- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 03:00 | China | Trade Balance, bln | December | 37.93 | 48 |

| 05:00 | Japan | Eco Watchers Survey: Current | December | 39.4 | 36.9 |

| 05:00 | Japan | Eco Watchers Survey: Outlook | December | 45.7 | 44.7 |

| 08:30 | Eurozone | ECB's Yves Mersch Speaks | |||

| 13:30 | U.S. | CPI, m/m | December | 0.3% | 0.3% |

| 13:30 | U.S. | CPI excluding food and energy, m/m | December | 0.2% | 0.2% |

| 13:30 | U.S. | CPI, Y/Y | December | 2.1% | 2.3% |

| 13:30 | U.S. | CPI excluding food and energy, Y/Y | December | 2.3% | 2.3% |

| 14:00 | U.S. | FOMC Member Williams Speaks | |||

| 21:45 | New Zealand | Food Prices Index, y/y | December | 2.4% |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 03:00 | China | Trade Balance, bln | December | 37.93 | 48 |

| 05:00 | Japan | Eco Watchers Survey: Current | December | 39.4 | 36.9 |

| 05:00 | Japan | Eco Watchers Survey: Outlook | December | 45.7 | 44.7 |

| 08:30 | Eurozone | ECB's Yves Mersch Speaks | |||

| 13:30 | U.S. | CPI, m/m | December | 0.3% | 0.3% |

| 13:30 | U.S. | CPI excluding food and energy, m/m | December | 0.2% | 0.2% |

| 13:30 | U.S. | CPI, Y/Y | December | 2.1% | 2.3% |

| 13:30 | U.S. | CPI excluding food and energy, Y/Y | December | 2.3% | 2.3% |

| 14:00 | U.S. | FOMC Member Williams Speaks | |||

| 21:45 | New Zealand | Food Prices Index, y/y | December | 2.4% |

- Expectations for future sales growth remain positive. Foreign demand, particularly US demand, continues to lift export prospects, with businesses reporting improved orders from foreign customers compared with 12 months ago. In addition, with concerns around trade tensions declining somewhat, firms' expectations for US economic growth have recovered slightly

- Intentions to increase investment spending are somewhat less widespread but remain positive

- Firms' hiring intentions improved

- The indicator of capacity pressures edged up for the third consecutive quarter, suggesting that economic slack has been absorbed

- Inflation expectations are unchanged

- Watching for risks of higher inflation and asset prices

- Downside risks include trade and slower global growth

- This is what a soft landing looks like

- Strong labor market putting upward pressure on wages

- Low-interest rates may spur house-price increases

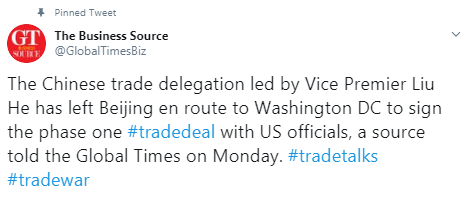

Analysts at Deutsche Bank suggest the main highlights for the week ahead will be the signing of the Phase One trade deal between the U.S. and China (Wednesday).

- "US Treasury Secretary Steven Mnuchin said over the weekend that an English-language version of the agreement will be released this week. It's quite remarkable that we still don't know much in the way of details so eyes will be on this. We'll also see the start of US earnings season with a number of banks reporting. On Tuesday we'll hear from JPMorgan Chase, Wells Fargo and Citigroup. Then on Wednesday we'll get Bank of America, UnitedHealth Group, Goldman Sachs, US Bancorp and BlackRock. Finally on Thursday, we'll hear from Morgan Stanley and BNY Mellon. In terms of data CPI (Tuesday), retail sales (Thursday), and consumer confidence (Friday) are the main highlights in the US. In China we have trade data (Tuesday) and Q4 GDP/retail sales/industrial production (Friday). So we'll have quite a good idea about momentum in the Chinese economy by the end of the week. In Europe industrial production numbers (Tuesday), and the flash CPI (Friday) are the highlights. The UK also sees CPI (Wednesday) and retail sales (Friday).

- In terms of central banks over the coming week, publications to watch for include the Beige Book from the Fed on Wednesday, and then the ECB's monetary policy account of its December meeting (and Christine Lagarde's first as ECB President) on Thursday.

- Over to politics now, and there's a number of upcoming events this week. In the US, it's the last Democratic primary debate on Tuesday before primary voting kicks off in February. Former Vice President Biden is currently ahead in the national polling according to the average on RealClear Politics. However, the polls in the first two states to vote in February, Iowa and New Hampshire, are much tighter, with the RealClear Politics average putting the 3 top candidates in Iowa between 20% and 22%, so it's a tight race going into the caucuses there on 3rd February."

