- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | National Australia Bank's Business Confidence | October | ||

| 02:00 | New Zealand | Expected Annual Inflation 2y from now | Quarter IV | 1.86% | |

| 06:00 | Japan | Prelim Machine Tool Orders, y/y | October | -35.5% | |

| 08:00 | Eurozone | ECB's Benoit Coeure Speaks | |||

| 08:30 | Eurozone | ECB's Yves Mersch Speaks | |||

| 09:30 | United Kingdom | Average earnings ex bonuses, 3 m/y | September | 3.8% | 3.8% |

| 09:30 | United Kingdom | Average Earnings, 3m/y | September | 3.8% | 3.8% |

| 09:30 | United Kingdom | ILO Unemployment Rate | September | 3.9% | 3.9% |

| 09:30 | United Kingdom | Claimant count | October | 21.1 | 20 |

| 10:00 | Eurozone | ZEW Economic Sentiment | November | -23.5 | -32.5 |

| 10:00 | Germany | ZEW Survey - Economic Sentiment | November | -22.8 | -13 |

| 10:30 | U.S. | FOMC Member Clarida Speaks | |||

| 18:00 | U.S. | FOMC Member Harker Speaks | |||

| 21:45 | New Zealand | Food Prices Index, y/y | October | 2.2% | |

| 23:00 | U.S. | FOMC Member Kashkari Speaks | |||

| 23:30 | Australia | Westpac Consumer Confidence | November | 92.8 |

U.S. major stock indexes were mostly down as U.S. President Donald Trump’s recent comments dampened investor optimism about the U.S.-China deal, while the escalation of violence in Hong Kong added to concern.

The US president said on Friday that he had not yet agreed to abolish existing tariffs on Chinese imports, but China would "like" to do so. On Saturday, Trump announced his intention to conclude a trade agreement with China only if it would be a “right deal” for the United States, adding that negotiations were progressing more slowly than he would have liked. Trump's recent comments have dampened hopes for progress in trade negotiations between the two largest economies in the world.

Hong Kong's growing violence also negatively affected market sentiment. Hong Kong police used weapons against the demonstrators and wounded one of them in the 24th week of protests for democracy in the territory controlled by China.

Most of the DOW components completed trading in the red (21 of 30). Outsiders were 3M Co. (MMM; -2.02%). The biggest gainers were The Boeing Company (BA; + 5.15%).

Most S&P sectors recorded a decline. The largest drop was shown by the utilities sector (-0.5%). The conglomerate sector grew more than the rest (+ 0.3%).

At the time of closing:

Dow 27,691.49 +10.25 +0.04%

S&P 500 3,087.01 -6.07 -0.20%

Nasdaq 100 8,464.28 -11.04 -0.13%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | National Australia Bank's Business Confidence | October | ||

| 02:00 | New Zealand | Expected Annual Inflation 2y from now | Quarter IV | 1.86% | |

| 06:00 | Japan | Prelim Machine Tool Orders, y/y | October | -35.5% | |

| 08:00 | Eurozone | ECB's Benoit Coeure Speaks | |||

| 08:30 | Eurozone | ECB's Yves Mersch Speaks | |||

| 09:30 | United Kingdom | Average earnings ex bonuses, 3 m/y | September | 3.8% | 3.8% |

| 09:30 | United Kingdom | Average Earnings, 3m/y | September | 3.8% | 3.8% |

| 09:30 | United Kingdom | ILO Unemployment Rate | September | 3.9% | 3.9% |

| 09:30 | United Kingdom | Claimant count | October | 21.1 | 20 |

| 10:00 | Eurozone | ZEW Economic Sentiment | November | -23.5 | -32.5 |

| 10:00 | Germany | ZEW Survey - Economic Sentiment | November | -22.8 | -13 |

| 10:30 | U.S. | FOMC Member Clarida Speaks | |||

| 18:00 | U.S. | FOMC Member Harker Speaks | |||

| 21:45 | New Zealand | Food Prices Index, y/y | October | 2.2% | |

| 23:00 | U.S. | FOMC Member Kashkari Speaks | |||

| 23:30 | Australia | Westpac Consumer Confidence | November | 92.8 |

- Risks to growth outlook remain on the downside

- Likelihood of deflation is limited

- Better policy mix can help ECB to achieve goal faster

- Likelihood of deflation remains limited, market expectations of inflation over the medium-term are settling around the values that are not consistent with our inflation aim

Analysts at Danske Bank suggest that on the back of the Fed's new 'wait-and-see' approach and the better-than-expected October jobs report, they now expect only one more cut in 3-6M (previously three more cuts) from the US Fed.

