- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Major US stock indices grew moderately on Friday amid reports that the US Senate approved the budget plan for the 2018 financial year. The budget plan is $ 4 trillion. was approved by the US Senate in a vote of 51 to 49 votes. The adoption of the budget is one of the stages in the implementation of the tax reform promised by US President Donald Trump, since it allows Republicans to avoid blocking this process by the Democrats. The tax reform will be possible due to the reduction in expenses set in the draft budget. The document also sets the budget framework for the period from 2019 to 2027. It is worth emphasizing that the reduction of taxes provided by Trump within 10 years will increase the US budget deficit by $ 1.5 trillion. The plan should now be coordinated with the budget plan of the House of Representatives.

In addition, as it became known today, in September, home sales in the United States unexpectedly increased, as the consequences of Hurricanes Harvey and Irma began to dissipate, but the constant shortage of offers for sale continued to affect overall activity. The National Association of Realtors said on Friday that home sales in the secondary market increased by 0.7% to a seasonally adjusted annual figure of 5.39 million units last month. Economists predicted that sales would fall to 5.30 million units. Sales have decreased by 1.5 percent since September 2016, this is the first annual decline since July 2016.

Most components of the DOW index finished trading in positive territory (25 out of 30). The leader of growth was the shares of The Boeing Company (BA, + 2.19%). Outsider were the shares of The Procter & Gamble Company (PG, -4.04%).

Almost all sectors of the S & P index recorded an increase. The sector of industrial goods grew most (+ 1.0%). The largest decrease was shown by the consumer goods sector (-0.2%).

At closing:

Dow + 0.71% 23,328.63 +165.59

Nasdaq + 0.36% 6,629.05 +23.98

S & P + 0.51% 2.575.13 +13.03

Existing-home sales stumbled for the fourth time in five months as strained supply levels continue to subdue overall activity, according to the National Association of Realtors. Sales gains in the Northeast and Midwest were outpaced by declines in the South and West.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, retreated 1.7 percent to a seasonally adjusted annual rate of 5.35 million in August from 5.44 million in July. Last month's sales pace is 0.2 percent above last August, and is the lowest since then.

EURUSD: 1.1650 (EUR 460m) 1.1800 (1.42bln) 1.1855 (1.35bln)

USDJPY: 111.00-10 (USD 1.3bln) 111.50-55 (680m) 112.00 (1.7bln) 112.50 (980m) 113.00 (480m) 113.50 (420m) 114.00 (1.25bln)

GBPUSD: 1.3225 (GBP 675m)

EURGBP: 0.8940 (EUR 450mn) 0.8950 (390m)

AUDUSD: 0.7810 (AUD 570m) 0.7910 (310m)

U.S. stock-index futures rose, supported by reports the U.S. Senate has approved a budget resolution for the 2018 fiscal year.

Global Stocks:

Nikkei 21,457.64 +9.12 +0.04%

Hang Seng 28,487.24 +328.15 +1.17%

Shanghai 3,379.50 +9.33 +0.28%

S&P/ASX 5,906.99 +10.86 +0.18%

FTSE 7,534.14 +11.10 +0.15%

CAC 5,370.10 +1.81 +0.03%

DAX 12,999.81 +9.71 +0.07%

Crude $51.06 (-0.87%)

Gold $1,285.10 (-0.38%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 219.65 | 0.41(0.19%) | 328 |

