- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | National Australia Bank's Business Confidence | April | 1 | |

| 05:00 | Japan | Eco Watchers Survey: Outlook | April | 48.6 | 49.4 |

| 05:00 | Japan | Eco Watchers Survey: Current | April | 44.8 | 46.7 |

| 06:00 | Germany | CPI, m/m | April | 0.4% | 1% |

| 06:00 | Germany | CPI, y/y | April | 1.3% | 2% |

| 06:30 | Switzerland | Producer & Import Prices, y/y | April | -0.2% | -0.4% |

| 07:15 | U.S. | FOMC Member Williams Speaks | |||

| 08:30 | United Kingdom | Average earnings ex bonuses, 3 m/y | March | 3.4% | 3.3% |

| 08:30 | United Kingdom | Average Earnings, 3m/y | March | 3.5% | 3.4% |

| 08:30 | United Kingdom | ILO Unemployment Rate | March | 3.9% | 3.9% |

| 08:30 | United Kingdom | Claimant count | April | 28.3 | 24.2 |

| 09:00 | Eurozone | ZEW Economic Sentiment | May | 4.5 | 1.0 |

| 09:00 | Germany | ZEW Survey - Economic Sentiment | May | 3.1 | 5 |

| 09:00 | Eurozone | Industrial production, (MoM) | March | -0.2% | -0.3% |

| 09:00 | Eurozone | Industrial Production (YoY) | March | -0.3% | -0.8% |

| 12:30 | U.S. | Import Price Index | April | 0.6% | 0.7% |

| 16:45 | U.S. | FOMC Member Esther George Speaks |

Major US stock indexes have fallen significantly, as investors reacted to Beijing’s decision to raise tariffs on certain US goods in response to Washington’s increase in tariffs on Chinese imports last week. This raised fears that another round of retaliation might push the US economy into recession.

China announced its intention to raise tariffs on American goods by $ 60 billion to 5-25% from 5-10%, starting from June 1. Products subject to new tariffs include a wide range of agricultural products. This happened after US President Donald Trump raised tariffs for Chinese products totaling $ 200 billion from 10% to 25% at the end of last week. China’s statement said the US decision jeopardized the interests of both countries and did not meet the “general expectations of the international community.”

Against this background, the shares of technology companies, including manufacturers of microcircuits, industrial giants, and retailers, whose business is largely tied to China, were in the epicenter of sales.

