- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(raw materials / closing price /% change)

Oil 55.00 -3.10%

Gold 1,280.30 +0.11%

(index / closing price / change items /% change)

Nikkei -0.98 22380.01 +0.00%

TOPIX -4.62 1778.87 -0.26%

Hang Seng -30.06 29152.12 -0.10%

CSI 300 -28.72 4099.35 -0.70%

Euro Stoxx 50 -18.14 3556.38 -0.51%

FTSE 100 -0.76 7414.42 -0.01%

DAX -40.94 13033.48 -0.31%

CAC 40 -26.05 5315.58 -0.49%

DJIA -30.23 23409.47 -0.13%

S&P 500 -5.97 2578.87 -0.23%

NASDAQ -19.72 6737.87 -0.29%

S&P/TSX -113.13 15913.13 -0.71%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1797 +1,11%

GBP/USD $1,3164 +0,38%

USD/CHF Chf0,98911 -0,70%

USD/JPY Y113,44 -0,15%

EUR/JPY Y133,83 +0,96%

GBP/JPY Y149,341 +0,24%

AUD/USD $0,7630 +0,12%

NZD/USD $0,6874 -0,38%

USD/CAD C$1,27299 -0,01%

02:30 Australia Westpac Consumer Confidence November 101.35

02:50 Japan GDP, y/y (Preliminary) Quarter III 2.5% 1.3%

02:50 Japan GDP, q/q (Preliminary) Quarter III 0.6% 0.3%

03:30 Australia New Motor Vehicle Sales (YoY) October -0.8%

03:30 Australia New Motor Vehicle Sales (MoM) October -0.5%

03:30 Australia Wage Price Index, q/q Quarter III 0.5% 0.7%

03:30 Australia Wage Price Index, y/y Quarter III 1.9% 2.2%

07:30 Japan Industrial Production (YoY) (Finally) September 5.3% 2.5%

07:30 Japan Industrial Production (MoM) (Finally) September 2.0% -1.1%

10:45 France CPI, y/y (Finally) October 1.0% 1.1%

10:45 France CPI, m/m (Finally) October -0.2% 0.1%

11:00 U.S. FOMC Member Charles Evans Speaks

12:30 United Kingdom Average Earnings, 3m/y September 2.2% 2.1%

12:30 United Kingdom Average earnings ex bonuses, 3 m/y September 2.1% 2.2%

12:30 United Kingdom ILO Unemployment Rate September 4.3% 4.3%

12:30 United Kingdom Claimant count October 1.7 2.3

13:00 Eurozone Trade balance unadjusted September 16.1

13:00 Eurozone ECB's Peter Praet Speaks

16:00 United Kingdom MPC Member Dr Ben Broadbent Speaks

16:30 U.S. NY Fed Empire State manufacturing index November 30.2 26.00

16:30 U.S. Retail Sales YoY October 4.4%

16:30 U.S. Retail sales October 1.6% 0.1%

16:30 U.S. Retail sales excluding auto October 1% 0.2%

16:30 U.S. CPI excluding food and energy, m/m October 0.1% 0.2%

16:30 U.S. CPI, m/m October 0.5% 0.1%

16:30 U.S. CPI, Y/Y October 2.2% 2.0%

16:30 U.S. CPI excluding food and energy, Y/Y October 1.7% 1.7%

18:00 U.S. Business inventories September 0.7% 0.1%

18:30 U.S. Crude Oil Inventories November 2.237 -2.850

Major US stock indexes finished trading in negative territory against the backdrop of a strong fall in shares of General Electric for the second day in a row, as well as a collapse in oil prices.

In addition, as it became known today, in October the producer price index in the US has steadily increased, which indicates an increase in inflationary pressures. The producer price index, the inflation rate experienced by enterprises, increased by 0.4% in October compared with a month earlier, the Labor Ministry reported on Tuesday. If we exclude more volatile food and energy components, the so-called base prices also increased by 0.4% in October. According to the economist of the Ministry of Labor, the growth of the general producer price index as a whole was due to the surge in trade services, which grew by 1.1% compared to a month earlier. Economists had expected a 0.1% increase in total producer prices and 0.2% in base prices.

