- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Westpac Consumer Confidence | July | 100.7 | |

| 01:30 | China | PPI y/y | June | 0.6% | 0.3% |

| 01:30 | China | CPI y/y | June | 2.7% | 2.7% |

| 06:45 | France | Industrial Production, m/m | May | 0.4% | 0.2% |

| 08:30 | United Kingdom | Industrial Production (YoY) | May | -1% | 1.1% |

| 08:30 | United Kingdom | Industrial Production (MoM) | May | -2.7% | 1.5% |

| 08:30 | United Kingdom | Manufacturing Production (MoM) | May | -3.9% | 2.1% |

| 08:30 | United Kingdom | Manufacturing Production (YoY) | May | -0.8% | 1% |

| 08:30 | United Kingdom | Total Trade Balance | May | -2.740 | |

| 08:30 | United Kingdom | GDP m/m | May | -0.4% | 0.3% |

| 13:00 | United Kingdom | NIESR GDP Estimate | Quarter II | 0.1% | -0.1% |

| 14:00 | U.S. | Wholesale Inventories | May | 0.9% | 0.4% |

| 14:00 | Canada | Bank of Canada Rate | 1.75% | 1.75% | |

| 14:00 | Canada | Bank of Canada Monetary Policy Report | |||

| 14:00 | U.S. | Fed Chair Powell Testimony | |||

| 14:30 | U.S. | Crude Oil Inventories | July | -1.085 | -3.567 |

| 15:00 | Canada | BOC Press Conference | |||

| 17:10 | United Kingdom | MPC Member Tenreyro Speaks | |||

| 17:30 | U.S. | FOMC Member James Bullard Speaks | |||

| 18:00 | U.S. | FOMC meeting minutes |

Major US stock indices have predominantly increased, as investors expected clues about the Fed’s next step in monetary policy. However, concerns remained about the potential damage to corporate segment profits from a trade dispute between the United States and China,

The latest sign of a negative impact of trade disputes on business was the warning of the German chemical giant BASF about the likely 30% decrease in adjusted annual profits due to a slowdown in global growth and a protracted trade war, which affected the agricultural sector, as well as global car manufacturing and sales. In addition, analysts RBC Capital Markets downgraded the company 3M Co. (MMM; -2.03%) to the level of “Sector perform” from “Outperform”, citing concerns about the macroeconomic situation.

The United States and China intend to resume trade negotiations this week after a two-month break, but even a year after the start of the trade war, little indicates that their differences have softened.

The season of publication of corporate reporting for the second quarter of 2019 will start next week. According to IBES Refinitiv, analysts expect the profits of the S & P 500 companies to show a decline of 0.2% y / y in the reporting period.

On Wednesday, a two-day congressional hearing will start with the participation of the Fed Chairman, Jerome Powell, who will submit a semi-annual monetary policy report. In addition, tomorrow will be announced minutes of the June Fed meeting. In the comments of the Fed, investors will look for clues about whether the Fed will cut rates at the end of this month, or whether the Fed believes the economy is strong enough to withstand current policies.

Most of the components of DOW recorded a decline (17 of 30). Verizon Communications Inc. was an outsider. (VZ; -2.45%) The growth leader was Merck & Co. (MRK; + 1.01%).

Most sectors of the S & P finished trading in the red. The largest decline was shown by the consumer goods sector (-0.6%). The technological sector grew the most (+ 0.3%).

At the time of closing:

Dow 26,783.49 -22.65 -0.08%

S & P 500 2,979.63 +3.68 +0.12%

Nasdaq 100 8,141.73 +43.35 +0.54%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Westpac Consumer Confidence | July | 100.7 | |

| 01:30 | China | PPI y/y | June | 0.6% | 0.3% |

| 01:30 | China | CPI y/y | June | 2.7% | 2.7% |

| 06:45 | France | Industrial Production, m/m | May | 0.4% | 0.2% |

| 08:30 | United Kingdom | Industrial Production (YoY) | May | -1% | 1.1% |

| 08:30 | United Kingdom | Industrial Production (MoM) | May | -2.7% | 1.5% |

| 08:30 | United Kingdom | Manufacturing Production (MoM) | May | -3.9% | 2.1% |

| 08:30 | United Kingdom | Manufacturing Production (YoY) | May | -0.8% | 1% |

| 08:30 | United Kingdom | Total Trade Balance | May | -2.740 | |

| 08:30 | United Kingdom | GDP m/m | May | -0.4% | 0.3% |

| 13:00 | United Kingdom | NIESR GDP Estimate | Quarter II | 0.1% | -0.1% |

| 14:00 | U.S. | Wholesale Inventories | May | 0.9% | 0.4% |

| 14:00 | Canada | Bank of Canada Rate | 1.75% | 1.75% | |

| 14:00 | Canada | Bank of Canada Monetary Policy Report | |||

| 14:00 | U.S. | Fed Chair Powell Testimony | |||

| 14:30 | U.S. | Crude Oil Inventories | July | -1.085 | -3.567 |

| 15:00 | Canada | BOC Press Conference | |||

| 17:10 | United Kingdom | MPC Member Tenreyro Speaks | |||

| 17:30 | U.S. | FOMC Member James Bullard Speaks | |||

| 18:00 | U.S. | FOMC meeting minutes |

- Says he would entertain rate cuts if you believe the economy was weakening substantially