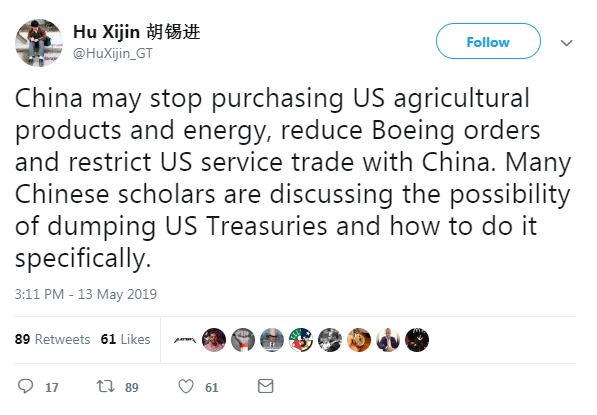

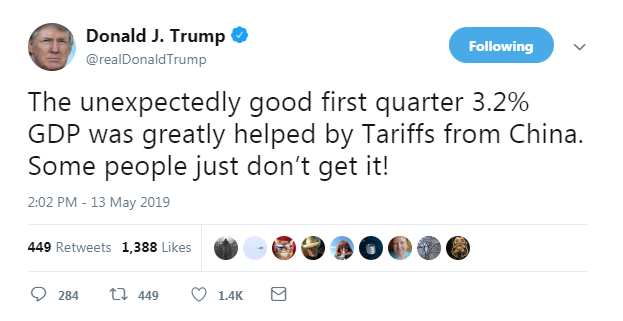

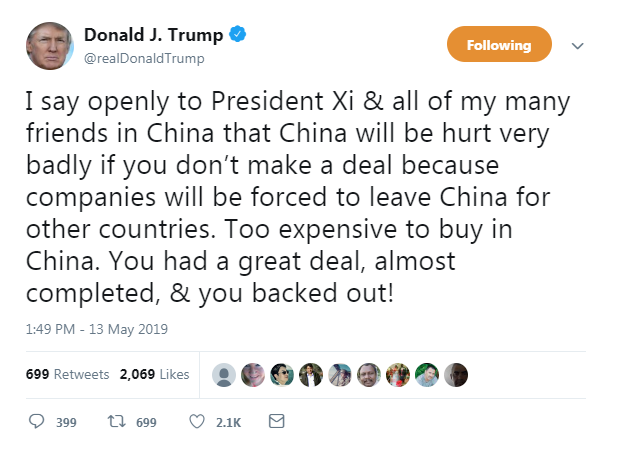

US President Trump said earlier on Twitter: “I openly tell President Xi and all my many friends in China that it will be very painful for China if you do not make a deal because companies will have to leave China in favor of other countries. Too expensive to buy in China. You had a great deal, almost done, but you backed off! ”He also warned Beijing not to retaliate against the tariff increase he introduced last week.

Despite tensions between the two largest economies in the world, White House Economic Adviser Larry Kudlow said Sunday that Trump and Chinese President Xi Jinping will most likely meet at the G-20 summit in Japan in June. Cudlow said that the chances for such a meeting were “pretty good,” but added that “there are no concrete, clear plans” for when the negotiators of the United States and China will meet again.

Almost all DOW components recorded a decline (29 of 30). Outsider were shares of Apple Inc. (AAPL; -5.85%). Only the shares of The Procter & Gamble Company (PG, + 0.18%) went up.

Almost all sectors of the S & P finished trading in the red. The largest decline was shown by the conglomerate sector (-4.4%). Only the utility sector grew (+ 0.4%).

At the time of closing:

Dow 25,324.99 -617.38 -2.38%

S & P 500 2,811.87 -69.53 -2.41%

Nasdaq 100 7,647.02 -269.92 -3.41%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | National Australia Bank's Business Confidence | April | 1 | |

| 05:00 | Japan | Eco Watchers Survey: Outlook | April | 48.6 | 49.4 |

| 05:00 | Japan | Eco Watchers Survey: Current | April | 44.8 | 46.7 |

| 06:00 | Germany | CPI, m/m | April | 0.4% | 1% |

| 06:00 | Germany | CPI, y/y | April | 1.3% | 2% |

| 06:30 | Switzerland | Producer & Import Prices, y/y | April | -0.2% | -0.4% |

| 07:15 | U.S. | FOMC Member Williams Speaks | |||

| 08:30 | United Kingdom | Average earnings ex bonuses, 3 m/y | March | 3.4% | 3.3% |

| 08:30 | United Kingdom | Average Earnings, 3m/y | March | 3.5% | 3.4% |

| 08:30 | United Kingdom | ILO Unemployment Rate | March | 3.9% | 3.9% |

| 08:30 | United Kingdom | Claimant count | April | 28.3 | 24.2 |

| 09:00 | Eurozone | ZEW Economic Sentiment | May | 4.5 | 1.0 |

| 09:00 | Germany | ZEW Survey - Economic Sentiment | May | 3.1 | 5 |

| 09:00 | Eurozone | Industrial production, (MoM) | March | -0.2% | -0.3% |

| 09:00 | Eurozone | Industrial Production (YoY) | March | -0.3% | -0.8% |

| 12:30 | U.S. | Import Price Index | April | 0.6% | 0.7% |

| 16:45 | U.S. | FOMC Member Esther George Speaks |

Survey of Consumer Expectations, released by the Federal Reserve Bank of New York’s Center for Microeconomic Data, revealed a decline in short- and medium- term inflation expectations in April.

According to the report, median inflation expectations dropped by 0.2 percentage points at both the one-year and three-year horizon, to 2.6% and 2.7% in April respectively, their lowest readings since late 2017. The decreases were broad-based across income groups.

Median home price change expectations remained stable at 3.0% in April, the fifth consecutive reading at this level, while expectations for changes in the cost of a college education and medical care rose to 7.2% and 7.8% in April, from 5.8% and 7.5% in March, respectively. The median one-year ahead expected change in gasoline prices increased to 4.9% in April from 4.7% in March.

TD Securities' analysts are not expecting further rate increases from the Bank of Canada (BoC), meaning the overnight rate will top out at 1.75% this cycle.