- “The timing of the cut is difficult but, as the Fed wants to see how things play out, the March meeting is probably the earliest possibility. Most FOMC members (including the doves) have said they think the current policy stance is appropriate and that it would take a further deterioration of data to make further cuts.

- We keep a cut in our forecast profile, as we still believe the US economy is more fragile than the Fed believes and that the renewed trade optimism is unlikely to be enough to trigger a rebound in business investments just yet. Most soft indicators on investment intentions signal a further decline in business investments.

- In our view, we need a more permanent deal for investments to kick off again (we assign a 50% probability of this happening). The world economy also looks fragile, in particular in Europe, despite the early signs of stabilization in China.”

Analysts at National Bank Financial (NBF) note that in the U.S., the week will provide important information about the consumer price index in October.

- "Industrial production should have continued to suffer from the GM strike which likely hampered output in the manufacturing sector. October retail sales report will also come out and poor auto sales during the month may have translated in just a marginal expansion of headline retail outlays.

- Fed officials will be busy this week. Chairman Jerome Powell is slated to testify before the Joint Economic Committee of Congress on Wednesday. Other officials will deliver speeches, notably Patrick Harker (Tuesday), Neel Kashkari (Tuesday and Wednesday), Richard Clarida (Thursday), Mary Daly (Thursday), John Williams (Thursday) and James Bullard (Thursday).”

U.S. stock-index futures fell on Monday as U.S. President Donald Trump’s remarks cooled expectations around a U.S.-China trade deal, while escalating violence in Hong Kong hit investor sentiment.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 23,331.84 | -60.03 | -0.26% |

Hang Seng | 26,926.55 | -724.59 | -2.62% |

Shanghai | 2,909.97 | -54.21 | -1.83% |

S&P/ASX | 6,772.50 | +48.40 | +0.72% |

FTSE | 7,284.54 | -74.84 | -1.02% |

CAC | 5,887.60 | -2.10 | -0.04% |

DAX | 13,183.31 | -45.25 | -0.34% |

Crude oil | $56.45 | -1.38% | |

Gold | $1,461.10 | -0.12% |

- The fact that rates are negative in Europe means we have less room to manoeuvre in U.S.

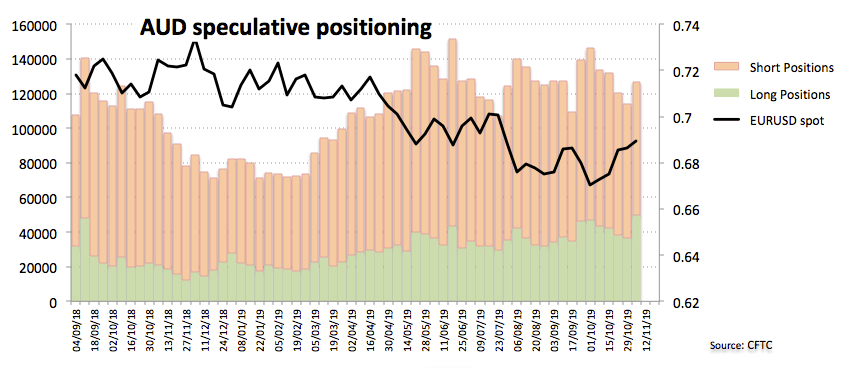

The CFTC Positioning Report for the week ended on November 5, reveals the following:

- "Speculators kept trimming gross shorts in the Sterling, taking net shorts to the lowest level since late May. Shrinking odds for a ‘no deal’ Brexit in tandem with rising speculations that PM B.Johnson could clinch a majority win in the December elections have been bolstering the upside momentum around the quid.

- JPY net shorts increased to levels last seen in June, always on the back of the recent improvement in the US-China trade scenario and the perceived likelihood that the ‘Phase One’ deal could be signed anytime soon.

- AUD saw an important uptick in gross longs, dragging the net shorts to the lowest level since the mid-June 2018. Upbeat news from the US-China scenario coupled with the expected ‘wait-and-see’ mode from the RBA gave much-needed oxygen to the Aussie Dollar during last week."

