- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

Analysts at TD Securities note that the Canadian economy added 53k jobs in September, beating the market consensus for +7.5k.

- “Details were largely upbeat with full time employment (+70k) leading job growth while the one wrinkle was a modest pullback in private employment (-21k). However, this comes on the heels of outsized gains during August, and private employment is still 70k higher over the last two months.

- The robust job growth was not the only positive element of this report; the unemployment rate fell to 5.5% in September while wage growth firmed back to 4.3% y/y (from 3.8%). The former is even more impressive when considering the participation rate has increased 1.4pp from last October and more comprehensive measures that capture discouraged and involuntary part-time workers showed similar improvement, with the R8 rate falling from 8.1% to 7.8% (pre-crisis low was 8.3%). Hours worked fell by 0.3% m/m, but that shouldn't take much away from the overall strength of this report.

- We don't think these numbers are sustainable, and we don't think they tell the full story for the Canadian economy - but they do underscore the different policy outlooks facing the BoC and Fed. Robust labour market performance gives the BoC a cushion the Fed doesn't enjoy, and will let the BoC lag behind the Fed for a longer period than would normally be plausible.

- We continue to look for an ease in January, predicated on a weaker global outlook.”

A report from

the University of Michigan revealed on Friday the preliminary reading for the

Reuters/Michigan index of consumer sentiment rose to 96.0 in early October. That was the highest reading since July.

Economists had

expected the index would decrease to 92.0 this month from September’s final

reading of 93.2.

According to

the report, the index of current U.S. economic conditions increased to 113.4

in October from 108.5 in the previous month. Meanwhile, the index of consumer

expectations grew to 84.8 this month from 83.4 in September.

Sentiment

rebounded in early October as consumers anticipated larger income gains and

lower inflation during the year ahead, the report noted.

- We should put yield curve control into our toolbox

- Balance sheet growth should not be confused with QE, which was designed to move down long-term rates

- We have to figure out what is the right growth rate of our balance sheet that isn't about stimulating the economy

- Over the long term, we still have evidence that the economy will grow at around 2% and we're drifting back to that level

Robert Rennie, an analyst at Westpac, thinks the BoJ has the benefit yet again of being able to observe the outcome of the FoMC meeting October 29/30 before it announces policy October 30/31.

- “Over the last three weeks, we have seen some clear indications that the BoJ is gearing up for some potentially significant announcements at that meeting. The most obvious of course was the Sep 19 MPC statement which noted that the “Bank will re-examine economic & price developments at the next MPM”. In addition, BoJ member Funo suggested that a number of options are open for discussion at the “very important meeting” at the end of the month.

- This plus the fact that Japanese investors appear to be increasingly turning to unhedged foreign debt purchases adds to the idea that USD/JPY should be well supported on dips. However, we maintain our negative medium-term view on the basis that we do not expect a lasting US/ China trade agreement and expect to see increased US/ Europe trade friction in the weeks ahead. Use strength above 108.50 as an opportunity to sell.”

Josh Nye, the senior economist at Royal Bank of Canada (RBC), notes that Canada's employment rose 54,000 in September, while the unemployment rate fell 0.2 ppts to 5.5% and the hourly wage growth surpassed 4% in Q3.

- “There was no give-back after August’s strong jobs numbers as Canada recorded another above-50,000 employment gain in September (the fifth such increase in nine months this year). The labour force is growing at its fastest pace in more than a decade, helping sustain job growth late in the economic cycle.

- Wage growth, previously the missing link in a strong labour market backdrop, has picked up momentum this year and is running north of 4% per today’s data. A broader look at wages also suggests cycle-high growth.

- The combination of expanding employment and rising wages has provided some insulation for consumers, some of whom have faced higher debt servicing costs after rate hikes in 2017 and 2018.

- Today’s data suggest the BoC doesn’t need to rush to undo those earlier rate hikes, even as other central banks are opting for additional accommodation.”

Statistics

Canada reported on Friday that the number of employed people surged by 53,700

m-o-m in September, while economists had forecast a gain of 10,000 and after an

unrevised climb of 81,100 in the previous month.

Meanwhile,

Canada's unemployment remained dropped to 5.5 percent in September from 5.7

percent in August, while economists’ had forecast the rate to remain unchanged.

According to

the report, full-time employment increased by 70,000 (or +0.5 percent m-o-m) in

September, while part-time jobs dropped by 16,300 (or -0.4 percent m-o-m).

