- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- AUD/USD gains 0.34% on positive sentiment, defying a negative housing market report impact.

- Neutral bias with an upside tilt; breach of 200-DMA at 0.6579 may target 0.6600 and 0.6639.

- Downside risks include 200-DMA at 0.6579 and the January 17 low of 0.6523 before testing 0.6500.

The Australian Dollar (AUD) registers solid gains from the US Dollar (USD) amid an upbeat market mood following the release of an improvement in consumer sentiment and a bad housing market report. At the time of writing, the AUD/USD exchanges hands at 0.6373, gains 0.34%.

The daily chart portrays the pair as neutral biased, though tilted to the upside, after breaking above the 200-day moving average (DMA) at 0.6579. Further upside is seen at 0.6600, followed by the 50-day moving average (DMA) at 0.6639. Once surpassed, the next stop would be the January 12 cycle high at turned resistance at 0.6728.

For a bearish resumption, AUD/USD first support would be the 200-DMA at 0.6579, followed by the January 17 daily low of 0.6523. A drop below that level, and sellers could challenge the 0.6500 figure

AUD/USD Price Action – Daily Chart

AUD/USD Technical Levels

- US indexes climbed on Friday, led by chip makers.

- Investors have pivoted to tech shares to shake off Fed rate tantrum.

- Markets go haywire as the US Dollar, US equities, and Treasury yields all rise.

The Standard & Poor’s drove to a new all-time high of $4,839.58 on Friday as equities broadly rallied as investors pile into future earnings bets on large-cap tech stocks, with chip-makers loosely associated with AI tech projects leading the charge.

Money markets are broadly shaking off months of begrudgingly giving up ground on rate cut expectations from the Federal Reserve (Fed). According to the CME’s FedWatch tool, rate swap bets are pricing in nearly a 40% chance of a rate cut at the Fed’s March policy meeting, down significantly from over a 70% chance just a month ago.

Fed officials have been pushing back against market expectations of an increased pace of rate cuts from the US central bank, and markets appear to finally be listening as US economic data continues to thump market forecasts, printing consistently higher and healthier than investors were hoping for as markets yearn for cheaper lending and borrowing costs.

US Consumer Sentiment improved to its best reading since July of 2021 according to the University of Michigan’s consumer sentiment survey. The UoM’s 5-year Consumer Inflation Expectations Survey in January also declined to familiar lows at 2.8% from December’s 2.9%.

With the US economy continuing to bump along at a healthy clip and US consumers expecting inflation to remain above the Fed’s 2% target for the foreseeable future, market hopes of Fed rate cuts are unlikely to see a happy conclusion, with money markets now leaning into the FOMC’s May meeting as a possible start to the next cutting cycle.

The Dow Jones Industrial Average (DJIA) also rose to an all-time high, touching $37,931.36 and wrapping up Friday at $37,863.80, climbing over 395 points and gaining 1.05% on the day.

The NASDAQ Composite and NASDAQ 100 indexes hit their own all-time highs on Friday, with the NASDSAQ Composite climbing 255.32 to $15,310.97 to a Friday gain of 1.7% while the NASDAQ 100 soared 1.75% to end at $17,316.87, up over 296 points.

S&P 500 Technical Outlook

The S&P 500 major equity index climbed nearly one and a quarter percent to hit an all-time high of its own, ending Friday at $4,839.81, up 58.87 points on the day.

Near-term bullish momentum in equity indexes has sent the S&P well above any technical zones and pinning into record peaks. The S&P could decline over 8% and still be in bull country above the 200-day Simple Moving Average (SMA) near $4,400.00, and the closest technical barrier sits at the 50-day SMA near $4,650.00.

S&P 500 Hourly Chart

S&P 500 Daily Chart

- Crude Oil markets pushed into a new high for the week before settling back on Friday.

- WTI roils between $74.50 and $73.00 on Friday.

- Freezing temperatures and geopolitical tensions weigh on supply concerns.

Crude Oil bids broadly rose over the week in jittery trading that saw frequent peaks and dips into highs and lows, with West Texas Intermediate (WTI) US Crude Oil settling the week near $73.60 with a 5.6% or $3 spread between the week’s late peak set late on Friday at $74.60 and Wednesday’s weekly low at $70.62.

Broad-market concerns about production caps from the Organization of the Petroleum Exporting Countries (OPEC) that plagued energy markets for much of the third quarter of 2023 have all but evaporated, being replaced by broad-market concerns that Iran-backed Houthi rebels attacking civilian ships in the Red Sea will hamper critical global supply lines between Europe and Asia.

Bullish Crude Oil prices on supply concerns have seen significant downside pressure crimp topside momentum, with the US hitting record levels of Crude Oil production in 2023 and on pace to continue ramping up barrel output looking forward.

Canada is also set to hit new production highs as Crude Oil producers in Alberta ramp up production as the Trans Mountain pipeline nears completion, which will make it easier for the oil-exporting country to add their raw light sweet crude oil supplies to the US’ logistics chain. As the fourth-largest global producer of Crude Oil, Canada stands poised to launch the US even further to the top of the leaderboard as a global net producer and exporter of downstream oil products.

Despite a historic overhang in partially-refined Crude Oil products, declines in near-term raw barrel supplies is drawing a line underneath barrel prices as energy markets await a more solidified outlook on global supply balances in Crude Oil.

WTI Technical Outlook

Choppy trading as markets get pulled in both directions leave Crude Oil traders strung along the midrange, with WTI testing familiar territory near the $74.00 handle. WTI has cycled the key price handle in a tightening pattern since descending into the neighborhood in early November, and a sideways grind in the WTI chart has the 50-day Simple Moving Average (SMA) descending into intraday territory.

The 200-day SMA is accelerating a downturn from the $78.00 handle, which will add bearish pressure to near-term price action to the low side if bulls can’t push WTI back over medium-term technical resistance at the $76.00 handle.

WTI Daily Chart

San Francisco Federal Reserve (Fed) President Mary C. Daly hit newswires for the second time on Friday, expanding on statements she made during an interview with Fox Business earlier in the day.

Read more: Fed's Daly says shifts in labor market could trigger policy adjustments

Key highlights:

- Fed policy remains in a good place, as does the US economy.

- Need to be patient, there's still plenty of work to do.

- Fed doesn't want to loosen policy too soon or try to squeeze out inflation too fast.

- 2024 will be a focus on policy calibration.

- Easing too quickly or before 2% target is reached would be too scarring.

- Goods and services prices are both coming down steadily.

- GBP/JPY fluctuates, impacted by Japanese CPI and weak UK retail sales; currently at 188.11.

- Bullish bias persists, but a close below 188.22 may trigger retracement towards 187.00 and potential support levels.

- Break above 188.00 sets the stage for further gains, targeting YTD high at 188.92 and potentially reaching 190.00.

GBP/JPY seesaws late in the North American session but is down 0.05% so far after trading within a 150 pips range courtesy of CPI data from Japan and weaker retail sales from the UK. Therefore, the pair traveled within its daily and eight-year high and low of 188.92/187.40 before settling at current exchange rates. At the time of writing, the cross trades at 188.11.

From a technical standpoint, the pair remains bullishly biased, but a daily close below January’s 18 one at 188.22 could initially open the door for a retracement toward the 187.00 figure. Further downside sentiment could drag the GBP/JPY exchange rate towards the Tenkan-Sen at 185.84 before challenging the Senkou Span A at 184.74.

On the contrary, a daily close above 188.00 could pave the way for further upside, with the year-to-date (YTD) high in place at 188.92, ahead of 189.00. Further upside is seen once those levels are cleared on its way to 190.00.

