- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | National Australia Bank's Business Confidence | May | ||

| 06:00 | Japan | Prelim Machine Tool Orders, y/y | May | -33.4% | |

| 08:30 | Eurozone | Sentix Investor Confidence | June | 5.3 | |

| 08:30 | United Kingdom | Average earnings ex bonuses, 3 m/y | April | 3.3% | 3.1% |

| 08:30 | United Kingdom | Average Earnings, 3m/y | April | 3.2% | 3% |

| 08:30 | United Kingdom | ILO Unemployment Rate | April | 3.8% | 3.8% |

| 08:30 | United Kingdom | Claimant count | May | 24.7 | |

| 12:30 | U.S. | PPI, y/y | May | 2.2% | 2% |

| 12:30 | U.S. | PPI, m/m | May | 0.2% | 0.2% |

| 12:30 | U.S. | PPI excluding food and energy, m/m | May | 0.1% | 0.2% |

| 12:30 | U.S. | PPI excluding food and energy, Y/Y | May | 2.4% | 2.3% |

| 22:45 | New Zealand | Visitor Arrivals | April | -2.6% | 3.3% |

| 23:25 | Australia | RBA Assist Gov Kent Speaks | |||

| 23:50 | Japan | Core Machinery Orders, y/y | April | -0.7% | -5.3% |

| 23:50 | Japan | Core Machinery Orders | April | 3.8% | -0.8% |

Major US stock indexes rose moderately, as the United States abandoned its plans to introduce tariffs on Mexican imports, which helped to ease some of the trade concerns that had put pressure on the market since the beginning of May.

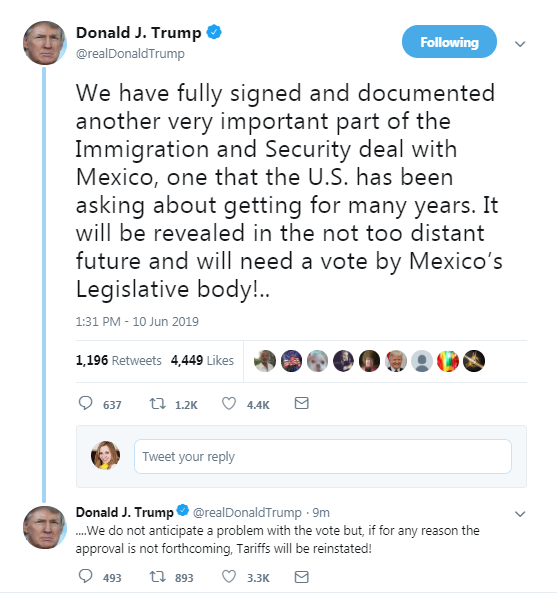

The US president said on Sunday on Twitter that the proposed 5 percent tariffs on Mexican imports would be suspended for an “indefinite period.” The head of the White House also expressed confidence that Mexico will deal with migration from Central America after the two neighbors reached an agreement.

Meanwhile, investors continued to closely monitor the development of the trade war between the United States and China. Donald Trump told CNBC today that he believes that China will make a deal with the US “because they have to.”

Donald Trump and Chinese leader Xi Jinping are due to meet at the G-20 summit later this month. On Monday, Trump said that if C missed the meeting, more tariffs on Chinese imports would take effect immediately. The head of the White House also threatened to impose duties on goods from China for another $ 300 billion, if they can not make a deal in the near future.

Investor optimism has also contributed to the message of a multibillion-dollar merger deal in the aerospace industry. Raytheon (RTN) and United Technologies (UTX) have agreed to a merger, which will result in a new company worth about $ 121 billion. However, the shares of these companies came under pressure after Trump said he was “a little concerned” with this merger, how it can adversely affect competition in the sector.

Market participants also studied the vacancy and labor turnover survey from the US Bureau of Labor Statistics, which showed that in April, the number of vacancies fell to 7,449 million from 7,474 million in March (revised from 7,488 million). Analysts had expected the number of vacancies to fall to 7.4 million. The level of vacancies did not change, and amounted to 4.7%.

Most of the components of DOW finished trading in positive territory (21 out of 30). The growth leader was the shares of The Goldman Sachs Group (GS; + 2.30%). Outsider were United Technologies Corp. (UTX; -2.91%).

Almost all sectors of the S & P recorded an increase. The largest growth was shown by the service sector (+ 0.9%). Only the utility sector decreased (-0.7%).

