- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 07:00 | Germany | Producer Price Index (YoY) | November | -0.6% | -0.6% |

| 07:00 | Germany | Producer Price Index (MoM) | November | -0.2% | 0.1% |

| 08:30 | Eurozone | ECB President Lagarde Speaks | |||

| 09:00 | Germany | IFO - Expectations | December | 92.1 | 93 |

| 09:00 | Germany | IFO - Current Assessment | December | 97.9 | 98.1 |

| 09:00 | Germany | IFO - Business Climate | December | 95.0 | 95.5 |

| 09:30 | United Kingdom | Producer Price Index - Input (MoM) | November | -1.3% | 0.1% |

| 09:30 | United Kingdom | Producer Price Index - Input (YoY) | November | -5.1% | -2.5% |

| 09:30 | United Kingdom | Producer Price Index - Output (YoY) | November | 0.8% | 0.8% |

| 09:30 | United Kingdom | Producer Price Index - Output (MoM) | November | -0.1% | 0.1% |

| 09:30 | United Kingdom | Retail Price Index, m/m | November | -0.2% | 0.1% |

| 09:30 | United Kingdom | HICP ex EFAT, Y/Y | November | 1.7% | |

| 09:30 | United Kingdom | Retail prices, Y/Y | November | 2.1% | 2.1% |

| 09:30 | United Kingdom | HICP, m/m | November | -0.2% | 0.2% |

| 09:30 | United Kingdom | HICP, Y/Y | November | 1.5% | 1.4% |

| 10:00 | Eurozone | Construction Output, y/y | October | -0.7% | 2.4% |

| 10:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | November | 1.1% | 1.3% |

| 10:00 | Eurozone | Harmonized CPI | November | 0.1% | -0.3% |

| 10:00 | Eurozone | Harmonized CPI, Y/Y | November | 0.7% | 1% |

| 10:15 | U.S. | FOMC Member Brainard Speaks | |||

| 11:00 | United Kingdom | CBI retail sales volume balance | December | -3 | |

| 11:15 | Eurozone | ECB's Benoit Coeure Speaks | |||

| 13:30 | Canada | Consumer Price Index m / m | November | 0.3% | -0.1% |

| 13:30 | Canada | Bank of Canada Consumer Price Index Core, y/y | November | 1.9% | 1.9% |

| 13:30 | Canada | Consumer price index, y/y | November | 1.9% | 2.2% |

| 14:00 | Switzerland | SNB Quarterly Bulletin | |||

| 15:30 | U.S. | Crude Oil Inventories | December | 0.822 | -1.92 |

| 17:40 | U.S. | FOMC Member Charles Evans Speaks | |||

| 21:45 | New Zealand | Trade Balance, mln | November | -1013 | -0.875 |

| 21:45 | New Zealand | GDP y/y | Quarter III | 2.1% | 2.4% |

| 21:45 | New Zealand | GDP q/q | Quarter III | 0.5% | 0.6% |

Major US stock indexes showed a slight increase, as investors decided to take a break after the recent rally, triggered by reports of an agreement between the US and China on the first phase of the trade deal.

Market participants also focused on exceeding expectations for housing and industrial production. For example, a report by the Department of Commerce showed that in November US housing construction grew more than expected, and the number of permits for future housing construction rose to a 12.5-year high, as lower mortgage rates continue to stimulate the housing market and support the economy in whole. According to the report, housing construction volumes rose in November by 3.2% to an annual rate of 1.35 million compared with the revised October estimate of 1.332 million. Economists expected housing construction to begin to grow by 2.4% to 1.345 million from 1.314 million . originally reported in the previous month. Housing construction rose 13.6% year on year in November. Building permits, an indicator of future housing demand, also rose in November by 1.4% to an annual level of 1.482 million from 1.461 million in October. The continued increase came as a surprise to economists, who expected the number of building permits to fall by 3.5% to 1.410 million.

In turn, the Fed said industrial production also rose 1.1% in November after revising downward by 0.9% in October, as the end of an almost six-week strike at General Motors (GM) factories led to an increase in car production. Excluding automobiles and spare parts, the total industrial production in November grew by 0.5%. Economists predicted that the total industrial production will grow by 0.8%.

DOW components completed trading mixed (15 in the red, 15 in the red). The biggest gainers were The Goldman Sachs Group, Inc. (GS; + 1.48%). The outsider was Walgreens Boots Alliance (WBA; -1.27%).

