- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(raw materials / closing price /% change)

Oil 51.40 -1.23%

Gold 1,291.90 +0.69%

(index / closing price / change items /% change)

Nikkei +85.47 21448.52 +0.40%

TOPIX +5.40 1730.04 +0.31%

Hang Seng -552.67 28159.09 -1.92%

CSI 300 -12.91 3931.25 -0.33%

Euro Stoxx 50 -17.57 3602.08 -0.49%

FTSE 100 -19.83 7523.04 -0.26%

DAX -52.93 12990.10 -0.41%

CAC 40 -15.52 5368.29 -0.29%

DJIA +5.44 23163.04 +0.02%

S&P 500 +0.84 2562.10 +0.03%

NASDAQ -19.15 6605.07 -0.29%

S&P/TSX +35.84 15818.00 +0.23%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1845 +0,46%

GBP/USD $1,3151 -0,39%

USD/CHF Chf0,97603 -0,48%

USD/JPY Y112,56 -0,35%

EUR/JPY Y133,34 +0,11%

GBP/JPY Y148,03 -0,74%

AUD/USD $0,7877 +0,37%

NZD/USD $0,7026 -1,86%

USD/CAD C$1,24848 +0,19%

00:45 New Zealand Visitor Arrivals September 5.80% 3.10%

09:00 Germany Producer Price Index (MoM) September 0.2% 0.1%

09:00 Germany Producer Price Index (YoY) September 2.6% 2.9%

11:00 Eurozone Current account, unadjusted, bln August 32.5 26.2

11:30 United Kingdom PSNB, bln September -5.09 -5.7

15:30 Canada Retail Sales YoY August 7.8%

15:30 Canada Retail Sales, m/m August 0.4% 0.5%

15:30 Canada Retail Sales ex Autos, m/m August 0.2% 0.3%

15:30 Canada Bank of Canada Consumer Price Index Core, y/y September 0.9%

15:30 Canada Consumer price index, y/y September 1.4% 1.6%

15:30 Canada Consumer Price Index m / m September 0.1% 0.3%

17:00 U.S. Existing Home Sales September 5.35 5.30

20:00 U.S. Baker Hughes Oil Rig Count October 743

21:00 U.S. FOMC Member Mester Speaks

Major US stock indexes completed the trading session without a single dynamic against the backdrop of the fall in Apple shares and a number of weak corporate results.

A certain influence on the course of trading was provided by the US data. The Ministry of Labor reported that the number of Americans applying for unemployment benefits fell to its lowest level for more than 44 years in the past week, indicating a rebound in employment growth after the decline associated with a decline in employment in September. Primary claims for unemployment benefits fell by 22,000 to 222,000, seasonally adjusted for the week to October 4, the lowest level since March 1973. Data for the previous week were revised, and showed 1000 more initial hits than previously reported.

At the same time, the report submitted by the Federal Reserve Bank of Philadelphia showed that the index of business activity in the production sector increased in October, reaching a level of 27.9 points compared to 23.8 points in September. Economists had expected a decline to 22 points.

In addition, the index of leading indicators from the Conference Board for the US fell by 0.2 percent in September to 128.6, after an increase of 0.4 percent in August and 0.3 percent in July. "The index fell for the first time in the past 12 months, partly as a result of the temporary impact of hurricanes," said Ataman Ozildirim, director of business cycles at the Conference Board. - The source of weakness was focused on the labor market, while most of the components of the index continued to make a positive contribution. Despite the decline in September, the long-term trend of LEI remains in line with the continued steady growth of the US economy in the second half of the year. "

