- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Westpac Consumer Confidence | May | 100.7 | |

| 01:30 | Australia | Wage Price Index, q/q | Quarter I | 0.5% | 0.6% |

| 01:30 | Australia | Wage Price Index, y/y | Quarter I | 2.3% | 2.3% |

| 02:00 | China | Retail Sales y/y | April | 8.7% | 8.6% |

| 02:00 | China | Industrial Production y/y | April | 8.5% | 6.5% |

| 02:00 | China | Fixed Asset Investment | April | 6.3% | 6.4% |

| 06:00 | Japan | Prelim Machine Tool Orders, y/y | April | -28.5% | |

| 06:00 | Germany | GDP (QoQ) | Quarter I | 0% | 0.4% |

| 06:00 | Germany | GDP (YoY) | Quarter I | 0.6% | 0.7% |

| 06:45 | France | CPI, y/y | April | 1.1% | 1.2% |

| 06:45 | France | CPI, m/m | April | 0.8% | 0.2% |

| 09:00 | Eurozone | Employment Change | Quarter I | 0.3% | 0.3% |

| 09:00 | Eurozone | GDP (YoY) | Quarter I | 1.1% | 1.2% |

| 09:00 | Eurozone | GDP (QoQ) | Quarter I | 0.2% | 0.4% |

| 12:30 | U.S. | Retail Sales YoY | April | 3.6% | |

| 12:30 | U.S. | Retail sales excluding auto | April | 1.2% | 0.7% |

| 12:30 | U.S. | Retail sales | April | 1.6% | 0.2% |

| 12:30 | U.S. | NY Fed Empire State manufacturing index | May | 10.1 | 8.5 |

| 12:30 | Canada | Bank of Canada Consumer Price Index Core, y/y | April | 1.6% | 1.8% |

| 12:30 | Canada | Consumer Price Index m / m | April | 0.7% | 0.4% |

| 12:30 | Canada | Consumer price index, y/y | April | 1.9% | 2% |

| 13:15 | U.S. | Capacity Utilization | April | 78.8% | 78.7% |

| 13:15 | U.S. | Industrial Production (MoM) | April | -0.1% | 0.1% |

| 13:15 | U.S. | Industrial Production YoY | April | 2.8% | |

| 14:00 | U.S. | NAHB Housing Market Index | May | 63 | 64 |

| 14:00 | U.S. | Business inventories | March | 0.3% | 0% |

| 14:15 | Eurozone | ECB's Benoit Coeure Speaks | |||

| 14:30 | U.S. | Crude Oil Inventories | May | -3.963 | 2.984 |

| 16:00 | U.S. | Fed Barkin Speech | |||

| 16:30 | Eurozone | ECB's Peter Praet Speaks | |||

| 20:00 | U.S. | Total Net TIC Flows | March | -21.6 | -30.9 |

| 20:00 | U.S. | Net Long-term TIC Flows | March | 51.9 | 36.3 |

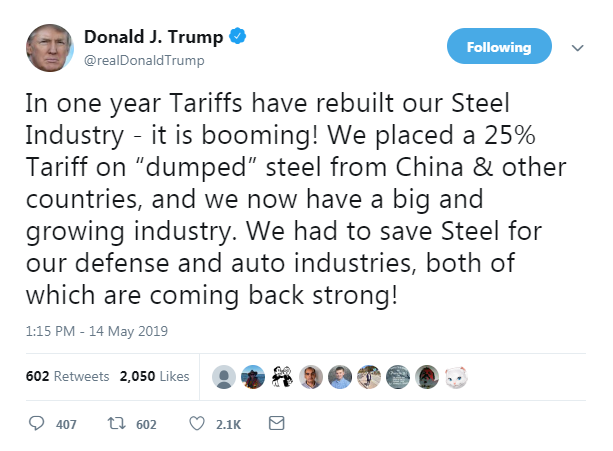

Major US stock indexes rose moderately, as investors bought up shares of technological and industrial companies, which significantly lost in value at the previous session, after optimistic comments by Washington and Beijing, which somewhat eased concerns about a further escalation of the trade war.

US President Trump said on Monday that he would hold talks with Chinese President Xi Jinping at the G20 summit in late June. On Tuesday, the Chinese government announced that both sides agreed to continue discussions on trade disputes. These messages have brought some peace to the markets.