Almost all S&P sectors recorded an increase. The real estate sector grew the most (+ 0.9%). The largest decline was shown by the consumer goods sector (-0.5%).

At the time of closing:

Index

Dow 28,276.65 +40.76 + 0.14%

S&P 500 3,192.62 +1.17 + 0.04%

Nasdaq 100 8,820.56 +6.33 + 0.07%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 07:00 | Germany | Producer Price Index (YoY) | November | -0.6% | -0.6% |

| 07:00 | Germany | Producer Price Index (MoM) | November | -0.2% | 0.1% |

| 08:30 | Eurozone | ECB President Lagarde Speaks | |||

| 09:00 | Germany | IFO - Expectations | December | 92.1 | 93 |

| 09:00 | Germany | IFO - Current Assessment | December | 97.9 | 98.1 |

| 09:00 | Germany | IFO - Business Climate | December | 95.0 | 95.5 |

| 09:30 | United Kingdom | Producer Price Index - Input (MoM) | November | -1.3% | 0.1% |

| 09:30 | United Kingdom | Producer Price Index - Input (YoY) | November | -5.1% | -2.5% |

| 09:30 | United Kingdom | Producer Price Index - Output (YoY) | November | 0.8% | 0.8% |

| 09:30 | United Kingdom | Producer Price Index - Output (MoM) | November | -0.1% | 0.1% |

| 09:30 | United Kingdom | Retail Price Index, m/m | November | -0.2% | 0.1% |

| 09:30 | United Kingdom | HICP ex EFAT, Y/Y | November | 1.7% | |

| 09:30 | United Kingdom | Retail prices, Y/Y | November | 2.1% | 2.1% |

| 09:30 | United Kingdom | HICP, m/m | November | -0.2% | 0.2% |

| 09:30 | United Kingdom | HICP, Y/Y | November | 1.5% | 1.4% |

| 10:00 | Eurozone | Construction Output, y/y | October | -0.7% | 2.4% |

| 10:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | November | 1.1% | 1.3% |

| 10:00 | Eurozone | Harmonized CPI | November | 0.1% | -0.3% |

| 10:00 | Eurozone | Harmonized CPI, Y/Y | November | 0.7% | 1% |

| 10:15 | U.S. | FOMC Member Brainard Speaks | |||

| 11:00 | United Kingdom | CBI retail sales volume balance | December | -3 | |

| 11:15 | Eurozone | ECB's Benoit Coeure Speaks | |||

| 13:30 | Canada | Consumer Price Index m / m | November | 0.3% | -0.1% |

| 13:30 | Canada | Bank of Canada Consumer Price Index Core, y/y | November | 1.9% | 1.9% |

| 13:30 | Canada | Consumer price index, y/y | November | 1.9% | 2.2% |

| 14:00 | Switzerland | SNB Quarterly Bulletin | |||

| 15:30 | U.S. | Crude Oil Inventories | December | 0.822 | -1.92 |

| 17:40 | U.S. | FOMC Member Charles Evans Speaks | |||

| 21:45 | New Zealand | Trade Balance, mln | November | -1013 | -0.875 |

| 21:45 | New Zealand | GDP y/y | Quarter III | 2.1% | 2.4% |

| 21:45 | New Zealand | GDP q/q | Quarter III | 0.5% | 0.6% |

Analysts at Wells Fargo note that data released on Tuesday showed the U.S. industrial production rose 1.1% in November, which represents a welcome shift after declines in three out of the four preceding months, but they warn is not the end of the struggles for manufacturing.

- “Manufacturing output, which comprises three quarters of all industrial activity, jumped 1.1% in November, the largest monthly increase since February 2018.

- The gain comes after manufacturing output fell in three out of four prior months and was down in seven of the first 10 months of the year. But low base effects may have played a role, and the level of factory output is still off 0.7% compared to a year ago.

- The factory sector is not out of the woods, but a step toward détente in the trade war last week and signs of bottoming in other areas—like the November rise in the ISM production component to a less-bad 49.1—suggest hope for improvement.”

Analysts at TD Securities are projecting Canada’s CPI inflation to firm to 2.2% YoY in November, owing to a significant tailwind from base-effects, with prices down 0.1% MoM.

- “Energy prices are the main catalyst for the month-over-month decline, as a change from summer to winter gasoline blends weighs on the price at the pump. While this is typical for Q4, last November saw a much sharper pullback in gasoline prices due to softer crude oil prices, and the base effects from this move should eliminate a 0.2pp drag from gasoline on a year-ago basis.