GBP/JPY Price Action – Daily Chart

GBP/JPY Technical Levels

San Francisco Federal Reserve (Fed) President Mary C. Daly spoke about the Fed's policy outlook during an interview on Fox Business on Friday.

The San Francisco Fed President since 2018, Mary C. Daly will be rotating from an Alternate Member voting seat to a full Member for the 2024 Fed chair rotation when the Fed next meets on January 31, and she will directly vote on rate operations through the fiscal year.

Key highlights

- Fed's Daly: early signs of faltering in the labor market could trigger policy adjustments.

- It's also important to watch for any rises in delinquency rates as an early indicator of economic weakness.

- Fed needs to get inflation on a consistent trajectory to 2%, need further evidence to feel confident in rate adjustments.

- Markets are premature in thinking rate cuts are just around the corner.

- It is far too early to declare victory on inflation.

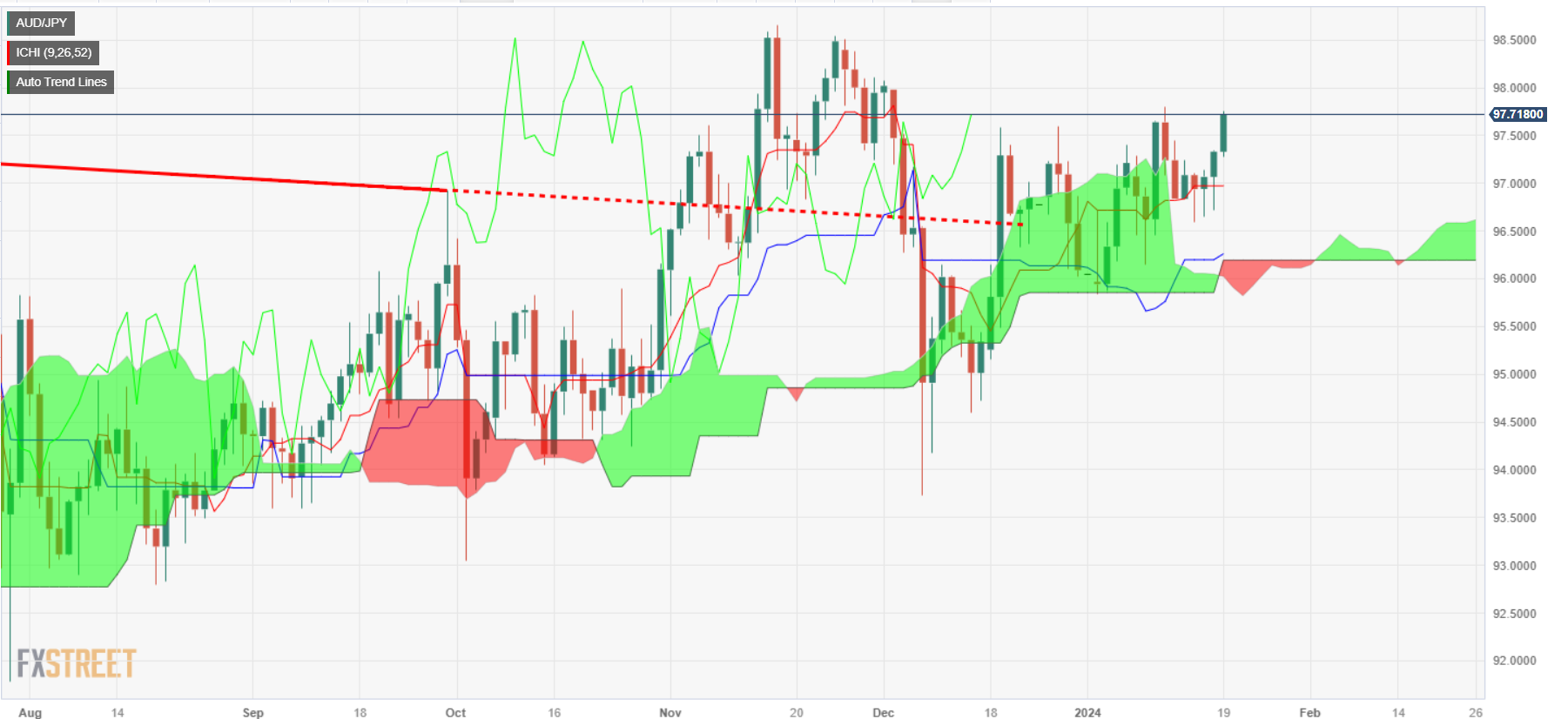

- AUD/JPY rises late in the session, supported by a risk-on sentiment fueled by Wall Street's advance.

- Buyers in control as the pair surpasses 97.00, aiming for a daily close above 98.00 for further gains.

- Despite the ascent, pullback risks persist; sellers may target levels below 97.00 for bearish momentum.

AUD/JPY edges higher late in Friday’s North American session, sponsored by a risk-on impulse, as the advance in Wall Street could appreciate it. Therefore, safe-haven peers are pressured while US Treasury yields retrace, a tailwind for riskier assets. At the time of writing, the AUD/JPY exchanged hands at 97.79, printing a new six-day high.

The pair began the week at around the lows of the week, below the Tenkan-Sen, but the AUD/JPY exchange rate was already above the Ichimoku Cloud (Kumo), suggesting that buyers were in charge. Consequently, they reclaimed 97.00 and, on Friday, extended its gains. Still, pullback risks remain, as buyers need a daily close above the 98.00 figure so they can remain hopeful of testing last year’s high of 98.58. Once those levels are surpassed, the next stop would be the 99.00 figure.

For a bearish case, sellers need to drive prices below 97.00, through the Tenkan Sen at 96.97, toward the January 16 low of 96.58. A breach of the latter will expose the Kijun-Sen at 96.18, ahead of the Senkou Span B and A, each at 96.14 and 96.01.

AUD/JPY Price Action – Daily Chart

AUD/JPY Key Technical Levels

- European equity indexes saw slim losses on Friday to wrap up another down week.

- Davos wrapped up with little rate clues from policymakers.

- Rate tantrum is underway as investors pull back from overextended rate cut hopes.

European equity indexes declined on Friday as investors walked away from the World Economic Forum (WEF) in Davos, Switzerland with little upbeat headlines from the European Central Bank (ECB). ECB policymakers worked overtime this week talking down market expectations of impending rate cuts from the ECB. With inflation continuing to run hotter for longer in the European economy, the ECB is hamstrung on rate cuts for the time being.

ECB President Christine Lagarde put significant effort into avoiding discussing monetary policy durign her scheduled appearances during the Davos economic summit, but noted during a sideline interview with Bloomberg that overextended market expectations of rate cuts from the ECB may be hindering rather than helping on progress fighting inflation.

ECB Lagarde: Aggressive rate cut bets don't help ECB

With investors begrudgingly forced to push back their bets of ECB rate cuts after a lack of supporting statements from Davos, European equities pulled back on Friday. Most indexes saw their worst declines in several months this week, and bullish momentum continues to get hung up on misaligned market expectations.

The German DAX closed mostly flat on Friday, down a scant 0.07% and declining 12 points to close at €16,555.13. France’s CAC 40 declined nearly 40 points to close down 0.4% at €7,371.64. The pan-European STOXX600 closed at €469.24, down 0.26% and shedding 1.21 points.

London’s FTSE major equity index saw a scant gain on Friday, closing up 0.04% at £7,461.93, up 2.84 points but still tipping into a six-week low near £7,400.00.

