- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Analysts at RBC Financial Group note that Canada's retail sales fell 1.2% in October as 8 of 11 sectors posted declines.

- "The larger-than-expected 1.2% drop in sales in October - which was an even larger 1.4% drop excluding the impact of price-changes - caps off a month of broadly soft economic data reports following earlier-reported declines in October wholesale and manufacturing sale volumes. The numbers will keep concerns alive that the domestic Canadian economic growth backdrop has lost its footing somewhat at the end of the year, particularly after an unusually bad looking November employment report.

- To be sure, all of these monthly reports are volatile, perhaps the employment numbers most of all. The retail numbers in particular still look oddly soft given what has been an unspectacular but still decent household income backdrop. Even in that ugly November employment report, strong wage growth meant that household income growth still looked okay. And the external growth backdrop has begun to look a little less scary with US/China trade tensions easing. Still, Q4 GDP growth now looks like it's tracking firmly below the Bank of Canada's call for a 1.3% increase (and our own 1.4% call), and economic data releases, particularly the next Canadian labour market report, will be watched just that much more closely for confirmation that soft October/November data to-date has been more monthly volatility than new trend."

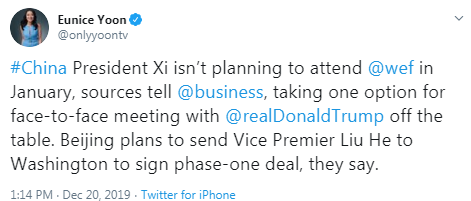

Analysts at Danske Bank offer to look out for the expected finalization and signing of the U.S.-China phase-one deal in early January.

- "In the US in coming weeks, focus is set to be on the ISM manufacturing index, the December jobs report, FOMC minutes and the impeachment process. We believe employment growth remains solid - at least soft survey indicators suggest so.

- In the euro area, focus is on preliminary HICP inflation figures and German industrial production for November. Despite improvement in soft indicators, German industrial production in October was lacklustre.

- In the UK, the monthly GDP estimate for November should shed light on whether the economy continues to move sideways.

- In China, we expect Caixin PMI manufacturing to come down from its very high levels, while the NBS PMI manufacturing should be broadly unchanged."

The final reading for the December Reuters/Michigan index of consumer sentiment came in at 99.3 compared to a preliminary reading of 99.2 and the November final reading of 96.8. That was the highest reading since May.

Economists had forecast the index to be unrevised at 99.2.

According to the report, the index of the current economic conditions climbed to 115.5 from November's final reading of 111.6.

Meanwhile, the index of consumer expectations rose to 88.9 from November's final reading of 87.3.

The report notes that impeachment hearing had a barely noticeable impact on economic expectations.

The Commerce Department reported on Friday that consumer spending in the U.S. rose 0.4 percent m-o-m in November, following an unrevised 0.3 percent m-o-m gain in October. Economists had forecast the reading to show a 0.4 percent m-o-m growth.

Meanwhile, consumer income climbed 0.5 percent m-o-m in November, following a revised 0.1 percent m-o-m gain in the previous month (originally flat m-o-m). Economists had forecast a 0.3 percent m-o-m advance.

The November advance in personal income primarily reflected gains in compensation of employees, farm proprietors' income, and personal interest income.

The personal consumption expenditures (PCE) price index, excluding the volatile categories of food and energy, which is the Fed's preferred inflation measure, edged up 0.1 percent m-o-m in November, the same pace as in the prior month. Economists had projected the index would rise 0.1 percent m-o-m.

In the 12 months through November, the core PCE increased 1.6 percent, following a revised 1.7 percent growth in the 12 months through October (originally a 1.6 percent increase). Economists had forecast a gain of 1.6 percent y-o-y.

The European Commission (EC) said on Friday its flash estimate showed the consumer confidence indicator for the Eurozone decreased by 0.8 points to -8.1 in December from the previous month.

Economists had expected the index to improve to -7.0.

Considering the European Union (EU) as a whole, consumer sentiment fell by 0.3 points to -7.0.

Despite these declines, both indicators remain on a broadly horizontal trajectory well above their respective long-term averages of -10.6 (Eurozone) and -9.9 (EU), the report said.

Lawmakers have agreed to the bill in principle and it will now be debated further by both chambers of Parliament early next year. But it now looks likely that it will complete its passage with 358 members of Parliament backing it and 234 voting against it.

If passed into law, it would mean that the U.K. would leave the EU on January 31, three-and-half years after the 2016 referendum.