Oil prices fell by about 2%, due to the evidence of growth in US production, and a gloomy outlook for demand growth in the report of the International Energy Agency (IEA). The IEA in its monthly report presented a surprisingly gloomy outlook for oil demand, which suggests slowing consumption, and contradicts the more bullish forecasts from OPEC voiced the day before. IEA lowered the forecast of growth in oil demand by 100,000 barrels per day this year and in 2018, to about 1.5 million barrels per day in 2017 and up to 1.3 million barrels per day in 2018. The IEA said that warmer temperatures could reduce consumption, while a sharp increase in output outside the OPEC group of producers could mean that the global market will return to excess in the first half of 2018.

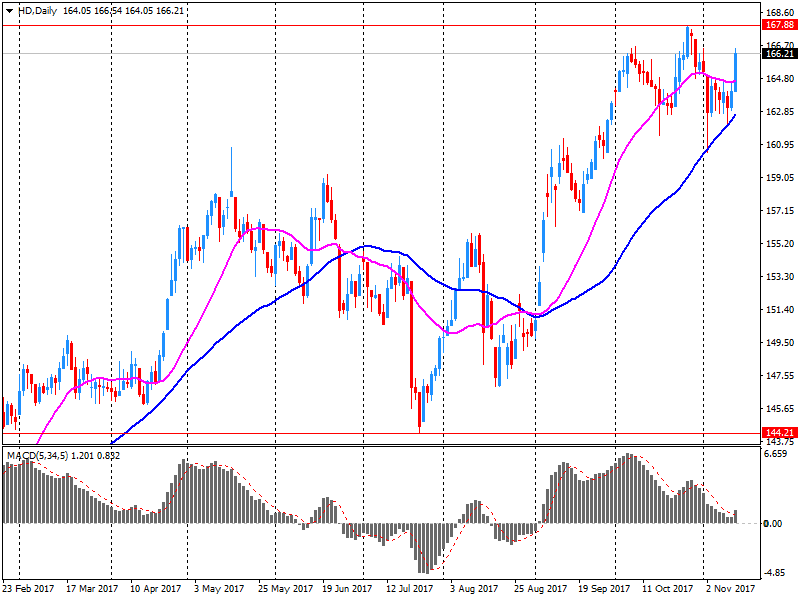

Most components of the DOW index finished the session in the red (16 of 30). Outsider were shares of General Electric Company (GE, -5.52%). The growth leader was the shares of The Home Depot, Inc. (HD, + 1.54%).

Almost all sectors of the S & P index recorded a fall. The greatest decrease was shown by the sector of raw materials (-1.8%). Growth was recorded only by the utilities sector (+ 0.8%).

At closing:

DJIA -0.13% 23,409.54 -30.16

Nasdaq -0.29% 6,737.87 -19.72

S & P-0.23% 2.578.86 -5.98

-

Expects slowing labour productivity to weigh on Swiss growth

-

Board unanimously decided to maintain existing levels of minimum reserve requirement ratios on both RON- and foreign currency-denominated liabilities

-

Board decided with a majority of votes - 8 votes for, 1 vote against - to narrow the symmetrical corridor of interest rates

-

Members remark economic growth in 2017 was expected to accelerate markedly faster than previously anticipated, before slowing down more steeply in 2018 and losing momentum moderately in 2019

-

Household consumption would likely contribute more to economic growth in 2017-2018, whereas the contribution made by gross fixed capital formation could remain modest

U.S. stock-index futures were lower on Tuesday as investors continued to worry about Republican tax plans.

Global Stocks:

Nikkei 22,380.01 -0.98 0.00%

Hang Seng 29,152.12 -30.06 -0.10%

Shanghai 3,429.97 -17.87 -0.52%

S&P/ASX 5,968.75 -53.03 -0.88%

FTSE 7,425.27 +10.09 +0.14%

CAC 5,318.98 -22.65 -0.42%

DAX 13,042.65 -31.77 -0.24%

Crude $56.47 (-0.51%)

Gold $1,272.90 (-0.47%)

The Producer Price Index for final demand increased 0.4 percent in October, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.4 percent in September and 0.2 percent in August. On an unadjusted basis, the final demand index increased 2.8 percent for the 12 months ended in October, the largest rise since an advance of 2.8 percent for the 12 months ended February 2012.

