- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- The Federal Reserve pivoted on its rate hike policy, puts rate cuts on the table.

- The FOMC sees several rate cuts next year for a combined 75 basis points in cuts.

- The ECB’s Christine Lagarde has a tough act to follow on Thursday.

The EUR/USD saw a hard rebound on Wednesday, coming within inches of reclaiming the 1.0900 handle after the Federal Reserve (Fed) pivoted into a path towards rate cuts after months of towing the “higher for longer” line.

Forex Today: Dollar tumbles as Fed signals cuts in 2024

The Fed’s latest dot plot of policymaker interest rate expectations now sees at least three rate cuts on the table for 2024, for a combined 75 basis points in cuts. While investors’ hopes for rate cuts remain firmly higher than the Fed’s outlook, with money markets pricing in an eye-watering 140 basis points in cuts next year, the Fed’s dovish showing on Wednesday covered significant ground in meeting markets at the halfway point.

The Fed held rates at 5.5% for the third straight meeting, its longest stretch of no hikes since rates first started climbing in early 2022.

ECB Preview: Forecasts from 10 major banks, more dovish direction as inflation trends to the downside

The European Central Bank (ECB) will have a tough act to follow in the Fed’s dovish pivot. The ECB is broadly expected to maintain its main reference rate at 4.5% when it delivers its last rate call of the year on Thursday.

The ECB will deliver its final rate call and Monetary Policy Statement for 2023 at 13:15 GMT Thursday, followed by a press conference to be run by ECB President Christine Lagarde at 13:45 GMT.

EUR/USD Technical Outlook

The Euro caught a hard bid against the US Dollar on Wednesday, shearing the 200-hour Simple Moving Average (SMA) at 1.0800 and sending the EUR/USD within reach of the 1.0900 handle.

Intraday chart action has the 50-hour SMA set for a bullish cross of the 200-hour SMA, providing technical support for any potential pullbacks into the 1.0800 region.

Wednesday’s risk-on bid for the EUR/USD has the pair extending into the north side of the 200-day SMA drifting higher above thew 1.0800 handle, but the pair’s recent backslide from late November’s peaks at the 1.1000 major handle leave the pair hampered in familiar consolidation territory.

EUR/USD Hourly Chart

EUR/USD Daily Chart

EUR/USD Technical Levels

- NZD/USD loses ground near 0.6175 following the weaker New Zealand GDP data.

- New Zealand's economy in Q3 contracted by 0.3% QoQ vs. 0.5% prior, below the 0.2% expected.

- The Federal Reserve (Fed) kept the interest rates steady at its December meeting on Wednesday, as widely expected.

- Traders will focus on the US weekly Jobless Claims and Retail Sales.

The NZD/USD pair holds ground around 0.6175 after facing a rejection around the 0.6200 mark during the early Asian session on Thursday. The downbeat New Zealand’s GDP growth numbers drag the New Zealand Dollar (NZD) lower. However, the downside of the pair seems limited as investors digest the outcome of the Federal Reserve meeting.

The latest data from Statistics New Zealand on Thursday revealed that the nation’s economy in the third quarter (Q3) contracted by 0.3% QoQ versus the 0.2% expansion expected and a 0.5% rise prior. Additionally, the annual GDP shrank 0.6% compared with the 1.5% growth in Q2, worse than the market expectation of a 0.5% increase. In response to the data, the Kiwi attracts some sellers against the USD.

On the USD’s front, the Greenback has dropped sharply after the Federal Reserve (Fed) meeting. The central bank decided to keep interest rates unchanged at its December meeting, as widely expected. The Fed now anticipates three rate cuts next year rather than two, according to interest rate projections. Regarding a drop in inflation, the likelihood of the Fed cutting interest rates before the middle of next year has increased.

During the press conference, Fed Chair Jerome Powell said that the inflation battle isn’t over, but central bank policymakers will start to discuss policy easing amid signs of cooling in both inflation and the labor market. The dovish comments from Powell exert some selling pressure on USD.

Looking ahead, market players will keep an eye on the US weekly Jobless Claims and Retail Sales for November, due later on Thursday. On Friday, the Business NZ Purchasing Managers' Index (PMI) and US S&P Global PM will be released. Traders will take cues from these data and find trading opportunities around the NZD/USD pair.

- Silver soared more than 4%, after bouncing off the daily lows of $22.51.

- Fed’s decision to ease monetary policy in 2024, weakened the Greenback.

Silver price stages a comeback after sliding for seven straight days as the Federal Reserve pivots toward easing monetary policy, a tailwind for the grey metal, set to make a U-turn in the week. At the time of writing, the XAG/USD is trading at $23.79 after rallying more than 4% on Wednesday.

XAG/USD has shifted neutral to upward bias after reclaiming the 50, 100, and 200-day moving averages (DMAs), on its way toward the current price. A breach of the $24.00 figure could pave the way to test the August 30 swing high at $25.00, before launching an assault toward the May 10 swing high at $25.91.

On the other hand, if Silver sellers drag prices below the 200-DMA at around $23.55, the non-yielding metal could dive towards the 50-DMA at $23.24, before slumping toward the 100-DMA at $23.19.

XAG/USD Price Analysis – Daily Chart

XAG/USD Technical Levels

The New Zealand Gross Domestic Product (GDP) for the third quarter (Q3) came in at -0.3%, following 0.5% in the previous reading. The market consensus was for a 0.2% expansion, according to the latest data released by Statistics New Zealand on Thursday.

The annual third-quarter GDP contracted by 0.6%, compared with the 1.5% growth in Q2 while missing estimates of a 0.5% increase.

Market reaction

The NZD/USD pair edges lower following the New Zealand GDP data release. At the press time, the spot is down 0.46% on the day to trade at 0.6176.

GDP FAQs

What is GDP and how is it recorded?

A country’s Gross Domestic Product (GDP) measures the rate of growth of its economy over a given period of time, usually a quarter. The most reliable figures are those that compare GDP to the previous quarter e.g Q2 of 2023 vs Q1 of 2023, or to the same period in the previous year, e.g Q2 of 2023 vs Q2 of 2022.

Annualized quarterly GDP figures extrapolate the growth rate of the quarter as if it were constant for the rest of the year. These can be misleading, however, if temporary shocks impact growth in one quarter but are unlikely to last all year – such as happened in the first quarter of 2020 at the outbreak of the covid pandemic, when growth plummeted.

How does GDP influence currencies?

A higher GDP result is generally positive for a nation’s currency as it reflects a growing economy, which is more likely to produce goods and services that can be exported, as well as attracting higher foreign investment. By the same token, when GDP falls it is usually negative for the currency.

When an economy grows people tend to spend more, which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation with the side effect of attracting more capital inflows from global investors, thus helping the local currency appreciate.

How does higher GDP impact the price of Gold?

When an economy grows and GDP is rising, people tend to spend more which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold versus placing the money in a cash deposit account. Therefore, a higher GDP growth rate is usually a bearish factor for Gold price.

- Crude Oil is looking for a rebound after getting knocked back into five-month lows.

- WTI is clawing back into $70 after backsliding to $68, a low not seen since June.

- A drawdown in Crude Oil stocks is helping to prop up battered barrel prices.

West Texas Intermediate (WTI) is scrambling to find a foothold near the $70-per-barrel handle. An extended backslide in Crude Oil sent WTI into the floorboards near $68, driven by overarching energy market concerns that slumping global demand for Crude Oil continues to undercut fierce production cuts from the Organization of the Petroleum Exporting Countries (OPEC).

