- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(raw materials / closing price /% change)

Oil 52.03 +0.29%

Gold 1,282.70 -0.27%

(index / closing price / change items /% change)

Nikkei +26.93 21363.05 +0.13%

TOPIX +1.27 1724.64 +0.07%

Hang Seng +14.27 28711.76 +0.05%

CSI 300 +31.09 3944.16 +0.79%

Euro Stoxx 50 +11.88 3619.65 +0.33%

FTSE 100 +26.70 7542.87 +0.36%

DAX +47.97 13043.03 +0.37%

CAC 40 +22.44 5383.81 +0.42%

DJIA +160.16 23157.60 +0.70%

S&P 500 +1.90 2561.26 +0.07%

NASDAQ +0.56 6624.22 +0.01%

S&P/TSX -34.74 15782.16 -0.22%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1791 +0,22%

GBP/USD $1,3202 +0,11%

USD/CHF Chf0,98069 +0,26%

USD/JPY Y112,95 +0,67%

EUR/JPY Y133,20 +0,90%

GBP/JPY Y149,126 +0,78%

AUD/USD $0,7847 +0,04%

NZD/USD $0,7157 -0,19%

USD/CAD C$1,24608 -0,49%

02:50 Japan Trade Balance Total, bln September 113.6 560

03:30 Australia Unemployment rate September 5.6% 5.6%

03:30 Australia Changing the number of employed September 54.2 15

05:00 China Industrial Production y/y September 6.0% 6.2%

05:00 China Retail Sales y/y September 10.1% 10.2%

05:00 China Fixed Asset Investment September 7.8% 7.7%

05:00 China NBS Press Conference

05:00 China GDP y/y Quarter III 6.9% 6.8%

07:30 Japan All Industry Activity Index, m/m August -0.1% 0.2%

09:00 Switzerland Trade Balance September 2.17 2.470

11:30 United Kingdom Retail Sales (YoY) September 2.4% 2.1%

11:30 United Kingdom Retail Sales (MoM) September 1% -0.1%

15:30 U.S. Continuing Jobless Claims 1889 1900

15:30 U.S. Philadelphia Fed Manufacturing Survey October 23.8 22

15:30 U.S. Initial Jobless Claims 243 240

16:30 U.S. Fed's George Speaks

17:00 U.S. Leading Indicators September 0.4% 0.1%

The major US stock indexes finished higher, with the Dow Jones industrial index rising most, updating its record high with support from IBM, which reported strong earnings.

In addition, as it became known, in September, the pace of housing construction in the US fell to a one-year low, as Hurricanes Harvey and Irma violated the construction of single-family houses in the South, which indicates that the housing market is likely to remain a brake on economic growth in the third quarter. The laying of new homes fell 4.7% to a seasonally adjusted annual figure of 1.127 million units, the Commerce Department said on Wednesday. This was the lowest level since September 2016, which followed the August revised rate of 1.183 million units.

Meanwhile, the review of the Fed "Beige Book" indicated that economic activity in September and October continued to grow at a moderate pace, despite the hurricanes that hit the south-east of the country. In the area of responsibility of the Fed-Richmond, the Fed-Atlanta and the Fed-Dallas, heavy consequences of natural disasters were noted. The impact of Hurricane Irma on the tourist sphere of Florida was especially noticeable. The survey also showed that employment growth "was generally modest," while labor markets across the country were marked by high labor demand. The rate of inflation has also remained modest since the release of the latest Beige Book, which corresponded to other indicators of price dynamics. The increase in prices was noted in the transport and energy sectors, and in construction.

Most components of the DOW index recorded a rise (19 out of 30). The leader of growth was the shares of International Business Machines Corporation (IBM, + 9.23%). Outsider were shares of Chevron Corporation (CVX, -1.77%).

Most sectors of the S & P index finished trading in positive territory. The financial sector grew most (+ 0.5%). The largest decrease was in the base resources sector (-0.6%).

At closing:

DJIA + 0.70% 23,157.60 +160.16

Nasdaq + 0.01% 6,624.22 +0.56

S & P + 0.07% 2.561.26 +1.90

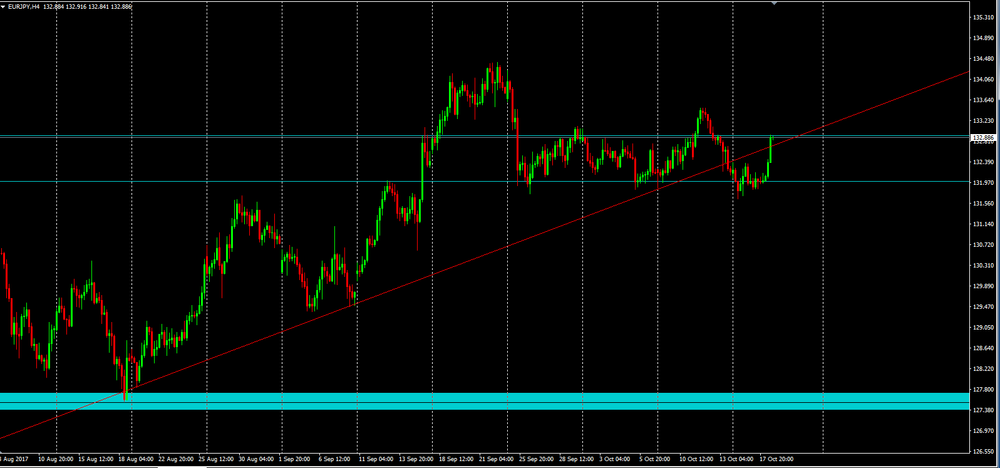

As we can see on 4h time frame chart on EUR/JPY, as soon as the price hit new highs there was a correction of the previous movement and that correction become the price indecisive (it has been consolidating).

We also can see that even with the fake breakout from a relatively large trend line which may indicate that once the price breaks the consolidation zone above, we can expect the formation of a new maximum.

Our suggestion is to wait for the breakout above consolidation line at 132.91 and put stops below consolidation in order to give margin for price moves and take profit slightly above the previous high or for the more conservative, at the same level as the previous high price.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.7 million barrels from the previous week. At 456.5 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year.

Total motor gasoline inventories increased 0.9 million barrels last week, and are in the upper half of the average range. Finished gasoline inventories increased last week, but blending components inventories decreased last week.

Distillate fuel inventories increased by 0.5 million barrels last week and are in the lower half of the average range for this time of year. Propane/propylene inventories decreased by 0.1 million barrels last week and are in the lower half of the average range. Total commercial petroleum inventories decreased by 8.7 million barrels last week.

EURUSD: 1.1685 (EUR 870m) 1.1825-30 (420m) 1.1930 (1.32bln)

USDJPY: 111.20 (USD (520m) 112.25 (310m) 112.30 (1.16bln) 112.50 (500m) 113.25 (500m)

GBPUSD: 1.3055 (GBP 1.16bln) 1.3530-35 (1.8bln)

EURGBP: 0.8940 (EUR 1.1bln) 0.8960 (530m)*

AUDUSD: 0.7700 (AUD 670m) 0.7790 (760m)

U.S. stock-index futures were slightly higher on Wednesday as positive sentiment continued to linger amid upbeat earnings reports from the U.S. companies.

Global Stocks:

Nikkei 21,363.05 +26.93 +0.13%

Hang Seng 28,711.76 +14.27 +0.05%

Shanghai 3,381.37 +9.33 +0.28%

S&P/ASX5,890.48 +0.865 +0.01%

FTSE 7,548.57 +32.40 +0.43%

CAC 5,392.48 +31.11 +0.58%

DAX 13,060.81 +65.75 +0.51%

Crude $52.09 (+0.40%)

Gold $1,280.10 (-0.47%)

The gain was mainly attributable to higher sales in the transportation equipment, and petroleum and coal product industries.

Sales were up in 8 of the 21 industries, representing 66% of the Canadian manufacturing sector.

Once price changes are taken into account, sales volume in the manufacturing sector rose 1.2% in August.

Sales in the transportation equipment industry rose 8.2% to $10.4 billion, after falling 13.6% in July. This growth was the result of gains in the motor vehicle (+12.9%) and motor vehicle parts (+5.7%) industries, primarily reflecting higher volumes generated by increased production after the longer-than-usual shutdowns of motor vehicle assembly plants in July. In constant dollars, sales volumes rose 13.3% in the motor vehicle and 5.8% in the motor vehicle parts industries in August.

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 47.65 | -0.12(-0.25%) | 2300 |

| ALTRIA GROUP INC. | MO | 65 | 0.13(0.20%) | 188 |

| Amazon.com Inc., NASDAQ | AMZN | 1,009.93 | 0.80(0.08%) | 13400 |

| American Express Co | AXP | 91.91 | 0.22(0.24%) | 1642 |

| Apple Inc. | AAPL | 160.8 | 0.33(0.21%) | 139742 |

| AT&T Inc | T | 36.29 | 0.06(0.17%) | 13824 |

| Barrick Gold Corporation, NYSE | ABX | 16.11 | -0.11(-0.68%) | 11400 |

| Caterpillar Inc | CAT | 131 | 0.46(0.35%) | 77744 |

| Chevron Corp | CVX | 119.61 | -0.61(-0.51%) | 153448 |

| Cisco Systems Inc | CSCO | 33.61 | 0.01(0.03%) | 1047 |

| Citigroup Inc., NYSE | C | 72.48 | 0.29(0.40%) | 31857 |

| Exxon Mobil Corp | XOM | 82.56 | -0.40(-0.48%) | 160643 |

| Facebook, Inc. | FB | 176.7 | 0.59(0.34%) | 82153 |

| Ford Motor Co. | F | 12.3 | 0.03(0.24%) | 45598 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.92 | -0.01(-0.07%) | 37380 |

