- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 06:00 | Germany | CPI, m/m | September | -0.2% | 0% |

| 06:00 | Germany | CPI, y/y | September | 1.4% | 1.2% |

| 12:00 | U.S. | FOMC Member Kashkari Speaks | |||

| 12:30 | U.S. | Import Price Index | September | -0.5% | 0% |

| 12:30 | Canada | Employment | September | 81.1 | 10 |

| 12:30 | Canada | Unemployment rate | September | 5.7% | 5.7% |

| 14:00 | U.S. | Reuters/Michigan Consumer Sentiment Index | October | 93.2 | 92 |

| 17:00 | U.S. | Baker Hughes Oil Rig Count | October | 710 | |

| 17:15 | U.S. | FOMC Member Rosengren Speaks | |||

| 19:00 | U.S. | FOMC Member Kaplan Speak |

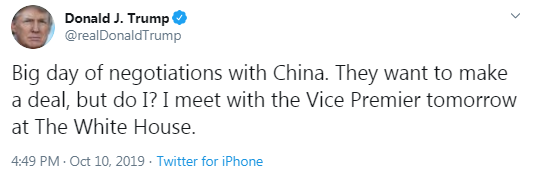

Major US stocks rose moderately after US President Donald Trump announced that he would meet with Chinese Deputy Prime Minister Liu HE on Friday, which gives hope that the world's largest economies will be able to make progress in trade negotiations.

Trump wrote on Twitter: “This is a big day of negotiations with China. They want to make a deal, but do I want to? Tomorrow I will meet with the Deputy Prime Minister at the White House. ” Recall, earlier today, the Chinese newspaper South China Morning Post reported that the Chinese delegation, headed by Liu He, plans to leave Washington on Thursday.

In addition, Liu He said that Beijing is ready to conclude an agreement with Washington to prevent further escalation of the trade war. According to him, the Chinese side arrived with great sincerity and they are ready to cooperate with the United States on trade balance, market access and investor protection.

Market participants also analyzed inflation data for September, which showed that consumer prices in the United States remained virtually unchanged last month, as higher housing and food prices were offset by lower prices for energy and used cars and trucks. According to a report by the Ministry of Labor, the consumer price index did not change in September after rising 0.1% in August. Economists had expected another 0.1% increase. Over the 12 months to September, the consumer price index rose 1.7% after rising by the same margin in August. Economists surveyed by the agency predicted an increase in consumer price index in September of 1.8% year on year. At the same time, excluding food and energy prices, basic consumer prices rose 0.1% in September after rising 0.3% for three consecutive months . Economists had expected base prices to rise 0.2%. In the 12 months to September, the base consumer price index rose 2.4%, which corresponds to an increase in August. The fact that consumer prices in the US did not change in September, and core inflation receded slightly, is fueling expectations that the Fed will lower interest rates in October for the third time this year amid risks to the economy as a result of trade tensions.

Most DOW components recorded an increase (23 out of 30). The biggest gainers were Caterpillar Inc. (CAT; + 2.80%). Outsiders were shares of Cisco Systems (CSCO; -1.42%).

Almost all S&P sectors completed trading in positive territory. Only the utilities sector declined (-0.1%). The largest growth was shown in the base materials sector (+ 1.3%).

At the time of closing:

Dow 26,496.67 +150.66 +0.57%

S&P 500 2,938.13 +18.73 +0.64%

Nasdaq 100 7,950.78 +47.04 +0.60%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 06:00 | Germany | CPI, m/m | September | -0.2% | 0% |

| 06:00 | Germany | CPI, y/y | September | 1.4% | 1.2% |

| 12:00 | U.S. | FOMC Member Kashkari Speaks | |||

| 12:30 | U.S. | Import Price Index | September | -0.5% | 0% |

| 12:30 | Canada | Employment | September | 81.1 | 10 |

| 12:30 | Canada | Unemployment rate | September | 5.7% | 5.7% |

| 14:00 | U.S. | Reuters/Michigan Consumer Sentiment Index | October | 93.2 | 92 |

| 17:00 | U.S. | Baker Hughes Oil Rig Count | October | 710 | |

| 17:15 | U.S. | FOMC Member Rosengren Speaks | |||

| 19:00 | U.S. | FOMC Member Kaplan Speak |

Analysts at TD Securities note that the U.S. headline inflation surprised to the downside in September at 0.0% m/m (0.023% unrounded), keeping the annual rate unchanged at 1.7% y/y (TD and consensus: 1.8%).