Shares of technology companies, which showed the biggest daily fall in the last four months at the previous session, rose appreciably (+ 1.4% in the moment), supporting the growth of a broader market. The growth drivers in this segment are Microsoft Corp., Apple Inc, as well as chip manufacturers, which suffered a lot on Monday, since most of their business is tied to China. Shares of the banking sector also significantly added to the cost.

Market participants also analyzed the report of the Ministry of Labor, which showed that import prices rose less-than-expected in April, as the rise in oil and food prices was constrained by the largest decline in prices for capital goods over the past 10 years .. According to the report, prices for imports rose 0.2% last month, after rising 0.6% in March. Economists had forecast that import prices would rise by 0.7% in April. On an annualized basis, import prices fell 0.2% after rising 0.1% in March. The report also showed that export prices rose 0.2% in April, after rising 0.6% in March.

Most of the components of DOW finished trading in positive territory (25 out of 30). The growth leader was Dow Inc. (DOW, + 3.00%). More than the rest of the shares fell UnitedHealth Group Inc. (UNH; -1.30%).

Almost all sectors of the S & P recorded an increase. The largest growth was shown by the conglomerate sector (+ 3.4%). Only the utilities sector declined (-0.5%).

At the time of closing:

Dow 25,532.05 +207.06 +0.82%

S & P 500 2,834.41 +22.54 +0.80%

Nasdaq 100 7,734.49 +87.47 +1.14%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Westpac Consumer Confidence | May | 100.7 | |

| 01:30 | Australia | Wage Price Index, q/q | Quarter I | 0.5% | 0.6% |

| 01:30 | Australia | Wage Price Index, y/y | Quarter I | 2.3% | 2.3% |

| 02:00 | China | Retail Sales y/y | April | 8.7% | 8.6% |

| 02:00 | China | Industrial Production y/y | April | 8.5% | 6.5% |

| 02:00 | China | Fixed Asset Investment | April | 6.3% | 6.4% |

| 06:00 | Japan | Prelim Machine Tool Orders, y/y | April | -28.5% | |

| 06:00 | Germany | GDP (QoQ) | Quarter I | 0% | 0.4% |

| 06:00 | Germany | GDP (YoY) | Quarter I | 0.6% | 0.7% |

| 06:45 | France | CPI, y/y | April | 1.1% | 1.2% |

| 06:45 | France | CPI, m/m | April | 0.8% | 0.2% |

| 09:00 | Eurozone | Employment Change | Quarter I | 0.3% | 0.3% |

| 09:00 | Eurozone | GDP (YoY) | Quarter I | 1.1% | 1.2% |

| 09:00 | Eurozone | GDP (QoQ) | Quarter I | 0.2% | 0.4% |

| 12:30 | U.S. | Retail Sales YoY | April | 3.6% | |

| 12:30 | U.S. | Retail sales excluding auto | April | 1.2% | 0.7% |

| 12:30 | U.S. | Retail sales | April | 1.6% | 0.2% |

| 12:30 | U.S. | NY Fed Empire State manufacturing index | May | 10.1 | 8.5 |

| 12:30 | Canada | Bank of Canada Consumer Price Index Core, y/y | April | 1.6% | 1.8% |

| 12:30 | Canada | Consumer Price Index m / m | April | 0.7% | 0.4% |

| 12:30 | Canada | Consumer price index, y/y | April | 1.9% | 2% |

| 13:15 | U.S. | Capacity Utilization | April | 78.8% | 78.7% |

| 13:15 | U.S. | Industrial Production (MoM) | April | -0.1% | 0.1% |

| 13:15 | U.S. | Industrial Production YoY | April | 2.8% | |

| 14:00 | U.S. | NAHB Housing Market Index | May | 63 | 64 |

| 14:00 | U.S. | Business inventories | March | 0.3% | 0% |

| 14:15 | Eurozone | ECB's Benoit Coeure Speaks | |||

| 14:30 | U.S. | Crude Oil Inventories | May | -3.963 | 2.984 |

| 16:00 | U.S. | Fed Barkin Speech | |||

| 16:30 | Eurozone | ECB's Peter Praet Speaks | |||

| 20:00 | U.S. | Total Net TIC Flows | March | -21.6 | -30.9 |

| 20:00 | U.S. | Net Long-term TIC Flows | March | 51.9 | 36.3 |

Analysts at TD Securities are expecting the Canadian headline CPI to firm to 2.0% y/y in April, leaving inflation at the Bank of Canada's (BoC) target for the first month since December.