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 176.15 | 2.15(1.24%) | 3644 |

ALTRIA GROUP INC. | MO | 46.08 | 0.17(0.37%) | 5007 |

Amazon.com Inc., NASDAQ | AMZN | 1,803.00 | 7.23(0.40%) | 17843 |

AMERICAN INTERNATIONAL GROUP | AIG | 55.75 | 0.23(0.41%) | 2317 |

Apple Inc. | AAPL | 258.5 | 2.03(0.79%) | 226509 |

AT&T Inc | T | 39.3 | 0.05(0.13%) | 37195 |

Boeing Co | BA | 356 | 3.87(1.10%) | 28264 |

Caterpillar Inc | CAT | 147.1 | 1.61(1.11%) | 8591 |

Cisco Systems Inc | CSCO | 48.62 | 0.35(0.73%) | 21815 |

Citigroup Inc., NYSE | C | 75.49 | 1.07(1.44%) | 33630 |

Deere & Company, NYSE | DE | 177 | 1.03(0.59%) | 746 |

E. I. du Pont de Nemours and Co | DD | 71 | 0.67(0.95%) | 800 |

Exxon Mobil Corp | XOM | 72 | 0.51(0.71%) | 10150 |

Facebook, Inc. | FB | 192.35 | 0.80(0.42%) | 41042 |

FedEx Corporation, NYSE | FDX | 165.25 | 2.08(1.27%) | 4638 |

Ford Motor Co. | F | 9 | 0.08(0.90%) | 199064 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.96 | 0.32(3.01%) | 36203 |

General Electric Co | GE | 11.1 | 0.08(0.73%) | 200450 |

General Motors Company, NYSE | GM | 38.81 | 0.39(1.02%) | 3848 |

Goldman Sachs | GS | 221 | 2.58(1.18%) | 6213 |

Google Inc. | GOOG | 1,296.90 | 5.10(0.39%) | 3391 |

Hewlett-Packard Co. | HPQ | 19.73 | 0.16(0.82%) | 50592 |

Home Depot Inc | HD | 234.85 | 0.84(0.36%) | 1657 |

HONEYWELL INTERNATIONAL INC. | HON | 181.05 | 0.24(0.13%) | 197 |

Intel Corp | INTC | 58.14 | 0.54(0.94%) | 42839 |

International Business Machines Co... | IBM | 138 | 0.84(0.61%) | 13778 |

Johnson & Johnson | JNJ | 131.4 | 0.44(0.34%) | 4364 |

JPMorgan Chase and Co | JPM | 130.7 | 1.40(1.08%) | 9620 |

McDonald's Corp | MCD | 195.59 | 1.41(0.73%) | 17139 |

Merck & Co Inc | MRK | 83.4 | 0.15(0.18%) | 4300 |

Microsoft Corp | MSFT | 144.57 | 0.51(0.35%) | 71251 |

Nike | NKE | 90.65 | 1.17(1.31%) | 10775 |

Pfizer Inc | PFE | 37.3 | 0.05(0.13%) | 25726 |

Procter & Gamble Co | PG | 119.85 | -0.47(-0.39%) | 5872 |

Starbucks Corporation, NASDAQ | SBUX | 83.15 | 0.16(0.19%) | 16372 |

Tesla Motors, Inc., NASDAQ | TSLA | 329.54 | 2.96(0.91%) | 107021 |

The Coca-Cola Co | KO | 52.76 | -0.04(-0.08%) | 16581 |

Twitter, Inc., NYSE | TWTR | 29.07 | -0.47(-1.59%) | 380560 |

United Technologies Corp | UTX | 149.15 | 0.84(0.57%) | 899 |

UnitedHealth Group Inc | UNH | 251.98 | 1.46(0.58%) | 1074 |

Verizon Communications Inc | VZ | 60.2 | 0.07(0.12%) | 5864 |

Visa | V | 177.2 | 0.43(0.24%) | 15834 |

Wal-Mart Stores Inc | WMT | 120.1 | 0.60(0.50%) | 23150 |

Walt Disney Co | DIS | 132.4 | 1.13(0.86%) | 61970 |

Yandex N.V., NASDAQ | YNDX | 34.35 | 0.15(0.44%) | 1972 |

Analysts at ING note the apparent improvement in U.S.-China trade has triggered a sharp steepening in the US yield curve and ING’s rates team thinks that steepening in the 2-10 curve is probably limited to the 30bp area, suggesting that US 10 year yields stall around 2.00%.

- “Given USD/JPY typically has one of the tightest correlations with US yields, the above views suggest USD/JPY may not have too much more upside mileage at this stage – perhaps 110.80 might be the best case on the week if we are under-estimating the scale of this bond tantrum.