- “At 0.1% m/m (0.132% unrounded), core inflation finally lost some steam in September following three consecutive 0.3% increases in Jun-Aug. Despite the softer-than-expected monthly print, core inflation remained at a still solid 2.4% y/y for September.

- Looking into the details, weakness in the core segment was largely explained by a -0.3% drop in core goods prices, which registered its first decline in four months.

- On the other hand, core services inflation remained firm on a monthly basis, rising 0.3% m/m.

- Although inflation continues to be a factor in the Fed's reasoning behind recent rate cuts, we don't see this month's CPI reading changing the calculus for the Fed in the near-term. Core PCE inflation remains below-target and inflation expectations continue to hover below the historical levels associated with price stability. Weaker PPI and CPI inflation reports aren't likely to change that picture, in our view.

- We continue to expect the Fed to deliver another rate cut at the end of the month, with global growth, manufacturing, and trade also remaining key concerns.”

Trump administration understands the negative consequences of an escalation in U.S.-China trade agreement

Anders Svendsen, an analyst at Nordea Markets, notes that the U.S. core CPI inflation remains at the highest in more than 10-years despite cooling momentum.

- “Core CPI increased slightly less than expected in September, while remaining unchanged at 2.4% y/y. The main culprits of the weaker-than-expected momentum in core CPI was a 1.6% drop in used-car prices during September, while new vehicle costs were down 0.1% and apparel prices fell 0.4%. Headline CPI also increased slightly less than expected and headline CPI inflation is trending lower due to decreasing energy prices.

- Core CPI has been above or at 2% since March-2018, to a large extent driven by growth in core services prices. However, over the last months core goods prices have clearly increased and now stand close to the highest level since 2012 in year-over-year terms.

- Stronger inflationary pressure has also started to appear in Fed’s favourite inflation measure, Core PCE, which hit 1.8% y/y in August. Even if Core PCE converges towards the 2% target over the next months, we don’t expect it to have much implication for monetary policy. Fed has earlier indicated that they would like to see inflation above 2 % for a prolonged period to be in line with its symmetrical 2% target.

- More importantly is the contraction among US manufacturers and weaker growth among US non-manufacturers. Therefore, we expect another 25bp rate cut in both October and December with risks tilted towards another cut in 2020.”

China willing to reach agreement on matters that both sides care about and to prevent friction from further escalation

China-U.S. economic and trade relations are very important, with global influence

Chinese side came with great sincerity

Willing to cooperate with the U.S. on trade balance, market access and investors' protection

U.S. stock-index futures traded little changed on Thursday, as investors closely monitor the developments of high-level trade talks between the United States and China.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,551.98 | +95.60 | +0.45% |

Hang Seng | 25,707.93 | +25.12 | +0.10% |

Shanghai | 2,947.71 | +22.85 | +0.78% |

S&P/ASX | 6,547.10 | +0.40 | +0.01% |

FTSE | 7,170.20 | +3.70 | +0.05% |

CAC | 5,517.70 | +18.56 | +0.34% |

DAX | 12,091.67 | -2.59 | -0.02% |

Crude oil | $53.08 | +0.91% | |

Gold | $1,507.80 | -0.33% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 151 | 0.01(0.01%) | 1404 |