At the time of closing:

Dow 26,062.68 +78.74 +0.30%

S & P 500 2,886.73 +13.39 +0.47%

Nasdaq 100 7,823.17 +81.07 +1.05%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | National Australia Bank's Business Confidence | May | ||

| 06:00 | Japan | Prelim Machine Tool Orders, y/y | May | -33.4% | |

| 08:30 | Eurozone | Sentix Investor Confidence | June | 5.3 | |

| 08:30 | United Kingdom | Average earnings ex bonuses, 3 m/y | April | 3.3% | 3.1% |

| 08:30 | United Kingdom | Average Earnings, 3m/y | April | 3.2% | 3% |

| 08:30 | United Kingdom | ILO Unemployment Rate | April | 3.8% | 3.8% |

| 08:30 | United Kingdom | Claimant count | May | 24.7 | |

| 12:30 | U.S. | PPI, y/y | May | 2.2% | 2% |

| 12:30 | U.S. | PPI, m/m | May | 0.2% | 0.2% |

| 12:30 | U.S. | PPI excluding food and energy, m/m | May | 0.1% | 0.2% |

| 12:30 | U.S. | PPI excluding food and energy, Y/Y | May | 2.4% | 2.3% |

| 22:45 | New Zealand | Visitor Arrivals | April | -2.6% | 3.3% |

| 23:25 | Australia | RBA Assist Gov Kent Speaks | |||

| 23:50 | Japan | Core Machinery Orders, y/y | April | -0.7% | -5.3% |

| 23:50 | Japan | Core Machinery Orders | April | 3.8% | -0.8% |

A widely anticipated meeting between Chinese President Xi Jinping and US President Donald Trump at the end of June in Japan could be a formal face-to-face negotiation over dinner instead of a quick handshake and chat, a source told the South China Morning Post (SCMP).

Neither Beijing or Washington have formally confirmed any plans or provided any details of the meeting, which is widely expected to take place on the sidelines of the G20 leaders summit in Japan on June 28-29.

The SCMP notes that the manner, duration and format of the meeting will be important to gauge the relationship between the two leaders and the prospect of progress toward a solution to the trade war. If confirmed, the setting of a formal sit-down negotiation would not only allow the two leaders and their aides relatively sufficient time to address their differences but also to agree on a conciliatory tone.

The Job

Openings and Labor Turnover Survey (JOLTS) published by the Labor Department on

Monday showed a slight decrease (-0.3 percent m-o-m) in the U.S. job openings

in April.

According to the

report, employers posted 7.449 million job openings in April, compared to the March

figure of 7.474 million (revised from 7.488 million in original estimate) and economists’

expectations of 7.400 million. The job openings rate was 4.7 percent in April, the

same as in the prior month. The report showed that the number of job openings

was little changed for total private and for government. The job openings level

increased in federal government (+22,000) and educational services (+20,000).

Job openings declined in professional and business services (-172,000).

Meanwhile, the

number of hires edged up to 5.937million in April from 5.697 in March. The

hiring rate was 3.9 percent, up from 3.8 percent in March. The hires level

edged up for total private (+217,000) and was little changed for government.

Hires rose in real estate and rental and leasing (+34,000).

The separation rate in April was at 5.578 million or 3.7 percent, compared to 5.508 million or 3.7 percent in March. Within separations, the quits rate was 2.3 percent (flat m-o-m), and the layoffs rate was 1.2 percent (+0.1 pp m-o-m).

Josh Nye, a senior economist at the Royal Bank of Canada, notes that the Canadian housing starts were close to expectations, dropping to 202,000 annualized units in May from 233,000 in April.

- “The six-month trend was also 202k, which is the slowest pace in more than two years.

- May’s pullback was concentrated in multi-unit starts though the trend in that component remains solid.

- A separate report saw building permits jump to their highest level since 2005, largely due to a surge in BC ahead of an increase in development costs in Vancouver.

- We expect starts will continue to slow gradually as the year progresses, albeit remaining at fairly solid levels thanks to ongoing strength in the multi-unit segment.”

National Institute of Economic and Social Research (NIESR) reported its estimates revealed the UK's economy is on course to contract by 0.2 percent in the second quarter.

The latest data from ONS showed the UK economy expanded by 0.3 percent in the three months to April, which was weaker than the 0.4 percent growth rate that NIESR forecast last month for the same period.

