- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 04:30 | Japan | Industrial Production (YoY) | October | 1.3% | -7.4% |

| 04:30 | Japan | Industrial Production (MoM) | October | 1.7% | -4.2% |

| 13:30 | U.S. | Import Price Index | November | -0.5% | 0.2% |

| 13:30 | U.S. | Retail sales | November | 0.3% | 0.5% |

| 13:30 | U.S. | Retail Sales YoY | November | 3.1% | |

| 13:30 | U.S. | Retail sales excluding auto | November | 0.2% | 0.4% |

| 15:00 | U.S. | Business inventories | October | 0% | 0.2% |

| 18:00 | U.S. | Baker Hughes Oil Rig Count | December | 663 |

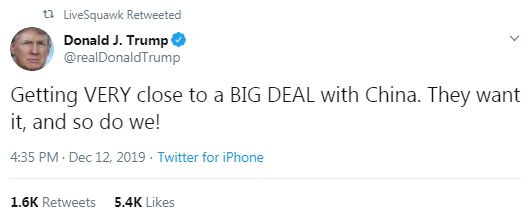

Major US stocks rose significantly after U.S. President Trump wrote on Twitter that the United States was “very close to a major deal with China,” and WSJ reported that U.S. resellers proposed lowering Chinese import tariffs by 50% $360 billion worth of goods, as well as canceling a new round of tariffs on Chinese goods, the introduction of which is scheduled for December 15.

However, the Chinese publication Global Times was skeptical about Trump's tweet, saying the US president’s announcement of the deal "could just be another trick to stimulate stock markets." It also added that “China wants to see real actions, not just words.”

Market participants also studied US data. According to a report from the Department of Labor, producer prices in the US did not change in November, as rising food and gas prices were offset by lower costs of services, indicating moderate inflation despite recent consumer price increases. In the 12 months to November, the producer price index rose 1.1%, which corresponds to the growth in October, which was the smallest increase since October 2016. Economists predicted that the consumer price index would rise by 0.2% per month and increase by 1.2% year on year.

In a separate report, the Department of Labor reported that the number of Americans applying for unemployment benefits rose to more than a two-year high last week, but this probably does not signal an increase in layoffs, since the data tends to be unstable since Thanksgiving . Initial jobless claims increased by 49,000 to 252,000, seasonally adjusted for the week ending December 7, which is the highest since September 2017. Economists forecast that the number of applications will increase to 213,000.

Almost all DOW components completed trading in positive territory (28 out of 30). The biggest gainers were Cisco Systems Inc. (CSCO; + 3.26%). Outsider were the shares of The Boeing Co. (BA; -0.87%).

Most S&P sectors recorded an increase. The raw materials sector grew the most (+ 1.6%). The decrease was shown by the conglomerate sector (-0.3%) and the utilities sector (-0.3%).

At the time of closing:

Dow 28,132.05 +220.75 + 0.79%

S&P 500 3,168.57 +26.94 + 0.86%

Nasdaq 100 8,717.32 +63.27 + 0.73%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 04:30 | Japan | Industrial Production (YoY) | October | 1.3% | -7.4% |

| 04:30 | Japan | Industrial Production (MoM) | October | 1.7% | -4.2% |

| 13:30 | U.S. | Import Price Index | November | -0.5% | 0.2% |

| 13:30 | U.S. | Retail sales | November | 0.3% | 0.5% |

| 13:30 | U.S. | Retail Sales YoY | November | 3.1% | |

| 13:30 | U.S. | Retail sales excluding auto | November | 0.2% | 0.4% |

| 15:00 | U.S. | Business inventories | October | 0% | 0.2% |

| 18:00 | U.S. | Baker Hughes Oil Rig Count | December | 663 |

Carsten Brzeski, the Chief Economist ING Germany, notes that the style and communication of new ECB President Christine Lagarde were the subject of much speculation in the run-up to today’s meeting.

"Lagarde took this bull by the horns immediately and started the Q&A session with a long speech about how she had her own style and warned against making comparisons with Mario Draghi and over-interpreting her words. She also said that she might not know everything and would admit if this was the case.

After these personal words, the traditional Q&A session started. In all honesty, it is, in our view, still hard to identify what Lagarde actually stands for. Just some highlights:

- Lagarde wants to be as consensual as possible. “I am neither a dove nor a hawk, I see myself as an owl. An owl with wisdom”.