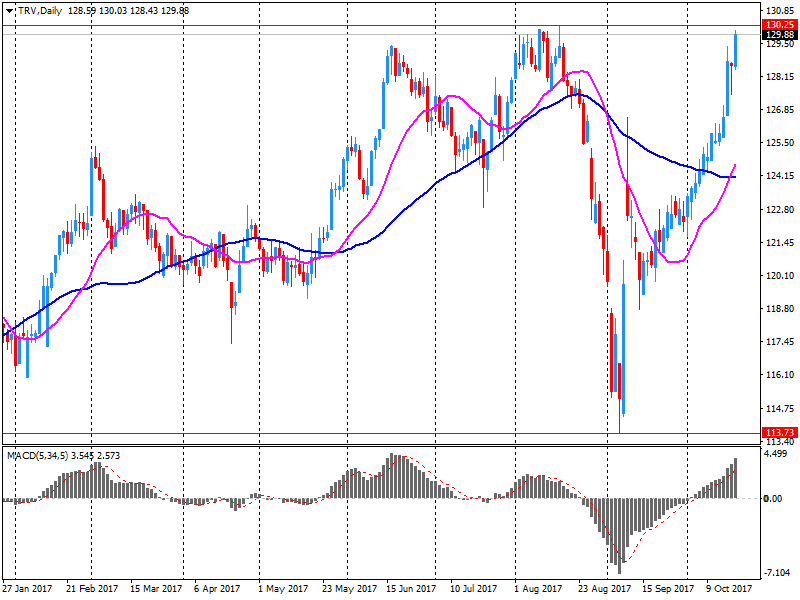

Most components of the DOW index finished trading in positive territory (20 out of 30). The leader of growth was the shares of The Travelers Companies, Inc. (TRV, + 2.28%). Outsider were the shares of Apple Inc. (AAPL, -2.60%).

Most sectors of the S & P index recorded a decline. The largest decrease was in consumer goods (-1.3%). The utilities sector grew most (+ 0.7%).

At closing:

DJIA + 0.04% 23,166.69 +9.09

Nasdaq -0.29% 6,605.07 -19.15

S & P + 0.03% 2.562.11 + 0.85

As we can see on 1 hour time frame chart, the price is about to hit our downside trend line.

In this way, we can be attentive to two scenarios. If the price breaks our trend line and if as the next h1 candles close above the same line, then we can expect a bullish move to values close to 0.9868 by stopping slightly below the trend line.

Other scenario, if the price shows signs of downward rejection of this same line then it may indicate a possible new downward impulse thus forming a lower low relative to the previous one.

EURUSD: 1.1600 (EUR 320m) 1.1700 (665m) 1.1750 (725m) 1.1765 (715m) 1.2000 (1.42bln)

USDJPY: 110.00-05 (USD 905m) 111.30 (350m) 111.50 (505m) 112.20 (370m) 112.30(320m) 112.50 (445m) 113.00-10 (855m) 113.95-00 (560m)

GBPUSD: 1.3170 (GBP 470m) 1.3250 (265m) 1.3480 (400m) 1.3495-00 (500m)

USDCHF: 0.9600 (USD 400m)

AUDUSD: 0.7500(AUD 670m) 0.7700 (325m) 0.7800 (360m) 0.7900 (405m)

USDCAD: 1.2400 (490m) 1.2500 (890m)

AUDNZD: 1.1015 (540m)

AUDJPY: 87.50 (230m)

U.S. stock-index futures signaled that equities would retreat from their freshly minted record highs at today's opening bell.

Global Stocks:

Nikkei 21,448.52 +85.47 +0.40%

Hang Seng 28,159.09 -552.67 -1.92%

Shanghai 3,370.10 -11.70 -0.35%

S&P/ASX 5,896.13 +5.65 +0.10%

FTSE 7,500.33 -42.54 -0.56%

CAC 5,347.25 -36.56 -0.68%

DAX 12,938.63 -104.40 -0.80%

Crude $51.25 (-1.52%)

Gold $1,287.30 (+0.34%)

(company / ticker / price / change ($/%) / volume)

