- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(raw materials / closing price /% change)

Oil 57.12 +0.14%

Gold 1255.80 -0.10%

(index / closing price / change items /% change)

Nikkei -63.62 22694.45 -0.28%

TOPIX -2.70 1808.14 -0.15%

Hang Seng -55.72 29166.38 -0.19%

CSI 300 -23.94 4026.15 -0.59%

Euro Stoxx 50 -25.53 3556.22 -0.71%

FTSE 100 -48.39 7448.12 -0.65%

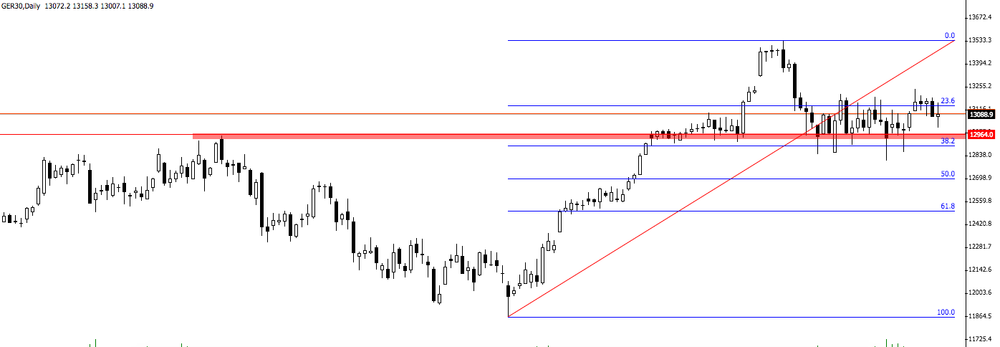

DAX -57.56 13068.08 -0.44%

CAC 40 -42.31 5357.14 -0.78%

DJIA -76.77 24508.66 -0.31%

S&P 500 -10.84 2652.01 -0.41%

NASDAQ -19.27 6856.53 -0.28%

S&P/TSX -120.13 16016.46 -0.74%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1776 -0,42%

GBP/USD $1,3430 +0,11%

USD/CHF Chf0,98889 +0,35%

USD/JPY Y112,40 -0,12%

EUR/JPY Y132,36 -0,54%

GBP/JPY Y150,956 -0,01%

AUD/USD $0,7664 +0,36%

NZD/USD $0,6981 -0,61%

USD/CAD C$1,27954 -0,14%

10:00 Eurozone Trade balance unadjusted October 26.4 24.6

12:00 United Kingdom BOE Quarterly Bulletin

13:15 United Kingdom MPC Member Andy Haldane Speaks

13:30 Canada Manufacturing Shipments (MoM) October 0.5% 0.8%

13:30 U.S. NY Fed Empire State manufacturing index December 19.40 18.60

14:15 U.S. Capacity Utilization November 77.0% 77.2%

14:15 U.S. Industrial Production YoY November 2.9%

14:15 U.S. Industrial Production (MoM) November 0.9% 0.3%

18:00 U.S. Baker Hughes Oil Rig Count December 751

21:00 U.S. Net Long-term TIC Flows October 80.9

21:00 U.S. Total Net TIC Flows October -51.30

The main US stock indexes have moderately decreased, having receded from record marks. Market dynamics continued to be affected by the Fed's optimistic view of the economy and news that changes in the Republican tax code will be put to the final vote in Congress before the end of the year.

In addition, as it became known, the initial applications for unemployment benefits in the US for the week to December 9 fell by 11,000 to 225,000. This is only slightly higher than the post-recession low. Economists predicted that the figure would be 239,000.

Meanwhile, the US Department of Commerce reported that retail sales for November, adjusted for seasonal fluctuations and holidays and trading days, but not price changes, amounted to $ 492.7 billion, which is 0.8% more than in October, and 5.5% higher than November 2016. Total sales for the period from September 2017 to November 2017 increased by 5.2% compared to the same period in 2016. The change from September to October was revised from 0.2% to 0.5%.

A separate report from the Ministry of Trade indicated that the volume of commercial inventories in the US declined in October on the back of strong sales growth, which indicates that investment in inventories is likely to make a major contribution to economic growth in the fourth quarter. Commodity inventories declined 0.1% in October after they did not change in September. The last change coincided with the forecasts. Retail stocks, except for cars that go into the calculation of GDP, increased by 0.4%. In September, they decreased by 0.1%.