DAX Technical Outlook

The German DAX tested a seven-week low this week, catching a late-week bid to wrap up trading near €16,550.00, still down on the week but keeping closing bids within reach of near-term lows.

The DAX is down for 2024, but remains decidedly higher from the last major low from October’s bottom bids near €14,600.00.

Intraday topside momentum got hamstrung by the 200-hour Simple Moving Average (SMA) near €16,600. Bidding action next week will face significant technical resistance from near-term congestion between €16,700.00 and €16,750.00.

DAX Hourly Chart

DAX Daily Chart

- The USD/JPY pair sees mild gains, settling at 148.25.

- No policy changes are expected at next week’s BoJ meeting; guidance will be looked upon.

- Despite bearish undertones in the four-hour-chart outlook, the pair's position above the 20,100,200-day SMAs indicates a broader bullish control.

On Friday's session, the USD/JPY was observed to be mildly gaining, currently trading at 148.25, and will close a 2% winning week. Dominating the daily chart, bullish sentiments prevail, with the bulls firmly holding their stance but seem to be taking a breather. Next week, the bulls might get further momentum if the Bank of Japan (BoJ) does not give additional clues on its monetary policy plans.

On the USD side, it remains resilient on the back of the US yields recovering and positive University of Michigan (UoM) Consumer Sentiment data, which gave the Greenback an additional boost. Next week, markets will eye December’s Personal Consumption Expenditures (PCE) figures from December, the Federal Reserve (Fed) preferred gauge of inflation to continue placing their bets on the next decision. The dovish expectations eased somewhat this week but are still high, and according to the CME FedWatch Tool, the odds of cuts in March and May stand at around 50% and 45%, respectively.

USD/JPY Technical Analysis

From a daily standpoint, the technical indicators reflect bullish strength, maintaining a firm position, but buyers are running out of steam. The Relative Strength Index (RSI) demonstrates a slight positive tilt within the positive region, while flat green bars of the Moving Average Convergence Divergence (MACD) further confirm a positive outlook but with a slight deceleration. Moreover, the placement of the pair distinctly above the 20, 100, and 200-day Simple Moving Averages (SMAs) indicates that the buying momentum overpowers any bearish undertones, giving the bulls an overall command.

USD/JPY daily chart

-638412895432125121.png)

- The CHF is broadly lower on the week, sending USD/CHF into a fresh six-week high.

- Switzerland Producer and Import Prices slipped further in December.

- SNB’S Jordan: appreciating Franc threatens Swiss inflation stability.

The Swiss Franc (CHF) slid further on Friday, extending recent losses as the market walks back a massive dogpile into the Swiss currency. The USD/CHF has climbed around 4.5% from December’s late low of 0.8332, a 12-year low for the pair.

Switzerland enjoys an economic environment massively different from its immediate European neighbors, with inflation already well within the Swiss National Bank’s (SNB) 2% maximum target and a stubbornly-healthy domestic economy.

The CHF gained significant value through 2023, climbing nearly 18% bottom-to-top against the US Dollar (USD) from 2022’s Q3 USD/CHF peak of 1.1047. With the popular CHF outrunning valuations and hampering the SNB’s ability to fine-tune policy using foreign currency reserves, the SNB flashed a warning to broader markets recently that if the CHF continues to appreciate, it will begin to transfer disinflationary pressure directly into the Swiss economy.

Having battled a disinflation cycle in the past, the SNB is in no rush to find itself mired in the same scenario again. Markets have apparently heeded SNB Chairman Thomas Jordan’s call for the time being, setting the USD/CHF on pace for its single-best weekly performance since late 2022.

USD/CHF Technical Outlook

The US Dollar is up around 1.85% against the Swiss Franc this week, climbing from Monday’s early bids near 0.8525, tapping the 0.8700 handle on Friday heading into the week’s closing bell.

The USD/CHF is set for its first technical challenge since finding the floor in late December, with the pair pushing directly into technical resistance from the 50-day Simple Moving Average (SMA) in the back half of the week’s trading.

A further technical ceiling is priced in at the 200-day SMA near 0.8850, with near-term technical barriers at the 0.880 handle where the pair last caught a swing high.

USD/CHF Hourly Chart

USD/CHF Daily Chart

- Retail Sales Plunge: Pound Sterling drops against US Dollar as UK retail sales witness a staggering -3.2% month-over-month decline.

- BoE Policy Concerns: Bleak retail data raises doubts about Bank of England's policy tightening amid recession fears.

- Mixed US Data Influence: GBP/USD impacted by contrasting US data, with improved consumer sentiment but lower home sales.

The Pound Sterling (GBP) slumped against the US Dollar (USD) after the Office for National Statistics (ONS) revealed that retail sales plunged sharply, which could deter the Bank of England (BoE) from keeping policy tight without tapping the economy into a recession. Mixed data from the United States (US) sponsored a leg-down in the major, as the GBP/USD exchanged hands at 1.2687 after hitting a daily high of 1.2714.

Pound Sterling faces headwinds as poor retail data raises concerns, while mixed US indicators contribute to market volatility

Besides that, Chicago’s Federal Reserve (Fed) President Austan Goolsbee said that they (Fed) need more data before beginning to ease monetary policy to determine an appropriate level of restrictiveness. On the data front, Consumer Sentiment in the US improved sharply, according to a University of Michigan (UoM) poll, while inflation expectations were trimmed for one and five-year periods.

The Consumer Sentiment rose to 78.8, surpassing both forecasts and the previous month's increase of 69.7. Additionally, Americans expect a decrease in inflation, as expectations for one year declined from 3.1% to 2.9%, and for the next five years, it cooled from 2.9% to 2.8%.

US Existing Home Sales in December slid to their lowest level in over 13 years. The sales slumped by -1% month-over-month, falling from 3.82 million to 3.78 million, which is below both the previous month's figure and the forecast.

Across the pond, retail sales in the UK plunged a staggering -3.2% MoM, following an increase of 1.4% in November, and below forecasts for a 0.5% contraction. The release poured cold water on Sterling’s rally, which benefited from a red-hot inflation report, which, according to sources cited by Reuters, “the December CPI surprise was a blip.”

Ahead of the day, the San Franciso Fed President Mary Daly is expected to cross wires ahead of the blackout period, which is ahead of the first monetary policy meeting of 2024.

GBP/USD Price Analysis: Technical outlook

From a technical point of view, GBP/USD is trading sideways but tilted to the downside after peaking at around 1.2785 on January 12, but sellers had failed to crack the 50-day moving average (DMA) at 1.2616. if buyers want the rally to continue, they must drag prices bove 1.2700, followed by 1.2785, ahead of the 1.2800 mark. Conversely, if sellers achieve a daily close below January’s 18 open of 1.2676, that would form a ‘tweezers top,’ opening the door for further losses. First support is seen at the 50-DMA at 1.2616, followed by 1.2600 and the 200-DMA at 1.2547.

- The DXY Index trades just below the 200-day SMA as bulls are struggling to hold their ground.

- Existing Home Sales from December were weak, while the University of Michigan Consumer Sentiment arrived better than expected.

- Dovish bets on the Fed remain high.

The US Dollar (USD) is seen neutral by the end of the week and currently tallies a 0.90% weekly gain. Strong University of Michigan (UoM) data is keeping the USD afloat, but steady dovish bets on the Federal Reserve (Fed) limit the upward potential.

The US economy appears overheated, tempering the market's dovish expectations, although the chances of interest rate cuts in March and May lingers at around 50%. Thus, the US dollar remains in fluctuating currents, affected by both resilient economic performance and dovish bets on the Fed's likely moves.

