- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Rabobank analysts think that the ECB’s Governing Council will use the July meeting to steer towards a rate cut in September.

- “Policy rates:

- We expect forward guidance to be updated to signal a rate cut, e.g. “The Governing Council now expects the key ECB interest rates to remain at their present or lower levels [...]”

- We think that this would herald a 10bp rate cut in September. Additionally, we see 3 follow-up cuts in the coming 12 months.

- Draghi signaled that further rate cuts would be accompanied by some form of mitigating factors. We believe a tiered deposit rate is the most feasible solution.

- We don’t expect changes to the reinvestment program or its forward guidance, nor do we anticipate the ECB to restart net asset purchases at this stage.”

A report from

the University of Michigan revealed on Friday the preliminary reading for the

Reuters/Michigan index of consumer sentiment rose to 98.4 in early July.

Economists had

expected the index would increase to 98.5 this month from June’s final reading

of 98.2.

According to

the report, the index of current U.S. economic conditions edged down to 111.1

in July from 111.9 in the previous month. Meanwhile, the index of consumer

expectations rose to 90.1 this month from 89.3 in June.

The Consumer Expectations Index falls as inflation expectations rise, signifying that consumers view higher inflation as a threat to economic growth, the report said. Higher inflation was related more frequently to rising interest rates and was associated with higher unemployment expectations.

Nathan Janzen, the senior economist at Royal Bank of Canada (RBC), notes that the Canadian retail sales fell 0.1% in May and excluding prices, sales were down 0.5%.

- “The details of the May report don’t look quite as soft as the headline. Most of the month-over-month decline was attributed to an unusually large 2.0% drop in food & beverage store sales that will probably reverse at some point. Sales increased in 7 of 11 subsectors – including another sizeable monthly rise in sales at furniture stores. That latter increase probably has something to do with stabilization in housing markets in recent months.

- To be sure, overall retail purchases have still been on the soft side. Sale volumes were down 1% from a year ago and are tracking little if any increase in Q2 from Q1. But other developments have arguably been more favourable for the near-term household spending outlook.”

U.S. stock-index futures fell slightly on Tuesday, as better-than-expected results from Microsoft (MSFT) fed into a bullish mood following signals from New York Fed President John Williams that the U.S. central bank was set to cut interest rates this month.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,466.99 | +420.75 | +2.00% |

Hang Seng | 28,765.40 | +303.74 | +1.07% |

Shanghai | 2,924.20 | +23.02 | +0.79% |

S&P/ASX | 6,700.30 | +51.20 | +0.77% |

FTSE | 7,499.10 | +6.01 | +0.08% |

CAC | 5,561.41 | +10.86 | +0.20% |

DAX | 12,243.41 | +15.56 | +0.13% |

Crude oil | $55.88 | +1.10% | |

Gold | $1,436.10 | +0.56% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 173.5 | 0.44(0.25%) | 413 |

ALCOA INC. | AA | 23.18 | -0.23(-0.98%) | 17249 |

ALTRIA GROUP INC. | MO | 50.69 | 0.16(0.32%) | 4587 |

Amazon.com Inc., NASDAQ | AMZN | 1,992.01 | 14.11(0.71%) | 28091 |

American Express Co | AXP | 127.4 | -1.00(-0.78%) | 96703 |

Apple Inc. | AAPL | 205.93 | 0.27(0.13%) | 106658 |

AT&T Inc | T | 33.24 | 0.15(0.45%) | 10421 |

Boeing Co | BA | 369.15 | 8.04(2.23%) | 75019 |

Caterpillar Inc | CAT | 134.25 | 0.39(0.29%) | 2717 |

Chevron Corp | CVX | 125.1 | 0.42(0.34%) | 641 |

Cisco Systems Inc | CSCO | 57.6 | -0.14(-0.24%) | 18441 |

Citigroup Inc., NYSE | C | 71.8 | 0.01(0.01%) | 75760 |

Exxon Mobil Corp | XOM | 74.5 | -0.34(-0.45%) | 11693 |

Facebook, Inc. | FB | 202 | 1.22(0.61%) | 38239 |

FedEx Corporation, NYSE | FDX | 165.75 | 0.37(0.22%) | 711 |

Ford Motor Co. | F | 10.29 | 0.03(0.29%) | 38639 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.45 | 0.30(2.69%) | 308626 |