- Slowing global growth and uncertainty over trade policy have created clear risks to a no change outlook

- He supported decision to hold rates steady, and projected no change to rates this year

- The U.S. still has a strong labor market

- There is no need to move rates in either direction at this point in my view

- Fed has been surprised by a cooling of inflation this year

- Does not see inflation as an imminent crisis, and thinks the Fed can give it some time to move back up to 2% target

- He did not think it would be a mistake to cut rates but says the prudent path for me is to hold steady and see how the economy evolves

- Fed does not discuss political pressure when making interest-rate decisions

Nathan Janzen, the senior economist at the Royal Bank of Canada (RBC), notes that Canada’s total house starts increased to 246k from 197k in May, while permit issuance slowed 234k in May after April surge.

“Canadian homebuilding continues to chug along at elevated levels – still suggesting that significantly slower resale markets over the last year have had limited spillovers into homebuilding activity. Part of the latest monthly jump may have had something to do with an earlier surge in permit issuance in B.C. in April.

And permits issued in May (released separately today) remained elevated at an annualized 234k despite BC more-than-retracing a huge 71k surge the prior month.

We still think that homebuilding will ultimately drift lower going forward given the earlier easing in resale markets.”

The Job

Openings and Labor Turnover Survey (JOLTS) published by the Labor Department on

Tuesday showed a slight decrease (-0.7 percent m-o-m) in the U.S. job openings

in May.

According to

the report, employers posted 7.323 million job openings in May, compared to the

April’s figure of 7.372 million (revised from 7.449 million in the original

estimate) and economists’ expectations of 7.470 million. The job openings rate

was 4.6 percent in May, down from 4.7 percent in the prior month. The report

showed that the number of job openings was little changed for total private and

dropped for government (-54,000 jobs). The job openings level rose in other

services (+77,000). Job openings declined in a number of industries with the

largest decreases in construction (-65,000), transportation, warehousing, and

utilities (-60,000), and real estate and rental and leasing (-49,000).

Meanwhile, the

number of hires fell to 5.725 million in May from 5.991 in April. The hiring

rate was 3.8 percent, down from 4.0 percent in April. The hires level reduced

for total private (-262,000) and was little changed for government. Hires declined

in professional and business services (-129,000).

The separation

rate in May was at 5.495 million or 3.6 percent, compared to 5.687 million or

3.8 percent in April. Within separations, the quits rate was 2.3 percent (flat

m-o-m), and the layoffs rate was 1.2 percent (flat m-o-m).

Analysts at ING expect the Bank of Canada (BoC) will confirm a neutral stance on monetary policy at its 10 July meeting, stressing a data-dependent approach.

- "The BoC should continue to highlight the downside risks stemming from trade tensions and slowing global economic activity. Nonetheless, the data flow since the May meeting has been broadly positive, which tends to suggest a cautiously upbeat domestic economic assessment, while signaling little appetite for policy easing. This may be particularly true given the recent boom in inflation and wage growth which should prompt an upside revision in the CPI forecasts as the monetary policy report is published.

- In the aftermath of the meeting, the USD/CAD reaction may be broadly muted, as markets seem to have already priced in most of the positives for the loonie. We continue to expect policy rates to remain untouched over the next 18 months and believe that CAD will stay supported despite possibly facing kick-back from re-escalating trade tensions. Accordingly, we stick to our current USD/CAD forecasts at 1.30 for 4Q19 and 1.28 for 1Q20."

U.S. stock-index futures fell moderately on Tuesday as investors awaited several Fed officials to speak throughout the session.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,565.15 | +30.80 | +0.14% |

Hang Seng | 28,116.28 | -215.41 | -0.76% |

Shanghai | 2,928.23 | -5.13 | -0.18% |

S&P/ASX | 6,665.70 | -6.50 | -0.10% |

FTSE | 7,539.86 | -9.41 | -0.12% |

CAC | 5,564.46 | -24.73 | -0.44% |

DAX | 12,422.00 | -121.51 | -0.97% |

Crude oil | $57.94 | +0.49% | |

Gold | $1,394.70 | -0.38% |

According to IMM net speculators’ positioning as at July 2, 2019, USD longs consolidated having dropped sharply the previous week to their lowest level since July 2018, note analysts at Rabobank.

- “The USD has recovered some ground in the spot market following the stronger than expected June US Labour Report. This suggests there is scope for a bounce in the next set of positioning data.

- The level of JPY shorts dropped sharply for a third consecutive week despite news of a truce on US/China trade wars.

- The level of net EUR short positions dropped again last week to their lowest levels since October 2018.