- Q4 GDP was the nail in the coffin, as the muted growth figures and expectations for sub-trend growth in Q1 imply an output gap that will not close before the end of 2020; our current tracking of Q1 growth sits at 0.6%.

- Furthermore, recent developments suggest that homeowners are still struggling to adapt to higher rates, with existing home sales holding near a 7-year low in March while household leverage sits at a record high. Core inflation firmed to 1.97% in March but most of the move was driven by base-effects and we see little scope for further gains given the muted growth backdrop.

- The labour market remains the one bright spot in the domestic economy, perplexingly, with the April LFS reporting monthly job creation of 106.5k which pushed the six-month average to 51k. Furthermore, wages have finally started to pick up off the lows with average hourly earning for permanent workers running at 2.6% y/y. While this should provide the BoC some comfort to remain on the sidelines as the market prices in cuts, it is not enough to keep the Bank on a tightening path.

Monetary policy is currently accommodative, one uncertainty is trade

Any weakening in U.S. economy from this stage due to trade would be noticeable to people

Analysts at TD Securities are expecting the Canadian headline CPI to firm to 2.0% y/y in April, leaving inflation at Bank of Canada's (BoC) target for the first month since December.

- Our forecast is consistent with a 0.4% m/m increase, helped by a broad pickup in energy prices on the heels of the federal carbon backstop imposed on Ontario, Saskatchewan, Manitoba and New Brunswick on April 1st.

- Looking past energy prices, we expect CAD depreciation to provide a tailwind to food products while ex. food and energy prices should see a soft 0.1% increase (0.2% seasonally adjusted); BoC measures of core inflation are likely to hold at 2.0% on average.

- Inflation running close to our 2%-objective

- Fed open-minded as we review policy practices

U.S. stock-index futures fell sharply on Monday after China decided to hike tariffs on $60 billion worth of U.S. imports as the ongoing trade tension between the world’s two largest economies intensifies.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,191.28 | -153.64 | -0.72% |

Hang Seng | - | - | - |

Shanghai | 2,903.71 | -35.50 | -1.21% |

S&P/ASX | 6,297.60 | -13.30 | -0.21% |

FTSE | 7,161.59 | -41.70 | -0.58% |

CAC | 5,262.84 | -64.60 | -1.21% |

DAX | 11,867.81 | -192.02 | -1.59% |

Crude oil | $62.64 | +1.57% | |

Gold | $1,292.20 | +0.37% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 172.76 | -3.10(-1.76%) | 19468 |

ALCOA INC. | AA | 24.5 | -0.54(-2.16%) | 5252 |

ALTRIA GROUP INC. | MO | 51.7 | -0.41(-0.79%) | 3604 |

Amazon.com Inc., NASDAQ | AMZN | 1,838.26 | -51.72(-2.74%) | 123013 |

American Express Co | AXP | 116.09 | -2.37(-2.00%) | 2778 |

AMERICAN INTERNATIONAL GROUP | AIG | 50.25 | -1.39(-2.69%) | 397 |

Apple Inc. | AAPL | 189.6 | -7.58(-3.84%) | 739134 |

AT&T Inc | T | 30.36 | -0.26(-0.85%) | 91651 |

Boeing Co | BA | 342.93 | -11.74(-3.31%) | 117005 |

Caterpillar Inc | CAT | 126.1 | -5.24(-3.99%) | 43737 |

Chevron Corp | CVX | 121 | -0.99(-0.81%) | 4340 |

Cisco Systems Inc | CSCO | 52.2 | -1.16(-2.17%) | 38795 |

Citigroup Inc., NYSE | C | 66.3 | -1.60(-2.36%) | 23125 |

Deere & Company, NYSE | DE | 149.2 | -6.85(-4.39%) | 4755 |

Exxon Mobil Corp | XOM | 75.8 | -0.76(-0.99%) | 13828 |

Facebook, Inc. | FB | 183.81 | -4.53(-2.41%) | 104360 |

FedEx Corporation, NYSE | FDX | 174.05 | -3.95(-2.22%) | 2171 |

Ford Motor Co. | F | 10.16 | -0.22(-2.12%) | 162310 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11 | -0.37(-3.25%) | 47446 |