Amazon.com Inc., NASDAQ | AMZN | 1,722.00 | 0.01(0.00%) | 16943 |

AMERICAN INTERNATIONAL GROUP | AIG | 53 | -0.04(-0.08%) | 1517 |

Apple Inc. | AAPL | 227.82 | 0.79(0.35%) | 259718 |

AT&T Inc | T | 37.09 | 0.04(0.11%) | 42374 |

Boeing Co | BA | 373.76 | -1.20(-0.32%) | 5463 |

Caterpillar Inc | CAT | 119 | -0.44(-0.37%) | 1861 |

Cisco Systems Inc | CSCO | 46.08 | -0.76(-1.62%) | 65143 |

Citigroup Inc., NYSE | C | 67.8 | 0.37(0.55%) | 5546 |

Exxon Mobil Corp | XOM | 67.46 | 0.02(0.03%) | 6563 |

Facebook, Inc. | FB | 180.2 | 0.35(0.19%) | 29260 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 8.77 | 0.22(2.57%) | 234330 |

General Electric Co | GE | 8.34 | -0.01(-0.12%) | 21850 |

General Motors Company, NYSE | GM | 34.13 | -0.01(-0.03%) | 12851 |

Goldman Sachs | GS | 197.1 | 0.25(0.13%) | 4881 |

Google Inc. | GOOG | 1,199.90 | -2.41(-0.20%) | 2217 |

Hewlett-Packard Co. | HPQ | 15.97 | -0.43(-2.62%) | 113240 |

Intel Corp | INTC | 50.51 | 0.03(0.06%) | 19096 |

Johnson & Johnson | JNJ | 128.51 | -0.71(-0.55%) | 5606 |

JPMorgan Chase and Co | JPM | 112.89 | 0.26(0.23%) | 3726 |

McDonald's Corp | MCD | 212.2 | -0.63(-0.30%) | 970 |

Merck & Co Inc | MRK | 83.73 | -0.45(-0.53%) | 1071 |

Microsoft Corp | MSFT | 138.34 | 0.10(0.07%) | 81489 |

Nike | NKE | 92.6 | 0.08(0.09%) | 4427 |

Pfizer Inc | PFE | 35.61 | -0.08(-0.22%) | 658 |

Procter & Gamble Co | PG | 121.49 | -0.49(-0.40%) | 1200 |

Starbucks Corporation, NASDAQ | SBUX | 85.8 | -0.05(-0.06%) | 4304 |

Tesla Motors, Inc., NASDAQ | TSLA | 244.76 | 0.23(0.09%) | 22289 |

The Coca-Cola Co | KO | 53.7 | -0.13(-0.24%) | 498 |

Twitter, Inc., NYSE | TWTR | 39.41 | -0.09(-0.23%) | 13015 |

UnitedHealth Group Inc | UNH | 218 | -4.08(-1.84%) | 1636 |

Visa | V | 174.94 | 0.06(0.03%) | 3665 |

Wal-Mart Stores Inc | WMT | 118.8 | -0.13(-0.11%) | 1396 |

Walt Disney Co | DIS | 129.07 | -0.26(-0.20%) | 4597 |

Yandex N.V., NASDAQ | YNDX | 35.64 | -0.02(-0.06%) | 500 |

Uber (UBER) target lowered to $50 from $52 at Needham

Cisco Systems (CSCO) downgraded to Neutral from Buy at Goldman; target lowered to $48

HP (HPQ) downgraded to Sell from Neutral at Goldman; target lowered to $14

UnitedHealth (UNH) downgraded to Hold from Buy at Jefferies; target lowered to $235

Apple (AAPL) upgraded to Buy from Neutral at Longbow; target $260

Says he will take some time to carefully monitor developments after rate cuts

Says he will be highly vigilant, keep an open mind on further easing

Concerned about slowing global growth

Says downside risks would decrease if trade tensions moderate

Worried that U.S. manufacturing weakness could spread to broader U.S. economy

Market-determined rates showed policy was too tight before rate cuts

Says U.S. economy is at or past full employment

Expects inflation to reach 2% target over medium-term

Expects 2.1% US GDP growth this year

The Labor

Department announced on Thursday the U.S. consumer price index (CPI) was

unchanged m-o-m in September, following a 0.1 percent m-o-m increase in the

previous month.