- On inflation. An inflation rate of 1.7% at the end of 2022 was pointing in the right direction but it's not enough to be satisfied. At the same time, Lagarde said that the eurozone economy was getting close to potential in the medium term, which eventually could argue against a very accommodative monetary stance.

- Adverse effects. The ECB was “very aware” of side effects of negative rates.

- On country-specific developments. “I will not comment on countries” when asked about France but Lagarde gave answers to a question on Greece.

- On unconventional measures and adverse effects, Lagarde remarked that she “won’t revisit past policy decisions”, while at the same time she said that the “effectiveness and appropriateness” of past measures will be examined in the strategic review.

All in all this was a very entertaining press conference with a self-proclaimed monetary policy owl. As regards the short-term outlook for monetary policy, further easing seems to be off the table, at least with the current macro projections, and wait-and-see looks the way forward. For ECB watchers and financial market participants, however, learning how to read Christine Lagarde will take some time. Today, at least we had the impression that it was not always clear whether Lagarde spoke on behalf of herself or on behalf of – at least the majority of – the ECB’s Governing Council."

- And to cancel planned December 15 tariffs, as well

Analysts at Deutsche Bank note that turning to the Fed last night, the main headline was that the FOMC unanimously voted to leave rates unchanged, in line with the market’s expectations following a run of 3 successive 25bp cuts.

“This was actually the first unanimous decision since May. Looking at the statement, the language on the economy was unchanged, with the Fed continuing to say that “the labor market remains strong and that economic activity has been rising at a moderate rate.” In a slightly hawkish lean, however, they also removed their comment from the previous meeting’s statement that “uncertainties about this outlook remain.

Examining the dot plot, the median dot for next year saw policy remaining unchanged, with just 4 members wanting a 25bp increase, while the median dot for 2021 saw a 25bp hike. That said, there was some variation around this, with 5 members seeing no change in policy, 4 with a 25bp increase, 5 with a 50bp increase, and 3 with a 75bp increase from present levels. But notably, not a single FOMC member opted for a cut, signaling that the Fed has finished its period of insurance cuts.

In his press conference, however, Chair Powell pushed back against any inferences that this meant the Fed now had a tightening bias, saying that “a significant move-up in inflation” was needed in order to support rate hikes.

The most important conclusion from it was Chair Powell's strong signal of a low-for-longer outlook for the policy rate with rate hikes very unlikely for the foreseeable future. In contrast to the signal from a year ago when normalization was the driving force for the policy outlook, Powell stressed below-target inflation creates challenges, slack remained in the labor market despite a fifty-year low in unemployment, and a "persistent" and "significant" rise in inflation was needed to justify higher policy rates. These signals reinforce our team’s view the Committee is cognizant of the benefits of a hot labor market and is therefore likely to adopt an inflation makeup strategy as a result of the policy review. As Powell made clear, this change will require a credible commitment to be successful.”

U.S. stock-index futures traded flat on Thursday, as investors continued to digest the latest Fed’s statements on the economy, while waiting for U.S. President Donald Trump to meet with his top trade advisors ahead of a key deadline with China.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 23,424.81 | +32.95 | +0.14% |

Hang Seng | 26,994.14 | +348.71 | +1.31% |

Shanghai | 2,915.70 | -8.72 | -0.30% |

S&P/ASX | 6,708.80 | -43.80 | -0.65% |

FTSE | 7,253.38 | +37.13 | +0.51% |

CAC | 5,852.10 | -8.78 | -0.15% |

DAX | 13,124.50 | -22.24 | -0.17% |

Crude oil | $58.94 | +0.31% | |

Gold | $1,487.80 | +0.87% |

- Says some initial signs of stabilization in growth slowdown

- Incoming data point to continued muted inflation pressures

- Highly accommodative policy still needed

- Easier borrowing conditions for firms and households will support the euro area expansion, the ongoing build-up of domestic price pressures and, thus, the robust convergence of inflation to our medium-term aim

- Says she's committed to symmetry

- Eurozone's fiscal stance is 'mildly expansionary'

- Risks remain tilted to the downside but have become somewhat less pronounced

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 166.7 | -2.04(-1.21%) | 6434 |