- Elsewhere, food prices should make a positive contribution on higher crop prices alongside a modest pullback in the Canadian dollar, while shelter should provide another tailwind as the housing market recovery feeds into higher homeowner replacement costs.

- Muted base-effects to CPI-trim and CPI-median suggest a high hurdle to any pullback in core CPI, which should leave the average of the three near 2.1% y/y and allow the BoC some patience as they monitor incoming activity data for signs of slowdown.”

The Job

Openings and Labor Turnover Survey (JOLTS) published by the Labor Department on

Tuesday showed a 3.3 percent m-o-m advance in the U.S. job openings in October

after a 7.4 percent m-o-m drop in September.

According to the

report, employers posted 7.267 million job openings in October, compared to the

September figure of 7.302 million (revised from 7.024 million in original

estimate) and economists’ expectations of 7.018 million. The job openings rate

was 4.6 percent in October, down from a revised 4.4 percent in the prior month.

The report showed that he largest gains in job openings levels were in retail

trade (+125,000 jobs), finance and insurance (+56,000), and durable goods

manufacturing (+50,000). At the same time, the largest decreases in job

openings were recorded in nondurable goods manufacturing (-36,000), information

(-33,000), and arts, entertainment, and recreation (-26,000).

Meanwhile, the

number of hires fell by 3.1 percent m-o-m to 5.764 million in October from 5.951

in September. The hiring rate was 3.8 percent, down from 3.9 percent in September.

The number of hires edged down for total private (-194,000) and was little

changed for government. The hires level declined in retail trade (-97,000).

The separation

rate in October was 5.636 million or 3.7 percent, compared to 5.798 million or

3.8 percent in September. Within separations, the quits rate was 2.3 percent

(flat m-o-m), and the layoffs rate was 1.2 percent (-0.1 pp m-o-m).

The Federal

Reserve reported on Tuesday that the U.S. industrial production rose 1.1 m-o-m

in November, following a revised 0.9 percent m-o-m decline in October

(originally a 0.8 percent m-o-m decrease). That marked the biggest jump in

industrial output since October of 2017.

Economists had

forecast industrial production would increase by 0.8 percent m-o-m in November.

According to

the report, the November surge was largely due to a bounce-back in the output

of motor vehicles and parts following the end of a strike at a major

manufacturer, General Motors (GM). Excluding motor vehicles and parts, the

indexes for total industrial production and for manufacturing rose up 0.5

percent m-o-m and 0.3 percent m-o-m, respectively. Meanwhile, mining production

edged down 0.2 percent m-o-m, while the output of utilities climbed 2.9 percent

m-o-m.

Capacity

utilization for the industrial sector increased 0.7 percentage point m-o-m in November

to 77.3 percent. That was 0.1 percentage point below economists’ forecast and 2.5

percentage points below its long-run (1972-2018) average.

In y-o-y terms,

the industrial output dropped 0.8 percent in November, following an unrevised 1.1

percent fall in the prior month.

U.S. stock-index futures rose slightly on Tuesday as investors took a breather after four straight days of gains.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 24,066.12 | +113.77 | +0.47% |

Hang Seng | 27,843.71 | +335.62 | +1.22% |

Shanghai | 3,022.42 | +38.03 | +1.27% |

S&P/ASX | 6,847.30 | -2.40 | -0.04% |

FTSE | 7,508.57 | -10.48 | -0.14% |

CAC | 5,977.89 | -13.77 | -0.23% |

DAX | 13,311.96 | -95.70 | -0.71% |

Crude oil | $60.47 | +0.43% | |

Gold | $1,479.20 | -0.09% |

- China deal will provide structural change on IP and tech transfer

- China deal will double overall exports to China

- U.S.-UK trade deal is a priority

- Can't get global grade deficit down without reducing trade deficit with Europe

- We have a basic trade problem with Europe, we have to find ways to sell more goods to EU

(company / ticker / price / change ($/%) / volume)

