- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(raw materials / closing price /% change)

Oil 49.56 +0.55%

Gold 1,286.40 +0.90%

(index / closing price / change items /% change)

Hang Seng -131.45 28326.59 -0.46%

CSI 300 +45.71 3882.21 +1.19%

Euro Stoxx 50 +7.18 3610.50 +0.20%

FTSE 100 -14.98 7507.89 -0.20%

DAX +20.46 12976.40 +0.16%

CAC 40 +5.93 5365.83 +0.11%

DJIA -12.60 22761.07 -0.06%

S&P 500 -4.60 2544.73 -0.18%

NASDAQ -10.45 6579.73 -0.16%

S&P/TSX -47.98 15728.32 -0.30%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1740 +0,06%

GBP/USD $1,3141 +0,58%

USD/CHF Chf0,9795 +0,21%

USD/JPY Y112,65 +0,03%

EUR/JPY Y132,27 +0,07%

GBP/JPY Y148,035 +0,58%

AUD/USD $0,7752 -0,30%

NZD/USD $0,7057 -0,44%

USD/CAD C$1,25499 +0,17%

02:50 Japan Current Account, bln August 2320 2.262

03:30 Australia National Australia Bank's Business Confidence September 5 6

06:20 Australia RBA Assist Gov Debelle Speaks

08:00 Japan Eco Watchers Survey: Current September 49.7 49.9

08:00 Japan Eco Watchers Survey: Outlook September 51.1

08:45 Switzerland Unemployment Rate (non s.a.) September 3% 3%

09:00 Germany Current Account August 19.4

09:00 Germany Trade Balance (non s.a.), bln August 19.5

09:45 France Industrial Production, m/m August 0.5% 0.4%

11:30 United Kingdom Industrial Production (MoM) August 0.2% 0.2%

11:30 United Kingdom Industrial Production (YoY) August 0.4% 0.8%

11:30 United Kingdom Manufacturing Production (YoY) August 1.9% 1.9%

11:30 United Kingdom Manufacturing Production (MoM) August 0.5% 0.3%

11:30 United Kingdom Total Trade Balance August -2.87 -3.60

15:00 United Kingdom NIESR GDP Estimate September 0.4%

15:15 Canada Housing Starts September 223.2 210.0

15:30 Canada Building Permits (MoM) August -3.5%

17:00 U.S. FOMC Member Kashkari Speaks

21:00 Canada Gov Council Member Wilkins Speaks

Major US stock indices fell slightly on Monday amid losses in the healthcare sector and the conglomerate sector, as well as expectations for the third quarter's report season.

The unofficial start of the season of US companies' reports will occur this week with the publication of financial results of several major financial institutions: on Thursday, October 12, reports will be submitted by Citigroup (C) and JPMorgan Chase (JPM), on Friday, October 13 - Bank of America (BAC) and Wells Fargo (WFC).

According to Thomson Reuters, the profits of companies in the S & P 500 index basket are expected to show an increase of 4.2% compared to the same period last year, after exceeding expectations of growth of 12.3% y / y in the second quarter.

Oil prices rose slightly, backed up by OPEC comments, which signaled the possibility of further actions to restore the market balance in the long term. Meanwhile, the oil platforms in the Gulf of Mexico began to return to work after the hurricane Nate forced to stop more than 90% of the oil production in the area. In general, the prospect of resuming production limited the growth of oil quotes.

Most components of the DOW index recorded a rise (16 out of 30). Wal-Mart Stores, Inc. became the leader of growth. (WMT, + 1.85%). Outsider were shares of General Electric Company (GE, -4.35%).

Almost all sectors of the S & P index finished trading in the red. The health sector showed the greatest decline (-0.8%). Only the utilities sector grew (+ 0.1%).

At closing:

