- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- WTI price loses ground to around $70.70 in Thursday’s early Asian session.

- Easing fears of an oil supply disruption in the Middle East, sluggish global oil demand outlook weigh on the WTI price.

- Any positive development surrounding more Chinese fresh stimulus plans could cap the WTI’s downside.

West Texas Intermediate (WTI), the US crude oil benchmark, is trading around $70.70 on Thursday. The WTI price edges lower after selling off on reports that Israel will not attack Iran’s oil facilities.

Israel told the United States that a planned retaliatory attack on Iran won’t target nuclear and oil facilities, according to senior Biden administration officials, a promise sought by the White House to head off further Middle East escalation and to avoid a potential oil price increase, per the Wall Street Journal. Traders will closely watch the developments surrounding the geopolitical tensions in the Middle East. Any signs of escalation could lift the WTI price.

US crude oil inventories rose more than expected last week. According to the American Petroleum Institute (API), crude oil stockpiles in the United States for the week ending October 11 fell by 1.58 million barrels, compared to a rise of 10.9 million barrels in the previous week. The market consensus estimated that stocks would increase by 2.3 million barrels.

The Organisation of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (EIA) this week cut their 2024 global oil demand growth forecasts. The IEA estimated global oil demand to grow 1.2 million barrels per day to 104.3 million bpd next year, about 300,000 bpd below prior forecasts. Furthermore, stimulus measures in China fail to boost the black gold price.

"On the top of every ardent bear's wish list are a stuttering Chinese economy, relative calm in the Near East, and downward revisions in global oil demand growth. These wishes were granted at the beginning of the week," noted Tamas Varga, an analyst at TP ICAP.

The Chinese officials will hold a joint briefing at 2.00 GMT on Thursday on potential measures to support the economy. Additional fresh stimulus plans from China, the top largest consumer of oil in the world, could provide some support to the WTI price in the near term.

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

- USD/CAD trades with mild gains around 1.3755 in Thursday’s early Asian session.

- The expectation of a slower pace of Fed rate cuts underpins the USD broadly.

- The BoC is expected to cut rates by 50 bps next week.

The USD/CAD pair posts modest gains to near 1.3755 during the early Asian session on Thursday. The US Dollar Index (DXY) rose further to multi-week tops above 103.50 amid rising bets that the US Federal Reserve (Fed) will proceed with modest interest rate cuts over the next year. Later on Thursday, the US Retail Sales will take centre stage.

The Greenback edges higher as traders see the Fed gradually lowering interest rates in the remainder of the year. Traders have priced in a nearly 94% chance of a 25 basis points (bps) Fed rate cut in November, according to the CME FedWatch tool.

Minneapolis Fed President Neel Kashkari said earlier this week that future interest rate cuts would be “modest” and emphasized that policy decisions would depend on economic data. Meanwhile, San Francisco Fed President Mary Daly said on Tuesday that there is room for the Fed to lower rates further, following last month’s half point reduction in fed funds to 4.75% to 5.00%

Additionally, persistent geopolitical tensions in the Middle East and US election uncertainty could provide some support to the USD. "Volatility ... and the U.S. dollar tend to rise in tandem going into the U.S. election, especially with the rise of (former U.S. President) Trump in betting markets and the 50 basis-point (bp) cut being out of the picture for the Fed at least in November. This would be the best case for the dollar in the short term,” said Boris Kovacevic, global macro strategist, at Convera in Vienna, Austria.

On the Loonie front, a fall in crude oil prices might weigh on the commodity-linked Canadian Dollar (CAD) as Canada is the largest oil exporter to the United States. Furthermore, the expectation that the Bank of Canada (BoC) would accelerate its easing cycle after September’s inflation data might cap the CAD’s upside. Statistics Canada reported on Tuesday that the Consumer Price Index (CPI) rose 1.6% YoY in September, the slowest annual pace of inflation since February 2021.

“I think this morning’s inflation number has really solidified the case for the Bank of Canada to cut by 50 basis points next week,” noted Charles St-Arnaud, the chief economist with Alberta Central and former economist at the Bank of Canada.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- EUR/USD withered further on Wednesday, sagging below 1.0900.

- ECB rate cut looms large around the corner, broadly expected to trim rates 25 bps.

- Final EU inflation figures are unlikely to move the needle on Thursday.

EUR/USD is in freefall, plummeting to multi-week lows as the Euro continues to crumple ahead of the European Central Bank’s (ECB) upcoming rate call on Thursday. The ECB is widely expected to trim interest rates by a quarter of a percent, or 25 bps.

All eyes will be on the ECB during Thursday’s European market session. The ECB is widely expected to trim its Main Refinancing Operations Rate by 25 bps to 3.4% from 3.65%, with the ECB’s Rate on Deposit Facility expected to take a matching 25 bps trim to 3.25% from 3.5%. With the ECB broadly expected to reduce rates in the face of a lopsided and cooling pan-EU economy, the Euro is running out of room quickly and can be expected to continue declining in the near-term.

With the ECB set to dominate Fiber flows heading into the back half of the trading week, all that’s on the Greenback side of the data docket will be Thursday’s US Retail Sales. Markets are expecting an improvement in US retailer volumes, forecasting a MoM uptick of 0.3% in September Retail Sales compared to August’s 0.1% print.

EUR/USD price forecast

EUR/USD continues to tilt firmly into bearish momentum, slumping further below the 200-day Exponential Moving Average (EMA) at the 1.0900 handle. Extended short pressure could see the pair continue its current one-sided backslide to the 1.0800 region.