ALCOA INC. | AA | 20.8 | -0.18(-0.86%) | 12605 |

Amazon.com Inc., NASDAQ | AMZN | 1,775.11 | 5.90(0.33%) | 16889 |

American Express Co | AXP | 124.09 | 0.41(0.33%) | 1101 |

Apple Inc. | AAPL | 279.3 | -0.56(-0.20%) | 223451 |

AT&T Inc | T | 38.6 | 0.01(0.03%) | 7453 |

Boeing Co | BA | 324.1 | -2.90(-0.89%) | 145107 |

Cisco Systems Inc | CSCO | 46.15 | 0.17(0.37%) | 15889 |

Citigroup Inc., NYSE | C | 77.05 | 0.14(0.18%) | 1156 |

E. I. du Pont de Nemours and Co | DD | 64.87 | -0.02(-0.03%) | 185 |

Facebook, Inc. | FB | 198.45 | 0.53(0.27%) | 13304 |

FedEx Corporation, NYSE | FDX | 162.31 | -1.79(-1.09%) | 18731 |

Ford Motor Co. | F | 9.37 | -0.02(-0.21%) | 6157 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.17 | 0.22(1.70%) | 56401 |

General Electric Co | GE | 11.13 | -0.04(-0.36%) | 102763 |

General Motors Company, NYSE | GM | 35.9 | -0.21(-0.58%) | 773 |

Goldman Sachs | GS | 228.8 | 0.76(0.33%) | 6946 |

Home Depot Inc | HD | 216 | 0.47(0.22%) | 4666 |

Intel Corp | INTC | 57.82 | 0.12(0.21%) | 2900 |

International Business Machines Co... | IBM | 134.34 | 0.21(0.16%) | 1982 |

Johnson & Johnson | JNJ | 143.36 | 1.57(1.11%) | 17324 |

JPMorgan Chase and Co | JPM | 137.05 | -0.29(-0.21%) | 2587 |

Merck & Co Inc | MRK | 89.5 | 0.21(0.24%) | 487 |

Microsoft Corp | MSFT | 155.71 | 0.18(0.12%) | 53099 |

Nike | NKE | 99.15 | 0.34(0.34%) | 5852 |

Pfizer Inc | PFE | 39.46 | 0.32(0.82%) | 33465 |

Procter & Gamble Co | PG | 125.11 | -0.45(-0.36%) | 4087 |

Starbucks Corporation, NASDAQ | SBUX | 88.85 | 0.07(0.08%) | 1555 |

Tesla Motors, Inc., NASDAQ | TSLA | 377.9 | -3.60(-0.94%) | 107504 |

The Coca-Cola Co | KO | 54.45 | 0.03(0.06%) | 2502 |

Twitter, Inc., NYSE | TWTR | 31.05 | 0.08(0.26%) | 25088 |

UnitedHealth Group Inc | UNH | 293 | 0.97(0.33%) | 692 |

Verizon Communications Inc | VZ | 61.35 | 0.12(0.20%) | 1619 |

Visa | V | 186.5 | 0.26(0.14%) | 1825 |

Wal-Mart Stores Inc | WMT | 120.38 | -0.16(-0.13%) | 1354 |

Walt Disney Co | DIS | 148.2 | -0.26(-0.18%) | 16978 |

Yandex N.V., NASDAQ | YNDX | 42.68 | -0.16(-0.36%) | 10918 |

Statistics

Canada released its Monthly Survey of Manufacturing on Tuesday, which showed

that the Canadian manufacturing sales fell 0.7 percent m-o-m in October to

CAD57.06 billion, following an unrevised 0.2 percent m-o-m decline in September.

Economists had

anticipated a flat m-o-m performance for October.

According to

the survey, sales decreased in 11 of 21 industries, representing 48.8 percent

of total manufacturing sales. Lower sales in the transportation equipment (-3.1

percent m-o-m) and fabricated metal product (-8.2 percent m-o-m) industries

were partly offset by higher sales in the petroleum and coal product industry (+6.2

percent m-o-m).

Overall, sales

of non-durable goods rose 1.3 percent m-o-m in October, while sales of durable

goods declined 2.4 percent m-o-m.

NIKE (NKE) target raised to $105 from $98 at Needham

Apple (AAPL) target raised to $325 from $290 at Cowen

DuPont (DD) target lowered to $80 from $83 at Cowen

Alcoa (AA) downgraded to Market Perform from Outperform at BMO Capital Markets

Freeport-McMoRan (FCX) upgraded to Outperform from Market Perform at BMO Capital Markets; target raised to $17

Johnson & Johnson (JNJ) upgraded to Overweight from Equal-Weight at Morgan Stanley; target raised to $170

The Commerce

Department reported on Tuesday the building permits issued for privately owned

housing units rose by 1.4 percent m-o-m in November to a seasonally adjusted

annual pace of 1.482 million (the highest level since May 2007), while housing

starts jumped by 3.2 percent m-o-m to an annual rate of 1.365 million.

