- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- EUR/USD continues to decline as the Euro deflates.

- Fiber found a 57-week low as the Greenback continues to climb.

- US Retail Sales in the barrel for Friday will wrap up the economic calendar.

EUR/USD briefly tested fresh year-long lows on Thursday, piercing the 1.0500 handle for the first time in 54 weeks. A lack of meaningful EU data is doing very little to provide support for the Euro, and Fiber bids continue to tilt in favor of the safe haven US Dollar. European Gross Domestic Product (GDP) growth figures failed to spark a bid under the Euro, printing exactly at-expectations. Quarterly pan-EU GDP came in at 0.4% QoQ exactly as markets expected, with annualized GDP also matching forecasts at 0.9% YoY.

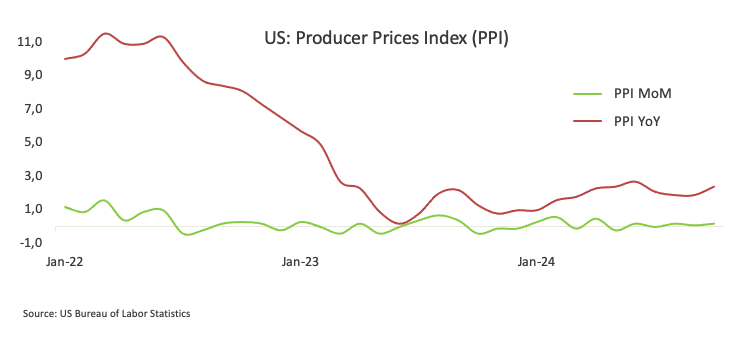

Producer Price Index (PPI) producer-level inflation figures came in roughly as expected, despite a slight upswing in annualized core PPI numbers. Headline PPI matched forecasts in October, rising 0.2% MoM compared to the previous month’s revised 0.1%. Core PPI for the year ended in October accelerated more than expected, ticking up to 3.1% compared to the expected 3.0% rising above the previous period’s 2.9%, which was also revised slightly higher from 2.8%.

The economic calendar is once again one-sided on Friday, with US Retail Sales in the barrel to wrap up the trading week. The last blast of US economic data this week will be Retail Sales for October, which are expected to ease to 0.3% from the previous month’s 0.4%.

EUR/USD price forecast

The EUR/USD daily chart is displaying sustained bearish momentum, with the pair sharply falling below the 50-day and 200-day Exponential Moving Averages (EMAs), which are positioned around 1.0867 and 1.0884, respectively. The recent "death cross," where the 50-day EMA crossed below the 200-day EMA, reinforces the downside pressure and suggests a continuation of the prevailing downtrend. EUR/USD is now trading near multi-month lows around the 1.0520 level, which could act as a psychological support in the short term. However, any recovery is likely to face strong resistance around the 1.0700 level, where the EMAs converge.

The MACD indicator further supports the bearish outlook, as the MACD line remains below the signal line in negative territory, with expanding histogram bars below the zero line. This configuration indicates a robust downward trend, with selling momentum persisting. Unless the pair manages to stage a clear breakout above the EMAs, the bias remains firmly to the downside. A break below the 1.0500 level could open the door for a deeper decline, with 1.0400 emerging as the next potential support area. Bulls would need a decisive recovery above the 1.0880 mark to negate the bearish bias.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- USD/CAD trades on a flat note around 1.4060 in Friday’s early Asian session.

- Fed’s Powell said there is no need to hurry rate cuts as the US economy remains strong.

- The lower crude oil prices continue to undermine the Loonie.

The USD/CAD pair trades flat near 1.4060 amid the consolidation of the US Dollar (USD) during the early Asian session on Friday. The US October Retail Sales will be in the spotlight on Friday along with the Fedspeak.

The Greenback holds steady near the fresh 2024 highs despite Trump trades showing signs of slowing. The upside of the pair might be limited amid the cautious remarks from the US Federal Reserve (Fed). On Thursday, Fed Chair Jerome Powell said that the recent performance of the US economy has been “remarkably good,” giving the Fed room to lower interest rates at a careful pace.

Furthermore, Producer inflation in the US rose more than expected in September. Data released by the US Bureau of Labor Statistics on Thursday showed that the US Producer Price Index (PPI) rose 2.4% on a yearly basis in October. This figure followed the 1.9% rise seen in September (revised from 1.8%) and came in above the market expectation of 2.3%.

On the Loonie front, the decline in crude oil prices could weigh on the commodity-linked Canadian Dollar (CAD) in the near term. It's worth noting that Canada is the largest oil exporter to the United States (US), and lower crude oil prices tend to have a negative impact on the CAD value.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- GBP/USD backslid yet again on Thursday, falling to a 19-week low.

- Cable is on pace for its single worst week since mid-2023.

- GBP bidders will be waiting for Friday’s UK GDP print.

GBP/USD fell to a fresh 19-week low on Thursday, piercing the 1.2700 handle before finding near-term technical support from 1.2650. The Pound continues to ease with a lack of meaningful faith behind it, while broader markets continue to bolster the Greenback higher across the board.

Producer Price Index (PPI) producer-level inflation figures came in roughly as expected, despite a slight upswing in annualized core PPI numbers. Headline PPI matched forecasts in October, rising 0.2% MoM compared to the previous month’s revised 0.1%. Core PPI for the year ended in October accelerated more than expected, ticking up to 3.1% compared to the expected 3.0% rising above the previous period’s 2.9%, which was also revised slightly higher from 2.8%.

Coming up on Friday, UK Gross Domestic Product (GDP) figures will give Cable bidders something to chew on, while Greenback buyers will be looking for a surprise improvement in US Retail Sales. UK GDP for the third quarter is expected to sink to 0.2% QoQ from the previous quarter’s print ofg 0.5%. US Retail Sales are likewise forecast to ease slightly in October, expected to print at 0.3% MoM compared to September’s 0.4%.