In September, the

number of public sector employees grew by 32,600 (+0.8 percent m-o-m), while the

number of private sector employees declined by 21,000 (-0.2 percent m-o-m). At

the same time, the number of self-employed jumped by 42,100 (+1.4 percent

m-o-m) last month.

Sector-wise,

there were more people working in health care and social assistance (+30,000),

as well as in accommodation and food services (+23,300). At the same time,

there were declines in information, culture and recreation (-36,700), and in

natural resources (-7,000).

On a

year-over-year basis, employment grew by 456,000 (+2.4 percent) in September,

driven by gains in both full- (+386,000 or +2.5 percent) and part-time work

(+69,800 or +2.0 percent).

In the third

quarter, employment increased by 111,000, or 0.6 percent, following a 0.7

percent growth rate in the second quarter.

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC. | MO | 43.21 | 0.23(0.54%) | 22504 |

Amazon.com Inc., NASDAQ | AMZN | 1,740.00 | 19.74(1.15%) | 38428 |

American Express Co | AXP | 116.01 | 0.99(0.86%) | 214 |

Apple Inc. | AAPL | 232.9 | 2.81(1.22%) | 325863 |

AT&T Inc | T | 37.59 | 0.17(0.45%) | 62442 |

Boeing Co | BA | 373.85 | 2.85(0.77%) | 10221 |

Caterpillar Inc | CAT | 124.2 | 1.51(1.23%) | 15985 |

Chevron Corp | CVX | 116.16 | 1.57(1.37%) | 6162 |

Cisco Systems Inc | CSCO | 46.63 | 0.48(1.04%) | 35306 |

Citigroup Inc., NYSE | C | 69.95 | 1.33(1.94%) | 40221 |

Exxon Mobil Corp | XOM | 68.99 | 0.74(1.08%) | 17057 |

Facebook, Inc. | FB | 182.11 | 2.08(1.16%) | 54247 |

FedEx Corporation, NYSE | FDX | 142.65 | 1.29(0.91%) | 5350 |

Ford Motor Co. | F | 8.7 | 0.08(0.93%) | 135052 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.14 | 0.23(2.58%) | 57804 |

General Electric Co | GE | 8.58 | 0.13(1.54%) | 118859 |

General Motors Company, NYSE | GM | 35.15 | 0.49(1.41%) | 10074 |

Goldman Sachs | GS | 203.41 | 3.54(1.77%) | 4840 |

Google Inc. | GOOG | 1,223.00 | 14.33(1.19%) | 4376 |

Hewlett-Packard Co. | HPQ | 16.16 | 0.13(0.81%) | 2139 |

Home Depot Inc | HD | 233.62 | 2.01(0.87%) | 1336 |

Intel Corp | INTC | 52.06 | 0.95(1.86%) | 67596 |

International Business Machines Co... | IBM | 142.99 | 1.86(1.32%) | 4521 |

Johnson & Johnson | JNJ | 131 | 1.94(1.50%) | 13029 |

JPMorgan Chase and Co | JPM | 115.93 | 1.72(1.51%) | 18241 |

McDonald's Corp | MCD | 212.16 | 0.40(0.19%) | 4103 |

Merck & Co Inc | MRK | 84.19 | 0.43(0.51%) | 19282 |

Microsoft Corp | MSFT | 140.5 | 1.40(1.01%) | 103663 |

Nike | NKE | 94 | 1.00(1.08%) | 4323 |

Pfizer Inc | PFE | 36.12 | 0.33(0.92%) | 22683 |

Starbucks Corporation, NASDAQ | SBUX | 86.51 | 0.55(0.64%) | 12656 |

Tesla Motors, Inc., NASDAQ | TSLA | 247.03 | 2.29(0.94%) | 42644 |

Travelers Companies Inc | TRV | 142.89 | 1.33(0.94%) | 1091 |

Twitter, Inc., NYSE | TWTR | 39.98 | 0.44(1.11%) | 28956 |

UnitedHealth Group Inc | UNH | 225.15 | 1.42(0.63%) | 3561 |

Verizon Communications Inc | VZ | 60.14 | 0.31(0.52%) | 9695 |

Visa | V | 176.85 | 1.97(1.13%) | 16419 |

Wal-Mart Stores Inc | WMT | 120.13 | 0.52(0.43%) | 16493 |

Walt Disney Co | DIS | 130.5 | 1.16(0.90%) | 13195 |

Yandex N.V., NASDAQ | YNDX | 32.9 | -2.66(-7.48%) | 536181 |

Twitter (TWTR) target lowered to $47 from $49.75 at Pivotal Research Group

Johnson & Johnson (JNJ) upgraded to Outperform from Mkt Perform at Bernstein; target $155

Barrick (GOLD) upgraded to Buy at Canaccord Genuity

The Labor

Department reported on Friday the import-price index, measuring the cost of

goods ranging from Canadian oil to Chinese electronics, rose 0.2 percent m-o-m

in September, following a revised 0.2 percent m-o-m decline in August

(originally a 0.5 percent m-o-m drop). Economists had expected prices to be flat

m-o-m last month.

