by the US Supreme Court.

- At 12:00 GMT, the Mortgage Bankers Association (MBA) was released.Previous number was 7.4% and declined by 1.5% this week.

- At 15:00 GMT, US Consumer Confidence for December is due. the previous reading was at 102, forecasts show 104.5.

- At the same time, Existing Home Sales data will be released. Previous was for 3.79 million, and a decline to 3.77 million is expected.

- Chicago Federal Reserve President Austan Goolsbee will be speaking near 17:00 GMT.

- Around 18:00 GMT, the US Treasury Department will allocate a 20-year bond auction.

- Equities are mixed. In Asia, the Japanese Nikkei closed up over 1%, while in China the Shanghai-Shenzhen index dropped over 1%. Europe is trading flat, with minor losses at hand.

- The CME Group’s FedWatch Tool shows that markets are pricing in a 87.6% chance that the Federal Reserve will keep interest rates unchanged at its January 31 meeting. Around 12.4% expect the first cut already to take place.

- The benchmark 10-year US Treasury Note trades near 3.89%, making another low since July.

US Dollar Index Technical Analysis: Entering calm water

The US Dollar Index is starting to consolidate looking at the daily chart. This points to both buyers and sellers being pushed toward each other, with lower highs and higher lows. Once the melting point has been reached, a breakout will take place either way, which fits with the US GDP numbers and PCE inflation being published on Thursday and Friday, respectively.

Still, US Dollar bulls have their work cut out to salvage what was lost last week. On the daily chart, look for 103.00 as the first level to watch. Once trading above there, the 200-day Simple Moving Average (SMA) at 103.50 is the next important level to get to.

To the downside, the pivotal level at 101.70– the low of August 4 and 10 – is vital to hold. Once broken, look for 100.82, which aligns with the bottoms from February and April. Should that level snap, nothing will stand in the way of DXY heading to the sub-100 region.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- The New Zealand dollar reaches overbought levels after an 8-day rally.

- Risk appetite and the correlation with the AUD are buoying the pair.

- NZD/USD rally is likely to meet strong resistance at 0.6375.

The Kiwi maintains its bid tone intact on Wednesday´s European session. Investors’ optimism about the end of the global tightening cycle has buoyed the risk-sensitive NZD, which is on track to an 8-day rally, reaching overbought levels in daily and hourly timeframes.

NZD´s correlation with the AUD has contributed to sustaining the rally. The hawkish minutes of the Australian Central Bank’s last meeting, released on Tuesday boosted the antipodean currencies, offsetting the impact of a poor New Zealand trade balance.

NZD/USD faces strong resistance at 0.6375

From a technical perspective, the pair seems in the last leg of a 5-wave impulse from 0.5775 lows with an important resistance at 0.6375. This is a previous resistance level and the 261% Fibonacci extension, which tends to be an exhaustion zone.

On the downside, Immediate support lies at the 0.6220 previous high, and below here, 0.6165 and the December 13 low at 0.6090.

Technical levels to watch

The BRL has done well this year to rally 7.7% on spot basis vs. USD. Economists at Société Générale analyze USD/BRL technical outlook.

Right shoulder near 4.97 must be overcome to negate the Head and Shoulders formation

The pair is now close to crucial graphical level of 4.84 which is also the neckline of Head and Shoulders. Break below this support would confirm the pattern and denote an extended decline towards 4.78 and July low of 4.73/4.69.

The right shoulder near 4.97 must be overcome to negate the formation.

- WTI Oil snaps above $74 and enters room for more upside.

- Oil surges as demand is set to pick up after all big freight shipping companies are taking longer routes to avoid the Red Sea passage.

- The DXY US Dollar Index jumps higher after a downbeat start of the week.

Oil prices are jumping higher throughout the week as Red Sea attacks fuel fears of disrupted supply chains. On Monday, a vessel was attacked by missiles coming from Houthi rebels, making the passage in the Red Sea to the Suez Canal unsafe as a travel route. All big freight shipping companies have deviated their fleet away from the Red Sea, taking the much longer road around Africa, making it more expensive and diesel consuming to get goods where they need to be.

Meanwhile, the US Dollar (USD) is unable to benefit from the safe-haven inflow, with markets rather focusing on the quick solutions delivered. Instead, the Greenback is stuck with markets being clueless about what to do with all comments from Fed speakers that are pushing back against early rate cuts expectations from markets. From a technical point of view, trading volumes are starting to die down ahead of Christmas.

Crude Oil (WTI) trades at $74.70 per barrel, and Brent Oil trades at $79.90 per barrel at the time of writing.

Oil News and Market Movers: Demand to pick up

- The US is forming a task force with France, Canada and several other countries to monitor safe passage in the Red Sea. However, this will take time before becoming a reality.