GBP/USD price forecast

The GBP/USD daily chart shows a pronounced downtrend with significant bearish momentum. After a brief consolidation period around the 1.2900 level, the pair has broken below the 50-day and 200-day Exponential Moving Averages (EMAs), which were providing support near 1.2990 and 1.2865, respectively. This bearish cross between the 50-day EMA (blue line) and the 200-day EMA (black line) is a strong sell signal, commonly known as a "death cross," suggesting further downside potential. The recent break below these key moving averages reinforces the likelihood of continued downward pressure, with the next significant support zone around 1.2600.

The MACD indicator also confirms the bearish bias, as the MACD line has crossed below the signal line in negative territory. This indicates a strong bearish trend with increasing downside momentum. The histogram bars are deepening below the zero line, suggesting that selling pressure remains strong and the pair may struggle to find support. If the bearish momentum persists, GBP/USD could extend its losses, potentially testing the psychological 1.2500 level. A break above the 1.2865 resistance (200-day EMA) would be required to alleviate some of the immediate downside pressure, though the bias remains bearish as long as price remains below the 50-day EMA.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- The Canadian Dollar found new lows against the Greenback on Thursday.

- Canada remains largely absent from the economic calendar until next week.

- US PPI inflation accelerated faster than expected for the year ended October.

The Canadian Dollar (CAD) backslid into new lows against the Greenback on Thursday, slipping to a fresh 54-month low and sending the USD/CAD pair to its highest prices in four and a half years. The pair broke through the 1.4000 handle, with the US Dollar getting sent even higher on the back of a slight upswing in US Producer Price Index (PPI) inflation figures on Thursday, sending the Loonie to multi-year lows.

Canada remains absent from the economic calendar this week with a notable lack of meaningful data releases on the radar. CAD traders will be forced to sit on their hands until next Tuesday’s Canadian Consumer Price Index (CPI) inflation update for October, which is unlikely to deliver much good news to Loonie fans.

Daily digest market movers: Canadian Dollar gets pummeled by US producer inflation

- The Canadian Dollar found a new four and a half year low against the Greenback on Thursday, tumbling to its lowest bids against the safe haven US Dollar in 54 months.

- US PPI inflation accelerated a little bit more than expected in October, keeping investors wary and reminding them that rock-bottom interest rates are much easier to wish for than to get.

- US core PPI inflation for the year ended in October rose 3.1% YoY, more than the forecast 3.0% and rising even further from the previous period’s revised 2.9%, which initially printed at 2.8%.

- Canadian CPI inflation data due next week is unlikely to deliver much good news to Loonie bulls as inflation in Canada slumps and the Bank of Canada (BoC) gets pulled into a rate cutting spiral.

- US Retail Sales figures due on Friday could give the US Dollar one last kick up the charts to wrap up the trading week.

Canadian Dollar price forecast

With USD/CAD breaching into multi-year highs, a chasm is opening up below the Canadian Dollar (CAD). After a brief reprieve last week, the Greenback is once again on pace to close higher against the CAD on a weekly basis. USD/CAD has risen nearly 5% since finding a floor near 1.3400 in September, cracking through long-term technical resistance and piercing the 1.4000 handle.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- NZD/USD declines 0.65% during Thursday's session.

- The pair resumed downturn and printed fresh multi-month lows as bears extended the control.

- The NZD/USD RSI slipped into oversold territory after falling below 30, indicating rising selling pressure.

The NZD/USD pair declined by 0.65% during Thursday's session and fell below the 0.5900 mark, extending declines for the sixth day and hitting lows since November 2023. The bearish momentum escalated and oversold signals emerged.

The NZD/USD pair's bearish sentiment is reinforced by technical indicators. The Relative Strength Index (RSI) has slipped below 30, indicating oversold territory and rising selling pressure. The declining slope of the RSI suggests that this pressure is intensifying. Furthermore, the Moving Average Convergence Divergence (MACD) remains bearish, with the histogram declining and red. These indicators align with the price action, confirming the pair's downward trajectory.

Support levels are at 0.5830, 0.5810, and 0.5800, while resistance levels are at 0.5900, 0.5950, and 0.5970. Traders should monitors these levels in case the oversold nature of the movements push the pair into a consolidation mode.