General Electric Co | GE | 9.93 | -0.20(-1.97%) | 250219 |

General Motors Company, NYSE | GM | 37.16 | -0.73(-1.93%) | 11005 |

Goldman Sachs | GS | 197.88 | -4.17(-2.06%) | 10007 |

Google Inc. | GOOG | 1,143.32 | -20.95(-1.80%) | 11880 |

Hewlett-Packard Co. | HPQ | 18.8 | -0.32(-1.67%) | 2790 |

Home Depot Inc | HD | 191.24 | -3.34(-1.72%) | 4240 |

HONEYWELL INTERNATIONAL INC. | HON | 168.67 | -2.96(-1.72%) | 1008 |

Intel Corp | INTC | 45.13 | -1.07(-2.32%) | 132928 |

International Business Machines Co... | IBM | 133.13 | -2.19(-1.62%) | 8924 |

International Paper Company | IP | 44.97 | -0.68(-1.49%) | 1504 |

Johnson & Johnson | JNJ | 137.51 | -1.54(-1.11%) | 2965 |

JPMorgan Chase and Co | JPM | 110 | -2.51(-2.23%) | 23271 |

McDonald's Corp | MCD | 198.76 | -1.23(-0.62%) | 7568 |

Merck & Co Inc | MRK | 77.39 | -0.80(-1.02%) | 3678 |

Microsoft Corp | MSFT | 124.28 | -2.85(-2.24%) | 126754 |

Nike | NKE | 82.22 | -1.73(-2.06%) | 10098 |

Pfizer Inc | PFE | 40.21 | -0.51(-1.25%) | 18019 |

Procter & Gamble Co | PG | 105.75 | -0.26(-0.25%) | 8076 |

Starbucks Corporation, NASDAQ | SBUX | 77.4 | -1.02(-1.30%) | 14818 |

Tesla Motors, Inc., NASDAQ | TSLA | 232.25 | -7.27(-3.04%) | 214416 |

The Coca-Cola Co | KO | 47.86 | -0.33(-0.68%) | 6200 |

Travelers Companies Inc | TRV | 142.66 | -1.30(-0.90%) | 1517 |

Twitter, Inc., NYSE | TWTR | 37.36 | -1.09(-2.83%) | 67004 |

United Technologies Corp | UTX | 130.92 | -6.25(-4.56%) | 775 |

UnitedHealth Group Inc | UNH | 236.75 | -3.84(-1.60%) | 4905 |

Verizon Communications Inc | VZ | 56.55 | -0.36(-0.63%) | 7126 |

Visa | V | 157.22 | -3.49(-2.17%) | 26726 |

Wal-Mart Stores Inc | WMT | 101 | -0.91(-0.89%) | 11125 |

Walt Disney Co | DIS | 132.2 | -1.84(-1.37%) | 48195 |

Yandex N.V., NASDAQ | YNDX | 35.99 | -0.26(-0.72%) | 210 |

Chevron (CVX) resumed with a Buy at Citigroup; target lowered to $135

Deere (DE) downgraded to Neutral from Outperform at Robert W. Baird; target lowered to $150

Exxon Mobil (XOM) downgraded to Hold from Buy at HSBC Securities

Christopher Graham, the economist at Standard Chartered, suggests that the European parliamentary elections, which are set to be held on 23-26 May, could be the most important in years, with populist, Eurosceptic parties potentially securing more than 30% of seats in the parliament.

- We are likely to see an end to the centre-left, centre-right grand coalition which has dominated European politics for years, and a more diverse coalition of governing parties emerging as a result, rendering reform efforts and policy-making potentially more difficult than previously.

- The rise of populist, Eurosceptic parties does not present an immediate existential risk to the EU, given that most parties are no longer pushing to leave the EU but rather reform it from within. However, if these parties can align their interests on key issues, they could become a potent force in the EU legislative process, providing a robust check on the Commission and national governments seeking to adopt a more pro-integrationist policy framework.

- Investor sentiment is susceptible to the rise in prominence of populist, Eurosceptic parties at the European level; however, given that a centrist coalition is still likely to emerge (albeit with more parties), any immediate market volatility is likely to be tempered.

- The bigger threat to investor sentiment will be the extent to which fragmentation of the European Parliament (EP) following this election holds back the completion of post-euro area crisis reforms to European institutions and financial architecture, given their importance to the EU’s long-term economic stability.

- Need to let inflation continue to build

- Tariff rate will go into effect on June 1st at 12:01 a.m.