- In Japan, the focus will be on Thursday’s release of 3Q19 GDP data – expected at 0.2% QoQ. It's expected to be supported by front-loaded consumption ahead of the October sales tax hike. We’ll also be watching the regular portfolio flows data and whether Japanese buying of foreign bonds is accelerating. That's been implied by recent surveys of Life Insurance managers and Japan’s largest fund manager, the GPIF, suggesting it was making room for larger unhedged foreign bond purchases. Indeed, we’re starting to doubt whether USD/JPY will make it below 105 over coming quarters. We're also not too distracted by the President Trump impeachment process – which we rather see as noise for FX markets.”

Tesla (TSLA) target raised to $400 from $300 at Jefferies

Cisco Systems (CSCO) downgraded to Neutral from Overweight at Piper Jaffray; target lowered to $51

Home Depot (HD) downgraded to Hold from Buy at Edward Jones

Hewlett Packard Enterprise (HPE) upgraded to Neutral from Sell at UBS; target raised to $18

HP (HPQ) upgraded to Outperform from In-line at Evercore ISI; target $24

Analysts at the Royal Bank of Canada (RBC) are expecting the diverging trends in the consumer and industrial sectors to remain in evidence this week for the U.S. economy.

- “Retail sales likely increased in October, adding to gains that saw real consumer spending rise an annualized 3% in Q3.

- Industrial production is forecast to have slowed further, due in part to labour disruptions in the auto sector that continued in October. Manufacturing has been a drag on growth for much of 2019, falling 1.5% in the first nine months of the year. The ISM manufacturing report showed a slight improvement in sentiment last month—a trend that would be helped by a reduction in trade uncertainty.”

Paolo Pizzoli, ING's senior economist covering Italy, notes that seasonally-adjusted industrial production in Italy contracted by 0.4% month-on-month (+0.4% in August), slightly better than consensus.

- "Averaging the July-September monthly numbers, we iron out possible distortions to monthly releases related to August closures. Over 3Q19, industrial production contracted by 0.5% quarter-on-quarter, following a 0.8% decline in 2Q19. The year-on-year measure, adjusted for working days, edged lower to -2.1% in September (from -1.8% in August), confirming that the trend in industry remains firmly in contraction. A brief look at the big aggregate decomposition shows that the SA monthly decline was driven by energy and intermediate goods, only partially compensated by increases in consumption and investment goods.

- Today’s data confirms that the manufacturing recession continued over the summer, which mirrors the concurrent PMI readings hovering at six-year lows. Tentative high-frequency evidence for 3Q19 is suggesting that an industrial turnaround is not imminent. The October manufacturing PMI edged down marginally from already low levels, and the moving average of volatile order books has been contracting both on the domestic and on the external front over the summer months. With trade war- and Brexit-generated headwinds still blowing in 4Q19, we struggle to see any sustainable rebound in manufacturing materializing in 4Q19.

- Service sector resilience will be decisive in avoiding a GDP contraction in 4Q19

- However, as has likely been the case over 3Q19, the service sector should continue to offer support in 4Q19. Employment data has remained resilient to quasi-stagnation and the October service sector PMI has shown a decent acceleration, moving into expansion territory. Domestic consumption might benefit from this, possibly providing a positive contribution to growth over 4Q19. Our tentative call remains that this will allow Italian GDP to post flat growth in 4Q19, which would bring average 2019 GDP growth to 0.2%."

Steven Trypsteen, ING economist, covering Spain and Portugal, notes that the biggest winner in Spain's elections was the far-right Vox party.

- "In April, they won 24 seats, but this time they won 52 seats, becoming Spain’s third-largest party. The Partido Popular (PP) also gained more seats increasing their share from 66 to 88.

- The center-right party, Ciudadanos were the biggest losers last night as they lost seats 47 seats coming down from 57 to just 10. Spain's far-left Unidas Podemos party also lost seats. It now controls just 35 seats, compared to 42 previously. This loss is partly due to the split with Más País (green-left and radical left) who gained two seats.

- Spain's governing Socialists (PSOE) remains the largest party as it gained 120 seats compared to 123 in April.

- In terms of seats, the power of the main Catalan parties hasn't changed much compared to the previous elections (Republican Left of Catalonia-Sovereignitists loses 2 seats and so now controls 13 seats and Together for Catalonia-Together gains one and so now controls 8 seats ).

- The two Basque parties: the Basque Nationalists and the Basque Country Unite gained one seat each.

- The results haven't made us change our view. The political situation remains difficult, but the pressure to find a solution after four elections has risen. A minority government led by the PSOE remains the most likely outcome."