Economists had

forecast housing starts increasing to a pace of 1.345 million units last month

and building permits falling to a pace of 1.410 million units.

Data for October

was revised to show homebuilding growing to a pace of 1.323 million units,

instead of increasing at a rate of 1.314 million units as previously reported.

According to

the report, permits for single-family homes, the largest segment of the market,

increased 0.8 percent m-o-m at 918,000 in November (the highest since July 2007),

while approvals for the multi-family homes segment climbed 2.5 percent m-o-m to

a 564,000 unit-rate.

In the

meantime, groundbreaking on single-family homes rose 2.4 percent m-o-m to a

rate of 938,000 units in November (the highest level since January), while

housing starts for the multi-family surged 4.9 percent m-o-m to a 427,000 -unit

pace.

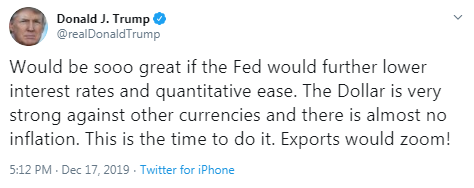

- We're at or past full employment, not much slack is left

- Expects economy to grow by about 2% next year and for inflation pressures to remain muted

- Power has shifted from the sellers of goods to the buyer, making it difficult for businesses to pass on higher costs

- Tech-enabled disruption is limiting the pricing power of business

- U.S. initial crackdown on advanced tech exports appears more restrained than feared

- Commerce Department is finishing the first batch of rules that touch on just a few technologies that will be proposed to international bodies before taking effect, a reprieve for U.S. companies

- Commerce could issue more rules in the future regulating sales abroad of cutting-edge items

- Says he is worried that unless the bloc uses all these tools properly, it won't see any significant structural recovery any time soon

- ECB mandate is clear regarding inflation

- Intend new relationship with EU to be ready to start by January 2021

- In all circumstances, we are leaving EU customs union and single market

- Election manifesto was explicit in ruling out any extension of transition period

James Smith, a Developed Market economist at ING, says that, for the moment, he does not expect the Bank of England (BoE) to cut interest rates in the first half of 2020, but this will depend heavily on whether the jobs' market deteriorates further.

- "There are undoubtedly early signs of weakness. Vacancy levels have consistently dropped through 2019. The latest Markit/RECS jobs report points to another fall in permanent placements, while some other recent PMIs have anecdotally indicated that some staff are not being replaced and in some cases, they're being made redundant.

- However, all of this is only partially reflected in the latest official figures. Jobs' growth grew by a modest, but positive, 24,000 in the three months to October. As we've seen in the past few readings, a lot of the weakness is concentrated in part-time and 18 to 24 year-old workers. This can be a fairly volatile part of the data and, once removed, the picture has been slightly less negative over recent months

- In short, it’s probably too early to make firm conclusions about where the jobs' market is headed. But it’s worth remembering that a lot of the current weakness is driven by persistently low investment, and today’s headlines on the potential non-extension of the Brexit transition period will only add to the uncertain business climate in 2020.

- Should we see unemployment begin to tick higher, then that would have negative implications for wage growth. Excluding bonuses, pay is growing at a healthy 3.5% annual rate, and this has been a key pillar of the Bank of England's hawkish rationale over recent years.

- Admittedly policymakers are already pencilling in a modest fall in wage growth to around 2.5% during 2020. We tend to agree that we're unlikely to see a severe slowdown here, partly because wage gains over recent years have been amplified by other, structural factors. Demographics (high retirement rates relative to new joiners in certain sectors), as well as a noticeable fall in EU immigration, have played a role in driving skill shortages."

Analysts at TD Securities are forecasting Canada’s manufacturing sales to rise by 0.1% in October (market: 0.0%) as a large drag from motor vehicles offsets strength in ex-auto shipments.

- “Petroleum sales should make a positive contribution to the headline print, while the pickup in export activity suggests another source of strength. Real shipments should rise in line with the nominal print, owing to factory prices that were largely unchanged in October.”

Analysts at Danske Bank note that, according to UK news, PM Boris Johnson intends to implement in law that the UK cannot extend the transition period.

- “This supports our view that the no-deal risk is still present as Boris Johnson will not exploit his huge majority to be flexible on the end-2020 deadline for negotiating a trade agreement with the EU. This new legislation will eliminate the option of extending the transition by two years.

- In fact, this may at the end of the day turn out to be pure political symbolism, as the law can always be amended, but it shows Johnson is intent on honouring the Tory manifesto commitment to terminate the transition in just over a year from now.”