According to

the report, the September gain was driven by higher fuel prices (+2.1 percent

m-o-m), while prices for nonfuel goods edged down 0.1 percent m-o-m.

Over the

12-month period ended in September, import prices dropped 1.6 percent, weighed

down by declines in both fuel (-5.1 percent) and nonfuel (-1.1 percent) prices.

Meanwhile, the

price index for U.S. exports decreased 0.2 percent m-o-m in September,

following an unrevised 0.6 percent m-o-m fall in the previous month.

Lower

agricultural (-1.8 percent m-o-m) and nonagricultural (-0.1 percent m-o-m)

prices both contributed to the September fall.

Over the past

12 months, the price index for exports dropped 1.6 percent, weighed down by

lower prices for nonagricultural exports (-1.9 percent), while agricultural

prices went up 0.2 percent.

- Maintains 2019 GDP growth forecast at 0.5%

- There is more slack in the labour market

- Wage growth is still tepid

- Not the time to tap the brakes on the economy

- Extended trade war could lower neutral rate further

- We can't model the shock a trade war will have on psychology and how it is going to ripple through to the economy

ANZ analysts suggest that the ongoing trade war and geopolitical issues have increased the risk of a financial decoupling between China and the U.S.

- “Although China still allocates a high share of its FX exchange reserves to the USD, estimated at around 59% as of June 2019, the pace of diversification into other currencies will likely quicken going forward.

- In fact, we believe that the Chinese government has already discreetly diversified its offshore portfolios to include alternative investments. We estimate that other forms of sovereign wealth likely amounts to CNY1.8trn as of June 2019. Since the assets held are mostly in the form of equities and entrusted loans in Europe, as well as countries involved in China’s ‘Belt and Road’ initiative, the share of USD in China’s sovereign portfolio should be lower than that in China’s FX reserves.”

Tim Riddell, an analyst at Westpac, notes that Eurozone activity data and surveys continue to signal growing risks of recession and any inflation pressures appear to the downside.

- “This week, ECB officials have affirmed their recent stimulus package, despite numerous critics stating that ECB’s NIRP is distorting the economy and financial markets while impairing the struggling financial sector.

- The departure of Draghi next month is unlikely to see any change in monetary policy, but Lagarde’s arrival could increase the urgency of the ECB’s much-repeated pleas for both fiscal and structural support.

- In the interim, Eurozone nations are compiling budget proposals for submission to the EC at the end of this month so fiscal relaxation is unlikely. Germany may be facing a recession and has a relatively favourable fiscal stance, but its finance ministry is not showing any sign of fiscal leniency. Even their recent carbon reduction initiatives are fiscally neutral.

- Despite recent data weakness, Westpac’s Data Pulse has rebounded and the Surprise Index is holding. Although this does not imply a EUR turn, it may allow for interim bounces before ECB accommodation pressures trigger redefinition of a lower trading range.”

Analysts at TD Securities note that the market expects University of Michigan’s consumer report to show that sentiment dropped modestly in October to 92.0, down from 93.2 in the month before.

- “If realized, the decline would keep consumer sentiment at still solid levels and within the 90-100 range that has been maintained since 2017.”

- Brexit is like climbing a mountain

- We need vigilance, determination

- We need to keep calm

- Says the policymakers are operating in a time of substantial uncertainty

Analysts at TD Securities are looking for the Canadian economy to add 5k jobs during September, in line with the market consensus for a 6k increase, on the heels of a massive 88k print for August.

“Details should prove largely downbeat, with private employment projected to contract on the month while the unemployment rate is expected to edge higher by 0.1pp to 5.8% (market: 5.7%). Wage growth should be the one bright spot, with average hourly earnings forecast to hold at 3.8% y/y.”

China announced a firm timetable for opening its futures, brokerage and mutual fund sectors fully to foreign investors next year, the latest step to deregulate the country's giant financial industry.

The announcement by the China Securities Regulatory Commission (CSRC) to scrap foreign ownership restrictions in these sectors comes amid on-going top-level Sino-U.S. trade talks in Washington.

