- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Bank of Canada (BoC) Governor Tiff Macklem reiterated on Wednesday that there is a limit to how far the Canadian central bank can diverge on rates from the Federal Reserve (Fed), but they’re not close to that limit.

Key quotes

"For many of our citizens, this has been their first experience with high inflation, and it has been painful.”

"We need to meet people where they are and ensure they understand what we’re doing and why we’re doing it.”

"Recent history has been a stark reminder that inflation is our common enemy.”

“It's reasonable to expect more cuts on the horizon, but that the central bank is taking it "one meeting at a time."

“There are limits to that divergence, but we’re not close to that limit.”

Market reaction

At the time of writing, USD/CAD is trading 0.02% lower on the day to trade at 1.3720.

Bank of Canada FAQs

The Bank of Canada (BoC), based in Ottawa, is the institution that sets interest rates and manages monetary policy for Canada. It does so at eight scheduled meetings a year and ad hoc emergency meetings that are held as required. The BoC primary mandate is to maintain price stability, which means keeping inflation at between 1-3%. Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Canadian Dollar (CAD) and vice versa. Other tools used include quantitative easing and tightening.

In extreme situations, the Bank of Canada can enact a policy tool called Quantitative Easing. QE is the process by which the BoC prints Canadian Dollars for the purpose of buying assets – usually government or corporate bonds – from financial institutions. QE usually results in a weaker CAD. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The Bank of Canada used the measure during the Great Financial Crisis of 2009-11 when credit froze after banks lost faith in each other’s ability to repay debts.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Bank of Canada purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the BoC stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Canadian Dollar.

- GBP/USD edges lower to 1.2795 after retreating from three-month highs on Thursday.

- The Fed kept its benchmark overnight borrowing rate targeted in a range of 5.25%-5.50% on Wednesday, as widely expected.

- The UK GDP flatlined in April, arriving at 0% after expanding 0.4% in March.

The GBP/USD pair loses some ground near 1.2795 after retracing from three-month highs of 1.2860 during the early Asian session on Thursday. The negative surprise of the US Consumer Price Index (CPI) inflation report in May weighs on the Greenback, but the hawkish hold by the Federal Reserve (Fed) modestly caps the USD’s downside.

Inflation in the United States held flat in May, dragging the US Dollar (USD) lower. The CPI figure eased to 3.3% on a yearly basis in May from 3.4% in April, below the market consensus of 3.4%, the US Bureau of Labor Statistics (BLS) reported on Wednesday. The core CPI, which excludes volatile food and energy prices, increased 3.4%, compared to a 3.6% rise in April and the estimation of 3.5%. On a monthly basis, the CPI was unchanged, while the core CPI increased 0.2% in May.

Furthermore, the Federal Open Market Committee (FOMC) decided to keep its benchmark lending rate in a range of 5.25%-5.50% for the seventh time in a row at its June meeting on Wednesday. The FOMC officials expect just one rate cut this year, down from three in March, according to its most recent economic predictions. The so-called ‘dot-plot’ showed that the median of the FOMC officials revised their forecast of the federal funds rate from 4.6% to 5.1%, towards the end of 2024.

Futures traders are now pricing in a 73% odds of rate cut from the Fed in September, up from 53% before the CPI data released, according to the CME FedWatch tool. Later on Thursday, investors will keep an eye on the US weekly Initial Jobless Claims, along with the Producer Prices Index (PPI) and the Fed's John Williams speech.

On the other hand, the UK economic growth stalls in April, according to a flash reading published by the Office for National Statistics (ONS) on Wednesday. The UK Gross Domestic Product (GDP) came in at 0% in April after growing 0.4% in March, in line with the market consensus. The Bank of England (BoE) will meet on June 20 for the next move of its monetary policy. Investors believe there is little possibility of a rate cut in June and shift their expectations towards August or September.

- EUR/USD climbed to 1.0850 before facing a pullback after Fed rate call.

- FOMC “dot plot” teases less rate cuts in 2024 than previously expected.

- ECB talking points to round out the Euro’s week.

EUR/USD launched higher on Wednesday, climbing after broad-market risk appetite surged following a cooler-than-expected print in US Consumer Price Index (CPI) inflation, but a hawkish tilt to the Federal Reserve’s latest update to its dot plot of interest rate expectations crimped market sentiment to round out the day.

Forex Today: US inflation dominates headlines

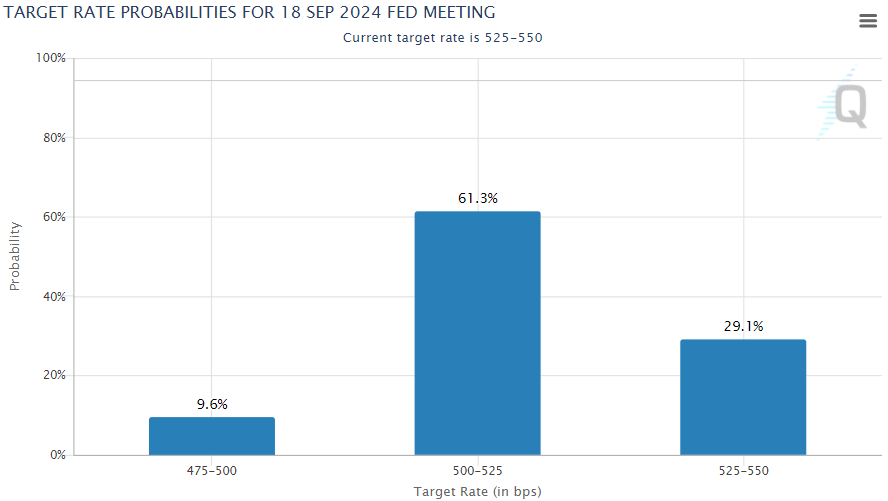

According to the Federal Open Market Committee (FOMC) and its Summary of Economic Projections (SEP), only a single quarter-point rate cut is now expected in 2024. Market hopes for Fed rate cuts have steadily clashed with the Federal Reserve’s own rate cut expectations through 2024, and according to the CME’s FedWatch Tool, rate markets are still pricing in over 60% odds of at least a 25 basis-point rate trim on September 18.