National Institute of Economic and Social Research (NIESR) reported on Monday its estimates revealed the UK's economy is on course to show zero growth in Q4 of 2019, consistent with a growth of 1.4 percent in 2019 as a whole. Economist had forecast a 0.3 percent decline in Q4.

It was also noted that the ONS statistics published this morning revealed the UK economy grew by 0.1 percent in the three months to November, a little faster than NIESR had expected last month, reflecting upward revisions to the September and October data.

Dr. Garry Young, Director of Macroeconomic Modelling and Forecasting at NIESR, said: "The latest data confirm that economic growth in the United Kingdom had petered out at the end of last year. GDP was virtually flat in the three months to November and the latest surveys point to further stagnation in December. While there is some evidence of an improvement in business optimism following the general election, it is doubtful that this will do much to change the short-term economic outlook of further lacklustre growth."

U.S. stock-index futures rose on Monday ahead of an eventful week, which sees the start of the fourth-quarter earnings season, as well as the signing of a Phase One trade deal with China and a bulk of important economic data.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | - | - | - |

| Hang Seng | 28,954.94 | +316.74 | +1.11% |

| Shanghai | 3,115.57 | +23.28 | +0.75% |

| S&P/ASX | 6,903.70 | -25.30 | -0.37% |

| FTSE | 7,607.82 | +19.97 | +0.26% |

| CAC | 6,043.05 | +5.94 | +0.10% |

| DAX | 13,459.77 | -23.54 | -0.17% |

| Crude oil | $59.07 | | +0.05% |

| Gold | $1,555.90 | | -0.26% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 181.8 | 0.60(0.33%) | 3869 |

| ALCOA INC. | AA | 19.79 | -0.02(-0.10%) | 2899 |

| ALTRIA GROUP INC. | MO | 50.4 | -0.17(-0.34%) | 6770 |

| Amazon.com Inc., NASDAQ | AMZN | 1,907.00 | 5.95(0.31%) | 32993 |

| American Express Co | AXP | 128 | 0.19(0.15%) | 2532 |

| AMERICAN INTERNATIONAL GROUP | AIG | 52.31 | 0.03(0.06%) | 1206 |

| Apple Inc. | AAPL | 310.8 | 1.17(0.38%) | 684820 |

| AT&T Inc | T | 38.86 | 0.06(0.15%) | 28435 |

| Boeing Co | BA | 334.3 | -2.04(-0.61%) | 75405 |

| Caterpillar Inc | CAT | 147.65 | 0.34(0.23%) | 1197 |

| Chevron Corp | CVX | 117.65 | 0.14(0.12%) | 1466 |

| Cisco Systems Inc | CSCO | 47.38 | 0.06(0.13%) | 9500 |

| Citigroup Inc., NYSE | C | 80.01 | -0.07(-0.09%) | 26862 |

| E. I. du Pont de Nemours and Co | DD | 61 | 0.05(0.08%) | 613 |

| Exxon Mobil Corp | XOM | 69.85 | 0.09(0.13%) | 10977 |

| Facebook, Inc. | FB | 219.7 | 1.40(0.64%) | 125612 |

| FedEx Corporation, NYSE | FDX | 158.12 | 0.07(0.04%) | 1149 |

| Ford Motor Co. | F | 9.28 | 0.02(0.22%) | 32200 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.02 | 0.06(0.46%) | 758 |