Within final demand in October, prices for final demand services rose 0.5 percent, and the index for final demand goods moved up 0.3 percent.

Prices for final demand less foods, energy, and trade services rose 0.2 percent in October. For the 12 months ended in October, the index for final demand less foods, energy, and trade services advanced 2.3 percent.

EURUSD: 1.1575-80 (545 млн) 1.1600 (275 млн) 1.1650 (455 млн)

USDJPY: 114.00-05 (1.54 млрд) 114.25 (675 млн) 114.50 (435 млн) 115.00 (3.18 млрд)

GBPUSD: 1.3150 (605 млн) 1.3300 (810 млн)

USDCHF: 0.9950 (315 млн)

AUDUSD: 0.7650 (490 млн) 0.7805-10 (315 млн)

EURJPY: 133.00 (325 млн)

USDCAD: 1.2510 (445 млн)

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 65.76 | -0.08(-0.12%) | 1502 |

| Amazon.com Inc., NASDAQ | AMZN | 1,133.64 | 4.47(0.40%) | 13808 |

| Apple Inc. | AAPL | 173.8 | -0.17(-0.10%) | 53680 |

| AT&T Inc | T | 34.19 | 0.02(0.06%) | 8748 |

| Barrick Gold Corporation, NYSE | ABX | 13.85 | -0.10(-0.72%) | 74226 |

| Boeing Co | BA | 262.64 | 0.22(0.08%) | 3953 |

| Caterpillar Inc | CAT | 137.3 | 0.77(0.56%) | 3068 |

| Citigroup Inc., NYSE | C | 71.7 | -0.29(-0.40%) | 8317 |

| Facebook, Inc. | FB | 178.6 | -0.17(-0.10%) | 15734 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.21 | -0.22(-1.52%) | 35298 |

| General Electric Co | GE | 18.95 | -0.07(-0.37%) | 797837 |

| General Motors Company, NYSE | GM | 43.56 | -0.01(-0.02%) | 460 |

| Google Inc. | GOOG | 1,025.25 | -0.50(-0.05%) | 702 |

| Home Depot Inc | HD | 165.7 | 0.35(0.21%) | 245532 |

| Intel Corp | INTC | 45.6 | -0.15(-0.33%) | 2804 |

| International Business Machines Co... | IBM | 148.74 | 0.34(0.23%) | 3086 |

| JPMorgan Chase and Co | JPM | 97.52 | -0.34(-0.35%) | 2435 |

| McDonald's Corp | MCD | 167.42 | 0.05(0.03%) | 770 |

| Merck & Co Inc | MRK | 55.59 | 0.49(0.89%) | 175 |

| Microsoft Corp | MSFT | 84 | 0.07(0.08%) | 4657 |

| Nike | NKE | 55.93 | 0.02(0.04%) | 1526 |

| Pfizer Inc | PFE | 35.29 | -0.01(-0.03%) | 3229 |

| Tesla Motors, Inc., NASDAQ | TSLA | 314.84 | -0.56(-0.18%) | 24070 |

| The Coca-Cola Co | KO | 46.91 | 0.19(0.41%) | 40237 |

| Twitter, Inc., NYSE | TWTR | 20.2 | 0.03(0.15%) | 13153 |

| Wal-Mart Stores Inc | WMT | 91.04 | 0.05(0.06%) | 8003 |

| Walt Disney Co | DIS | 104.75 | 0.01(0.01%) | 1444 |

Apple (AAPL) maintained at Outperform at RBC Capital Mkts; target $190

General Electric (GE) downgraded to Sector Perform at RBC Capital Mkts; target lowered to $20

Coca-Cola (KO) upgraded to Outperform from Market Perform at Wells Fargo

Home Depot (HD) reported Q3 FY 2017 earnings of $1.84 per share (versus $1.60 in Q3 FY 2016), beating analysts' consensus estimate of $1.82.