- Products included in this tranche of tariffs: Medium sized aircraft, metals, tires, golf clubs, crude oil, and liquified natural gas

- Having dropped lower in the November/December period in response to a more dovish outlook for the Fed, USD longs then consolidated for a lengthy period. Another leg lower occurred in mid-March.

- The level of JPY shorts lurched lower last week as tension in the market regarding US/China trade talks and Iran spiked higher.

- Net short GBP positions extended further for a third consecutive week.”

- Short EUR positions crept a little higher and are holding at their highest levels since December 2016.

- CHF net shorts edged down a touch in reflection of the demand for safe haven. That said, they remain at relatively elevated levels.

- CAD net shorts edged lower for a third consecutive week following the surge in mid- April that followed the dovish headlines that accompanied the BoC policy meeting.

- AUD net shorts dropped back last week following the steady policy decision from the RBA.

- Time to ease off the gas pedal in terms of stimulating the economy

- PM believes clear desire from country and business for parliament to find a way to support the deal, acknowledges uncertainty

- Brexit talks with Labour will resume later on Monday

- Talks are serious, two sides have discussed many issues and exchanged correspondence

Analysts at the Royal Bank of Scotland note that the U.S. president Donald Trump upped the ante in the U.S.-China trade talks last week, hiking tariffs on $200 billion worth of Chinese goods from 10% to 25%.

- Earlier hikes in tariffs have had, to date, a limited impact. A combination of the tariffs being devised to be felt by Chinese suppliers, a falling Chinese currency and producers accepting smaller margins blunted their efficacy. This time it might be harder to insulate US consumers from the effects, a little upward pressure on prices may be unavoidable. Who has more to lose?

- Well, Chinese exports to the US are equal to about 2.5% of China’s GDP. For the US it’s much smaller, around 1%. But that’s just one angle to the trade war, there are a host of others.

- Says hoping for the best regarding possible auto tariffs

- Says will be meeting with U.S. Trade Representative Lighthizer next week

According to analysts at ING, there seems to be a little reason to change the near term view that EUR/USD pair stays offered this summer and will test the 1.10, barring a temporary squeeze of short EUR positions.

“US-China trade tension is unresolved and there is a still a risk that later this month President Trump opts for tariffs on auto imports. Admittedly there are a few green shoots in terms of European growth, but probably not enough to lift Euro area interest rates off the floor. The TLTRO III to be announced by the ECB in June should also cement the view that EUR rates stay lower for longer. A good showing from Salvini’s League in European elections end month also raises the risk of new Italian elections later this year.”

Germany is liaising closely with the European Union on a U.S. threat to impose higher car tariffs, the Economy Ministry said, adding that the German government would not speculate about the timing of the U.S. decision.

"Our general point of view is clear: We need fewer tariffs, not more," the ministry said, adding that Germany was in favour of reaching an industrial tariffs agreement to reduce all tariffs in this sector to zero.

European Trade Commissioner Cecilia Malmstrom told that she expects U.S. President Donald Trump to delay a May 18 deadline for U.S. tariffs on cars imported from the European Union.

In view of Axel Rudolph, analyst at Commerzbank, USD/JPY pair remains under pressure following its recent key week reversal from the 112.48 2015-2019 downtrend.

“It has however sold off to an interim target at 109.70/23. This area represents the March low, the base of the weekly cloud at 109.55 and the 38.2% retracement at 109.23 and we may see some near term consolidation around here. Failure there targets the 50% retracement at 108.25 and the 107.27 61.8% Fibonacci retracement. Intraday rallies are indicated to fail around 110.10/40. Above the 112.48 downtrend will target the 114.55 October 2018 high.”

China's yuan was set for its worst daily fall in nine months on Monday as trade negotiations between the U.S. and China ended after President Donald Trump raised tariffs on Chinese goods.

Currency moves in response to the latest trade hostilities have been muted, but on Monday the yuan fell 0.85% to 6.9043, its weakest since December. 27. Some analysts say it may breach 7 per dollar in coming months, a level last seen during the global financial crisis.

China would probably use its vast currency reserves to stop any plunge through 7 to the dollar, which could trigger speculation and heavy capital outflows.

"We’re waiting to see if China retaliates to the latest round of U.S. tariffs ... and continue to favour the yen on a short-term basis and expect the market to remain focussed on the yuan," said Chris Turner, an ING currency strategist.