Most components of the DOW index recorded a decline (22 out of 30). Outsider were shares of Caterpillar Inc. (CAT, -1.39%). The leader of growth was the shares of The Walt Disney Company (DIS, + 2.99%).

All sectors of the S & P index finished trading in the red. The health sector showed the greatest decline (-0.9%).

At closing:

DJIA -0.31% 24.510.11 -75.32

Nasdaq -0.28% 6,856.53 -19.27

S & P -0.40% 2,652.14 -10.71

Manufacturers' and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,885.7 billion, down 0.1 percent (±0.1 percent) from September 2017, but were up 3.5 percent (±0.3 percent) from October 2016.

The total business inventories/sales ratio based on seasonally adjusted data at the end of October was 1.35. The October 2016 ratio was 1.39.

December data pointed to divergent trends across the U.S. private sector economy, with a slowdown in services growth more than offsetting a robust and accelerated upturn in manufacturing output. As a result, the seasonally adjusted IHS Markit Flash U.S. Composite PMI Output Index dropped to 53.0 in December, from 54.5 in November.

U.S. stock-index futures were flat on Thursday as investors focused on a $52.4 billion stock deal between Walt Disney (DIS) and 21st Century Fox (FOX) and gains in shares of big banks.

Global Stocks:

Nikkei 22,694.45 -63.62 -0.28%

Hang Seng 29,166.38 -55.72 -0.19%

Shanghai 3,293.58 -9.46 -0.29%

S&P/ASX 6,011.30 -10.50 -0.17%

FTSE 7,484.30 -12.21 -0.16%

CAC 5,388.46 -10.99 -0.20%

DAX 13,043.94 -81.70 -0.62%

Crude $56.26 (-0.60%)

Gold $1,253.50 (+0.65%)

-

As soon as we got news of Steinhoff scandal we stopped buying the bond

-

Revision in projections goes in right direction

-

We haven't discussed next downturn, doesn't seem likely today

-

Size of corporate buys were not discussed

-

Growth news are very positive

-

Did not discuss cutting link in guidance between app and inflation

-

News on inflation remains somewhat muted

EUR/USD: 1.1610 (1.7 млрд), 1.1700 (1.2 млрд), 1.1800 (1.0 млрд), 1.1820 (828 млн), 1.1860 (728 млн), 1.1900 (601 млн)

USD/JPY: 111.50-60 (396 млн), 112.00 (754 млн), 112.40-50 (1.4 млрд), 112.70 (580 млн), 113.00 (525 млн), 113.50 (464 млн), 114.00 (522 млн)

USD/CHF: 0.9795 (108 млн), 0.9915-25 (160 млн), 1.0000 (301 млн)

USD/CAD: 1.2710-15 (310 млн), 1.2800 (240 млн), 1.2950 (316 млн)

AUD/USD: 0.7620-30 (574 млн), 0.7700-10 (408 млн)

NZD/USD: 0.6870-80 (492 млн)

EUR/GBP: 0.8805 (200 млн)

AUD/NZD: 1.0950 (272 млн)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 42.04 | 0.18(0.43%) | 402 |

| ALTRIA GROUP INC. | MO | 72.49 | 0.17(0.24%) | 530 |

| Amazon.com Inc., NASDAQ | AMZN | 1,164.00 | -0.13(-0.01%) | 10851 |

| Apple Inc. | AAPL | 172.46 | 0.19(0.11%) | 31043 |

| AT&T Inc | T | 37.9 | -0.14(-0.37%) | 9245 |

| Boeing Co | BA | 292.4 | 0.56(0.19%) | 8915 |

| Caterpillar Inc | CAT | 149 | 0.43(0.29%) | 3424 |

| Chevron Corp | CVX | 119.98 | 0.05(0.04%) | 143 |

| Cisco Systems Inc | CSCO | 38.25 | 0.10(0.26%) | 10010 |

| Citigroup Inc., NYSE | C | 75.33 | 0.19(0.25%) | 9505 |

| Exxon Mobil Corp | XOM | 82.99 | -0.13(-0.16%) | 1986 |

| Facebook, Inc. | FB | 178.4 | 0.10(0.06%) | 35714 |

| Ford Motor Co. | F | 12.71 | 0.08(0.63%) | 1697 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.28 | -0.04(-0.25%) | 12690 |