The company's quarterly revenues amounted to $25.026 bln (+8.1% y/y), beating analysts' consensus estimate of $24.533 bln.

HD fell to $164.63 (-0.44%) in pre-market trading.

As we can see on 4 hours time frame chart, the price has broken the support level, however, in this moment the price is testing below the support area.

If the price shows clear signs of rejection of this support then we can expect a depreciation of the Australian dollar (AUD) against U.S dollar (USD)

-

Medvedev, on new U.S. sanctions, says Moscow ready for any new restrictions

-

U.S., by imposing sanctions, declare Russia as its enemy, not just opponent

-

So many Fed voices speaking may be confusing to the public

-

UK is operating under exceptional circumstances now due to Brexit

The ZEW Indicator of Economic Sentiment for Germany in November 2017 has once again improved on the result from the previous month. The indicator currently stands at 18.7 points, which corresponds to an increase of 1.1 points compared with the October result. The indicator, however, still remains below the long-term average of 23.7 points.

"The prospects for the German economy remain encouragingly positive. Overall high levels of growth across Europe in the third quarter are supporting further growth in Germany and boosting expectations for the coming six months. This favourable economic climate should be used to create a stronger and more robust basis for future growth," comments ZEW President Professor Achim Wambach.

In September 2017 compared with August 2017, seasonally adjusted industrial production fell by 0.6% in the euro area (EA19) and by 0.5% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In August 2017, industrial production rose by 1.4% in the euro area and by 1.7% in the EU28. In September 2017 compared with September 2016, industrial production increased by 3.3% in the euro area and by 3.6% in the EU28.

Seasonally adjusted GDP rose by 0.6% in both the euro area (EA19) and the EU28 during the third quarter of 2017, compared with the previous quarter, according to a flash estimate published by Eurostat, the statistical office of the European Union. In the second quarter of 2017, GDP grew by 0.7% in both zones. Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 2.5% in both the euro area and the EU28 in the third quarter of 2017, after +2.3% and +2.4% respectively in the previous quarter. During the third quarter of 2017, GDP in the United States increased by 0.7% compared with the previous quarter (after +0.8% in the second quarter of 2017). Compared with the same quarter of the previous year, GDP grew by 2.3% (after +2.2% in the previous quarter).

The headline rate of inflation for goods leaving the factory gate (output prices) rose 2.8% on the year to October 2017, down from 3.3% in September 2017.

Prices for materials and fuels (input prices) rose 4.6% on the year to October 2017, down from 8.1% in September 2017.

Core input inflation was 3.2% on the year to October 2017, which is the lowest it has been since June 2016.

The Consumer Prices Index including owner occupiers' housing costs (CPIH) 12-month inflation rate was 2.8% in October 2017, unchanged from September 2017.

The inflation rate for food and non-alcoholic beverages continued to increase to 4.1%, the highest since September 2013.

Rising prices for food and, to a lesser extent, recreational goods provided the largest upward contributions to change in the rate between September 2017 and October 2017.

The upward contributions were offset by falling motor fuel and furniture prices, along with owner occupiers' housing costs, which remained unchanged between September 2017 and October 2017, having risen a year ago.

The Consumer Prices Index (CPI) 12-month rate was 3.0% in October 2017, unchanged from September 2017.

EURUSD: 1.1575-80 (545m) 1.1600 (275m) 1.1650 (455m)

USDJPY: 114.00-05 (1.54b) 114.25 (675m) 114.50 (435m) 115.00 (3.18b)

GBPUSD: 1.3150 (605m) 1.3300 (810m)

USDCHF: 0.9950 (315m)

AUDUSD: 0.7650 (490m) 0.7805-10 (315m)

EURJPY: 133.00 (325m)

USDCAD: 1.2510 (445m)

The overall index of producer and import prices rose by 0.5 percent in October 2017 compared to the previous month, reaching 101.0 points (base of December 2015 = 100). The increase is mainly due to higher prices for machinery, electrical equipment and metal products. Compared to October 2016, the price level of the total supply of domestic and imported products increased by 1.2 percent. This is evident from the figures of the Federal Statistical Office (FSO). The increase in the producer price index compared with the previous month was mainly due to higher machine prices.