Statistics Canada reported on Friday the New Housing Price Index (NHPI) edged down 0.1 percent m-o-m in November, following a 0.1 percent m-o-m gain in the previous month.

According to the report, Regina (-1.7 percent m-o-m) and Edmonton (-1.0 percent m-o-m) registered largest decreases, due to cash rebates as incentives to buyers and lower negotiated selling prices. Overall, out of the 27 census metropolitan areas (CMAs) surveyed, new house prices increased the most in the CMA of Montréal (+1.1 percent m-o-m) in November, supported by the new phases of developments opening.

In y-o-y terms, NHPI was fell 0.1 in November after being unchanged in the previous month. Prices have been flat or declining since May 2019.

U.S. stock-index futures rose slightly on Friday amid lingering trade optimism that the U.S. and China would sign a long-awaited trade deal early in the new year.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 23,816.63 | -48.22 | -0.20% |

| Hang Seng | 27,871.35 | +70.86 | +0.25% |

| Shanghai | 3,004.94 | -12.13 | -0.40% |

| S&P/ASX | 6,816.30 | -16.80 | -0.25% |

| FTSE | 7,584.36 | +10.54 | +0.14% |

| CAC | 6,007.97 | +35.69 | +0.60% |

| DAX | 13,282.97 | +71.01 | +0.54% |

| Crude oil | $61.00 | | -0.29% |

| Gold | $1,483.90 | | -0.03% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 172 | -0.15(-0.09%) | 930 |

| ALCOA INC. | AA | 21.57 | 0.10(0.47%) | 8742 |

| ALTRIA GROUP INC. | MO | 50.89 | 0.10(0.20%) | 12938 |

| Amazon.com Inc., NASDAQ | AMZN | 1,795.73 | 3.45(0.19%) | 11176 |

| Apple Inc. | AAPL | 281 | 0.98(0.35%) | 145316 |

| AT&T Inc | T | 38.95 | 0.02(0.05%) | 19771 |

| Boeing Co | BA | 332.6 | -0.90(-0.27%) | 49887 |

| Caterpillar Inc | CAT | 146 | 0.98(0.68%) | 2799 |

| Cisco Systems Inc | CSCO | 48.05 | 0.17(0.36%) | 19996 |

| Citigroup Inc., NYSE | C | 78.5 | 0.30(0.38%) | 6185 |

| Exxon Mobil Corp | XOM | 69.48 | 0.09(0.13%) | 9152 |

| Facebook, Inc. | FB | 206.59 | 0.53(0.26%) | 86096 |

| FedEx Corporation, NYSE | FDX | 147.5 | 0.48(0.33%) | 9871 |

| Ford Motor Co. | F | 9.45 | 0.04(0.43%) | 205440 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.01 | 0.01(0.08%) | 8486 |

| General Electric Co | GE | 11.09 | 0.06(0.54%) | 141481 |

| Goldman Sachs | GS | 228.95 | -0.99(-0.43%) | 2660 |

| Home Depot Inc | HD | 220.69 | 0.47(0.21%) | 1204 |

| Intel Corp | INTC | 58.05 | 0.09(0.16%) | 21355 |

| International Business Machines Co... | IBM | 134.52 | -0.04(-0.03%) | 1117 |

| JPMorgan Chase and Co | JPM | 137.86 | 0.51(0.37%) | 5812 |

| McDonald's Corp | MCD | 197.25 | 0.19(0.10%) | 1407 |

| Merck & Co Inc | MRK | 90.5 | 0.51(0.57%) | 4965 |

| Microsoft Corp | MSFT | 156.07 | 0.36(0.23%) | 72773 |

| Nike | NKE | 99.81 | -1.34(-1.32%) | 145857 |

| Pfizer Inc | PFE | 39.07 | 0.10(0.26%) | 11559 |

| Procter & Gamble Co | PG | 125 | 0.08(0.06%) | 5746 |

| Tesla Motors, Inc., NASDAQ | TSLA | 409.79 | 5.75(1.42%) | 295754 |

| The Coca-Cola Co | KO | 54.3 | -0.02(-0.04%) | 8619 |

| Twitter, Inc., NYSE | TWTR | 32.16 | 0.13(0.41%) | 44115 |

| Verizon Communications Inc | VZ | 60.94 | 0.14(0.23%) | 3960 |

| Visa | V | 186.75 | 0.21(0.11%) | 7410 |

| Walt Disney Co | DIS | 146.4 | 0.25(0.17%) | 8704 |

| Yandex N.V., NASDAQ | YNDX | 43.09 | 0.37(0.87%) | 1856 |

Statistics Canada reported on Friday that the Canadian retail sales fell 1.2 percent m-o-m to CAD50.92 billion in October, following a revised flat m-o-m performance in September (originally a 0.1 percent m-o-m drop). That represented the sharpest decline in retail sales since November 2018.