| General Electric Co | GE | 17.82 | 0.06(0.34%) | 43669 |

| Goldman Sachs | GS | 256.5 | 0.94(0.37%) | 816 |

| Hewlett-Packard Co. | HPQ | 20.6 | -0.25(-1.20%) | 2118 |

| Home Depot Inc | HD | 183.41 | 0.38(0.21%) | 193 |

| Intel Corp | INTC | 43.57 | 0.23(0.53%) | 1495 |

| International Business Machines Co... | IBM | 154.5 | 0.59(0.38%) | 908 |

| JPMorgan Chase and Co | JPM | 105.9 | 0.39(0.37%) | 16573 |

| McDonald's Corp | MCD | 173.75 | 0.20(0.12%) | 989 |

| Merck & Co Inc | MRK | 56.61 | 0.18(0.32%) | 4203 |

| Microsoft Corp | MSFT | 85.54 | 0.19(0.22%) | 9376 |

| Nike | NKE | 64.46 | 0.16(0.25%) | 32741 |

| Pfizer Inc | PFE | 36.67 | 0.03(0.08%) | 3887 |

| Starbucks Corporation, NASDAQ | SBUX | 59.44 | -0.05(-0.08%) | 1452 |

| Tesla Motors, Inc., NASDAQ | TSLA | 340.55 | 1.52(0.45%) | 20602 |

| The Coca-Cola Co | KO | 46.05 | 0.15(0.33%) | 2098 |

| Twitter, Inc., NYSE | TWTR | 21.83 | 0.17(0.78%) | 30671 |

| United Technologies Corp | UTX | 124.47 | 0.17(0.14%) | 100 |

| Verizon Communications Inc | VZ | 52.64 | -0.25(-0.47%) | 3387 |

| Visa | V | 113.6 | 0.29(0.26%) | 646 |

| Wal-Mart Stores Inc | WMT | 98 | 0.24(0.25%) | 3013 |

| Walt Disney Co | DIS | 106.4 | -1.21(-1.12%) | 757115 |

| Yandex N.V., NASDAQ | YNDX | 33.08 | 0.36(1.10%) | 3705 |

Procter & Gamble (PG) initiated with Buy at Deutsche Bank

McDonald's (MCD) target raised to $185 from $175 at Piper Jaffray

NIKE (NKE) target raised to $76 from $61 at Deutsche Bank

Honeywell (HON) target raised to $180 from $162 at Jefferies

Honeywell (HON) target lowered to $169 at Stifel

-

Underlying inflation have moderated somewhat recently

-

Risks to growth broadly balanced

-

Inflation to moderate in coming months before increasing again

-

ECB sees 2017 gdp growth at 2.4 pct vs 2.2 pct seen in sept

-

2018 gdp growth at 2.3 pct vs 1.8 pct seen in sept

-

Underlying inflation yet to show more convincing sign of upturn

-

Support provided by buys, bond stocks, reinvestments, guidance

-

Survey results point to solid, broad growth

-

Sees significant improvement in growth outlook

-

Favourable financing conditions still needed

Advance estimates of U.S. retail and food services sales for November 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $492.7 billion, an increase of 0.8 percent from the previous month, and 5.8 percent above November 2016. Total sales for the September 2017 through November 2017 period were up 5.2 percent from the same period a year ago. The September 2017 to October 2017 percent change was revised from up 0.2 percent to up 0.5 percent . Retail trade sales were up 0.8 percent from October 2017, and were up 6.3 percent from last year. Gasoline Stations were up 12.2 percent from November 2016, while Building Materials and Garden Equipment and Supplies Dealers were up 10.7 percent from last year.

"At today's meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively. The Governing Council expects the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases".

"The Bank of England's Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. At its meeting ending on 13 December 2017, the MPC voted unanimously to maintain Bank Rate at 0.5%. The Committee voted unanimously to maintain the stock of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £10 billion. The Committee also voted unanimously to maintain the stock of UK government bond purchases, financed by the issuance of central bank reserves, at £435 billion".

EUR/USD: 1.1610 (1.7b), 1.1700 (1.2b), 1.1800 (1.0b), 1.1820 (828m), 1.1860 (728m), 1.1900 (601m)

USD/JPY: 111.50-60 (396 m), 112.00 (754m), 112.40-50 (1.4b), 112.70 (580m), 113.00 (525m), 113.50 (464m), 114.00 (522m)

USD/CHF: 0.9795 (108m), 0.9915-25 (160m), 1.0000 (301m)

USD/CAD: 1.2710-15 (310m), 1.2800 (240m), 1.2950 (316m)

AUD/USD: 0.7620-30 (574m), 0.7700-10 (408m)

NZD/USD: 0.6870-80 (492m)

EUR/GBP: 0.8805 (200m)

AUD/NZD: 1.0950 (272m)

The underlying pattern in the retail industry in November 2017, as suggested by the three-month on three-month measure remains one of growth, with the quantity bought increasing by 0.8%.