Barrel count data from the Energy Information Administration (EIA) revealed an unexpected drawdown in US Crude Oil reserves, showing a 4.259 million decline in US barrel counts for the week ended December 8th. Markets were expecting a much smaller decline of 650K, compared to the previous week’s decline of 4.635 million barrels.

Despite the unexpected decline in barrel counts, US Crude Oil inventories remain a little above 440 million barrels, with the Cushing, Oklahoma facility recovering an additional 1.2 million barrels.

OPEC remains dedicated to drawing down production quotas to bolster Crude Oil prices, but markets remain skeptical that the oil cartel will successfully draw member states into adhering to stiff production caps. OPEC currently has no policy framework or mechanisms in place to force member states to produce beyond quota caps, nor to punish members for failing to adhere to production and selling quotas.

The US Federal Reserve (Fed) gave a dovish showing on Wednesday, helping to bolster broad-market risk appetite as the US central bank officially embraces the end of the rate hike cycle, though Fed Chair Jerome Powell was quick to warn that more rate hikes wouldn't be off the table if inflation returns to being a problem.

WTI Technical Outlook

WTI’s Wednesday rebound sees WTI clambering back into $70, but US Crude Oil remains deeply in the cut, trading on the south side of the 200-hour Simple Moving Average (SMA) near $71.50. WTI hasn’t come within touch range of the 200-hour SMA since intraday bids dropped away from the moving average at the beginning of December when barrel prices dropped from $76.50.

Daily candlesticks have WTI trading firmly into bear country, trading below the 200-day SMA near the 78.00 handle as oil bulls struggle to keep Crude Oil above six-month lows near the $67.00 handle. Oil bidders will have their work cut out for them as the 50-day SMA sets up for a bearish crossover of the 200-day SMA.

WTI Hourly Chart

WTI Daily Chart

WTI Technical Levels

- The AUD/USD gathered significant momentum at 0.6670, posting a 1.60% rise.

- With the RSI on a positive track and the MACD histogram demonstrating ascending green bars, the daily chart suggests increasing buying momentum.

- Indicators, including an overbought RSI on the four-hour chart, imply possible correction.

On Wednesday's session, the AUD/USD rose to 0.6670, witnessing an upward rally of 1.60%. The recent price action suggests bullish dominance on the daily chart, with buyers gaining significant ground. However, on the four-hour chart, overbought conditions have been signaled, indicating a potential shift in momentum.

From a technical standpoint, the daily chart indicators are depicting a distinctive bullish scenario. The Relative Strength Index (RSI) presents an upward trajectory, nestled securely within positive territory. This signals a strong buying momentum dominating the market currently. Coinciding with this, the Moving Average Convergence Divergence (MACD) is highlighting an increase in green bars, lending further weight to the bullish momentum. What further bolsters the positive bias are the Simple Moving Averages (SMAs) as the pair trades comfortably above its 20, 100, and 200-day SMAs, a clear indication that control resides firmly with the bulls over the long haul.

Switching focus to the four-hour chart, the overall momentum still skews towards the bullish side. The Relative Strength Index (RSI) on the four-hour chart signals overbought conditions, an indication of intense buying pressure. Correspondingly, the MACD on the four-hour scale echoes this bias with rising green bars. Even though these conditions might suggest a potential pullback due to the overextended nature of the rally, the buying momentum appears to still hold the upper hand.

Support Levels: 0.6580 (20 and 200-day SMA convergence), 0.6540, 0.6500.

Resistance Levels: 0.6695, 0.6730, 0.6750.

AUD/USD daily chart

-638381008224734953.png)

After the Federal Reserve, several other central banks, including the Bank of England, the European Central Bank, the Swiss National Bank, and the Norges Bank, will announce their decisions on monetary policy. In the Asian session, important economic data will be released, such as New Zealand's Q3 GDP data and Australia's employment report. Additionally, Japan will release data on Machinery Orders and Industrial Production.

Here is what you need to know on Thursday, December 14:

After the Federal Reserve meeting, the US Dollar experienced a significant collapse. As expected, the central bank decided to keep interest rates unchanged. Market analysts are forecasting three rate cuts for 2024. Fed Chair Jerome Powell leaned dovish, adding fuel to the rally in Treasury bonds. He refrained from declaring victory on inflation, but markets did.

The 10-year yields dropped more than 4%, reaching their lowest level since August. At the same time, the US Dollar Index (DXY) declined by 0.85% to 102.80, marking its lowest point in two weeks. The US Dollar is under pressure and appears to have resumed its downward trend after a two-week correction.

On Thursday, important data from the US will be released, including the weekly Jobless Claims and Retail Sales reports.

The EUR/USD pair surged and reached the 20-day Simple Moving Average (SMA). However, the rally encountered resistance around the 1.0900 level. The European Central Bank (ECB) will hold its monetary policy meeting, and it is widely expected to keep rates unchanged. The focus will be on the ECB's hints for 2024, especially regarding the timing of potential interest rate cuts.

GBP/USD rallied after the Fed meeting, reaching one-week highs above 1.2600. The technical outlook suggests potential for further gains. The key support level remains at 1.2500. The Bank of England will announce its decision on monetary policy, and no change is expected in interest rates.

Analysts at TD Securities on the BoE:

Another hold is virtually guaranteed from the MPC, as weak data (particularly on the wages & inflation front) suggests that hikes are a thing of the past. Focus will be on whether the MPC pushes back on market pricing for aggressive cuts by May. Following downside misses to wages and GDP earlier this week, we now see a 7-2 vote.

USD/JPY lost almost 300 pips over the weekend due to a weaker US Dollar and lower Treasury yields. The pair dropped below the 143.00 level. Despite the rally in Wall Street, the Japanese Yen was one of the strongest gainers after the Federal Reserve meeting. Looking ahead, Japan has important data releases scheduled, including Machinery Orders and Industrial Production, following a positive Tankan survey.

USD/CHF resumed its decline towards the 20-day Simple Moving Average (SMA) and is currently testing the 0.8700 area. The Swiss National Bank (SNB) is expected to keep interest rates unchanged, with the key rate remaining at 1.75%.

NZD/USD rallied back towards December highs and is holding above 0.6200, showing strong bullish momentum ahead of the Asian session. New Zealand will release Q3 Gross Domestic Product (GDP) figures, with a 0.2% expansion expected.

AUD/USD had its best performance in a month, breaking a multi-day range. The pair approached December highs, and the 0.6700 area is back on the radar. The Australian November Employment Report is due on Thursday, with a positive change of 11,000 in employment expected after the increase of 55,000 recorded in October. The Melbourne Institute Consumer Inflation Expectation report is also scheduled for release.

Gold is shining again after rising by over $40 in just a few hours following he FOMC meeting. XAU/USD reached the $2,020 area. If the decline in US yields continues, there may be further potential for gains. Silver also joined the rally, climbing more than 4%.

Like this article? Help us with some feedback by answering this survey:

- Gold’s rallied more than 1.30% as traders brace for Powell’s press conference.

- Federal Reserve officials voted unanimously and expect at least three rate cuts for 2024.

- XAU/USD hits a three-day high, eyeing more gains above $2000.