- Our forecast is consistent with a 0.4% m/m increase, in line with the market consensus, helped by a broad pickup in energy prices on the heels of the federal carbon backstop imposed on Ontario, Saskatchewan, Manitoba and New Brunswick on April 1st. This set the price for carbon emissions at $20/tonne and pushed gasoline prices higher by 4.4 cents per litre, contributing to another 10% m/m increase in the price at the pump following an 11.6% gain in March.

- The combination of carbon taxes alongside seasonal fluctuations and a pickup in oil prices briefly pushed average gasoline prices above their Q4 highs to $1.35 on April 29, just five cents shy of the record from 2014.

- Looking past energy prices, we expect CAD depreciation to provide a tailwind to food products while ex. food and energy prices should see a soft 0.1% increase (0.2% seasonally adjusted); BoC measures of core inflation are likely to hold at 2.0% on average.

Analysts at Rabobank note the recently held local elections in England and Northern Ireland had expected results and led to a breakthrough in Tory-Labour talks on a desired Brexit outcome.

- There has however been a lack of progress, and talks could even collapse.

- The UK has confirmed it will hold European Parliament (EP) elections on 23 May.

- The government’s new aim is to get the Withdrawal Agreement ratified before the instalment of the new EP on 2 July.

- The pressure on Prime Minister May to resign mounts, but attempts to remove her from her function have failed so far.

- However, the risk of a forced leadership change or a cabinet fall persists and is likely to rise following the EP elections on 23 May, an important milestone in that sense.

- Meanwhile, we still see an orderly Brexit as the most likely outcome, but the slow progress in Tory-Labour talks is concerning.

- A series of parliamentary votes on various Brexit outcomes can be an alternative way forward.

- Given the gridlock on Brexit in British politics the odds of a Hard Brexit remain high.

- We have not seen a shift from government in talks to break Brexit deadlock

- A customs union is absolutely key for us

- Concerned future Conservative leader could overturn any deal agreed with his party

- Government may have to accept there is a second Brexit referendum at some point

- Cabinet had extensive talks with Labour

- Ministers detailed compromises government was willing to consider in talks

- Agreed to continue talks but agreed it was imperative to bring forward the withdrawal bill in time to receive Royal assent before summer recess

- Not aware of any talks with Brussels to change political declaration

- Definitive votes remain under consideration as a way forward

U.S. stock-index futures surged on Tuesday, following Monday’s market rout, as optimistic comments from Washington and Beijing eased somewhat investor concerns about a further escalation in U.S.-China trade war.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,067.23 | -124.05 | -0.59% |

Hang Seng | 28,122.02 | -428.22 | -1.50% |

Shanghai | 2,883.61 | -20.10 | -0.69% |

S&P/ASX | 6,239.90 | -57.70 | -0.92% |

FTSE | 7,223.81 | +60.13 | +0.84% |

CAC | 5,317.33 | +54.76 | +1.04% |

DAX | 11,924.55 | +47.90 | +0.40% |

Crude oil | $61.64 | +0.98% | |

Gold | $1,300.10 | -0.14% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 174.85 | 0.78(0.45%) | 3590 |

ALCOA INC. | AA | 24.75 | 0.21(0.86%) | 1100 |

ALTRIA GROUP INC. | MO | 51.5 | 0.06(0.12%) | 492 |

Amazon.com Inc., NASDAQ | AMZN | 1,842.20 | 19.52(1.07%) | 84063 |

American Express Co | AXP | 116.26 | 0.36(0.31%) | 2156 |

Apple Inc. | AAPL | 186.79 | 1.07(0.58%) | 400652 |

AT&T Inc | T | 30.75 | 0.28(0.92%) | 105885 |

Boeing Co | BA | 339.78 | 2.41(0.71%) | 42126 |

Caterpillar Inc | CAT | 126.38 | 1.08(0.86%) | 6156 |

Chevron Corp | CVX | 121.5 | 1.06(0.88%) | 3597 |

Cisco Systems Inc | CSCO | 51.47 | 0.17(0.33%) | 17140 |

Citigroup Inc., NYSE | C | 64.94 | 0.56(0.87%) | 12090 |

Deere & Company, NYSE | DE | 144 | -2.28(-1.56%) | 6154 |

Exxon Mobil Corp | XOM | 76.21 | 0.50(0.66%) | 8721 |

Facebook, Inc. | FB | 182.63 | 1.09(0.60%) | 83421 |

FedEx Corporation, NYSE | FDX | 172.5 | 0.20(0.12%) | 2471 |

Ford Motor Co. | F | 10.15 | 0.07(0.69%) | 83243 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.83 | 0.12(1.12%) | 75779 |