| ALCOA INC. | AA | 46.85 | 0.31(0.67%) | 4445 |

| Amazon.com Inc., NASDAQ | AMZN | 992.65 | 6.04(0.61%) | 24945 |

| American Express Co | AXP | 92.2 | 0.30(0.33%) | 2230 |

| AMERICAN INTERNATIONAL GROUP | AIG | 65.15 | 0.08(0.12%) | 250 |

| Apple Inc. | AAPL | 156.61 | 0.63(0.40%) | 131679 |

| AT&T Inc | T | 35.74 | 0.05(0.14%) | 19236 |

| Barrick Gold Corporation, NYSE | ABX | 16.05 | -0.05(-0.31%) | 24823 |

| Boeing Co | BA | 260.6 | 1.56(0.60%) | 331 |

| Caterpillar Inc | CAT | 131.5 | 0.73(0.56%) | 6558 |

| Cisco Systems Inc | CSCO | 33.9 | 0.15(0.44%) | 15261 |

| Citigroup Inc., NYSE | C | 73.85 | 0.97(1.33%) | 117851 |

| Exxon Mobil Corp | XOM | 82.48 | -0.26(-0.31%) | 13383 |

| Facebook, Inc. | FB | 175.5 | 0.94(0.54%) | 67816 |

| FedEx Corporation, NYSE | FDX | 223.9 | -0.07(-0.03%) | 236 |

| Ford Motor Co. | F | 12.1 | 0.02(0.17%) | 34612 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15 | 0.19(1.28%) | 24757 |