Fiber is down over 3% and falling fast after tumbling from recent highs above the 1.1200 handle set in late September. The pair has closed in the red for all but four of the last 15 consecutive trading days, and is poised for a third consecutive bearish week.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- GBP/USD backslid another two-thirds of one percent on Wednesday.

- Cable shed more weight after UK CPI inflation figures missed the mark.

- US & UK Retail Sales figures go head-to-head with releases on Thursday and Friday, respectively.

Tension snapped in GBP/UISD chart action on Wednesday, with Cable losing the tug of war and backsliding out of recent congestion. Cable tumbled two-thirds of one percent and slipped below the 1.3000 handle during the midweek market session. GBP markets withered after UK Consumer Price Index (CPI) inflation figures missed the mark, sending the Pound Sterling to a fresh eight-week low.

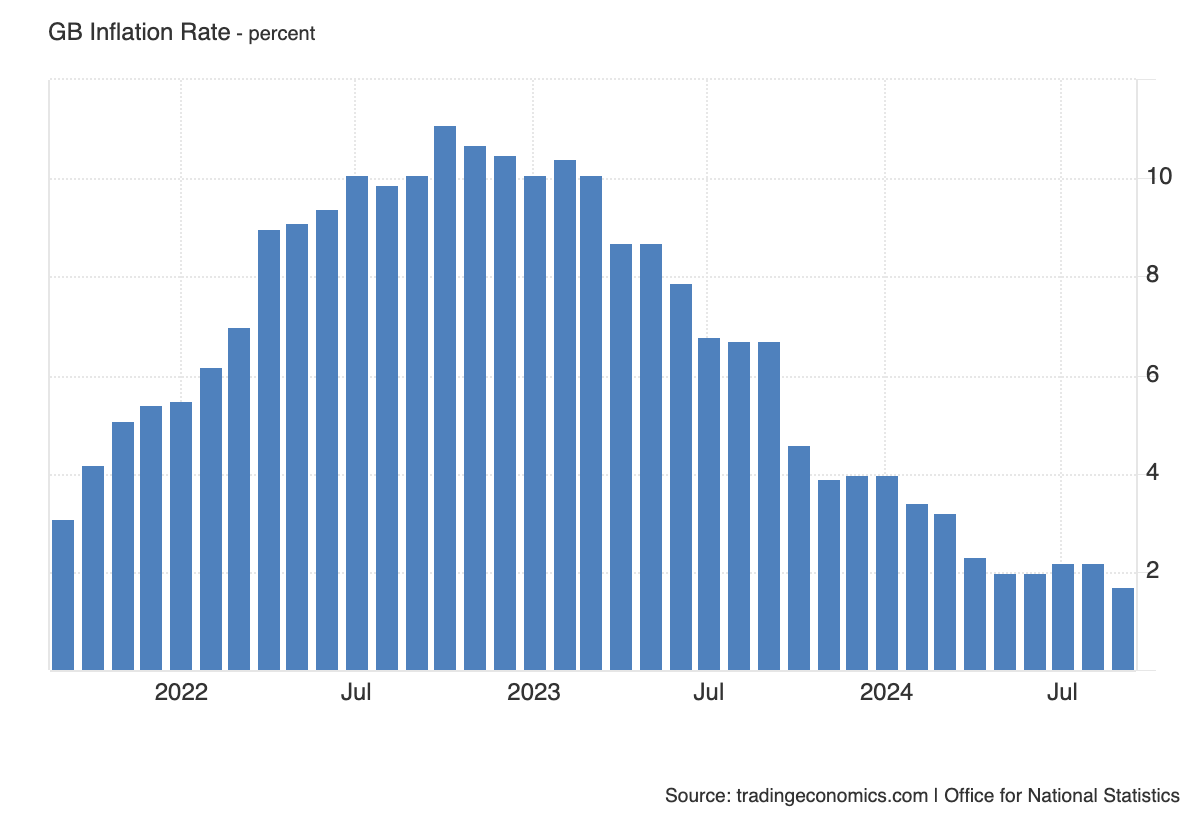

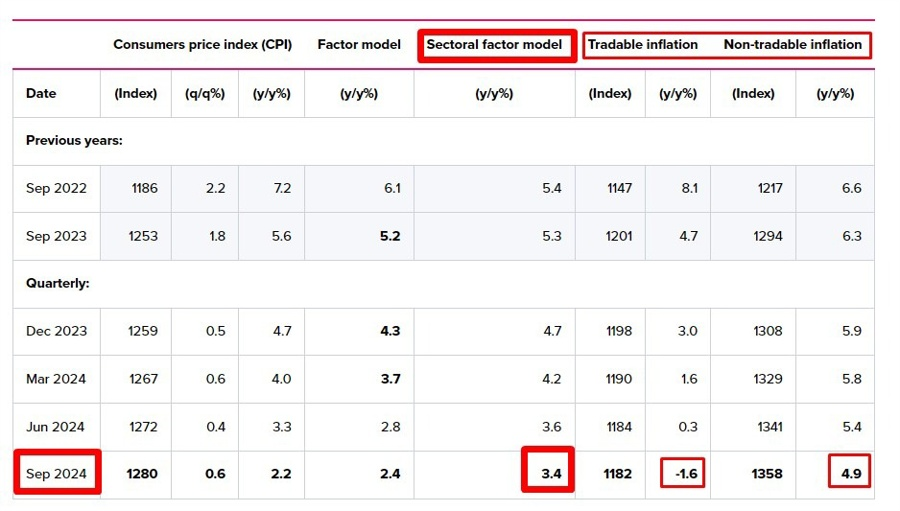

UK CPI inflation number widely missed median market forecasts as inflation drops faster and further than investors initially anticipated in September. Headline CPI inflation for the year ended in September eased to 1.7% from 2.2%, with markets expecting a print of 1.9%. Core CPI inflation remains stubbornly higher than headline inflation measures, but still eased faster than expected, dipping to 3.2% YoY from the previous 3.6% and wringing extra out of the forecast 3.4%.