Read more: Jerome Powell comments on rate outlook after keeping policy settings unchanged

Eurogroup meetings on Thursday and Friday, pan-European Industrial Production figures, and several speeches from European Central Bank (ECB) policymakers will wrap up the trading week’s Euro events, while US jobless claims and the Michigan Consumer Sentiment Index will provide perspective after the Fed’s latest rate call.

European Industrial Production figures for April are slated for Thursday, with median market forecasts expecting figures to ease to 0.2% MoM compared to the previous 0.6%. US Initial Jobles Claims for the week ended June 7 are expected later on Thursday, with investors expecting 225K new jobless claimants compared to the previous week’s 229K.

A handful of speeches from ECB central planners smatter Friday’s economic calendar, and the Univeristy of Michigan’s Consumer Sentiment Index for June is expected to recover to 72.0 from 69.1.

EUR/USD technical outlook

EUR/USD is once again mired in congestion at the 200-day Exponential Moving Average (EMA) at 1.0803. Wednesday’s bullish push dragged the pair back into contention with a descending trendline drawn from 2024’s peak bids near 1.1150, but near-term technical resistance is keeping the Fiber pinned. The pair has etched in a near-term technical rejection from 1.0850, and the way is open for a bearish return to this week’s low bids near 1.0720.

EUR/USD hourly chart

EUR/USD daily chart

- Silver rises 1.45% as Fed leaves policy unchanged, adjusts inflation outlook, and anticipates one rate cut.

- XAG/USD shows a double-top pattern indicating potential declines; initial support at $29.00.

- Resistance at $30.05; surpassing this could target recent highs, though buyers continue to face challenges.

Silver prices registered solid gains of 1.45% on Wednesday, as the US Federal Reserve kept monetary policy unchanged while upwardly reviewing its inflation expectations and adjusted its estimates for the federal funds rate. As the US central bank projects one rate cut, the XAG/USD trades at $29.59, down 0.29% as Thursday’s Asian session begins.

XAG/USD Price Analysis: Technical Outlook

Silver's double-top chart pattern remains in effect, suggesting that the metal's spot prices might decline further. XAG/USD fell below the May 24 low of $30.05, confirming the double-top pattern.

The initial support for XAG/USD is at $29.00, followed by the June 7 low of $29.12. Breaking below this level could lead to a drop under $29.00, then to the May 18, 2021, high turned support of $28.74, and subsequently to the June 10, 2021, high of $28.34. The final target is the double top objective at $27.80.

Conversely, if XAG/USD moves upwards and closes above $29.00, it could challenge the May 24 low, which has turned into resistance at $30.05. Buyers are struggling to reclaim $30.00, indicating potential for further downside.

XAG/USD Price Action – Daily Chart

- Guppy tips into new 16-year high of 200.95 despite soft UK data.

- UK Manufacturing Production tumbled in April, contracted more than expected.

- Yen traders look ahead to Friday’s latest rate call from BoJ.

GBP/JPY found a new 16-year high of 200.95 on Wednesday, with Guppy bidders shrugging off a steep miss in UK manufacturing activity as the Yen continues to weaken across the board.

UK Manufacturing Production saw its sharpest drawdown since 2021, declining -1.4% MoM in April and completely missing the forecast -0.2% contraction from the previous month’s scant 0.3% growth. GBP traders shrugged off the downside print in UK manufacturing activity to bid the Sterling higher against the Yen, clipping into a 16-year peak before slipping back slightly amidst broad-market flows.

Yen markets are pivoting to face the Bank of Japan’s (BoJ) latest rate call and Monetary Policy Statement. The BoJ has left the Yen notoriously unprotected as the Japanese central bank’s hypereasy policy stance leaves the JPY notably weak, with Yen flows floundering as the rate differential between the BoJ and other major global central banks weighs on JPY strength.

GBP/JPY technical outlook

GBP/JPY continues to pin firmly into bullish territory, trading north of the 200-hour Exponential Moving Average (EMA) at 199.73. The pair’s tilt into new highs on Wednesday leaves the pair overextended with few technical resistance points in the way. However, overbought conditions could see a near-term snap back to consolidation levels near 199.50.

GBP/JPY hourly chart

GBP/JPY daily chart

- USD/CHF trades at 0.8944, recovering from daily lows of 0.8893 following the Fed's hawkish stance.

- Fed keeps rates at 5.25%-5.50%, revises federal funds rate projection to 5.1% for end of 2024.

- May’s US inflation data is weaker than April’s, impacting USD as Treasury yields plunge; upcoming PPI and jobless claims data are in focus.

The USD/CHF remains in the red, yet off daily lows of 0.8893 after the US Federal Reserve held rates unchanged and tilted hawkish. Policymakers expected just one rate cut instead of the three foresaw in the Summary of Economic Projections (SEP) in March 2024. Therefore, traders booked profits as the major recovered some ground and exchanged hands at 0.8944, down 0.35%.

Swiss Franc trims some gains after Fed’s adjust interest rate cut expectations

Federal Reserve officials tilted hawkish on their June monetary policy meeting decision via the Summary of Economic Projections (SEP), as they project just one interest rate cut instead of the three foresaw since the December 2023 meeting. They voted unanimously to keep the federal funds rate (FFR) at around 5.25%-5.50% and upward revised their inflation expectations as measured by the Personal Consumption Expenditure (PCE) Price Index.

The SEP showed that Fed officials upward revised their projections of the federal funds rate from 4.6% to 5.1% toward the end of 2024. Regarding Gross Domestic Product (GDP) for 2024, they project a 2.1% increase, as foreseen in March, while the Unemployment Rate is projected at 4%, unchanged from March’s SEP. PCE inflation is expected to rise from 2.4% to 2.6%, and Core PCE is expected to rise from 2.6% to 2.8%.