- I was very unhappy with the Brexit deal agreed by PM Johnson

- Says Johnson's deal would not 'get Brexit done'

- We won't contest the 317 Tory seats won in 2017

- Brexit Party will fight Labour candidates in election

- Says that efforts to build a Leave alliance has come to nought

- Says fundamentals of the UK economy are strong

- Brexit-related uncertainty has held back the economy

- Government will keep gilt issuance under control

- It is important to keep the government's spending under control

- Says that no need to extend Carney's term as BOE governor

- Next BoE governor to be announced "very, very quickly" after the election

The latest CFTC Commitment of Traders Report reveals that USD net longs slipped for a fifth consecutive week as expectations that a phase 1 trade deal between the US and China could be close to being achieved coupled with another Fed rate cut in October boosted risk appetite.

- "Net EUR short positions pushed higher for a second week. In late October they had dropped sharply to their lowest levels since early September.

- Net short GBP positions dropped back for an eighth consecutive week and are now at their lowest level since May.

- JPY net positions held in negative ground for a fourth consecutive week.

- CHF net shorts increased moderately. Despite its safe-haven status, signs that the SNB is prepared to intervene in the FX market have distorted demand for the CHF.

- CAD net long positions continued to surge last week. Robust jobs data strengthened the case for steady rates from the BoC going forward. However, the BoC wants to keep that door open.

- AUD net shorts dropped sharply as hopes for a US/China trade deal grew. The AUD’s role as a proxy for confidence in China suggests that doubts over the trade deal could be reflected in the next set of data.”

James Smith, a Developed Market economist at ING, notes the UK economy grew by 0.3% in the third quarter, although the ongoing distortions of Brexit continue to make the figures hard to read.

- "These latest growth figures suggest there was a sizable drawdown in inventory during the third quarter, despite the revised Brexit deadline fixed at the end of October. It’s possible that firms built up the buffers to some extent again in October, although with warehousing space in short-supply and some existing stock presumably still held, we suspect this effect will be fairly modest.

- Ultimately, this is essentially noise and makes extracting the underlying growth trend trickier. It also means that the trade data should be taken with a fairly large pinch of salt.

- Even if the Conservatives win a majority at the forthcoming election – and the deal is swiftly ratified – focus will quickly turn to the transition period. This standstill phase lasts until December 2020, and almost certainly will require extending. Until it is, there remains a risk of the UK (excluding Northern Ireland) leaving the single market and customs union at the end of 2020 – a scenario not dissimilar from ‘no deal’ for most firms.

- One of the more surprising features of this year’s economic performance is the resilience in consumer spending. Admittedly, the pace of consumption growth has been fairly unexciting – spending contributed 0.25% to the overall growth performance. But the performance over the first three quarters of 2019 has been fairly consistent, and indicates that unlike firms, consumers have been less fazed by the twists-and-turns of the Brexit story.

- However, amid the challenging investment backdrop, there are early signs that the glut in new orders is translating into weaker hiring demand (including in the dominant services sector). Vacancy numbers have fallen modestly, while the latest PMIs spoke of redundancies in some areas. If this story deteriorates further in 2020, this would be negative for consumer activity.

- All in all, we think the economy is probably growing at a pace of roughly 0.2% per quarter. For now, we think the Bank of England will probably avoid cutting interest rates in the near-term, although a lot depends on Brexit, and whether the jobs market deteriorates further."

Analysts at Royal Bank of Scotland (RBS) note that two Monetary Policy Committee (MPC) members of BoE, Michael Saunders and Jonathan Haskel, surprisingly voted for a 0.25% Bank Rate cut last week.

- “The rest supported leaving policy on hold; the first MPC split since June 2018. The Bank of England’s Monetary Policy Report (formerly the Inflation Report) is cautious about the UK economic outlook, shaving it’s medium-term growth forecasts due to increased Brexit-related uncertainty and weaker global demand.

- Consumer spending is expected to remain resilient but the outlook for investment remains clouded by uncertainty. Still, the BoE’s probability of a UK recession in 2020 dropped to around 20%, from 30% three months ago.”

New bank loans in China fell more than expected to the lowest in 22 months in October, but the drop was likely due to seasonal factors and policymakers are still expected to ramp up support for the cooling economy in coming months.

Chinese regulators have been trying to boost bank lending and lower financing costs for over a year, especially for smaller and private companies which generate a sizeable share of the country's economic growth and jobs.

Chinese banks extended 661.3 billion yuan ($94.55 billion) in new yuan loans in October - the weakest since December 2017, data from the central bank showed, down sharply from September and falling short of analyst expectations. Analysts had predicted new yuan loans would fall to 800 billion yuan in October, down from 1.69 trillion yuan in September. Household loans, mostly mortgages, fell to 421 billion yuan in October from 755 billion yuan in September, while corporate loans dipped to 126.2 billion yuan from 1.01 trillion yuan.