The UK is witnessing its slowest pace of annual inflation growth since May of 2021, and rising concerns of a deepening economic slowdown are dragging Cable lower. UK Producer Price Index (PPI) figures also contracted more than expected in September, with headline PPI Output prices swooning -0.7% YoY, below the forecast -0.6% and eating away the previous 0.2%. The UK Retail Price Index also hit its lowest measure since April of 2021, falling to 2.7% YoY compared to the previous period’s 3.5% and the median market forecast of 3.1%.

Up next on the data docket will be Thursday’s US Retail Sales. Markets are expecting an improvement in US retailer volumes, forecasting a MoM uptick of 0.3% in September Retail Sales compared to August’s 0.1% print.

The UK’s last chance to impress traders will come on Friday, when UK Retail Sales figures get released. Unfortunately, investors aren’t expecting much; September’s UK Retail Sales are forecast to slump to -0.3% MoM from the previous 0.1%.

GBP/USD price forecast

GBP/USD is set to close for a third straight week in the red as long as Greenback bulls can keep their hands on the wheel for the back half of the trading week. The pair has declined nearly 3.5% after hitting multi-month highs near 1.3450 in September, and the loss of the 1.3000 handle serves as a last-chance wakeup call for Pound Sterling bidders.

GBP/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- The NZD/USD declined in Wednesday's session, continuing its bearish momentum.

- RSI has dropped to 34, indicating oversold conditions and rising selling pressure.

- MACD remains flat and red, suggesting a bearish trend with weakening selling pressure.

In Wednesday's session, the NZD/USD extended its recent decline, falling by 0.27% to 0.6050. The technical indicators remain bearish, indicating a continuation of the selling pressure that has dominated recent trading sessions.

The Relative Strength Index (RSI) has fallen into oversold territory, with a value of 34 and a sharply declining slope. This suggests that selling pressure is increasing and that the bears are gaining strength but that a correction might be in the horizon. The Moving Average Convergence Divergence (MACD) histogram is flat and red, indicating a bearish outlook. As long as the RSI remains below 50 and the MACD remains red, the technical outlook will remain bearish for the NZD/USD but sellers shouldn’t take off the table a healthy correction.

NZD/USD daily chart

The overall outlook for the NZD/USD remains bearish. The pair has been trading below key support levels for several sessions and has yet to show any signs of a recovery. The 0.6100 area where the 100 and 200-day Simple Moving Average (SMA) remains a key level to watch, as a consolidation below this level could open the door for a further decline towards 0.6000 while an upwards break of this level might trigger a recovery.

- The NZD/JPY continues trading side-ways using the 20-day SMA as a support.

- RSI and MACD indicate declining buying pressure.

- Buyers must defend th 20-day SMA to avoid losses.

In Wednesday's session, the NZD/JPY mildly fell to 90.60, continuing the sideways movement seen in the past few sessions.

The daily Relative Strength Index (RSI) is currently at 51, indicating that the pair is in the positive area. However, the RSI is declining, suggesting that buying pressure is declining. The Moving Average Convergence Divergence (MACD) histogram is green and decreasing, confirming the bearish momentum.

The 90.60 level remains crucial for the near-term outlook of the NZD/JPY pair. On Wednesday, the pair continued to struggle near this support level. A breakdown below 90.60 could pave the way for further losses, potentially targeting the next psychological support at 89.50. However, if the pair holds above 90.60 and buyers regain strength, a reversal could push the price towards the 91.00 resistance level and even up to 92.00, where the 20, 100, and 200-day Simple Moving Averages (SMA) converge.

Bears have been persistently testing the 20-day SMA, which has served as a notable support. A successful break below this level could solidify the bearish momentum, leading to increased downside pressure.

NZD/JPY Daily chart

- USD/JPY rises from a two-day low of 148.85, gaining strength amid dip-buying and risk-on sentiment.

- The pair remains within the Ichimoku Cloud, signaling neutral-to-upward bias but suggesting the uptrend could be overextended.

- A break above 150.00 could target the 100-DMA at 150.98, while 149.00 provides key short-term support for bulls.

The US Dollar prints solid gains of more than 0.30% against the Japanese Yen after the pair dropped to a two-day low of 148.85, yet buyers bought the dip and push the exchange rate higher. Although US Treasury bond yields dropped, the USD/JPY trades at 149.71, above its opening price.

USD/JPY Price Forecast: Technical outlook

The daily chart suggests that USD/JPY is on a steady upward trajectory, though it maintains a neutral-to-upward bias. While technical signals indicate that buyers are in control, USD/JPY remains within the Ichimoku Cloud (Kumo), which is limiting its advance. Additionally, despite bullish conditions, the Relative Strength Index (RSI) has failed to surpass its last three peaks, indicating that the uptrend could be overextended.