ALTRIA GROUP INC. | MO | 50.21 | -0.09(-0.18%) | 2184 |

Amazon.com Inc., NASDAQ | AMZN | 1,746.10 | -2.62(-0.15%) | 11651 |

Apple Inc. | AAPL | 267.81 | -2.96(-1.09%) | 509966 |

AT&T Inc | T | 38.21 | 0.04(0.10%) | 10406 |

Boeing Co | BA | 348.25 | -1.75(-0.50%) | 13905 |

Chevron Corp | CVX | 116.4 | 0.17(0.15%) | 495 |

Cisco Systems Inc | CSCO | 44.54 | 0.26(0.59%) | 37519 |

Citigroup Inc., NYSE | C | 75.5 | -0.05(-0.07%) | 3911 |

Deere & Company, NYSE | DE | 169.75 | 0.05(0.03%) | 2178 |

Exxon Mobil Corp | XOM | 68.91 | -0.05(-0.07%) | 6163 |

Facebook, Inc. | FB | 202.39 | 0.13(0.06%) | 25953 |

FedEx Corporation, NYSE | FDX | 159 | -0.08(-0.05%) | 10796 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.75 | -0.09(-0.70%) | 78815 |

General Electric Co | GE | 11.31 | 0.34(3.10%) | 992131 |

Goldman Sachs | GS | 221 | -0.19(-0.09%) | 363 |

Google Inc. | GOOG | 1,346.00 | 0.98(0.07%) | 2724 |

Hewlett-Packard Co. | HPQ | 20 | -0.07(-0.35%) | 396 |

Home Depot Inc | HD | 212.3 | 0.30(0.14%) | 56246 |

Intel Corp | INTC | 56.95 | -0.12(-0.21%) | 27041 |

International Business Machines Co... | IBM | 133.9 | 0.14(0.10%) | 897 |

Johnson & Johnson | JNJ | 141.35 | 0.37(0.26%) | 418 |

JPMorgan Chase and Co | JPM | 134 | -0.18(-0.13%) | 4273 |

McDonald's Corp | MCD | 194.8 | 0.08(0.04%) | 1382 |

Merck & Co Inc | MRK | 89.44 | 0.46(0.52%) | 1796 |

Microsoft Corp | MSFT | 151.83 | 0.13(0.09%) | 76865 |

Nike | NKE | 97.21 | 0.03(0.03%) | 1890 |

Pfizer Inc | PFE | 38.3 | 0.08(0.21%) | 2917 |

Starbucks Corporation, NASDAQ | SBUX | 87.96 | 1.37(1.58%) | 48481 |

Tesla Motors, Inc., NASDAQ | TSLA | 354.74 | 2.04(0.58%) | 56174 |

The Coca-Cola Co | KO | 54.08 | 0.13(0.24%) | 3687 |

Twitter, Inc., NYSE | TWTR | 30.5 | -0.05(-0.16%) | 16223 |

United Technologies Corp | UTX | 148.22 | 0.95(0.65%) | 3122 |

Verizon Communications Inc | VZ | 61.13 | 0.05(0.08%) | 2246 |

Visa | V | 181.75 | -0.26(-0.14%) | 4365 |

Walt Disney Co | DIS | 147.7 | 0.11(0.07%) | 20179 |

Yandex N.V., NASDAQ | YNDX | 41.55 | 0.09(0.22%) | 171 |

Home Depot (HD) target lowered to $210 from $220 at Telsey Advisory Group

Home Depot (HD) downgraded to Accumulate from Buy at Gordon Haskett; target $230

Starbucks (SBUX) upgraded to Overweight from Neutral at JP Morgan; target raised to $94

General Electric (GE) upgraded to Buy from Neutral at UBS

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment benefits jumped to the highest level in more than two years last week,

but that probably does not signal a rise in layoffs as the claims data tends to

be volatile in the period following the Thanksgiving Day holiday.

According to

the report, the initial claims for unemployment benefits surged by 49,000 to a

seasonally adjusted 252,000 for the week ended December 7, the highest level

since September 2017.

Economists had

expected 213,000 new claims last week.

Claims for the

prior week were remained unchanged at 203,000.

Meanwhile, the

four-week moving average of claims rose by 6,250 to 224,000 last week.

The Labor

Department reported on Thursday the U.S. producer-price index (PPI) was flat

m-o-m in November, following an unrevised 0.4 percent m-o-m gain in October.

For the 12

months through November, the PPI rose 1.1 percent, the same pace as in the

previous month. That remained the smallest gain in PPI since October 2016.

Economists had

forecast the headline PPI would increase 0.2 percent m-o-m and 1.2 percent over

the past 12 months.