Over the last

12 months, the CPI rose 1.7 percent y-o-y last month, the same pace as in the

12 months through August.

Economists had

forecast the CPI to increase 0.1 percent m-o-m and 1.8 percent y-o-y in the

12-month period.

According to

the report, gains in the indexes for shelter (+0.3 percent m-o-m) and food (+0.1

percent m-o-m) were offset by declines in the indexes for energy (-1.4 percent

m-o-m) and used cars and trucks (-1.6 percent m-o-m) to result in the

seasonally adjusted all items index being flat.

Meanwhile, the

core CPI excluding volatile food and fuel costs edged up 0.1 percent m-o-m in

September, following a 0.3 percent m-o-m gain in the previous month.

In the 12 months

through September, the core CPI rose 2.4 percent, the same pace as in the 12

months ending August.

Economists had

forecast the core CPI to rise 0.2 percent m-o-m and 2.4 percent y-o-y last

month.

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment benefits unexpectedly decreased last week, suggesting the labor

market remains on solid footing.

According to

the report, the initial claims for unemployment benefits fell by 10,000 to a

seasonally adjusted 220,000 for the week ended October 5.

Economists had

expected 219,000 new claims last week.

Claims for the

prior week were revised upwardly to 220,000 from the initial estimate of 219,000.

Meanwhile, the

four-week moving average of claims increased by 1,000 to 213,750 last week.

Analysts at TD Securities are expecting the U.S. headline CPI to tick up a tenth to 1.8% YoY in September (0.1% MoM) despite another monthly decline in energy prices.

- “Conversely, core inflation should stay unchanged at 2.4% y/y, reflecting a firm 0.2% m/m advance — though slightly softer than in Jun-Aug, as core goods inflation likely lost some steam on a monthly basis. That said, a steady 0.2% m/m gain in services should support core prices in September.

- We anticipate OER to advance at 0.3% m/m, up from two consecutive 0.2% monthly gains, and for the ex-shelter segment to slow modestly on a monthly basis.”

Richard Franulovich, the head of FX strategy at Westpac, suggests the Fed’s decision to rebuild their balance sheet shouldn’t upset the USD much as short-dated bill purchases - to facilitate implementation of existing monetary policy - is a very different beast from large scale ECB/BoJ QE aimed at boosting credit, cutting risk premiums and lifting growth.

- “US-China trade talks unlikely to yield much, visa bans and blacklistings raising the hurdle for even a modest interim mini-deal. Trade and supply chain uncertainty likely extends deep into 2020. That will sap US and global growth yet further and compel more Fed cuts. Powell did not push back on expectations for an Oct rate cut and if anything stressed prospective downward revisions to employment trends.

- But USD should remain resilient and DXY support at 98-98.5 likely holds. Rates markets already fully price a 31 Oct Fed cut and the global economy is not faring any better. A more protracted easing cycle will weigh on the USD but past cycles suggests there are long lags at play and it won’t be a negative story for the USD until well into 2020.”

- QE was opposed by a number of members, arguing it should be instrument of last resort

- Some members argued QE was not an efficient instrument given low yields

- Some members argued that open-ended QE could push ECB into bigger purchases

- That will create problems and challenge purchase limits

- There were a number of reservations about rate tiering

- Some policymakers were ready to support 20 bps rate cut if package excluded QE

- Some policymakers questioned growth forecasts, calling them too optimistic

- All policymakers agreed on the need for further easing

- If recovery doesn't set it, we are ready to act

- Germany already has an expansive fiscal policy

Bill Diviney, the senior economist at ABN AMRO, expects the Fed to formally announce a decision on the balance sheet at the 29-30 October FOMC.