The latest

survey by the Confederation of British Industry (CBI) showed on Tuesday the UK

manufacturers’ order books fell in December, remaining below the long-run

average (-13).

According to

the report, the CBI's monthly factory order book balance decreased to -28 in

December from -26 in the previous month.

Export order book gauge also weakened on the previous month,

reaching -35, down from -22 in November, remaining below its long-run

average of -17. Meanwhile, stocks of finished goods rose to +24 from +17,

exceeding the long-run average of +13%. Expectations for average selling prices

for the coming three months picked up somewhat to +6 in December, up from -1 in

November.

Tom Crotty,

Group Director, INEOS and Chair of the CBI Manufacturing Council, noted: “These

disappointing figures are reflective of the widespread weakness in the global

manufacturing sector and the impact of continued Brexit uncertainty in the

run-up to the General Election. Following the General Election, manufacturers

will be eager to see the Prime Minister break the cycle of Brexit uncertainty

as a priority. There is also a fresh opportunity for the sector to work with

the government to solve long-term challenges such as raising productivity,

addressing skills shortages, improving sustainability and tackling climate

change.”

Analysts at TD Securities suggest the U.S. industrial production likely surged in November, due largely to a rebound in auto production following the end of the GM strike (TD 1.0%; consensus 0.8%).

- “Weather-related strength in utilities probably contributed to the surge as well. We estimate manufacturing output rose 1.1% m/m, with non-auto manufacturing flat. Separately, we expect housing starts to add 1,355k units in November - just below its recent high - as the housing sector continues to benefit from low-interest rates and still solid consumer fundamentals.”

Economists at Deutsche Bank has upgraded their US 2020 growth outlook by 0.2pp to 2.0%, mostly on more resilient consumer spending in the first half of the year.

“Capex should remain muted, however, as election uncertainty weighs even if trade tensions dissipate. The team now expect core PCE inflation to remain below the Fed’s target through 2022. This is a critical point given the conclusion to the Fed’s policy review in mid-2020, where they expect a dovish renaissance to the Committee’s reaction function. In particular, the team now sees a commitment to avoid the disinflationary fates of other major developed market economies pushing the Fed to cut rates by another 50bps in 2021, even in the presence of near-record low unemployment.”

Chinese government spending slowed toward the end of the year, after Beijing front-loaded some of its fiscal firepower earlier in the year to spur growth.

Fiscal spending rose 7.7% in the January-November period from a year earlier, compared with an 8.7% increase in the January-October period, the finance ministry said.

China's fiscal revenue in the first 11 months of the year rose 3.8% on year, the same rate recorded in the January-October period, the ministry said.

Land sales revenue, the main source of income for local governments, rose 8.1% over the first 11 months, compared with a 6.9% increase in the January-October period. Spending on transportation projects was up 6.3% for the January-November period, compared with a 7.9% rise in the first 10 months of the year.

According to the report from Eurostat, the first estimate for euro area (EA19) exports of goods to the rest of the world in October 2019 was €217.9 billion, an increase of 4.1% compared with October 2018 (€209.3 bn). Imports from the rest of the world stood at €189.9 bn, a fall of 3.2% compared with October 2018 (€196.1 bn). As a result, the euro area recorded a €28 bn surplus in trade in goods with the rest of the world in October 2019, compared with +€13.2 bn in October 2018. Intra-euro area trade fell to €174.9 bn in October 2019, down by 1.4% compared with October 2018.

In January to October 2019, euro area exports of goods to the rest of the world rose to €1 959.8 bn (an increase of 3.1% compared with January-October 2018), and imports rose to €1 776.6 bn (an increase of 2% compared with January-October 2018). As a result the euro area recorded a surplus of €183.2 bn, compared with +€160.5 bn in January-October 2018. Intra-euro area trade rose to €1 647.7 bn in January-October 2019, up by 1.2% compared with January-October 2018.

According to the report from Office for National Statistics, the UK unemployment rate was estimated at 3.8%, 0.3 percentage points lower than a year earlier but largely unchanged on the previous quarter. Economists had expected a 0.1 percentage points increase.

The UK employment rate was estimated at 76.2%, 0.4 percentage points higher than a year earlier but little changed on the previous quarter; despite just reaching a new record high, the employment rate has been broadly flat over the last few quarters.

The UK economic inactivity rate was estimated at 20.8%, 0.2 percentage points lower than a year earlier but largely unchanged on the previous quarter.