If USD/JPY rises above 150.00, it could pave the way for a move towards the 100-day moving average (DMA) at 150.98, followed by the 200-DMA at 151.27.

Conversely, if USD/JPY drops below 149.00, the Tenkan-Sen at 147.95 will act as the first support for bulls. If breached, the next key support levels would be the Senkou Span A at 146.48, followed by the 50-DMA at 145.36.

USD/JPY Price Action – Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.31% | 0.67% | 0.30% | -0.18% | 0.56% | 0.43% | 0.37% | |

| EUR | -0.31% | 0.37% | 0.02% | -0.46% | 0.26% | 0.14% | 0.02% | |

| GBP | -0.67% | -0.37% | -0.37% | -0.82% | -0.10% | -0.23% | -0.29% | |

| JPY | -0.30% | -0.02% | 0.37% | -0.45% | 0.26% | 0.16% | 0.10% | |

| CAD | 0.18% | 0.46% | 0.82% | 0.45% | 0.72% | 0.59% | 0.54% | |

| AUD | -0.56% | -0.26% | 0.10% | -0.26% | -0.72% | -0.13% | -0.18% | |

| NZD | -0.43% | -0.14% | 0.23% | -0.16% | -0.59% | 0.13% | -0.06% | |

| CHF | -0.37% | -0.02% | 0.29% | -0.10% | -0.54% | 0.18% | 0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

- The Australian Unemployment Rate is foreseen stable at 4.2% in September.

- Employment Change is expected at 25K, focus will be on the details.

- AUD/USD is technically bearish, so any data-inspired spike may attract sellers.

The Australian Bureau of Statistics (ABS) will release the monthly employment report at 00:30 GMT on Thursday. The country is expected to have added 25K new positions in September, while the Unemployment Rate is foreseen stable at 4.2%. The Australian Dollar (AUD) has weakened against the US Dollar (USD) ahead of the event, with the AUD/USD pair trading below the 0.6700 mark.

The ABS reports Employment Change separating full-time from part-time positions. According to its own definitions, full-time jobs imply working 38 hours per week or more and usually include additional benefits, but they mostly represent consistent income. On the other hand, part-time employment generally means higher hourly rates but lacks consistency and benefits. That’s why full-time jobs have more weight than part-time ones when setting the directional path for the AUD.

Back in August, the monthly employment report showed that Australia managed to create 50.6K part-time jobs while losing 3.1K full-time positions, resulting in a net Employment Change of 47.5K. The Unemployment Rate, in the meantime, stayed at 4.2%.

Australian Unemployment Rate seen steady in September

As previously noted, financial markets anticipate the Unemployment Rate to be at 4.2%. If that’s the case, it will be the third consecutive reading at such a level. Job creation, in the meantime, is foreseen to have grown at a solid pace.

However, market players will be more attentive to details. The strong headline figure from August showed that most jobs created were part-time, while the country lost full-time positions. That’s usually bad news for the economy, regardless of the total. Still, it could be seen as good news regarding monetary policy updates.

The creation of part-time positions, generally understood to have lower wages and fewer benefits than their counterparts, is usually seen as a weakness in the labor market.

The Reserve Bank of Australia (RBA) is in no rush to trim the interest rate. The Official Cash Rate (OCR) has been steady at 4.35% for almost a year now, as the labor market has remained tight. Indeed, it helped bring headline inflation down towards the RBA’s goal to between 2% and 3%, with core inflation still high. Besides easing inflation, the RBA requires a looser job sector to ease the monetary policy.

With that in mind, the sharp increase in part-time jobs in August sparked a bit of hope among those expecting the RBA will soon start lowering the OCR. But a swallow does make a summer. A one-stand macroeconomic report signaling in the “right” direction is not enough. However, if September employment figures point in the same direction, there is a good chance market players will start pricing in an interest rate cut. Three reports in a row will be heaven for doves.

In the meantime, RBA Governor Michele Bullock repeated after the September meeting that underlying inflation remains too high and that the time to trim interest rates has not yet come. At the time being, market players are betting the central bank will deliver a rate cut in February 2025.

When will the Australian employment report be released, and how could it affect AUD/USD?

The ABS will publish the September employment report early on Thursday. As previously stated, Australia is expected to have added 25K new job positions in the month, while the Unemployment Rate is foreseen at 4.2%. Finally, the Participation Rate is expected to hold at 67.1%.

Generally speaking, a strong report will boost the AUD, even if the larger increase comes from part-time jobs. Any weak underlying subcomponent will likely fuel hopes of rate cuts, but not enough to trigger an AUD sell-off. The opposite case is also valid, with soft figures putting pressure on the Aussie.

Ahead of the announcement, the AUD/USD pair trades a handful of pips below the 0.6700 mark and is technically bearish.

Valeria Bednarik, Chief Analyst at FXStreet, notes: “The AUD/USD pair is trading below the 61.8% Fibonacci retracement of the 0.6621-0.6941 rally at 0.6743, meaning there is a good chance the pair will soon test the bottom of the range. The bearish case is also being supported by technical indicators, as the Momentum and the Relative Strength Index (RSI) head firmly south well below their midlines in the daily chart, reflecting persistent selling interest. At the same time, the pair is currently battling with a directionless 100 Simple Moving Average (SMA) while the 20 SMA gains bearish traction over 100 pips above the current level.”

Bednarik adds: “AUD/USD may surge towards the aforementioned Fibonacci resistance level with an upbeat report, but given the dominant trend, sellers may take their chances around it once the dust settles. Near-term support comes at 0.6670 en route to the 0.6620 price zone. A break below the latter should favor a near-term extension towards a strong static support area surrounding the 0.6570 mark.”