Outstanding yuan loans grew 12.4% from a year earlier. Analysts had expected 12.5% growth, in line with September's 12.5%.

In view of Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, the stance on USD/CHF is seen negative as long as 0.9978 caps the upside.

“USD/CHF spent last week recovering from the .9844/41 September and October lows, and starts this week at the .9978 downtrend, which ideally will cap. Failure here should leave attention on the downside and on supports (.9844/41). A negative bias is maintained while capped by the downtrend at .9978, above here will neutralise the chart. Failure at the next lower .9799 September low would push key support at .9716/.9659 to the fore. It is the location of the January, June, mid- and late August lows. Below here sits the .9659 August low and the September 2018 low at .9543”.

November 12

Before the Open:

Tyson Foods (TSN). Consensus EPS $1.27, Consensus Revenues $10934.42 mln

November 13

After the Close:

Cisco Systems (CSCO). Consensus EPS $0.81, Consensus Revenues $13088.27 mln

November 14

Before the Open:

Walmart (WMT). Consensus EPS $1.09, Consensus Revenues $127890.97 mln

After the Close:

Applied Materials (AMAT). Consensus EPS $0.76, Consensus Revenues $3682.41 mln

NVIDIA (NVDA). Consensus EPS $1.57, Consensus Revenues $2915.22 mln

November 15

Before the Open:

JD.com (JD). Consensus EPS $1.20, Consensus Revenues $128487.45 mln

European Union banks have put in place all the plans for Brexit but execution is lagging as lenders await the outcome of negotiations between Britain and the EU, European Central Bank banking supervisor Andrea Enria said on Monday.

Some banks planning to relocate to the EU are postponing moving staff and capital to the bloc, waiting to see whether Britain is headed for a hard Brexit or a negotiated exit, Enria told a conference organised by German newspaper Handelsblatt.

Office for National Statistics said, UK production output fell by 0.3% between August 2019 and September 2019. Economists had expected a 0.2% decrease. Manufacturing provided the largest downward contribution (0.4%), followed by electricity and gas (0.5%).

The 0.4% monthly decrease in manufacturing output was widespread with falls in 8 of the 13 subsectors; the largest downward contribution came from a 5.1% fall in basic pharmaceutical products.

Total production output was flat at 0.0% for Quarter 3 (July to Sept) 2019, compared with Quarter 2 (Apr to June) 2019; manufacturing output was also flat at 0.0%, with falls in mining and quarrying (1.7%) and electricity and gas (0.7%), offset by a rise in water and waste (1.2%). Negative contributions to quarterly growth by eight of the subsectors is almost wholly offset by notable strength from transport equipment (6.2%), mainly because of significant weakness during Quarter 2 2019, rather than notable strength during Quarter 3 2019.

For Quarter 3 2019, production output decreased by 1.4% compared with Quarter 3 2018; led by a fall in manufacturing of 1.4% and supported by falls in mining and quarrying (5.3%) and electricity and gas (1.0%).

According to the report from Office for National Statistics, UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.3% in Quarter 3 (July to Sept) 2019. Economists had expected a 0.4% increase.

When compared with the same quarter a year ago, UK GDP increased by 1.0% in Quarter 3 2019; this is the slowest rate of quarter-on-year growth since Quarter 1 (Jan to Mar) 2010. Economists had expected a 1.1% increase

The service and construction sectors provided positive contributions to GDP growth, while output in the production sector was flat in Quarter 3 2019. Private consumption, government consumption and net trade contributed positively to GDP growth, while gross capital formation (GCF) contributed negatively to growth in Quarter 3 2019.

Nominal GDP increased by 0.5% in Quarter 3 2019, down from 0.7% in Quarter 2 (Apr to June) 2019.

Commenting on today’s GDP figures for Quarter 3, an ONS Statistician said: “GDP grew steadily in the third quarter, mainly thanks to a strong July. Services again led the way with construction also performing well. Manufacturing failed to grow as falls in many industries were offset by car production bouncing back following April shutdowns. Looking at the picture over the last year, growth slowed to its lowest rate in almost a decade. The underlying trade deficit narrowed, mainly due to growing exports of both goods and services.”

AUD/USD is now expected to move into a consolidative phase within the 0.6810/0.6910 range.