Daily digest market movers: US Dollar stands neutral as markets asses UoM and Housing data

- The Michigan Consumer Expectations for January reported by the University of Michigan (UoM) came in at 75.9, an increase from the December figure of 67.4.

- The five-year Inflation Expectations saw a slight decrease of 2.8% compared to the previous month's 2.9%.

- Similarly, the UoM’s Inflation Expectations for January were down to 2.9% from the previous 3.1%.

- The Current Conditions for January increased to 83.3 compared to December's 73.3.

- December’s Existing Home Sales from the National Association of Realtors (NAR) turned out lower than expected at 3.78M against the anticipated 3.82M.

- The yields for US bonds are still advancing with the 2-year yield at 4.41%, the 5-year yield at 4.09%, and the 10-year yield at 4.17%. All three are at their highest level since mid-December.

- As per the CME FedWatch Tool, the odds of cuts for March and May eased, but they remain high at 55% and 45%, respectively.

Technical Analysis: DXY Index bulls shows resilience, must recover the 200-day average

The Relative Strength Index (RSI) showcases an upward slope, residing well within positive territory, which generally denotes bullish strength. This is concurrent with the Moving Average Convergence Divergence (MACD), which, propelled by the rising green bars, indicates strong buying momentum. However, those indicators are starting to flatten as the index tallied a five-day winning streak.

Reflecting upon the Simple Moving Averages (SMAs), the index holds a position above the 20-day average, denoting an undercurrent of bullish dominance in the immediate short term. However, if the bulls fail to regain the 200-day SMA, more downside may be on the horizon.

Support levels: 103.20, 103.00, 102.80.

Resistance levels 103.40 (200-day SMA), 103.60, 103.80.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Atlanta Federal Reserve (Fed) President Raphael Bostic is crossing the newswires on Friday, reaffirming his stance on rate cut expectations ahead of the Fed entering the "blackout" period before the US central bank's next rate meeting, slated for January 31.

Key highlights

- Atlanta Fed President Bostic: I am open to changing my outlook on the timing of rate cuts.

- Fed remains data-dependent, Bostic will only change position if inflation numbers change.

- Fed's Bostic needs to see inflation well on the way to 2% before actively advocating for rate cuts.

- The Euro saw slim to moderate gains on Friday ahead of ECB blackout.

- Europe got a reprieve from high-impact economic data this week.

- Next week sees euro area’s latest HCOB PMIs, as well the ECB’s next rate call.

The Euro (EUR) stepped broadly higher on Friday as market sentiment recovered its footing in the last day of trading for the week.

Europe got a break from the economic calendar this past week with most markets focused on headlines from the World Economic Forum (WEF) in Davos, Switzerland. European Central Bank (ECB) policymakers have been running a media circuit in an effort to talk down market expectations of rate cuts from the ECB, and ECB President Christine Lagarde put significant effort into specifically not addressing monetary policy during a slew of scheduled appearances at the WEF.

Daily digest market movers: Euro catches a thin rebound on Friday

- ECB President Lagarde wrapped up the last of her three scheduled appearances at Davos without specifically addressing monetary policy.

- ECB officials have hit the newswires in a steady stream this week, cautioning that market expectations of rate cuts have run well ahead of what the ECB is willing to execute.

- ECB President Lagarde warned that too-optimistic markets will hamper rather than help in the fight with inflation.

- ECB could cut by the summer, but only if new inflationary pressures don’t appear.

- ECB’s Lagarde on Davos sidelines: Aggressive rate cut bets don't help ECB

- A lack of economic data for the euro area this week gave Euro traders a reprieve from headline shock.

- The ECB has entered the “blackout” period ahead of next Thursday’s ECB policy meeting and rate call.

- Euro area Purchasing Managers’ Index figures due next Wednesday, markets forecast a slight uptick in HCOB Composite PMI for January from 47.6 to 48.1.

- Coming up next week: It is central banks’ time

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Pound Sterling.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.11% | 0.23% | -0.18% | -0.12% | -0.05% | 0.17% | 0.13% | |

| EUR | 0.11% | 0.33% | -0.07% | -0.02% | 0.06% | 0.27% | 0.24% | |

| GBP | -0.23% | -0.33% | -0.40% | -0.37% | -0.28% | -0.06% | -0.07% | |

| CAD | 0.18% | 0.05% | 0.39% | 0.02% | 0.11% | 0.33% | 0.32% | |

| AUD | 0.14% | 0.06% | 0.40% | -0.04% | 0.09% | 0.30% | 0.27% | |

| JPY | 0.05% | -0.05% | 0.29% | -0.11% | -0.08% | 0.23% | 0.20% | |

| NZD | -0.16% | -0.27% | 0.06% | -0.33% | -0.30% | -0.21% | -0.01% | |

| CHF | -0.16% | -0.23% | 0.06% | -0.33% | -0.29% | -0.18% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Euro sees an uptick on Friday but little momentum against the Greenback

The Euro (EUR) rebounds softly on Friday and is in the green across the major currency board except for thin mileage against the US Dollar (USD) and the Canadian Dollar (CAD). The Euro is up around a third of a percent against the Pound Sterling (GBP) and the Australian Dollar (AUD), and about a quarter of a percent higher versus the Swiss Franc (CHF).

The EUR/USD sees limp trading with the pair caught in near-term congestion between major moving averages. Intraday action on Friday has been mostly flat as the pair sees a thin rebound from midweek declines into 1.0850, and the near-term price ceiling is drawn in from 1.0900.

Daily candlesticks are trapped between the 50-day and 200-day Simple Moving Averages (SMA) at 1.0920 and 1.0850, respectively. The pair remains in technically bullish territory with a higher-lows pattern etched in from September’s lows near 1.0450. Price action sees a technical ceiling at January’s soft barrier at the 1.1000 handle.

EUR/USD Hourly Chart

EUR/USD Daily Chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

While Fed and ECB officials pushed back expectations of interest rate cuts for later than anticipated amidst strong data and the rebound in inflation, the upcoming week is also expected to maintain the centre of the debate around central banks. In addition, key data is expected in the US as well as preliminary PMIs on both sides of the ocean.

On the US calendar, flash Manufacturing and Services PMIs for the month of January are due on January 24 ahead of a slew of data releases on January 25: Durable Goods Orders, another revision of the Q4 GDP Growth Rate, weekly Initial Claims, the Chicago Fed National Activity Index, and New Home Sales. Closing the week comes another version of inflation, this time tracked by the PCE along with Personal Income, Personal Spending, and Pending Home Sales. Stronger-than-estimated results from key fundamentals and their impact on the Fed rate cut bets were the main drivers of the USD Index (DXY) during the past week. In light of those upcoming releases, the so-far 2024 peak around 103.70 could be challenged.

In the euro docket, the European Commission will publish its preliminary print of Consumer Confidence for the current month on January 23. Advanced January PMIs are also due in Germany and the broader Euroland on January 25. On January 26, the IFO institute will publish its Business Climate gauge in Germany, while GfK will measure its Consumer Confidence for the month of February. In the meantime, EUR/USD seems to have met some contention around 1.0840, a region also reinforced by the 200-day SMA.

In Japan, December Balance of Trade figures are due along with flash PMIs (January 24) and the BoJ Minutes on January 26. USD/JPY maintained the bullish view intact this week, advancing to seven-week tops in levels shy of the 149.00 barrier.