According to

the report, the November flat reading reflected a 0.3-percent rise in prices

for final demand goods, which was offset a 0.3-percent decline in the index for

final demand services.

Excluding

volatile prices for food and energy, the PPI fell 0.2 percent m-o-m but rose 1.3

percent over 12 months. Economists had forecast gains of 0.2 percent m-o-m and

1.6 percent y-o-y, respectively.

Analysts at Danske Bank note that in the ECB's TLTRO3.2 operation (December 2019), banks took only EUR97.7, much below their expectations with 122 banks participating in the operation.

- “The September operation only saw EUR3.4bn. This needs to be seen in the context of the EUR146.8bn that banks will voluntarily repay later this month, as already announced last week. Despite the low take-up resulting in net liquidity drainage of almost EUR50bn, the ECB and markets should not be concerned with excess liquidity still above EUR1.7trn, which is far above the level at which we would expect short-end rates to be materially moved by excess liquidity levels.

- The TLTRO operations will run quarterly until March 2021, so banks will have plenty of opportunities to take liquidity. There are solid reasons why banks may want to wait for the take-up.”

lululemon athletica (LULU) reported Q3 FY 2019 earnings of $0.96 per share (versus $0.75 in Q3 FY 2018), beating analysts’ consensus estimate of $0.93.

The company’s quarterly revenues amounted to $0.916 bln +22.5(% y/y), beating analysts’ consensus estimate of $0.898 bln.

The company also issued in-line guidance for Q4 FY 2019, projecting EPS of $2.10-2.13 vs. analysts’ consensus estimate of $2.13 and revenues of $1.315-1.330 bln vs. analysts’ consensus estimate of $1.32 bln.

It also raised FY 2019 EPS to $4.75-4.78 from $4.63-4.70; revenues to $3.895-3.910 bln from $3.80-3.84 bln.

LULU fell to $225.29 (-3.39%) in pre-market trading.

The European

Central Bank (ECB) left its main refinancing rate unchanged at 0.00 percent on

Thursday, as widely expected.

Its interest

rates on the marginal lending facility and the deposit facility were also left

unchanged at 0.25 percent and -0.50 percent, respectively.

In its policy

statement, the ECB repeated again the Governing Council expects its key

interest rates to remain at their present or lower levels until it has seen the

inflation outlook robustly converge to a level sufficiently close to, but

below, 2% within its projection horizon, and such convergence has been

consistently reflected in underlying inflation dynamics.

In addition,

the European regulator noted that in November net purchases were restarted

under the Governing Council’s asset purchase programme (APP) at a monthly pace

of €20 billion. The Governing Council expects them to run for as long as

necessary to reinforce the accommodative impact of its policy rates, and to end

shortly before it starts raising the key ECB interest rates.

In addition, the ECB promised to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

Axel Rudolph, an analyst at Commerzbank, points out that GBP/USD has reached the January high at 1.3217 which so far capped.

- “Minor support below yesterday’s low at 1.3104 is offered by the 1.3013 October high. It guards the 1.2768 November low. Failure at 1.2768 would probably see a slide to the 200-day moving average at 1.2697 below which lies the 1.2582 September high.

- A daily chart close above the 1.3217 January high would open the way to the 1.3382-mark peak and potentially the 61.8% Fibonacci retracement at 1.3453 to be reached.”

Peter Vanden Houte, a Chief Economist at ING, notes the Eurozone's industrial production fell by 0.5% m-o-m in October after a downwardly revised 0.1% contraction in September. Year-on-year, it fell by 2.2%, compared to a 1.8% decline in September.

- "The main culprit was the 1.6% month-on-month fall in capital goods production, a direct consequence of the hesitant business investments in the wake of global uncertainty. After the disappointing German industrial production data, it was more or less expected that industrial production won't be looking pretty for the eurozone as a whole. However, this conflicts with the better sentiment data that has been published over the last few months.

- Bottom line is that looking at real data, the fourth quarter started on a weak footing and this weakness could linger on a bit longer as the main uncertainties could still take some time to dissipate.

- A weak quarter will create a negative base effect and that is the reason while, even taking into account some improvement over the course of the year, we only expect 0.7% GDP growth in 2020, clearly below consensus."