When compared with October 2017, the quantity bought in November 2017 increased by 1.1%, with household goods stores showing strong growth at 2.9%.

Retailers' feedback suggests that "Black Friday" events contributed to the monthly increase in household goods stores, with electrical household appliances making the largest contribution to the growth.

The year-on-year growth rate shows the quantity bought increased by 1.6%.

The headline IHS Markit Eurozone PMI rose to 58.0 in December, according to the 'flash' estimate (based on approximately 85% of final replies), up from 57.5 in November and its highest since February 2011. The upturn continued to be led by manufacturing, where the headline PMI rose to its highest since the series began in June 1997. Faster manufacturing output growth (the best since April 2000) was accompanied by the largest monthly imp

German firms finished 2017 on a high note by recording the sharpest growth in business activity in more than six-and-a-half years, according to December's flash PMI survey from IHS Markit. Moreover, the overall performance in the manufacturing sector was the best seen since survey data were first collected in early-1996.

The IHS Markit Flash Germany Composite Output Index climbed to an 80-month high of 58.7 in December, after registering 57.3 in the penultimate month of the year. Growth accelerated across both manufacturing and services, with the latter seeing the steepest rise in business activity for two years. It was the goods-producing sector that continued to lead the way, however, recording the strongest expansion in output in almost seven years.

"The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at -0.75% and the target range for the three-month Libor is unchanged at between -1.25% and -0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration".

The latest flash data were indicative of further growth in the French private sector economy. Indeed, the rate of expansion remained among the sharpest recorded since data were first available in May 1998, with the IHS Markit Flash France Composite Output Index, which is based on around 85% of usual monthly survey replies, posting 60.0 down only fractionally from 60.3 in November

In November 2017, the Consumer Prices Index (CPI) rose by 0.1% as in October 2017. This increase resulted from an acceleration in energy prices and an increase in tobacco prices. . On the other hand, services prices and those of manufactured goods fell back slightly. Food prices slowed down sharply due to a downturn in fresh food prices, which had sharply rebounded in the previous month.

Seasonally adjusted, consumer prices hardly accelerated: +0.2% after +0.1% in October.

Year-on-year, consumer prices rose by 1.2% in November, 0.1 point of percentage more than in the previous month. This fourth consecutive acceleration resulted from a stronger growth in energy prices and tobacco prices and a lower drop in the prices for manufactured goods. Food and energy prices increased at the same rate as in October.

-

Upward adjustment of interest rates reflects supply and demand in the market

-

Interest rate adjustment was less than market expectations, will be good for shaping reasonable interest rate expectations in market

-

Rate rise will help keep financial institutions from over-leveraging and expanding credit, will help control macro leverage ratio

Retail sales in China were up 10.2 percent on year in November, the National Bureau of Statistics said on Thursday, cited by rttnews.

That missed forecasts for 10.3 percent but was still up from 10.0 percent in October.

The bureau also noted that industrial production advanced an annual 6.1 percent - matching forecasts and down from 6.2 percent in the previous month.

Fixed asset investment was up 7.2 percent, again in line with expectations and slowing from 7.3 percent a month earlier.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1968 (4498)

$1.1945 (3767)

$1.1911 (2224)

Price at time of writing this review: $1.1822

Support levels (open interest**, contracts):

$1.1772 (4463)

$1.1733 (3396)

$1.1690 (4475)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 5 is 92643 contracts (according to data from December, 13) with the maximum number of contracts with strike price $1,1900 (4498);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3531 (2103)

$1.3503 (1362)

$1.3483 (745)

Price at time of writing this review: $1.3428

Support levels (open interest**, contracts):

$1.3370 (1844)

$1.3340 (2013)

$1.3306 (1630)

Comments:

- Overall open interest on the CALL options with the expiration date January, 5 is 30101 contracts, with the maximum number of contracts with strike price $1,3500 (3853);

- Overall open interest on the PUT options with the expiration date January, 5 is 29584 contracts, with the maximum number of contracts with strike price $1,2900 (2426);

- The ratio of PUT/CALL was 0.98 versus 0.97 from the previous trading day according to data from December, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Anticipates some strengthening in labor market conditions