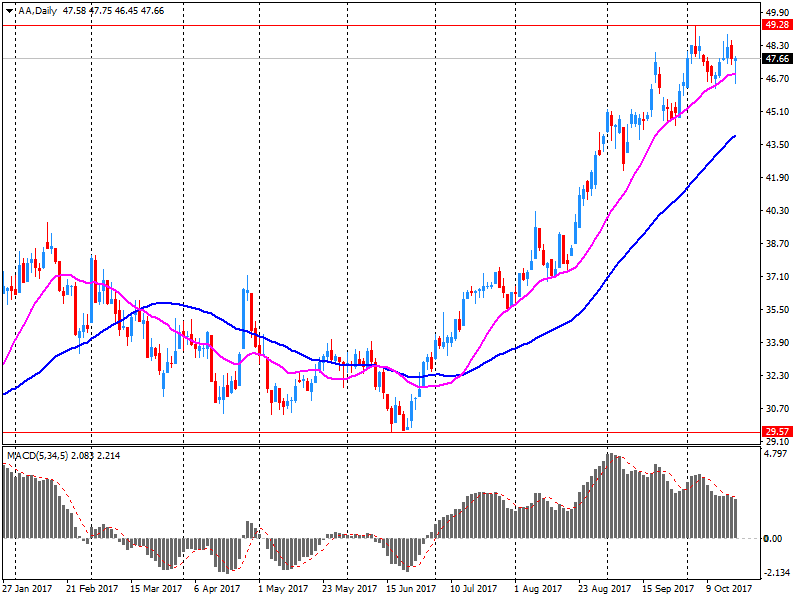

| ALCOA INC. | AA | 46.25 | -1.50(-3.14%) | 5806 |

| ALTRIA GROUP INC. | MO | 64.1 | -0.71(-1.10%) | 40703 |

| Amazon.com Inc., NASDAQ | AMZN | 989 | -8.00(-0.80%) | 19466 |

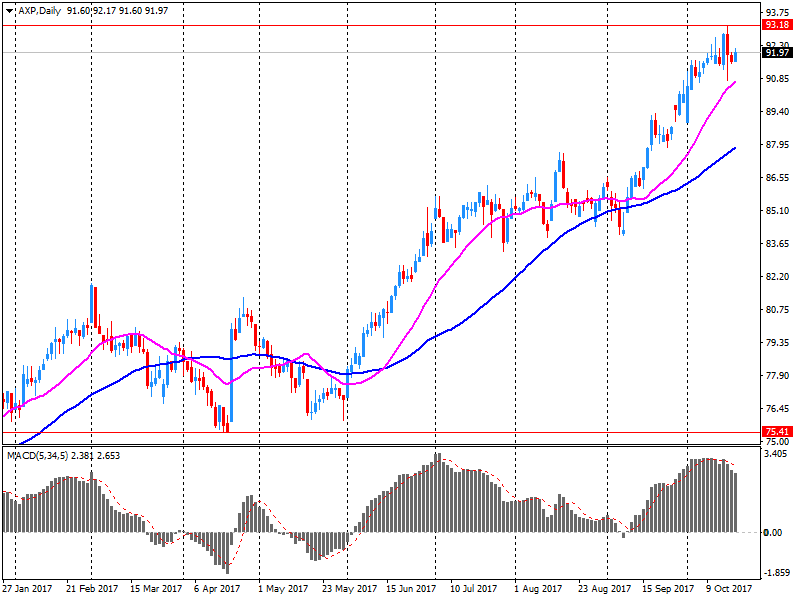

| American Express Co | AXP | 89.54 | -2.54(-2.76%) | 29442 |

| Apple Inc. | AAPL | 157.15 | -2.61(-1.63%) | 484349 |

| AT&T Inc | T | 35.87 | 0.16(0.45%) | 137912 |

| Barrick Gold Corporation, NYSE | ABX | 16.28 | 0.11(0.68%) | 86486 |

| Boeing Co | BA | 257.1 | -2.94(-1.13%) | 11634 |

| Caterpillar Inc | CAT | 130.02 | -1.27(-0.97%) | 5126 |

| Chevron Corp | CVX | 117.6 | -0.55(-0.47%) | 3554 |

| Cisco Systems Inc | CSCO | 33.47 | -0.08(-0.24%) | 4398 |

| Citigroup Inc., NYSE | C | 72.44 | -0.68(-0.93%) | 33989 |

| Deere & Company, NYSE | DE | 129.33 | 0.61(0.47%) | 100 |

| Exxon Mobil Corp | XOM | 82.48 | -0.28(-0.34%) | 3159 |

| Facebook, Inc. | FB | 174.65 | -1.38(-0.78%) | 97961 |

| Ford Motor Co. | F | 12.12 | -0.07(-0.57%) | 8995 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.7 | -0.13(-0.88%) | 25959 |