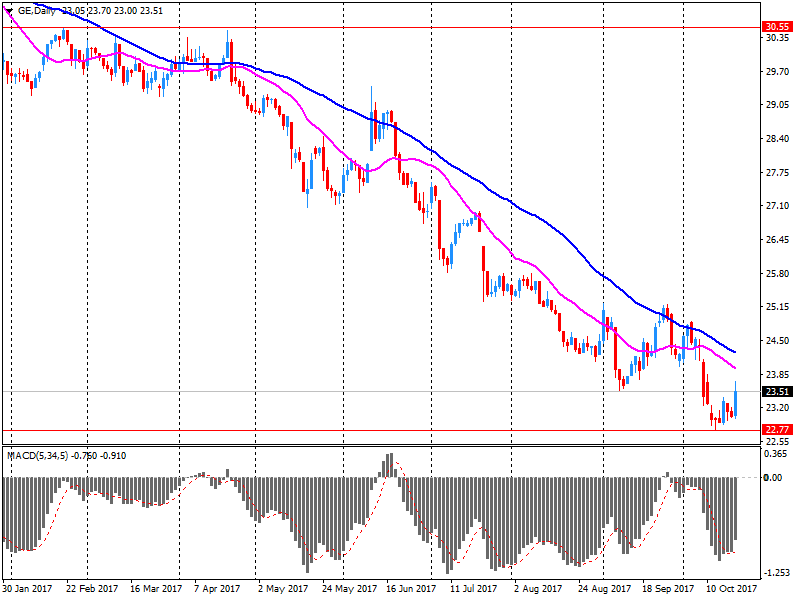

| General Electric Co | GE | 21.63 | -1.95(-8.27%) | 10976463 |

| General Motors Company, NYSE | GM | 45.59 | 0.24(0.53%) | 3455 |

| Goldman Sachs | GS | 242.78 | 2.79(1.16%) | 4713 |

| Google Inc. | GOOG | 988.58 | 4.13(0.42%) | 3992 |

| Hewlett-Packard Co. | HPQ | 22.1 | 0.14(0.64%) | 222 |

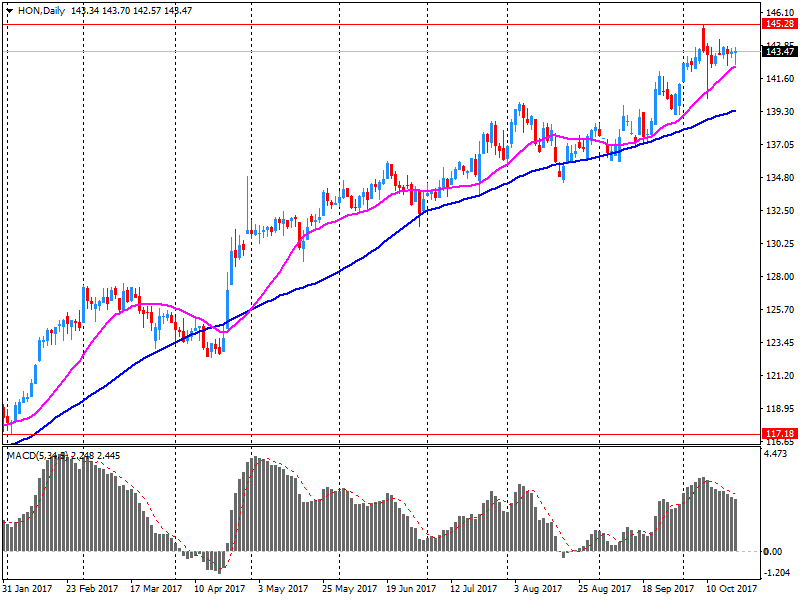

| HONEYWELL INTERNATIONAL INC. | HON | 145 | 1.38(0.96%) | 12951 |

| Intel Corp | INTC | 40.36 | 0.27(0.67%) | 13661 |

| International Business Machines Co... | IBM | 161.11 | 0.21(0.13%) | 13196 |

| Johnson & Johnson | JNJ | 142.95 | 0.91(0.64%) | 1345 |

| JPMorgan Chase and Co | JPM | 99.35 | 1.24(1.26%) | 58982 |

| Microsoft Corp | MSFT | 78.19 | 0.28(0.36%) | 5716 |

| Nike | NKE | 52.87 | 0.18(0.34%) | 10018 |

| Pfizer Inc | PFE | 36.16 | -0.08(-0.22%) | 288 |

| Procter & Gamble Co | PG | 90 | -1.59(-1.74%) | 40527 |

| Starbucks Corporation, NASDAQ | SBUX | 55.2 | -0.20(-0.36%) | 3361 |

| Tesla Motors, Inc., NASDAQ | TSLA | 351.6 | -0.21(-0.06%) | 24720 |

| Twitter, Inc., NYSE | TWTR | 17.94 | 0.05(0.28%) | 6917 |

| United Technologies Corp | UTX | 119.5 | 0.01(0.01%) | 100 |

| UnitedHealth Group Inc | UNH | 203 | -0.25(-0.12%) | 2140 |

| Verizon Communications Inc | VZ | 49.31 | 0.10(0.20%) | 8811 |

| Visa | V | 107.56 | 0.54(0.50%) | 1630 |

| Wal-Mart Stores Inc | WMT | 86.63 | 0.23(0.27%) | 7840 |

Travelers (TRV) reiterated with a Neutral at FBR & Co., target $119

Freeport-McMoRan (FCX) reiterated with a Neutral at FBR & Co., target $12

Honeywell (HON) reported Q3 FY 2017 earnings of $1.75 per share (versus $1.51 in Q3 FY 2016), beating analysts' consensus estimate of $1.74.

The company's quarterly revenues amounted to $10.121 bln (+3.2% y/y), generally in-line with analysts' consensus estimate of $10.046 bln.

HON rose to $144.60 (+0.68%) in pre-market trading.

After increasing 0.4% in July, retail sales declined 0.3% in August to $48.9 billion. Sales were down in 8 of 11 subsectors, representing 57% of retail trade.

Lower sales at food and beverage stores more than offset higher sales at gasoline stations and motor vehicle and parts dealers. Excluding the latter two subsectors, retail sales were down 1.3%.

In volume terms, retail sales decreased 0.7%.

Following four consecutive monthly increases, sales at food and beverage stores (-2.5%) declined in August. The decrease was largely attributable to lower sales at supermarkets and other grocery stores (-2.8%). Sales at specialty food stores (+1.4%) were up for the third month in a row.

Sales were down at store types traditionally associated with housing purchases and home renovation in August. Sales at building material and garden equipment and supplies dealers (-1.9%) and furniture and home furnishings stores (-2.4%) declined for the second consecutive month.