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

- AUD/USD fell on Wednesday, reaching five-week lows below 0.6700.

- Markets await key employment figures from Australia in Thursday’s session.

- A stronger USD, worries from the Chinese economic situation and falling metal prices are pushing down the Aussie.

The AUD/USD continued its downtrend on Wednesday, declining by 0.60% to 0.6662, marking a five-week low. The pair breached the crucial 0.6700 support level, potentially leading to a test of the 200-day SMA at 0.6625. The outcome of local employment figures to be released on Thursday will also set the pace of the Aussie’s dynamics.

Despite a mixed economic outlook for Australia, the Reserve Bank of Australia's (RBA) focus on combating high inflation has tempered market expectations. As a result, the markets now anticipate only a modest 0.25% interest rate cut in 2024. If employment data comes in weak, markets might place bets on another cut.

Daily digest market movers: Australian Dollar declines after breaking key support, employment figures ahead

- AUD/USD breaks below key support at 0.6700 on USD's recovery as traders doubt China's stimulus efforts.

- China's latest press conference raises uncertainty over stimulus plan's scope and impact.

- Markets only anticipate 50% chance of RBA rate cut by year-end, potentially aiding AUDUSD recovery.

- On Thursday, investors will eye Employment Change and Participation rate figures from September from Australia, which are expected to show weakness in the labor market.

AUD/USD technical outlook: Bearish momentum rising, support at 0.6700 gone

The AUD/USD pair is currently trading in a bearish trend. The Relative Strength Index (RSI) is in the oversold area, suggesting that selling pressure is intense but soon to potentially pause for consolidation. The Moving Average Convergence Divergence (MACD) is also rising, indicating that the overall outlook is bearish.

Support levels include 0.6660, 0.6650 and 0.6630, while resistance levels lie at 0.6700, 0.6730and 0.6750.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- The Canadian Dollar has found a brief recovery after steady multi-week declines.

- Canada remains light on the economic calendar until next week’s BoC rate call.

- The BoC is widely expected to trim interest rates by a further 50 bps, decaying the CAD.

The Canadian Dollar (CAD) pared near-term losses on Wednesday, but not nearly enough to spark a fresh bull run. Markets are likely taking a breather after pummeling the CAD for nearly three straight weeks. The Loonie has shed over 3% against the Greenback since hitting a recent peak against the US Dollar in the bottom half of September.

Daily digest market movers

- The Canadian Dollar recovered some lost ground against the US Dollar, but still remains at the bottom of a long slide.

- The Bank of Canada (BoC) is widely expected to trim interest rates by 50 bps next week, leaving the CAD with little support heading into the rate call window.

- Canadian Consumer Price Index (CPI) inflation figures did little to bolster Loonie investor confidence this week, with a sharp drawdown in headline inflation but an uptick in core BoC-measured inflation.

- Canadian Housing Starts rose in September on a seasonally-adjusted basis to 223.8K from the previous 217.4K, but missed the forecast 237.5K.

- Canadian Manufacturing Sales in August beat expectations, but still contracted by 1.3% compared to the previous 1.4% upswing. Markets expected a print of -1.5% or worse.

Canadian Dollar price forecast

The USD/CAD daily chart shows the pair is losing some steam after a strong rally that propelled it above the key resistance of 1.3750. The pair briefly touched the 1.3800 mark, but recent price action indicates a minor pullback, suggesting that the bulls might be taking a pause. However, the price remains well above the 50-day EMA at 1.3624 and the 200-day EMA at 1.3610, signaling that the overall bullish trend remains intact for now. A close below these moving averages could signal a deeper retracement, but as long as USD/CAD holds above these levels, the bullish momentum is likely to continue.

The MACD indicator remains in positive territory, with the MACD line still above the signal line, but the histogram is showing signs of flattening out. This could suggest that the bullish momentum is waning, and traders should be cautious of a potential consolidation or minor pullback in the near term. A clear break above 1.3800 would be needed to confirm further upside, while a drop below the 1.3650 level could invite fresh selling pressure. Traders will be watching closely for any fundamental catalysts that could push the pair decisively in either direction.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- XAU/USD climbs as falling US Treasury yields boost demand for non-yielding assets.

- Traders anticipate rate cuts from major central banks as inflation cools with the ECB expected to act on October 17.

- Geopolitical uncertainty and upcoming US elections fuel demand for Gold as a safe-haven asset amidst economic slowdown fears.

Gold prices rose during the mid-North American session on Wednesday, underpinned by the drop in US Treasury yields and the shrug off recent US Dollar strength. Expectations that major central banks would cut rates amid soft inflation readings weighed on bond yields and boosted the non-yielding metal. At the time of writing, the XAU/USD trades at $2,674, up by 0.46%.

Market sentiment has improved lately, as portrayed by three of the four US equity indices trading in the green. US Treasury bond yields had extended their fall, a tailwind for Bullion prices, which hit $2,685, the year-to-date (YTD) high, yet lacked the strength to push prices toward $2,700.

During the European session, inflation in the UK tumbled below the Bank of England’s (BoE) 2% goal. Hence, the BoE is expected to resume its easing cycle in tune with the Federal Reserve and the European Central Bank. Traders expect the ECB to lower rates on October 17 as inflation aimed toward the bank’s target and also on fears the bloc's economy is at risk of hitting a recession.