- “The question is, by how much will the Fed need to regrow the balance sheet, and at what pace? Clues for this are provided by the continued repo operations that the NY Fed has conducted to address the liquidity shortage in the short term. While demand at these operations has fallen considerably, from a peak of $92bn in September to $30.8bn in today’s operation, the Fed will want to regrow the balance sheet at least by the maximum amount demanded at these operations, plus a buffer to be sure demand is sufficiently met.

- We, therefore, expect an initial boost of c.$150-200bn – with purchases conducted over a few months – followed by organic growth of the balance sheet in line with nominal GDP growth (to meet growing cash demand – as occurred prior to the financial crisis), i.e. c.4% p.a. In the meantime, the Fed will likely want to continue its repo operations until it judges the balance sheet has reached a level sufficient to cover reserve demand.”

- World is becoming unpredictable in terms of economic outlook and geopolitics

- Saudi attack is almost behind us thanks to swift response

- OPEC's challenge has always been to depoliticise oil

James Smith, the developed markets economist at ING, notes that UK's GDP contracted by 0.1% in August, suggesting there is very little to cheer about in the UK economy at the moment.

- "Admittedly it is worth noting that this latest fall in output followed a decent July figure, which was revised upwards to 0.4%. It is also true that the 0.7% fall in manufacturing output during August was amplified by a fall in volatile pharmaceutical production, according to the ONS (the UK’s statistics agency).

- However, that was counterbalanced by greater momentum in transport-related output – many of the factory shutdowns that normally occur over the summer had been brought forward to April to shield against possible Brexit-related disruption. That meant that output was perhaps slightly higher for the time of year.

- In the short-term, there is some potential for manufacturing to bounce back as stock building activities resume ahead of October 31 – albeit with inventory levels already high and warehousing space scarce, this will be on a much more limited scale than before the original March deadline.

- That said, the economy will most likely avoid a near-term technical recession. Consumer activity is continuing to grow, even if confidence remains fairly depressed. Shoppers appear to have been less fazed by the ups-and-downs of the Brexit process than businesses.

- But even so, economic growth is likely to remain fairly modest for the rest of this year, averaging around 0.2-0.3% per quarter. This means that the Bank of England is likely to remain cautious, although we still feel its probably too early to be pencilling in UK rate cuts."

- Says that UK data is fairly volatile at the moment

- Today's data is consistent with picture of soft underlying growth

- BoE is ready for any Brexit contingency

- There is plenty of time for the government to choose a new BoE governor

- In more dramatic potential Brexit outcomes, we will look to do whatever we can to support growth

The European Commission approved on Thursday a Greek plan to reduce bad loans by up to 30 billion euros ($33.04 billion) at the country's banks, as expected, saying it did not violate state aid rules.

Bankers told last month that they expected a green light from the EU executive to put in place the asset protection scheme that will help its banks offload the loans.

The scheme, known as Hercules Asset Protection Scheme, aims to bring down the amount of bad, or non-performing, loans which are weighing on Greek banks, without distorting the market through government subsidies.

"The European Commission has found Greek plans aimed at supporting the reduction of non-performing loans of Greek banks to be free of any state aid," the Commission said in a statement.

Banks in Greece have been working to reduce a pile of about 80 billion euros in bad loans, the legacy of a financial crisis that shrank the country's economy by a quarter. Shedding the bad loans is crucial for their ability to lend and shore up their profitability.

Risks for the offshore yuan are skewed toward the downside as hopes of a “narrow” deal have been dented in recent days as China and the U.S. prepare for trade talks, according to Citigroup Inc.

China’s persistently defiant attitude on structural issues, and a newly narrowed focus in trade discussions -- opposed by U.S. President Donald Trump -- have extinguished optimism that a deal can be done, Citigroup strategists, including Johanna Chua, said in a note.

“The likelihood of plausible scenarios from the trade talks has also been shifting around rapidly,” the strategists said. “With due consideration to the expectation built up, we assess the risk for USDCNH is tilted upwards.”

