- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(raw materials / closing price /% change)

Oil 57.27 +0.19%

Gold 1264.80 -0.06%

(index / closing price / change items /% change)

Nikkei +348.55 22901.77 +1.55%

TOPIX +24.43 1817.90 +1.36%

Hang Seng +202.30 29050.41 +0.70%

CSI 300 +4.43 3985.29 +0.11%

Euro Stoxx 50 +48.89 3609.42 +1.37%

FTSE 100 +46.44 7537.01 +0.62%

DAX +208.74 13312.30 +1.59%

CAC 40 +71.28 5420.58 +1.33%

DJIA +140.46 24792.20 +0.57%

S&P 500 +14.35 2690.16 +0.54%

NASDAQ +58.18 6994.76 +0.84%

S&P/TSX +89.66 16131.64 +0.56%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1781 +0,23%

GBP/USD $1,3381 +0,40%

USD/CHF Chf0,98557 -0,49%

USD/JPY Y112,53 -0,02%

EUR/JPY Y132,58 +0,21%

GBP/JPY Y150,587 +0,37%

AUD/USD $0,7665 +0,27%

NZD/USD $0,6992 +0,03%

USD/CAD C$1,28621 -0,12%

00:00 New Zealand ANZ Business Confidence December -39.3

00:30 Australia RBA Meeting's Minutes

06:45 Switzerland SECO Economic Forecasts

09:00 Germany IFO - Expectations December 111 110.6

09:00 Germany IFO - Current Assessment December 124.4 124.8

09:00 Germany IFO - Business Climate December 117.5 117.6

10:00 Eurozone Construction Output, y/y October 3.1%

13:30 U.S. Current account, bln Quarter III -123.1 -117.2

13:30 U.S. Housing Starts November 1290 1230

13:30 U.S. Building Permits November 1316 1280

18:10 U.S. FOMC Member Kashkari Speaks

21:45 New Zealand Visitor Arrivals November 3.90%

21:45 New Zealand Current Account Quarter III -0.62 -4.29

21:45 New Zealand Trade Balance, mln November -871 -550

23:30 Australia Leading Index November 0.1%

The main US stock indices grew moderately and reached record highs amid investors' optimism about the US tax reform, which, among other things, provides for the reduction of corporate income tax to 21% from 35% and introduces a new regime for paying taxes from foreign profits.

In addition, as it became known, the confidence of builders in the market of newly built houses for one family increased by five points to 74 in December, according to the housing market index (HMI) from the National Association of Home Builders (NAHB) / Wells Fargo after the revised downward November reading. This was the highest rate since July 1999. "Housing market conditions are partially improving because of a new policy aimed at providing regulatory assistance to the business community," said NAHB chairman Granger McDonald.

Oil prices have risen slightly, facilitated by a simple oil pipeline in the North Sea and a workers strike in the Nigerian energy sector. The reduction in the number of oil drilling rigs in the US also supported prices, but the increase in oil production in the US cast a shadow on the market.

Most components of the DOW index finished trading in positive territory (22 out of 30). The leader of growth was shares of Intel Corporation (INTC, + 3.31%). Outsider were the shares of The Coca-Cola Company (KO, -0.52%).

Almost all sectors of the S & P index recorded an increase. The commodities sector grew most (+ 1.2%). The decrease was shown only by the utilities sector (-0.7%).

At closing:

DJIA + 0.57% 24.792.20 +140.46

Nasdaq + 0.84% 6,994.76 +58.18

S & P + 0.54% 2,690.16 +14.35

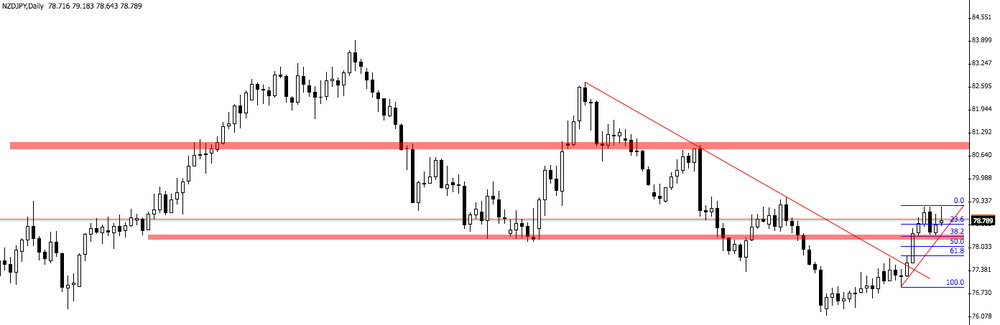

NZD/JPY is showing a slowdown of its last bullish movement.