Economists had forecast a 0.5 percent m-o-m increase for October.

According to the report, the October decrease was primarily attributable to lower sales at motor vehicle and parts dealers (-3.2 percent m-o-m) and at building material and garden equipment and supplies dealers (-3.1 percent m-o-m). At the same time, sales at gasoline stations rose 1.5 percent m-o-m in October, primarily reflecting higher prices at the pump.

Excluding motor vehicle and parts dealers, retail sales dropped 0.5 percent m-o-m in October compared to a revised 0.1 percent m-o-m fall in September (originally a 0.2 percent m-o-m gain) and economists' forecast for a 0.3 percent m-o-m advance. Excluding motor vehicle and parts dealers and gasoline stations, retail sales reduced by 0.8 percent m-o-m in October.

In y-o-y terms, Canadian retail sales decreased 0.6 percent in October, following a 1.0 percent jump in September.

Apple (AAPL) target raised to $305 from $290 at Piper Jaffray

A report from the Commerce Department showed on Friday the U.S. economy grew as initially estimated in the third quarter of 2019, as upward revisions to personal consumption expenditures (PCE) and nonresidential fixed investment were offset by a downward revision to private inventory investment.

According to the third estimate, the U.S. gross domestic product (GDP) grew at a 2.1 percent annual rate in the third quarter, as reported in the second estimate.

Economists had expected the growth rate to remain unrevised at 2.1 percent.

In the second quarter, the economy expanded by 2.0 percent.

The increase in real GDP in the third quarter reflected positive contributions from PCE, federal government spending, residential investment, exports, and state and local government spending that were partly offset by negative contributions from nonresidential fixed investment and private inventory investment. Meanwhile, imports, which are a subtraction in the calculation of GDP, rose.

The acceleration in real GDP in the third quarter reflected a smaller drop in private inventory investment and upturns in exports and residential fixed investment that were partly offset by decelerations in PCE, federal government spending, and state and local government spending, and a larger decline in nonresidential fixed investment.

Analysts at TD Securities note that the People's Bank of China (PBoC) surprisingly kept its 1-year loan prime rate (LPR) unchanged at 4.15% (mkt 4.10%, TD 4.10%), while also keeping its 5-year LPR unchanged at 4.8%.

- "The market impact is likely to be limited especially as prior to the announcement PBoC injected net CNY 630bn in open market operations ahead of likely liquidity withdrawals next month ahead of Lunar New Year holidays. We expect China to continue to incrementally cut rates, with further cuts in the LPR, MLF and RRR likely, albeit gradually."

Analysts at Nordea Markets note that at its latest meeting, the Fed decided to keep its Federal Funds target rate unchanged at 1.50%-1.75% with the dot plot indicating unchanged rates in 2020.

- "We still see the case for another rate cut in March as there are several questions marks about the economic outlook - especially related to the recession in the manufacturing sector and potential spill-overs to the service sector.

- If the production halt at Boeing does not end within the first few months of 2020, it all else equal increases the scope for the Fed to ease monetary policy in March - even if some of the negative effects could be temporary and primarily related to inventories."

Analysts at TD Securities suggest that the U.S. key core PCE price index probably rose just 0.1% in November, lowering the 12-month change to 1.5% from 1.6% in October.

- "Base effects should help boost the 12-month change again in Q1, but for now the pace is moving away from the Fed's 2% goal. We expect the headline PCE price index to be up 0.2% m/m, lifting the 12-month change to a still-low 1.4% from 1.3%.

- Separately, we anticipate personal spending to advance a firm 0.4% in November, marking its strongest monthly increase in four months. Despite that, the November print should continue to indicate household spending is moderating in Q4. Lastly, we forecast UMich's consumer sentiment to have improved modestly to 99.5 from its preliminary value at 99.2 for December."

NIKE (NKE) reported Q2 FY 2020 earnings of $0.70 per share (versus $0.52 in Q2 FY 2019), beating analysts' consensus estimate of $0.58.

The company's quarterly revenues amounted to $10.326 bln (+10.2% y/y), beating analysts' consensus estimate of $10.090 bln. Meanwhile, its gross margin increased 20 bps y/y to 44.0% vs. analysts' consensus estimate of 44.1%.