NZD/USD daily chart

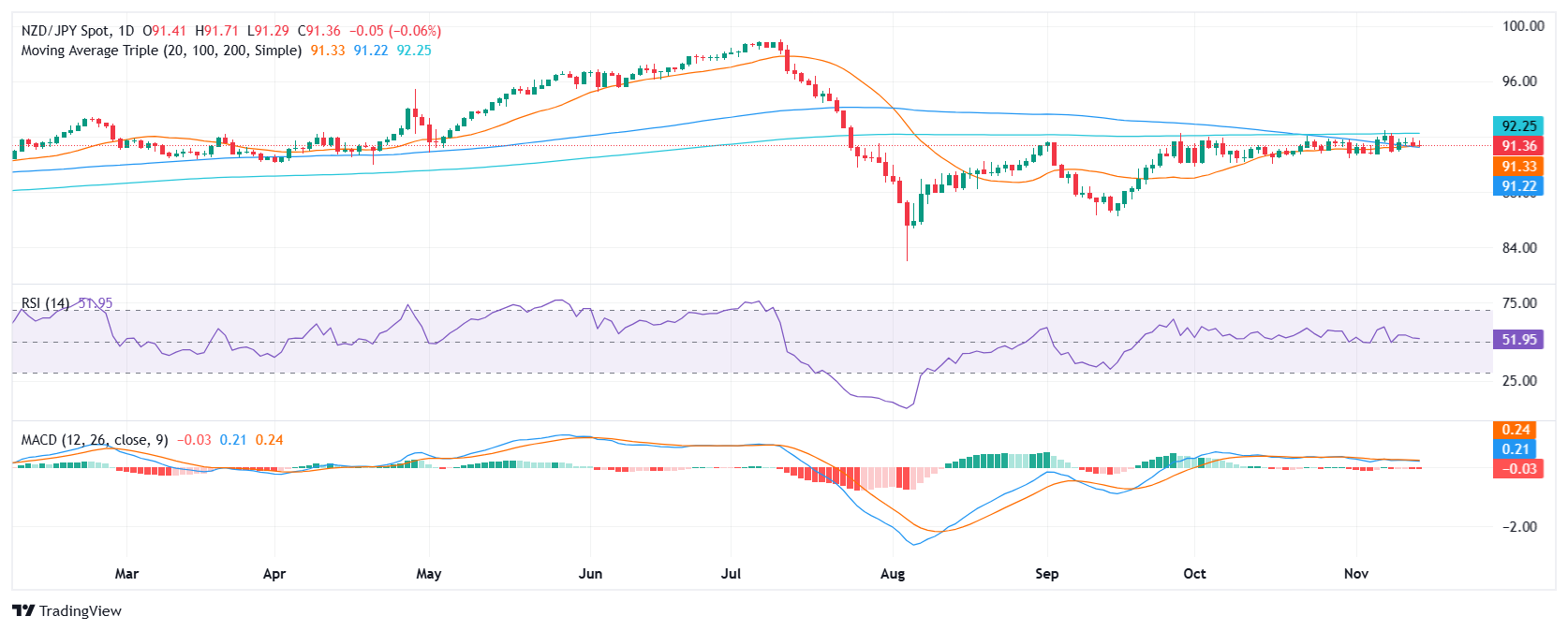

- NZD/JPY declined mildly to 91.40 on Thursday's session.

- The pair continued trading within the range of 92.00-91.00 going nowhere.

- The RSI was at 52, showing flat buying pressure and the MACD histogram flat and red indicated selling pressure was flat.

The NZD/JPY pair declined mildly to 91.40 on Thursday's session and continued trading within the range of 92.00-91.00. Indicators are neutral with no clear dominant, but a recently completed bearish crossover between the 20 and 100-day Simple Moving Averages (SMAs) might eventually push the pair lower.

The NZD/JPY pair's technical outlook remains mixed, as suggested by neutral indicators. The Relative Strength Index (RSI) stands at 52, indicating balanced buying and selling pressures, while the Moving Average Convergence Divergence (MACD) histogram is flat and red, suggesting flat selling pressure.The pair is currently trading sideways, with support levels at 91.00, 90.50, and 90.00, and resistance levels at 92.00, 92.50, and 93.00.

NZD/JPY daily chart

- XAU/USD remains subdued under the weight of a strengthening Dollar and recent US inflation data.

- Producer Price Index exceeds expectations, suggesting Fed easing cycle might be reconsidered.

- Investors recalibrate expectations for December Fed rate cut amid ongoing inflation concerns.

Gold recovers some ground on Thursday yet remains trading below its opening price for the fifth consecutive day, undermined by the Greenback’s advance for its own fifth consecutive day. A slightly hot inflation report in the US and solid jobs data sponsored XAU/USD’s leg down toward the 100-day Simple Moving Average (SMA). At the time of writing, Bullion trades at $2,568.

The market mood shifted negatively yet failed to boost Gold’s prices and underpin the US Dollar. The US Bureau of Labor Statistics revealed that the Producer Price Index (PPI) rose in October, exceeding estimates and September’s figures.

This indicates that the Federal Reserve's (Fed) job is far from done, even though the central bank embarked on an easing cycle that has seen the Fed lower its primary interest rate instrument by 75 basis points since September 2024.

At the same time, the US Department of Labor revealed that unemployment claims filled by Americans diminished compared to the previous reading

Fed officials have recently underscored the delicate act of balancing inflation control with employment goals. Governor Adriana Kugler stressed the importance of addressing both mandates, pointing out that while strides have been made toward reducing inflation, hitting the 2% target remains challenging.

Likewise, Richmond Fed President Thomas Barkin acknowledged the progress in curbing inflation but warned against premature optimism. He sees risks like substantial union wage settlements and potential tariff hikes, which could spark inflationary pressure.

Gold has been undermined by investor fears that US President-elect Donald Trump’s proposed tariffs and tax reductions are likely to increase inflation, which could prompt the Fed to pause its easing cycle.

Market participants see a 72% chance of a quarter percentage rate cut by the Fed in the upcoming December meeting, down from 82% a day ago.

Investors are awaiting remarks from Fed Chair Jerome Powell later on Thursday along with Friday's US Retail Sales data.

Daily digest market movers: Gold steadies alongside strong US Dollar

- Gold prices recover as US real yields, which inversely correlate against Bullion, fall three basis points to 2.068%. The DXY registers gains of 0.18% to 106.67.

- Fed Chair Jerome Powell, commented the US economy is not sending signals that US central bank needs to be in a hurry to lower interest rates, and he expect inflation to “come down toward the 2% goal.” Powell reassured the Fed’s commitment on inflation.

- The US PPI surpassed expectations with the headline increasing by 2.4% YoY, beating the 2.3% forecast and up from 1.9% in September. The Core PPI, often influencing the core Personal Consumption Expenditures (PCE) Price Index, rose by 3.1% YoY, higher than the prior 2.9% and above the expected 3%.

- Initial Jobless Claims for the week ending November 9 came in at 217K, a decrease from the previous week's 221K and below the forecast of 223K.

- According to the December fed funds futures contract data from the Chicago Board of Trade, investors are projecting a 25 bps Fed rate cut in December.

