- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

The main US stock indexes registered a moderate increase, which was promoted by the rise in price of shares in the consumer sector and conglomerate sector.

The focus was also on the United States. As shown by preliminary research results submitted by Thomson-Reuters and the Michigan Institute, a gauge of sentiment among US consumers fell in January despite the average predictions of experts. According to the data, in January the consumer sentiment index fell to 94.4 compared with the final reading for December 95.9. It was expected that the index will rise to the level of 97 points.

Quotes of oil moderately fell on Friday, as the rebound in oil production in the US outweighed the continued decline in crude oil reserves in the country.

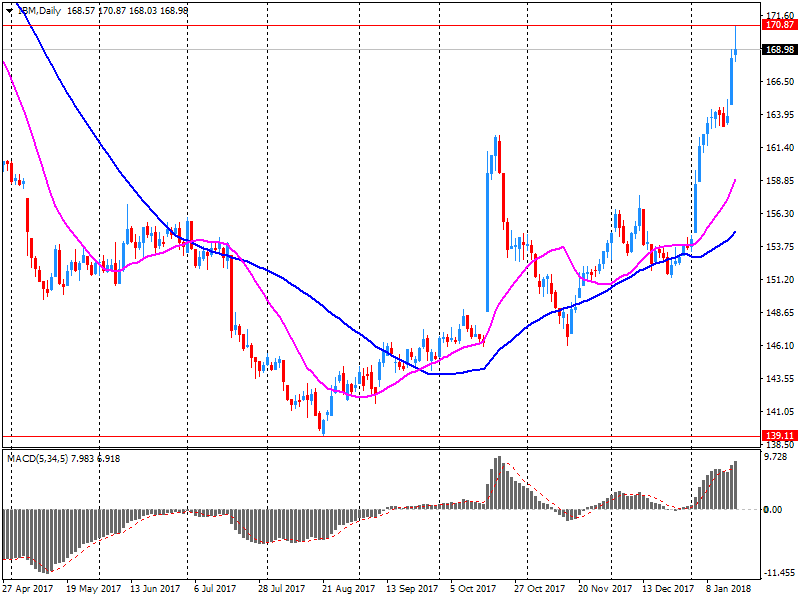

The components of the DOW index finished the auction mixed (15 in positive territory, 15 in negative territory). Leader of the growth were shares of NIKE, Inc. (NKE, + 4.73%). Outsider were shares of International Business Machines Corporation (IBM, -4.09%).

Most sectors of the S & P recorded a rise. The conglomerate sector grew most (+ 0.9%). The utilities sector showed the greatest decrease (-0.2%).

At closing:

Dow + 0.21% 26,071.72 +53.91

Nasdaq + 0.55% 7.336.38 +40.33

S & P + 0.44% 2,810.30 +12.27

While the preliminary January reading for the Sentiment Index was largely unchanged from last month (-1.5%), consumers evaluated current economic conditions less favorably (-4.6%). This small decrease in current conditions produced a small overall decline. Importantly, the survey recorded persistent strength in personal finances and buying plans, while favorable levels of buying conditions for household durables have receded to preholiday levels in early January, largely due to less attractive pricing.

The Expectations Index remained virtually unchanged at 84.8. Tax reform was spontaneously mentioned by 34% of all respondents; 70% of those who mentioned tax reform thought the impact would be positive, and 18% said it would be negative. The disconnect between the future outlook assessment and the largely positive view of the tax reform is due to uncertainties about the delayed impact of the tax reforms on the consumers.

U.S. stock-index futures rose slightly on Thursday, as investors looked eager to buy yesterday's dip, despite risks of a U.S. government shutdown.

Global Stocks:

Nikkei 23,808.06 +44.69 +0.19%

Hang Seng 32,254.89 +132.95 +0.41%

Shanghai 3,489.11 +14.35 +0.41%

S&P/ASX 6,005.80 -8.80 -0.15%

FTSE 7,709.25 +8.29 +0.11%

CAC 5,513.83 +19.00 +0.35%

DAX 13,406.71 +125.28 +0.94%

Crude $63.04 (-1.42%)