Across the Channel, the Public Sector finances take centre stage on January 23, followed by preliminary PMIs (January 24) and Gfk’s Consumer Confidence on January 26. GBP/USD closed the week with modest losses, although it maintained the yearly consolidation between 1.2600 and 1.2800.

Flash PMIs will take centre stage in Australia (January 23), ahead of the Westpac Leading Index (January 24). Australian markets will be closed on January 26 in observance of the Australia Day holiday. AUD/USD extended its pessimistic start of the year for yet another week, although the decent bounce in the latter part of the week allows for some near-term recovery.

In the central bank's galaxy, the PBoC is seen trimming its 1-Year LPR and 5-Year LPR by 10 bps to 3.35% and 4.10%, respectively (January 21). No surprises are expected from the BoJ at its event on January 23, nor from the BoC and the BNM when they meet on January 24. On January 25, a 25 bps rate hike is not ruled out by the Norges Bank, while the ECB is widely anticipated to keep rates unchanged and uncertain remains around the interest rate decision by the CBRT.

- Silver holds ground at $22.50, resilient amid losses, finding strong support at this key level.

- US Consumer Sentiment boost lifts US Treasury yields, affecting XAG/USD dynamics.

- Mixed economic signals: Wall Street gains, but US Existing Home Sales hit 13-year low; improved inflation outlook.

Silver price is extending its losses for the third time in the week and faces solid support at around familiar levels, with sellers unable to decisively push prices below the $22.50 figure. Sentiment improvement amongst US consumers spurred a jump in US Treasury yields. At the time of writing, the XAG/USD trades at $22.50, down 0.99%.

XAG/USD holds ground at $22.50 despite Treasury yields surge

Wall Street trades solidly in the green while US Treasury bond yields advance. Despite that, the US Dollar Index (DXY), which measures the buck’s value against a basket of six currencies, is virtually unchanged at 103.41.

Data-wise, US Existing Home Sales fell to their lowest level over 13 years, slumping -1 % MoM to 3.78 million from 3.82 million the previous months and forecasts. At the same time, US households became more optimistic about the economic and inflation outlook, revealed the University of Michigan (UoM): The UoM Consumer Sentiment on its preliminary reading for January rose by 78.8, exceeding forecasts and last month’s 69.7 increase. Moreover, Americans expect inflation to tick lower in 12 months from now, from 3.1% to 2.9%, and for five years, cooled from 2.9% to 2.8%.

Following the data, the US 10-year Treasury note yield soared toward 4.196% before stabilizing at around 4.163%, a headwind for precious metals, which usually benefit from lower yields.

In the meantime, Chicago’s Fed President Austan Goolsbee said they need more data before cutting rates to determine the level of restrictiveness.

Ahead of the day, the San Franciso Fed President Mary Daly is expected to cross wires ahead of the blackout period, which is ahead of the first monetary policy meeting of 2024.

XAG/USD Price Analysis: Technical outlook

From a technical standpoint, Silver has consolidated above/below the $22.50 area, which, once decisively broken to the downside, should expose the next support level seen at the November 13 cycle low of $21.88. Further losses are seen, once surpassed with the next swing at at$20.69, the October 3 low. On the other hand, if buyers lift XAG/USD above the $23.00 figure, that would expose key resistance levels seen at $23.17, the 100-day moving average (DMA), followed by the 200 and 50-DMAs, each at $23.54 and $23.66, respectively.

- Canadian Dollar softly up on Friday as Crude Oil rises.

- Canada Retail Sales decline more than expected, hampers topside.

- Loonie up overall on the week but still down against the US Dollar.

The Canadian Dollar (CAD) rose on Friday, bolstered by a late-week climb in Crude Oil bids as CAD traders shrugged off headwinds for the time being.

Canada saw Retail Sales decline at a faster pace than expected in November, and the Bank of Canada (BoC) was added to the growing list of global central banks that are expected to deliver rate cuts at a slower and shallower pace than investors initially hoped for.

Daily digest market movers: Canadian Dollar sheds overhang in headlines to rebound on Friday

- Canadian Retail Sales declined 0.2% in November, missing the forecast hold at 0.0% and declining further from October’s 0.7%.

- Core Retail Sales accelerated declines, printing at -0.5% versus the anticipated -0.1% and the previous 0.4% (revised down from 0.6%).

- Canada Employment Insurance Beneficiaries Change rose to 1.7% in November versus the previous 0.7%.

- US Consumer Inflation Expectations declined in January from 2.9% to 2.8%, according to the University of Michigan’s (UoM) consumer survey.

- UoM’s Consumer Sentiment Index also improved in January, rising from 69.7 to 78.8 compared to the forecast 70.0.

- US Existing Home Sales declined 1% in December, swallowing November’s 0.8% uptick.

- According to surveyed economists, the Bank of Canada is expected to start cutting interest rates much later than previously anticipated, with the majority seeing no rate changes until June at the earliest.

- Overall rate cuts are expected to be much shallower than investors initially hoped.

- Bottomless Crude Oil demand from US refineries as well as a cold snap trimming production rates see US reserves declining, bumping Crude Oil bids heading into the weekend.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.07% | 0.27% | -0.14% | -0.01% | 0.02% | 0.29% | 0.10% | |

| EUR | 0.06% | 0.32% | -0.08% | 0.04% | 0.08% | 0.35% | 0.16% | |

| GBP | -0.27% | -0.36% | -0.44% | -0.30% | -0.26% | 0.02% | -0.17% | |

| CAD | 0.14% | 0.08% | 0.43% | 0.13% | 0.17% | 0.45% | 0.26% | |

| AUD | 0.00% | -0.05% | 0.29% | -0.14% | 0.01% | 0.28% | 0.09% | |

| JPY | -0.01% | -0.11% | 0.26% | -0.18% | -0.04% | 0.27% | 0.09% | |

| NZD | -0.28% | -0.38% | -0.01% | -0.46% | -0.32% | -0.28% | -0.19% | |

| CHF | -0.11% | -0.16% | 0.17% | -0.26% | -0.14% | -0.06% | 0.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Canadian Dollar climbs across the board on Friday, USD/CAD sheds 1.3500

The Canadian Dollar (CAD) is in the green against all of its major currency peers on Friday, gaining around four-tenths of a percent against the Pound Sterling (GBP) and the New Zealand Kiwi (NZD), with the smallest gains of around a tenth of a percent against the Euro (EUR) and the Australian Dollar (AUD).

The US Dollar is down about a fifth of a percent against the Canadian Dollar on Friday after an intraday rejection from the 1.3500 level before testing into the 1.3450 region. Near-term momentum is seeing the USD/CAD drift back toward the 200-day Simple Moving Average (SMA) near 1.3430.

Daily candlesticks are getting hung up on the 200-day SMA just below the 1.3500 level, and the USD/CAD could see a technical rejection extend into a bearish pullback with a price floor chalked in near 1.3200.

Even if buyers find the topside momentum necessary to carry the USD/CAD over the consolidation of the 50-day and 200-day SMAs near 1.3500, there’s still a lot of ground to cover before bids can recover the last swing high set in early November near 1.3900.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- Mexican Peso appreciates more than 0.15%, overcoming weak Retail Sales data and sluggish economic growth projections.

- Former Banxico Deputy Governor Elizondo suggests a continued tight monetary policy stance in Mexico.

- Improved US Consumer Sentiment and revised inflation expectations likely capped the Peso’s advance.