Earlier, the US Bureau of Labor Statistics (BLS) revealed that May’s inflation in the US was unchanged, but lower than April’s data. This weakened the Greenback due to plunging US Treasury bond yields.

Ahead of the week, the US economic docket will feature May’s Producer Price Index (PPI) and Initial Jobless Claims (IJC) on Thursday.

USD/CHF Price Analysis: Technical outlook

From a daily chart perspective, the USD/CHF dived and tested the 200-day moving average (DMA) at 0.8896 before recovering from its earlier losses. Although the pair aimed higher, it was capped at the 100-DMA at 0.8949, a strong resistance level. If it’s cleared, the pair could rally toward 0.9000 and beyond. On the downside, the first support would be the 200-DMA at 0.8896. Key support levels lie below, like the 0.8800 figure.

- The AUD/JPY pair surpassed the 20-day SMA, indicating a rising bullish momentum.

- Despite the rise, the pair is still in a consolidation phase, hinting at the possibility of limited gains.

- The bull's next target stands at 105.00.

In Wednesday's session, the AUD/JPY pair exhibited a promising move, surpassing the 20-day Simple Moving Average (SMA) at 103.90. This could be a positive sign, demonstrating strength in the Australian Dollar against its competitors. However, the ongoing consolidation phase suggests that there may not be enough momentum for a persistent rise.

The daily Relative Strength Index (RSI) for the AUD/JPY currently stands at 59 suggesting a significant shift from Tuesday’'s 53. On the other hand, the Moving Average Convergence Divergence (MACD) continues to display decreasing red bars, suggesting a potential weakening in the bearish momentum.

AUD/JPY daily chart

In conclusion, the AUD/JPY pair seems to be in a consolidation phase, despite successfully rising above the 20-day SMA. The range of 102.00-103.00 may denote the next trading patterns unless the bulls retain control above the 20-day SMA. Nonetheless, the reduction in selling momentum could denote a preparation by the bulls for the next upward swing and might retest the 105.00 area.

- The Australian Unemployment Rate is foreseen to contract to 4% in May.

- Employment Change expected to remain tepid, up by 27.5K in the month.

- AUD/USD set to run to fresh multi-month highs with an upbeat report.

Australia is set to release the May employment report on Thursday at 1:30 GMT. The Australian Bureau of Statistics (ABS) is expected to announce the country added 27.5K new job positions in the month, down from the 38.5K gained in April. The Unemployment Rate is foreseen at 4%, easing from the previous 4.1%. Ahead of the announcement, the Australian Dollar (AUD) is up amid broad US Dollar’s weakness.

Headline Employment Change is split into full-time and part-time positions. Generally speaking, full-time jobs imply working 38 hours per week or more and usually include additional benefits, but they mostly represent consistent income. On the other hand, part-time employment generally means higher hourly rates but lacks consistency and benefits. That’s why the economy prefers full-time jobs.

According to the April report, seasonally adjusted, the number of people counted as officially unemployed increased by 30,300 in the month, while the number of employed people increased by 38,500. The latter combines an increase of 44,600 part-time positions and a loss of 6,100 full-time jobs.

Australian unemployment rate expected to ease in May

Market analysts anticipate the Australian Unemployment Rate will ease from the 4.1% posted in April to 4%. April’s level was the highest since March 2022, and was also hit in January this year.

The decline in full-time employment and the uptick in the unemployment rate in April was seen as a tepid sign of a loosening labor market. Speculative interest would welcome another monthly report in such a line as it could lift the odds for an interest rate cut in the country before the year's end.

The Reserve Bank of Australia (RBA) met early in May, and policymakers decided to leave the benchmark rate at 4.35%. The RBA also warned about inflation risks being on the upside but refrained from reinstating the tightening bias dropped in the previous meeting. Policymakers also noted that inflation is easing more slowly than previously expected. “The economic outlook remains uncertain, and recent data have demonstrated that the process of returning inflation to target is unlikely to be smooth,” said the Board’s statement.

Ahead of the employment report, market players believe the RBA could deliver a rate cut in November and four more throughout 2025. However, sticky inflation and a tight labor market may push the odds further down the road. According to the ABS, the Consumer Price Index rose by 3.6% in the twelve months to April, up from the previous 3.5%. It was the second consecutive month in which inflation posted a small increase, in line with policymakers’ concerns.

With that in mind, a better-than-anticipated employment report would fuel speculation the RBA will not cut rates until February 2025 and boost the Australian Dollar.

Ahead of Australian employment figures, the focus was on the United States (US). The Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose 3.3% YoY in May after hitting 3.4% in April. The CPI remained unchanged on a monthly basis, easing from the previous 0.3%. The core readings, which exclude volatile food and energy prices, were also below forecast and eased from the April readings. The annual core CPI rose 3.4%, while the monthly figure was up by 0.2%.

The softer-than-anticipated US inflation figures triggered a US Dollar sell-off, prompting AUD/USD higher.

When will the Australian employment report be released, and how could it affect AUD/USD?

The ABS will publish the May employment report early on Thursday. As previously stated, Australia is expected to have added 27.5K new job positions in the month, while the Unemployment Rate is foreseen at 4%. Finally, the Participation Rate is foreseen to hold at 66.7%.

From a technical perspective, Valeria Bednarik, Chief Analyst at FXStreet, notes: “The AUD/USD pair nears a relevant high posted mid-May at 0.6713 as optimism reigns. Beyond the 0.6700 mark, the pair can run towards the 0.6700 region with an upbeat Australian employment report, although given the pre-news rally, additional advances without a pullback in the middle seem unlikely. Near-term support can be found at around 0.6630, followed by the 0.6580 price zone.”

Bednarik adds: “Ultimately, AUD/USD direction will depend on how the data would affect the odds for a rate cut in Australia. It is worth remembering that the Australian interest rate peaked below those of its major counterparts, making it less worrisome should local policymakers decide to delay the decision.”

Employment FAQs

Labor market conditions are a key element in assessing the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels because low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given their significance as a gauge of the health of the economy and their direct relationship to inflation.