DJIA -0.06% 22.760.00 -13.67

Nasdaq -0.16% 6,579.73 -10.45

S & P-0.18% 2.544.62 -4.71

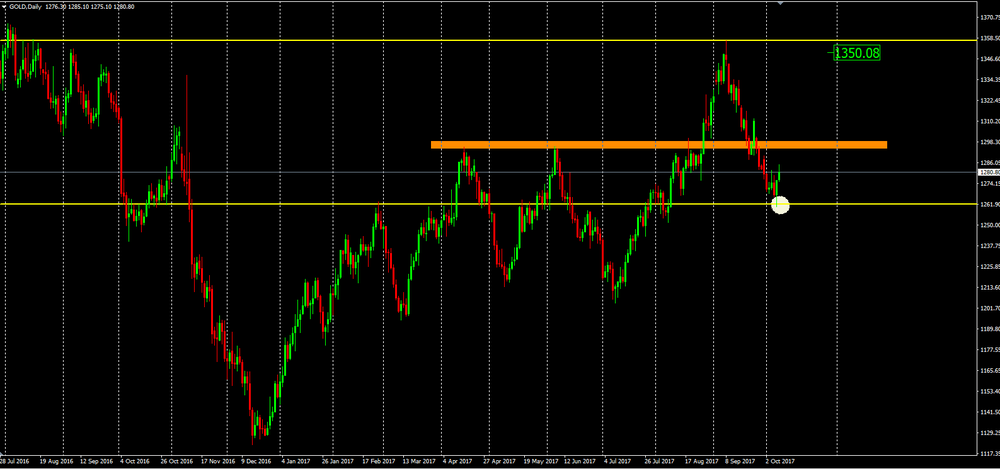

Gold has become very volatile and has sparked some interest from investors due to the instability experienced at the international level, with the main focus being the exchange of words between the United States and North Korea.

After successive weeks of devaluation of the value of gold, we can now expect a recovery of its value and perhaps until the formation of a new maximum relative to the previous one (values close to 1350.08).

-

Says that in august, overhang in OECD oil products stocks compared to 5-year average was a 'mere' 25 million barrels, 'almost converging with the 5-year average'

EUR/USD: 1.1795(305 млн), 1.1765(108 млн), 1.1700(156 млн),

USD/JPY: 113.00(555 млн), 112.50(330 млн)

AUD/USD: 0.7700(330 млн)

U.S. stock-index futures were higher on Monday as investors turned their focus to earnings from big banks later in the week.

Global Stocks:

Nikkei -

Hang Seng 28,326.59 -131.45 -0.46%

Shanghai 3,374.87 +25.93 +0.77%

S&P/ASX 5,739.26 +28.58 +0.50%

FTSE 7,502.75 -20.12 -0.27%

CAC 5,354.83 -5.07 -0.09%

DAX 12,956.05 +0.11 0.00%

Crude $49.29 (0.00%)

Gold $1,283.30 (+0.66%)

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 993.65 | 4.07(0.41%) | 14787 |

| Apple Inc. | AAPL | 155.85 | 0.55(0.35%) | 98199 |

| AT&T Inc | T | 38.76 | 0.17(0.44%) | 2514 |

| Barrick Gold Corporation, NYSE | ABX | 16.69 | 0.10(0.60%) | 19796 |

| Boeing Co | BA | 258.95 | 0.37(0.14%) | 820 |

| Caterpillar Inc | CAT | 127.19 | 0.26(0.20%) | 126 |

| Cisco Systems Inc | CSCO | 33.8 | 0.05(0.15%) | 486 |

| Citigroup Inc., NYSE | C | 75.99 | 0.35(0.46%) | 30938 |

| Exxon Mobil Corp | XOM | 81.51 | -0.20(-0.24%) | 482 |

| Facebook, Inc. | FB | 172.99 | 0.76(0.44%) | 63043 |

| Ford Motor Co. | F | 12.3 | -0.01(-0.08%) | 22328 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.35 | 0.02(0.14%) | 32240 |

| General Electric Co | GE | 24.15 | -0.24(-0.98%) | 386419 |

| General Motors Company, NYSE | GM | 45.1 | 0.17(0.38%) | 24265 |

| Goldman Sachs | GS | 245.45 | -0.57(-0.23%) | 4576 |

| Google Inc. | GOOG | 980 | 1.11(0.11%) | 4315 |

| Home Depot Inc | HD | 166.2 | 0.35(0.21%) | 3170 |

| HONEYWELL INTERNATIONAL INC. | HON | 145.51 | 1.89(1.32%) | 17472 |

| Intel Corp | INTC | 39.74 | 0.11(0.28%) | 6366 |

| Johnson & Johnson | JNJ | 134.22 | 1.00(0.75%) | 25744 |

| JPMorgan Chase and Co | JPM | 97.2 | 0.28(0.29%) | 11250 |

| McDonald's Corp | MCD | 159.56 | -0.04(-0.03%) | 229 |

| Merck & Co Inc | MRK | 64.5 | -0.05(-0.08%) | 127 |

| Microsoft Corp | MSFT | 76.05 | 0.05(0.07%) | 2041 |

| Nike | NKE | 52.6 | 0.18(0.34%) | 799 |

| Pfizer Inc | PFE | 36.11 | 0.06(0.17%) | 12684 |

| Starbucks Corporation, NASDAQ | SBUX | 55.19 | 0.02(0.04%) | 400 |

| Tesla Motors, Inc., NASDAQ | TSLA | 350.65 | -6.23(-1.75%) | 79653 |

| The Coca-Cola Co | KO | 45.55 | 0.06(0.13%) | 1306 |

| Twitter, Inc., NYSE | TWTR | 17.74 | -0.11(-0.62%) | 10840 |

| United Technologies Corp | UTX | 117.98 | -0.25(-0.21%) | 165 |

| Verizon Communications Inc | VZ | 48.52 | -0.29(-0.59%) | 1822 |

| Visa | V | 107 | 0.27(0.25%) | 812 |

| Wal-Mart Stores Inc | WMT | 79.3 | 0.30(0.38%) | 4530 |

| Walt Disney Co | DIS | 100.7 | 0.63(0.63%) | 7867 |

Intel (INTC) target raised to $45 from $42 at Mizuho

Honeywell (HON) target raised to $170 from $155 at Citigroup

Goldman Sachs (GS) downgraded to Neutral from Outperform at Credit Suisse

Johnson & Johnson (JNJ) upgraded to Outperform from Market Perform at Wells Fargo