Gold climbed as traders seeking safety bought the dip amid woes that the global economy could be headed for a slowdown and uncertainty on upcoming US elections.

UBS analysts wrote, “We anticipate uncertainty and volatility to rise until the next US administration is settled,” and suggested that gold and oil could be “effective portfolio hedges.”

In the meantime, according to the CME FedWatch tool, traders see a 96% chance of a 25-basis-point US rate cut in November.

The lack of economic data keeps traders focused on Middle East developments and China’s stimulus program.

Market participants' attention turns to upcoming US Retail Sales, Industrial Production data, and Initial Jobless Claims due later this week.

Daily digest market movers: Gold price climbs as investors eye key US data

- Gold prices remained underpinned by the fall of the US 10-year Treasury bond yield.

- The 10-year benchmark note rate is down two basis points to 4.014%.

- Despite that, overall US Dollar strength has capped Bullion’s rally toward $2,700.

- The US Dollar Index, which tracks the buck’s value against a basket of six currencies, gains 0.34% to 103.57.

- Data from the Chicago Board of Trade, based on the December fed funds rate futures contract, indicates that investors are pricing in 50 basis points (bps) of easing by the Fed in the last two months of 2024.

XAU/USD technical outlook: Gold price surges above $2,670, eyes on YTD peak

The uptrend of Gold remains in place, with buyers launching their first attack to the YTD high of $2,685, yet they fell short of cracking the latter. Momentum remains bullish, as shown by the Relative Strength Index (RSI), opening the door for higher prices.

Therefore, Gold’s first resistance is the YTD high at $2,685. Once cleared, a move to $2,700 is on the cards, followed by $2,750 and $2,800.

Conversely, if XAU/USD falls below the October 4 high at $2,670, a retracement toward $2,650 is on the cards. On further weakness, the next support would be $2,600, followed by the 50-day Simple Moving Average (SMA) at $2,561.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- XAG/USD climbs to $31.74, driven by falling US Treasury yields and stronger risk sentiment in the market.

- Momentum favors bulls, with RSI clearing key resistance, suggesting further upside potential towards $33.00.

- Key support lies at $31.60, with a break below potentially leading Silver to retest the $30.76 level.

Silver prices climbed on Wednesday as US Treasury yields fell, a tailwind for the non-yielding metal. An improvement in risk appetite underpins the precious metal sector, pushing the grey metal to hit a seven-day high at $32.17. At the time of writing, XAG/USD trades at $31.74 and gains more than 0.85%.

XAG/USD Price Forecast: Technical outlook

After diving almost vertically from a year-to-date (YTD) peak of $32.95 to $30.12 in three days, Silver is recovering, with buyers eyeing a test of $33.00.

The momentum remains constructive, supporting bulls as shown by the Relative Strength Index (RSI. The RSI cleared the 55 peak with enough room to spare before turning overbought.

Hence, Silver’s path of least resistance is tilted to the upside. The first resistance would be the $32.00 figure, followed by today’s high at $32.17. Once those levels are surpassed, the next stop would be the May 20 swing high at $32.51 before challenging the YTD high at $32.95.

Conversely, if XAG/USD slips below $31.60, Silver could drop to the weekly low of $30.76. This clears the path to an October 8 low of $30.12 if surpassed.

XAG/USD Daily Chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

- EUR/USD withered further on Wednesday, sagging below 1.0900.

- ECB rate cut looms large around the corner, broadly expected to trim rates 25 bps.

- Final EU inflation figures are unlikely to move the needle on Thursday.

EUR/USD is in freefall, plummeting to multi-week lows as the Euro continues to crumple ahead of the European Central Bank’s (ECB) upcoming rate call on Thursday. The ECB is widely expected to trim interest rates by a quarter of a percent, or 25 bps.

All eyes will be on the ECB during Thursday’s European market session. The ECB is widely expected to trim its Main Refinancing Operations Rate by 25 bps to 3.4% from 3.65%, with the ECB’s Rate on Deposit Facility expected to take a matching 25 bps trim to 3.25% from 3.5%. With the ECB broadly expected to reduce rates in the face of a lopsided and cooling pan-EU economy, the Euro is running out of room quickly and can be expected to continue declining in the near-term.

EUR/USD price forecast

EUR/USD continues to tilt firmly into bearish momentum, slumping further below the 200-day Exponential Moving Average (EMA) at the 1.0900 handle. Extended short pressure could see the pair continue its current one-sided backslide to the 1.0800 region.

Fiber is down over 3% and falling fast after tumbling from recent highs above the 1.1200 handle set in late September. The pair has closed in the red for all but four of the last 15 consecutive trading days, and is poised for a third consecutive bearish week.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

There was no timeout for the US Dollar’s rally on Wednesday, which extended its gains for the sixth consecutive day and hit new two-month highs despite global yields retreated further.

Here is what you need to know on Thursday, October 17:

The US Dollar Index (DXY) rose further to multi-week tops above 103.50 on the back of further weakness in the risk complex. Retail Sales will be at the centre of the debate along with the Philly Fed Manufacturing Index, usual weekly Initial Jobless Claims, Industrial and Manufacturing Production, Business Inventories, the NAHB Housing Market Index, and the weekly report by the EIA.

EUR/USD extended further its multi-day leg lower and broke below the 1.0900 support with marked conviction. The ECB will decide on rates seconded by the usual press conference by President Christine Lagarde. Additional data will include Balance of Trade results and the final Inflation Rate, along with the speech by the ECB’s McCaul.