Goldman Sachs | GS | 214.5 | -0.02(-0.01%) | 12385 |

Google Inc. | GOOG | 1,146.11 | -0.22(-0.02%) | 2289 |

International Business Machines Co... | IBM | 149.5 | -0.13(-0.09%) | 8193 |

International Paper Company | IP | 42.91 | 0.41(0.96%) | 321 |

Johnson & Johnson | JNJ | 132 | -0.07(-0.05%) | 1560 |

JPMorgan Chase and Co | JPM | 114.78 | 0.11(0.10%) | 106849 |

McDonald's Corp | MCD | 216.5 | 0.59(0.27%) | 4199 |

Merck & Co Inc | MRK | 82.99 | 0.30(0.36%) | 530 |

Microsoft Corp | MSFT | 140.1 | 3.68(2.70%) | 864284 |

Nike | NKE | 87.7 | 0.26(0.30%) | 787 |

Pfizer Inc | PFE | 43.22 | 0.16(0.37%) | 286 |

Procter & Gamble Co | PG | 115.6 | 0.16(0.14%) | 1569 |

Tesla Motors, Inc., NASDAQ | TSLA | 254.99 | 1.45(0.57%) | 55487 |

The Coca-Cola Co | KO | 52 | -0.03(-0.06%) | 7245 |

Twitter, Inc., NYSE | TWTR | 37.84 | 0.18(0.48%) | 8940 |

Visa | V | 181.4 | 0.87(0.48%) | 18528 |

Walt Disney Co | DIS | 142 | 0.37(0.26%) | 12849 |

Yandex N.V., NASDAQ | YNDX | 39.76 | 0.15(0.38%) | 5764 |

Microsoft (MSFT) target raised to $160 from $153 at BMO Capital Markets

Travelers (TRV) downgraded to Neutral from Buy at Buckingham Research; target $158

Alcoa (AA) downgraded to Hold from Buy at Jefferies; target lowered to $23 from $29

Alcoa (AA) downgraded to Hold from Buy at Argus

Statistics

Canada reported on Friday that the Canadian retail sales edged down 0.1 percent

m-o-m to CAD51.46 billion in May, following a revised 0.2 percent m-o-m gain in

April (originally a 0.1 percent m-o-m increase). That marked the first monthly decrease

in retail sales since January.

The result was

below economists’ forecast, suggesting a 0.3 percent m-o-m advance for May.

According to

the report, sales declined in 4 of 11 subsectors, representing 39 percent of

retail trade.

The May drop

was primarily attributable to lower sales at food and beverage stores (-2.0

percent m-o-m).

Excluding motor

vehicle and parts dealers, retail sales fell 0.3 percent m-o-m in May compared

to an unrevised 0.1 percent m-o-m gain in April and economists’ forecast of a

0.4 percent m-o-m rise.

In y-o-y terms,

Canadian retail sales jumped 1.0 percent in May, following an unrevised 3.7

percent jump in April. That was the smallest annual increase in retail trade

since January.

Analysts at TD Securities are expecting the University of Michigan's сonsumer sentiment indicator to show a modest improvement in July to 98.8 from 98.2 before and just a tad below this year's high at 100.

- “Strong stock market performance and a still-solid labor market are likely to be factors behind the improvement. Most of the attention, however, will be on the inflation expectations components that have gained particular relevance in the Fed's reaction function. At 2.3%, 5-10y inflation expectations remain stuck at all-time lows and continue to be an ongoing concern for the Fed.”

Analysts at TD Securities note that the Canadian retail sales for May are the lone data release heading into the weekend and will be a key economic release for the day.

- “TD looks for a 0.3% increase in line with the market consensus, as a pullback in motor vehicle sales weighs on a 0.6% increase in the ex-autos measure (market: 0.4%). After a 0.3% (sa) increase in consumer prices for May, this should leave real retail sales little changed on the month, consistent with some moderation in household consumption after a robust Q1.”