Economic Indicator

Unemployment Rate s.a.

The Unemployment Rate, released by the Australian Bureau of Statistics, is the number of unemployed workers divided by the total civilian labor force, expressed as a percentage. If the rate increases, it indicates a lack of expansion within the Australian labor market and a weakness within the Australian economy. A decrease in the figure is seen as bullish for the Australian Dollar (AUD), while an increase is seen as bearish.

Read more.Last release: Thu May 16, 2024 01:30

Frequency: Monthly

Actual: 4.1%

Consensus: 3.9%

Previous: 3.8%

Source: Australian Bureau of Statistics

The Australian Bureau of Statistics (ABS) publishes an overview of trends in the Australian labour market, with unemployment rate a closely watched indicator. It is released about 15 days after the month end and throws light on the overall economic conditions, as it is highly correlated to consumer spending and inflation. Despite the lagging nature of the indicator, it affects the Reserve Bank of Australia’s (RBA) interest rate decisions, in turn, moving the Australian dollar. Upbeat figure tends to be AUD positive.

- Crude Oil markets rose on Wednesday before trimming gains post-Fed.

- WTI peaked near $79.00 per barrel before falling back into the day’s range.

- Odds of two rate cuts in 2024 are evaporating, crimping risk appetite.

West Texas Intermediate (WTI) US Crude Oil rose through Wednesday’s early trading, hitting a fresh June high near $79.00 per barrel before slumping back below $78.00 after the Energy Information Administration (EIA) reported another buildup in US Crude Oil supplies coupled with another Federal Reserve (Fed) rate hold.

Fed Chairman Jerome Powell hit markets with a cautious tone on rate cut expectations, noting that inflation progress still has a lot of progress to make before the Fed will be confident enough to cut rate. The Federal Open Market Committee (FOMC) has trimmed expectations of rate cuts, with the FOMC’s Summary of Economic Projections (SEP) or “dot plot” expecting only a single quarter-point cut in 2024 according to the median projection.

Broader market sentiment tilted firmly into the bullish early Wednesday after US Consumer Price Index (CPI) inflation cooled faster than expected in May, with headline CPI inflation easing to 0.0% MoM compared to the forecast tick down to 0.1% from the previous 0.3%, and YoY Core CPI inflation also eased to 3.4% versus the forecast 3.5% and last of 3.6%. Market hopes for a September rate cut of at least 25 basis points peaked over 70% in the early US trading session before Fed caution swamped out sentiment.

The Energy Information Administration (EIA) reported another unexpected buildup in US Crude Oil Stocks Change for the week ended June 7, adding 3.73 million barrels to the previous week’s 1.233 million, washing out the forecast contraction of -1.55 million.

WTI technical outlook

WTI peaked just shy of $79.00 per barrel on Wednesday before facing a technical rejection from a descending trendline drawn from 2024’s peak bids at $87.12, and near-term strength goes to the bears. However, technical support comes from the 200-hour Exponential Moving Average (EMA) rising into $76.60 and could limit downside momentum.

Wednesday’s bullish peak ran aground of heavy resistance from the 200-day EMA at $78.83, and US Crude Oil’s recovery from near-term lows near $72.45 could face another turn lower.

WTI hourly chart

WTI daily chart

The Greenback sharply reversed its recent positive streak on the back of the negative surprise of US CPI in May, while the hawkish hold by the Federal Reserve helped the USD Index (DXY) regain some composure.

Here is what you need to know on Thursday, June 13:

The USD Index (DXY) revisited the area of three-day lows on the back of declining US yields, lower CPI and after the Fed left rates unchanged, as expected. On June 13, the usual weekly Initial Jobless Claims are due seconded by Producer Prices and the speech by Fed’s Williams.

EUR/USD managed to stage quite a colourful comeback and advanced beyond 1.0800 the figure, although part of those gains fizzled out post-Powell’s press conference. Industrial Production readings in the euro bloc are expected on June 13.

GBP/USD rose to three-month highs well north of 1.2800 following the sharp sell-off in the US Dollar. There are no data releases scheduled for June 13 across the Channel.

USD/JPY reversed three consecutive daily declines, although it bounced off three-day lows near 155.70 as the Greenback trimmed some losses at the end of the day. The Quarterly BSI Large Manufacturing index and weekly Foreign Bond Investment figures will be published on June 13.

AUD/USD briefly retested the area just beyond the 0.6700 barrier against the backdrop of a strong pick-up in the selling bias in the US Dollar. The release of the Australian labour market report takes centre stage on June 13 seconded by Westpac’s Consumer Confidence print.

Prices of WTI advanced marginally as traders assessed the Fed’s interest rate decision and another negative weekly report of US crude oil inventories.

Gold prices ended Wednesday’s session marginally on the defensive after it could not sustain a post-Fed move above $2,340 region. Silver charted small gains but it came under pressure soon after hitting the $30.00 mark per ounce.

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25%-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"We will look at totality of data on labor, economic growth and inflation to begin rate cuts."

"I am not at a point of giving dates for rate cuts."

"We are well aware of the two-sided risks we face."

"We understand risks of waiting too long, or moving too quickly."

"We are trying to manage those risks."

"We don't think it will be appropriate to loosen policy until we are more confident on inflation."

"I think our current approach is the right way to think about it."

"It is not our plan to wait for things to break and then try to fix them."

"Our plan is not to wait for things to break and then try to fix it."

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25%-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"Readings like today's CPI is a step in the right direction."

"But one reading is just one reading, don't want to be too motivated by that."

"We are doing everything we can to bring inflation back down under control."

"We in the phase of sticking with it until we get it done."

"We are encouraged that we are still seeing solid economic growth."

"Today's inflation report is also encouraging, but comes after several that were not so encouraging."

"It may take several years for the bulge in rent prices to work it's way through to lower housing inflation."

"Household sector is still in pretty good shape, just not as good as a year ago."

"We do see increasing financial pressures on more lower income people."

"Best thing we can do is foster a strong jobs economy."