| General Electric Co | GE | 23.03 | -0.09(-0.39%) | 76848 |

| General Motors Company, NYSE | GM | 44.8 | -0.32(-0.71%) | 13269 |

| Goldman Sachs | GS | 239.41 | -2.62(-1.08%) | 6609 |

| Google Inc. | GOOG | 984 | -8.81(-0.89%) | 3050 |

| Hewlett-Packard Co. | HPQ | 21.65 | -0.07(-0.32%) | 2030 |

| Home Depot Inc | HD | 162.7 | -0.75(-0.46%) | 3732 |

| Intel Corp | INTC | 39.85 | -0.40(-0.99%) | 45004 |

| International Business Machines Co... | IBM | 159 | -0.53(-0.33%) | 58797 |

| JPMorgan Chase and Co | JPM | 97.23 | -0.76(-0.78%) | 29356 |

| McDonald's Corp | MCD | 165.3 | -0.47(-0.28%) | 1836 |

| Merck & Co Inc | MRK | 63.16 | -0.35(-0.55%) | 3595 |

| Microsoft Corp | MSFT | 77.28 | -0.33(-0.43%) | 39106 |

| Nike | NKE | 51.4 | -0.90(-1.72%) | 47074 |

| Pfizer Inc | PFE | 35.73 | -0.10(-0.28%) | 5286 |

| Procter & Gamble Co | PG | 91.7 | -0.38(-0.41%) | 6456 |

| Starbucks Corporation, NASDAQ | SBUX | 54.95 | -0.26(-0.47%) | 3372 |

| Tesla Motors, Inc., NASDAQ | TSLA | 355.61 | -4.04(-1.12%) | 59504 |

| The Coca-Cola Co | KO | 46.24 | -0.16(-0.34%) | 2042 |

| Travelers Companies Inc | TRV | 129.99 | -0.03(-0.02%) | 4045 |

| Twitter, Inc., NYSE | TWTR | 17.88 | -0.14(-0.78%) | 18278 |

| United Technologies Corp | UTX | 119.14 | -0.04(-0.03%) | 1843 |

| UnitedHealth Group Inc | UNH | 204.09 | -1.14(-0.56%) | 330 |

| Verizon Communications Inc | VZ | 49.65 | 1.00(2.06%) | 243891 |

| Visa | V | 107.31 | -0.49(-0.45%) | 10407 |

| Wal-Mart Stores Inc | WMT | 86 | -0.22(-0.26%) | 7125 |

| Walt Disney Co | DIS | 98 | -0.25(-0.25%) | 3845 |

| Yandex N.V., NASDAQ | YNDX | 32.1 | -0.22(-0.68%) | 100 |

Facebook (FB) reiterated with a Buy at Stifel; target $200

Manufacturing firms reported continued growth in regional manufacturing in October. The survey's current indicators for general activity, new orders, shipments, and employment all remained positive this month. Both of the survey's current labor market indicators showed notable improvement. The indexes assessing the six-month outlook suggest that firms remained optimistic about future growth.

The index for current manufacturing activity in the region increased 4 points to a reading of 27.9 and is now at its highest reading since May (see Chart 1). More than 39 percent of the firms indicated increases in activity this month, while 11 percent reported decreases. Both the new orders and shipments indexes remained positive but fell this month, decreasing 10 points and 13 points, respectively. Both the unfilled orders and delivery times indexes were positive for the 12th consecutive month, suggesting longer delivery times and an increase in unfilled orders.

In the week ending October 14, the advance figure for seasonally adjusted initial claims was 222,000, a decrease of 22,000 from the previous week's revised level. This is the lowest level for initial claims since March 31, 1973 when it was 222,000. The previous week's level was revised up by 1,000 from 243,000 to 244,000. The 4-week moving average was 248,250, a decrease of 9,500 from the previous week's revised average. The previous week's average was revised up by 250 from 257,500 to 257,750.

Claims taking procedures continue to be severely disrupted in Puerto Rico and the Virgin Islands as a result of power outages and infrastructure damage caused by Hurricanes Irma and Maria.

Verizon (VZ) reported Q3 FY 2017 earnings of $0.98 per share (versus $1.01 in Q3 FY 2016), beating analysts' consensus estimate of $0.97.

The company's quarterly revenues amounted to $31.700 bln (+2.5% y/y), generally in-line with analysts' consensus estimate of $31.446 bln.

VZ rose to $49.70 (+2.16%) in pre-market trading.

Travelers (TRV) reported Q3 FY 2017 earnings of $0.91 per share (versus $2.40 in Q3 FY 2016), beating analysts' consensus estimate of $0.37.

The company's quarterly revenues amounted to $6.660 bln (+4.2% y/y), beating analysts' consensus estimate of $6.426 bln.

TRV rose to $132.20 (+1.68%) in pre-market trading.

American Express (AXP) reported Q3 FY 2017 earnings of $1.50 per share (versus $1.24 in Q3 FY 2016), beating analysts' consensus estimate of $1.48.

The company's quarterly revenues amounted to $8.436 bln (+8.5% y/y), beating analysts' consensus estimate of $8.307 bln.

The company also issued upside guidance for FY2017, projecting EPS of $5.80-5.90 (prior $5.60-5.80), versus analysts' consensus estimate of $5.74.

AXP fell to $90.10 (-2.15%) in pre-market trading.

Alcoa (AA) reported Q3 FY 2017 earnings of $0.72 per share (versus $0.32 in Q3 FY 2016), missing analysts' consensus estimate of $0.77.

The company's quarterly revenues amounted to $2.964 bln (+27.3% y/y), generally in-line with analysts' consensus estimate of $2.946 bln.

AA fell to $46.40 (-2.83%) in pre-market trading.

-

There is no doubt the oil market is rebalancing at an accelerating pace

The underlying pattern in the retail industry is one of growth; for the three-months on three-months measure, the quantity bought increased by 0.6%.