NKE fell to $99.90 (-1.24%) in pre-market trading.

- It is fine to cut rates as BoE can raise them back by more later

GBP/USD: Supported here? - Commerzbank

Axel Rudolph, an analyst at Commerzbank, suggests that GBP/USD probes the October 21 and 31 highs at 1.3013/1.2976, which are to offer support.

- "Further support can be seen along the 55-day moving average at 1.2896. Minor resistance comes in around the May high at 1.3187 as well as at the January high at 1.3217 and more significant resistance at the 1.3351/82 February and March highs.

- Above the current December high at 1.3515 sits the December 2017 high at 1.3550 and still further up the September 2017 peak at 1.3658 as well as the February 2018 low at 1.3712, all of which remain in focus for the months to come.

- Failure at the 1.3013/1.2976 support area would put the 200-day moving average at 1.2695 back on the plate."

- UK outlook has weakened in the past year

- Current data justifies looser monetary policy

- Cutting interest rates now would be insurance against rates getting stuck near zero in future

- Brexit uncertainties may become entrenched and world economy may weaken

- Sees substantial chance of "quite weak" UK inflation in near-term

- Sees growth in near-term

- Says slow and gradual rise in bank rate may be needed if path to post-Brexit EU trade agreement smoother than he expects

- Effect of unconventional policies such as QE "much more uncertain" than for traditional tools

British Prime Minister Boris Johnson welcomed the appointment of Andrew Bailey to head the Bank of England and has full confidence he will do an excellent job, his spokesman said.

"The prime minister wants to thank the Bank of England Governor Mark Carney for his hard work and dedication over the past six and a half years. Andrew Bailey brings a wealth of experience of central banking and the prime minister has full confidence that he will do an excellent job," the spokesman said.

Analysts at TD Securities are expecting the Canadian retail sales are expected to rise by 0.5% (TD & market) on the combination of stronger motor vehicle sales and a 0.3% increase in the ex-autos print.

"Real retail sales should rise in line with the nominal print, owing to largely unchanged consumer prices, which will provide a solid start for Q4 consumption after a muted handoff from the 0.1% decline in retail volumes for September. New house prices for October will be released alongside retail sales with the market looking for a 0.1% m/m increase."

Britain's car industry body called on Prime Minister Boris Johnson to secure a tariff-free trade deal with the European Union which avoids barriers for businesses as production slumped in November.

Output fell 16.5 percent last month to 107,753 cars, continuing a trend of decline in 2019 which leaves output down 14.5% in the first 11 months of the year to 1.2 million vehicles, according to the Society of Motor Manufacturers and Traders (SMMT).

"UK car production is export-led, so we look forward to working with the new government to deliver an ambitious trade deal with the EU," said SMMT Chief Executive Mike Hawes.

"That deal needs to be tariff-free and avoid barriers to trade, which, for automotive, means that our standards must be aligned."

Danske Bank analysts note that as per expectations, a majority of the policymakers at the Bank of England voted to keep the Bank Rate unchanged at 0.75%.

"The Bank of England repeated that it thinks GDP growth will 'pick up from current below-potential rates, supported by the reduction of Brexit-related uncertainties, an easing of fiscal policy and a modest recovery in global growth'. While we agree we are about to see a modest recovery in global growth, we think UK growth will remain subdued for domestic reasons and thus expect Bank of England to cut interest rates in early 2020."

British Prime Minister Boris Johnson said on Friday there would be no alignment with European Union rules under the terms of the free trade deal he wants to strike with the bloc next year.

Johnson said his divorce deal "paves the way for a new agreement on our future relationship with our European neighbors based on an ambitious free trade agreement ... with no alignment on EU rules, but instead control of our own laws."

Axel Rudolph, analyst at Commerzbank, notes that USD/JPY continues to trade in a tight range just below the 109.71/79 resistance zone, made up of the current December highs and also the November 2018 to 2019 downtrend line as well as the 200 week moving average.

"Only if the 109.71/79 area were to successfully be exceeded on a daily chart closing basis, would the 2015-2019 downtrend line at 110.38 be back in the picture. We expect it to cap, if reached, however. Support can still be seen between the 200- and 55-day moving averages as well as the current December low at 108.76/43. Only unexpected failure at 107.89 would probably trigger losses to the 106.48 October low. Failure at 106.48 would target the 106.00 mark. On a weekly chart close above the 2015-2019 downtrend line and the current December high at 109.72/73."