General Electric Co | GE | 9.93 | 0.06(0.61%) | 296613 |

General Motors Company, NYSE | GM | 36.84 | 0.28(0.77%) | 5041 |

Goldman Sachs | GS | 195.5 | 0.53(0.27%) | 4178 |

Google Inc. | GOOG | 1,138.00 | 5.97(0.53%) | 5599 |

Hewlett-Packard Co. | HPQ | 18.34 | 0.07(0.38%) | 7720 |

Home Depot Inc | HD | 191.25 | 0.91(0.48%) | 1882 |

HONEYWELL INTERNATIONAL INC. | HON | 167.45 | 0.63(0.38%) | 1162 |

Intel Corp | INTC | 45.24 | 0.48(1.07%) | 60286 |

International Business Machines Co... | IBM | 132.1 | 0.68(0.52%) | 2242 |

International Paper Company | IP | 44.38 | 0.22(0.50%) | 520 |

JPMorgan Chase and Co | JPM | 109.95 | 0.50(0.46%) | 11277 |

McDonald's Corp | MCD | 199.1 | 0.07(0.04%) | 2748 |

Merck & Co Inc | MRK | 77.6 | 0.43(0.56%) | 1964 |

Microsoft Corp | MSFT | 124.29 | 0.94(0.76%) | 92693 |

Nike | NKE | 82.77 | 0.24(0.29%) | 2744 |

Pfizer Inc | PFE | 40.64 | 0.07(0.17%) | 7292 |

Procter & Gamble Co | PG | 106.05 | -0.06(-0.06%) | 138823 |

Starbucks Corporation, NASDAQ | SBUX | 76.75 | 0.07(0.09%) | 2603 |

Tesla Motors, Inc., NASDAQ | TSLA | 228.99 | 1.98(0.87%) | 93054 |

The Coca-Cola Co | KO | 48.4 | 0.35(0.73%) | 29956 |

Travelers Companies Inc | TRV | 143.7 | 0.29(0.20%) | 795 |

Twitter, Inc., NYSE | TWTR | 36.9 | 0.31(0.85%) | 134255 |

United Technologies Corp | UTX | 132.9 | 0.94(0.71%) | 1131 |

UnitedHealth Group Inc | UNH | 241 | 1.45(0.61%) | 5265 |

Verizon Communications Inc | VZ | 56.9 | 0.15(0.26%) | 4694 |

Visa | V | 157.85 | 0.52(0.33%) | 11772 |

Wal-Mart Stores Inc | WMT | 100.3 | 0.41(0.41%) | 11243 |

Walt Disney Co | DIS | 132.05 | 0.71(0.54%) | 18808 |

Yandex N.V., NASDAQ | YNDX | 35.18 | 0.35(1.00%) | 13108 |

Deere (DE) downgraded to Underweight from Neutral at JP Morgan; target lowered to $132

Coca-Cola (KO) upgraded to Overweight from Equal-Weight at Morgan Stanley; target raised to $55

The Labor Department reported the import-price index, measuring the cost of goods ranging from Canadian oil to Chinese electronics, rose 0.2 percent m-o-m in April, following an unrevised 0.6-percent m-o-m increase in March. Economists had expected prices to gain 0.7 percent m-o-m last month.

According to the report, prices for fuel imports rose 2.5 percent m-o-m in April, after advancing 6.9 percent m-o-m in March. A 6.1-percent m-o-m rise in petroleum prices drove the gain in fuel prices. Meanwhile, natural gas prices declined 53.7 percent m-o-m in April, the largest drop since the index was first published on a monthly basis in December 1994. The prices for nonfuel imports edged down 0.1 percent m-o-m in April, after falling 0.2 percent m-o-m in March as falling prices for finished goods and nonfuel industrial supplies and materials more than offset an increase in prices for foods, feeds, and beverages.

Over the 12-month period ended in April, import prices recorded a 0.2 percent decrease, driven by lower nonfuel prices.

The price index for U.S. exports also rose 0.2 percent m-o-m in April, following a revised 0.6 percent m-o-m gain in the previous month (originally a 0.7 percent increase).

Rising prices for nonagricultural exports (+0.4 percent m-o-m) led the overall increase in April and more than offset a decline in prices for agricultural exports (-1.5 percent m-o-m).