Gold price advanced sharply late in the New York session after the Federal Reserve decided to keep rates unchanged, opening the door for monetary policy easing next year. Buyers saw that as a green light to open fresh positions, as XAU/USD has climbed more than 1.80%, trading at around the $2000-$2020 range at the time of writing.

XUAU/USD extends its rally above $2020 as rate cut expectations climbed

On Wednesday, the Fed stuck to its plan to hold rates at the current rate despite acknowledging that growth and the jobs market have moderated; it stated that inflation. Despite that, Fed officials added that inflation has cooled but remains elevated.

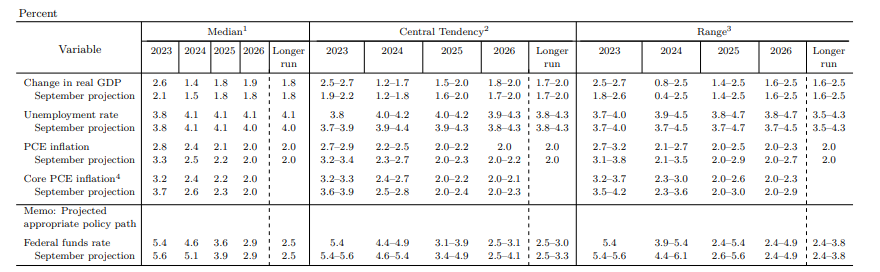

Besides that, the Summary of Economic Projections (SEP) hinted that the Fed is done raising rates and that they expect three 25 basis points for the following year. Further data was reviewed, with growth expected to increase compared to September’s, while inflation would head toward the 2% target.

Source: Federal Reserve

Aside from this, the Chairman of the Fed, Jerome Powell, stated the US Central Bank is fully committed to attaining both of its mandates. Even though he kept the door open for additional hikes, he said, “we likely at or near peak for rates,” sponsoring a leg up on the non-yielding metal. He said rate cuts “is now a topic of discussion” and added that the question is when it would be appropriate to begin easing policy.

When asked about a recession, he said they don’t see that scenario right now but that there’s always a probability next year. Although he welcomed progress on inflation, he said it’s too early to declare victory.

When asked about cutting rates until inflation hits 2%, he said it would be too late, adding that “you need to reduce restriction on economy well before 2%.”

In the meantime, Gold price continued to print gains, sponsored by the Fed’s pivot. Consequently, US Treasury bond yields are plunging more than 15 bps in the short and long end of the curve, with the 10-year benchmark note standing at 4.02%.

The US Dollar Index (DXY) tracks currency performance against a basket of six peers and is sinking 0.84%, down at 102.94. Meanwhile, the Fed’s interest rate probabilities for the next year expect more than 140 basis points of rate cuts, twice the Fed’s projections. That means investors estimate the federal funds rate (FFR) to be 4%.

XAU/USD Hourly Chart after Fed’s decision

XAU/USD Technical Levels

- The AUD/USD is back into the high side after the Fed signals the end of rate hikes.

- FOMC rate outlook sees three rate cuts in 2024.

- Aussie sees strong Wednesday performance against weakening Greenback.

The AUD/USD is catching a firm risk-bid as markets surge higher following a dovish pivot to the Federal Reserve’s (Fed) policy stance; the Fed now sees at least three rate cuts in 2024, for a combined 75 basis points in rate cuts next year.

Powell speech: Difference in projections reflect lower inflation than previously expected

The Australian Dollar (AUD) is one of the best-performing currencies of the majors bloc on Wednesday, seeing a firm bullish break to climb 1.5% against the US Dollar (USD) on the day. The Fed’s dot plot adjustment on Wednesday still falls well short of market expectations, but does a good job of meeting investors at the halfway mark: money markets are currently pricing in a combined 140 basis points of rate cuts for 2024, with the first cut potentially expected as soon as the March Fed meeting.

Read More: Jerome Powell speaks on policy outlook after holding policy rate steady

With the Fed easing back from its hawkish policy stance in the face of steadily declining inflation, broad-market risk appetite is rebounding heading into the latter half of the trading week.

Fed Statement comparison: December vs November

The economic calendar still isn’t done with the AUD/USD this week; early Thursday sees Australian labor figures, to be followed up by US Retail Sales and US S&P Global Purchasing Manager Index (PMI) figures heading into Friday.

There’s still plenty of time left in the trading week for the Aussie to squander its lead against the US Dollar, with the Australian Unemployment Rate expected to tick up from 3.7% to 3.8% in November, while Australian jobs additions are forecast to slump to 11K in November from October’s 55K print.

US Retail Sales for November are expected to print at -0.1%, a minor decline but in-line with October’s -0.1%.

December’s US PMI figures are forecast to see slight declines in both the Services and Manufacturing components; US Services PMI is forecast to print at 49.3 versus the previous 49.4, while the Manufacturing PMI is seen declining slightly from 50.8 to 50.6.

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.75% | -0.43% | -0.61% | -1.50% | -1.54% | -1.05% | -0.46% | |

| EUR | 0.78% | 0.36% | 0.19% | -0.71% | -0.74% | -0.27% | 0.33% | |

| GBP | 0.37% | -0.37% | -0.18% | -1.12% | -1.11% | -0.63% | -0.09% | |

| CAD | 0.60% | -0.14% | 0.18% | -0.91% | -0.93% | -0.46% | 0.12% | |

| AUD | 1.50% | 0.74% | 1.10% | 0.93% | 0.00% | 0.49% | 1.02% | |

| JPY | 1.53% | 0.72% | 1.11% | 0.92% | -0.04% | 0.49% | 1.02% | |

| NZD | 1.00% | 0.27% | 0.63% | 0.45% | -0.48% | -0.52% | 0.55% | |

| CHF | 0.46% | -0.28% | 0.08% | -0.09% | -1.03% | -1.03% | -0.55% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

AUD/USD Technical Outlook

The AUD/USD has seen a hard rally on the intraday charts, breaking through and soaring well above the 200-hour Simple Moving Average (SMA) just below 0.67590, and bids are now testing back into the 0.6660 and within reach range of December's peak bids near 0.6690, with the 0.6700 handle just beyond that.

0.6550 is forming up into a significant technical floor for the AUD/USD, etching in a technical higher low in the pair's medium-term trend that has the Aussie rising from October's bottom bids near the 0.6300 handle.

The AUD/USD is testing into familiar consolidation territory that plagued the pair in the early half of 2023, and bulls will be looking to capitalize off of any technical pullbacks towards the 200-day SMA which is currently near 0.6575.

AUD/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Technical Levels

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"Participants are encouraged to update SEP forecasts until mid-morning Wednesday."

"Some people did update their forecasts based on CPI and PPI data."

"We don't know if neutral rate has risen."

"Reason you wouldn't wait to 2% inflation to cut rates is it would be too late."

"You need to reduce restriction on economy well before 2%."

"Takes a while for policy to get into the economy."

"At some point you will run out of supply-side help, and then it gets harder, but it's uncertatin."

"We are not talking about altering the pace of QT."

"Balance sheet is working pretty much as expected."

"At a certain point reverse repo facility levels out and reserves will come down."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"We are very focused on not making the mistake of keeping rates too high too long."

"Both mandates are more in balance now."

"We will be looking hard at what's happening with demand."

"We haven't worked out if we will follow a threshold-based path for cutting rates."

"We have seen real progress on core inflation."

"We've seen reasonable progress in non-housing services inflation."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"We think we have done enough on rates but we are not fully confident in that view yet."

"Discussion on when to cut rates is still ahead, will decide very carefully."