China will actively help firms in the traditional manufacturing sector to get out of trouble next year, and keep pushing lending to smart and green manufacturing industries, the banking and insurance regulator said.

The non-performing asset in some small and medium banks are rising, curbing their lending capability, Yang Liping, chief supervision officer with the regulator told reporters at a briefing in Beijing.

Disposing of the bad loans of small and medium banks needs time, and will not be improved in the short term, Yang added.

Office for National Statistics said, UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.4% in Quarter 3 (July to Sept) 2019, revised upwards by 0.1 percentage points from the first quarterly estimate. Economists had expected a 0.3% increase.

When compared with the same quarter a year ago, UK GDP increased by 1.1% to Quarter 3 2019; revised upwards by 0.1 percentage points from the previous estimate. Economists had expected a 1.0% increase.

At headline level, the GDP dataset is largely unrevised, with 0.1 percentage point revisions to Quarter 4 (Oct to Dec) 2018 and Quarter 3 2019; revisions reflect the inclusion of annual benchmarks from a number of sources for 2018 and the incorporation of administrative Value Added Tax turnover data in the output approach to measuring GDP for Quarter 2 (Apr to June) 2019.

Services remained the strongest contributor to growth in the output approach to GDP in Quarter 3 2019; construction and production also contributed positively to growth.

Household consumption and net trade contributed positively, while gross capital formation and government expenditure contributed negatively to GDP growth in Quarter 3 2019.

European Central Bank said, in October 2019 the current account of the euro area recorded a surplus of €32 billion, compared with a surplus of €28 billion in September 2019. Surpluses were recorded for goods (€30 billion), services (€10 billion) and primary income (€6 billion). These were partly offset by a deficit for secondary income (€13 billion).

In the 12 months to October 2019, the current account recorded a surplus of €324 billion (2.7% of euro area GDP), compared with a surplus of €373 billion (3.2% of euro area GDP) in the 12 months to October 2018. This decline was mainly driven by a reduction in the surpluses for services (down from €117 billion to €79 billion) and to a smaller extent for primary income (down from €89 billion to €77 billion), but also by a widening of the secondary income deficit (up from €142 billion to €160 billion). These developments were only partly offset by a larger surplus for goods (up from €308 billion to €328 billion).

In the financial account, euro area residents made net acquisitions of foreign portfolio investment securities totalling €308 billion in the 12-month period to October 2019 (up from €283 billion in the 12 months to October 2018). Over the same period, non-residents made net acquisitions of euro area portfolio investment securities amounting to €276 billion (up from €146 billion).

Danske Research discusses GBP outlook and adopts a neutral bias on GBP/USD and bullish bias on EUR/GBP in the medium-term.

"Near term, we look for Sterling to move sideways at current levels. Although we expect a subdued economy to provide weakness in H2, this is not key to current EUR/GBP pricing. To take EUR/GBP notably lower, three things need to happen: (1) expansive fiscal policy must be enacted; (2) we need a rebound in soft and hard data and (3) the withdrawal agreement needs to be approved by Parliament. We remain sceptical as to the ease of reaching a UK-EU foreign trade agreement, but such concerns are unlikely to affect EUR/GBP until H2 next year," Danske adds.

In view of Danske Bank analysts, the main release today is the US PCE core inflation and real consumer spending for November.

"The PCE inflation is the measure the Fed is targeting. Consensus looks for a small decline in core PCE inflation to 1.5% y/y from 1.6% y/y in October, still below the Fed's 2% target. Euro consumer confidence is expected to move broadly sideways at a level above the long-term average as has been the case for the past year. The UK House of Commons is set to vote on the Withdrawal Agreement Bill. It sets the end of transition at 11pm on 31 December 2020. Swedish retail sales and wages as well as Norway unemployment are released."

National Institute of Statistics and Economic Studies (INSEE) said, in November 2019, household consumption expenditure on goods slowed down slightly (+0.1% in volume, after +0.2% in October). Economists had expected a 0.3% increase.

In November, food consumption fell sharply (-0.8% after +0.8%) due to the decline in tobacco consumption, due to the rise in prices this month, and the sharp decline in processed agri-food consumption. Energy consumption rebounded (+1.2% in November after -1.5%), due to the increase in gas and electricity consumption. Manufactured good consumption rose again (+0.5% in November after +0.5%). Purchases of durable goods slowed down (+0.6% after +1.1%). On the other hand, spending on clothing and textiles rebounded (+0.5% after -0.5%) and consumption of other manufactured goods increased again (+0.2% after +0.0%). In November, durable good expenditure slowed down but remained lifted by the consumption of transport equipment (+0.9% after +2.1%), particularly second-hand cars purchases. On the other hand, household durable goods consumption fell (-0.4% after +0.5%).