Gold $1,334.90 (+0.58%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 53.02 | 0.02(0.04%) | 2716 |

| ALTRIA GROUP INC. | MO | 70.63 | 0.60(0.86%) | 9858 |

| Amazon.com Inc., NASDAQ | AMZN | 1,298.00 | 4.68(0.36%) | 22324 |

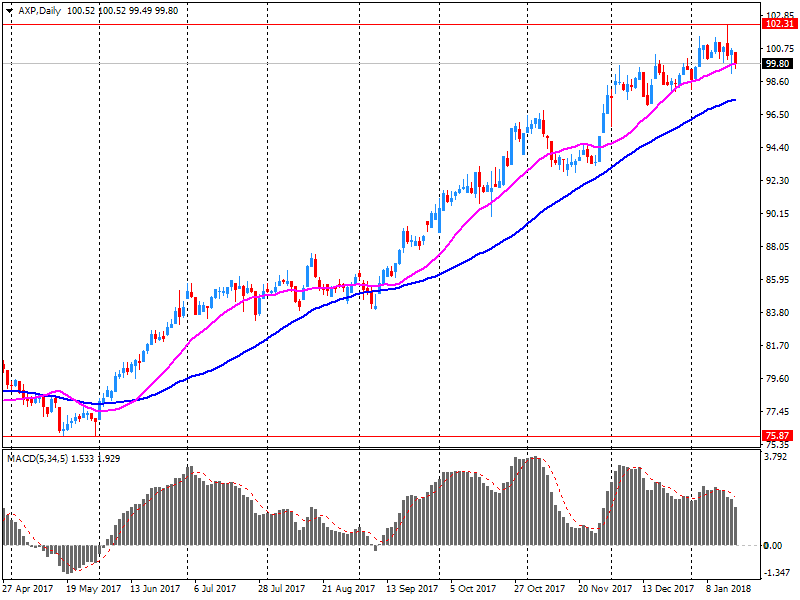

| American Express Co | AXP | 97 | -2.86(-2.86%) | 95157 |

| Apple Inc. | AAPL | 178.99 | -0.27(-0.15%) | 127089 |

| AT&T Inc | T | 37 | -0.15(-0.40%) | 3307 |

| Barrick Gold Corporation, NYSE | ABX | 14.46 | 0.18(1.26%) | 25167 |

| Boeing Co | BA | 340.51 | 0.35(0.10%) | 30833 |

| Caterpillar Inc | CAT | 169.1 | 1.05(0.62%) | 15662 |

| Chevron Corp | CVX | 131.46 | -0.13(-0.10%) | 15597 |

| Cisco Systems Inc | CSCO | 41.34 | 0.04(0.10%) | 800 |

| Citigroup Inc., NYSE | C | 77.41 | 0.02(0.03%) | 12675 |

| Facebook, Inc. | FB | 180.28 | 0.48(0.27%) | 122797 |

| FedEx Corporation, NYSE | FDX | 272.5 | 0.32(0.12%) | 836 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.33 | -0.07(-0.36%) | 6886 |