"If we see unemployment more than we forecast, we would view that as unexpected weakening."

"Of course we can't wait for that to happen, and that's why we always look at balance of risks."

"A decision to loosen policy could have several reasons associated with it."

"If we saw troubling weakening in labor market, that is something we would consider responding to."

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25%-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"Improvement in inflation has been coming from unwinding of pandemic distortions, complemented by monetary policy."

"Inflation is also improving because of positive supply shock."

"These inflation dynamics can continue."

"We don't know if we are down to demand determining inflation."

"We are getting good results in bringing down inflation with gradual cooling of economy so far."

"Housing situation is complicated."

"Ultimately, best thing we can do for housing market is bring inflation down."

"Banking system has been solid, strong, well-capitalized."

"Wages still running above a sustainable path."

"Wages not principle cause of inflation, but needs them to come down for overall inflation to get back to 2%."

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25%-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"I like to look at 3 and 6 month series on payrolls report given differences in establishment and household survey."

"Overall picture is one of strong and gradually cooling labor market."

"It has given us an ambiguous result, but fact remains labor market is strong."

"No longer the super heated labor market of a few years ago."

"The big thing that change rate path forecasts was inflation."

"We had a pause in progress in inflation in first quarter, the takeaway was that it will take longer to get to rate cuts."

"We have to let the data light the way."

"Today was a better inflation report than almost anyone expected."

"Long-run neutral rate of interest is theoretical."

"People are coming to the view that rates are less likely to go back down to pre-pandemic levels."

"We are making policy with the economy we have and distortions we have."

"Policy is restrictive."

"The question of whether it's restrictive enough will be answered over time."

"Evidence is pretty clear though that policy is currently restrictive and having impact we hoped for."

"We are prepared to adjust policy as appropriate."

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25%-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"We need further confidence, more good inflation readings but won't be specific about how many to start rate cuts."

"We'll also be looking at balance of risks, outlook as well."

"Unexpected weakness in labor market could also call for a response."

"We will be monitoring labor market for signs of weakness, but not seeing that right now."

"We don't see ourselves as having the confidence that would warrant policy loosening at this time."

"FOMC participants were allowed to update their forecasts to incorporate CPI data today if they wanted to."

"We still have low unemployment, but has softened a bit and that's an important statistic."

"Argument that job gains may be a bit overstated, but still strong."

"We are seeing gradual cooling in labor market as it moves into better balance."

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25%-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"The Summary of Economic Projections are not a plan or any kind of decision."

"Assessment of policy will adjust."

"If the economy remains solid and inflation persists, will keep rates where they are for as long as needed."

"The opposite is also true in terms of rate cuts."

"Policy is well-positioned, will continue to make decisions meeting by meeting."

"We are practicing a slight element of conservatism on our inflation outlook."

"We don't have high confidence in forecasts."

"We welcome today's inflation reading, hope for more like that."

"We need more confidence on inflation moving back down to 2%."

"The test for cutting rates is more confidence that inflation is moving toward 2%."

"We have a fairly conservative forecast on inflation, if we get better readings, I think we will see forecasts come down."

"We all agree that we are data dependent."

"No one on the Committee has a strong commitment to a rate forecast."

"We have no commitment to a particular rate cut."

"Policymakers are not trying to send a strong signal with forecasts."

Dot Plot FAQs

The “Dot Plot” is the popular name of the interest-rate projections by the Federal Open Market Committee (FOMC) of the US Federal Reserve (Fed), which implements monetary policy. These are published in the Summary of Economic Projections, a report in which FOMC members also release their individual projections on economic growth, the unemployment rate and inflation for the current year and the next few ones. The document consists of a chart plotting interest-rate projections, with each FOMC member’s forecast represented by a dot. The Fed also adds a table summarizing the range of forecasts and the median for each indicator. This makes it easier for market participants to see how policymakers expect the US economy to perform in the near, medium and long term.

The US Federal Reserve publishes the “Dot Plot” once every other meeting, or in four of the eight yearly scheduled meetings. The Summary of Economic Projections report is published along with the monetary policy decision.

The “Dot Plot” gives a comprehensive insight into the expectations from Federal Reserve (Fed) policymakers. As projections reflect each official’s projection for interest rates at the end of each year, it is considered a key forward-looking indicator. By looking at the “Dot Plot” and comparing the data to current interest-rate levels, market participants can see where policymakers expect rates to head to and the overall direction of monetary policy. As projections are released quarterly, the “Dot Plot” is widely used as a guide to figure out the terminal rate and the possible timing of a policy pivot.

The most market-moving data in the “Dot Plot” is the projection of the federal funds rate. Any change compared with previous projections is likely to influence the US Dollar (USD) valuation. Generally, if the “Dot Plot” shows that policymakers expect higher interest rates in the near term, this tends to be bullish for USD. Likewise, if projections point to lower rates ahead, the USD is likely to weaken.

Federal Reserve Chairman Jerome Powell explains the decision to leave the policy rate, federal funds rate, unchanged at the range of 5.25%-5.5% and responds to questions in the post-meeting press conference.

Key quotes

"Our economy has made considerable progress."

"Continued strong job gains in the economy."

"Inflation has eased substantially but it's still too high."

"We are maintaining a restrictive stance to keep demand in line with supply."

"Recent indicators suggest economic growth still expanding at solid pace."

"Private domestic final purchases, a clearer signal, is still strong."

"Consumer spending remains solid."

"Investment in equipment has picked up from an anemic pace."

"Labor market coming into better balance."

"April and May jobs pace still strong, unemployment rate remains low."

"A broad set of indicators suggest the labor market back to where it was on the eve of the pandemic."

"Overall broad set of indicators in the labor market show it is relatively tight but not overheated."

"We expect labor market strength to continue."

"More recent readings on inflation have shown easing."

"So far this year, we have not got greater confidence on inflation in order to cut."

"Will need to see more good data to bolster confidence on inflation."

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- Fed maintains interest rates; projects higher rates through 2024 with a federal funds rate adjustment to 5.10%.