XAU/USD Technical Outlook: Gold price holds firm, but downside risks remain

Gold (XAU/USD) has recently declined below the October 10 swing low of $2,603, exacerbating further losses below $2,600 and opening the door to a new two-month low of $2,536, briefly below the 100-day Simple Moving Average (SMA) at $2,547. Nevertheless, sellers’ failure to push Bullion prices toward $2,500 paved the way for a leg-up.

XAU/USD’s first resistance is seen at $2,600. If buyers reclaim that level, they could test the 50-day SMA at $2,650, with subsequent resistance around $2,700. Surpassing this could open the path to the November 7 high of $2,710.

The Relative Strength Index (RSI) has moved away from its neutral line, suggesting a bearish momentum that could lead to further declines in XAU/USD.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- AUD/USD declines with the rising US Dollar as Australian employment data disappoints.

- Sluggish job growth and unchanged Unemployment Rate at 4.1% reduce inflation fears in Australia.

- Markets might start to bet on a less aggressive RBA.

The AUD/USD declined by 0.34% to 0.6470 in Thursday's session, extending its decline to a fresh three-month low of 0.6460. The US Dollar is easing after mixed data, while weak Australian employment data has reduced inflationary concerns, which might change the outlook of the Reserve Bank of Australia (RBA).

Lately, the AUD declined against the strengthening USD, driven by positive US economic indicators and increased confidence following Donald Trump’s presidential election. Despite a neutral stance from the RBA, the central bank hinted at a possible rate cut in May 2025. The overall price action indicates that the AUD/USD pair may continue its downtrend, with the DXY reaching new yearly highs, putting pressure on risk-related currencies like the AUD.

Daily digest market movers: Australian Dollar declines due to weak labor data, US data

- Australia's job growth slowed in October, adding 15.9K workers against estimates of 25K, easing inflation concerns.

- Despite the slowdown, the Unemployment Rate remained at 4.1%, suggesting a still-tight labor market.

- The RBA is unlikely to cut interest rates soon as Governor Bullock emphasizes the need to control inflation.

- The US Dollar Index surged to a one-year high near 107.00, driven by Trump's campaign promises of higher import tariffs and lower taxes.

- Investors await Federal Reserve Chair Powell's speech for guidance on interest rate policy.

- As for now, markets anticipate the first 25-basis-point interest rate cut in Australia not before May 2025 but remain confident in a 25 bps cut by the Fed in December.

AUD/USD technical outlook: Pair’s bearish momentum intact, it might start to consolidate

The AUD/USD downtrend remains intact, but oversold conditions in the daily RSI suggest a potential bounce. The indicator has reached deeply into negative territory around 30, a level that often precedes a reversal in momentum. This suggests that the pair may be due for a temporary rebound, although any gains should be viewed as corrective within the broader downtrend.

Support levels lie at 0.6450, 0.6430, and 0.6400, while resistance is encountered at 0.6500, 0.6515, and 0.6550.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

The US Dollar continued its ascent, reaching fresh 2024 highs, even as the Trump-led rally showed signs of slowing and US yields dipped slightly ahead of a busy economic calendar on Friday.

Here is what you need to know on Friday, November 15:

The US Dollar Index (DXY) printed a new 2024 peak north of 107.00 despite declining US yields across the curve. Retail Sales will be at the centre of the debate across the pond, seconded by the NY Empire State Manufacturing Index, Export and Import Prices, Industrial and Manufacturing Production, and Business Inventories.

EUR/USD broke below the 1.0500 support to hit new 2024 lows amidst the incessant move higher in the Greenback. Germany’s Wholesale Prices are due along with speeches by the ECB’s McCaul, Lane, and Cipollone.

GBP/USD broke below the 1.2700 support to reach new lows amid further gains in the Greenback. The advanced Q3 GDP Growth Rate figures takes centre stage on the UK docket, followed by Business Investment, Goods Trade Balance, Industrial and Manufacturing Production, Construction Output, the final Q2 Labour Productivity index, and the NIESR Monthly GDP Tracker.

USD/JPY climbed past the 156.00 hurdle for the first time since mid-July on the back of further gains in the US Dollar. Key data releases in Japan will include flash Q3 GDP Growth Rate, Capacity Utilization, Industrial Production, and the Tertiary Industry Index.

Extra strength in the Greenback and the inconclusive price action in the commodity complex dragged AUD/USD to new lows near 0.6450. The RBA’s Jones will be the sole event Down Under at the end of the week.

WTI prices added to Wednesday’s marginal gains and shifted their focus to the key $70.00 mark on the back of a positive EIA’s weekly report.

Prices of Gold advanced marginally and regained the $2,570 region after bottoming out in new lows near $2,535 earlier in the day. Silver prices bounced off the sub-$30.00 zone per ounce, making a decent U-turn and eventually ending the day with marked gains.

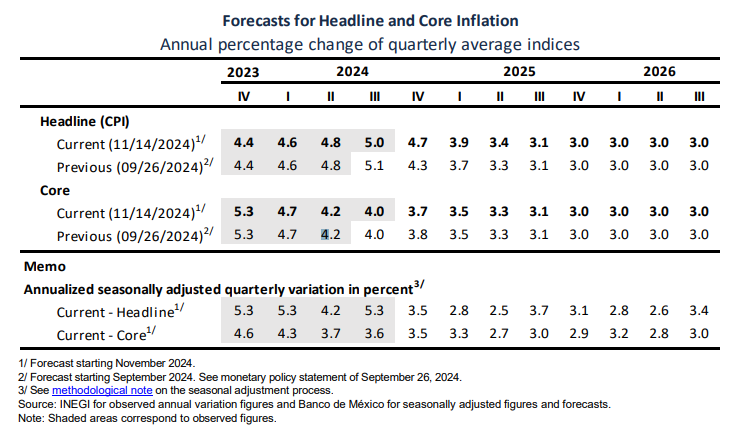

- Unanimous decision reflects changed stance since September; further rate cuts may follow as inflation outlook improves.