"People will have different forecasts about the economy, those will show up, or not, in market conditions."

"Important that in financial conditions are aligned with our actions in the long run."

"Really good to see progress we are making on inflation."

"We are still well above 3% on core PCE though."

"We are pleased with progress, but we see the need for further progress on inflation."

"Fair to say there is a lot of uncertainty still going forward."

"We will look at the totality of data when making policy decisions."

"Above-trend growth is not in itself a problem, only if it makes it more difficult to achieve our goals."

"Such a scenario could mean we would have to keep rates higher for longer or hike again."

"Wages still running bit above what is consistent with 2% inflation."

"Unemployment rate is very, very low but overall development of labor market has been positive."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

- NZD/USD advances more than 1% as the Fed hints end of rate hikes.

- The Fed’s SEP confirmed rates in the US are at the highest level expected by policymakers.

- Fed officials project at least three rate cuts for 2024.

The NZD/USD surged more than 1% on Wednesday as the Federal Reserve shifted dovish, as Fed Chair Jerome Powell turned dovish as he answered a question that “we likely at or near peak for rates,” sponsoring another leg up on the Kiwi. At the time of writing, the NZD/USD trades volatile within the 0.6120/0.6200 area.

NZD/USD soars as the Fed turns dovish

As of writing, the Fed Chair Jerome Powell is crossing the wires, he has shifted dovish, adopting a more neutral stance. He said they could be at peak rates while adding it’s too far to declare victory on inflation. When asked of a possible recession, there is a possibility for the next year, but said “I have always felt there was a possibility economy could avert recession while inflation came down, and so far that's what we are seeing. That said, the result is not guaranteed.”

The US central bank stated there are some signals that monetary policy effects are being felt, as growth has eased and the jobs market has moderated. They said inflation data is better than expected, but it remains elevated.

Moving to the Summary of Economic Projections (SEP) officials expect rates to peak at 5.4%, while for 2024, they expect 80 basis points of rate cuts.

Regarding GDP, the central bank estimates the country will grow from 2.1% to 2.6%, and the Fed’s preferred gauge for inflation, the PCE to slump below 3%, while Core PCE is foreseen to edge lower from 3.7% to 3.2%

NZD/USD Hourly Chart – Reaction to Fed’s decision

NZD/USD Technical Levels

- The USD/JPY is nearing the 143.70 level after a 1.10% downward shift en route toward the 200-day SMA.

- Federal Reserve's latest hint at three potential rate cuts in 2024 signifies dovish forward guidance, negatively impacting the dollar.

- During the press conference, Powell

In Wednesday's session, the USD/JPY pair witnessed a downward journey, plunging to 143.70, driven by the speculation surrounding the Federal Reserve's anticipated rate cuts.

In December’s monetary policy statement, the Federal Reserve left rates unchanged at 5.25%-5.50% and anticipated making three 25-basis-point reductions in 2024. Although not as deep or numerous as the market had previously anticipated, it significantly narrows the discrepancy between investor expectations and the Fed's prior rate prediction, which was cheered by markets fuelling risk-on flows.

During the press conference, Powell was seen as cautious. He recognized that inflation is on its path to reaching the 2% target but is still high and that more tightening will be considered if data justifies it. Regarding cutting rates in early 2024, he refrained from committing to early easing as policymakers didn’t want to take the possibility of further hikes off the table.

As a reaction, US bond yields are falling. The 2-year rate fell to 4.50%, while the 5-year and 10-year yields stand at 4.05% and 4.07% respectively. This directly impacts the value of USD as when yields rise; it tends to make the Greenback gain interest and vice-versa.

USD/JPY levels to watch

The daily chart presents a bearish prospect for the pair, as suggested by the indicators. The Relative Strength Index (RSI) has taken a nosedive into negative territory, showing a negative slope. This generally signifies that the sellers currently have the upper hand, exerting downward pressure on the pair.

The Moving Average Convergence Divergence (MACD) further bolsters this scenario. Rising red bars in the MACD Histogram reveal a strengthening selling momentum. The momentum seeming to tilt towards the sellers becomes more apparent when noting the histogram, implying a bearish market sentiment.

However, the position of the pair relative to its Simple Moving Averages (SMAs) presents a slightly more complex picture. While the pair is trading below the 20 and 100-day SMAs, emphasizing the shorter-term bearish momentum, it remains above the long-term, 200-day SMA. This means that the bulls, despite recent setbacks, continue to exert influence over the pair in the longer-term horizon.

Support Levels: 143.00, 142.80, 142.40 (200-day SMA)

Resistance Levels: 144.0, 144.50, 145.00.

USD/JPY daily chart

-638380939986325609.png)

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"Today at Fed meeting, many people mentioned their rate forecasts."

"There was a general expectation that rate cuts will be a topic of conversation going forward."

"Little basis for thinking the economy is in recession now."

"Always a probability there is a recession next year."

"I have always felt there was a possibility economy could avert recession while inflation came down, and so far that's what we are seeing."

"Difference in projections reflect lower inflation than previously expected."

"We are very conscious of real rates."

"It's very hard to know exactly how tight policy is at any given time."

"Expectation would be that real rates are declining as we move forward."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"We are still focused on the question of whether rates are high enough."

"It's not likely we will hike further."

"Policymakers are thinking, talking about when it will be appropriate to cut rates."

"We are seeing strong growth that appears to be moderation and inflation making real progress."

"We still have a ways to go."

"No one is declaring victory, that would be premature."

"We are not guaranteed of progress, so moving carefully in assessment of if we need to do more."

"The question of when it will be appropriate to cut rates is coming into view."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"Lower inflation readings over last several months are welcome."

"We estimate core PCE prices rose 3.1% in 12 months ending November."

"We anticipate the process of getting inflation to 2% will take some time."

"Our restrictive stance is putting downward pressure on economic activity and inflation."

"While we believe our policy rate is likely at or near its peak for this cycle, we have been surprised in the past."

"Prepared to tighten policy further if appropriate."

"Will keep policy restrictive until confident on path to 2% inflation."

"Policymakers don't want to take possibility of further hikes off the table."

"We will adjust policy as needed, not on a preset course."

"We will continue to make our decisions meeting by meeting."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"Inflation has eased without significant increase in unemployment."

"Inflation is still too high."

"The path forward is uncertain."

"We are fully committed to returning inflation to 2%."

"We have significantly tightened monetary policy."

"Our actions have moved policy rate well into restrictive territory.

"Full effects of tightening are likely not yet felt."

"Given how far we've come, and given uncertainties, we are proceeding carefully."

"We will make future decisions on totality of data, evolving outlook and incoming risks."

"Growth in economic activity has slowed substantially."

"Activity in the housing sector has flattened out."

"Higher interest rates are also weighing on business fixed investment."

"Labor market remains tight but it's coming into better balance."

"We expect labor market easing to continue, that will put downward pressure on prices."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

- Gold’s rallied more than 1.30% as traders brace for Powell’s press conference.

- Federal Reserve officials voted unanimously and expect at least three rate cuts for 2024.

- XAU/USD hits a three-day high, eyeing more gains above $2000.

Gold price rallied sharply as the Federal Reserve held rates, showing they finished their tightening cycle. As projections for the federal funds rate eased, reassuring market participants it would ease monetary policy, but not as they had priced in. Despite keeping the door open for additional tightening, traders perceived the decision as a dovish hold. At the time of writing, XAU/USD trades volatile within the $1950-$2000 range ahead of Powell’s press conference.