The Mexican Peso (MXN) registered solid gains against the US Dollar (USD), but it remains set to register losses of more than 1.45% in the week after Retail Sales in the country missed estimates, growing less than expected. In addition, the National Statistics Agency (INEGI) revealed that Mexico’s economy would likely grow below the 3% expected by analysts in December in a preliminary reading by the Timely Indicator of Economic Activity (IOAE). Nevertheless, the USD/MXN exchanges hands at 17.11, down by 0.29%, favoring the emerging market currency.

In the meantime, former Bank of Mexico (Banxico) Deputy Governor Everardo Elizondo commented that it’s too soon to relax monetary policy in Mexico, adding, “There are enough reasons to remain worried.” Elizondo added, "if [policy] is loosened, inflationary expectations will deteriorate.”

Across the border, Consumer Sentiment improved, according to a University of Michigan poll, and households downwardly revised inflation expectations for one and five-year periods.

Daily digest market movers: Mexican Peso regains control amid mixed Mexico data

- Mexico’s Retail Sales rose by a minimum of 0.1% MoM, below forecasts of 0.5% and trailing October’s 0.7%. Annually the indicator slowed from 3.4% to 2.7%, lower than estimates of 3.2%.

- Mexico’s INEGI revealed that the Timely Indicator of Economic Activity (IOAE) anticipates economic growth of 2.6% in December.

- The preliminary reading from the Michigan Consumer Sentiment Index reached its highest level since the summer of 2021 and came in at 78.8, exceeding forecasts of 70 and the previous reading of 69.7. Joanne Hsu, the Director of Surveys of Consumer, said, “Consumer views were supported by confidence that inflation has turned a corner and strengthening income expectations.”

- US households’ inflation expectations for one year dropped from 3.1% to 2.9% and from 2.9% to 2.8% for five years.

- Existing Home Sales fell in December as supply showed signs of improvement, according to the National Association of Realtors. Sales rose by 3.78 million, below estimates of 3.82 million and trailed November’s 0.8% increase.

- The US economy remains robust, as most data suggests the economy continues to expand at a steady pace. The Atlanta GDPNow model suggests last year’s Q4 would likely expand by 2.4%, spurred by strong retail sales, firm industrial production, a tight labor market and consumer sentiment improvement.

- Following the release of the Michigan survey of consumer sentiment, investors continued to trim bets on rate cuts by the Federal Reserve. At the beginning of the week, the swaps market priced in 175 basis points of rate cuts in 2024. But following solid US data this week, those were trimmed to 150 bps.

- The strongest catalyst in the week has been Federal Reserve Governor Christopher Waller’s speech: “No reason to move as quickly or cut as rapidly as in the past.” This kept investors in check despite supporting rate cuts if inflation indeed gets lowered.

- Mexico witnessed a jump in headline inflation, but core data suggests the Bank of Mexico (Banxico) has done a good job, curbing elevated prices after hiking rates toward 11.25%.

- Despite indications from the December meeting minutes of Banxico (the Central Bank of Mexico) that the bank may consider easing its monetary policy, the inflation report for December poses a potential obstacle to any such policy relaxation.

- Analysts at Standard Chartered noted, “We expect the policy rate to be lowered to 9.25% by end-2024, although an official downward revision in the output gap could open the door for more aggressive rate cuts.”

- On January 5, a Reuters poll suggested the Mexican Peso could weaken 5.4% to 18.00 per US Dollar in the 12 months following December.

Technical analysis: Mexican Peso stays firm as USD/MXN meanders around 100-day SMA

The USD/MXN remained trading sideways on Friday, though with a tilt to the upside as buyers reclaimed the 17.00 psychological barrier. If they push the exchange rate toward the 200-day Simple Moving Average (SMA) at 17.36, that could pave the way to test the 100-day SMA at 17.42. That level comes ahead of the December 5 high at 17.56 and the May 23 high of 17.99.

On the other hand, the ongoing pullback below 17.20 could pave the way for a drop toward the 17.00 figure. Once cleared, further downside is expected at the January 8 low of 16.78. Once surpassed, the next support would be the August 28 cycle low of 16.69, ahead of last year’s low of 16.62.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The EUR/GBP pair trades at 0.8584, recording a 0.30% gain, showcasing a pause in the bearish momentum.

- Weak Retail Sales figures from the UK from December give reasons for sticky inflation to ease.

- The overall trend for the cross is still tilted to the downside.

In Friday's session, the EUR/GBP pair was sighted at 0.8584, appreciating by 0.30%. After two consecutive days of losses, a neutral to bearish outlook persists in the daily chart as bears take a pause. However, in the four-hour chart, there's a change of scenery with bulls establishing their momentum.

On the fundamental side, the Pound Sterling is experiencing a significant sell-off following the Office for National Statistics's (ONS) report of a steep drop in December's Retail Sales. Sales, excluding fuel, fell by 3.3%, far below the expected 0.6% decrease. Additionally, the measure that excludes fuel declined by 2.1%, against a forecasted 1.3% rise. This unexpected decrease in Retail Sales, including a 3.2% monthly drop in in-store sales, is likely to impact the persistently high inflation outlook, which may push the Bank of England to consider sooner rate cuts. In that sense, if hawkish bets start to ease, the GBP may find further downside.

Technically speaking, the current position of the pair, sitting below the 20, 100, and 200-day Simple Moving Averages (SMAs), sends a clear signal that sellers hold the upper hand in the broader market outlook. The negative slope of the Relative Strength Index (RSI), even though in negative territory, indicates a hint of upward momentum, but it may not be enough to overturn the bearish sentiment. Additionally, the flat red bars of the Moving Average Convergence Divergence (MACD) entail a stalemate between buyers and sellers, consolidating the bear's control over the pair's direction. Furthermore, the bears seem to be pausing after two days of marked losses, underlining the short-term bearish view.

Shifting the focus to the shorter-term momentum, the four-hour chart presents a somewhat different scenario. Here, even though the RSI is still sloping upward within the negative territory, the gathered momentum by the bulls may spark a bout of buying pressure, while the MACD’s flat red bars also suggest that the bears are taking a breather.

EUR/GBP technical levels

EUR/GBP daily chart

-638412777364196234.png)

The late 2023 rally in AUD/USD has faded somewhat in early 2024. Economists at Danske Bank analyze the pair’s outlook.

AUD/USD remains firmly in the hands of global risk sentiment

With Australian leading indicators pointing firmly downward, and US economic data still remaining solid, we expect relative rates and growth to weigh on AUD/USD going forward.

AUD/USD remains firmly in the hands of global risk sentiment, where the outlook for inflation and rate cuts remains a key driver.

We generally think that the Fed will opt for a more gradual pace for rate cuts, which will be a supportive factor for broad USD. We maintain our downward-sloping forecast profile unchanged.

AUD/USD Forecast: 0.6600 (1M), 0.6400 (3M), 0.6300 (6M), 0.6200 (12M)

EUR/USD could be somewhere near 1.1500 by end-2024, economists at ING report.

A dose of patience is required

We retain a 1.1500 end-year forecast for EUR/USD but see range trading in the near term.

While a re-assessment of the aggressively priced European Central Bank easing cycle could in theory be positive for the Euro, a deteriorating investment environment could well curtail any sizable near-term gains in EUR/USD and other risk-sensitive currencies.

EUR/USD – 1M 1.0800 3M 1.0800 6M 1.1000 12M 1.1500

Strategists at Commerzbank discuss poor sentiment in the metals markets.

No positive impetus for metal prices

The market balance figures from the International Copper Study Group are likely to confirm that the supply situation on the copper market improved last year. They therefore do not promise a boost for the struggling metal markets.

The Oil market is also sufficiently supplied. However, Oil prices remain well supported by the tensions in the Middle East.