| General Electric Co | GE | 23.27 | 0.08(0.35%) | 30656 |

| General Motors Company, NYSE | GM | 45.1 | 0.08(0.18%) | 11525 |

| Goldman Sachs | GS | 236.63 | 0.54(0.23%) | 30985 |

| Google Inc. | GOOG | 992 | -0.18(-0.02%) | 831 |

| Hewlett-Packard Co. | HPQ | 21.7 | 0.15(0.70%) | 304304 |

| Intel Corp | INTC | 39.9 | 0.11(0.28%) | 152070 |

| International Business Machines Co... | IBM | 156 | 9.46(6.46%) | 512394 |

| Johnson & Johnson | JNJ | 140.63 | -0.16(-0.11%) | 9250 |

| JPMorgan Chase and Co | JPM | 98.1 | 0.48(0.49%) | 10831 |

| Merck & Co Inc | MRK | 64.25 | 1.03(1.63%) | 92512 |

| Microsoft Corp | MSFT | 77.81 | 0.22(0.28%) | 163272 |

| Nike | NKE | 51.83 | -0.17(-0.33%) | 1258 |

| Pfizer Inc | PFE | 36.28 | 0.08(0.22%) | 171062 |

| Tesla Motors, Inc., NASDAQ | TSLA | 355.51 | -0.24(-0.07%) | 5471 |

| Twitter, Inc., NYSE | TWTR | 18.25 | -0.03(-0.16%) | 1553 |

| UnitedHealth Group Inc | UNH | 204.78 | 0.89(0.44%) | 33414 |

| Verizon Communications Inc | VZ | 48.5 | 0.10(0.21%) | 874 |

| Visa | V | 107.6 | 0.06(0.06%) | 758 |

| Wal-Mart Stores Inc | WMT | 86.1 | 0.12(0.14%) | 104491 |

| Walt Disney Co | DIS | 98.7 | 0.34(0.35%) | 1649 |

Apple (AAPL) target raised to $160 from $150 at Mizuho

Johnson & Johnson (JNJ) target raised to $165 from $150 at Leerink Partners

Johnson & Johnson (JNJ) target raised to $142 at Stifel

Johnson & Johnson (JNJ) target raised to $147 from $144 at RBC Capital Mkts

HP Inc. (HPQ) target raised to $26 from $22 at RBC Capital Mkts

Goldman Sachs (GS) target raised to $250 from $243 at Buckingham Research

Chevron (CVX) downgraded to Hold from Buy at Societe Generale

Chevron (CVX) downgraded to Market Perform from Outperform at BMO Capital Markets

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,215,000. This is 4.5 percent below the revised August rate of 1,272,000 and is 4.3 percent below the September 2016 rate of 1,270,000. Single-family authorizations in September were at a rate of 819,000; this is 2.4 percent above the revised August figure of 800,000. Authorizations of units in buildings with five units or more were at a rate of 360,000 in September.

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 1,127,000. This is 4.7 percent below the revised August estimate of 1,183,000, but is 6.1 percent above the September 2016 rate of 1,062,000. Single-family housing starts in September were at a rate of 829,000; this is 4.6 percent below the revised August figure of 869,000. The September rate for units in buildings with five units or more was 286,000.

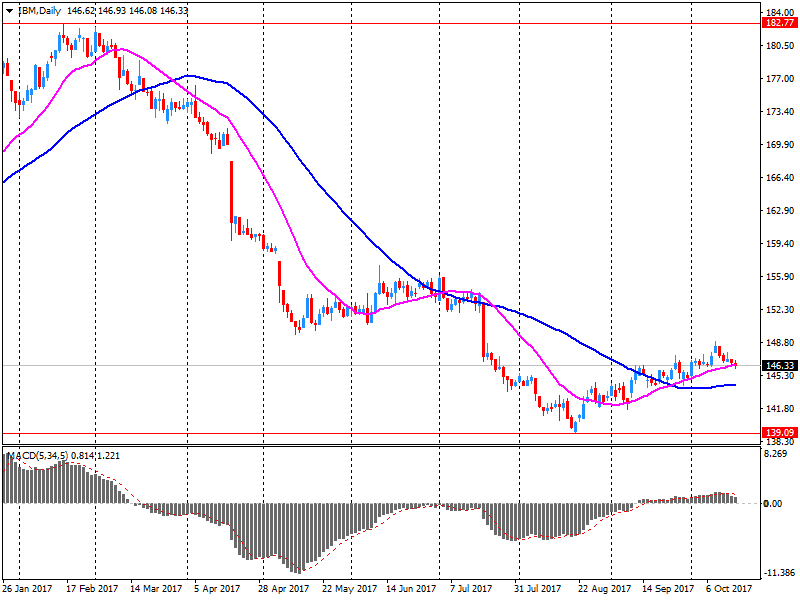

IBM (IBM) reported Q3 FY 2017 earnings of $3.30 per share (versus $3.29 in Q3 FY 2016), beating analysts' consensus estimate of $3.28.