Summary of the Fed’s monetary policy statement

In the monetary policy statement, Fed officials stated the held monetary policy unchanged at the 5.25% - 5.50% range for the third consecutive meeting while acknowledging that growth has eased and the labor market has moderated. Despite that, Fed officials added that inflation has cooled but remains elevated.

The US central banks stated they would remain data-dependent to set monetary policy in the upcoming year and continue to reduce their balance sheet as previously described. In contrast, they said their commitment to bring inflation towards its 2% goal.

Aside from this, the highlight was the Summary of Economic Projections (SEP) that confirmed the Fed had finished its tightening cycle, as most officials estimate the federal funds rate (FFR) to be at 5.4% for the remainder of the year. For 2024, the US central bank has telegraphed it would ease monetary policy by 72 basis points, from the FFR effective rate of 5.33% to 4.61%.

In other projections, growth is foreseen to rise to 2.6% from September 2.1%, while headline inflation is expected to dip below 3% and core to ease towards 3.2%, with both readings projected to reduce compared to September.

Gold’s (XAU/USD) market reaction to the decision

Gold hourly chart witnessed the yellow metal exploding to the upside, breaking the $2000 mark, though it remains trading volatile as traders brace for Fed Chair Jerome Powell's press conference. Upside risks are seen at the October 27 high of around $2009.42, followed by the December 8 high at $2034. Downside risks emerge at $1972.60.

XAU/USD Technical Levels

- The Federal Reserve keeps rates steady as expected but hints at potential rate cuts next year.

- US Dollar tumbles on US yields decline sharply.

- EUR/USD approaches the 20-day SMA.

The EUR/USD pair jumped from 1.0785 to around 1.0850 following the Federal Reserve's decision to keep interest rates unchanged. The US Dollar weakened across the board as US Treasury yields plummeted.

Fed signals no more rate hikes

The Federal Reserve kept the key rate unchanged at the 5.25%-5.50% range, the highest level in 22 years, as widely expected. In the statement, the Fed recognized that inflation “eased” but “remains elevated”.

According to the FOMC staff projections, there is an expectation of weaker economic growth compared to the September projections. Regarding interest rates, no policymakers foresee rates being higher by the end of 2024 than their current levels. Attention turns to Fed Chair Jerome Powell’s press conference.

On Thursday, the European Central Bank (ECB) will announce its decision on monetary policy. No change is expected at the last meeting of the year. Markets will receive updated staff macroeconomic projections and will hear from ECB President Christine Lagarde.

Follow Fed meeting – Live coverage

EUR/USD levels to watch

If the upside momentum continues, the EUR/USD pair could test the 20-day Simple Moving Average (SMA) at 1.0870 and a daily close above it would strengthen the outlook for the Euro. On the flip side, immediate support is seen at 1.0810, followed by the 1.0770 area.

- GBP/USD rebounds from the day’s lows to chalk in a new daily high as risk appetite flares up.

- Federal Reserve sees three rate cuts next year, meeting investor expectations in the middle.

- BoE has its own final rate call of 2023 due early Thursday.

The GBP/USD rallied back into 1.2580 on reaction to the Federal Reserve’s (Fed) rate outlook for 2024. The US Dollar plunged alongside US Treasury yields, with US equities spiking as investors piled back into risk-on bets after the Fed all but formally announced that the rate hike cycle is truly over.

Fed Statement comparison: December vs November

The Federal Reserve sees three 25-basis-point rate cuts in 2024, not as many or as much as markets had been hoping for, but it significantly closes the gap between investor expectations and the Fed’s stance from its previous rate call.

Markets will now be focusing on the Fed’s press conference, headed by Fed Chairman Jerome Powell and scheduled for 30 minutes after the rate release.

The Bank of England (BoE) makes one last appearance for the year early Thursday. The UK’s central bank is broadly expected to stand pat on interest rates at 5.25% alongside the BoE’s latest Meeting Minutes and its Monetary Policy Report, all slated for 12:00 GMT Thursday.

GBP/USD Technical Outlook

The GBP/USD rallied into a fresh high for Wednesday, testing 1.2585 following the Fed rate statement, drawing the pair into near-term highs close to the 200-hour Simple Moving Average (SMA) just north of 1.2580.

Intraday action continues to cycle within familiar consolidation levels, with the GBP/USD stuck in a rough near-term channel just above the 200-day SMA, rising into the major 1.2500 price handle.

The GBP/USD remains down one and a third percent from late November’s swing high of 1.2733.

GBP/USD Hourly Chart

GBP/USD Daily Chart

Fed FAQs

What does the Federal Reserve do, how does it impact the US Dollar?

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

How often does the Fed hold monetary policy meetings?

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

What is Quantitative Easing (QE) and how does it impact USD?

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

What is Quantitative Tightening (QT) and how does it impact the US Dollar?

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

GBP/USD Technical Levels

FOMC meeting statement comparison

November 1December 13, 2023

Recent indicators suggest that growth of economic activity expanded at ahas slowed from its strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

The U.S. banking system is sound and resilient. Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy. In determining the extent of any additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lisa D. Cook; Austan D. Goolsbee; Patrick Harker; Philip N. Jefferson; Neel Kashkari; Adriana D. Kugler; Lorie K. Logan; and Christopher J. Waller.

Follow Fed meeting – Live coverage

- EUR/JPY slips below 157.00 as sentiment shifts negatively, ahead of the Fed’s.

- The pair is bearishly biased and could extend its losses below the 156.00 figure.

- However, upside risks remain, with the 157.48 as key resistance to get towards 158.00.

The EUR/JPY cross pair retraces from daily highs reached earlier at around 157.48 and tumbled below the 157.00 figure as market participants get ready for the central bank bonanza, starting with the US Federal Reserve on Wednesday. At the time of writing, the pair is trading at 156.58, down 0.24%-

The pair is downward biased once it breaches below the Ichimoku Cloud (Kumo), and also with the Tenkan-Sen turning bearish, dropping below the Kijun-Sen. In addition, the EUR/JPY has failed to regain a five-month-old previous support trendline turned resistance.

In the outcome of a bearish resumption, the EUR/JPY first support would be 156.00, followed by December’s 8 daily low of 153.86, followed by the December 7 swing low of 153.11.

On the flip side, if the pair edged higher, the first resistance is seen at 157.48, followed by the bottom of the Kumo at around 158.00. Once the pair gets inside the Kumo, the Senkou Span B and the Kijun-Sen confluence would be the next supply zone at 158.41.

EUR/JPY Price Analysis – Daily Chart

EUR/JPY Technical Levels

- AUD/USD remains in the green despite market sentiment shifting neutral.

- Traders are eyeing the Fed’s decision, updated projections, and Powell’s press conference.

- On Thursday, the Aussie’s docket will feature jobs data.

The AUD/USD rises in the middle of the North American session by 0.32%, while Wall Street trims its earlier gains as we get closer to the Federal Reserve’s decision. At the time of writing, the pair is trading at 0.6577 after bouncing off a low of 0.6541.

AUD/USD meanders around the 200-DMA awaiting for Powell and Co

US equities paired their earlier gains as traders prepare for Jerome Powell and his colleagues, which are expected to keep the federal funds rate (FFR) unchanged at around 5.25% - 5.50%, though they will reveal its projections for the next year. Money market futures had priced that the Fed would cut rates four times, each by 25 basis points, but the latest estimates by Fed officials foresaw only two cuts for the next year.