American Express (AXP) reported Q2 FY 2019 earnings of $2.07 per share (versus $1.84 in Q2 FY 2018), beating analysts’ consensus estimate of $2.02.

The company’s quarterly revenues amounted to $10.838 bln (+8.4% y/y), generally in line with analysts’ consensus estimate of $10.825 bln.

The company also reaffirmed guidance for FY 2019, projecting EPS of $7.85-8.35 (versus analysts’ consensus estimate of $8.09) and revenues of +8-10% y/y to ~$43.6-44.4 bln (versus analysts’ consensus estimate of $43.57 bln).

AXP fell to $127.60 (-0.62%) in pre-market trading.

Microsoft (MSFT) reported Q2 FY 2019 earnings of $1.37 per share (versus $1.14 in Q2 FY 2018), beating analysts’ consensus estimate of $1.21.

The company’s quarterly revenues amounted to $33.717 bln (+12.1% y/y), beating analysts’ consensus estimate of $32.797 bln.

MSFT rose to $140.43 (+2.94%) in pre-market trading.

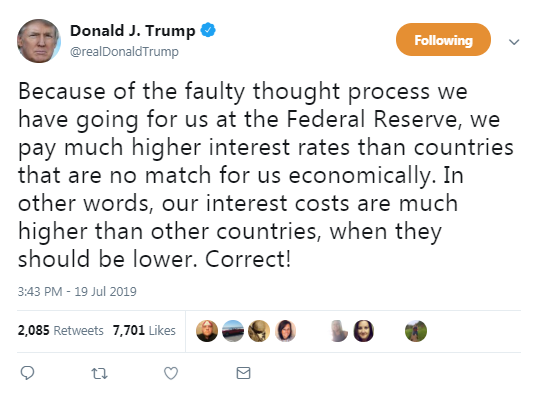

Analysts at ABN AMRO note that the U.S. exchange rate policy has been in the spotlight recently, and the U.S. Treasury Secretary Mnuchin was quizzed on the topic in a post-G7 finance minister meeting press briefing this afternoon.

- “In his remarks, Mr. Mnuchin confirmed that there is no change to the US administration’s dollar policy ‘as of now’, although he did not rule anything out either, stating ‘this is something we could consider in the future’. This followed a tweet by President Trump on 3 July hinting at currency intervention, when he said the US should ‘match’ China and Europe who he accused of ‘playing [a] big currency manipulation game’.

- We judge that unilateral intervention to weaken the dollar by the US authorities is unlikely, as that there is little chance of it being effective, but given the erratic moves of the administration it is not something we would dismiss outright.”

Danske Bank's analysts note that on Thursday, a majority in the House of Commons passed an amendment, making it harder for the UK's government to prorogue Parliament in the run-up to the current Brexit date of 31 October.

- “While this does not prevent a no-deal Brexit outcome (it is still the default option from a legal point of view), it makes it more difficult for Boris Johnson (assuming he wins the leadership contest) to force a no-deal Brexit through by sending Parliament home.

- Some 17 Conservative rebels voted against their own government (which did not include politicians such as Phillip Hammond), supporting our view that it is hard to find a majority for a no-deal Brexit outcome.

- We may soon have a more pro-Brexit prime minister but it does not change the arithmetic in the Commons.”

Tuuli Koivu, an analyst at Nordea Markets, thinks that given the weak economic outlook, low core inflation and inflation expectations for Euro area, more stimulus is in the pipeline from the ECB.

- “Long rates set to fall ahead of QE. Lower for longer weighs on 5y rates. Despite TLTRO&QE, relative liquidity points to higher EURUSD.

- The ECB has been carefully preparing the ground for a new stimulus package in recent weeks. The speeches, especially by President Draghi and Chief Economist Lane, have been interpreted as support for further easing. The main motivation for a new round of easing is that the macroeconomic outlook has remained highly uncertain and core inflation, in particular, has not shown robust signs of acceleration closer to the ECB target. In addition, market-based inflation expectations are at very low levels raising concerns of the ECB’s credibility.