France is forecast to expand at a steady pace in the second quarter, according to a monthly survey from Bank of France.

Gross domestic product is expected to grow 0.3 percent in the second quarter, the same rate as registered in the first quarter.

The confidence index in the manufacturing sector dropped to 99 in April from 100 in March. In April, industrial production slowed down. However, business leaders expect output to pick up in May.

In services, the business sentiment indicator came in at 100 in April versus 101 in March. Business leaders forecast activity to grow in May.

The business sentiment index in construction slid to 105 in April from 106 in March.

China's foreign ministry said on Monday the country will never surrender to foreign pressure after Washington renewed its threat to impose tariffs on all Chinese imports in an escalating trade dispute.

Foreign ministry spokesman Geng Shuang made the comments at a daily briefing in Beijing.

Geng declined to comment on what countermeasures China planned to announce in response to the U.S. tariff hike on $200 billion worth of Chinese goods on Friday.

delay in Brexit deadline to October will have a negative impact on investments.

Investment already feeling the consequences of uncertainty.

If Brexit deal is struck, there could be quite a strong rebound in investment.

any BOE rate hikes will be gradual.

Haven't decided whether to apply to succeed Carney as BoE Governor.

According to analysts at National Bank Financial, for the US economy, we’ll get information about economic activity in early Q2 thanks to April data and will be in focus this week.

“Industrial production could have bounced back in the month following March’s lackluster performance, as shrinking production in both the utilities and mining segments may have been offset by a healthy expansion in the manufacturing sector. The April retail sales report will also come out. Poor auto sales during the month hint at a stagnation of headline retail outlays. Ex-auto sales, on the other hand, may have continued to expand, helped by another sharp increase in seasonally-adjusted pump prices which likely boosted station receipts. The week will also provide some important information about the state of the housing market in April with the publication of building permits and housing starts. The latter may have increased to around 1,220K in seasonally adjusted annualized terms. The first clues on the state of the manufacturing sector in May will be available with the publication of the Empire State and Philly Fed manufacturing surveys.”

European Trade Commissioner Cecilia Malmstroem expects U.S. President Donald Trump to delay a May 18 deadline for U.S. tariffs on cars imported from the EU, according to an interview published in the Sueddeutsche newspaper.

Trump, who raised tariffs on $200 billion of Chinese imports earlier this month, is due to make a decision about European cars which could affect some 47 billion euros worth of car and auto part exports.

Malmstroem said it was possible the deadline could be extended as Washington focuses on its ongoing negotiations with Beijing.

Should Trump go ahead with tariffs on May 18, the EU had a list of U.S. products worth 20 billion euros on which retaliatory tariffs could be levied, she said.

Axel Rudolph, analyst at Commerzbank, suggests that the EUR/USD pair is nearing the 55 day moving average at 1.1261 and they continue to favour the topside.

“For now they are unable to rule out a retest of the 1.1110 April low. If seen, we look for this to hold. Be advised that the pattern being traced out is a potential large reversal pattern. We have positive divergence on the weekly RSI and a Tom DeMark 13 count on the weekly chart as well and hence there is a high chance of bullish reversal soon being seen. Overhead lies the 100 day ma at 1.1319 and the September-to-May resistance line at 1.1339. Further up meanders the 200 day moving average at 1.1400. This would have to be bettered for a bullish reversal to be confirmed. Support at 1.1110 is regarded as the break down point to the 2018-2019 support line at 1.1100 and the 1.0814 78.6% Fibonacci retracement.”

As the relationships between countries shift over the next few decades, expect trade to remain a hot button issue, according to one analyst. That prediction comes as the U.S. and China continue to square off in a trade war that has roiled global markets. Last week, U.S. President Donald Trump hiked tariffs on billions of dollars worth of Chinese goods, and China threatened to retaliate.

As countries, including China, accrue more power on the global stage, investors should expect more trade arguments ahead, according to James Sullivan, head of Asia ex-Japan equity research at J.P. Morgan.

“As we start to move toward a multi-polar world, I think we have to recognize that these trade conversations are not fits and starts. I think we have to recognize this is now the new normal,” Sullivan told.

“These trade conversations are now part of the backdrop of global markets for the next ... 10 to 20 years as these countries and economies work out their relative place in the world and how we reorder the overall global structure to account for the rise of China, to account for a multi-polar environment,” he said.