In September 2017, the quantity bought in the retail industry decreased by 0.8% when compared with August 2017; non-food stores provided the greatest downward pressure following growth in August 2017.

Year on year, the quantity bought in the retail sector increased by 1.2%, with non-food (household goods, clothing stores) and non-store retailing all providing growth.

Store prices continue to rise across all store types and are at their highest year-on-year price growth since March 2012 at 3.3% (non-seasonally adjusted).

Online sales values increased year-on-year by 14%, accounting for approximately 17% of all retail spending.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1943 (3609)

$1.1883 (3012)

$1.1831 (388)

Price at time of writing this review: $1.1803

Support levels (open interest**, contracts):

$1.1749 (2365)

$1.1699 (2999)

$1.1666 (4761)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 99165 contracts (according to data from October, 18) with the maximum number of contracts with strike price $1,2000 (6332);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3294 (1454)

$1.3261 (1366)

$1.3233 (1050)

Price at time of writing this review: $1.3211

Support levels (open interest**, contracts):

$1.3175 (2105)

$1.3145 (2133)

$1.3099 (1285)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 37539 contracts, with the maximum number of contracts with strike price $1,3300 (3440);

- Overall open interest on the PUT options with the expiration date November, 3 is 33001 contracts, with the maximum number of contracts with strike price $1,3000 (2287);

- The ratio of PUT/CALL was 0.88 versus 0.88 from the previous trading day according to data from October, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

While exports were adjusted for working days in the third quarter of 2017 by 2.5% imports rose by as much as 7.4% with this plus the Foreign trade continues at a high level. The trade balance decreased from CHF 10.3 billion 8.5 billion francs In the third quarter of 2017, exports grew by 2.5% per working day (real: + 1.4%).

Compared to the record high quarter, they still rose by a seasonally adjusted 0.2% to. Imports showed an increase of 7.4% (real: + 1.6%) compared with the previous year. The seasonally adjusted increase to the strong second quarter of 2017 was still 0.6%.

China's gross domestic product expanded 1.7 percent on quarter in the third quarter of 2017, the National Bureau of Statistics cited by rttnews.

That was in line with forecasts and down from 1.8 percent in the second quarter.

On a yearly basis, GDP advanced 6.9 percent - unchanged from the previous three months and exceeding expectations for 6.8 percent.

The bureau also said that industrial production jumped an annual 6.6 percent in September - beating forecasts for 6.5 percent and up from 6.0 percent in August.

Retail sales were up 10.3 percent on year, beating expectations for 10.2 percent and up from 10.1 percent in the previous month.

Fixed asset investment was up an annual 7.5 percent, missing forecasts for 7.7 percent and down from 7.8 percent a month earlier.

-

Employment increased 23,800 to 12,281,200.

-

Unemployment decreased 2,200 to 716,600.

-

Unemployment rate remained steady at 5.5%, following a revised august 2017 estimate.

-

Participation rate increased by less than 0.1 pts, but remained at 65.2% in rounded terms.

-

Monthly hours worked in all jobs increased 3.1 million hours (0.2%) to 1,714.5 million Hours.

Seasonally adjusted:

-

Employment increased 19,800 to 12,290,200. Full-time employment increased 6,100 to

-

8,398,200 and part-time employment increased 13,700 to 3,892,000.

-

Unemployment decreased 11,800 to 711,500. The number of unemployed persons

-

Looking for full-time work decreased 10,600 to 487,100 and the number of unemployed

-

Persons only looking for part-time work decreased 1,200 to 224,400.

-

Unemployment rate decreased 0.1 pts to 5.5%.

-

Participation remained steady at 65.2%.

-

Monthly hours worked in all jobs increased 11.2 million hours (0.7%) to 1,718.2 million Hours.

European stocks finished with gains Wednesday, as falls in the euro and the pound helped exporters and offset disappointing financial updates from companies such as Zalando. Where indexes are trading: The Stoxx Europe 600 index SXXP, +0.29% posted a 0.3% rise to end at 391.56. On Tuesday, the pan-European benchmark fell 0.3%.

The Dow Jones Industrial Average punched firmly higher on Wednesday to a historic close above 23,000. It took 54 trading days for the gauge to close above the next round-number milestone, representing the third fastest 1,000-point advance in history. However, the record-setting climb for the more than 120-year old stock-market average might hint at some softness.

Asian stocks inched up to near decade highs on Thursday, continuing to ride on a global equities rally, while the dollar resumed its rise on the back of a spike in U.S. yields.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.