Besides that, traders would be looking for the Chair Powell press conference, in which he’s expected to push back against easing monetary policy as the markets project while refraining from saying that policy is already restrictive, keeping the door open for further tightening.

On the Australia front, Consumer Sentiment in December improved while investors prepared for the release of employment data on Thursday’s session. On Wednesday, Australia’s Treasurer Jim Chalmers projected a budget deficit of A$1.1 billion in the year to end June 2024, down from A$13.9 billion estimated in May.

Given the backdrop, if the Fed strikes a hawkish tone and market participants buy it, the AUD/USD could drop below the 0.6500 figure and extend its losses to the confluence of the 50 and 100-day moving averages (DMAs) at 0.6458/59. Otherwise, the pair could extend its gains past the 200-DMA.

AUD/USD Price Analysis: Technical outlook

The AUD/USD is neutral to upward biased, once buyers reclaimed the latest cycle high at 0.6522, but it faced strong resistance at around 0.6700, which sent the pair into a tailspin, toward 0.6520. Since then, the game’s name is consolidation. But the Fed’s decision, could give direction for the reminder of the year. Upside risks lie above 0.6600, while a drop below 0.6500, would likely exposed the 0.6450 area and below.

- The USD/JPY tightens into a middling range just north of 145.00.

- The Fed’s last rate statement for the year is expected to be a third straight rate hold.

- US PPI figures missed the mark, but inflation remains a consumer-facing problem.

The USD/JPY is getting boxed into a tight consolidation range as markets hunker down ahead of the US Federal Reserve’s (Fed) final appearance for 2023. Markets are broadly expecting a shift in the Fed’s policy stance as investors anticipate an accelerated path toward multiple rate hikes in 2024.

With the Fed broadly expected to stand pat on interest rates for the third straight meeting, investors will be deep-diving into the Fed’s Monetary Policy Statement and the attached Interest Rate Expectations, also known as the “dot plot”, a summary of interest rate forecasts from individual Fed policymakers. At the last read in September, the Federal Open Market Committee (FOMC) expected Personal Consumption Expenditure (PCE) inflation to decline to 3.3% by the end of 2023 and 2.2% by year-end 2025. Investors eager for rate cuts will be looking for the FOMC’s dot plot to shift downwards, implying more frequent rate cuts looking forward.

Read More: Federal Reserve dot plot expected to signal upcoming policy pivot

With the Fed dominating markets in the mid-week trading session, other calendar events are getting pushed off the table for the time being, but the latter half of the trading week still brings US November Retail Sales on Thursday, followed by Friday’s Preliminary US S&P Global Purchasing Manager Index (PMI) figures for December.

US Retail Sales for November are expected to print at -0.1%, a minor decline but in-line with October’s -0.1%.

December’s US PMI figures are forecast to see slight declines in both the Services and Manufacturing components; US Services PMI is forecast to print at 49.3 versus the previous 49.4, while the Manufacturing PMI is seen declining slightly from 50.8 to 50.6.

USD/JPY Technical Outlook

The USD/JPY is seeing a rough box forming on the intraday charts as the technicals take a step down against major fundamental events, leaving the pair to cycle around 145.50 in the midweek market session.

The USD/JPY is caught in the middling recovery range of last week’s plunge into 141.60, with the bullish rebound getting capped off by resistance from the 200-hour Simple Moving Average (SMA) descending into the 146.00 handle, and near-term chart action is seeing technical support from the 145.00 handle.

The Japanese Yen is one of the better-performing of the major currencies bloc on Wednesday, but the JPY is still in the red against the majority of its peers on the week.

The USD/JPY is down a little under a tenth of a percent from Wednesday’s opening bids, but still up roughly a sixth of a percent on the week.

USD/JPY Hourly Chart

USD/JPY Daily Chart

USD/JPY Technical Levels

- The DXY Index trades flat at 103.80.

- Investors await Fed decision alongside fresh economic and interest rate projections.

- November’s PPI from the US came in lower than expected.

The US Dollar (USD) Index holds steady around 103.8 on Wednesday, consolidating its position as investors weigh the data on November's Headline and Core Producer Price Index (PPI), which came in lower than expected. At the backdrop is the anticipation ahead of the Federal Reserve's (Fed) final meeting of 2023, a factor bearing heavily on the current market sentiment as it may shape the pace of the markets for the short term.

As the US economy confronts cooling inflation and a resilient labor market, the Fed presents a cautious stance, not dismissing prospects of further tightening. Despite market speculation asserting a dovish orientation, the Fed still hasn’t declared victory on inflation, and this ambiguity keeps investors anxiously anticipating the Fed's Dot Plot projection, crucial for determining potential interest rate cuts in 2024.

Daily Market Movers: US Dollar holds steady before Federal Reserve decision despite soft PPI figures

- The US Dollar is neutral as the market remains anticipative ahead of the Federal Reserve's last hike of 2023.

- The US Producer Price Index (PPI) showed a yearly ascent of 0.9% in November, a slowdown from its 1.2% climb in October.

- Furthermore, the yearly Core PPI rose by a marginal 2%, lower than October's figures and the market’s forecast of 2.4% and 2.2%, respectively.

- US bond yields are on a downward slope, with the 2-year, 5-year, and 10-year rates reported at 4.66%, 4.17%, and 4.15%,, respectively.

- No rate hikes are expected for today’s meeting, according to the CME FedWatch Tool. Expectations are forming around potential rate cuts for May 2024.

- The latest interest rate Dot Plot chart from the Federal Reserve indicates a median projection that places the Federal Funds Rate at 5.1% by the conclusion of 2024. This means a modest 25-basis-point rate reduction over the course of next year.

Technical Analysis: DXY index faces consolidation phase with a bullish tilt

The indicators on the daily chart reflect a somewhat neutral yet cautiously optimistic stance. The Relative Strength Index (RSI) is flat and currently in negative territory, and yet the bears are taking a breather, which underscores that selling pressure is easing.

The Moving Average Convergence Divergence (MACD), which mirrors similar sentiment, is flat too but with green bars suggesting a minor bullish bias in the short term.

In terms of Simple Moving Averages (SMAs), the price is oscillating above the 20-day SMA and the 200-day SMA, reflecting that buyer momentum is holding resilient, especially in the larger time frames, with some degree of dominance over the sellers.

However, the asset is trading below the 100-day SMA, indicating that the bullish momentum is somewhat restrained and could face resistance. Also, traders should eye a potential bearish crossover between the 100-day and 200-day SMA, which could shift the balance toward sellers.

Support levels: 103.70 (20-day SMA), 103.50, 103.30.

Resistance levels: 104.50 (100-day SMA), 104.50, 104.70.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- The Euro is giving a middling performance on Wednesday, mostly flat against the USD.

- Eurozone Industrial Production missed the mark earlier, as did US PPI figures.

- It’s all eyes on Powell for the Fed’s last appearance of the year.

The EUR/USD is a mixed bag in the mid-week trading session, caught in a tight range between 1.0810 and 1.0775. Euro traders are battening down the hatches alongside the broader market as the Federal Reserve (Fed) prepares to give its final rate call of 2023.

The Fed is set to keep rates steady for the third straight meeting at 5.5%, the Fed’s longest holding pattern since beginning the rate hike cycle in early 2022.