- Cooler US inflation report pressures the Greenback, leading to a decline in USD/JPY.

- Fed's economic outlook: Stable growth at 2.1%, steady unemployment at 4%, with minor hikes in PCE and Core PCE inflation rates.

The USD/JPY retreated on Wednesday after the Federal Reserve's decision to keep interest rates unchanged while tilting slightly hawkish as Fed officials upward revised the federal fund's rates. However, a cooler-than-expected US inflation report weighed on the Greenback ahead of Fed Chair Jerome Powell's presser. The major trades at 156.26, down 0.55%.

USD/JPY drops 0.55% amid Fed's hawkish hold, cooler US inflation report

The Federal Reserve’s monetary policy statement highlighted that Fed officials do "not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent." They also stated that "the Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals."

Meanwhile, the Summary of Economic Projections (SEP) revealed that policymakers tilted slightly hawkish, as the median foresees the federal funds rate to end at 5.10% in 2024, up from 4.60% in March’s projections. The economy is expected to grow 2.1%, consistent with their March forecast, while the unemployment rate is projected to remain at 4%, unchanged from the previous SEP. PCE inflation is expected to rise slightly from 2.4% to 2.6%, and Core PCE inflation is projected to increase from 2.6% to 2.8%.

USD/JPY Reaction to Fed’s Decision - Hourly Chart

The USD/JPY bounced off daily lows at around 155.80 and edged above the 156.00 figure, but it was capped by the 100-Simple Moving Average (SMA) at 156.55. For buyers to extend its gains, they must clear the 100-SMA, and test the bottom of the Ichimoku Cloud at around 156.80/95. Further gains are seen above 157.00.

- Fed holds rates steady at 5.25%-5.50% as expected.

- Dot plot indicates that most FOMC members are seeing fewer rate cuts this year.

- As an initial reaction, the USD recovered and the pair cleared some of its daily losses.

On Wednesday, the GBP/USD cleared some of its gains following the Federal Reserve (Fed) decision to hold rates steady at 5.25%-5.50% and stands at 1.2830. What strengthened the USD is that the dot plot suggested that the members are seeing two instead of three rate cuts in 2024.

Regarding economic protections, the bank revised its Personal Consumption Expenditures (PCE) forecasts to 2.4% YoY from 2.6% YoY, while growth protections remain unchanged. The interest protections, via the so-called dot plot, showed an upward revision of the interest rates by the end of 2024 now at 5.1%, up from 4.6%, and for the 2025 at 4.1%, up from 3.9%. The projection for 2026 stood at 3.1%, and the longer-run rate has been revised to 2.8% from 2.6%.

As a reaction, the USD recovered some ground following the soft Consumer Price Index (CPI) figures from May, which triggered a sharp decline in US Treasury bond yields earlier in the session. The US 2, 5 and 10-year rates cleared some losses but are still down by more than 2%.

GBP/USD technical analysis

Indicators on the daily chart significantly recovered and remain deep in positive terrain. The Relative Strength Index (RSI) moved toward 60, while the Moving Average Convergence Divergence (MACD) prints decreasing red bars, indicating a decreasing selling pressure. The overall outlook remains positive as the pair rides above the 20, 100 and 200-day Simple Moving Averages (SMA).

- Gold trades at $2,335 as lower-than-expected US inflation boosts rate cut speculation, but Fed holds rates steady.

- Fed’s statement highlights a cautious approach to rate cuts, with inflation projections for 2024 edging higher.

- US 10-year Treasury yield drops 14 basis points to 4.266%, while DXY falls 0.83% to 104.38, supporting gold prices.

Gold prices climbed on Wednesday following a lower-than-expected inflation report in the United States (US), which increased the odds of a Federal Reserve (Fed) interest rate cut later in the year. Nevertheless, the Federal Reserve decided to keep rates unchanged at its meeting and revised lower interest rate cut expectations for 2024, tilting hawkish. The XAU/USD trades at $2,335, gaining 0.81% on the day.

In its monetary policy statement, the Fed mentioned they do “not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” They added that “the Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.”

Aside from this, the so-called ‘dot-plot’ showed that the median of the Fed officials upward revised their projections of the federal funds rate from 4.6% to 5.1%, toward the end of 2024. This means they are foreseen just one rate cut, compared to the current effective federal funds rate standing at 5.33%.

Federal Reserve officials updated their economic projections for 2024. According to the Summary of Economic Projections (SEP), they expect the economy to grow 2.1%, as foreseen in March, while the Unemployment Rate is estimated at 4%, unchanged from the previous SEP. PCE inflation is expected to edge higher from 2.4% to 2.6%, and Core PCE to rise from 2.6% to 2.8%.

Earlier, the US Bureau of Labor Statistics (BLS) revealed that May’s inflation in the US was unchanged compared to April’s data, strengthening the golden metal as US Treasury bond yields plunged. The Greenback tumbled to a three-day low, as revealed by the US Dollar Index (DXY), which measures the performance of the buck’s value against a basket of six other currencies.

The US 10-year Treasury note yield edges down 14 basis points to 4.266%, a tailwind for the yellow metal. Consequently, the DXY plummeted 0.83% to 104.38.

According to the CME FedWatch Tool, the latest US inflation report increased the odds of a Fed rate cut in September from 46.7% to 61.3%.

Daily digest market movers: Gold price stays firm post Fed’s decision

- US Consumer Price Index (CPI) remained unchanged at 0% MoM, falling short of the 0.1% monthly estimate and April's 0.3% increase. Over the twelve months leading to May, the CPI rose by 3.3%, below both April's figure and the 3.4% consensus.

- Core inflation figures decreased from 0.3% to 0.2% MoM. Annually, core inflation was 3.4%, which was lower than expected 3.5% and April's 3.6%.

- On Tuesday, the NFIB Small Business Optimism Index for May hit its highest level of the year. The survey highlighted that businesses struggle with inflation and access to cheap financing.

- December’s 2024 fed funds futures contract hints that investors expect 28 basis points of rate cuts by the Fed through the end of the year.