GBP/USD dropped markedly and cleared the key 1.3000 support in the wake of lower UK inflation data. The BoE’s Wood is due to speak.

USD/JPY remained choppy and always below the 150.00 barrier, advancing modestly on Wednesday following Dollar’s gains and dovish remarks from the BoJ’s Adachi. The Balance of Trade results and the Tertiary Industry Index will be published.

AUD/USD retreated to multi-week lows after breaching the key 0.6700 support, shifting its focus to the key 200-day SMA. All the attention shifts to the release of the Australian labour market report.

Shrinking geopolitical effervescence and omnipresent demand concerns from China weighed further on WTI prices, motivating them to break below the $70.00 mark once again on Wednesday.

Lower yields and prospects of further easing by central banks lent extra wings to Gold prices, pushing them to the area of all-time highs around $2,685 per ounce troy. Silver prices added to Tuesday’s advance and climbed to six-day tops past the $32.00 mark per ounce.

- US Dollar proves strong as markets are pricing in a Trump victory in November.

- Fed easing expectations: 150 bps of total easing seen over the next 12 months.

- Retail Sales on Thursday will be closely watched.

The US Dollar Index (DXY), which measures the value of the USD against a basket of six others, continues rising as financial markets are doubling down on a Donald Trump win in the US presidential election. This is mainly due to Trumps’s plans on several sectors of the economy of deregulating according to IG Bank’s analyst. The DXY has broken above key resistance and is on its way to 104.00.

With the US economy showing mixed signs, Federal Reserve (Fed) officials remain cautious, signaling that the pace of the easing will rely on incoming data. In the meantime, political jitters seem to be benefiting the USD ahead of November’s election.

Daily digest market movers: US Dollar adds more ground on quiet Wednesday

- The US economic calendar showed no highlights on Wednesday as markets wait for Thursday’s Retail Sales figures.

- In case those figures come in strong, it could give the USD another boost. As for now, markets are expecting a slight monthly expansion.

- Fed officials Daly and Bostic remain cautious, suggesting only one or two rate cuts this year.

- Market expectations for Fed easing have slightly decreased, with two cuts by year-end no longer fully priced in but still remaining high above 80%.

DXY technical outlook: DXY pierces through key levels, correction looms

Technical analysis for the DXY index indicates continued momentum among indicators with some flashing overbought signals. The index has broken above the crucial 100-day Simple Moving Average (SMA), with the next major resistance at the 200-day SMA at 103.80. While buyers are pushing for an optimistic outlook, a potential correction may occur before the next upswing.

Supports are found at 103.00, 102.50 and 103.00, while resistances lie at 103.30, 103.50 and 104.00.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- The Dow Jones rose 250 points on Wednesday as the index recovered.

- Equities are rebounding from Tuesday’s declines, with indexes sticking close to record highs.

- The recent ‘Fed frenzy’ has abated, with markets confident of a 25 bps cut in November.

The Dow Jones Industrial Average (DJIA) rallied roughly 250 points on Wednesday as equities pivot around the mid-week inflection point. The Dow Jones is paring away Tuesday’s losses, where the index shed over three-quarters of a percent, keeping price action tight to record highs.

Markets have settled into a holding pattern on Federal Reserve (Fed) rate cuts, with rate traders firmly pricing in 90% odds of a 25 bps rate trim on November 7, with another quarter-point trim firmly priced in for December 18. Investors are exhausted after spending most of 2024 on Fed watch, and Q3 earnings reports have dominated traders’ viewports this week.

The US banking sector posted bumper Q3 earnings this week, dragging multiple indexes to record highs, and a steady stream of warnings about how high interest rates could negatively impact bank profitability has dried up practically overnight. Major players in the tech space, including Amazon (AMZN) and Google (GOOG), are busy inking deals for future nuclear projects. Large-scale companies that deal in data storage and computing farms are looking to provide enough power to server farms being swallowed whole by the amorphous AI sphere.

Costs are rising quickly for the still-budding “AI industry”, a label slapped onto any project that uses large dataset-crunching modeling methods to spit out other recombined, pre-shaped datasets. As energy demand and equivalent power costs soar, the companies selling the shovels in the AI goldrush are looking for ways to deliver cheap, readily available power on a large scale to an industry already grappling with finding value that isn’t direct injections from investors, and future net-positive revenue streams remain elusive.

Dow Jones news

Wednesday is a firm recovery day for the Dow Jones, with two-thirds of the equity index testing into the green. Apple (AAPL) fumbled during the midweek market session, backsliding 1.2% and falling to $231 per share as the tech company took a breather from making recent all-time highs. Intel (INTC) also shed 1.3% to fall below $22.50 per share after it was announced that Qualcomm’s exploratory takeover bid of the chipmaker has been delayed until after the US election in November.

Dow Jones Price forecast

Despite a recent knockback, the Dow Jones continues to test close to record highs. Bullish price action is on pace to take a fresh topside run at the 43,200 level, but intraday bids will first need to firmly recapture the 43,000 handle.

The Dow Jones has climbed over 16% bottom-to-top in 2024, with bullish momentum outrunning the 200-day Exponential Moving Average (EMA) since November of last year. The DJIA has gained nearly 8% in the past two months alone after recovering from a mid-September swing low that pierced the 50-day EMA and tested the 40,000 major price handle.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Mexican Peso weakened as US Dollar gains despite falling US yields.

- IMF downgrades Mexico's 2024 GDP growth outlook, citing capacity constraints and tight monetary policy.