- China to maintain prudent monetary policy

- Prudent monetary policy should be flexible, appropriate

- China to maintain proactive fiscal policy

- China to maintain stability of macroeconomic policy

- China will prioritise stability of its economy

- Downwards pressure to the economy has increased

- China will ensure economic growth is within reasonable range

Analysts at TD Securities note the market expects the U.S. PPI inflation to advance 0.2% m/m in November, lifting the annual measure by two tenths to 1.3% y/y.

- “Core prices are also expected to rise at a similar monthly pace, leading to a one-tenth gain on the annual to a still tame 1.7% y/y pace.

- Separately, consensus projects initial jobless claims to rebound to a still moderate 214k for the week of Dec 7, up from a soft 203k print in the prior week.”

The ifo Institute confirmed its 1.1% growth forecast for the German economy in 2020 and revised its growth forecast for 2021 upwardly by 0.1 percentage points to 1.5%.

"At present, a recession in the general economy is very unlikely," said Timo Wollmershaeuser, head of forecasts at the ifo Institute.

Mr. Wollmershaeuser said fiscal policy is partly responsible for the gradual recovery of the German economy, with boosts coming from tax reliefs, social-insurance contributions and an increase in public-investment expenditure.

According to the ifo Institute, the measures amount to almost 25 billion euros per year, increasing GDP growth by 0.25 percentage points. The German government's surplus will shrink to EUR30.5 billion in 2020, from EUR55 billion this year, the institute said.

The ifo Institute expects unemployment to decline further to 2.25 million in 2020, bringing the unemployment rate down to 4.9% in 2020 and 4.8% in 2021.

Germany's current account--the balance of exports, imports and transfers--will continue to show a large surplus, reaching EUR271 billion, or 7.7 percent of annual economic output in 2020, the ifo Institute said.

Axel Rudolph, analyst at Commerzbank, points out that USD/JPY continues to hover above the 55 day moving average at 108.52 which remains exposed and failure there would re-engage the November low at 107.89.

“Given the very dense overhead resistance, namely the 200 week moving average at 109.81 and the 2015-2019 downtrend line at 110.46, we will assume that the cross has topped for now. Failure at 107.89 would probably trigger losses to the 106.48 October low. Failure at 106.48 would target the 106.00 mark. On a weekly chart close above the 2015-2019 downtrend line.”

China's auto market, the world's biggest, is likely to register a 2% decline in sales next year as pressures from the slowing economy and U.S.-China trade tensions continue, the country's top auto industry body said.

The China Association of Automobile Manufacturers (CAAM) expects sales to slide to about 25.31 million vehicles in 2020, it said at a conference on Thursday.

According to estimates from Eurostat, in October 2019 compared with September 2019, seasonally adjusted industrial production fell by 0.5% in the euro area (EA19) and by 0.4% in the EU28. In September 2019, industrial production fell by 0.1% in the euro area and rose by 0.1% in the EU28.

In October 2019 compared with October 2018, industrial production decreased by 2.2% in the euro area and by 1.7% in the EU28.

In the euro area in October 2019, compared with September 2019, production of capital goods fell by 2.0% and energy by 0.7%, while production of non-durable consumer goods rose by 0.4%, intermediate goods by 0.6%, and durable consumer goods by 1.9%. In the EU28, production of capital goods fell by 1.6% and energy by 0.4%, while production of non-durable consumer goods rose by 0.2%, intermediate goods by 0.4% and durable consumer goods by 1.5%.

In the euro area in October 2019, compared with October 2018, production of both intermediate goods and capital goods fell by 3.6% and energy by 2.5%, while production of durable consumer goods rose by 0.9% and nondurable consumer goods by 2.7%. In the EU28, production of intermediate goods fell by 3.0%, capital goods by 2.8% and energy by 2.6%, while production of durable consumer goods rose by 1.7% and non-durable consumer goods by 2.7%.

Bank of America Global Research discusses its expectations for ECB policy meeting.

"The highlight of the ECB meeting this week could be the start date for the strategy review, without much news on timeline or content. The juice will be in the likely upward revisions to core inflation forecasts. That will matter for 2020. We stick to our view: the strategy review, doubts over "QE infinity" and the reversal rate debate make for a volatile 2020. We do not expect a market impact from this week's meeting, but the review will be very important for markets next year. Depending on the details, the market may reassess the chances of an earlier return to 0. We see positive risks for the EUR from next year's review, even if the ECB "gets it right."," BofA adds.