Estimated annual growth in average weekly earnings for employees in Great Britain slowed to 3.2% for total pay (including bonuses) and 3.5% for regular pay (excluding bonuses); the annual growth in total pay was weakened by unusually high bonus payments paid in October 2018 compared with more typical average bonus payments paid in October 2019.

In real terms (after adjusting for inflation), annual growth in total pay is estimated to be 1.5%, and annual growth in regular pay is estimated to be 1.8%.

Fiscal policy must play a key role in supporting Japan's economy if overseas risks threaten to derail a fragile recovery, as the central bank has little left in its policy tool kit, a former Bank of Japan executive said.

Kazuo Momma, who retains close contact with current BOJ officials, said it would be best if the central bank refrained from expanding an already massive stimulus for as long as needed, given the rising cost of prolonged easing.

But if the BOJ is forced to address an abrupt yen spike that hurts Japan's export-reliant economy, the only option left would be to push short-term interest rates deeper into negative territory, said Momma, who is now an executive economist at private think tank Mizuho Research Institute.

"If it turns out that the economy needs further support, it ought to come from fiscal policy," Momma said, adding the government still had room to ramp up spending if external shocks cool demand and tips the economy into recession.

"As for monetary policy, the only feasible and possible tool the BOJ has left going forward is to deepen negative rates," he told.

If the BOJ were to ease further, it will likely accompany the move with measures to ease the strain ultra-low rates have placed on financial institutions, Momma said.

In view of analysts at TD Securities, while survey data indicates that the UK’s labour market data is likely to turn for a worse, it will probably still be at least another couple of months before we see that come through.

“For October, we look for the unemployment rate to tick back up to 3.9% (mkt 3.9%), as it's bounced around between 3.8-3.9% for the last 9 months now. We look for wage growth to decelerate a bit on base effects after a very strong Oct 2018 m/m print, with both total and ex-bonus pay slipping to 3.4% y/y (mkt also 3.4% for both).”

Euro area inflation rate remains below the target level for price stability

Monetary policy stance remains accommodative

That supports our pursuit of price stability

Also fosters conditions that are favourable to growth and employment

Outlook remains more or less unchanged compared to September ECB staff macroeconomic projections, owing to global economic uncertainties

JP Morgan raised its oil price outlook and forecast supply-demand balance to tighten next year against the backdrop of the OPEC and its allies increasing output cuts and stronger economic growth in emerging markets.

The investment bank revised its Brent price forecast to $64.5 per barrel in 2020 from $59 earlier, although it expects prices to slip to $61.50 in 2021. West Texas Intermediate prices are seen following a similar trajectory with prices averaging $60 per barrel in 2020 and $57.50 in 2021, JP Morgan said.

The end of UK electoral uncertainty and the U.S.-China trade truce along with fading of idiosyncratic headwinds in some of the larger emerging markets economies have improved the global growth outlook for next year, the bank said.

"In contrast to our September forecast that the global oil market will be in surplus of 0.6 million barrels per day (mbpd) on average for 2020, we now estimate the market will be in deficit of 0.2 mbpd," the bank said.

Axel Rudolph, analyst at Commerzbank, suggests that EUR/USD once more flirts with the 200 day moving average at 1.1152, having last week briefly shot up to the 1.1200 mark.

“Further range trading around the 200 day moving average is on the cards today. Above 1.1200 lie the 55 week moving average at 1.1208 and the August peak at 1.1249. Further up meanders the 200 week moving average at 1.1358 which remains in focus for the weeks to come. It represents a critical break point on the topside from a medium term perspective. Support below the 1.1116 December 4 high and the 1.1097 November 21 high is seen at the December 6 low at 1.1040. Failure at 1.0981 would target the 78.6% Fibonacci retracement at 1.0943. This is seen as the last defence for the 1.0879 October low. If revisited, we would look for signs of reversal from there.”

Data from the European Automobile Manufacturers' Association (ACEA) showed that in November EU demand for new passenger cars increased by 4.9%, marking the third consecutive month of growth this year. To a large extent this is the result of a low base of comparison, because in November 2018 registrations went down 8.0%. With the exception of the United Kingdom (-1.3%) all major European markets posted growth last month: Germany (+9.7 %), Spain (+2.3%), Italy (+2.2%) and France (+0.7%).

Eleven months into the year, new car registrations across the European Union were almost back at levels from one year ago (-0.3%), thanks to the strong results of the last three months. Nevertheless, four of the five major EU markets declined from January to November, most notably Spain (-5.7%) and the United Kingdom (-2.7%). Germany (+3.9%) remains the only big market that recorded growth so far in 2019.