The Consumer Price Index (CPI) rose 1.6% on a year-over-year basis in September, following a 1.4% gain in August. The all-items CPI excluding gasoline rose 1.1% year over year in September, matching the gain in both July and August.

Prices were up in six of the eight major CPI components in the 12 months to September, with the transportation and shelter indexes contributing the most to the year-over-year rise. The clothing and footwear index and the household operations, furnishings and equipment index both declined on a year-over-year basis.

Transportation costs rose 3.8% on a year-over-year basis in September, following a 2.8% increase in August. For a third consecutive month, gasoline prices were the largest contributor to the gain in transportation prices and also to their acceleration. The gasoline index rose 14.1% in the 12 months to September, largely due to supply disruptions caused by Hurricane Harvey. The purchase of passenger vehicles index accelerated 1.0% year over year in September, up from a 0.7% increase in August.

Procter & Gamble (PG) reported Q1 FY 2018 earnings of $1.09 per share (versus $1.03 in Q1 FY 2017), beating analysts' consensus estimate of $1.08.

The company's quarterly revenues amounted to $16.653 bln (+0.8% y/y), generally in-line with analysts' consensus estimate of $16.687 bln.

The company also reaffirmed guidance for FY2018, projecting EPS of +5-7% to ~$4.12-4.19 (versus analysts' consensus estimate of $4.18) and revenues of +3% to ~$67.0 bln (versus analysts' consensus estimate of $67.15 bln).

PG fell to $90.00 (-1.74%) in pre-market trading.

General Electric (GE) reported Q3 FY 2017 earnings of $0.29 per share (versus $0.32 in Q3 FY 2016), missing analysts' consensus estimate of $0.49.

The company's quarterly revenues amounted to $33.470 bln (+11.5% y/y), beating analysts' consensus estimate of $32.505 bln.

The company also issued downside guidance for FY2017, projecting EPS of $1.05-1.10, compared to prior $1.60-1.70 and analysts' consensus estimate of $1.53.

GE fell to 21.94 (-6.95%) in pre-market trading.

-

Measures to impose direct rule on Catalonia presented on saturday will have backing from opposition parties PSOE and Ciudadanos

-

I am ambitious and positive about the Brexit negotiations

-

I have made clear to EU that they do not need to be concerned over the current budget plan

-

If we are going to take a step forward we must work together on brexit

-

Agreed with EU Northern Ireland needs specific solutions post-brexit

-

We will honour commitments made to EU

-

Following discussion among EU leaders, they will consider vision for future partnership

EUR/USD: 1.1600(475 m), 1.1650(456 m), 1.1800(1.48 b), 1.1850-55(1.38 b)

USD/JPY: 111.10(911 m), 111.50-53(630 m), 112.00(1.71 b), 112.50(973 m), 112.60-63(536 m), 113.00(477 m), 113.50(421 m), 114.00(1.45 b)

GBP/USD: 1.3225(668 m)

AUD/USD: 0.7715(648 m), 0.7810(561 m), 0.7900(335 m)

EUR/GBP: 0.8775(400 m), 0.8940(452 m), 0.8950(387 m)

NZD/USD: 0.7200(353 m)

USD/CAD: 1.2345-50(366 m), 1.2400(347 m), 1.2545-50(473 m)

Public sector net borrowing (excluding public sector banks) decreased by £2.5 billion to £32.5 billion in the current financial year-to-date (April 2017 to September 2017), compared with the same period in 2016; this is the lowest year-to-date net borrowing since 2007.

Public sector net borrowing (excluding public sector banks) decreased by £0.7 billion to £5.9 billion in September 2017, compared with September 2016; this is the lowest September net borrowing since 2007.

The Office for Budget Responsibility (OBR) forecast that public sector net borrowing (excluding public sector banks) will be £58.3 billion during the financial year ending March 2018, an increase of £12.6 billion on the outturn net borrowing in the financial year ending March 2017.