Earlier this year, China vowed to scrap ownership limits for foreign investors in its financial sector in 2020, but has not given a specific timetable.

CSRC told a press conference in Beijing that ownership limits in futures companies will be scrapped January. 1, 2020.

Limits on foreign ownership of securities firms will be removed on Dec. 1, 2020, while such limits will be scrapped for mutual fund companies on April 1, 2020.

A total of $11.1 billion flowed into bond funds in the week to Wednesday as investors left stocks amid a “bearish paralysis” on Wall Street, Bank of America Merrill Lynch said.

Investors pulled $9.8 billion from equity funds during the week as they remained cautious against an uncertain global backdrop caused by the United States-China trade war, the threat of impeachment against U.S. President Donald Trump, Brexit and the risk of recession, the bank said, citing EPFR data.

UK has not come forward with a realistic and workable proposal

If there is no proposal by today, will announce that there is no more chance at summit

Have received promising signals from Varadkar after meeting yesterday

Even the slightest chance must be used

Pound traders are more optimistic -- or worried -- than ever before that a Brexit deal is possible, based on derivatives pricing.

Options show investors are the most bullish on the U.K. currency on a one-month basis that they’ve been since Bloomberg began compiling the data in 2003. The upswing follows Thursday’s positive meeting between U.K. Prime Minister Boris Johnson and Irish Premier Leo Varadkar.

Risk reversals, a barometer of market sentiment and positioning, surged for options that benefit from a stronger sterling after Varadkar said he believed an agreement is possible by the Oct. 31 deadline.

The pound rose by the most in seven months as traders unwound bets that sterling would weaken.

On longer tenors, investors remain more cautious. While demand for options that look for a weaker pound has waned, the market is still biased in favor of downside protection.

Around 60% of Germany's Mittelstand, the small and medium-sized companies that form the backbone of Europe's biggest economy, see no impact on their business from a hard Brexit, a survey by Germany's KfW state development bank showed on Friday.

The survey of around 2,000 firms with annual revenues of up to 500 million euros ($550.60 million) found that about a quarter of Germany's Mittelstand expected a hard Brexit to disadvantage them.

The survey was conducted from 11 to 23 September.

An Iranian oil tanker was damaged Friday near the Saudi port of Jeddah after being hit by suspected missiles, Iranian state media said, raising the prospect of military escalation in the Middle East.

The explosions on the tanker, operated by the National Iranian Oil Company, occurred between 5:00 and 5:20 a.m. local time damaging two of its main oil tanks, the Islamic Republic News Agency reported. The spill from the tanker into the Red Sea had been halted and the damage minimized, the Iranian oil ministry’s Shana news service said.

Saheb Sadeghi, the spokesman for the National Iranian Tanker Company, said in a call with Iran’s Press TV that two missiles hit the tanker and probably came from the direction of Saudi Arabia.

Analysts at Commerzbank point out that EUR/USD has at last taken out the four month downtrend and given that the market has recently turned from the base of the weekly channel at 1.0892, they view the market as a base.

“We look for recovery to initially the mid September high at 1.1110. A close above here would trigger another leg higher to the 200 day ma at 1.1220. Longer term the critical resistance to overcome it the top of the one year channel at 1.1303 and the 200 week ma at 1.1354. Below 1.0879 we have the January 2017 low at 1.0829 and the 78.6% Fibonacci retracement of the 2017-2018 advance at 1.0814.”

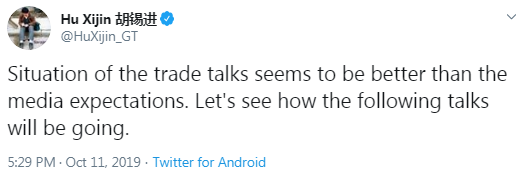

China's foreign ministry said on Friday it hoped China can work with the United States for progress on trade consultations, when asked about trade talks between the two countries.

Foreign Ministry spokesman Geng Shuang made the comments at a daily briefing.

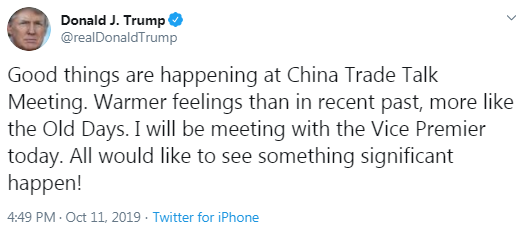

Top U.S. and Chinese negotiators wrapped up a first day of trade talks in more than two months on Thursday as business groups expressed optimism that the two sides might be able to ease a 15-month trade war and delay a U.S. tariff hike scheduled for next week.