- News that the People’s Bank of China paused its 18-month bullion buying spree weighed on the precious metal. PBOC holdings held steady at 72.80 million troy ounces of Gold in May.

Technical analysis: Gold price rises as buyers target $2,380

Gold remains neutral to downwardly biased after forming a Head-and-Shoulders chart pattern. Although it hints that the non-yielding metal could be headed to the downside, the Fed’s decision could negate the chart pattern if XAU/USD climbs past the June 7 cycle high of $2.387, opening the door to test the $2,400 mark.

Conversely, if XAU/USD drops below the $2,300 figure, the next demand area would be the May 3 low of $2,277, followed by the March 21 high of $2,222. Further losses lie beneath, as sellers would eye the Head-and-Shoulders chart pattern objective at around $2170 to $2160.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- EUR/USD pulls back from 1.0850 after Fed holds rates; rate cuts look less likely.

- Fed dot plot sees less likelihood of rate cuts in 2024.

- Fed's forward-looking rate expectations tick higher.

EUR/USD pivoted away from 1.0850 on Wednesday after the Federal Reserve (Fed) held rates as markets broadly expected, but a shift in the Fed's "dot plot" of interest rate expectations is warning that interest rates are likely to continue holding higher for longer

Fed leaves policy rate unchanged at 5.25%-5.5% as forecast

The Fed's interest rate outlook sees higher rates than previously expected, with the 1-year rate outlook rising to 4.1% from the previous 3.9%. The 2-year rate outlook held steady at 3.1%, and the long-term interest rate outlook rose to 2.8% from 2.6%.

Live Coverage: Fed dot plot cools Gold, stocks, buoys US Dollar

According to the Fed's dot plot, only a single rate cut in 2024 is looking more likely. Four members of the Federal Open Market Committee (FOMC) see no rate cuts at all in 2024, with seven FOMC members expecting only a single quarter-point cut. Eight FOMC voters still see two cuts for the year, but the summary of FOMC rate expectations has shifted firmly back from previous forecasts.

EUR/USD rallied hard early Wednesday after US Consumer Price Index (CPI) inflation cooled faster than expected in May. The Fiber rose 1.10% to 1.0850 after May's US CPI eased to 0.0% MoM, down from the forecast 0.1% and easing further from the previous 0.3%. However, an uneasy Fed has trimmed bullish momentum, and the pair is dropping back post-FOMC as investors await Fed Chair Jerome Powell's press conference at the bottom of the hour.

more to come...

- AUD/USD surges as soft US inflation figures buoy the Australian Dollar.

- Attention is now on Fed's decision later in the session.

- Australian traders are digesting the inflation figures from China released during the Asian session.

On Tuesday, the Australian Dollar (AUD) gained against the US Dollar (USD), countering the prior bearish pressure, and is now lingering around the 0.6705 area. This uptrend is likely induced by the release of soft inflation figures from the US. The announcement of the Federal Reserve (Fed) meeting, at 18:00 GMT, is expected to trigger volatility.

On the Australian front, soft inflation data from China, a vital trading partner, is currently being evaluated by Australian traders. The Chinese inflation figures could influence the monetary policy of the Reserve Bank of Australia (RBA) and the performance of the Australian dollar as economic weakness in China might prompt sooner rate cuts.

Daily digest market movers: Australian Dollar is gaining strength as traders digest US CPI data

- On the US side, markets were met with somewhat softer May Consumer Price Index (CPI) data on Tuesday.

- CPI dropped to 3.3% annually in May, falling short of the market's 3.4% expectation.

- Core CPI also saw a dip, while the overall CPI remained stable on a monthly basis.

- Two-day Fed meeting concludes on Wednesday. Given that most inflation measures have remained higher than desired since their last meeting, it's highly unlikely that there will be any shift in Fed's tone.

- On the Chinese side, China's May Consumer Price Index (CPI) was slightly lower than expected, while its Producer Price Index (PPI) was higher than anticipated.

- As Chinese economy grapples with deflationary risks that could steer their monetary policy to remain loose, which might be followed by the RBA.

Technical analysis: AUD/USD bulls gain momentum, outlook looks bright

The Relative Strength Index (RSI) has ascended above the 50 level, which supports the bullish sentiment, while the Moving Average Convergence Divergence (MACD) presents shrinking red bars that reflect diminishing selling pressure.

The overall positive outlook remains intact as the pair continues to stay above the 100 and 200-day Simple Moving Averages (SMA) around 0.6550. This position above these key levels suggests an overall favorable trend. Furthermore, the bulls took over the 20-day SMA on Wednesday, leading to a brightened short-term outlook.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- Mexican Peso falls 0.60%, continuing its decline for a second consecutive day.

- Political turmoil and judicial reform concerns in Mexico lead to over 10% depreciation since June 2 election.

- A softer US inflation report moderates further Peso losses, yet political uncertainties maintain USD/MXN near multi-month highs.

The Mexican Peso extended its losses for the second straight day on Wednesday against the US Dollar after hitting a 14-month low of 18.99, as traders remained nervous about controversial reforms to the Mexican constitution. Meanwhile, a softer-than-expected US inflation report capped the Mexican currency fall, yet it remains trading with losses of 0.65% near18.66.

Mexico’s political turmoil has weakened the Mexican currency by more than 10% following the June 2 general election. Investors are nervous about President Andres Manuel Lopez Obrador’s (AMLO) imminent judicial reform in September, which would allow the popular election of judges and magistrates of the Supreme Court.

The dissolution of key autonomous bodies, including the INAI and the Electoral Institute (INE), poses a significant threat to Mexico's hard-won democracy, which has been in place since the 1990s. If implemented, this move could potentially disrupt the democratic processes that have been the cornerstone of Mexico's political and economic stability.

During his morning press conference, President AMLO belittled the markets. According to Reuters, he said, "They are wrong, respectfully, if they are thinking that we are going to go back on reforming the judiciary, which is rotten, which is dominated by corruption, just because there is financial nervousness."