Global oil inventories could rise sharply despite an agreement by OPEC and its allies to deepen output cuts as well as lower expected production by the U.S. and other non-OPEC countries, the International Energy Agency (IEA) said on Thursday.

"Despite the additional curbs ... and a reduction in our forecast of 2020 non-OPEC supply growth to 2.1 million barrels per day (bpd), global oil inventories could build by 700,000 bpd in Q1 2020," the IEA said in a monthly report.

The OPEC and other producers agreed last week to rein in output by an extra 500,000 bpd in the first quarter of 2020 in order to balance the market and buoy prices.

Even if the group adhered strictly to the new pact and output from members beset by political troubles like Iran, Libya and Venezuela stayed steady, the IEA said only 530,000 bpd of crude would be withdrawn from the market compared to November production.

The IEA revised down its forecast for supply growth by non-OPEC countries in 2020 by 200,000 bpd "on a continued slowdown in the U.S., reduced expectations for Brazil and Ghana as well as additional cuts by (OPEC's allies)".

According to analysts at Westpac, GBP seems unlikely to gain much more ground against either the US dollar or Euro as Brexit's reality sets in.

“The polls suggest PM Johnson will be returned with a workable majority and thus that the withdrawal agreement bill (WAB) will be passed as he intends. This outcome is likely to see an election honeymoon for GBP/USD to USD1.33 in early–2020. However, the WAB only starts the Brexit process, with all of the detail of trade post separation still to be agreed. This will be an arduous and likely contentious process which, to our mind, will push Sterling lower again, to around USD1.31 from end–2020. To this profile, risks are skewed downward. For the UK, lingering uncertainty will hold back growth in business investment, while the labour market can likely to only improve marginally from its historically–strong state.”

Remains prepared to intervene in markets if needed

Risks to the global economy remain tilted to the downside

Franc remains highly valued; FX market remains fragile

Willing to intervene in FX market as necessary, while taking overall currency situation into consideration

Negative rates and willingness to intervene should counteract attractiveness of the franc and ease upward pressure on the currency

2019 GDP forecast seen at around 1.0% (previously 0.5% to 1.0%)

2020 GDP forecast seen between 1.5% to 2.0%

2019 inflation forecast seen at 0.4% (unchanged)

2020 inflation forecast seen at 0.1% (previously 0.2%)

2021 inflation forecast seen at 0.5% (previously 0.6%)

China and the United States are in close communication on trade, its commerce ministry said on Thursday, declining to comment on possible retaliatory steps if Washington imposes more tariffs on Chinese goods this weekend.

The United States is due to impose tariffs on almost $160 billion of Chinese imports such as video game consoles, computer monitors and toys on Sunday. U.S. President Donald Trump is expected to meet top trade advisers on Thursday to discuss the move.

"The two sides' economic and trade teams are maintaining close communication," Gao Feng, spokesman at the Chinese commerce ministry, told reporters at a regular briefing.

The countries agreed in October to conclude a preliminary trade agreement, but talks have failed to produce deals on agricultural purchases by China and rollbacks of existing tariffs imposed by the United States. Many analysts had expected a deal ahead of Dec. 15.

According to the report from INSEE, in November 2019, the Consumer Prices Index (CPI) rose by 0.1% over a month, after a stability in October. This slight increase resulted from the sharp rise in tobacco prices (+6.0% after 0.0%) and a more moderate one in the prices of energy (+0.3% after 0.0%) and food (+0.1% after −0.4%). The drop in services prices was accentuated (−0.2% after −0.1%) and the prices of manufactured products slightly edged down (−0.1% after +0.3%).

Seasonally adjusted, consumer prices rose by 0.2% in November after a stability in October.

Year on year, consumer prices gathered pace after four consecutive months of slowdown: +1.0% after +0.8%. This rise in inflation came from a sharp acceleration in tobacco prices, an accentuated dynamism in those of food and services and a lesser drop in energy prices. Contrariwise, the prices of manufactured products dropped a little less than in the previous month.

Year on year, core inflation was stable in November: +1.0%, as in the previous month. The Harmonised Index of Consumer Prices (HICP) rose by 0.1% over a month, after −0.1% in October; year on year, it accelerated to +1.2%, after +0.9% in the previous month.

Westpac analysts continue to expect USD/JPY to move in line with the broad US dollar trend into 2020.