| General Electric Co | GE | 11.87 | -0.04(-0.34%) | 128749 |

| General Motors Company, NYSE | GM | 35.16 | 0.08(0.23%) | 2379 |

| Goldman Sachs | GS | 243 | 0.40(0.16%) | 43077 |

| Google Inc. | GOOG | 1,426.00 | 6.17(0.43%) | 7606 |

| Home Depot Inc | HD | 226 | 0.81(0.36%) | 5654 |

| HONEYWELL INTERNATIONAL INC. | HON | 179.16 | 0.09(0.05%) | 106 |

| Intel Corp | INTC | 59.47 | 0.17(0.29%) | 39114 |

| International Business Machines Co... | IBM | 137.1 | 0.36(0.26%) | 4110 |

| Johnson & Johnson | JNJ | 145.58 | 0.19(0.13%) | 1946 |

| JPMorgan Chase and Co | JPM | 137.53 | 0.09(0.07%) | 98624 |

| McDonald's Corp | MCD | 208.73 | 0.38(0.18%) | 1856 |

| Merck & Co Inc | MRK | 89.68 | 0.30(0.34%) | 1446 |

| Microsoft Corp | MSFT | 162.7 | 0.61(0.38%) | 131565 |

| Nike | NKE | 101.7 | 0.22(0.22%) | 2679 |

| Pfizer Inc | PFE | 39.01 | 0.12(0.31%) | 6779 |

| Starbucks Corporation, NASDAQ | SBUX | 90.65 | 0.12(0.13%) | 9840 |

| Tesla Motors, Inc., NASDAQ | TSLA | 485 | 3.66(0.76%) | 299075 |

| The Coca-Cola Co | KO | 55.35 | 0.01(0.02%) | 5270 |

| Twitter, Inc., NYSE | TWTR | 32.91 | -0.31(-0.93%) | 77877 |

| Verizon Communications Inc | VZ | 58.94 | 0.09(0.15%) | 6987 |

| Visa | V | 193.3 | 0.05(0.03%) | 19163 |

| Wal-Mart Stores Inc | WMT | 117.01 | -0.35(-0.30%) | 14260 |

| Walt Disney Co | DIS | 145.3 | 0.47(0.32%) | 8269 |

| Yandex N.V., NASDAQ | YNDX | 44.7 | 0.16(0.36%) | 5425 |

Analysts at Rabobank note the latest CFTC Commitment of Traders Report reveals that USD net longs continue to consolidate, having hit their lowest levels since mid-June in December.

- "Net EUR short positions have dropped back having risen to their highest levels since October the previous week.

- Net GBP positions have held in positive ground for three consecutive weeks. This is the longest run for GBP net longs since mid-2018.

- JPY net positions have held in negative ground for thirteen consecutive weeks.

- CHF net shorts have fallen for five consecutive weeks.

- CAD net long positions doubled last week. This is likely linked to the sharp rise in oil prices on the back of the US/Iran tensions which have now eased.

- AUD net shorts continued to drop."

Tesla (TSLA) target raised to $612 from $385 at Oppenheimer; Outperform

IBM (IBM) downgraded to In-line from Outperform at Evercore ISI; target $145

Morgan Stanley (MS) downgraded to Mkt Perform from Mkt Outperform at JMP Securities

Goldman Sachs (GS) upgraded to Mkt Outperform from Mkt Perform at JMP Securities; target $290

Analysts at TD Securities note the UK's November GDP was quite a bit softer than expected at -0.3% MoM (vs. market est. of 0.0%).

- "There were a few analysts (including us) calling for -0.1%, but no one any weaker than that. The decline was led by manufacturing at -1.7% m/m (mkt -0.2%, TD -0.9%), but the important index of services was also much weaker than expected at -0.3% (mkt 0.0%), with fairly widespread declines among sub-sectors. That being said, we don't think that the November GDP data is likely to be a make-or-break factor for the BoE decision in two weeks.

- The story for the MPC instead seems to be the split between those who believe that the data will bounce in Jan once the political uncertainty recedes, and those who are sceptical. However, with Vlieghe's comments over the weekend, it seems that the MPC's optimistic camp may be starting to lose members to the pessimistic side, and the January decision is certainly a closer call now than what we had previously thought."

- Says checks would only be needed for goods going on to Ireland if we do not have a zero tariff, zero quota agreement with the EU

Analysts at Nordea Markets believe that, while the Riksbank's 2nd hike was not the formal start of a hiking cycle, it arguably felt, as one and the pattern suggested a bottom in EUR/SEK between 10.40 and 10.50 after the hike in December, and that the cross would bounce after the hike - as it has indeed started doing.

- "Now the pattern suggests a move to the 10.60-10.70 area. In related news, the Riksbank's krona-killing machine is still running (Riks' balance sheet expansion), SE growth expectations are still falling relative to the EA's, and the SE surprise index (CESISEK) is back in negative territory. Good times. Well, not for the SEK. Nordea's forecast for December's inflation figures is in line with the Riksbank's view, but weaker inflation in Norway could fuel some speculation of a disappointment also in Sweden."

Analysts at TD Securities note the Bank of Canada's (BoC) Business Outlook Survey (BOS) will be watched for any signs of near-term malaise following the recent deterioration in economic data surprises and small business sentiment, which currently sits at the second lowest level since 2016.