New points of conflict outside the usual parameters of asymmetric trade and intellectual property rights have also emerged this week, darkening the prospects of trade-deal progress, they said. These include the potential restrictions on U.S. portfolio flows into China, as well as the Trump administration’s new blacklist of eight Chinese technology companies and accompanying visa ban on certain Chinese officials.

“China officials have left the door open to retaliate,” according to the report, dated Oct. 9. Tensions over the Hong Kong protests are also pressuring negotiations, the note added.

USD/JPY is expected to remain sidelined for the time being, noted FX Strategists at UOB Group.

24-hour view: “The choppy and rapid swings in USD have resulted in a mixed outlook. US/China headlines could result in further volatile price action as USD could continue to swing between 106.85 and 107.80”.

Next 1-3 weeks: “We highlighted the “diminished odds for further USD weakness” on Tuesday (08 Oct, spot at 107.25) and the break of the 107.50 ‘strong resistance’ level yesterday (high of 107.62) indicates that USD has moved back into a sideway-trading phase (we previously expected USD to trade lower towards 106.35). From here, USD is likely to trade between the two major levels of 106.50 and 108.50 for a period”.

Analysts at TD Securities note that following China's increased purchases of US agricultural goods, US tariff delays and President Trump noting that a deal "could happen sooner than you think", hopes of progress during a fresh round of trade talks between senior US and Chinese officials in Washington were growing.

“While the incentive for both sides to get a deal done is intensifying given rising economic pressures on both countries, reports early in Asian trade cast doubt on whether any progress is likely. It began with the South China Morning Post reporting no advances in deputy level trade talks, that would see the Chinese delegation leave the US later today instead of Friday. However these remarks were contradicted first by CBNC, reporting that the South China Morning Post comments were inaccurate. Bloomberg also confirmed China’s Lie He would remain in Washington through to Friday. To add to this confusion, Fox news cited Chinese ‘trade sources’ that its Country’s team will leave on Thursday, but reports emerged the US was considering a currency pact with China as part of a partial deal. Earlier Trump signed off on licenses for some US companies to do business with Huawei.”

According to the report from Office for National Statistics, total production output fell by 0.4% for the three months to August 2019, compared with the three months to May 2019; falls in manufacturing (1.1%) and mining and quarrying (2.3%) were partially offset by rises in electricity and gas (3.2%) and water and waste (1.6%). The three-monthly fall in manufacturing of 1.1% is because of widespread weakness with 11 of the 13 subsectors decreasing; this was led by food, beverages and tobacco (2.0%) and computer, electronic and optical products (3.5%).

Production output fell by 0.6% between July 2019 and August 2019. Economists had expected a 0.1% decrease. Manufacturing provided the largest downward contribution (0.7%), supported by electricity and gas (0.7%) and mining and quarrying (1.0%). The 0.7% monthly decrease in manufacturing output was widespread with falls in 10 of the 13 subsectors; the largest downward contribution came from a 4.7% fall in basic pharmacutical products.

For the three months to August 2019, production output decreased by 1.3%, compared with the same three months to August 2018; led by a fall in manufacturing of 1.5%.

Office for National Statistics said, monthly gross domestic product (GDP) growth was negative 0.1% in August 2019, following growth in both June and July 2019. GDP was expected to remain unchanged. The monthly growth rate for GDP is volatile and so it should be used with caution and alongside other measures, such as the three-month growth rate, when looking for an indicator of the longer-term trend of the economy. However, it is useful in highlighting one-off changes that can be masked by three-month growth rates.

UK GDP grew by 0.3% in the three months to August 2019. The main contributor to gross domestic product (GDP) growth in the three months to August 2019 was the services sector, which grew by 0.4%. This was driven by widespread strength across the services industries in June and July, following a period of largely flat growth in the previous three months. Meanwhile, the production sector fell by 0.4% in the same period, while construction output grew by 0.1%.

Commenting on today’s GDP figures, Head of GDP Rob Kent-Smith said: "Growth increased in the latest three months, despite a weak performance across manufacturing, with TV and film production helping to boost the services sector."