The Gold price is also unlikely to fall much lower, as US key interest rates will be reduced later than some had hoped, but they will fall.

The US Dollar (USD) is poised to notch up a solid gain on the week. Economists at Scotiabank analyze Greenback’s outlook.

The underlying trend remains USD positive in general

The underlying trend remains USD positive in general and a bit more USD strength overall seems more likely than not in the coming weeks.

Fed repricing, USD bullish seasonal trends and supportive medium term technical pointers all suggest that the US Dollar is likely to strengthen or at least remain better supported for now.

The Euro loses steam as German Producer Prices drop beyond expectations.

In Japan, the soft inflation data is weighing on a sharper JPY recovery.

EUR/JPY faces a significant resistance at 161.80.

The Euro retreated against the Japanese Yen ahead of Friday's European session opening. Weak German PPI data weighed on the Common currency, which found buyers in the upper ranges of 160.00.

German Producer Prices declined 1.2% in November and 8.6% year-on-year, well beyond the 0.5% monthly and 8% yearly decline anticipated by the market.

These data confirm the deflationary trend observed by ECB policymakers at the minutes of the last monetary policy meeting and are contributing to keep Euro upside attempts limited, despite the brighter market sentiment.

In Japan, the Nationwide CPI corroborated the soft inflation figures shown by last week’s Tokyo reading. The core inflation eased to a 2.3% yearly pace, its lowest level in one and a half years, suggesting that next week’s BoJ monetary policy meeting will be a non-event.

EUR/JPY Technical Analysis

The broader trend remains bullish although the pair faces a strong resistance at the 161.85 area. This is the 78.6% Fibonacci retracement of the late 2023 sell-off, often a target for corrective movements.

Support levels at 160.65 and 160.00 are keeping bears at bay for now. A break below 158.45 would cancel the positive view.

On the upside, above 161.85, the next targets are 162.30 and 162.95.

Technical Levels to Watch

The Canadian Dollar (CAD) edges slightly higher but scope for gains looks limited, economists at Scotiabank report.

Uptrend in place since the start of the year remains intact

USD/CAD has drifted from the high around 1.3540 seen earlier in the week but losses are relatively mild and the broader uptrend in the USD in place since the start of the year remains intact.

Shorter-term trend oscillators are leaning USD-bullish still.

Spot may edge a little lower in the short run as price action corrects from the test of the 50% Fibonacci resistance from the USD’s Q4 drop (1.3538) but the USD should find support on dips to the low/mid-1.3400s absent any sign of a reversal in the USD bull trend at this point.

- GBP/JPY falls sharply from 189.00 as the Pound Sterling hit by weaker Retail Sales data.

- Vulnerable UK consumer spending data has deepened recession fears.

- Market participants shift focus towards the BoJ policy meeting.

The GBP/JPY pair drops from fresh eight-year high of 189.00 in the early New York session. The cross faces pressure as the United Kingdom Retail Sales contracted sharply in December despite festive season.

The Office for National Statistics (ONS) has reported that significant fall in sales at food stores and early Christmas shopping resulted in a sharper decline in the overall consumer spending. Meanwhile, higher consumer spending was also dented by deep cost-of-living crises due to higher interest rates and stubborn price pressures.

Annual Retail Sales suffered a steep contraction of 2.4% while market participants projected a strong growth of 1.1%. A vulnerable consumer spending has renewed fears of a technical recession in the UK economy.

Investors should note that the UK economy contracted by 0.1% in the third quarter of 2023 as per the revised estimates from the UK ONS. Latest projections from the Bank of England (BoE) indicated that the economy is not expected to show any growth in the final quarter of 2023. If the Q4 Gross Domestic Product (GDP) contracts, it would be right to state the UK economy in a technical recession.

Going forward, it would be challenging for Bank of England (BoE) policymakers to retain restrictive monetary policy stance for ensuring a price stability or deliver a dovish decision due to dismal economic outlook.

On the Japanese Yen front, market participants await Bank of Japan’s (BoJ) first monetary policy meeting, which is scheduled for Tuesday. The BoJ is unlikely to emphasize on exiting the decade-long ultra-loose monetary policy due to unfavorable Middle East tensions, easing consumer price inflation and slower wage growth.

Sideways range for the GBP/USD pair in place over the past month or so remains intact, economists at Scotiabank report.

Neither technical chart provides any strong insight into directional risks

Sterling has weakened on the day so far but the GBP/USF pair has edged off the earlier low and holding just below the mid-point of the flat 1.2600-1.2825 trading range in place since mid-December.

More range trading is likely for now.

Neither the daily nor weekly charts are providing any strong insight into directional risks.

- The Canadian Dollar loses ground as Canadian Retail Sales disappoint.

- Retail consumption declined 0.2% in November against market expectations of a flat reading.

- Longer-term, the US Dollar maintains its positive trend from late December lows intact.

The US Dollar nudged higher on Friday, following an unexpected decline in Canadian Retail sales. The pair bounced up from intra-day lows near 1.3450 although it remains negative on the daily chart.

Retail consumption declined 0.2% in Canada in November, against expectations of flat performance, following a downwardly revised 0.5% increase in the previous month. Excluding autos, sales of all other products fell 0.5%, beyond the 0.1% contraction expected.

Beyond that, Statistics Canada reported that the amount of employment insurance beneficiaries rose by 1.7% in November. This is the largest increase since August and adds to evidence that the Canadian economy is losing momentum.

Later today the US Michigan Consumer Sentiment Index is expected to show a moderate improvement before a speech of the San Francisco Fed President, Mary Daly, which will close the week.

USD/CAD Technical Analysis

The US Dollar is correcting lower following a sharp rally in the previous three weeks. The broader trend, however, remains positive, with the bullish cross on 4h SMAs adding credence for bulls.

Support levels are the mentioned 1.3450 and the 38.2% Fibonacci retracement of January;’s rally, at 1.3410. Resistances are at 1.3500 area and 1.3545.

Technical Levels to Watch

The Japanese Yen (JPY) has experienced notable swings on the back of US Dollar (USD) action and central bank commentary. Economists at the National Bank of Canada analyze USD/JPY outlook.

Raising rates while much of the world is set to ease could set up JPY for appreciation

The much-discussed abandonment of abnormal monetary policy (read: negative rates) has yet to materialize despite inflationary pressures.

The Bank of Japan is showing reticence to ditch loose policy until inflation is sustainably at 2%. That said, it is contending with an acceleration in wages which should put pressure on to normalize policy.

A first rate hike could occur in the Spring (perhaps April). As such, raising rates while much of the world is set to ease could set up the island nation currency for appreciation.

We see the Yen gaining ground all through 2024.

- The New Zealand Dollar has found support at 0.6690 although upside attempts remain capped below 0.6135.

- New Zealand's Business PMI and Visitor arrivals have failed to support the Kiwi.

- The brighter market sentiment is weighing the US Dollar.

The New Zealand Dollar’s bearish momentum has lost stream although price action is struggling to find acceptance above the 0.6125/35 resistance area so far.

The improved market sentiment is providing some support to the Kiwi on Friday. Most European markets are going through moderate advances and Wall Street futures are pointing to a positive opening, which is weighing on the Safe-haven USD.

New Zealand data released earlier today revealed that business activity deteriorated further in December, while visitor arrivals experienced a significant decline compared to the same time last year. This was bad news for the Kiwi.

In the US Calendar, the highlight of the day will be the Michigan Consumer Sentiment Index, which is expected to have improved moderately. After that, San Francisco Fed President, Mary Daly will close the week.