On daily time frame chart, we can see that the price has broken the downside trend.

However, it didn't test the trend line so the price could go back close to that trend line again.

In this scenario, we can expect a slight correction of the price in order to start a new bullish movement.

U.S. stock-index futures were higher on Monday as optimism on Wall Street was fueled by the GOP's tax reform bill.

Global Stocks:

Nikkei 22,901.77 +348.55 +1.55%

Hang Seng 29,050.41 +202.30 +0.70%

Shanghai 3,268.33 +2.19 +0.07%

S&P/ASX 6,038.90 +41.90 +0.70%

FTSE 7,525.73 +35.16 +0.47%

CAC 5,416.24 +66.94 +1.25%

DAX 13,310.21 +206.65 +1.58%

Crude $57.67 (+0.65%)

Gold $1,260.40 (+0.23%)

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 72.13 | 0.46(0.64%) | 1336 |

| Amazon.com Inc., NASDAQ | AMZN | 1,187.67 | 8.53(0.72%) | 35182 |

| Apple Inc. | AAPL | 174.85 | 0.88(0.51%) | 177712 |

| AT&T Inc | T | 38.46 | 0.22(0.58%) | 12843 |

| Barrick Gold Corporation, NYSE | ABX | 14.19 | 0.13(0.92%) | 28442 |

| Boeing Co | BA | 296.1 | 2.16(0.73%) | 7180 |

| Caterpillar Inc | CAT | 148.25 | 1.56(1.06%) | 2898 |

| Chevron Corp | CVX | 120.25 | 0.52(0.43%) | 1379 |

| Cisco Systems Inc | CSCO | 38.47 | 0.28(0.73%) | 16414 |

| Citigroup Inc., NYSE | C | 75.6 | 0.83(1.11%) | 15585 |

| Deere & Company, NYSE | DE | 152.35 | 1.48(0.98%) | 1780 |

| Exxon Mobil Corp | XOM | 83.04 | 0.01(0.01%) | 3946 |

| Facebook, Inc. | FB | 181.17 | 0.99(0.55%) | 87235 |

| FedEx Corporation, NYSE | FDX | 245.02 | 4.97(2.07%) | 7321 |

| Ford Motor Co. | F | 12.64 | 0.06(0.48%) | 16511 |

| General Electric Co | GE | 17.92 | 0.10(0.56%) | 86099 |

| General Motors Company, NYSE | GM | 41.19 | 0.24(0.59%) | 3502 |

| Goldman Sachs | GS | 260 | 2.83(1.10%) | 4221 |

| Google Inc. | GOOG | 1,069.20 | 5.01(0.47%) | 8617 |

| Home Depot Inc | HD | 184.01 | 1.43(0.78%) | 2686 |

| HONEYWELL INTERNATIONAL INC. | HON | 155.29 | 1.04(0.67%) | 3112 |

| Intel Corp | INTC | 44.86 | 0.30(0.67%) | 81472 |

| International Business Machines Co... | IBM | 153.72 | 1.22(0.80%) | 9300 |

| International Paper Company | IP | 56.3 | 0.05(0.09%) | 266 |

| Johnson & Johnson | JNJ | 143.09 | 0.63(0.44%) | 3559 |

| JPMorgan Chase and Co | JPM | 107.31 | 1.17(1.10%) | 12697 |

| McDonald's Corp | MCD | 174.5 | 0.44(0.25%) | 658 |

| Merck & Co Inc | MRK | 56.19 | -0.05(-0.09%) | 6334 |

| Microsoft Corp | MSFT | 87.39 | 0.54(0.62%) | 72271 |

| Nike | NKE | 64.91 | 0.12(0.19%) | 1810 |

| Pfizer Inc | PFE | 37.32 | 0.12(0.32%) | 5486 |

| Procter & Gamble Co | PG | 92.8 | 0.91(0.99%) | 4019 |

| Starbucks Corporation, NASDAQ | SBUX | 58.45 | 0.16(0.27%) | 9154 |

| Tesla Motors, Inc., NASDAQ | TSLA | 346.6 | 3.15(0.92%) | 51959 |

| The Coca-Cola Co | KO | 46.43 | 0.24(0.52%) | 248 |

| Twitter, Inc., NYSE | TWTR | 23.34 | 1.11(4.99%) | 814853 |

| Verizon Communications Inc | VZ | 53.06 | 0.39(0.74%) | 5521 |

| Visa | V | 114.5 | 0.68(0.60%) | 7782 |

| Wal-Mart Stores Inc | WMT | 97.5 | 0.39(0.40%) | 2634 |

| Walt Disney Co | DIS | 112 | 0.73(0.66%) | 20042 |

Twitter (TWTR) initiated with a Buy at Summit Redstone

NIKE (NKE) target raised to $68 at Telsey Advisory Group

Twitter (TWTR) upgraded to Overweight from Neutral at JPMorgan