The USD/MXN hit a new multi-month high of 18.99 during the European session amid political and economic uncertainty surrounding Mexico.

AMLO’s pending reforms will be submitted to the newly elected Mexican Congress once it takes office in September, one month before President-elect Claudia Sheinbaum begins her six-year presidency.

Across the border, May’s US inflation was softer than expected, which weakened the Greenback against a basket of six currencies, but not against the Peso. At 18:00 GMT, the US Federal Reserve (Fed) is expected to deliver its monetary policy decision and its economic projections.

Daily digest market movers: Mexican Peso on the defensive amidst political uncertainty

- In February 2024, AMLO put forward several proposals to the Mexican Congress. These include a Supreme Court reform that suggests electing Supreme Court ministers through popular vote; an electoral reform aimed at electing electoral commission councilors by popular vote and reducing multi-member representation; and a reform of autonomous bodies that proposes dissolving the transparency body.

- Mexican Peso depreciation could weigh on the Bank of Mexico's (Banxico) decision to ease policy, even though last month’s core inflation slowed. Therefore, keeping interest rates higher could prompt deceleration in the economy and increase odds of a recession.

- Morgan Stanley noted that if Mexico’s upcoming government and Congress adopted an unorthodox agenda, it would undermine Mexican institutions and be bearish for the Mexican Peso, which could weaken to 19.20.

- The US Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) remained unchanged at 0% MoM, falling short of the 0.1% monthly estimate and April's 0.3% increase. Over the twelve months leading to May, the CPI rose by 3.3%, below both April's figure and the 3.4% consensus.

- Core inflation figures decreased from 0.3% to 0.2% MoM. Annually, core inflation was 3.4%, which was lower than the expected 3.5% and April's 3.6%.

- The latest US inflation report increased the odds for a Fed rate cut in September, according to the CME FedWatch Tool, from 46.7% to 61.3%.

- December’s 2024 fed funds futures contract hints that investors expect 28 basis points of rate cuts by the Fed through the end of the year.

Technical analysis: Mexican Peso slides as USD/MXN approaches 19.00

The USD/MXN is bullishly biased even though the Peso has recovered some ground ahead of the Fed’s monetary policy decision. Once the exotic pair broke the four-year downslope resistance trendline, that opened the door for further upside. Momentum depicts that buyers are in charge, as portrayed by the Relative Strength Index (RSI) being overbought, hinting that bulls are taking a respite ahead of the Fed.

The USD/MXN's next resistance would be the year-to-date high of 18.99, followed by the March 20, 2023, high of 19.23. A breach of the latter will sponsor an uptick to 19.50, ahead of the psychological 20.00 mark.

On the other hand, sellers must push the USD/MXN back below the April 19 high of 18.15 if they want to keep the pair within the 18.00-18.15 trading range.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Dow Jones jumped a full percent after CPI inflation cooled before receding to flat.

- Fed watchers on high alert as “Dot plot” update looms ahead.

- Fed rate call broadly expected to hold as investors wrestle with September cut odds.

The Dow Jones soared over 350 points in early Wednesday trading after US Consumer Price Index (CPI) inflation receded faster than expected, but investors are pulling back ahead of the Federal Reserve’s (Fed) latest rate call that will bring a hotly-anticipated update to the Fed’s “dot plot” of Interest Rate Expectations. With the Fed still due on Wednesday, the Dow Jones has pulled back to the day’s opening bids near 38,780.00.

US CPI inflation cooled to 0.0% MoM in May, below the forecast 0.1% and receding even faster from the previous month’s 0.3%. Core CPI ticked down to 3.4% YoY, below the forecast 3.5% and dropping away from the previous period’s 3.6%. With CPI inflation figures easing further, investor sentiment is leaning further into hopes of a September rate cut.

According to the CME’s FedWatch Tool, rate markets are now pricing in 70% odds of the Fed trimming rates at least 25 basis points on September 18, but Wednesday’s Fed outing is reigniting some caution.

Dow Jones news

The Dow Jones is roughly on-balance on Wednesday but tilted towards the lower side. 20 of the index’s 30 securities are leaning into the red ahead of the Fed, with Nike Inc. (NKE) leading the crowd lower, falling -1.8% to $94.14 per share. Apple Inc. (AAPL) is extending a broad climb as investors pin their hopes on Apple’s announced integration of ChatGPT into their operating software. AAPL is up 4.11% on Wednesday, climbing to $215.83 per share.

Dow Jones technical outlook

Wednesday’s CPI-fueled rally briefly peaked above 39,120.00 before risk appetite chilled and sent the Dow Jones back into the day’s opening range near 38,790.00. The major equity index remains mired in near-term congestion at the 200-hour Exponential Moving Average (EMA) at 38,866.60. Bidders have manage to price in a technical rebound from the week’s low bids near 38,400.00, but technical resistance is building from multiple rejections from chart regions north of the 39,000.00 handle.

Dow Jones hourly chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- USD pauses uptrend after the release of soft US inflation.

- Greenback to rely on FOMC meeting to dictate its next move.

- Investors expect hawkish hold with US central bank keeping rates at 5.25-5.50% range.

On Wednesday, the US Dollar Index (DXY) saw a downward trend following the release of US Consumer Price Index (CPI) data and ahead of the Federal Reserve’s (Fed) Federal Open Market Committee (FOMC) decision.

The two-day FOMC meeting, which ends on Wednesday, is a pivotal point for market observers as they will get a clearer outlook on the latest data, which saw inflation softening despite a strong labor market.

Daily digest market movers: DXY absorbs hit on CPI reading, eyes turn to FOMC

- US Bureau of Labor Statistics (BLS) reports a decline in US CPI to 3.3% YoY in May, down from 3.4% in April and slightly below market expectation of 3.4%.

- Annual core CPI rose 3.4%, marking a decrease from April's 3.6% and falling below analysts' estimate of 3.5%.

- Markets expect a hawkish hold from the Fed, maintaining the stance that was portrayed before Wednesday's inflation data was released.