- "Despite recent softness in economic data, consensus GDP expectations have been revised higher in five of the last six months, which should lend support to expectations for sales growth.

- Elsewhere, the pickup in Q3 investment should translate into some relief capacity-related indicators and the recent moderation in employment data suggests an easing of labour shortages from the previous survey. Overall, this may result in a modest pullback for the aggregate BOS indicator, but we do not expect a retest of the Q1 lows."

Analysts at Nordea Markets note that the U.S. Fed will not only decide on a new T-bill purchase pace this week (anything else than 60bn will be a big surprise), it will also unveil a new schedule for its repo market operations.

- "A slight "tapering" of the ON repo offering can't be ruled out, while negative for risk appetite it shouldn't really matter given its limited usage.

- It's also worth noting that the seasonality in the US Treasury's crisis account (the TGA) suggests somewhat less liquidity support next week, but that tax refunds will boost liquidity substantially in February.

- In the bigger picture, while the Fed's balance sheet won't grow as quickly in Q1, 2020 as it did towards the end of 2019 (at an annualized pace of more than 1.2 trillion September to December), it will still grow at a solid pace -underpinning the market's current "QE psychology"."

Karen Jones, an analyst at Commerzbank, notes that USD/JPY pair last week eroded the 2018-2020 downtrend at 109.50.

- "The market is approaching the December highs at 109.71/73 and a second more important downtrend from 2015 which lies at 110.20. These should hold the topside and while they hold, we will maintain an overall longer-term bearish bias.

- Failure at 107.65 is needed to reassert downside pressure to the 106.48 October low and the 105.00-region.

- Only on a weekly chart close above the 2015-2019 downtrend line at 110.20 (not favoured) would we question our bearish bias and introduce scope to 114.55, the 2018 high."

January 14

Before the Open:

Citigroup (C). Consensus EPS $1.83, Consensus Revenues $17949.48 mln

Delta Air Lines (DAL). Consensus EPS $1.39, Consensus Revenues $11372.73 mln

JPMorgan Chase (JPM). Consensus EPS $2.36, Consensus Revenues $27693.61 mln

Wells Fargo (WFC). Consensus EPS $1.11, Consensus Revenues $20114.26 mln

January 15

Before the Open:

Bank of America (BAC). Consensus EPS $0.69, Consensus Revenues $22300.00 mln

Goldman Sachs (GS). Consensus EPS $5.52, Consensus Revenues $8568.84 mln

UnitedHealth (UNH). Consensus EPS $3.75, Consensus Revenues $61165.99 mln

After the Close:

Alcoa (AA). Consensus EPS -$0.22, Consensus Revenues $2493.31 mln

January 16

Before the Open:

Morgan Stanley (MS). Consensus EPS $1.04, Consensus Revenues $9739.93 mln

- Says the kingdom's oil production is at 9.744 million bpd in January and February

- Notes Iraq's compliance with OPEC cuts improved in December and the country is expected to have full compliance in January

Analysts at ANZ suggest that it's useful taking a big picture look at what they'll be watching closely, including some of the tail-risks

"We should acknowledge that over a one-year horizon, the fate of the NZ economy isn't entirely in its own hands. The weather, natural disasters, commodity prices, global geopolitics, global credit markets and the NZD could all have a say in how the economy performs, but it's a case of rolling with the punches. In terms of things that actually reflect our choices and policy settings, we'll be watching credit availability, business sentiment activity indicators, the details of the Government's infrastructure spend-up, the housing market, and indicators of resource stretch and inflation pressure in the economy."

Analysts at ANZ are expecting both US core and headline сonsumer price index to rise by 0.2% in December compared to the previous month.

"Core inflation should continue to increase at a rate of 0.2% m/m in the next few months. Domestic cyclical forces should put upward pressure on core service prices, while we expect underlying goods prices to ease. We see the Federal Reserve staying on hold for a significant period. The next move is more likely to be down than up, as (too much) inflation is unlikely to worry the Fed for a long time."

According to analysts at Rabobank, last comments from the BoE's Vlieghe suggesting that he would vote for a rate cut as early as January 30 if domestic economic data weakens

"Recent comments from BoE's Governor Carney were also viewed as dovish as were remarks from Tenreyro. Currently UK GDP growth is below trend and CPI inflation is below the Bank's inflation target. Any sign that talks between the UK and EU on their future arrangements are not smooth would increase downside risks to the UK economy. Given PM Johnson's refusal to extend the transition phase beyond the end of 2020, the risk of a disorderly Brexit remains in play. GBP/USD has pushed below the 1.30 level this morning. This compares with a post-election high around 1.35."