The slowdown in the three-month growth rate was associated with a 0.4 percent drop in GDP in April, driven by declines in the production and construction sectors, while output in the service sector was flat in April.

Recent surveys suggest that there has not been a material recovery in output in May, the NIESR said (UK's GDP is estimated to fall 0.1 percent in the three months to May).

Economic contraction of 0.2 percent in the second quarter is expected to be mainly driven by the production and construction sectors, with a small positive contribution from the service sector.

U.S. stock-index futures rose on Monday, helped by the news that the U.S. is not going to impose a 5% tariff on Mexican goods, while a multi-billion dollar deal between United Technologies (UTX) and Raytheon (RTN) added to the bullish sentiment.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,134.42 | +249.71 | +1.20% |

Hang Seng | 27,578.64 | +613.36 | +2.27% |

Shanghai | 2,852.13 | +24.33 | +0.86% |

S&P/ASX | - | - | - |

FTSE | 7,367.97 | +36.03 | +0.49% |

CAC | 5,378.19 | +14.14 | +0.26% |

DAX | 12,045.38 | +92.24 | +0.77% |

Crude oil | $54.22 | +0.43% | |

Gold | $1,332.50 | -1.01% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 170.02 | 3.41(2.05%) | 637 |

ALTRIA GROUP INC. | MO | 51.53 | 0.15(0.29%) | 1671 |

Amazon.com Inc., NASDAQ | AMZN | 1,819.18 | 15.15(0.84%) | 54877 |

AMERICAN INTERNATIONAL GROUP | AIG | 53.08 | 0.17(0.32%) | 4356 |

Apple Inc. | AAPL | 192.75 | 2.60(1.37%) | 287509 |

AT&T Inc | T | 32.63 | 0.14(0.43%) | 49525 |

Boeing Co | BA | 356.7 | 3.00(0.85%) | 13066 |

Caterpillar Inc | CAT | 125.5 | 1.04(0.84%) | 2840 |

Chevron Corp | CVX | 121.7 | 0.22(0.18%) | 1426 |

Cisco Systems Inc | CSCO | 56.05 | 0.12(0.21%) | 26767 |

Citigroup Inc., NYSE | C | 66.73 | 1.04(1.58%) | 38703 |

Deere & Company, NYSE | DE | 150 | 1.29(0.87%) | 150 |

Exxon Mobil Corp | XOM | 74.88 | 0.30(0.40%) | 3381 |

Facebook, Inc. | FB | 174.75 | 1.40(0.81%) | 89917 |

FedEx Corporation, NYSE | FDX | 159.99 | 1.97(1.25%) | 1543 |

Ford Motor Co. | F | 9.93 | 0.17(1.74%) | 182020 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.44 | 0.09(0.87%) | 34854 |