- Banxico emphasizes continuing economic challenges but sees potential for easing as non-core inflation effects diminish.

- Inflation expected to reach target by Q4 2025, with updated projections suggesting a gradual disinflationary trend.

The Bank of Mexico cut rates by 25 basis points for the fourth time since March 21, diminishing Mexico’s primary reference rate from 10.50% to 10.25%. It’s worth noting that the decision was unanimous after Deputy Governor Jonathan Heath voted to hold rates unchanged at the September meeting.

Bank of Mexico reduces key rate to 10.25%, citing improving inflation outlook and downside economic risks

In its monetary policy statement, Banxico acknowledged that the balance of risks to economic activity growth is skewed to the downside. They added, “the nature of the shocks that have affected the non-core component and the projection that their effects on headline inflation will dissipate over the next quarters.”

The board added the inflationary scenario “will allow further reference rates adjustments,” and although it requires a restrictive monetary policy stance, the evolution of the disinflation process “implies that it's adequate to reduce the level of monetary policy restriction.”

Banxico updated their forecasts for 2024, 2025 and 2025. The board projects that headline inflation will converge to the bank’s 3% target in Q4 2025.

USD/MXN Reaction to Banxico’s decision

The USD/MXN spiked toward 20.55, before printing new daily lows below 20.45. Despite this, the exotic pair bias is tilted to the upside, unless sellers push the exchange rate below 20.00, ahead of testing the 50-day Simple Moving Average (SMA) at 19.74. On the upside, buyers had a clear path to test year-to-date (YTD) highs at 20.80, if they reclaim 20.50.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

- Remarks from Fed Chair Jerome Powell will heat the US session on Thursday.

- Fed officials maintain the monetary policy path despite the new political scenario.

- Powell’s speech and Fed commentary will likely revolve around Trump’s victory.

Federal Reserve (Fed) Chairman Jerome Powell is due to participate in a panel discussion titled "Global Perspectives" at an event hosted by the Federal Reserve Bank of Dallas this Thursday, and speculative interest eagerly awaits his words.

The Fed had recently delivered as expected, trimming the benchmark interest rate by 25 basis points (bps) in November after cutting it by 50 bps in September. Back then, the Fed established a monetary policy path, which continues as planned.

However, the outcome of the recent United States (US) presidential election has made investors wonder for how long.

Fed policymakers and the Republican victory

The return of former President Donald Trump to the White House has fueled concerns about renewed inflationary pressures, as his platform would move the economy in a sharply different direction. Tax cuts, tariffs on foreign goods, and harsh migration policies are among Trump’s motto.

The Fed, particularly Chairman Jerome Powell, had done their best to clarify the central bank’s independence from the government, but that’s far from enough to grant a smooth continuation of the current monetary policy.

With a Republican Congress behind Trump, things will take an interesting twist next year, and financial markets are not quite sure where that will end.

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- The Dow Jones eased on Thursday as Trump election rally short-circuits.

- US producer-level prices printed at expectations, easing investor concerns.

- Friday brings Retail Sales data to round out the trading week.

The Dow Jones Industrial Average (DJIA) pumped the brakes on the recent post-election rally that saw a decisive win for presidential candidate and former President Donald Trump. Investors overwhelmingly perceived the returning contender for the White House as a pro-market representative within the US government. The election glut in equities is now fizzling out as equities pare back slightly from record highs.

Producer Price Index (PPI) producer-level inflation figures came in roughly as expected, despite a slight upswing in annualized core PPI numbers. Headline PPI matched forecasts in October, rising 0.2% MoM compared to the previous month’s revised 0.1%. Core PPI for the year ended in October accelerated more than expected, ticking up to 3.1% compared to the expected 3.0% rising above the previous period’s 2.9%, which was also revised slightly higher from 2.8%.

US Retail Sales are due on Friday and is the last batch of meaningful US data on the docket this week. October’s Retail Sales are expected to ease to 0.3% MoM from the previous 0.4%, while Retail Sales excluding automobiles are expected to decline to 0.3% from 0.5%.

Dow Jones news

The Dow Jones is roughly on-balance on Thursday despite a slight easing in the index’s headline average price. Half of the Dow’s constituent equities are in the green for the day, with gains led by Walt Disney (DIS). Disney is up nearly 7% for the day and testing $110 per share after beating earnings in FY Q4. On the low side, Salesforce (CRM) eased lower around 2.5% to $333 per share as the AI-fueled tech rally takes a breather on Thursday.

Dow Jones price forecast

The Dow Jones is struggling to hold onto the 44,000 handle as the major equity index eases back from record highs set just north of 44,4000. Downside potential remains limited as bears have few footholds to grab onto, but a near-term downturn to the 50-day Exponential Moving Average (EMA) near 42,400 can’t be discounted.

The Dow Jones is still trending deep into bull country regardless of any near-term drags; the index is on pace to close in the green for all but two months of 2024. The DJIA is also trading well above it’s 200-day EMA near 40,150, with nearly 10% of value between current price action and the long-term moving average.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- US Dollar retreats after reaching its highest level after labor and inflation data.

- US citizens filing new applications for unemployment insurance last week arrived below expectations.

- The headline PPI for October came in at 2.4%, higher than expected.

The US Dollar Index (DXY), a measure of the value of the USD against a basket of six currencies, softened after hitting a fresh year-to-date high near 107.00. The Greenback has been on a rise in recent days, but profit-taking and disappointing US economic data have led to a slight retracement. The headline Producer Price Index (PPI) for October came in at 2.4% YoY, above expectations of 2.3%, and the PPI excluding Food and Energy rose to 3.1% YoY, also arriving above forecasts.

Additionally, US citizens filing new applications for unemployment insurance was reported at 217K for the week ending November 9, which came in below expectations of 223K. .

Daily digest market movers: US Dollar eases after hitting new annual high due to profit-taking and economic data

- Initial Jobless Claims in the US increased to 217K in the week ending November 9, below estimates of 223K and the prior week’s 221K.