Over the past 12 months, the price index for exports rose 0.3 percent.

TD Securities' analysts believe that despite an improvement in the headline index to 8.2, the German ZEW Expectations Index defied consensus and declined for the first time since Oct 2018, to -2.1, slipping back into negative territory.

- The deterioration was seen in the Steel and Services sectors in particular, which reversed gains seen last month. Elsewhere in the survey, improvements were registered in the auto industry, which now sits at its best level since before the environmental regulations came in last September.

Analysts at TD Securities say the UK’s labour report for the 3 months ending March provided a mixed batch of news.

- The unemployment rate improved to another multi-decade low of 3.8%, but wage growth slowed slightly to 3.2% y/y for headline wage growth, while the ex-bonus measure slowed to 3.3% y/y and the important private sector regular pay measure slowed to 3.5% y/y.

- The decline in the unemployment rate came entirely from a sharp reduction in the number of people looking for work, perhaps over nervousness about job prospects ahead of the original 29 March Brexit deadline.

- On net, this report likely doesn't have any major implications for the Bank of England's MPC: they were expecting the unemployment rate to dip to 3.8% in 19Q2 anyway, and the slowdown in core wage growth is likely a bit faster than they were expecting.

Bert Colijn, a senior Eurozone economist at ING, notes that despite the fact that industry contributed positively to GDP growth, due to a strong January, the declining trend in production has not abated.

- Industrial production fell by 0.3% in March, which was in line with weak survey readings for the eurozone manufacturing sector. A strong reading for January had provided hope for a swift recovery from one off negative factors, but after declines in February and March, it seems that the upside remains limited. The strong January figure did boost quarterly growth in production to 0.8%, which has helped eurozone GDP to surprise on the upside.

- As businesses in industry continue to indicate that new orders are coming in weak and production expectations are sluggish, it is likely that industrial production will come in modest at best for the spring months. The intensifying trade conflict between the US and China will have a dampening effect on export orders, which have already been coming in at a slower pace.

- On the other hand, the weaker trade-weighted euro and some stronger global growth figures are bright spots to the industry outlook, for which a modest recovery does still seem to be in the offing over the course of the year. For eurozone GDP growth later in the year, this seems important, as prolonged weakness in manufacturing could start to negatively impact the strong performance of eurozone services.

Fed is close to achieving its goals

Need to keep focus on price stability, employment

US economy is in good shape

Economy has rebounded pretty solidly after soft patch at the end of last year

Sees mixed messages in Q1 GDP data

Economy is well positioned to deal with challenges

Business confidence in the US has rebounded

Tariffs have had a small boost to inflation

Larger tariffs will have a bigger impact

According to the report from Eurostat, in March 2019 compared with February 2019, seasonally adjusted industrial production fell by 0.3% in the euro area (EA19) and by 0.1% in the EU28. In February 2019, industrial production fell by 0.1% in the euro area and remained stable in the EU28. In March 2019 compared with March 2018, industrial production decreased by 0.6% in the euro area and increased by 0.4% in the EU28.

In the euro area in March 2019, compared with February 2019, production of non-durable consumer goods fell by 1.0% and energy by 0.3%, while production of intermediate goods rose by 0.1%, capital goods by 0.4% and durable consumer goods by 0.7%.

In the EU28, production of non-durable consumer goods fell by 0.5% and energy by 0.2%, while production of intermediate goods remained unchanged, capital goods rose by 0.4% and durable consumer goods by 0.5%.

According to the report from Centre for European Economic Research (ZEW), the ZEW Indicator of Economic Sentiment for Germany records a decrease of 5.2 points in May 2019, and now stands at minus 2.1 points. Economists had expected an increase to 5 from 3.1 in April. The indicator’s long-term average is 22.1 points.

Over the same period, the assessment of the economic situation in Germany has improved by 2.7 points, with the corresponding indicator climbing to a current reading of 8.2 points. The development of production and exports in Germany as well as Eurostat’s most recent flash estimate of GDP growth in the euro area in the first quarter of 2019 give rise to the hope that the German economy, too, has grown more strongly than expected in the first quarter.

The financial market experts’ sentiment concerning the economic development of the eurozone also experienced a drop. The corresponding indicator currently stands at minus 1.6 points, 6.1 points below the reading from the previous month. By contrast, the indicator for the current economic situation in the eurozone climbed 6.2 points to a level of minus 7.0 points in May. The economic outlook for the eurozone therefore also remains rather subdued.