24-hour view: “Expectation for AUD to “move above 0.6915” was incorrect as it plummeted from 0.6906 to 0.6848 during NY hours. The decline appears to be running ahead of itself and further sustained weakness is not expected. AUD is more likely to consolidate its loss and trade sideways at these lower levels, expected to be between 0.6840 and 0.6880”.

Next 1-3 weeks: “While our ‘strong support’ level of 0.6845 is still intact (low of 0.6848 last Friday), the weak daily closing at 0.6860 (-0.56%) is enough to indicate that our view for AUD to trade towards 0.6950 is incorrect. The price action was not exactly surprising as we noted last Wednesday (06 Nov, spot at 0.6895) that our “expectation is unlikely to pan out”. From here, the current movement is viewed as part of a consolidation phase and AUD could trade sideways between 0.6810 and 0.6910 for a period”.

“US recession risk has tumbled, on our modelling, the probability is down to a negligible 11% from 33%,” writes Richard Franulovich, head of FX Strategy at Westpac.

"The flattening of the curve and softening PMI/consumer surveys had been driving much of the lift in recession probabilities through Q2 and Q3. But as trade war tensions abated and Brexit tail risk declined these same indicators are driving a decline in recession probability. Soft surveys have recovered from their lows, albeit only modestly, equities have been hitting all-time highs, the curve is re-steepening and credit has continued to tighten. That, and a recovery in Oct payrolls has driven the implied probability of recession down sharply once again", - Franulovich added.

British employers' hiring plans have risen from an 18-month low, a survey showed on Monday, contrasting with other less upbeat signs from the labour market.

The Chartered Institute of Personnel and Development (CIPD) said its quarterly net employment balance rose to +22 from +18, bringing it back in line with its average over the past year.

"Despite the political uncertainty, employers have held their nerve and adopted a 'business as usual' approach to their hiring needs," CIPD economist Jon Boys said.

But the outlook for wages was more muted and the CIPD warned that weak productivity growth was likely to put the brakes on private-sector pay rises. Employers' average expectation for future pay settlements was unchanged at 2% in the three months to September. Private-sector employers cut their expectations to 2.2% from 2.5%, while public-sector expectations rose to 2.0% from 1.5%.

Analysts at Westpac offered their take on the recent upsurge in the US Treasury bond yields and provided a brief insight about the possibilities on any further rise.

"US 10yr yields underwent another significant increase last week. They have now risen by almost 50bps since August and are threatening to break above 2% for the first time since July. The market has now fully unwound its heightened fears around global trade and growth. The question is whether it has now priced-in too much good news, or whether the bearish bond market correction will be sustained? While Westpac remains sceptical of the positive growth hopes supporting record highs in US equities, from a bond market perspective, the answer really comes down to your medium-term FOMC expectations. Having delivered 75bp of easing over the three meetings to October, the FOMC has made clear that they intend to pause and reflect on the state of the economy in December. The data remains soft, but as yet has not pointed to a decisive shift in growth below trend. We expect employment to slow further and investment to remain weak. Consequently, despite market optimism over trade, rate cuts will most likely again be on the agenda in 2020 – in March June & September".

Nordea Research discusses the EUR outlook in light of its latest forecasts which now expects EUR/USD at 1.09 by year-end and at 1.13 by mid-2020.

"US liquidity momentum will improve in 2020, but in comparison to the episode in 2017 when it coincided with a decent rise in EUR/USD we are less optimistic for the EUR this time around. In 2017, the EUR and EUR FI were both significantly repriced as the market priced in fewer political risks following Macron’s win of the French presidential election, improved Euro-area growth prospects (#Euroboom was making waves in social media at the time) as well as an eventual QE exit by the ECB. This time around we don’t rule out more political risks being priced in later in 2020, our growth forecast remains fairly downbeat and our ECB forecast is for more QE, not less. As such we expect the EUR to trade on a weak footing well into 2020. In general, our new FX forecast reflects that currencies with a positive beta to world trade or to global risk appetite may continue to struggle for a while. However, things will start to look more upbeat in 2020," Nordea adds.

China’s consumer inflation will continue rising and could peak at around 5% or even 6% in January before gradually falling back, according to economists.

The consumer price index rose to a 7-year high of 3.8% in October due to soaring pork prices, and the demand from the Spring Festival in late January will push it higher to at least 5%, according to economists from Barclays Plc, Citigroup Inc., and Bank of China International Ltd. Huachuang Securities Co. said the headline number could even hit 6%.

Inflation will then likely slow down from that January peak, according to China Merchants Securities Co. While non-pork price rises remain benign for now, the brokerage house warned that the cost of eggs, seafood and cooking oil are most likely to rise, based on previous periods of pork price inflation.