General Electric Co | GE | 10.06 | 0.08(0.80%) | 168363 |

General Motors Company, NYSE | GM | 36.27 | 0.78(2.20%) | 34470 |

Goldman Sachs | GS | 191.5 | 1.69(0.89%) | 5726 |

Hewlett-Packard Co. | HPQ | 19.96 | 0.25(1.27%) | 400 |

Home Depot Inc | HD | 198.25 | 0.95(0.48%) | 2094 |

HONEYWELL INTERNATIONAL INC. | HON | 173.96 | 1.70(0.99%) | 801 |

Intel Corp | INTC | 46 | -0.03(-0.07%) | 61451 |

International Business Machines Co... | IBM | 134.1 | 0.79(0.59%) | 1951 |

Johnson & Johnson | JNJ | 138.58 | 0.03(0.02%) | 515 |

JPMorgan Chase and Co | JPM | 110.9 | 1.74(1.59%) | 19754 |

McDonald's Corp | MCD | 206.9 | 1.42(0.69%) | 664 |

Microsoft Corp | MSFT | 132.72 | 1.32(1.00%) | 149499 |

Nike | NKE | 84 | 0.59(0.71%) | 2378 |

Pfizer Inc | PFE | 43.02 | 0.10(0.23%) | 1501 |

Procter & Gamble Co | PG | 108.78 | 0.01(0.01%) | 2653 |

Starbucks Corporation, NASDAQ | SBUX | 82.71 | 0.23(0.28%) | 12606 |

Tesla Motors, Inc., NASDAQ | TSLA | 210.08 | 5.58(2.73%) | 183245 |

Twitter, Inc., NYSE | TWTR | 38.2 | 0.27(0.71%) | 33000 |

United Technologies Corp | UTX | 134.49 | 2.34(1.77%) | 192491 |

UnitedHealth Group Inc | UNH | 247.8 | 1.03(0.42%) | 971 |

Verizon Communications Inc | VZ | 57.4 | 0.16(0.28%) | 6167 |

Visa | V | 171.4 | 1.35(0.79%) | 8539 |

Wal-Mart Stores Inc | WMT | 106.35 | 0.29(0.27%) | 4792 |

Walt Disney Co | DIS | 138.9 | 0.86(0.62%) | 7611 |

- U.S. trade deal with China going to work out because of tariffs

- China is getting absolutely devastated

- Companies are leaving China and going elsewhere, including to the US

- "Tariffs are a beautiful thing"

- We talked about Mexico deal for months but we couldn't get there until the tariffs

- Mexico took 30% of our automobile companies, they would all move back if we put on tariffs

- As soon as I put tariffs on the table, it was done

- China has lost many trillions of dollars on tariffs

- From my standpoint, tariffs are a "no brainier"

- Our Fed is very, very disruptive to us

- The tariffs are putting us at a tremendous advantage

- China devalues its currency, something has to be done

- China currency moves nullified tariffs to some extent

- The Fed raised interest rates far too tightly

- We got everything we wanted from Mexico

- If China doesn't come to G20, tariffs will go on immediately; but I think we're scheduled for a meeting

- We're expecting to meet Xi at G20

Advanced Micro (AMD) target raised to $40 from $35 at BofA/Merrill

United Tech (UTX) upgraded to Buy from Neutral at Seaport Global Securities; target $165

Statistics

Canada announced on Monday that the value of building permits issued by the

Canadian municipalities surged 14.7 percent m-o-m in April, following a revised

2.8 percent m-o-m advance in March (originally a 2.1 percent m-o-m increase).

Economists had

forecast a 0.5 percent gain in April from the previous month.

According to

the report, the value of residential permits climbed 24.5 percent m-o-m in

April, as permits multi-family dwellings climbed by 39.6 percent m-o-m, while single-family

permits rose by 5.1 percent m-o-m.

At the same

time, the value of non-residential building permits increased by 1.1 percent

m-o-m in April, due to higher construction intentions for industrial buildings

(61.8 percent m-o-m), which however were offset by declines in permits for both

institutional (-24.5 percent m-o-m) and commercial (-5.3 percent m-o-m) components.

In y-o-y terms,

building permits increased 18.3 percent in April.

- Global headwinds weighing on the euro

- ECB is determined to act in case of adverse contingencies and stands ready to adjust all of its instruments, as appropriate

The Canada

Mortgage and Housing Corp. (CMHC) reported on Monday the seasonally adjusted

annual rate of housing starts was at 202,337 units in May, up 22.6 percent from

a downwardly revised 233,410 units in April (originally 235,460 units).

Economists had

forecast an annual pace of 196,400 for May.

According to

the report, urban starts fell by 14.4 percent m-o-m last month to 186,946 units,

as multiple urban starts tumbled by 18.5 percent m-o-m to 141,851 units, while

single-detached urban starts rose by 1.8 percent m-o-m, to 45,095 units. At the

same time, rural starts were estimated at a seasonally adjusted annual rate of 15,391

units, up 2.3 percent m-o-m.

Analysts at ANZ note that both leveraged funds and asset managers were net USD sellers, with the former continuing to trim their USD longs and the latter raising their USD shorts, according to the CFTC’s positioning data for the week ending 4 June 2019.

- “Post the CFTC cut-off date, the USD has lost further ground on growing expectation of Fed rate cuts. We expect Fed policy and developments on the trade front ahead of G-20 summit in late June to drive the near-term positioning in USD.

- Funds bought JPY and EUR against the USD, but were net sellers of GBP and CHF. Money managers also bought JPY but CHF as well, while selling EUR and GBP.

- On commodity FX, funds were net sellers while asset managers were net buyers. Funds raised their net shorts in CAD and cut their net NZD longs to a small short position, but they pared their net AUD shorts. Meanwhile, money managers pared their net CAD and AUD shorts but raised their net NZD shorts. Both funds and asset managers were net EMFX sellers.”

Paolo Pizzoli, ING's senior economist covering Italy, EMU and Greece, notes that Italian industrial production data turned out softer than consensus expectations, with the investment component being the main driver.