Walt Disney (DIS) upgraded to Top Pick from Outperform at RBC Capital Mkts

The economic momentum continues. The overall index for Euro area improves by 1.5 points and reaches a new 10-year high with 29.7 points. Current situation and expectations are improving to a similar extent. The first economic test after the Bundestag elections can be considered successful. The time series for German economy of the "first movers among the leading indicators" are clearly climbing and are promising an unbroken upturn - even under a changed government. The global economic engine continues to gain strength. For the US investors are shaking their intermittent worries and the region of Asia is also creating strong economic optimism. The sentix Global Aggregate also rises to a 10-year high.

EUR/USD: 1.1795(305 m), 1.1765(108 m), 1.1700(156 m),

USD/JPY: 113.00(555 m), 112.50(330 m)

AUD/USD: 0.7700(330 m)

-

Ecb finds interest rate risk is well managed in most european banks

-

Capital demand forindividual banks might be adapted

-

Supervisors will follow up on the results insupervisory dialogues with the individual banks

-

Says good business morale, positive trend in industrial orders point to continued upswing in sector

-

It's likely inflation pressures are building

-

The benefit of having a little time to decide on rate hike before december meeting 'and I plan to take it'

-

September job losses from hurricanes likely to be temporary

In August 2017, production in industry was up by 2.6% from the previous month on a price, seasonally and working day adjusted basis according to provisional data of the Federal Statistical Office (Destatis). In July 2017, the corrected figure shows a decrease of 0.1% (primary 0.0%) from June 2017.

In August 2017, production in industry excluding energy and construction was up by 3.2%. Within industry, the production of capital goods increased by 4.8% and the production of consumer goods by 2.1%. The production of intermediate goods showed an increase of 1.8%. Energy production was up by 1.7% in August 2017 and the production in construction decreased by 1.2%.

The Caixin China Composite PMI data (which covers both manufacturing and services) signalled a weaker expansion in total Chinese business activity at the end of the third quarter. Notably, the Composite Output Index fell from 52.4 in August to a three-month low of 51.4 in September.

The slowdown was driven by weaker increases in output at both manufacturing and services companies. A drop in the seasonally adjusted Caixin China General Services Business Activity Index from 52.7 to 50.6 in September pointed to only a marginal increase in services activity that was the slowest for 21 months. At the same time, growth in manufacturing production edged down to a three-month low.

European stocks ended a tumultuous week on a downbeat note, driven lower by continued uncertainty over the political drama in Spain and a mixed reading on the U.S. labor market. Closing levels: The Stoxx Europe 600 index SXXP, -0.40% ended 0.4% lower at 389.47, trimming its weekly gain to 0.3%.

The S&P 500 and Dow Jones Industrial Average logged minor losses Friday, though the Nasdaq eked out a closing record and major indexes added to their string of weekly gains as investors mostly shrugged off a September jobs report that showed the first monthly drop in payrolls in seven years.

After global stock gains last week, the Asia Pacific region started Monday on an upbeat note, led by buying in China after a weeklong holiday there. In the first action following Golden Week, the Shanghai SHCOMP, +1.24% and Shenzhen 399106, +1.51% composite indexes, which have lagged behind the double-digit gains seen in much of the region this year, both rose more than 1%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1912 (3313)

$1.1856 (1354)

$1.1805 (209)

Price at time of writing this review: $1.1738

Support levels (open interest**, contracts):

$1.1671 (2759)

$1.1642 (3137)

$1.1609 (2950)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 87029 contracts (according to data from October, 6) with the maximum number of contracts with strike price $1,2000 (5216);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3280 (2216)

$1.3225 (2246)

$1.3153 (1050)

Price at time of writing this review: $1.3096

Support levels (open interest**, contracts):

$1.2969 (1146)

$1.2912 (1670)

$1.2878 (1878)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 30842 contracts, with the maximum number of contracts with strike price $1,3300 (3071);

- Overall open interest on the PUT options with the expiration date November, 3 is 28173 contracts, with the maximum number of contracts with strike price $1,3400 (2160);

- The ratio of PUT/CALL was 0.91 versus 1.15 from the previous trading day according to data from October, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.