NZD/USD Technical Analysis

The technical picture remains bearish although the doji candles on the Daily chart and the strong support area above 0.6070 suggest the possibility of an upside correction.

Immediate resistance is at 0.6135 and above here, 0.6180. Sup[ports are at the mentioned 0.6070/90 and 0.6000.

Technical Levels to Watch

- USD/JPY finds support near 148.00 as bets favouring a rate-cut decision by the Fed are fading away.

- Fed Daly is expected to support the ‘restrictive interest rates’ narrative amid stubborn inflation.

- Soft inflation data could force the BoJ to delay loose-policy exit plans.

The USD/JPY pair attempts to recover after discovering an interim support near 148.00. The asset is aiming to rebound as the US Dollar Index (DXY) is gaining traction due to tempered bets supporting an interest rate cut by the Federal Reserve (Fed) in March.

As per the CME Fedwatch tool, traders see a 53% chance for an interest rate cut by 25 bps in March, which were above 70% last week.

S&P500 futures have added significant gains in the European session, portraying a significant improvement in the risk-appetite for equity-asset class. The USD Index demonstrates a sharp contraction in volatility amid absence of the release of the front-line economic indicators. 10-year US Treasury yields have eased to near 4.13%.

Going forward, market participants will focus on the commentary from San Francisco Fed Bank President Mary Daly, who is expected to support the ‘higher interest rates’ narrative beyond March. The argument in favour of keeping interest rates at restricted levels would be supported by stubborn price pressures, steady labor demand and robust consumer spending.

On the Tokyo front, investors hope that the Bank of Japan (BoJ) could delay their plans of exiting from the ultra-loose monetary policy due to slower wage growth. Meanwhile, producers at factory gates are struggling to raise prices of goods and services due to subdued demand.

Apart from that, the National headline Consumer Price Index (CPI) data for December decelerated to 3.7% against the prior reading of 3.6%. Inflation data excluding fresh foods also softened to 2.3% as expected against the former reading of 2.5%.

EUR/USD holds range around 1.0900 in quiet trade. Economists at Scotiabank analyze the pair’s outlook.

The market undertone remains soft

Spot looked vulnerable to more downside movement earlier in the week as the market (twice) tested the mid-1.0800 area but the lack of follow through selling pressure has averted more EUR losses for now, at least. The market undertone remains soft, however, with short-term trend oscillators and longer run price signal leaning EUR-negative.

EUR gains through 1.0910/1.0920 might give the market a short-term lift but there seems just as little interest in chasing the EUR higher as there was to lean on the downside earlier this week.

Gold has been under pressure as the market mulled the Fed’s interest rate path. Strategists at Commerzbank analyze the yellow metal’s outlook.

Weak demand from automotive industry and downturn in Gold are weighing on Palladium

Prices on the precious metal exchanges are under pressure: Palladium is the biggest loser, dropping around 15% since the beginning of the year. Weak demand from the automotive industry and the recent downturn in the Gold market are weighing on the price. The latter is mainly due to disappointed hopes of quick interest rate cuts.

We believe that the first interest rate cut in the US is not expected until May, so the Gold price is unlikely to make any major leaps in the short term.

- The US Dollar trades at small gains in a dispersed market.

- Traders are left clueless ahead of the Fed meeting next week.

- The US Dollar Index closed above important resistance, though fell back below it on Friday’s opening.

The US Dollar (USD) consolidates with lower highs and higher lows after the volatility pickup earlier this week. Traders are left clueless ahead of the first US Federal Reserve meeting to be held next week. Although it becomes clear no rate cut will take place, traders have only delayed their rate-cut expectations until May, (from March), which makes it difficult for the Greenback to rally substantially.

On the economic front, there is only one element that might push the US Dollar in either way, which is the University of Michigan Consumer Sentiment Index for January, together with inflation expectations. As seen earlier this week with some soft indicators like the NY Empire Manufacturing Index and the Philadelphia Manufacturing number all remaining very weak, a contraction in the Michigan Sentiment number could make traders push forward March again for an initial rate cut from the Fed.

Daily digest market movers: Michigan in the spotlight

- Fresh US air strikes took place against Houthi rebels on Thursday evening.

- The Senate’s stopgap funding bill has had enough votes to pass and is now making its way to the House.

- Near 15:00 GMT the University of Michigan will release its numbers:

- The Consumer Sentiment Index for January is expected to head from 69.7 to 70. Analysts are seeing lowest at 66 and highest estimate at 72.5.

- Any number above 72.5 will trigger an ample amount of US Dollar strength, while any print below 66 will be good for substantial US Dollar weakness.

- Inflation expectations are expected to head from 2.9% to 3.0%.

- Equity markets have shown resilience and have rebounded quite a lot. European equities are nearly erasing all incurred losses from this week and might head to a flat close for this week’s performance should the current gains be extended into the European close on Friday. US equities see the Dow Jones nearly paring back losses from earlier this week while the Nasdaq is already ahead of that option and is firmly in the green for this week’s close.

- The CME Group’s FedWatch Tool shows that markets are pricing in a 97.4% chance that the Federal Reserve will keep interest rates unchanged at its January 31 meeting. Around 2.6% expect the first cut already to take place.

- The benchmark 10-year US Treasury Note remains steady at 4.13%, making it a five-day winning streak.

US Dollar Index Technical Analysis: March or May or whenever

The US Dollar Index (DXY) is caught between a rock and a hard place on the charts. Although the moves earlier this week looked bullish, it makes sense that the US Dollar was unable to steam away and perform a substantial rally on the DXY chart. Reason for that is that traders only have rebalanced their bets for an initial rate cut by the Fed from March to June, which indeed asks for some higher valuation of the US Dollar, though possibly not enough to move away from the 55-day and the 200-day Simple Moving Averages (SMA) near 103.33 and 103.46 respectively.

The DXY is trading smack in the middle of those two moving averages this Friday. In case the DXY can get through that area again and run away, look for 104.44 as the first resistance level on the upside, in the form of the 100-day SMA. If that gets scattered as well, nothing will hold the DXY from heading to either 105.88 or 107.20, the high of September.

Risk of a bull trap is still a possible outcome, where US Dollar bulls were caught buying into the Greenback when it broke above both the 55-day and the 200-day SMA in early Wednesday trading. Price action could decline substantially and force US Dollar bulls to sell their positions at a loss. This would see the DXY first drop to 102.60, at the ascending trend line from September. Once threading below it, the downturn is open to head to 102.00.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

The US Dollar (USD) is still on top across G10 and EM FX. Economists at ING analyze Greenback’s outlook.

Dollar can stay broadly supported into the 31 January FOMC

We think the Dollar can consolidate after the recent gains, continuing to draw some benefits from Christopher Waller’s remarks earlier this week, which may have led markets to favour defensive positions heading into the FOMC on 31 January.

The only key data release in the US before then is the fourth quarter GDP figures next week, and barring major surprises there, there is no compelling bearish story for the next week or so.

The Pound Sterling (GBP) sustained its good form of 2023 in early 2024 following the upside surprise for the UK Consumer Price Index (CPI) in December. Economists at ING analyze EUR/GBP outlook.

EUR/GBP may struggle to find sustainable support above 0.8600 for now

We expect some 100 bps of BoE cuts this year. Since we also deem ECB rate cut bets as too aggressive, we are bullish on EUR/GBP into year-end. However, we think that the back up in EUR rates will be gradual and markets will be reluctant to let go of high-yielding GBP longs so close to the surprise December CPI print.