Markets will be leaning heavily into the Fed’s Interest Rate Expectations, also known as the “Dot Plot”, to get a bead on the Fed’s rate cut expectations for 2024.

Investors are broadly hoping for the Fed to begin a rate cut cycle sooner rather than later, with money markets anticipating cuts to begin as soon as the first quarter of 2024, but overeager investors may have let their expectations run far ahead of what the Fed is willing to provide.

Eurozone Industrial Production declined more than expected in October, contracting 0.7% versus the forecast 0.3% decline. The previous month’s figure saw only a slight revision upwards from -1.1% to -1.0%.

US Core Producer Price Index ((PPI) figures for the year ending in November eased back to a more sedate 2.0% versus the expected 2.2%, chipping away at the previous period’s 2.3%, which saw a minor revision down from 2.4%. Easing producer inflation numbers will have a limited impact, as profit-led inflation tends to face consumers at the end-point of the business cycle rather than further up the production chain.

After Federal Reserve Chairman is done making a mess of markets, Thursday will see the European Central Bank (ECB) make its own final appearance of 2023. The whole affair is unlikely to draw near the attention or market jitters that the Fed will. The ECB is broadly expected to maintain a holding pattern with its Main Refinancing Operations Rate 4.5%.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Pound Sterling.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.05% | 0.34% | -0.13% | -0.27% | -0.11% | 0.20% | 0.12% | |

| EUR | -0.06% | 0.28% | -0.18% | -0.34% | -0.17% | 0.14% | 0.06% | |

| GBP | -0.36% | -0.28% | -0.46% | -0.61% | -0.45% | -0.15% | -0.23% | |

| CAD | 0.11% | 0.17% | 0.47% | -0.17% | 0.01% | 0.31% | 0.21% | |

| AUD | 0.28% | 0.33% | 0.60% | 0.16% | 0.16% | 0.47% | 0.39% | |

| JPY | 0.12% | 0.18% | 0.45% | -0.02% | -0.18% | 0.34% | 0.24% | |

| NZD | -0.20% | -0.15% | 0.14% | -0.32% | -0.47% | -0.30% | -0.08% | |

| CHF | -0.12% | -0.07% | 0.22% | -0.23% | -0.39% | -0.23% | 0.08% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

EUR/USD Technical Outlook

Near-term consolidation in the EUR/USD leaves the pair testing into the 200-hour Simple Moving Average (SMA) near the 1.0800 handle as the Euro (EUR) attempts to claw back chart paper from the US Dollar.

The EUR/USD’s recent tumble from November’s peak of 1.1017 sees the pair sticking close to the 200-day SMA on the daily candlesticks, with near-term technical support coming from the 50-day SMA.

EUR/USD Hourly Chart

EUR/USD Daily Chart

EUR/USD Technical Levels

- Canadian Dollar is set for a bumpy ride as markets face down one last appearance from Fed Chair Powell.

- FOMC updates Dot Plot as investors hope for a firm path toward rate cuts in 2024.

- CAD catches a supporting bid from rising Crude Oil, WTI bounces from new lows.

The Canadian Dollar (CAD) is moderately bid on Wednesday, gaining support from a thin but noticeable relief rally in Crude Oil markets. Still, markets see plenty of chop as investors jockey for position ahead of the US Federal Reserve’s (Fed) last appearance for 2023.

The Canadian economic calendar remains tepid this week; Loonie traders will be forced to wait until Bank of Canada (BoC) Governor Tiff Macklem’s appearance late Friday before the CAD finds tradeable headlines from behind home plate.

Markets are keenly waiting the Fed’s Federal Open Market Committee (FOMC) meeting to deliver their updated Interest Rate Outlook, known as the “Dot Plot”. With the Fed all but guaranteed to hold rates at 5.5% for their last rate decision of 2023, investors will be diving into the FOMC’s rate expectations as well as the Fed’s stance moving forward.

The Fed’s Monetary Policy Statement and Interest Rate Projections will be released at 14:00 EST(19:00 GMT). Fed Chairman Jerome Powell’s last press conference of the year is slated to begin at 14:30 EST (19:30 GMT).

Daily Digest Market Movers: Canadian Dollar grinds through frothy markets ahead of Fed rate call

- Despite the Canadian Dollar’s Crude Oil-fueled bid on Wednesday, the Fed is stealing the limelight, and it’s all eyes on Powell for the mid-week market session.

- The Federal Reserve is set to hold rates at 5.5% for the third straight FOMC meeting, its longest holding pattern since the most recent rate hike cycle began in early 2022.

- Investors are broadly anticipating an accelerated path toward more frequent rate cuts next year.

- Markets are anticipating rate cuts to begin as soon as the first quarter of 2024, and investor expectations of easing rates may have run well ahead of what the Fed considers achievable.

- With Fed Chair Powell scrapping forward guidance last year, Fed rate statements have an outsized market impact as the US central bank assesses data on a case-by-case basis.

- Crude Oil markets sank to fresh lows this week, with West Texas Intermediate (WTI) sagging into $68 per barrel early Wednesday before catching a near-term relief rally back toward $70.

- The Canadian Dollar is latching onto the rebound in Crude Oil to squeeze out a tenth of a percent gain against the US Dollar (USD) heading into the Fed release window.

Canadian Dollar price this week

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies this week. Canadian Dollar was the strongest against the Pound Sterling.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.20% | 0.18% | -0.12% | 0.00% | 0.15% | 0.05% | -0.37% | |

| EUR | 0.22% | 0.40% | 0.10% | 0.26% | 0.37% | 0.28% | -0.14% | |

| GBP | -0.19% | -0.41% | -0.30% | -0.17% | -0.03% | -0.15% | -0.56% | |

| CAD | 0.12% | -0.08% | 0.29% | 0.12% | 0.27% | 0.17% | -0.25% | |

| AUD | -0.01% | -0.22% | 0.18% | -0.12% | 0.15% | 0.05% | -0.38% | |

| JPY | -0.16% | -0.39% | -0.09% | -0.28% | -0.17% | -0.12% | -0.55% | |

| NZD | -0.05% | -0.25% | 0.13% | -0.17% | -0.05% | 0.10% | -0.42% | |

| CHF | 0.37% | 0.17% | 0.54% | 0.25% | 0.41% | 0.53% | 0.43% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Canadian Dollar’s sideways stance set to get rattled, USD/CAD in play near 1.3600

The Canadian Dollar (CAD) sees choppy trading forming into a near-term sideways channel against the US Dollar (USD), keeping the USD/CAD capped between 1.3610 and 1.3550. Intraday action remains chained to the 200-hour Simple Moving Average (SMA) as near-term momentum drains out of the pair.

A bounce from the 200-day SMA for the USD/CAD at the start of December has failed to crystallize into a meaningful bullish recovery, keeping the pair constrained in a congestion zone just beneath the 1.3600 handle.

The US Dollar is down two-and-a-third percent against the Canadian Dollar after dropping from December’s early high of 1.3899 and making a clean shear of the 50-day SMA just below 1.3700.