China will take a targeted approach to boosting investment and will not resort to massive stimulus in its infrastructure push, the state planner said on Tuesday, as Beijing ramps up support to stabilise its slowing economy.

"We will resolutely not open the floodgate of stimulus and will scientifically push forward these major projects," Meng Wei, spokeswoman at the National Development and Reform Commission, told reporters in a regular briefing.

Meng said the market would play a decisive role in resource allocation and that policy support for infrastructure projects in the central and western China would be stepped up.

China has the confidence to achieve its full-year economic targets, Meng said.

Beijing has said it would maintain its proactive fiscal stance and prudent monetary policy, making economic adjustments more forward-looking, targeted and effective.

Rabobank analysts point out that the RBA’s December minutes showed that like the toaster that it is rates will go lower yet, but not until the February 2020 reassessment of the outlook with updated projections.

“The RBA also discussed community concerns about the effect of lower interest rates on confidence, noting the decline in business confidence and consumer sentiment this year. This decline had coincided with heightened economic uncertainty globally, a period of softer growth in the Australian economy and weakness in household income growth, and the Board had responded to these factors in preceding months. While members recognised the negative confidence effects for some parts of the community arising from lower interest rates, they judged that the impact of these effects was unlikely to outweigh the stimulus to the economy from lower interest rates.”

Credit Agricole Research discusses EUR/USD outlook and adopts a bullish bias going into next year, expressing that via recommending a long options exposure.

"EUR/USD should appreciate going into 2020 for two reasons. We expect the US outlook to deteriorate on the back of persistent weakness in investment activity because of recurring trade war headwinds and intensifying political risks ahead of the US presidential election. At the same time, we expect a cautious consolidation in the Eurozone on the back of the ECB’s aggressive easing measures in September and the abatement of Brexit risks. This could lead to some unwinding of EUR-funded USD carry trades and propel EUR/USD closer to the highs of its 2019 trading range around 1.1500. Our long-term valuation models and positioning data analysis further suggest that EUR/USD is very cheap and looking oversold," CACIB adds.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1249 (5160)

$1.1232 (2567)

$1.1223 (3729)

Price at time of writing this review: $1.1145

Support levels (open interest**, contracts):

$1.1094 (4153)

$1.1047 (5491)

$1.0998 (3082)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 3 is 53779 contracts (according to data from December, 16) with the maximum number of contracts with strike price $1,1050 (5491);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3486 (1153)

$1.3445 (727)

$1.3420 (1701)

Price at time of writing this review: $1.3274

Support levels (open interest**, contracts):

$1.3169 (1046)

$1.3127 (1266)

$1.3083 (903)

Comments:

- Overall open interest on the CALL options with the expiration date January, 3 is 19343 contracts, with the maximum number of contracts with strike price $1,3500 (3297);

- Overall open interest on the PUT options with the expiration date January, 3 is 27216 contracts, with the maximum number of contracts with strike price $1,2500 (2399);

- The ratio of PUT/CALL was 1.41 versus 1.41 from the previous trading day according to data from December, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 65.49 | 0.58 |

| WTI | 60.19 | 0.69 |

| Silver | 17.01 | 0.59 |

| Gold | 1475.894 | 0.09 |

| Palladium | 1976.27 | 2.05 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -70.75 | 23952.35 | -0.29 |

| Hang Seng | -179.67 | 27508.09 | -0.65 |

| KOSPI | -2.1 | 2168.15 | -0.1 |

| ASX 200 | 110 | 6849.7 | 1.63 |

| FTSE 100 | 165.61 | 7519.05 | 2.25 |

| DAX | 124.94 | 13407.66 | 0.94 |

| Dow Jones | 100.51 | 28235.89 | 0.36 |

| S&P 500 | 22.65 | 3191.45 | 0.71 |

| NASDAQ Composite | 79.35 | 8814.23 | 0.91 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.68846 | 0.08 |

| EURJPY | 122.086 | 0.4 |

| EURUSD | 1.11433 | 0.15 |

| GBPJPY | 146.079 | 0.2 |

| GBPUSD | 1.33337 | -0.04 |

| NZDUSD | 0.65963 | -0.07 |

| USDCAD | 1.31588 | -0.1 |

| USDCHF | 0.98242 | -0.07 |

| USDJPY | 109.554 | 0.25 |

© 2000-2024. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.