Britain needs to see the European Union compromise on Brexit and Prime Minister Boris Johnson is prepared to walk away from negotiations, education minister Gavin Williamson said on Friday amid hope that a deal can be struck by the Oct. 31 deadline.

“We need to see the European Union shift,” he told ITV.

“There is not a sense that we will... refuse to walk away from the table.”

A no-deal Brexit is likely if Britain does not seek compromise, French State Secretary for European Affairs Amelie de Montchalin said.

Asked whether it was increasingly likely that Britain was heading for a no-deal Brexit, de Montchalin said on France Inter radio: “It is likely”.

“At this point, if talks do not proceed the way we hope they will, if there is no desire, particularly from the British side, for compromise, then a no-deal (Brexit) is possible,” she added.

Danske Bank analysts suggest that US-China trade talks continue today and given the statements from President Trump, the trade talks have developed well so far and still see a decent chance of an interim deal being struck.

“UK and Ireland held "constructive" talks on Brexit yesterday. EU and UK will meet today and continue negotiations - see more below. The optimism had a significant impact on Gilts as well as the GBP. GBP strengthened against the Euro and 10Y Gilts moved some 12bp yesterday. On the data front, the preliminary consumer confidence for October from University of Michigan will be interesting. The service PMI has declined lately and suggests the slowdown is spreading to this part of the economy too. Consumer confidence has still held up well, which has also been highlighted by some Fed members. Any sign of weakness here would add to the pressure for more rate cuts. Tonight, Fed members Rosengren (non-voter, hawk) and Kaplan (non-voter, neutral) will both speak.”

With many investors worried about further economic damages from the U.S.-China trade war, even a “pause” in that bilateral fight would be a “big relief” to markets, according to an economist.

“Even if we just get a pause, I think that will be very good. I think it will be a big relief for markets, so I think we will get a risk rally,” Robin Brooks, managing director and chief economist at the Institute of International Finance, told CNBC.

Officials from both countries met in Washington on Thursday to discuss trade, which U.S. President Donald Trump said were “going really well.” Trump is set to meet with Chinese Vice Premier Liu He on Friday.

Many analysts have low expectations for what the two sides could achieve in this week’s talks. Some said the U.S. and China could reach a limited deal for the time being, while others predicted that the next rounds of tariff increases scheduled for Oct. 15 and Dec. 15 would be postponed.

David Dollar, a senior fellow at the Brookings Institution, warned that any deal reached by the two countries may not last. He noted there had been instances in the past when the U.S. and China appeared to have come close to reaching an agreement, only to have the tariff fight escalated all over again.

The U.S.-China trade war has dragged on for more than a year, with Washington slapping elevated tariffs on billions of dollars of Chinese goods and Beijing retaliating with levies of its own. That has dampened business sentiment and sparked fears of a global economic slowdown.

Shouldn't judge BOJ tools just by looking at short-term policy target level alone

BOJ policy can be very accommodative as compared to the Fed, ECB

BOJ has ample room for further action

Will carefully weigh the costs and benefits of each measure

MUFG Research discusses EUR/USD tactical outlook and adopts a neutral bias, expecting the pair to remain in 1.0850-1.1100 range in the near-term.

"The euro has risen marginally over the past week against the US dollar and just climbed back above the 1.1000-level. It has mainly been driven by US dollar weakness following on from recent softer US data releases. The release of the latest US retail sales report for September will be closely watched in the week ahead to assess how household spending is holding up after the surge in Q2. The US rate market is now more confident that the Fed will cut rates again later this month. The dovish tone of the FOMC minutes from the September meeting supported rate cut expectations. The outcome from US-China trade talks could prove pivotal for US dollar performance in the week ahead. If there is a partial trade deal which suspends planned tariff hikes, it could encourage an extended relief rally for EUR/USD beyond the 1.1000-level. In contrast if there remains a disappointing lack of progress and trade tensions are left on a course of confrontation, then recent US dollar weakness could quickly reverse," MUFG adds.

FX Strategists at UOB Group noted Cable could re-visit the 1.25 region before coming under some selling pressure.

24-hour view: “The blast-off in GBP was clearly unexpected as it rocketed to a high of 1.2469 before ending the day higher by +1.93% (1.2441), the largest 1-day gain in 7 months. The rapid rally is deep in overbought territory but impulsive upward momentum suggests there is room for GBP to test 1.2500 first before easing off. Support is at 1.2370 followed by 1.2330”.