“Having appreciated since August, the past month or so has seen USD/JPY flatten out, with moves mirroring price action in the US 10 year bond. From JPY108.5 currently, we foresee the cross falling to a low of JPY105 in the second half of 2020 after the FOMC's three cuts. Come 2021 however, the USD/JPY trend is likely to turn again, with the pair rising back to JPY109 end–2021 after the FOMC goes on hold and US growth stabilises. From 2021, there is likely to be greater downside risk to the Japanese economy than the US amid still–soft global trade, a competitive Asian market place, and limited scope to ease monetary policy. As per Sterling, risks for the Yen are skewed to the downside (higher USD/JPY) and are more likely to present in 2021 than 2020.”

According to the report from Federal Statistical Office (Destatis), consumer prices in Germany were up 1.1% in November 2019 compared with November 2018. Destatis also reports that the inflation rate - as measured by the consumer price index - had stood at +1.1% in October 2019, too. Compared with October 2019, consumer prices decreased markedly by 0.8% in November 2019.

Energy product prices fell 3.7% from November 2018 to November 2019. This was an even larger decline in energy prices than in the months before (October 2019: -2.1%; September 2019: -1.1%). Especially the price development of mineral oil products had a downward effect on the inflation rate in November 2019. There was an above-average increase in food prices of 1.8% in November 2019 year on year. The prices of goods (total) were only 0.1% higher in November 2019 than in the same month a year earlier. Service prices rose much more (+1.8%) than goods prices (+0.1%) from November 2018 to November 2019.

Compared with October 2019, the consumer price index fell by 0.8% in November 2019. A major reason for the decrease were the seasonally lower package holidays prices (-28.1%). Prices of energy (total) fell slightly by 0.1%. Food prices (total) were up 0.5% in November 2019 month on month. Higher prices than in October 2019 were observed for food (+1.9%) and edible fats and oils (+1.5%), for example.

The State Secretariat for Economic Affairs' (SECO) released its latest economic forecasts:

Sees 2019 GDP growth at 0.9% (previous forecast 0.8%).

Sees 2020 GDP growth at 1.7% (previous forecast 1.7%).

Sees 2019 inflation at 0.4% (previous forecast 0.5%).

Sees 2020 inflation at 0.1% (previous forecast 0.4%).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1257 (5389)

$1.1238 (2637)

$1.1225 (3770)

Price at time of writing this review: $1.1138

Support levels (open interest**, contracts):

$1.1086 (4035)

$1.1043 (5412)

$1.0996 (3150)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 3 is 50982 contracts (according to data from December, 11) with the maximum number of contracts with strike price $1,1050 (5412);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3352 (322)

$1.3325 (447)

$1.3305 (344)

Price at time of writing this review: $1.3209

Support levels (open interest**, contracts):

$1.3062 (533)

$1.3030 (982)

$1.2997 (379)

Comments:

- Overall open interest on the CALL options with the expiration date January, 3 is 22081 contracts, with the maximum number of contracts with strike price $1,3500 (5602);

- Overall open interest on the PUT options with the expiration date January, 3 is 19435 contracts, with the maximum number of contracts with strike price $1,2500 (2407);

- The ratio of PUT/CALL was 0.88 versus 0.84 from the previous trading day according to data from December, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 64.2 | -0.43 |

| WTI | 58.77 | -0.46 |

| Silver | 16.83 | 1.14 |

| Gold | 1474.664 | 0.71 |

| Palladium | 1910.51 | 0.78 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -18.33 | 23391.86 | -0.08 |

| Hang Seng | 208.81 | 26645.43 | 0.79 |

| KOSPI | 7.62 | 2105.62 | 0.36 |

| ASX 200 | 45.7 | 6752.6 | 0.68 |

| FTSE 100 | 2.49 | 7216.25 | 0.03 |

| DAX | 76.02 | 13146.74 | 0.58 |

| Dow Jones | 29.58 | 27911.3 | 0.11 |

| S&P 500 | 9.11 | 3141.63 | 0.29 |

| NASDAQ Composite | 37.87 | 8654.05 | 0.44 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.6877 | 1 |

| EURJPY | 120.807 | 0.16 |

| EURUSD | 1.11291 | 0.33 |

| GBPJPY | 143.232 | 0.15 |

| GBPUSD | 1.31946 | 0.33 |

| NZDUSD | 0.65839 | 0.64 |

| USDCAD | 1.31704 | -0.45 |

| USDCHF | 0.98279 | -0.15 |

| USDJPY | 108.547 | -0.18 |

© 2000-2024. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.