- "Italian industrial production came in disappointingly weak in April, posting a seasonally adjusted 0.7% month on month contraction (-1% MoM in March). The working days adjusted measure, better suited to monitor the underlying trend, posted a 1.5 YoY contraction (-1.6% in March). Admittedly, the April number might have been affected by calendar effects due to the timing of the 25 April national holiday, but we feel this only provides a partial explanation of the poor monthly turnout.

- The breakdown by broad aggregates shows that investment goods (-2.5% MoM), intermediate goods (-0.7% MoM) and consumer goods (-0.5% MoM) were all in negative territory, with energy alone posting a monthly expansion (+3.6%).

- No major change from the sector breakdown, but a confirmation that sectors topping the production rankings in 2018 have clearly slowed down over the first four months of 2019. In the January 2019 - April 2019 period annual working day adjusted data shows that energy production (2.9% YoY) leads the pack, followed by food and tobacco (+2.2% YoY) and electronic equipment (+0.5% YoY), with electrical equipment and chemicals hardly expanding. At the other end of the spectrum stand coke and refining (-7.7% YoY), transport equipment (-3.6% YoY), metal products (-3.7% YoY) and pharmaceuticals (-3.6% YoY).

- The poor reading of the investment component is worth noting, as it signals the underlying weakness in the national accounts investment component already shown by 1Q19 GDP data might be continuing over 2Q19."

Analysts at Rabobank notes that the level of net EUR shorts positions dropped sharply ahead of last week’s ECB meeting, according to the IMM net speculators’ positioning as at June 04, 2019.

“USD longs edged lower but once again lacked any drama. Net longs have remained essentially consolidative since the middle of March.

Net short GBP positions surged again in response to UK political tensions. The resignation of PM May and the strong showing for the Brexit party in the European parliamentary elections has meant that candidates for May’s replacement have hardened their Brexit positions. This leaves GBP vulnerable.

The level of JPY shorts dropped noticeably reflecting worsening tensions surrounding US/China trade talks.

CHF net shorts increased modestly.

CAD net shorts increased. BoC policy, trade talks and the recent drop in oil prices are in view.

AUD net shorts fell back after the RBA’s June rate cut with Governor Lowe being judged as holding a ‘glass half full’ outlook on the economy.”

- EU rules are the cause of some of Italy's problems

- Government does not want to fight with Europe

- Open to using alternative tools to mini-BOT securities to solve unpaid debt problem

James Smith, a developed markets economist at ING, notes that real GDP fell by 0.4% on the month, although this is almost entirely down to a Brexit-related correction in manufacturing.

- "UK-based firms significantly built levels of inventory during the first quarter, and while by definition much of this was sourced from Europe, UK manufacturing production also received a temporary boost. But as it became clear that the ‘no deal’ risk had been postponed with the Article 50 extension, firms began to grapple with what to do with all the extra stock. As the PMI indicators have also signalled, first and foremost this has meant a fall in production, which declined by 3.9% month-on-month – the sharpest such fall since 2002.

- It’s also worth noting that several firms said they were planning to bring forward their annual shutdown to April. This period, which typically lasts for two weeks over the summer to allow time for co-ordinated vacation as well as factory refitting/retooling, was made earlier in some cases to insulate against the initial impact of a ‘no deal’ exit.

- All of this raises the possibility that growth could come in negative for the second quarter as a whole, but either way, it should largely prove temporary. That said, the wider growth story continues to look fairly bleak. While consumer spending may be a little stronger given the modest improvement in real wage growth, investment is likely to continue falling over the summer as Brexit uncertainty weighs on decision-making.

- We, therefore, think it is unlikely that the Bank of England will hike rates during 2019, although we’d continue to flag that recent hawkish commentary from Governor Mark Carney suggests that a November move shouldn’t be 100% ruled out if Article 50 is extended further.

- In reality though, raising concerns about a possible ‘no deal’ Brexit, as well as the growing likelihood of a general election in the autumn, make it more likely that the central bank remains on hold through this year."

- Says satisfied with the cooperation with Russia within OPEC+

- There are big risks of oversupply

- But we need to monitor oil market to take a balanced decision in July

FX Strategists at UOB Group noted the pair’s upside could be limited around the 109.00 neighbourhood in the near term.

Next 1-3 weeks: “Our view for USD to “extend its weakness” did not really materialize as it traded sideways for most of last week. Downward momentum has eased considerably and while the current ‘negative phase’ in USD is still intact, the odds for further weakness have diminished. However, only a break of 109.30 (no change in ‘key resistance’ level) would indicate that the end of the ‘positive phase’ and the start of a ‘sideway-trading phase’”.