- We think that recent economic data have been positive enough to delay the decision until September when the new ECB staff macroeconomic projections will be published. Much may depend on the PMIs published only a day prior to the meeting. Weak prospects among companies could be a sufficient trigger to get the attention of the governors who have not so far seen further stimulus as necessary to support a new easing package.

- The main things to watch at the ECB meeting on 25 July are:

- Is the ECB Governing Council ready to decide about further easing already now?

- If yes, the size of the stimulus could be rather small because it might be difficult to achieve a consensus on e.g. a new round of net asset purchases, yet. The possibility of “lower levels” could be included again to the forward guidance.

- We expect to see more stimulus only in September, but will Draghi give any hints about the format and size of the stimulus?

- Are there any signs of how unified the Governing Council is in their view on the economic outlook and risks around it?”

- Says he will support a 25 bps rate cut in the central bank’s benchmark short-term rate at July 30-31 meeting

- Doesn’t think a larger cut at that meeting is needed

Analysts at ING suggest that the EUR/CHF is likely to move to 1.05 this summer as expectations are building of ECB quantitative easing.

“Effectively our call is that the Swiss National Bank will face the same kind of pressure (ECB money printing) that prompted them to abandon the 1.20 EUR/CHF floor in January 2015. This all comes at a time when eurozone peripheral debt spreads have already tightened significantly and in the case of Italy may have tightened too much. Our team are watching out for signals that Italy's Deputy Prime Minister Matteo Salvini may pull his Liga party out of the government, prompting early elections. Given our view of the dollar topping out this summer, we also see a chance of USD/CHF breaking below 0.97 amidst higher volatility.”

Analysts at Westpac, notes that China’s Q2 GDP was on expected lines with annual growth decelerating to 6.2%.

“Support from net exports abated, putting the onus for growth more on domestic demand. While consumption has received support from tax cuts, it is evident in the PMI detail that employment growth is under pressure. As a result, for both the short and long-term, investment is critical. Momentum in real estate investment is strong, but public infrastructure and private business investment remain weak. The credit data points to local governments accumulating funding, and so a lift in infrastructure work can be expected shortly. However, private sector investment looks set to remain weak absent greater liquidity and reduced cost for banks, as well as strong encouragement by authorities to lend to these firms.”

Chancellor Angela Merkel said on Friday that Germany was right to pursue a balanced budget - despite Europe's largest economy slowing - especially given the country's ageing population.

The federal government has managed to increase spending without incurring new debt since 2014. In March the cabinet passed a draft budget for 2020 that calls for a 1.7% spending increase and relies on ministries to cut costs to avoid incurring new debt.

Karen Jones, analyst at Commerzbank, explains that for the USD/CHF pair, their view of neutral to negative has been recently rejected by the 2 month downtrend at .9899 today.

“The market recently failed at its 50% retracement at .9967 and the 200 day ma at .9981. This is tough resistance and we suspect that the market has topped here. We look for further losses to .9695, the 25th June low. Above the 200 moving average lies the mid-June high at 1.0014. Longer term we target .9211/.9188, the 2018 low. Only a close above 1.0014 (high 19th June) would alleviate immediate downside pressure and target 1.0097 and possibly 1.0128 before failure again (November and March highs at 1.0124/28).”

According to the report from Office for National Statistics, borrowing (public sector net borrowing excluding public sector banks) in June 2019 was £7.2 billion, £3.8 billion more than in June 2018; the highest June borrowing since 2015.

Borrowing in the current financial year-to-date (April 2019 to June 2019) was £17.9 billion, £4.5 billion more than in the same period last year; the financial year-to-date April 2018 to June 2018 remains the lowest borrowing for that period since 2007.

Borrowing in the latest full financial year (April 2018 to March 2019) was £23.5 billion, £18.3 billion less than in the same period the previous year; the lowest financial year borrowing for 17 years.

Debt (public sector net debt excluding public sector banks) at the end of June 2019 was £1,818.1 billion (or 83.1% of gross domestic product (GDP)); an increase of £27.0 billion (or a decrease of 1.5 percentage points of GDP) on June 2018.