- Markets are already gearing up for a pickup in inflation on the back of the longer routes vessels, and ships will need to take to go around Africa, which comes with longer transportation times and more fuel consumption.

- Overnight, the weekly numbers from the American Petroleum Institute (API) were released. A build of 939,000 was reported for the Crude stockpile.

- At 15:30 GMT, the Energy Information Administration (EIA) is set to release its crude numbers. Previous was a drawdown of 4.259 million, and another drawdown of 2.233 million barrels is expected.

Oil Technical Analysis: The longer this takes, the higher Crude will go

Oil prices are soaring higher as problems mount in one of the most important areas for global trade. The Red Sea and Suez Canal will see substantially less passage as all big shipping firms are sending their fleet around Africa, awaiting the US-led task force to be operational. Meanwhile, demand for Crude will likely jump, with market participants afraid to fall without supply as longer routes now need to be factored in for delivery.

On the upside, $74 got broken and tested for support, offering more upside. Once through there, $80 comes into the picture. Although still far off, $84 is next on the topside once Oil sees a few daily closes above the $80 level.

Below $74, the $67.00 level could still come into play as the next support level to trade at as it aligns with a triple bottom from June.. Should that triple bottom break, a new low for 2023 could be close at $64.35 – the low of May and March – as the last line of defence. Although still quite far off, $57.45 is worth mentioning as the next level to keep an eye on if prices fall sharply.

-638386661727300126.png)

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

What is WTI Oil?

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

What factors drive the price of WTI Oil?

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

How does inventory data impact the price of WTI Oil

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

How does OPEC influence the price of WTI Oil?

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Economists at Goldman Sachs have revised their Franc’s forecasts against the Euro and Dollar.

USD/CHF forecast to be at 0.88, 0.86, and 0.85 in 3, 6 and 12 months, respectively

We revise our EUR/CHF forecasts to remain flat at 0.95 in 3, 6 and 12 months, adjusted from previous forecasts of 0.96, 0.95, and 0.94.

USD/CHF is forecast to be at 0.88, 0.86, and 0.85 in 3, 6, and 12 months, respectively. This is a change from previous predictions of 0.92, 0.90, and 0.85.

- The US Dollar hits new mid-term lows approaching 1.3300.

- Sticky Canadian inflation supports the BoC’s hawkish view.

- The Dollar remains depressed with investors eyeing Fed cuts.

The Greenback keeps heading south against its Canadian counterpart on Wednesday reaching fresh multi-month lows below 1.3330. Hopes of Fed cuts on early 2024 and a stronger Loonie following Canadian CPI figures are crushing the USD.

CAD surges on higher oil prices and a hawkish BoC

Data released by Statistics Canada on Tuesday revealed that inflation remained sticky above the 3% yearly level in November, against market expectations of a decline to 2,9%. The Core Index accelerated to 2.8% year-on-year, from 2.7% in October.

These figures back the hawkish message conveyed by the Bank of Canada after its December meeting, denying any chance of rate cuts in the near term.

On the other hand, heightened hopes that the Fed will start cutting rates in March are acting as a headwind for a significant US Dollar recovery. Investors are turning a deaf ear to Fed officials’ warnings against excessive optimism.

Beyond that, Oil prices continue appreciating, driven by concerns about supply disruptions and higher costs with shipping firms forced to find alternative routes to the Suez Canal. This provides additional support to the loonie as Canada is one of the world´s major oil exporters.

Technical levels to watch

Over the last year, EUR/GBP has averaged 0.87, trading roughly in a 0.85-0.90 range. Economists at Société Générale analyze the pair’s outlook.

EUR/GBP on the rise – buy gilts

Our forecast for 2024 looks for a gradual climb to 0.90, as the gap between UK MPC and ECB rates narrows and the UK economy marginally underperforms the Eurozone.

It’s not a thrilling prospect (a bearish consensus view of the UK means it would be more fun looking for positives in the outlook for Sterling).

Maybe we should just recommend gilts, which offer over 150 bps of yield pickup to Bunds at 10 years and 160 bps at 2 years.

GBP just lurched lower in response to the much weaker-than-expected inflation data from the UK. Economists at MUFG Bank analyze Sterling’s outlook.

Wages will need to show some big downside surprises to prompt a big dovish shift from the BoE

The sharp drop in the YoY headline CPI rate from 4.6% to 3.9% (expected at 4.3%) in November will be very welcomed by the BoE. The weakness looks broad-based as well with the core YoY rate 0.5ppt weaker than expected at 5.1%, down from 5.7%, helped by weaker services CPI which fell from 6.6% to 6.3% – the market expected it to remain unchanged.

The scale of the downside surprise in today’s CPI will likely prove telling, possibly not immediately, but as we proceed through Q1 next year. Before today, the OIS market implied the first rate cut would be in June. That is likely to be brought forward now and lower yields will keep GBP pressured to the downside for now.