Foreign investment in Canadian securities totalled $20.8 billion in October, led by record acquisitions of Canadian bonds. At the same time, Canadian investors increased their holdings of foreign securities by $16.5 billion, mainly purchases of US shares.

Since the beginning of the year, foreign acquisitions of Canadian securities have totalled $171.0 billion. Nearly three-quarters of this was in instruments issued by Canadian private corporations; mainly bonds denominated in foreign currencies. Foreign investment in Canadian private corporate bonds has been significant in recent years, as these firms were actively raising funds abroad through the issuance of bonds, in the context of continued low interest rates.

Manufacturing order books were close to a 30 year high in the three months to December, according to the latest monthly CBI Industrial Trends Survey.

In the survey of 371 manufacturers, strong overall order books were driven by Motor Vehicles and Transport Equipment, and Mechanical Engineering sectors, although the strength was broad-based with 14 out of 17 sub-sectors reporting that order books were above normal. Export order books weakened slightly compared with November's record levels, but remained strong.

-

Trump strategy will say North Korea seeking to be able to deliver launch missile attacks with chemical and bioweapons

AUD/JPY on daily time frame chart is giving signs of recovery its last bearish movement.

However, it can be interesting to see how the price reacts close to the downside trend line and the resistance level.

Therefore, if the price rejects the breakout of these levels then we can expect a new bearish movement

Euro area annual inflation was 1.5% in November 2017, up from 1.4% in October. In November 2016, the rate was 0.6%. European Union annual inflation was 1.8% in November 2017, up from 1.7% in October. A year earlier the rate was 0.6%. These figures come from Eurostat, the statistical office of the European Union.

The lowest annual rates were registered in Cyprus (0.2%), Ireland (0.5%) and Finland (0.9%). The highest annual rates were recorded in Estonia (4.5%), Lithuania (4.2%) and the United Kingdom (3.1%). Compared with October 2017, annual inflation fell in four Member States, remained stable in nine and rose in fifteen. The largest upward impacts to the euro area annual inflation came from fuels for transport (+0.21 percentage points), heating oil (+0.07 pp) and milk, cheese & eggs (+0.05 pp), while telecommunication (-0.11 pp), garments (-0.07 pp) and social protection (-0.04 pp) had the biggest downward impacts

-

Recovery of euro area economy, reduction of economic slack support confidence in inflation converging towards our inflation aim in due course

In October 2017 seasonally-adjusted data, compared to September 2017, increased both for outgoing flows (+0.5%) and for incoming flows (+2.6%). Exports increased for EU countries (+2.8%) and decreased for non EU countries (-2.4%). Imports increased for EU countries (+3.2%) and for non EU countries (+1.7%). Over the last three months, seasonally-adjusted data, in comparison with the previous three months, showed an increase for exports (+2.9%) and for imports (+1.1%).