Analysts TD Securities (TDS) offer their expectations on Monday’s Canadian housing data slated for release at 1215 GMT.

“CAD Housing starts and building permits will give an update on residential investment. TD looks for housing starts to slow to a 212k pace in May (market: 205k) on a pullback in multi-unit construction, which reached a new record the prior month. April building permits will be released shortly afterward at 8:30 ET, with the market consensus looking for a 1.8% advance.”

The Group of 20 finance ministers' statement that trade tensions have "intensified" puts the onus on the United States and China to solve their trade dispute, European Union Commissioner for Economic Affairs Pierre Moscovici said on Monday.

Moscovici, who spoke in Tokyo after attending the G20 finance ministers' meeting in Fukuoka, expressed hope that the United States and China could reach an agreement at a G20 leaders' summit in Osaka later this month.

The G20 finance ministers' statement issued on Sunday said trade and geopolitical tensions have "intensified", raising risks to improving global growth.

According to the report from Office for National Statistics, production output fell by 2.7% between March 2019 and April 2019; the manufacturing sector provided the largest downward contribution, falling by 3.9%, its largest fall since June 2002 and the impact of Golden Jubilee shutdowns. Economists had expected a 0.7% decrease of industrial production and a 0.2% increase of manufacturing production.

In April 2019, transport equipment fell by 13.4%, the largest fall since January 1974, providing the largest downward contribution to the monthly decrease in manufacturing; within this subsector, motor vehicles, trailers and semi-trailers fell by a record 24.0% (records began in January 1995).

Production output rose by 0.7% for the three months to April 2019, compared with the three months to January 2019, due to rises from manufacturing (1.2%), and mining and quarrying (2.9%). The three-monthly increase in manufacturing is due mainly to rises of 5.5% from pharmaceuticals, and 2.6% from food products, beverages and tobacco.

For the three months to April 2019, production output increased by 0.2% compared with the same three months to April 2018; with notable rises in manufacturing of 1.0% and mining and quarrying of 5.0%, partially offset by a fall of 7.0% from electricity and gas.

Office for National Statistics said, monthly GDP growth was negative 0.4% in April 2019, as the production sector and manufacturing sub-sector contracted. Economists had expected a 0.1% decrease.

In the three months to April 2019 UK gross domestic product (GDP) grew by 0.3%. The services sector had a positive contribution to rolling three-month growth in April 2019, increasing by 0.2%. The production sector increased by 0.7%, within which manufacturing grew by 1.2%, making it the second-largest contributor to rolling three-month growth. Construction also had a positive contribution, growing by 0.4% in the three months to April 2019.

Commenting on today’s GDP figures, Head of GDP Rob Kent-Smith said: “GDP growth showed some weakening across the latest 3 months, with the economy shrinking in the month of April mainly due to a dramatic fall in car production, with uncertainty ahead of the UK’s original EU departure date leading to planned shutdowns. There was also widespread weakness across manufacturing in April, as the boost from the early completion of orders ahead of the UK’s original EU departure date has faded.”

According to the report from Istat, in April 2019 the seasonally adjusted industrial production index decreased by 0.7% compared with the previous month. The percentage change of the average of the last three months with respect to the previous three months was +0.7.

The index measures the monthly evolution of the volume of industrial production (excluding construction). With effect from January 2018 the indices are calculated with reference to the base year 2015 using the Ateco 2007 classification.

The calendar adjusted industrial production index decreased by 1.5% compared with April 2018 (calendar working days being 20 versus 19 days in April 2018).

The unadjusted industrial production index increased by 0.1% compared with April 2018.

The pair’s upside could extend further and visit the 1.1380 region, suggested FX Strategists at UOB Group.

Next 1-3 weeks: “In our last update on 04 Jun (spot at 1.1245), we held the view that EUR has “moved into a ‘positive phase’” and “could move to 1.1300”. We added, the prospect for EUR strength to extend to 1.1380 is not high. EUR closed below 1.1300 on Wednesday and Thursday before surging higher on Friday (07 Jun) and hit 1.1347 (on a weekly basis, EUR gained +1.47%, the largest 1-week advance since Aug 2018). While the price action continues to suggest further EUR strength, upward momentum has not improved by as much as preferred. That said, a test of 1.1380 would not be surprising but whether EUR can maintain toehold above this level is left to be seen. All in, the ‘positive phase’ could last for a while more and only a break of 1.1230 (‘key support’ previously at 1.1155) would indicate that a short-term top is in place”.