Office for National Statistics said that total production output decreased by 0.6% for the three months to November 2019, compared with the three months to August 2019; this was led by manufacturing output, which fell by 0.8%. The three-monthly fall in manufacturing is because of widespread weakness, with 10 of the 13 subsectors providing downward contributions; this was led by pharmaceutical products (fall of 6.2%) and transport equipment (fall of 1.6%).

Production output fell by 1.2% between October 2019 and November 2019, with manufacturing providing the largest downward contribution, falling by 1.7%. Economists had expected a 0.1% decrease.

The monthly decrease of 1.7% in manufacturing output was because of downward contributions from 10 of the 13 subsectors; led by notable falls from transport equipment (3.4%), chemicals and chemical products (4.7%) and food, beverages and tobacco (1.8%).

For the three months to November 2019, production output decreased by 1.1%, compared with the same three months to November 2018; this was led by a fall in manufacturing of 1.2%.

According to the report from Office for National Statistics, monthly gross domestic product (GDP) fell by 0.3% in November 2019, driven by falls in both services and production. GDP was expected to remain unchanged. This followed growth of 0.1% in both September and October 2019.

ONS also reported that UK GDP grew by 0.1% in the three months to November 2019. The services and production sectors contributed positively to gross domestic product (GDP) growth in the three months to November 2019, growing by 0.1% and 1.1%, respectively. Meanwhile, the production sector fell by 0.6% in the same period, its second consecutive rolling three-month decline.

Commenting on today's GDP figures, Head of GDP Rob Kent-Smith said: "Overall, the economy grew slightly in the latest three months, with growth in construction pulled back by weakening services and another lacklustre performance from manufacturing. The UK economy grew slightly more strongly in September and October than was previously estimated, with later data painting a healthier picture. Long term, the economy continues to slow, with growth in the economy compared with the same time last year at its lowest since the spring of 2012. The underlying trade deficit narrowed as exports grew faster than imports."

Analysts from the National Bank of Canada note that in the US, the release of retail sales and CPI data will be watched closely.

"Gasoline prices rose at a steeper rate than usual in the month, a development that could translate into a 0.3% monthly increase of the headline index. This would allow the annual rate of inflation to rise three ticks to 2.4%. The core inflation rate, for its part, should have continued to be supported by the services sector, rising 0.2% m/m and 2.4% y/y. We'll also get December's U.S. retail sales report. Remember that, since Thanksgiving occurred late last year, the increasingly popular Cyber Monday sale event was pushed into December. This should have helped boost consumer outlays in the final month of the year. We expect both headline and ex-auto sale to have mustered healthy gains".

UOB Group expect USD/CNY to move to the 7.08 region in the first quarter of 2020.

"While a Phase 1 trade deal looks increasingly hopeful, structural differences between US and China trade stances (eg intellectual property, market access) make further progress beyond Phase 1 challenging. Together with growth risks of the Chinese economy which are still skewed to the downside, we continue to expect further weakness in the CNY ahead. However, we have dialled our bearish CNY expectations in recognition of the progress in trade talks so far and the reduced risks of further trade escalation. Our updated forecasts for USD/CNY are 7.08 in 1Q20, 7.10 in 2Q20, 7.20 in 3Q20 and 7.20 in 4Q20. Overall, we still see value for investors to hedge their USD risks."

China Association of Automobile Manufacturers (CAAM) said that auto sales in China fell 8.2% in 2019, a second consecutive drop in the world's largest auto market. A total of 25.8 million vehicles were sold last year. Sales in 2018 were off 2.8%.

Total auto sales fell 0.1% in December from the same month a year earlier, to 2.7 million vehicles. Sales have now dropped for 18 months in a row. Sales of new-energy vehicles, which includes electric cars, were down 4.0% in 2019 from a year earlier, to 1.2 million, after a 62% surge in 2018. The sector started to decline after subsidies were cut by more than half in June.

Analysts at TD Securities are looking for UK GDP to contract by -0.1% in November, making 4 months in a row with no real GDP growth.

"The weakness will likely be led by weaker manufacturing activity, but other sectors like retail sales and construction will also likely struggle due to continued political uncertainty, as the UK election campaign kicked off. The BoE won't put too much weight on this data though, and will be looking much more keenly at the January data when it starts to trickle out; that will be our first look at the post-election economic data, once political uncertainty has substantially receded. Although with the next potential Brexit cliff-edge just one year away, that may continue to weigh on the minds of businesses and consumers."