The company's quarterly revenues amounted to $19.153 bln (-0.4% y/y), beating analysts' consensus estimate of $18.632 bln.

The company also reaffirmed guidance for FY2017, projecting EPS of at least $13.80 versus analysts' consensus estimate of $13.75.

IBM rose to $155.24 (+5.94%) in pre-market trading.

-

Have genuine concerns about UK economic performance over next few years

-

ECB research finds no convincing evidence that high interest rates lead to more reforms

Latest estimates show that average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.2% including bonuses, and by 2.1% excluding bonuses, compared with a year earlier.

Average weekly earnings for employees in Great Britain in real terms (that is, adjusted for price inflation) fell by 0.3% including bonuses, and fell by 0.4% excluding bonuses, compared with a year earlier.

Estimates from the Labour Force Survey show that, between March to May 2017 and June to August 2017, the number of people in work increased, the number of unemployed people fell, and the number of people aged from 16 to 64 not working and not seeking or available to work (economically inactive) also fell.

There were 32.10 million people in work, 94,000 more than for March to May 2017 and 317,000 more than for a year earlier.

The employment rate (the proportion of people aged from 16 to 64 who were in work) was 75.1%, up from 74.5% for a year earlier.

There were 1.44 million unemployed people (people not in work but seeking and available to work), 52,000 fewer than for March to May 2017 and 215,000 fewer than for a year earlier.

The unemployment rate (the proportion of those in work plus those unemployed, that were unemployed) was 4.3%, down from 5.0% for a year earlier and the joint lowest since 1975.

-

Says people are more optimistic about the economic situation so it's appropriate to think about small corrections to ECB's bond purchases

EUR/USD: 1.1900 (133 m), 1.1825/30 (410 m), 1.1600 (865 m)

USD/JPY: 113.25 (490 m), 112.50 (490 m), 112.30 (115 m), 112.25 (305 m), 111.20 (520 m)

AUD/USD: 0.7790 (755 m), 0.7700 (665 m)

EUR/USD

Resistance levels (open interest**, contracts)

$1.1943 (3609)

$1.1883 (3012)

$1.1831 (388)

Price at time of writing this review: $1.1768

Support levels (open interest**, contracts):

$1.1726 (3125)

$1.1699 (3027)

$1.1666 (4909)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 99427 contracts (according to data from October, 17) with the maximum number of contracts with strike price $1,2000 (6332);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3294 (1465)

$1.3261 (1366)

$1.3233 (1050)

Price at time of writing this review: $1.3172

Support levels (open interest**, contracts):

$1.3099 (1318)

$1.3070 (2167)

$1.3038 (1669)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 37560 contracts, with the maximum number of contracts with strike price $1,3300 (3440);

- Overall open interest on the PUT options with the expiration date November, 3 is 33067 contracts, with the maximum number of contracts with strike price $1,3000 (2133);

- The ratio of PUT/CALL was 0.88 versus 0.88 from the previous trading day according to data from October, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

U.K. stocks finished lower on Tuesday after investors received inflation data that could harden the case for the Bank of England to raise British borrowing costs. The FTSE 100 index UKX, -0.14% fell 0.1% to close at 7,516.17, after darting between small gains and losses through the day. Among big movers Tuesday, shares of Merlin Entertainments PLC MERL, -15.94% tumbled 16%.

U.S. stocks ended mostly higher on Tuesday, with both the Dow and the S&P 500 finishing at records as a round of positive earnings reports from major companies boosted positive sentiment and extended the recent uptrend. The Dow Jones Industrial Average DJIA, +0.18% closed up 40.48 points, or 0.2%, at 22,997.44. The blue-chip average hit a record of 23,002.20 in midday trading, the first time in history it broke above that psychologically important level.

Equity markets in the Asia-Pacific region were slightly higher on Wednesday, building on Wall Street's bullish performance overnight, though gains were being capped as a key meeting of China's political elite kicked off. Regional investors were trading cautiously as the latest Communist Party congress got under way, where China's President Xi Jinping is expected to secure a second five-year term.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.