-

Evans says for any new policies to succeed, Fed must deliver on current 2-pct inflation goal

-

Price-level targeting may be a good way to go, but needs more study

EUR/USD

Resistance levels (open interest**, contracts)

$1.1796 (2770)

$1.1766 (5762)

$1.1724 (1391)

Price at time of writing this review: $1.1694

Support levels (open interest**, contracts):

$1.1643 (2254)

$1.1623 (5635)

$1.1597 (5544)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 8 is 151592 contracts (according to data from November, 13) with the maximum number of contracts with strike price $1,1500 (8357);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3225 (1375)

$1.3188 (782)

$1.3142 (750)

Price at time of writing this review: $1.3093

Support levels (open interest**, contracts):

$1.3068 (1099)

$1.3050 (1322)

$1.3028 (1483)

Comments:

- Overall open interest on the CALL options with the expiration date December, 8 is 40420 contracts, with the maximum number of contracts with strike price $1,3200 (3092);

- Overall open interest on the PUT options with the expiration date December, 8 is 39521 contracts, with the maximum number of contracts with strike price $1,3000 (4719);

- The ratio of PUT/CALL was 0.98 versus 0.99 from the previous trading day according to data from November, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

China's industrial production and retail sales growth decelerated in October and property investment cooled, as measures taken to curb excessive debt and factory pollution weighed on activity.

Industrial production grew 6.2 percent year-on-year in October, but slower than the 6.6 percent expansion seen in September, data from the National Bureau of Statistics, cited by rttnews. This was also weaker than the expected growth of 6.3 percent.

Likewise, retail sales growth eased to 10 percent from 10.3 percent in September. Economists had forecast growth to improve to 10.5 percent.

During January to October, fixed asset investment climbed 7.3 percent compared to 7.5 percent rise seen for nine months ended September.

The Federal Statistical Office (Destatis) reports that, in the third quarter of 2017, the gross domestic product (GDP) rose 0.8% on the second quarter of 2017 after adjustment for price, seasonal and calendar variations. In the first half of 2017, the GDP had also increased markedly, by 0.6% in the second quarter and 0.9% in the first quarter.

The quarter-on-quarter comparison (upon adjustment for price, seasonal and calendar variations) shows that positive contributions came for instance from foreign trade. In the third quarter of 2017, the increase in exports was higher than that of imports. Arithmetically, the balance of exports and imports had a positive effect on the GDP in a quarter-on-quarter comparison.

Consumer prices in Germany were 1.6% higher in October 2017 than in October 2016. The inflation rate, as measured by the consumer price index, was +1.8% in both September and August 2017. The consumer price index in October 2017 remained unchanged compared with September 2017. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 30 October 2017.

Energy prices in October 2017 were by 1.2% higher than a year earlier. In September 2017, the rate of energy price increase had been +2.7%. The upward effect of energy prices on the overall inflation rate diminished markedly. Prices of motor fuels and household energy rose by 1.2% each in October 2017 compared with the same month of the previous year.

European stocks on Monday closed lower for a fifth straight session, after French utility Electricite de France SA issued a profit warning, and on concerns about Brexit weighing on growth prospects for the eurozone. Markets also appeared rattled by uncertainty surrounding progress for a cut in U.S. taxes.

U.S. stocks closed marginally higher Monday after the Dow and the S&P 500 posted their first weekly drops in two months last week. Upside was capped, however, as uncertainty continued to swirl around the state of Republican tax-cut legislation while blue-chip General Electric Co. tumbled to a more-than-five-year low.

Global equity markets were lower in Asia on Tuesday, as a pullback in commodity shares dragged Australia's benchmark index lower, while tighter liquidity weighed on Chinese stocks. Commodity stocks have been key to the recent rebound for Australia's underperforming equities market, helping the S&P/ASX 200 XJO, -0.92% hit 10-year highs earlier this month, but profit-taking pressure has been building.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.