European Central Bank President Mario Draghi ignored advice from the bank's monetary policy committee not to resume bond purchases, the Financial Times reported on Thursday, shedding more light on how divisive the move was.

The ECB pledged indefinite bond purchases in September, even as more than a third of the rate-setting Governing Council opposed the move, an unusually high level of dissent for a body that normally strives for consensus.

The monetary policy committee - made up of technocrats mostly from the euro zone's 19 central banks - sent a letter to Draghi and other Governing Council members several days before the meeting, advising against fresh bond buys, the FT cited three members of the council as saying.

Although the committee's advice is not binding, there have only been a handful of occasions during Draghi's eight-year tenure that the Governing Council went against it, the FT added.

Japan's government and the central bank will take all necessary steps to ensure a sustained economic recovery as the country has not completely emerged from deflation yet, Economy Minister Yasutoshi Nishimura said on Thursday.

"We haven't reached a situation where we can say Japan has completely emerged from deflation," Nishimura told parliament.

"But the economy is making progress towards exiting from deflation. The government and the Bank of Japan will work closely together and take all necessary policy steps" to keep the economy on a recovery track, he said.

According to analysts at TD Securities, the big question mark for UK’s August GDP is the impact of the auto sector.

“There are normally scheduled shutdowns in August every year, but most major auto manufacturers had shutdowns in April this year, in anticipations of disruptions stemming from the original Brexit date of 29 March. This had initially led us to pencil in a strong pick-up in August IP, since seasonal factors would have been 'expecting' a drop in activity that didn't occur if the regular shutdowns already happened in April. However, anecdotal evidence suggests that at least some auto manufacturers did still go through with their regular August shutdowns, so any upside from IP should be limited. Overall, we look for August GDP to come in with a modest 0.2% gain (mkt: 0.0%), though this leaves the quarter on solid footing after the 0.4% increase in July.”

Danske Bank analysts point out that today the 13th round of high-level US-China trade talks kick off in Washington and continues tomorrow.

“We still see a good chance of an interim deal after China said it was still ready to make such a deal despite the US blacklisting of Chinese companies. FT also reported that China would offer to buy 10 million tons of soybeans in return for the US taking coming tariff hikes off the table. We do not know exactly when statements will come out of the talks but a good guess is late Friday (European time).”

“The minutes from the recent ECB meeting are set to be interesting reading. Since the meeting there have been frictions within the Governing Council, which peaked with the resignation of ECB board member Sabine Lautenschläger. Furthermore, we have seen conflicting comments in the media, in which Chief Economist Philip Lane said that he did not believe that the ECB had delivered a big package and that it could cut rates further.”

According to the report from Insee, in August 2019, output diminished in the manufacturing industry (−0.8%, after +0.4%), as well as in the whole industry (−0.9%, after +0.3%). Economists had expected a 0.3% increase in the whole industry.

Over the last three months, output declined in manufacturing industry (−1.2%), as well as in the whole industry (−0.9%).

Over the last three months, output decreased sharply in the manufacture of machinery and equipment goods (−3.3%) and in the manufacture of transport equipment (−1.6%), and more moderately in “other manufacturing” (−0.6%) and in the manufacture of food products and beverages (−0.7%). It decreased markedly in the manufacture of coke and refined petroleum products (−6.9%). Conversely, it grew in mining and quarrying, energy, water supply (+0.6%).

Manufacturing output of the last three months got worse compared to the same three months of 2018 (−0.8%), as well as in the whole industry (−0.5%).

Over a year, output dipped in most activities: in the manufacture of transport equipment (−2.2%), in the manufacture of food products and beverages (−0.8%), in the manufacture of coke and refined petroleum products (−10.3%), in “other manufacturing” (−0.2%) and in the manufacture of machinery and equipment goods (−0.7%). Conversely, output increased in mining and quarrying, energy, water supply (+1.0%).

Analysts at TD Securities note that the latest FOMC minutes shed light on a Fed that remains divided following its decision to ease rates again at the September meeting.