According to the report from European Central Bank, the current account of the euro area recorded a surplus of €30 billion in May 2019, an increase of €8 billion from the previous month. Surpluses were recorded for goods (€27 billion), primary income (€8 billion) and services (€5 billion). These were partly offset by a deficit for secondary income (€10 billion).

In the 12 months to May 2019, the current account recorded a surplus of €323 billion (2.8% of euro area GDP), compared with a surplus of €392 billion (3.4% of euro area GDP) in the 12-month period to May 2018. This decline was driven by smaller surpluses for goods (down from €322 billion to €287 billion), services (down from €114 billion to €102 billion) and primary income (down from €94 billion to €92 billion), as well as by a larger deficit for secondary income (up from €138 billion to €158 billion).

In the financial account, euro area residents made net acquisitions of foreign portfolio investment securities totalling €61 billion in the 12-month period to May 2019 (decreasing from €555 billion in the 12-month period to May 2018). Non-residents’ net purchases of euro area portfolio investment securities amounted to €50 billion (down from €279 billion).

Tim Riddell, analyst at Westpac, suggests that given sparse data releases over the next week, focus will concentrate on flash PMI’s on 24th and the ECB’s pre-summer break meeting on 25th.

“The weakness in Tuesday’s ZEW surveys, notably the failure of the expectations components to lift from recent lows, will heighten concerns that EZ’s manufacturing PMI might remain at, or even slip deeper into, recent contraction levels (June was 47.6). Draghi re-ignited the ECB’s “whatever ever it takes” stance initiated in 2012 and although markets do not expect changes in policy on 25th, weak PMI’s would raise their conviction that ECB will increase forward guidance by outlining intentions to move deeper into NIRP or re-open a looser APP. Despite media speculation that Italy’s coalition may falter and result in early elections, the BTP-Bund risk barometer has been narrowing. Consequently, EUR/USD remains at risk of redefining the lows within its broader 1.11-1.16 range.”

Chinese households' rising debt servicing costs could weigh on the medium-term economic growth, Fitch Ratings said in a report.

The rating agency noted that household debt had increased rapidly, to 85% of disposable income by the end of 2018. Although debt servicing costs do not pose near-term risks to financial stability, it will weigh on growth prospects in the medium-term.

Fitch estimated that household debt rose to around 53%of GDP last year, driven by mortgage borrowing.

China's household debt-to-disposable income ratio was lower than most developed markets. But the Fitch observed that the gap will narrow rapidly, with the ratio rising to close to 100% at the end of this decade if growth rates remain unchecked.

Earlier the Fitch had raised China's growth outlook to 6.2% this year. However, the projection for 2020 was lowered to 6%.

Karen Jones, analyst at Commerzbank, points out that EUR/USD pair is holding just above the March and mid-June lows at 1.1181/76 and has seen another recovery and while these hold the downside, an upside bias will prevail.

“We should then see a recovery towards the 200 day moving average and early June high at 1.1317/48. This guards the more important 1.1394/1.1412 55 week ma and recent high. Above the 1.1412 June high we look for resumption of the up move and a test of the 1.1570 2019 high. Slightly longer term we target 1.1815/54, the highs from June and September 2018. We regard the April and May lows at 1.1110/06 as a turning point and continue to view the market as based longer term and target 1.1990 (measurement higher from the wedge).”

The International Energy Agency (IEA) doesn't expect oil prices to rise significantly because demand is slowing and there is a glut in global crude markets, its executive director said.

Electric vehicles are not expected to make a dent on crude demand in India and elsewhere, IEA's Fatih Birol also said, adding that he expects India's oil demand to continue rising.

The IEA is reducing its 2019 oil demand forecast due to a slowing global economy amid a U.S.-China trade spat, and may cut it again if the global economy and especially China shows further weakness, Birol told.

ANZ analysts suggest that with the US-China trade dispute shaping up to be a long drawn-out affair, there have been some adjustments in Asia’s supply chain.