- The seasonally-adjusted insured unemployment rate remained at 1.2%, while the four-week moving average decreased to 221K.

- Headline PPI in the US rose 2.4% YoY in October, exceeding estimates and marking a significant increase from September's 1.9% revised gain.

- Excluding Food and Energy, PPI increased by 3.1% YoY, higher than expectations and the previous reading of 2.9%.

- On a monthly basis, headline PPI and core PPI both rose by 0.2% and 0.3%, respectively, meeting expectations but higher than the previous rate.

DXY technical outlook: Index shows bullish momentum, but overbought indicators warrant caution

The technical analysis of the DXY Index indicates a surge in momentum, driven by strong gains in the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). However, as these indicators approach overbought territory, the DXY may enter a period of consolidation.

The recent surge and subsequent retreat in the DXY suggests that buyers may be taking profits after a strong rally. This could indicate a potential reversal or consolidation in the short term. The 107.00 level has acted as a strong resistance, and its failure to break through on a sustained basis could add weight to the notion of a pullback.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Mexican Peso consolidates as traders anticipate a 25-basis-point cut from Banxico.

- US inflation data hints at halted disinflation, potentially influencing Fed's future decisions.

- Federal Reserve officials continue to remain cautious regarding December’s meeting.

The Mexican Peso wavers against the US Dollar on Thursday after snapping three days of losses on Wednesday. Traders await the Bank of Mexico (Banxico) monetary policy decision. Along with solid data from the US hinting that disinflation has halted, this capped the Peso’s recovery. The USD/MXN trades at 20.50, virtually unchanged.

Market participants await Banxico's decision, though the majority have priced in a 25-basis-point (bps) rate cut from 10.50% to 10.25%. The decision will be announced at 19:00 GMT, and the statement is expected to provide reasons behind the board’s decision and forward guidance.

Nevertheless, the latest inflation reading failed to justify Mexico’s central bank decision, as the headline Consumer Price Index (CPI) rose to 4.76% YoY. However, the core CPI has fallen to 3.80%, down for the tenth consecutive month since the beginning of 2024.

It would be interesting if the decision were unanimous after Deputy Governor Jonathan Heath voted to hold rates unchanged at the September 26 meeting. Most of the Governing Council adopted a dovish stance, justifying their decision on core prices moving toward the bank's 3% goal, but mainly on the economy showing signs of weakness.

The US Bureau of Labor Statistics revealed that prices paid by producers topped estimates in core and headline figures. At the same time, the number of Americans filing for unemployment claims dipped below estimates and the previous week's reading for the week ending November 9.

In the meantime, the Federal Reserve (Fed) parade continued. Fed Governor Adriana Kugler stated the Fed must be mindful of both inflation and employment mandates. Later, Richmond Fed President Thomas Barkin said the US central bank has made progress on inflation, but needs to continue.

According to CME FedWatch Tool data, odds for a rate cut decreased from 82% a day ago to 78% on Thursday, post PPI data.

Meanwhile, Minneapolis Fed President Neel Kashkari stated the Fed would need additional rate cuts, adding, “I think inflation is heading in the right direction and have confidence in that.”

Ahead this week, Mexico’s economic docket will feature the Banxico policy decision. On the US front, Fed speakers and Retail Sales will help dictate the direction of the USD/MXN pair.

Daily digest market movers: Mexican Peso steadies against US Dollar

- The USD/MXN hovers around 20.50 ahead of Banxico’s decision.

- The US Dollar Index (DXY), which tracks the performance of the Greenback against six peers, holds to minimal gains of 0.08% at 106.56 after refreshing yearly highs of 107.06.

- The Producer Price Index (PPI) in the US exceeded estimates. Headline PPI rose by 2.4% YoY, exceeding forecasts of 2.3%, up from 1.9% in September. Core PPI, which usually impacts the calculation of the core Personal Consumption Expenditures (PCE) Price Index, expanded by 3.1%YoY, up from 2.9% and above projections of 3%.

- Initial Jobless Claims for the week ending November 9, were 217K, down from prior 221K a week earlier and below forecasts of 223K.

- Data from the Chicago Board of Trade, via the December fed funds rate futures contract, shows investors estimate 25 bps of Fed easing by the end of 2024.

USD/MXN technical outlook: Mexican Peso counterattacks as USD/MXN hovers around 20.50

The USD/MXN pair remained upwardly biased, fluctuating around the psychological 20.50 figure. Although prices had consolidated during the last three straight days, bulls are in charge unless sellers push the exchange rate below 20.00, followed by a drop below the 50-day Simple Moving Average (SMA) at 19.74.

Oscillators like the Relative Strength Index (RSI) is bullish, suggesting that further upside in the USD/MXN is seen.

Therefore, the USD/MXN’s first resistance would be the current week’s peak at 20.69. Once surpassed, the year-to-date (YTD) high of 20.80 emerges as the next ceiling level before testing 21.00. A breach of the latter will expose the March 8, 2022, peak at 21.46.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- EUR/GBP rose by 0.14% to 0.8320 in Thursday's trading session.

- Bears took a breather after recent declines but technical indicators remain deeply negative.

- RSI signals recovering buying pressure while MACD suggests flattening selling pressure, overall outlook mixed.

The EUR/GBP pair rose to 0.8320 in Thursday's session. Despite a temporary respite for the bears after recent declines, technical indicators remain deeply negative, with the pair trading below the 20-day Simple Moving Average (SMA) which stands around 0.8340. This suggests that the short-term outlook remains bearish until this level is conquered.

The Relative Strength Index (RSI) which measures the strength of buying and selling pressure, has a reading of 47 and points up, indicating that buying pressure is recovering. The Moving Average Convergence Divergence (MACD), which is a trend-following indicator, is flat and in red, suggesting that selling pressure is flat. With the RSI suggesting that buying pressure is recovering, while the MACD, it suggests that selling pressure is flat and it points out that the pair may consolidate in the next sessions.