“This was already evident on the fact that the dot plot is now split on three clear groups, and also on the three voters who dissented against the rate cut decision. Officials remained generally positive on the economy, while also acknowledging the external and persistent risks to the outlook. Moreover, soft inflation and inflation expectations remain important factors behind the decision to ease for many officials. Also notable, several Fed officials began discussions about how to communicate to the market the possible end of further accommodation. All in, we judge that the data released since the September FOMC meeting continues to support our view for an additional rate cut this month.”

According to the report from Federal Statistical Office (Destatis), Germany exported goods to the value of 101.2 billion euros and imported goods to the value of 85.0 billion euros in August 2019. Destatis also reports that German exports decreased by 3.9% and imports by 3.1% in August 2019 year on year. After calendar and seasonal adjustment, exports were down 1.8% and imports up 0.5% compared with July 2019.

The foreign trade balance showed a surplus of 16.2 billion euros in August 2019. In August 2018, the surplus amounted to 17.6 billion euros. In calendar and seasonally adjusted terms, the foreign trade balance recorded a surplus of 18.1 billion euros in August 2019.

A separate report from Deutsche Bundesbank showed, the current account of the balance of payments showed a surplus of 16.9 billion euros in August 2019, which takes into account the balances of trade in goods including supplementary trade items (+17.0 billion euros), services (-5.0 billion euros), primary income (+9.1 billion euros) and secondary income (-4.2 billion euros). In August 2018, the German current account showed a surplus of 15.2 billion euros.

In August 2019, Germany exported goods to the value of 57.5 billion euros to the Member States of the European Union (EU), while it imported goods to the value of 47.2 billion euros from those countries. Compared with August 2018, exports to the EU countries decreased by 3.3%, and imports from those countries by 2.7%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1103 (2847)

$1.1078 (2321)

$1.1059 (587)

Price at time of writing this review: $1.0986

Support levels (open interest**, contracts):

$1.0947 (3754)

$1.0916 (3623)

$1.0879 (3281)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 8 is 64735 contracts (according to data from October, 9) with the maximum number of contracts with strike price $1,1000 (3754);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2511 (877)

$1.2442 (117)

$1.2385 (330)

Price at time of writing this review: $1.2228

Support levels (open interest**, contracts):

$1.2146 (604)

$1.2126 (651)

$1.2077 (626)

Comments:

- Overall open interest on the CALL options with the expiration date November, 8 is 32215 contracts, with the maximum number of contracts with strike price $1,3300 (3777);

- Overall open interest on the PUT options with the expiration date November, 8 is 18747 contracts, with the maximum number of contracts with strike price $1,2000 (1808);

- The ratio of PUT/CALL was 0.58 versus 0.58 from the previous trading day according to data from October, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 58 | 0.26 |

| WTI | 52.56 | 0.23 |

| Silver | 17.7 | -0.06 |

| Gold | 1505.298 | -0.01 |

| Palladium | 1679.08 | 0.43 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -131.4 | 21456.38 | -0.61 |

| Hang Seng | -210.59 | 25682.81 | -0.81 |

| ASX 200 | -46.7 | 6546.7 | -0.71 |

| FTSE 100 | 23.35 | 7166.5 | 0.33 |

| DAX | 124.06 | 12094.26 | 1.04 |

| Dow Jones | 181.97 | 26346.01 | 0.7 |

| S&P 500 | 26.34 | 2919.4 | 0.91 |

| NASDAQ Composite | 79.96 | 7903.74 | 1.02 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.6723 | -0.07 |

| EURJPY | 117.911 | 0.53 |

| EURUSD | 1.09725 | 0.16 |

| GBPJPY | 131.173 | 0.28 |

| GBPUSD | 1.22059 | -0.1 |

| NZDUSD | 0.62878 | -0.11 |

| USDCAD | 1.33337 | 0.08 |

| USDCHF | 0.99531 | 0.25 |

| USDJPY | 107.453 | 0.37 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.