Next 1-3 weeks: “Our expectation for GBP to trade with a “downside bias towards 1.2140” (09 Oct, spot at 1.2225) was proven wrong quickly as it rocketed past the 1.2300 ‘strong resistance’ before ending the day higher by a whopping +1.93% (1.2441), the largest 1-day gain in 7 months. While the price action has clearly shifted the risk to the upside, there are several strong resistance levels that are stacked close to each other and any further advance may not be ‘smooth sailing’. The resistance levels are at 1.2530, 1.2550 followed by last month’s top near 1.2580. On the downside, a break of 1.2300 (‘strong support’ level) would indicate that GBP is not ready to challenge the resistance levels mentioned above just yet”.

According to the report from Federal Statistical Office (Destatis), сonsumer prices in Germany in September 2019 were 1.2% higher than in September 2018. Destatis also reports that the inflation rate - as measured by the consumer price index - decreased again (August 2019: +1.4%).

Energy product prices were down 1.1% from September 2018 to September 2019 and had a downward effect on the overall price development. In August 2019, the rate of energy price increase had been +0.6%. The prices of food were up 1.3% in September 2019 compared with the same month a year earlier. The increase in food prices thus slowed (August 2019: +2.7%). The prices of goods (total) were 0.6% higher in September 2019 than in the same month a year earlier. Service prices rose much more strongly (+1.8%) than goods prices from September 2018 to September 2019. A major factor contributing to the development of service prices was the increase in net rents exclusive of heating expenses (+1.4%), as households spend a large part of their consumption expenditure on this item.

Compared with August 2019, the consumer price index remained unchanged in September 2019. Nevertheless, considerable month-on-month price increases were recorded for clothing (+7.2%) and footwear (+2.7%). A major reason here was the changeover to the autumn/winter collection. Due to the end of the summer holidays, there were seasonal price decreases for package holidays (-10.3%) and air tickets (-2.2%).

Nearly 70% of Japanese households expect to cut back on spending after October's increase in the sales tax rate, a central bank survey showed on Friday.

The survey also showed 37% of households had front-loaded purchases ahead of the October tax hike to avoid the heavier levy, with purchases centring on daily necessities and cars.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1120 (3035)

$1.1099 (2261)

$1.1083 (587)

Price at time of writing this review: $1.1015

Support levels (open interest**, contracts):

$1.0957 (3756)

$1.0922 (3679)

$1.0882 (3336)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 8 is 66398 contracts (according to data from October, 10) with the maximum number of contracts with strike price $1,1000 (3756);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2635 (879)

$1.2591 (116)

$1.2555 (330)

Price at time of writing this review: $1.2451

Support levels (open interest**, contracts):

$1.2311 (1170)

$1.2260 (576)

$1.2200 (624)

Comments:

- Overall open interest on the CALL options with the expiration date November, 8 is 33436 contracts, with the maximum number of contracts with strike price $1,3300 (3763);

- Overall open interest on the PUT options with the expiration date November, 8 is 18912 contracts, with the maximum number of contracts with strike price $1,2000 (1591);

- The ratio of PUT/CALL was 0.57 versus 0.58 from the previous trading day according to data from October, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 59.15 | 2.14 |

| WTI | 53.78 | 2.52 |

| Silver | 17.48 | -1.24 |

| Gold | 1493.302 | -0.8 |

| Palladium | 1698.71 | 1.15 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 95.6 | 21551.98 | 0.45 |

| Hang Seng | 25.12 | 25707.93 | 0.1 |

| KOSPI | -18.1 | 2028.15 | -0.88 |

| ASX 200 | 0.4 | 6547.1 | 0.01 |

| FTSE 100 | 19.86 | 7186.36 | 0.28 |

| DAX | 69.94 | 12164.2 | 0.58 |

| Dow Jones | 150.66 | 26496.67 | 0.57 |

| S&P 500 | 18.73 | 2938.13 | 0.64 |

| NASDAQ Composite | 47.04 | 7950.78 | 0.6 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67602 | 0.55 |

| EURJPY | 118.745 | 0.71 |

| EURUSD | 1.10078 | 0.32 |

| GBPJPY | 134.152 | 2.27 |

| GBPUSD | 1.24358 | 1.88 |

| NZDUSD | 0.63184 | 0.49 |

| USDCAD | 1.32874 | -0.35 |

| USDCHF | 0.99614 | 0.08 |

| USDJPY | 107.863 | 0.38 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.