“China’s exports to the US have been contracting, while exports to the US from some other Asian economies, notably Vietnam and Cambodia, have picked up. Taiwan and Singapore have also seen higher exports to the US. US trade deficit with China is narrowing, but its deficit with the lower-tariff countries is widening. Challenges lie ahead, however. Already, Vietnam’s widening trade surplus with the US has caught the attention of President Trump, and a number of Asian economies are already on US Treasury’s FX Monitoring List. Also, it appears that most of the supply chain adjustments have thus far involved re-routing of exports as opposed to relocation of production. China’s outbound direct investment has yet to show signs of a pick-up. Indeed, its M&A activity is seeing the slowest H1 in five years, with no notable increase in its activity in Asia.”

According to the report from Federal Statistical Office (Destatis), in June 2019 the index of producer prices for industrial products rose by 1.2% compared with the corresponding month of the preceding year. Economists had expected a 1.4% increase. In May 2019 the annual rate of change all over had been 1.9%. Compared with the preceding month May 2019 the overall index decreased by 0.4% in June 2019 (-0.1% in May 2019). Economists had expected a 0.2% decrease/

Energy prices, the development of which had the greatest impact on the growth of the overall index, rose by 2.2% (-1.4% compared to May 2019). On an annual basis electricity prices increased by 7.4% whereas prices of natural gas (distribution) decreased by 0.6% and prices of petroleum products by 2.0%. The overall index disregarding energy was 0.9% up on June 2018 and unchanged compared to May 2019.

Prices of non-durable consumer goods increased by 2.1% compared to June 2018 (+0.5% on May 2019). Food prices were up 2.6%. Prices of capital goods increased by 1.5%, prices of durable consumer goods were up 1.4%. Prices of intermediate goods decreased by 0.2% compared to June 2018 (-0.2% on May 2019).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1369 (1115)

$1.1350 (740)

$1.1329 (237)

Price at time of writing this review: $1.1260

Support levels (open interest**, contracts):

$1.1220 (3356)

$1.1183 (2901)

$1.1140 (3406)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 9 is 64577 contracts (according to data from July, 18) with the maximum number of contracts with strike price $1,1500 (3703);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2694 (1742)

$1.2640 (863)

$1.2608 (398)

Price at time of writing this review: $1.2541

Support levels (open interest**, contracts):

$1.2486 (1430)

$1.2454 (2345)

$1.2418 (2437)

Comments:

- Overall open interest on the CALL options with the expiration date August, 9 is 16373 contracts, with the maximum number of contracts with strike price $1,3000 (2053);

- Overall open interest on the PUT options with the expiration date August, 9 is 16704 contracts, with the maximum number of contracts with strike price $1,2450 (2437);

- The ratio of PUT/CALL was 1.02 versus 1.01 from the previous trading day according to data from July, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 62.12 | -1.62 |

| WTI | 55.68 | -1.68 |

| Silver | 16.31 | 2.32 |

| Gold | 1445.614 | 1.36 |

| Palladium | 1528.43 | -0.39 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -422.94 | 21046.24 | -1.97 |

| Hang Seng | -131.51 | 28461.66 | -0.46 |

| KOSPI | -5.95 | 2066.55 | -0.29 |

| ASX 200 | -24.2 | 6649.1 | -0.36 |

| FTSE 100 | -42.37 | 7493.09 | -0.56 |

| DAX | -113.18 | 12227.85 | -0.92 |

| Dow Jones | 3.12 | 27222.97 | 0.01 |

| S&P 500 | 10.69 | 2995.11 | 0.36 |

| NASDAQ Composite | 22.03 | 8207.24 | 0.27 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.70739 | 0.9 |

| EURJPY | 120.96 | -0.15 |

| EURUSD | 1.12765 | 0.45 |

| GBPJPY | 134.569 | 0.31 |

| GBPUSD | 1.25452 | 0.92 |

| NZDUSD | 0.67836 | 0.76 |

| USDCAD | 1.3029 | -0.15 |

| USDCHF | 0.98116 | -0.55 |

| USDJPY | 107.263 | -0.6 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.