Office for National Statistics said the UK employment rate was estimated at 76.1%, higher than for a year earlier (75.6%) and the joint- highest figure on record. For men was 80.3%; slightly higher than for a year earlier (80.0%), for women was 71.8%, the joint-highest since comparable records began in 1971

The UK unemployment rate was estimated at 3.8%; it has not been lower since October to December 1974.

The UK economic inactivity rate was estimated at 20.8%, lower than for a year earlier (21.1%) and close to a record low.

Excluding bonuses, average weekly earnings for employees in Great Britain were estimated to have increased by 3.3%, before adjusting for inflation, and by 1.5%, after adjusting for inflation, compared with a year earlier.

Including bonuses, average weekly earnings for employees in Great Britain were estimated to have increased by 3.2%, before adjusting for inflation, and by 1.3%, after adjusting for inflation, compared with a year earlier.

According to analysts at ANZ, for the Australian economy, opinion polls and betting markets favour a change of government when Australians go to the polls on Saturday.

“It would result in marginally tighter fiscal policy funded by higher taxes on high income earners relative to lower taxes and higher government spending for mainly low income earners. With a softening economy, a possible non-aligned Senate and ongoing concerns about equity and sustainability, the successful party will need discipline to maintain the rosy fiscal outlook.”

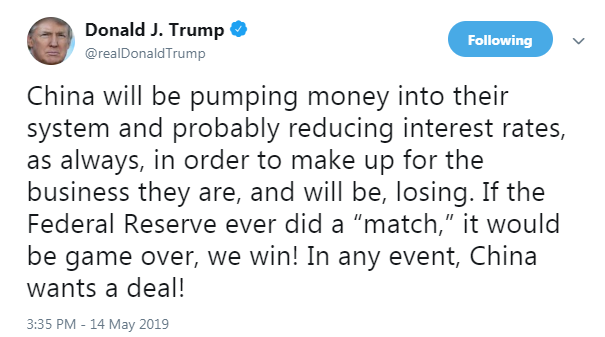

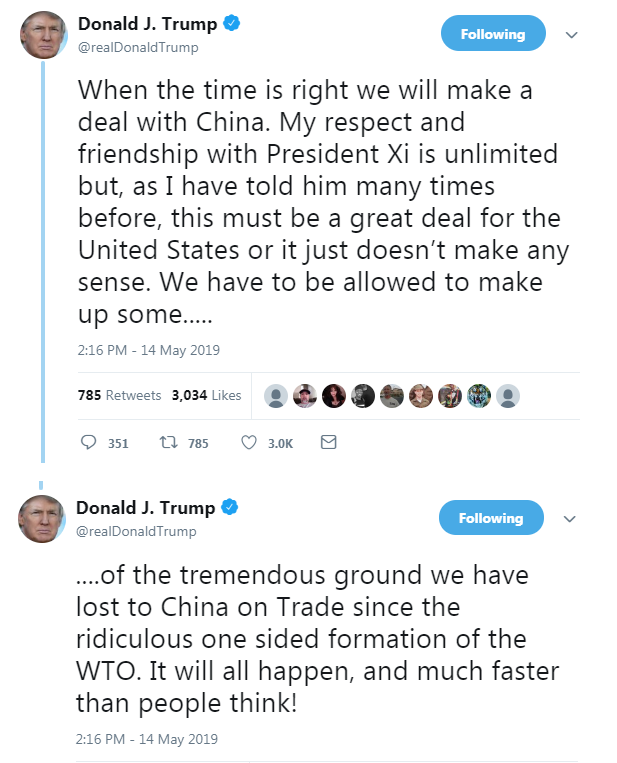

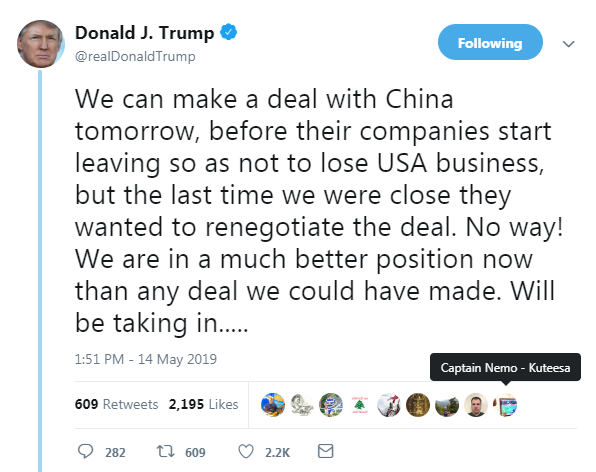

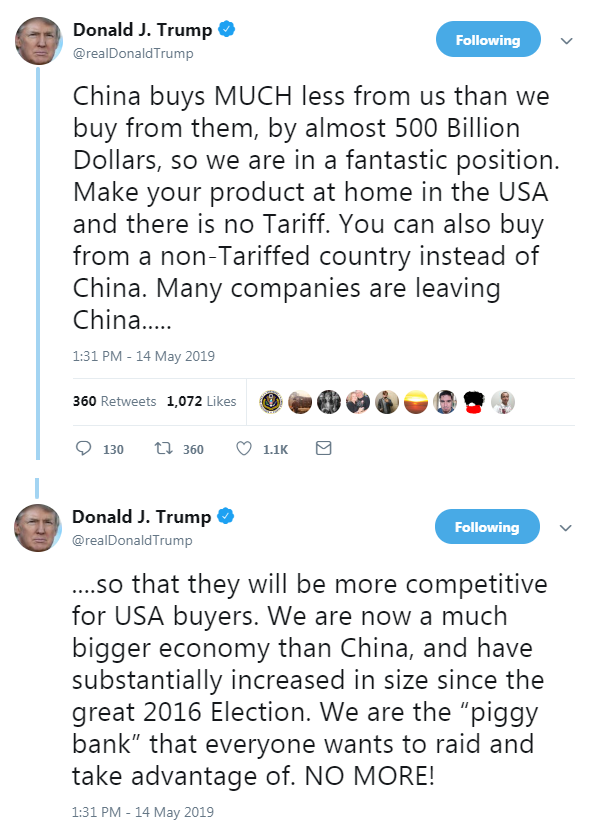

Piet P.H. Christiansen, senior analyst at Danske Bank, points out that there was an escalation in the US-China trade war as Trump continued to lash out at China in a string of tweets and China came with a retaliation response.

“We are increasingly concerned that the two sides are too far from each other to reach a deal in Q2. The trust between the two sides has been damaged and they both seem to dig in on issues that are important for both countries. For example, on the issue of the need to change Chinese laws. On Friday, China’s chief negotiator Liu He said China will not back down on matters of principle. The next key thing to look for is whether Xi and Trump talk on the phone at some point and try to get talks back on track. However, our concern is that it will require financial stress to create the necessary pressure to get the deal done.”