Japan's government has approved a record budget spending worth $939 billion for the coming fiscal year, the Ministry of Finance said on Friday, as it tries to balance the need to boost growth and manage the industrial world's heaviest public debt burden.

The 102.7 trillion yen ($939 billion) general-account budget for the year beginning April 1 marks a 1.2% rise from the current year, boosted by record outlays for welfare and the military and other spending aimed at boosting the economy.

Part of the planned spending will help finance a $122 billion fiscal package put together this month by Abe's cabinet to shore up growth beyond the 2020 Tokyo Olympics after hits from the U.S.-China trade war and an Oct. 1 sales tax hike to 10%.

Abe's administration is counting on economic expansion to boost tax revenues to help finance debt, as limited scope for monetary stimulus prompts global policymakers to focus on fiscal spending.

"We'll continue efforts on reform of expenditure so as to juggle both economic revival and fiscal reform," Finance Minister Taro Aso told reporters after a cabinet meeting.

"We are striving to achieve a primary budget surplus," he said, shrugging off a view that the Bank of Japan's ultra-low rate policy is allowing the government to effectively bankroll its debt.

According to the report from GfK institute, the mood among German consumers deteriorated unexpectedly heading into January, suggesting that household spending in Europe's largest economy could weaken at the beginning of next year.

The consumer sentiment indicator edged down to 9.6 from 9.7 in December. Economists had expected an increase to 9.8.

Household spending has turned into a steady and reliable driver of growth in Germany helped by record-high employment, inflation-busting pay hikes and historically low borrowing costs, providing a buffer against trade-related problems.

GfK researcher Rolf Buerkl said consumers were more pessimistic about the overall economic growth outlook. They also scaled back their personal income expectations, with GfK's sub-indicator falling to the lowest level in more than six years.

"News about job cuts in some industrial sectors, such as the car industry and automobile suppliers, are leading to less optimistic income expectations," Buerkl said.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1226 (5461)

$1.1204 (2547)

$1.1194 (3732)

Price at time of writing this review: $1.1116

Support levels (open interest**, contracts):

$1.1094 (4456)

$1.1072 (1233)

$1.1048 (5504)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 3 is 54827 contracts (according to data from December, 19) with the maximum number of contracts with strike price $1,1050 (5504);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3265 (1205)

$1.3224 (1736)

$1.3157 (1071)

Price at time of writing this review: $1.3018

Support levels (open interest**, contracts):

$1.2969 (697)

$1.2940 (1644)

$1.2907 (875)

Comments:

- Overall open interest on the CALL options with the expiration date January, 3 is 20627 contracts, with the maximum number of contracts with strike price $1,3500 (3258);

- Overall open interest on the PUT options with the expiration date January, 3 is 27220 contracts, with the maximum number of contracts with strike price $1,2800 (2331);

- The ratio of PUT/CALL was 1.32 versus 1.36 from the previous trading day according to data from December, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 66.59 | 0.63 |

| WTI | 61.11 | 0.46 |

| Silver | 17.03 | 0.29 |

| Gold | 1478.621 | 0.22 |

| Palladium | 1935.42 | 0.76 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -69.58 | 23864.85 | -0.29 |

| Hang Seng | -83.72 | 27800.49 | -0.3 |

| KOSPI | 1.8 | 2196.56 | 0.08 |

| ASX 200 | -18.3 | 6833.1 | -0.27 |

| FTSE 100 | 33.07 | 7573.82 | 0.44 |

| DAX | -10.2 | 13211.96 | -0.08 |

| Dow Jones | 137.68 | 28376.96 | 0.49 |

| S&P 500 | 14.23 | 3205.37 | 0.45 |

| NASDAQ Composite | 59.48 | 8887.22 | 0.67 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.68847 | 0.46 |

| EURJPY | 121.593 | -0.13 |

| EURUSD | 1.11195 | 0.06 |

| GBPJPY | 142.205 | -0.76 |

| GBPUSD | 1.30046 | -0.56 |

| NZDUSD | 0.66054 | 0.27 |

| USDCAD | 1.3123 | 0.07 |

| USDCHF | 0.97833 | -0.2 |

| USDJPY | 109.345 | -0.19 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.