Vehicles sales in China fell 14.6% in April from the same month a year earlier, to 1.98 million, marking the 10th consecutive month of decline, the China Association of Automobile Manufacturers (CAAM) said.

That followed declines of 5.2 percent in March and 14 percent in February, as well as the first annual contraction last year since the 1990s against a backdrop of slowing economic growth and crippling trade war with the United States.

Automakers have been lowering prices in China after the government introduced tax cuts to spur consumer spending.

Sales of new energy vehicles (NEV), however, remain a bright spot, rising 18.1% in April to 97,000 vehicles, CAAM said. NEV sales jumped almost 62 percent last year even as the broader auto market contracted.

President Donald Trump said on Sunday that the United States is "right where we want to be with China," adding that Beijing "broke the deal with us" and then sought to renegotiate.

"We will be taking in Tens of Billions of Dollars in Tariffs from China. Buyers of product can make it themselves in the USA (ideal), or buy it from non-Tariffed countries," Trump said on Twitter.

Trump added: "We will then spend (match or better) the money that China may no longer be spending with our Great Patriot Farmers (Agriculture), which is a small percentage of total Tariffs received, and distribute the food to starving people in nations around the world!"

TD Securities analysts note that the weekend developments in the US-China trade war included more Trump tweets and China denying that they had reneged on any prior agreements.

“Liu He said such changes were “natural” and he said the remaining differences were “matters of principle” ie China is unlikely to make concessions on such changes. Meanwhile Kudlow suggested that Trump and Xi could meet at the G20 at the end of next month, a glimmer of hope. The US administration is expected to give details of tariffs on a further $325bn of Chinese exports to the US as early as today. China has promised retaliation and we could see them outline further tariffs on US exports in the next couple of days as well as the possibility of non-tariff barriers. There are no further negotiations scheduled between the US and China though Kudlow has said that China has invited Mnuchin and Lighthizer to Beijing for further talks. Given that Trump now appears to have a unified administration while China stalls, we don’t expect any quick resolution.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1346 (4660)

$1.1320 (2937)

$1.1301 (1388)

Price at time of writing this review: $1.1228

Support levels (open interest**, contracts):

$1.1195 (3093)

$1.1164 (8130)

$1.1126 (5301)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date June, 7 is 116312 contracts (according to data from May, 10) with the maximum number of contracts with strike price $1,1200 (8131);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3201 (2709)

$1.3168 (1944)

$1.3114 (968)

Price at time of writing this review: $1.3006

Support levels (open interest**, contracts):

$1.2943 (2059)

$1.2918 (1296)

$1.2888 (1809)

Comments:

- Overall open interest on the CALL options with the expiration date June, 7 is 37667 contracts, with the maximum number of contracts with strike price $1,3450 (3309);

- Overall open interest on the PUT options with the expiration date June, 7 is 38100 contracts, with the maximum number of contracts with strike price $1,2700 (4175);

- The ratio of PUT/CALL was 1.01 versus 1.00 from the previous trading day according to data from May, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 70.28 | 0.64 |

| WTI | 61.79 | 0.18 |

| Silver | 14.75 | 0.14 |

| Gold | 1285.606 | 0.17 |

| Palladium | 1349.02 | 4.14 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -57.21 | 21344.92 | -0.27 |

| Hang Seng | 239.17 | 28550.24 | 0.84 |

| KOSPI | 6.03 | 2108.04 | 0.29 |

| ASX 200 | 15.6 | 6310.9 | 0.25 |

| FTSE 100 | -4.12 | 7203.29 | -0.06 |

| DAX | 85.91 | 12059.83 | 0.72 |

| CAC 40 | 14.28 | 5327.44 | 0.27 |

| Dow Jones | 114.01 | 25942.37 | 0.44 |

| S&P 500 | 10.68 | 2881.4 | 0.37 |

| NASDAQ Composite | 6.35 | 7916.94 | 0.08 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.69977 | 0.13 |

| EURJPY | 123.499 | 0.34 |

| EURUSD | 1.12326 | 0.13 |

| GBPJPY | 142.941 | 0.15 |

| GBPUSD | 1.30004 | -0.07 |

| NZDUSD | 0.65967 | 0.05 |

| USDCAD | 1.34125 | -0.4 |

| USDCHF | 1.01164 | -0.3 |

| USDJPY | 109.942 | 0.21 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.