ECB saw significant but temporary slowdown in the economy in March

Recent data doesn't contradict with March forecasts

Substantial geopolitical uncertainties continue to persist

Torturously slow recoveries from recessions and low inflation are here to stay unless policymakers can get a better grip on how to stabilize the global economy in an era of lower interest rates, New York Fed President John Williams said.

Lower birthrates are keeping population growth down in the world's wealthier economies and technological advancement has shifted down to more normal levels. Each trend is capping how much economies can grow, Williams said.

Williams, who earlier in his career was a researcher at the San Francisco Fed, is known for helping develop estimates of what the "neutral" interest rate might be. Now, he is pushing to encode some of that thinking in how the Fed approaches inflation from now on.

As part of a broad policy review, Williams has been advocating for the Fed to systematically respond to periods of tepid inflation by keeping U.S. interest rates "lower for longer."

Analysts at TD Securities point out that the UK’s labour data for 19Q1 is released and will be a key economic release for today’s session.

“We look for both the headline and ex-bonus wages to pull back to 3.3% y/y (mkt: 3.4% headline, 3.3% ex-bonus), while the "core" private sector ex-bonus measure remains unchanged at its recent high of 3.6% y/y. We also look for the unemployment rate to remain unchanged at 3.9% (mkt: 3.9%). The labour market remains very tight, and will be one of the key factors pushing the BoE toward a November hike, in our view.”

According to analysts at Danske Bank, in Germany, the ZEW survey is due to be released and will be a key release for today’s session.

“It has ticked higher in recent months, pointing to higher expectations. The NFIB small business optimism index in the US is expected to show a small increase for April from 101.8 to 102.0. The US-China trade war will continue to be the key theme in markets. On the data front we expect Swedish CPIF inflation for April to be 2.1% y/y (consensus 2.0% y/y). Overnight (to Wednesday), we get, among others, Chinese industrial production.”