S&P ratings agency said on Monday that Australia's pristine 'AAA' sovereign rating is not at "immediate risk" from the fiscal and economic impact of bushfires.

"We do not believe that these bushfires will affect credit metrics enough to trigger rating changes in the next one to two years," said S&P Global Ratings credit analyst Anthony Walker.

Ratings on the east coast states of New South Wales and Victoria - the most ravaged by the fires - were also likely to be unaffected, S&P said.

"We believe there is capacity within our current ratings on the sovereign and state governments to absorb the fiscal costs, which are relatively small compared with their budgets," Walker added.

Danske Bank analysts said that UK GDP estimate for November will be decisive for whether the BoE will cut the policy rate at the January meeting and think this may lead to further GBP weakness, as it is not yet priced in.

"This week we are looking very much forward to the official signing of the US-China phase-1 trade deal (on Wednesday). In terms of economic data releases, we have some highlights worth mentioning: Swedish CPI inflation and US retail sales on Wednesday, ECB minutes on Thursday and US industrial production and Chinese economic indicators for retail sales, investments and Q4 GDP on Friday."

According to the report from Federal Statistical Office (Destatis), in 2019 the average index of selling prices in wholesale trade was 0.1% lower than the average index of 2018.

In December 2019 the selling prices in wholesale trade fell by 1.3% compared with December 2018. In November 2019 and in October 2019 the annual rates of change had been -2.5% and -2.3%, respectively. From November 2019 to December 2019 the index remained unchanged.

Survey results from the Confederation of British Industry and PwC showed that sentiment among British financial services firms improved for the first time in twelve quarters.

According to the report, a balance of 8% expects business situation to improve compared with three months ago. This was the fastest since June 2015. Looking ahead to the quarter to March, a net 14% forecast business volumes to return to growth, the strongest expectations since March 2018.

"However, the sector isn't quite out of the woods yet. Against the backdrop of another fall in business and profits, Brexit uncertainty continues to drag on investment plans, and concerns over labour shortages have spiked," Rain Newton-Smith, CBI chief economist, said.

The survey was conducted before the 2019 general election.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1277 (2564)

$1.1237 (2997)

$1.1209 (2911)

Price at time of writing this review: $1.1127

Support levels (open interest**, contracts):

$1.1076 (4680)

$1.1038 (3991)

$1.0994 (1461)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 7 is 50372 contracts (according to data from January, 10) with the maximum number of contracts with strike price $1,1100 (4680);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3212 (1040)

$1.3184 (1318)

$1.3141 (898)

Price at time of writing this review: $1.3028

Support levels (open interest**, contracts):

$1.3212 (1040)

$1.3184 (1318)

$1.3141 (898)

Comments:

- Overall open interest on the CALL options with the expiration date February, 7 is 23182 contracts, with the maximum number of contracts with strike price $1,3600 (3949);

- Overall open interest on the PUT options with the expiration date February, 7 is 19159 contracts, with the maximum number of contracts with strike price $1,3000 (3084);

- The ratio of PUT/CALL was 0.83 versus 0.95 from the previous trading day according to data from January, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 65.34 | -0.5 |

| WTI | 59.06 | -0.81 |

| Silver | 18.08 | 1.12 |

| Gold | 1561.712 | 0.63 |

| Palladium | 2112.53 | 0.15 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 110.7 | 23850.57 | 0.47 |

| Hang Seng | 77.2 | 28638.2 | 0.27 |

| KOSPI | 19.94 | 2206.39 | 0.91 |

| ASX 200 | 54.8 | 6929 | 0.8 |

| FTSE 100 | -10.27 | 7587.85 | -0.14 |

| DAX | -11.75 | 13483.31 | -0.09 |

| CAC 40 | -5.44 | 6037.11 | -0.09 |

| Dow Jones | -133.13 | 28823.77 | -0.46 |

| S&P 500 | -9.35 | 3265.35 | -0.29 |

| NASDAQ Composite | -24.57 | 9178.86 | -0.27 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.68981 | 0.6 |

| EURJPY | 121.772 | 0.12 |

| EURUSD | 1.11205 | 0.15 |

| GBPJPY | 143.035 | -0.03 |

| GBPUSD | 1.30629 | -0.01 |

| NZDUSD | 0.6634 | 0.35 |

| USDCAD | 1.30527 | -0.02 |

| USDCHF | 0.97274 | -0.04 |

| USDJPY | 109.497 | -0.01 |

© 2000-2024. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.