Support levels can be found at 0.8300, 0.8250, and 0.8230, while resistance levels can be found at 0.8340, 0.8360, and 0.8400.

EUR/GBP daily chart

- GBP/USD struggles after new four-month low, as US PPI data indicates persistent inflation.

- Technical analysis shows potential for further declines, with next key support at 1.2600.

- Recovery targets for GBP/USD include retesting 1.2700 and aiming for the 200-day SMA at 1.2817.

The British Pound posted losses of 0.10% against the US Dollar after US economic data suggested that inflation remains above the Federal Reserve’s 2% goal. Headline PPI rose the most in four months on an annual basis for October, while core PPI accumulated three straight months of higher readings. The GBP/USD trades at 1.2692 after hitting a daily peak of 1.2710.

GBP/USD Price Forecast: Technical outlook

The GBP/USD tumbled to a four-month low of 1.2629 before recovering some ground, yet it traded below its opening price. On its way toward 1.2600, the pair printed a lower low beneath the August 8 daily low of 1.2664, paving the way for further losses. Indicators such as the Relative Strength Index (RSI) hint that further downside is seen.

That said, sellers must clear 1.2629 and the 1.2600 figure. Once achieved the next support would be the May 9 low of 1.2445, before challenging the year-to-date (YTD) low of 1.2299.

Conversely, buyers must lift GBP/USD above 1.2700, followed by the November 13 high at 1.2768. They must reclaim the 200-day Simple Moving Average (SMA) at 1.2817 if surpassed.

GBP/USD Price Chart – Daily

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.08% | 0.10% | 0.14% | 0.17% | 0.13% | 0.08% | 0.20% | |

| EUR | -0.08% | 0.02% | 0.07% | 0.09% | 0.04% | -0.00% | 0.12% | |

| GBP | -0.10% | -0.02% | 0.06% | 0.08% | 0.03% | -0.02% | 0.10% | |

| JPY | -0.14% | -0.07% | -0.06% | 0.04% | -0.01% | -0.09% | 0.07% | |

| CAD | -0.17% | -0.09% | -0.08% | -0.04% | -0.04% | -0.09% | 0.03% | |

| AUD | -0.13% | -0.04% | -0.03% | 0.00% | 0.04% | -0.04% | 0.08% | |

| NZD | -0.08% | 0.00% | 0.02% | 0.09% | 0.09% | 0.04% | 0.11% | |

| CHF | -0.20% | -0.12% | -0.10% | -0.07% | -0.03% | -0.08% | -0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

- Silver price gauges an interim cushion near $29.70, more downside looks likely.

- The US Dollar’s rally stalls after the release of the US jobless claims and the PPI data.

- A firm outlook on Trump’s policies will keep the Silver price edgy.

Silver price (XAG/USD) discovers a temporary support near $29.70 in Thursday’s North American session. The white metal finds cushion as the US Dollar (USD) gives up some intraday gains after posting a fresh annual high. The rally in the US Dollar index (DXY), which gauges Greenback’s value against six major currencies, pauses for a while after jumping to near 107.00.

The Greenback faces mild pressure after the release of the US Initial Jobless Claims for the week ending November 8 and the Producer Price Index (PPI) data for October even though the data was USD-positive. Individuals claiming jobless benefits for the first time came in surprisingly lower at 217K than the prior release of 221K, which was expected at 223K.

The headline producer inflation data accelerated to 2.4%, faster than estimates of 2.3% and the September reading of 1.9%. In the same period, the core PPI – which strips off volatile food and energy prices rose by 3.1% than estimates of 3% and the former release of 2.9%. Historically, signs of acceleration in price pressures weigh on market expectations for Federal Reserve (Fed) interest rate cuts, however, the impact is expected to negligible as officials are more worried about stabilizing job market.

For more interest rate cues, investors await Fed Chair Jerome Powell’s speech, which is scheduled at 20:00 GMT.

Meanwhile, the outlook of the Silver price is expected to remain vulnerable as policies of President-elected Donald Trump could limit the Fed’s potential of cutting interest rates aggressively.

Silver technical analysis

Silver price stays on track toward the upward-sloping trendline around $29.00, plotted from the February 28 low of $22.30. The white metal weakened after the breakdown of the horizontal support plotted from the May 21 high of $32.50.

The near-term trend of the Silver price has weakened as the 20-day Exponential Moving Average (EMA) starts declining, which trades around $32.00.

The 14-day Relative Strength Index (RSI) slides to near 40.00. A bearish momentum will trigger if the RSI (14) sustains below the same.

Silver daily chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

- USD/JPY may have formed a broadening formation pattern with bearish potential.

- The pair has overshot the upper boundary a little but it may be about to start a decline.

USD/JPY could be overshooting the upper boundary line of a Broadening Formation (BF) price pattern that looks like it has been forming over the last three weeks.

BFs develop when price starts to go sideways but forms higher highs and lower lows with each leg of the unfolding range.

USD/JPY 4-hour Chart

BFs occur during periods of high market volatility as has been the case during the formation of the one on USD/JPY which coincides with the US presidential election.

At a price top the pattern is a sign of a bearish reversal, with an eventual decline below the lower boundary line.

Assuming USD/JPY has formed the pattern, it has just overshot the upper boundary line. This could either mean the pattern is invalid or not. It is possible the overshoot is a sign of exhaustion and that the price will soon start to decline back down to the lower boundary line at around 151.30. A break below 1.5460 (November 6 high) would probably confirm such a decline.

If the (blue) Moving Average Convergence Divergence (MACD) momentum indicator crosses below its red signal line that will add further weight of evidence to the bearish thesis.