The market view of divergence of the BoE relative to the Fed and the ECB has been undermined by this CPI report but wages will need to show some big downside surprises too to prompt a big dovish shift from the BoE.

- The Aussie is showing bearish divergence at five-month highs.

- Hawkish RBA minutes and hopes of Fed cuts have boosted support for the AUD.

- The Dollar remains depressed despite Fed officials' efforts to push back rate cut hopes.

Investors´ appetite for risk as they see the end of the central bank´s tightening cycles has pushed the Aussie to nearly five-month highs. The pair is nearing the 0,6810 resistance area although the bearish divergence on the 4-hour chars suggests a reversal might be in the cards.

A hawkish RBA and Fed cut hopes are supporting the Aussie

The minutes of the RBA´s last meeting, released on Tuesday reflected a hawkish tone, with the bank keeping the options open for further tightening despite the “encouraging signs” on inflation.

This, coupled with the overall Dollar weakness, underpins support for the Aussie. The US Dollar Index remains close to four-month lows as investors ignore Fed officials’ efforts to push back hopes of March cuts.

Technical indicators remain bullish although the mentioned divergence and the hesitant mood seen on Wednesday might be anticipating a reversal or, at least some consolidation.

Immediate resistance lies at 0.6775, ahead of late July highs at 0,6820 and 0.6845. Support levels are 0.6735 and 0.6690.

Technical levels to watch

In an interview with German internet portal T-Online, European Central Bank (ECB) policymaker Joachim Nagel warned markets against betting on imminent rate cuts, per Reuters.

"We must initially remain at the current interest rate plateau so that monetary policy can fully develop its inflation-dampening effect," Nagel said and added:

"I would say to everyone who is speculating on an imminent interest rate cut: be careful, some people have already miscalculated that."

Market reaction

EUR/USD showed no immediate reaction to these comments and was last seen trading in its tight daily channel at around 1.0950.

- The Euro loses steam right below 1.1000, with downside attempts limited for now.

- The US Dollar remains weak as the market ignores Fed officials’ warnings about excessive optimism.

- The positive risk sentiment is keeping Euro bears subdued.

The Euro (EUR) recovery from Monday’s lows has lost steam right below the 1.1000 level, yet with bearish attempts lacking follow through. The US Dollar (USD) remains depressed near multi-month lows against most rivals, which is keeping the pair from a deeper reversal.

The positive market sentiment, with markets pricing in a quarter-point cut by the Federal Reserve (Fed) in March, keeps fuelling investors’ appetite for risk, underpinning support for the common currency.

On the other hand, recent macroeconomic data from the Eurozone is painting a grim outlook, which is likely to keep Euro bulls at bay. The final Consumer Prices Index (CPI) for November confirmed the disinflationary trends, and Monday’s IFO survey showed sentiment is deteriorating among German businesses.

These figures, combined with the weak Q3 GDP and the contracting services and manufacturing PMIs, bring into question the hawkish stance shown by the European Central Bank (ECB) after December´s meeting.

Daily digest market movers: Euro remains steady near four-month highs

- The Euro has lost steam on Wednesday, yet with bearish attempts limited amid the positive market sentiment.

- Atlanta Fed president Raphael Bostic affirmed that there is no “urgency” to cut rates and pointed to the second quarter of 2024 for the first easing move.

- Later today, Chicago Fed President Austan Goldsbee, a hawk, is likely to push back rate cut hopes.

- Investors keep pricing in nearly 75% chance that the US central bank will cut rates by 0.25% in their March meeting, according to data by the CME Group Fed Watch Tool.

- The uncertainty in the Red Sea has forced shipping companies to reroute their shipments. This is pushing Oil prices higher, which is likely to hurt the Euro, as the Eurozone is a net Oil importer.

- The US Dollar maintains its weak tone, with the US Dollar Index (DXY) fluctuating near four-month lows, weighed by low US bond yields.

Technical Analysis: Euro loses steam below 1.1000

Euro sellers have shown up right below 1.1000, pushing the pair to the mid-range of 1.0900. The US Dollar Index remains capped below previous support at 102.45 and the market mood is favourable, which maintains recent highs at a short distance.

From a wider perspective, the broader trend remains bullish, although resistance at the 1.1010 area is likely to be a serious obstacle. Above here, the next targets would be the August high at 1.1060, and the July 24 and 27 high at 1.1150.

To the downside, the pair should break the 1.0880 and the 4-hour 100 Simple Moving Average (SMA) at 1.0870 to increase bearish pressure and shift bears’ focus towards 1.0825 on the way to December lows at 1.0715.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Fed FAQs

What does the Federal Reserve do, how does it impact the US Dollar?

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

How often does the Fed hold monetary policy meetings?

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.