-

Macroeconomic effects of any tax changes are uncertain

-

Changes in tax policy will likely give lift to economy in coming years

-

Will do utmost to ensure smooth transition to new Fed chief Powell

-

Fed prepared to resume reinvestments in maturing securities if economic outlook warranted this

-

Fed did discuss tax policy; most colleagues factored in fiscal stimulus into their outlook along lines of what congress is considering

-

Stock valuations is on the list of risks for fed; not a major factor

-

Fed policymakers see tax package as mostly boosting aggregate demand but having potential of boosting aggregate supply

-

Says Fed has not studied negative rates to any considerable extent

-

Sees faster growth trajectory, faster decline in jobless rate than in previous projections; no change in inflation projections for 2018 and beyond

-

Vote in favor of policy 7 to 2, Evans and Kashkari dissented because they preferred to keep rates unchanged

-

Near-term risks to the economy appear "roughly balanced"

-

Inflation has declined this year but it still expects inflation to reach 2 pct goal over medium term

-

2019 - gdp growth 2.1 pct (prev 2.0 pct), unemployment rate 3.9 pct (prev 4.1 pct), core inflation 2.0 pct (prev 2.0 pct)

-

2018 - gdp growth 2.5 pct (prev 2.1 pct), unemployment rate 3.9 pct (prev 4.1 pct), core inflation 1.9 pct (prev 1.9 pct)

-

Median forecast of fed policymakers is for three rate hikes in 2018

-

Median view of appropriate federal funds rate at end-2018 2.125 (prev 2.125 pct): end-2019 2.688 (prev 2.688 pct) end-2020 3.063 (prev 2.875) longer-run 2.750 pct (prev 2.750 pct

-

Long-run forecasts - jobless rate 4.6 pct (prev 4.6 pct); gdp growth 1.8 pct (prev 1.8 pct)

Trend estimates (monthly change)

-

Employment increased 22,200 to 12,380,100.

-

Unemployment decreased 2,900 to 707,300.

-

Unemployment rate remained steady at 5.4%.

-

Participation rate increased less than 0.1 pts to 65.4%.

-

Monthly hours worked in all jobs increased 3.8 million hours (0.2%) to 1,734.4 million hours.

Seasonally adjusted estimates (monthly change)

-

Employment increased 61,600 to 12,403,000. Full-time employment increased 41,900 to 8,501,900 and part-time employment increased 19,700 to 3,901,100.

-

Unemployment increased 4,100 to 707,700. The number of unemployed persons looking for full-time work increased 2,500 to 489,900 and the number of unemployed persons only looking for part-time work increased 1,700 to 217,800.

-

Unemployment rate remained steady at 5.4%.

-

Participation rate increased 0.3 pts to 65.5%.

-

Monthly hours worked in all jobs increased 9.8 million hours (0.6%) to 1,740.9 million hours.

-

Flash Japan Manufacturing PMI rises to 54.2 in December (53.6 in November).

-

Solid output growth sustained amid a quickened expansion in new orders.

-

Output price inflation accelerates to 41-month high.

Commenting on the Japanese Manufacturing PMI survey data, Joe Hayes, Economist at IHS Markit, which compiles the survey, said: "With Q3 GDP growth recently revised higher, latest flash PMI data signalled further positivity for the Japanese economy in the final month of 2017. "A 46-month high in the PMI was supported by the sharpest boost in order book volumes since January 2014. Recent yen weakness appeared to benefit exporters, with new orders from abroad rising strongly. "Furthermore, the inflationary trend in output charges was extended to a full year. Selling prices were increased by manufacturers at the fastest pace since July 2014."

European stocks pulled back from a five-week high Wednesday, with investors bracing for an expected hike in borrowing costs by the Federal Reserve, while retail shares were showing strength. Italian stocks fared the worst in the region as the country begins to gear up for a national election next year.

U.S. stocks mostly rose on Wednesday, with the Dow ending at a record for a fourth straight session after the Federal Reserve raised interest rates, as had been widely expected. While the day's gains were broad, a sharp decline in financial shares limited the broader market's advance and pushed the S&P 500 into slightly negative territory in the final minutes of trading.

Asian stocks edged higher on Thursday after the Federal Reserve delivered a much-anticipated interest rate hike but flagged caution about inflation, tempering expectations for future tightening, which weighed on the dollar and Treasury yields. China's central bank also raised rates, though marginally.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.