- US import prices fell sharply in September, while Fed’s Bostic remains optimistic about inflation hitting the 2% target.

The Mexican Peso depreciated in early trading on Wednesday as the US Dollar strengthened amid a mixed market mood with falling US Treasury yields. Softer inflation readings among developed countries suggest that further easing is coming, indicating that the global economy might slow down. The USD/MXN trades at 19.87, registering gains of 1%.

US equities are fluctuating as traders shifts focus toward small caps as the Russell 2000 outperforms the NASDAQ and S&P 500. Therefore, emerging market currencies sensitive to risk, like the Peso, remained on the back foot.

On Tuesday, the International Monetary Fund (IMF) revised Mexico’s economy downward to 1.5% in 2024 due to capacity constraints and a restrictive monetary policy. This is well below the 2.4% estimated by the Secretaria de Hacienda y Credito Publico (SHCP).

The IMF estimates GDP growth for the next year at 1.3% as inflation closes in on the Bank of Mexico’s (Banxico) 3% objective.

On the US front, the docket revealed that import prices fell the most in nine months in September due to the fall of energy prices. Meanwhile, Export prices fell on monthly and annual figures.

On Tuesday, Atlanta’s Fed President Raphael Bostic commented the US economy is performing well, and that he’s confident that inflation will hit the 2% target. He doesn’t foresee a recession, though he expects inflation to remain choppy and employment robust.

Ahead in the week, Thursday’s economic docket will feature the release of Retail Sales, Initial Jobless Claims, Industrial Production and further Fed speakers.

Daily digest market movers: Mexican Peso slumps as USD/MXN surges past 19.80

- Earlier during the North American session, the Mexican Peso touched a five-week low as the USD/MXN hit a high of 19.93, shy of the psychological 20.00 figure.

- The IMF said that a recent judicial reform creates "important uncertainties about the effectiveness of contract enforcement and the predictability of the rule of law."

- Banxico’s survey revealed that economists estimate the central bank will lower rates by 50 bps for the rest of the year. The USD/MXN exchange rate is projected to end at 19.69, and the economy is expected to grow by 1.45% in 2024.

- US Import Prices plunged -0.4% MoM as expected in September. Export prices plummeted -0.7% more than estimates of -0.4% contraction and less than August’s -0.9%.

- Data from the Chicago Board of Trade via the December fed funds rate futures contract shows investors estimate 50 bps of Fed easing by the end of the year.

USD/MXN technical outlook: Mexican Peso nosedives as buyers eye USD/MXN at 20.00

The USD/MXN uptrend remains intact as the pair briefly surpassed 19.90 to hit multi-week highs. Momentum remains bullish as the Relative Strength Index (RSI) depicts. This would exert upward pressure on the exotic pair, which could clear the 20.00 figure as traders brace for safety ahead of the US election.

The USD/MXN next ceiling level would be 20.00. If surpassed, the next resistance would be the YTD high of 20.22, before challenging 20.50.

On the flip side, if USD/MXN tumbles below the October 1 high turned support at 19.82, it could exacerbate a test of the October 10 daily peak at 19.61. On further weakness, the next floor will be the October 4 swing low of 19.10 before testing 19.00.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- EUR/GBP rose on Wednesday, attempting to recover the 20-day SMA.

- RSI is rising sharply, while the MACD is flat and green, suggesting buying pressure is recovering.

On Wednesday's session, the pair landed at 0.8360 with a gain of 0.37%. The cross surged and attempts to recover the 20-day Simple Moving Average (SMA), but momentum is still flat.

The Relative Strength Index (RSI) is currently at 48, which is in the negative area, but its slope is rising sharply, suggesting that buying pressure is recovering. The Moving Average Convergence Divergence (MACD) is flat and green, which suggests that buying pressure is also flat.

In terms of price action, the pair has been trading within a range of 0.8352 and 0.8390. There are support levels at 0.8350, 0.8330, and 0.8315, and resistance levels at 0.8370, 0.8390, and 0.8400. In case the bulls fail to gain the 0.8360-0.8400 area, it might trigger a sharp selling pressure but a consolidation above could fuel a recovery. In the meantime, buying momentum remains subdued.

EUR/GBP daily chart

US Presidential candidate Trump yesterday declared that ‘tariff’ was the most beautiful word in the dictionary. He made the threat that if other countries were to attempt to move away from the USD as the world’s dominant reserve currency that he would increase trade tariffs on that country, Rabobank’s FX analyst Jane Foley notes.

USD’s position as the dominant reserve currency to continue slipping

“While the aggregated IMF FX reserve data do not show any evidence that the use of sanctions and tariff in recent years has accelerated the movement away from USDs, it is difficult to ignore the potential impact from changing geopolitical factors. Despite Trump’s threats, in our view, it remains likely that the USD’s position as the dominant reserve currency will continue to slip, though the pace is likely to remain slow.”

“For many countries, particularly those strongly aligned with the US, the risk of trade tariffs could be sufficient to prevent a movement away from using the USD as the dominant invoicing currency. However, the implications for countries which already have a soured geopolitical relationship with the US, the implementation of sanctions could provide a greater incentive to by-pass the USD over time.”

“Domestically produced good, however, will usually be either more expensive or of an inferior quality then the import they replace. Tariffs therefore tend to be inflationary which should lift the USD and for this reason we would expect the USD to be stronger in the early months of a Trump presidency than a Harris one. Over time, however, tariffs can reduce productivity and growth potential.”