The rising prices will complicate monetary policy, with markets closely watching how the People’s Bank of China balances the competing demands from rising consumer prices and falling producer prices over the rest of the year.

Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, suggested Cable could attempt another test of 1.30 provided the decline holds around the 1.2784/64 band.

“GBP/USD came under increasing pressure last week and starts this week sitting just above the 1.2784 25th June high and the 1.2764/23.6% retracement. It should hold here for another attempt at the psychological resistance at 1.3000. Failure will see a slide to the 200 day ma at 1.2703. Directly above here we have the 200 week ma at 1.3122 and the 1.3187 May high and these remain our short term targets, and we look for the market to be capped here. The 200 day ma at 1.2703 guards 1.2582. Below 1.2582 lies the 1.2382 17th July low and the 1.2403 uptrend. The uptrend guards 1.2196/94”.

Auto sales in China fell for a 16th consecutive month in October, with the number of new energy vehicles (NEVs) sold contracting for the fourth month in a row, data from the country's biggest auto industry association showed.

Total auto sales in the world's biggest auto market fell 4% from the same month a year earlier, the China Association of Automobile Manufacturers (CAAM) said. That followed declines of 5.2% in September and 6.9% in August. Car sales in 2018 declined from a year earlier, the first annual contraction since the 1990s, against a backdrop of slowing economic growth and a crippling trade war with the United States.

Sales of NEVs fell 45.6% in October, CAAM said, following a 33% decline in September. NEV sales jumped almost 62% last year even as the broader auto market contracted. NEVs include plug-in hybrids, battery-only electric vehicles and those powered by hydrogen fuel cells.

Analysts at Australia and New Zealand Banking Group (ANZ) provide their review on Saturday’s Chinese inflation report.

“China saw its consumer price index rise to 3.8% y/y, higher than the 3.4% y/y increase expected for October. Core CPI inflation held firm at 1.5% y/y. Higher food prices bolstered the headline number, with pork prices up 101.3% y/y, up from the 69.3% y/y rise seen in September. Meanwhile, following a 1.2% y/y decline in September, China’s producer price index fell by a further 1.6% y/y in October.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1166 (4575)

$1.1129 (2331)

$1.1078 (1572)

Price at time of writing this review: $1.1024

Support levels (open interest**, contracts):

$1.0999 (2998)

$1.0970 (3016)

$1.0934 (2935)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 6 is 94588 contracts (according to data from November, 8) with the maximum number of contracts with strike price $1,1250 (4790);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2945 (2180)

$1.2913 (1080)

$1.2847 (2246)

Price at time of writing this review: $1.2798

Support levels (open interest**, contracts):

$1.2714 (734)

$1.2636 (705)

$1.2553 (2246)

Comments:

- Overall open interest on the CALL options with the expiration date December, 6 is 35154 contracts, with the maximum number of contracts with strike price $1,3000 (11042);

- Overall open interest on the PUT options with the expiration date December, 6 is 29573 contracts, with the maximum number of contracts with strike price $1,2200 (2326);

- The ratio of PUT/CALL was 0.84 versus 1.17 from the previous trading day according to data from November, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 62.9 | 0.61 |

| WTI | 57.33 | 0.67 |

| Silver | 16.79 | -1.76 |

| Gold | 1459.05 | -0.63 |

| Palladium | 1744.21 | -3.12 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 61.55 | 23391.87 | 0.26 |

| Hang Seng | -196.09 | 27651.14 | -0.7 |

| KOSPI | -7.06 | 2137.23 | -0.33 |

| ASX 200 | -2.5 | 6724.1 | -0.04 |

| FTSE 100 | -47.03 | 7359.38 | -0.63 |

| DAX | -60.9 | 13228.56 | -0.46 |

| CAC 40 | -1.29 | 5889.7 | -0.02 |

| Dow Jones | 6.44 | 27681.24 | 0.02 |

| S&P 500 | 7.9 | 3093.08 | 0.26 |

| NASDAQ Composite | 40.79 | 8475.31 | 0.48 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.68549 | -0.61 |

| EURJPY | 120.366 | -0.32 |

| EURUSD | 1.10203 | -0.26 |

| GBPJPY | 139.594 | -0.31 |

| GBPUSD | 1.27813 | -0.25 |

| NZDUSD | 0.63266 | -0.63 |

| USDCAD | 1.32268 | 0.41 |

| USDCHF | 0.99763 | 0.29 |

| USDJPY | 109.214 | -0.06 |

© 2000-2024. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.