| General Electric Co | GE | 16.78 | 0.01(0.06%) | 703440 |

| General Motors Company, NYSE | GM | 43.61 | -0.25(-0.57%) | 650 |

| Goldman Sachs | GS | 251.22 | 0.25(0.10%) | 15486 |

| Google Inc. | GOOG | 1,134.00 | 4.21(0.37%) | 2090 |

| Home Depot Inc | HD | 199.4 | 1.07(0.54%) | 3159 |

| HONEYWELL INTERNATIONAL INC. | HON | 158.05 | 0.27(0.17%) | 236 |

| Intel Corp | INTC | 44.52 | 0.04(0.09%) | 18183 |

| International Business Machines Co... | IBM | 164 | -5.12(-3.03%) | 412534 |

| Johnson & Johnson | JNJ | 147.37 | 0.45(0.31%) | 511 |

| JPMorgan Chase and Co | JPM | 113.43 | 0.17(0.15%) | 19203 |

| McDonald's Corp | MCD | 174.75 | 0.18(0.10%) | 1119 |

| Merck & Co Inc | MRK | 61.15 | 0.02(0.03%) | 1905 |

| Microsoft Corp | MSFT | 90.31 | 0.21(0.23%) | 22777 |

| Nike | NKE | 64.9 | 0.79(1.23%) | 22863 |

| Pfizer Inc | PFE | 37.01 | 0.02(0.05%) | 13457 |

| Procter & Gamble Co | PG | 90.36 | 0.18(0.20%) | 100 |

| Starbucks Corporation, NASDAQ | SBUX | 61.4 | 0.31(0.51%) | 2642 |

| Tesla Motors, Inc., NASDAQ | TSLA | 345.49 | 0.92(0.27%) | 26716 |

| The Coca-Cola Co | KO | 46.73 | -0.15(-0.32%) | 4715 |

| Twitter, Inc., NYSE | TWTR | 24.18 | 0.14(0.58%) | 23490 |

| UnitedHealth Group Inc | UNH | 244.5 | 1.34(0.55%) | 4105 |

| Verizon Communications Inc | VZ | 51.65 | 0.10(0.19%) | 9104 |

| Visa | V | 123.19 | 0.08(0.07%) | 6177 |

| Wal-Mart Stores Inc | WMT | 104.48 | 0.18(0.17%) | 2061 |

| Walt Disney Co | DIS | 110.73 | 0.31(0.28%) | 2555 |

| Yandex N.V., NASDAQ | YNDX | 37.16 | -0.35(-0.93%) | 4900 |

Twitter (TWTR) resumed with a Hold at Stifel; target $21

Exxon Mobil (XOM) reiterated with an Outperform at Cowen; target $100

Home Depot (HD) target raised to $220 from $190 at Telsey Advisory Group

Apple (AAPL) target raised to $175 from $160 at Mizuho

Starbucks (SBUX) target raised to $70 from $66 at Telsey Advisory Group

IBM (IBM) target raised to $160 from $150 at Deutsche Bank

IBM (IBM) target raised to $170 from $160 at UBS

NIKE (NKE) upgraded to Outperform from Neutral at Wedbush

Altria (MO) upgraded to Buy from Hold at Jefferies

Manufacturing sales rose 3.4% to a record high $55.5 billion in November, mainly due to higher sales in the transportation equipment, petroleum and coal product and chemical industries.

Higher petroleum prices contributed to the overall increase in manufacturing sales. Once the effects of these and other price changes are removed, manufacturing sales volumes rose 2.5% in November.

Sales of transportation equipment increased 9.1% to $10.6 billion in November, following two consecutive monthly decreases. Most of the increase in November was attributable to higher sales in the motor vehicle assembly (+14.2%) and motor vehicle parts (+11.3%) industries, reflecting increased production after motor vehicle assembly plant shutdowns in October. In constant dollars, sales volumes rose 14.7% in the motor vehicle assembly industry and 10.9% in the motor vehicle parts industry in November.

Foreign investment in Canadian securities amounted to $19.6 billion in November, mainly purchases of Canadian bonds. Meanwhile, Canadian investors reduced their holdings of foreign securities by $4.6 billion, following strong acquisitions in October.

Non-resident acquisitions of Canadian bonds stood at $17.8 billion in November. Foreign investors acquired $8.8 billion of federal government bonds, the fifth consecutive month of strong investment. From July to November, foreign acquisitions of federal government bonds have totalled $36.6 billion, compared with a divestment of $7.9 billion in the first half of the year (January to June). Non-resident investors also added $6.6 billion of private corporate bonds to their holdings in November. Canadian long-term interest rates were down by 16 basis points in the month.

IBM (IBM) reported Q4 FY 2017 earnings of $5.18 per share (versus $5.01 in Q4 FY 2016), beating analysts' consensus estimate of $5.17.

The company's quarterly revenues amounted to $22.543 bln (+3.6% y/y), beating analysts' consensus estimate of $22.028 bln.

The company also said it expects to report 2018 operating EPS of 'at least $13.80' (flat y/y) versus analysts' consensus estimate of $13.92.

IBM fell to $163.48 (-3.33%) in pre-market trading.

American Express (AXP) reported Q4 FY 2017 earnings of $1.58 per share (versus $0.91 in Q4 FY 2016), beating analysts' consensus estimate of $1.54.

The company's quarterly revenues amounted to $8.839 bln (+10.2% y/y), beating analysts' consensus estimate of $8.730 bln.

The company also issued guidance for FY2018, projecting EPS of $6.90-7.30 versus analysts' consensus estimate of $7.29.

AXP also announced plans to suspend its share buyback program for the first half of 2018 "in order to rebuild our capital".

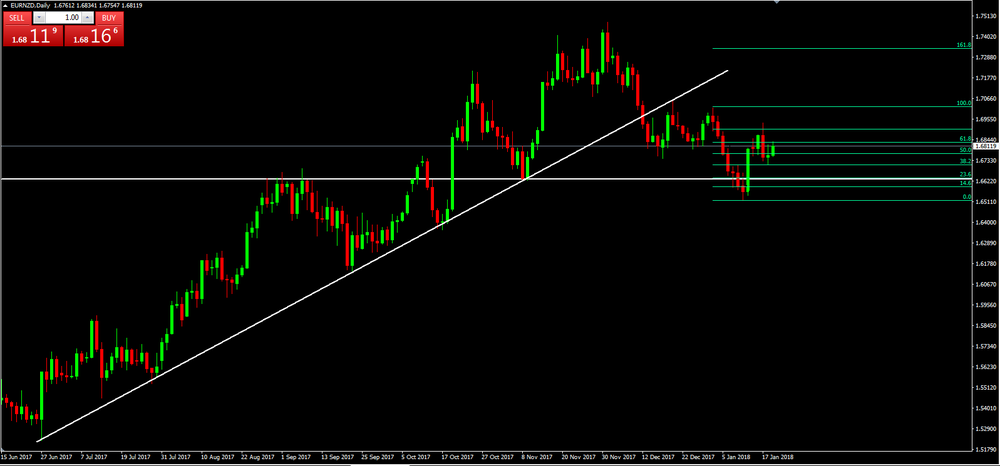

On daily time frame chart, we can see that EUR/NZD has broken an important upside trend line and since the breakout it starts a new bearish movement.