The probability of the U.K. leaving the European Union without a deal is “very small,” according to Philip Hammond, Britain’s chancellor of the exchequer.

Analysts and investors have raised the probability of a no-deal Brexit since Prime Minister Theresa May announced last month that she would step down. May officially resigned as leader of the Conservative Party on Friday, but remains prime minister until her party elects a new chief.

“Very small — that’s the key message,” Hammond said when asked about the likelihood of a no-deal Brexit happening.

“The key thing to remember is that Britain is a parliamentary democracy, and there is a clear majority in Parliament against a no-deal exit. Parliament will ensure, in my view, that that does not happen,” he said.

Technicals suggest the up move in the cross could lose momentum near 123.80, according to Karen Jones, Head of FICC Technical Analysis at Commerzbank.

“EUR/JPY has eroded the 20 day ma to extend its correction higher. Elliott wave counts are suggesting that this will fail around the 123.80 mark. Short term we continue to target the 119.91 78.6% Fibonacci retracement. Directly above lies lies the 123.75, May 21 high and the 55 day moving average at 123.98 – this maintains an overall negative bias”.

The European Union should allow Italy to cut tax and invest in the green economy to boost the country's economy, Deputy Prime Minister Luigi Di Maio said.

Di Maio, who heads the ruling 5 Star party, will meet his co-deputy PM and League party leader Matteo Salvini as well as Prime Minister Giuseppe Conte later on Monday to discuss the threat of EU action against Italy for excessive debt.

Di Maio said he expected the trio to agree on minimum salary, tax cuts and curbing privileges for politicians and policymakers.

Data from the People's Bank of China showed, China's foreign exchange reserves increased in May after falling a month ago.

Foreign exchange reserves rose by $6 billion to $3.101 trillion in May. Economists had forecast reserves to fall to $3.09 trillion.

Gold reserves were valued at $79.83 billion at the end of May compared to $78.35 billion in the previous month.

Gold reserves of China increased for a sixth month in a row in May.

Bank of Japan Governor Haruhiko Kuroda said the central bank can deliver more monetary stimulus if necessary.

The BOJ will ease further if the momentum towards its 2% inflation target is lost, Kuroda said in Fukuoka, Japan, where central bankers and finance chiefs from the Group of 20 met over the weekend.

Kuroda, however, said the BOJ did not need to act now, citing the health of the economy.

Asked if the BOJ still had the capacity to do "something big," Kuroda said: "I think so."

The options would be cutting the -0.1% negative rate further, lowering the target for 10-year yields, increasing the monetary base, or boosting asset purchases, he was quoted as saying.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1489 (3601)

$1.1454 (4097)

$1.1438 (598)

Price at time of writing this review: $1.1299

Support levels (open interest**, contracts):

$1.1274 (1818)

$1.1234 (2350)

$1.1190 (2731)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date July, 5 is 56809 contracts (according to data from June, 7) with the maximum number of contracts with strike price $1,1150 (4475);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2945 (2198)

$1.2886 (546)

$1.2846 (316)

Price at time of writing this review: $1.2705

Support levels (open interest**, contracts):

$1.2683 (924)

$1.2651 (612)

$1.2614 (1203)

Comments:

- Overall open interest on the CALL options with the expiration date July, 5 is 14750 contracts, with the maximum number of contracts with strike price $1,3000 (2697);

- Overall open interest on the PUT options with the expiration date July, 5 is 13476 contracts, with the maximum number of contracts with strike price $1,2500 (2018);

- The ratio of PUT/CALL was 0.91 versus 0.91 from the previous trading day according to data from June, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 110.67 | 20884.71 | 0.53 |

| KOSPI | 3.22 | 2072.33 | 0.16 |

| ASX 200 | 60.9 | 6443.9 | 0.95 |

| FTSE 100 | 72.09 | 7331.94 | 0.99 |

| DAX | 92.24 | 12045.38 | 0.77 |

| CAC 40 | 85.62 | 5364.05 | 1.62 |

| Dow Jones | 263.28 | 25983.94 | 1.02 |

| S&P 500 | 29.85 | 2873.34 | 1.05 |

| NASDAQ Composite | 126.55 | 7742.1 | 1.66 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.