Eventually price is likely to break below the lower boundary line and start an even deeper decline. If so, it is likely to fall to a point equal to the width of the pattern at its broadest point extrapolated lower.

Alternatively, the pattern may be false and USD/JPY could still be in a strong short and medium-term uptrend. If so, given the principle that “the trend is your friend” it will probably continue higher once the current pullback ends.

In such a case, a break above 156.25 would likely confirm further upside towards a target at around 157.86 (July 19 high).

The cards were set well before election night, with evidence overwhelmingly suggesting the melt-up in Gold was underscored by a liquidity vacuum, with the US election being the focal point, TDS’ Senior Commodity Strategist Daniel Ghali notes.

Significantly deeper-than-normal Gold consolidation

“The event risk has unleashed pent-up selling activity, and while price action may screen oversold, liquidations thus far have not been extreme. CTAs have shed only 10% of their max size and could be set to sell an additional -15% of their max size over the coming sessions in a continued downtape.”

“Given simultaneously extreme positioning cues from macro funds (Earth to macro funds!) and Shanghai traders — who are also now selling at their fastest clip in years, clocking in at more than 35t of notional Gold sold into a seasonal demand upswing over the last month — and still lackluster buying activity in physical markets, we expect continued pressure on Gold prices and a significantly deeper-than-normal consolidation.”

“While price action in Silver has remained relatively contained, given its cleaner positioning set-up, the outlook for CTA flows has now notably deteriorated, with our simulations now suggesting incoming selling activity in nearly every scenario for market prices over the coming week, barring a big uptape. Silver might catch-down to Gold before precious metals find a floor.”

Richmond Fed President Thomas Barkin noted that while the Fed has made strong progress so far, there’s still more work to be done to keep the momentum going.

Key Quotes

Fed is making great progress but needs to keep it going.

There is still more demand for housing than supply.

The better way to address housing imbalance at this point is to build more, not suppress demand.

The current level of unemployment is fine, whether it is normalizing or weakening is something still to be determined.

Companies still feel labor is short on a long-term basis, are not firing though job growth is slowing.

Important that all banking regulators agree on appropriate regime.

U.S. is only advanced economy where GDP is now beyond pre-pandemic trend.

The drivers of growth include wealth effects for higher income families, low unemployment, real wage increases.

Biggest risk to growth is probably the unemployment rate, a cycle of layoffs would dampen spending.

A significant market correction could also cause families with more net worth to slow consumption.

Hard to assess impact of tariffs, but there will be some ammount of cost pressure, some movement of jobs, depending on what is implemented.

Bank of England policymaker Catherine Mann argued that the central bank should maintain interest rates at their current level until the upside risks to inflation, including those stemming from the election of Donald Trump as the next US president, subside.

Key Quotes

I expect elevated volatility in macroeconomic variables over the coming years.

Activist policy means holding the bank rate firmly until sufficient evidence of diminished inflation persistence appears, then can move forcefully.

I see a need for an activist policy approach rather than a gradualist one.

U.S. political developments have not made a disorderly trade scenario less likely, with consequences for the UK.

Asked about the U.S. election, she says we are looking at more volatility and an upward bias to inflation from trade and financial market fragmentation.

Central banks must ensure these inflation pressures do not get embedded.

I do not think high interest rates are bad for high productivity.

High term premia in bond yields due to high inflation are more damaging to investment than central bank rate.

- Crude Oil support is under pressure as the IEA report adds to the bearish outlook.

- The monthly report from the IEA bears no change in the narrative for the 2025 outlook.

- The US Dollar Index rallies further after President-elect Trump secures a majority in both Senate and House.

Crude Oil steadies and consolidates recent losses after the International Energy Agency (IEA) released its monthly report for November on Thursday. The IEA follows the Organization of the Petroleum Exporting Countries (OPEC) outlook released earlier this week and has revised down its 2025 Oil demand forecast. Another downside revision adds more conviction to a bearish outlook on Oil prices in the long term.

The US Dollar Index (DXY), which tracks the performance of the Greenback against six other currencies, extends gains and reaches a fresh year-to-date high above 107.00.

In the economic data front, the US Producer Price Index (PPI) for October is not expected to make any waves on Thursday after the US Consumer Price Index (CPI) released on Wednesday fell broadly in line with expectations. All eyes will be on the Federal Reserve (Fed) Chairman Jerome Powell speech, scheduled at 20:00 GMT, with traders looking for clues on the December interest rate cut.

At the time of writing, Crude Oil (WTI) trades at $67.99 and Brent Crude at $71.80

Oil news and market movers: IEA agrees with OPEC

- A privately owned Chinese refiner bought West African crude in a rare purchase. Normally, independent processors in China tend to favor imports from Iran and Russia, Bloomberg reports.

- Non-OPEC capacity will be boosted by new offshore conventional projects. Projects in Brazil, Guyana, and Norway are set to add to the already oversupplied market, according to the IEA's monthly Oil Market Report.

- In its report, the IEA lifted its forecast for this year's oil-demand growth but slightly trimmed next year's estimates, citing the impact of China's economic slowdown on consumption, Bloomberg reports.

Oil Technical Analysis: Breakout risk at hand

Crude Oil price is starting to show the pattern that precedes a breakout, with lower highs and higher lows. A breakout looks imminent from a purely technical point of view. With all these bearish elements taken into account, a break to the downside seems rather plausible than a pop to the upside.

On the upside, the 55-day Simple Moving Average (SMA) at $70.25 is the first barrier to consider before the hefty technical level at $73.58, with the 100-day Simple Moving Average (SMA). The 200-day SMA at $76.68 is still quite far off, although it could get tested in case tensions in the Middle East arise.

On the other side, traders need to look towards $67.12 – a level that held the price in May and June 2023 – to find the first support. In case that level breaks, the 2024 year-to-date low emerges at $64.75, followed by $64.38, the low from 2023.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.