In October 2017, compared with the same month of the previous year, exports and imports increased (+11.3% and +10.4% respectively). Outgoing flows increased by 12.8% for EU countries and by 9.5% for non EU countries. Incoming flows increased by 11.7% for EU area and by 8.4% for non EU area. The trade balance in October amounted to +4,953 million Euros (+4,287 million Euros for non EU area and +666 million Euros for EU countries).

-

CME bitcoin front month futures volume at 79 contracts after first 15 minutes of trading

-

CBOE bitcoin front month futures volume at 241 contracts

-

Japan firms expect consumer prices to rise 0.8 pct a year from now vs +0.7 pct in prev survey

Japan posted a merchandise trade surplus of 113.357 billion yen in November, the Ministry of Finance said on Monday, cited by rttnews - down 22.6 percent on year.

The headline figure beat forecasts for a deficit of 40.0 billion yen following the 285.4 billion yen surplus in October.

Exports were up 16.2 percent on year to 6.930 trillion yen, topping expectations for a gain of 14.7 percent following the 14.0 percent gain in the previous month.

Exports to Asia advanced 20.4 percent on year to 3.894 trillion yen, while exports to China alone jumped an annual 25.1 percent to 1.379 trillion yen.

Stocks across Europe ended mostly lower on Friday, as retail and bank shares slumped into negative territory, and yanked the regional benchmark lower for a third straight session.

All three main U.S. stock-market benchmarks closed at records on Friday and booked weekly gains, as investor expectations grew for passage of Republican-backed tax-cut legislation.

Most major Asian indexes on Monday were given a boost by investor optimism that a plan to reduce corporate taxes would be passed stateside. Japan's Nikkei 225 added 1.47 percent as trading houses and banks rose. Tech and automaker blue-chips also saw gains, while several construction names declined. Toyota rose 2.86 percent, Sony gained 2.88 percent and SoftBank climbed 1.75 percent.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1908 (4485)

$1.1881 (2297)

$1.1848 (208)

Price at time of writing this review: $1.1761

Support levels (open interest**, contracts):

$1.1688 (4039)

$1.1644 (3554)

$1.1596 (2107)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 5 is 93450 contracts (according to data from December, 15) with the maximum number of contracts with strike price $1,2200 (5570);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3499 (2731)

$1.3447 (1354)

$1.3399 (745)

Price at time of writing this review: $1.3338

Support levels (open interest**, contracts):

$1.3253 (2521)

$1.3217 (2178)

$1.3176 (2002)

Comments:

- Overall open interest on the CALL options with the expiration date January, 5 is 30847 contracts, with the maximum number of contracts with strike price $1,3500 (4098);

- Overall open interest on the PUT options with the expiration date January, 5 is 31475 contracts, with the maximum number of contracts with strike price $1,3300 (2521);

- The ratio of PUT/CALL was 1.02 versus 0.99 from the previous trading day according to data from December, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(raw materials / closing price /% change)

Oil 57.38 +0.14%

Gold 1257.00 -0.04%

(index / closing price / change items /% change)

Nikkei -141.23 22553.22 -0.62%

TOPIX -14.67 1793.47 -0.81%

Hang Seng -318.27 28848.11 -1.09%

CSI 300 -45.29 3980.86 -1.12%

Euro Stoxx 50 +4.31 3560.53 +0.12%

FTSE 100 +42.45 7490.57 +0.57%

DAX +35.48 13103.56 +0.27%

CAC 40 -7.84 5349.30 -0.15%

DJIA +143.08 24651.74 +0.58%

S&P 500 +23.80 2675.81 +0.90%

NASDAQ +80.06 6936.58 +1.17%

S&P/TSX +25.52 16041.98 +0.16%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1754 -0,19%

GBP/USD $1,3328 -0,77%

USD/CHF Chf0,99038 +0,15%

USD/JPY Y112,56 +0,14%

EUR/JPY Y132,31 -0,04%

GBP/JPY Y150,027 -0,62%

AUD/USD $0,7645 -0,25%

NZD/USD $0,6990 +0,13%

USD/CAD C$1,28773 +0,64%

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.