At this moment, we can see that the price is correcting its last movement.

However, it can be interesting to short entries once the price starts to reject the fibonacci levels.

In the latest three months the quantity bought in retail sales increased by 0.4% compared with the previous three months; while the underlying pattern remains one of growth, this is the weakest quarterly growth since the decline of 1.2% in Quarter 1 (Jan to Mar) 2017.

On the month, the quantity bought decreased by 1.5% when compared with strong sales in November 2017.

In December 2017, the quantity bought increased by 1.4% when compared with December 2016, with positive contributions from all stores except food stores.

For the whole of 2017, the quantity bought in retail sales increased by 1.9%; the lowest annual growth since 2013.

Internet sales continued to increase when compared with previous years, with physical stores dominating online sales growth in December.

This reflected surpluses for goods (€31.1 billion), primary income (€10.5 billion) and services (€4.5 billion), which were partly offset by a deficit for secondary income (€13.6 billion).

The 12-month cumulated current account for the period ending in November 2017 recorded a surplus of €386.1 billion (3.5% of euro area GDP), compared with one of €375.1 billion (3.5% of euro area GDP) for the 12 months to November 2016. This development was due to increases in the surpluses for services (from €43.4 billion to €73.7 billion) and primary income (from €98.7 billion to €112.6 billion). These were partly offset by a decrease in the surplus for goods (from €371.9 billion to €349.1 billion) and an increase in the deficit for secondary income (from €138.9 billion to €149.4 billion).

The overall index of producer and import prices rose by 0.2% in December 2017 compared to the previous month, reaching 101.9 points (base of December 2015 = 100). Compared to December 2016, the price level of the total supply of domestic and imported products increased by 1.8%. The average annual inflation in 2017 was 0.9%. This is evident from the figures of the Federal Statistical Office (FSO). The average annual tax rate 2017 corresponds to the rate of change between the average for 2017 and the average for 2016. The annual average is calculated as the arithmetic average of the 12 monthly indices of the calendar year.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2346 (4125)

$1.2316 (5511)

$1.2299 (3465)

Price at time of writing this review: $1.2264

Support levels (open interest**, contracts):

$1.2194 (1325)

$1.2169 (1410)

$1.2140 (1530)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 110836 contracts (according to data from January, 18) with the maximum number of contracts with strike price $1,2100 (5511);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3986 (2030)

$1.3958 (3177)

$1.3941 (3482)

Price at time of writing this review: $1.3915

Support levels (open interest**, contracts):

$1.3837 (103)

$1.3793 (56)

$1.3766 (147)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 36477 contracts, with the maximum number of contracts with strike price $1,3600 (3482);

- Overall open interest on the PUT options with the expiration date February, 9 is 29027 contracts, with the maximum number of contracts with strike price $1,3500 (3054);

- The ratio of PUT/CALL was 0.80 versus 0.84 from the previous trading day according to data from January, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Primary dealers take 11.04 pct of U.S. indexed 10-yr note sale, direct 10.01 pct and indirect 78.95 pct

-

U.S. sells $13 bln indexed 10-year notes at high yield 0.548 pct, awards 91.10 pct of bids at high

In 2017 the index of producer prices for industrial products (domestic sales) for Germany increased by 2.6% on an annual average from the preceding year. As reported by the Federal Statistical Office (Destatis) this was the first increase on an annual average since 2012 (+ 1.6% compared with 2011). In 2016 the index had fallen by 1.7% compared with 2015.

In December 2017 the index of producer prices for industrial products rose by 2.3% compared with the corresponding month of the preceding year. In November 2017 the annual rate of change all over had been +2.5.

U.K. stocks dropped for a fourth straight session on Thursday, with pressure on London's blue-chips benchmark coming from continued strength in the pound and a decline in shares of Primark chain operator Associated British Foods following a trading update.

U.S. stock benchmarks finished lower Thursday, pressured by worries over the possibility of a partial government shutdown, as investors sorted through a fresh batch of quarterly earnings results. The Dow, however, managed to retain a foothold above 26,000 while the S&P 500 tied the longest stretch in history without a 5% pullback at 394 sessions.

Asia-Pacific stocks turned broadly higher by midday after a slow start to Friday's trading, as investors largely ignored ongoing U.S. budget negotiations. "Equities are the name of the game in Asia at the moment and it's going to continue," said Stephen Innes, head of trading in Asia at Oanda, in the wake of strong January gains in the region.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.