Public sector net debt (excluding public sector banks) was £1,785.3 billion at the end of September 2017, equivalent to 87.2% of gross domestic product (GDP), an increase of £145.2 billion (or 4.4 percentage points as a ratio of GDP) on September 2016.

This reflected surpluses for goods (€28.2 billion), primary income (€10.3 billion) and services (€7.2 billion), which were partly offset by a deficit for secondary income (€12.4 billion).

The 12-month cumulated current account for the period ending in August 2017 recorded a surplus of €338.5 billion (3.1% of euro area GDP), compared with one of €358.1 billion (3.3% of euro area GDP) for the 12 months to August 2016. This development was due to a decrease in the surplus for goods (from €374.1 billion to €339.0 billion) and an increase in the deficit for secondary income (from €131.9 billion to €150.2 billion). These were partly offset by increases in the surpluses for primary income (from €66.1 billion to €90.9 billion) and services (from €49.9 billion to €58.8 billion).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1937 (3422)

$1.1898 (1368)

$1.1867 (277)

Price at time of writing this review: $1.1817

Support levels (open interest**, contracts):

$1.1752 (3001)

$1.1718 (3086)

$1.1680 (4980)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 100720 contracts (according to data from October, 19) with the maximum number of contracts with strike price $1,2000 (6540);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3286 (3497)

$1.3242 (2227)

$1.3196 (1050)

Price at time of writing this review: $1.3119

Support levels (open interest**, contracts):

$1.3066 (2325)

$1.3002 (1994)

$1.2964 (2322)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 38907 contracts, with the maximum number of contracts with strike price $1,3200 (3497);

- Overall open interest on the PUT options with the expiration date November, 3 is 33528 contracts, with the maximum number of contracts with strike price $1,3150 (2325);

- The ratio of PUT/CALL was 0.86 versus 0.88 from the previous trading day according to data from October, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

In September 2017 the index of producer prices for industrial products rose by 3.1% compared with the corresponding month of the preceding year. In August 2017 the annual rate of change all over had been 2.6%, as reported by the Federal Statistical Office (Destatis).

Compared with the preceding month August 2017 the overall index rose by 0.3% in September 2017 (+0.2% in August and in July).

In September 2017 the price indices of all main industrial groups increased compared with September 2016: Prices of non-durable consumer goods rose by 3.4%, prices of intermediate goods by 3.6%. Energy prices rose by 4.6%, though the development of prices of the different energy carriers diverged. Prices of electricity increased by 8.9% and prices of petroleum products by 7.5%, whereas prices of natural gas (distribution) decreased by 4.6%. Prices of durable consumer goods and prices of capital goods increased each by 1.1%.

The overall index disregarding energy was 2.6% up on September 2016 and rose by 0.1% compared with August 2017.

In September 2017 compared with September 2016 visitor arrivals were up 7,700 to 252,700.

The biggest changes were in arrivals from:

-

Australia (up 4,800)

-

China (up 3,500)

-

United States of America (down 1,900)

-

Republic of Korea (up 1,400)

Overseas trips by New Zealand residents were up 5,600 to 273,600.

The biggest changes were in departures to:

-

Australia (down 7,200)

-

United States of America (down 2,800)

-

Fiji (up 2,100)

-

United Kingdom (up 2,000)

-

China (up 2,000)

U.S. stocks finished mixed on Thursday, with the Dow and S&P 500 inching up in the last minute to secure record finishes, according to preliminary numbers, shaking off earlier weakness tied to political headlines in Europe, muted data from China and the 30th anniversary of Black Monday--the worst one-day percentage fall in history.

Early weakness in Japan, Australia and New Zealand stocks faded Friday morning, but Asia-Pacific markets overall lacked direction following weakness in Europe and swings on Wall Street. Hong Kong stocks rebounded strongly at the open, with the Hang Seng Index HSI, +0.98% up 0.7%. A late-session selloff Thursday put the benchmark down 2%, after a warning from the governor of China's central bank rattled investors.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.