Fundamentals are going to drive the USD/CAD on Wednesday, and technical traders will need to be mindful that technical barriers could easily evaporate, depending on how investors digest the day’s headlines.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

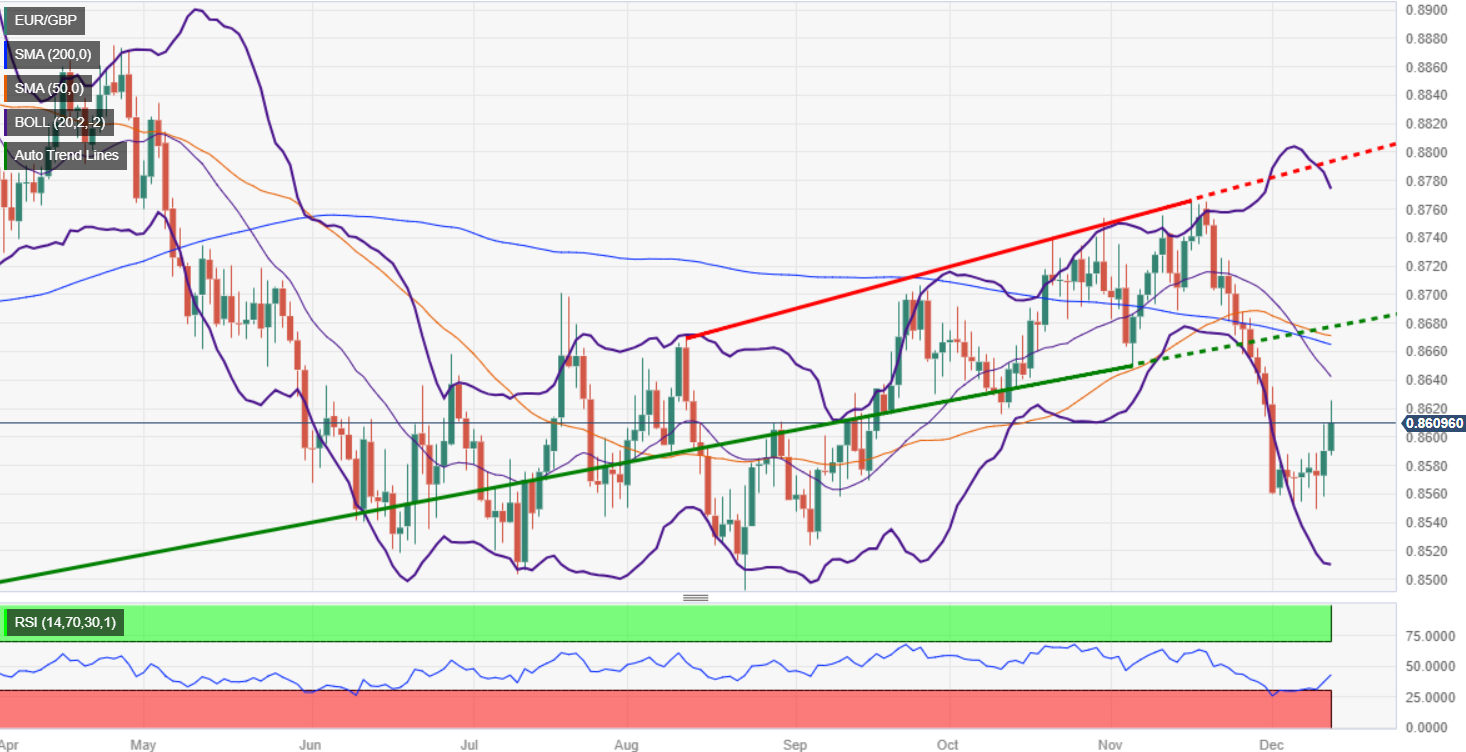

- EUR/GBP prints a new high in eight days, but it remains shy of reclaiming a key technical resistance level.

- Near term, the cross is upward biased and could extend its rally if it reclaims the 100, 200, and 50-DMAs.

- A drop below 0.8600 would confirm the downtrend remains intact.

The EUR/GBP advances to an eight-day high of 0.8623 but remains bearish in the medium term after news from the UK showed its economy contracted for the second time in the year, as data revealed. Hence, the cross is trading at 0.86100 after jumping from a daily low of 0.8583, a gain of 0.21%.

The daily chart depicts the downtrend remains intact, but if EUR/GBP buyers reclaim the 100-day moving average (DMA) at around 0.8638, that could pave the way to challenge the 200-DMA at 0.8663. further upside is seen above that level, with the 50-DMA at 0.8660, and expect an upside move to 0.8700.

On the other hand, if the pair slides below the 0.8600 figure, that could open the door to retesting the December 11 swing low of 0.8549, ahead of falling toward the year-to-date (YTD) low of 0.8492.

EUR/GBP Price Analysis – Daily Chart

EUR/GBP Technical Levels

- The XAG/USD hovers near the $22.70 level, experiencing 0.70% losses.

- Soft PPI figures underpin the Fed's dovish stance, producing a viable environment for sooner rate cuts.

- US bonds are sharply declining.

In Wednesday's trading session, Silver’s price (XAG/USD) recorded 0.70% losses, currently hovering around the $22.70 level. This decline comes ahead of the decision by the Federal Reserve, which will be a key driver in the market's next movements. In addition, the metal failed to capitalize on the lower US yields, which declined after the soft Producer Price Index (PPI) was reported from the US.

In that sense, the US Final Demand Producer Price Index (PPI) showed a yearly ascent of 0.9% in November, a slowdown from its 1.2% climb in October, as the US Bureau of Labor Statistics disclosed this Wednesday. The data fell short of the anticipated 1% market projection. Furthermore, the yearly Core PPI rose by a marginal 2%, underperforming October's figures and analysts' predictions of 2.4% and 2.2%, respectively.

As a reaction, US bond yields declined, as the US economy exhibited further evidence of inflation cooling down. The 2-year rate is noted at 4.66%, with the 5-year rate dropping to 4.17% and the 10-year yield further down at 4.15%. This downturn may lighten the load on non-yielding metals, as bond yields are commonly seen as the opportunity cost of holding these assets.

For the rest of the session, the Fed’s tone and fresh economic and interest projections will be closely watched for investors to place their bets on the calendar for rate cuts in 2024. In line with that, a more dovish approach may generate further pressure on bond yields which may open the upside to the gray metal.

XAG/USD levels to watch

On the daily chart, indicators suggest a bearish bias as the metal tallies an eight-day losing streak. The Relative Strength Index (RSI) sits flat and in negative territory, signaling that the selling pressure may be losing steam and that consolidation may be on the horizon.

However, the Moving Average Convergence Divergence (MACD) draws attention to the rising red bars, hinting that the momentum remains in favour of the sellers.

On a broader time frame, though, the position of the metal in relation to its Simple Moving Averages (SMAs) speaks more in favor of the sellers. The price is trading under the 20,100 and 200-day SMA, which indicates weakness, illustrating that bearish control is dominant over the long haul.

Support Levels: $22.30, $$22.15, $22.00.

Resistance Levels: $$22.80, $, $23.00, $23.15 (100-day SMA).

XAG/USD daily chart

-638380815057407747.png)

- GBP/USD has fallen below 1.2600 courtesy of weak UK economic data.

- UK GDP plunged for the second time in the year, as in June 2023.

- Traders are awaiting the Fed’s decision and projections material for clues on forward guidance.

The GBP/USD fell 0.32% during the North American session, after data from the United Kingdom (UK), depicted the economy is at the brisk of recession amid a high inflation period. That and investors awaiting the Federal Reserve’s decision on monetary policy keep the Greenback in the driver’s seat. At the time of writing, the major is trading at 1.2519.

UK GDP missed forecasts, while US inflation in the producer side eased