Federal Statistical Office (FSO) said the producer and import price index remained unchanged in April 2019 compared with the previous month. The index stood at 102.2 points (December 2015 = 100). Compared with April 2018, the price level of the whole range of domestic and imported products fell by 0.6%.

The increase in the producer price index compared to the previous month was mainly due to other non-industry-specific machines and watches. On the other hand, raw milk as well as metals and semi-finished metal products became cheaper.

Lower prices compared to March 2019 were registered in the import price index, especially for diesel and heating oil. Also cheaper were metals and semi-finished metal products. Price increases, however, showed gasoline and crude oil and natural gas.

Bank of Japan Governor Haruhiko Kuroda said he would consider additional easing without hesitation if consumer prices lost upward momentum.

Kuroda, speaking in parliament, said the BOJ was committed to keeping short- and long-term rates low until at least the spring of 2020, adding rates could remain low beyond that period.

Kuroda also said the BOJ's forward guidance did not mean it would re-evaluate its policy immediately in spring 2020.

According to the report from Destatis, consumer prices in Germany rose by 2.0% in April 2019 compared with April 2018. The inflation rate - as measured by the consumer price index - was considerably higher year on year than in March 2019 (+1.3%). Compared with March 2019, the consumer price index increased by 1.0% in April 2019.

The prices of energy products in April 2019 were up 4.6% year on year, which had an upward effect on the overall inflation rate. Marked price increases were also recorded for district heating (+5.3%), natural gas (+3.2%) and electricity (+3.0%). Excluding energy prices, the rate of inflation would have been +1.7% in April 2019.

In addition, the increase in package holiday prices (+11.2%) had a major effect on the inflation rate in April 2019. It was mainly due to a calendar effect caused by Easter falling late this year compared with a year earlier. Consumers paid markedly more than a year earlier also for long-distance bus journeys (+13.6%), air tickets (+6.1%) and rail tickets (+3.4%). Food prices rose below average (+0.8%) from April 2018 to April 2019. Vegetable prices increased substantially in April 2019 year on year (+9.7%). The prices of goods as a whole increased by 1.8% between April 2018 and April 2019. Compared to goods, the prices of services (total) were up above average in April 2019 year on year (+2.1%). This was mainly attributable to increases in travel service prices.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1347 (4671)

$1.1320 (2900)

$1.1301 (1387)

Price at time of writing this review: $1.1239

Support levels (open interest**, contracts):

$1.1194 (3229)

$1.1163 (8246)

$1.1126 (5253)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date June, 7 is 117138 contracts (according to data from May, 13) with the maximum number of contracts with strike price $1,1500 (8488);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3187 (2708)

$1.3150 (1946)

$1.3088 (962)

Price at time of writing this review: $1.2958

Support levels (open interest**, contracts):

$1.2874 (1810)

$1.2843 (2455)

$1.2808 (2675)

Comments:

- Overall open interest on the CALL options with the expiration date June, 7 is 38109 contracts, with the maximum number of contracts with strike price $1,3450 (3308);

- Overall open interest on the PUT options with the expiration date June, 7 is 38046 contracts, with the maximum number of contracts with strike price $1,2700 (4201);

- The ratio of PUT/CALL was 1.00 versus 1.01 from the previous trading day according to data from May, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 69.4 | -0.63 |

| WTI | 61 | -0.64 |

| Silver | 14.74 | -0.14 |

| Gold | 1299.731 | 0.97 |

| Palladium | 1321.67 | -2.09 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -153.64 | 21191.28 | -0.72 |

| KOSPI | -29.03 | 2079.01 | -1.38 |

| ASX 200 | -13.3 | 6297.6 | -0.21 |

| FTSE 100 | -39.61 | 7163.68 | -0.55 |

| DAX | -183.18 | 11876.65 | -1.52 |

| Dow Jones | -617.38 | 25324.99 | -2.38 |

| S&P 500 | -69.53 | 2811.87 | -2.41 |

| NASDAQ Composite | -269.92 | 7647.02 | -3.41 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.69435 | -0.71 |

| EURJPY | 122.592 | -0.6 |

| EURUSD | 1.12244 | -0.09 |

| GBPJPY | 141.519 | -0.83 |

| GBPUSD | 1.29582 | -0.33 |

| NZDUSD | 0.65689 | -0.38 |

| USDCAD | 1.34788 | 0.5 |

| USDCHF | 1.00581 | -0.48 |

| USDJPY | 109.203 | -0.5 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.