- Net short GBP positions increased for a third consecutive week on fears about a no deal Brexit and a weakening UK economic backdrop.

- CHF net shorts dropped back to their lowest levels since April 2018.

- CAD net positions popped back into the positive ground for the first time since March 2018 on speculation that policy divergence between the Fed and the BoC could end in the foreseeable future.

- AUD net shorts dropped back. Hopes are building that the RBA’s pre-emptive rate cuts and looser fiscal policy outlook may be sufficient stimulus for now.”

- We will issue licenses for US companies to sell products to Huawei when there is no threat to national security

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 166.4 | -2.79(-1.65%) | 15442 |

ALCOA INC. | AA | 21.98 | -0.32(-1.44%) | 8909 |

ALTRIA GROUP INC. | MO | 49.17 | 0.09(0.18%) | 2707 |

Amazon.com Inc., NASDAQ | AMZN | 1,947.65 | -4.67(-0.24%) | 28983 |

American Express Co | AXP | 124.42 | -0.43(-0.34%) | 428 |

Apple Inc. | AAPL | 199.85 | -0.17(-0.09%) | 190302 |

AT&T Inc | T | 33.72 | -0.02(-0.06%) | 120642 |

Boeing Co | BA | 349.75 | -1.37(-0.39%) | 10335 |

Caterpillar Inc | CAT | 134.49 | -0.35(-0.26%) | 1494 |

Chevron Corp | CVX | 123.33 | -0.27(-0.22%) | 281 |

Cisco Systems Inc | CSCO | 55.7 | -0.49(-0.87%) | 55851 |

Citigroup Inc., NYSE | C | 70.98 | -0.15(-0.21%) | 392 |

Deere & Company, NYSE | DE | 163 | -0.89(-0.54%) | 3101 |

Facebook, Inc. | FB | 194.7 | -1.06(-0.54%) | 34908 |

Ford Motor Co. | F | 10.19 | -0.01(-0.10%) | 16852 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.08 | -0.14(-1.25%) | 24040 |

General Electric Co | GE | 10.14 | -0.06(-0.59%) | 132332 |

General Motors Company, NYSE | GM | 38.13 | -0.10(-0.26%) | 344 |

Goldman Sachs | GS | 205 | -0.75(-0.36%) | 3485 |

Google Inc. | GOOG | 1,110.50 | -5.85(-0.52%) | 1738 |

Intel Corp | INTC | 47.47 | -0.35(-0.73%) | 21828 |

International Business Machines Co... | IBM | 140.49 | -0.08(-0.06%) | 1848 |

Johnson & Johnson | JNJ | 140.35 | -0.62(-0.44%) | 839 |

JPMorgan Chase and Co | JPM | 112.51 | -0.36(-0.32%) | 4650 |

McDonald's Corp | MCD | 211.94 | -0.22(-0.10%) | 328 |

Merck & Co Inc | MRK | 84 | -0.04(-0.05%) | 1542 |

Microsoft Corp | MSFT | 135.97 | -0.99(-0.72%) | 30885 |

Nike | NKE | 88.5 | 0.02(0.02%) | 8361 |

Pfizer Inc | PFE | 43.23 | -0.07(-0.16%) | 1100 |

Procter & Gamble Co | PG | 113.55 | -0.50(-0.44%) | 158 |

Starbucks Corporation, NASDAQ | SBUX | 87.35 | -0.09(-0.10%) | 2012 |

Tesla Motors, Inc., NASDAQ | TSLA | 228.8 | -1.54(-0.67%) | 35221 |

The Coca-Cola Co | KO | 51.92 | -0.08(-0.15%) | 238 |

Travelers Companies Inc | TRV | 152.9 | -0.90(-0.59%) | 780 |

Twitter, Inc., NYSE | TWTR | 36.31 | -0.14(-0.38%) | 4029 |

United Technologies Corp | UTX | 130.3 | -0.57(-0.44%) | 204 |

Verizon Communications Inc | VZ | 57.2 | -0.09(-0.15%) | 15598 |

Visa | V | 176.04 | -0.15(-0.09%) | 4865 |

Walt Disney Co | DIS | 140.85 | -0.17(-0.12%) | 7513 |

Apple (AAPL) target raised to $239 from $233 at JPMorgan

3M (MMM) downgraded to Sector Perform from Outperform at RBC Capital Mkts; target lowered to $176

Economists had

forecast a 2.5 percent drop in May from the previous month.

According to

the report, the value of residential permits tumbled 17.2 percent m-o-m in May,

as permits for multi-family dwellings plunged by 28.5 percent m-o-m, while single-family

permits rose by 1.8 percent m-o-m.

At the same

time, the value of non-residential building permits decreased by 5.7 percent

m-o-m in May, due to lower construction intentions for industrial buildings (-37.5

percent m-o-m), which however were offset by a surge in permits for institutional

component (+25.7 percent m-o-m). The value of commercial permits edged down 0.9

percent m-o-m in May.

In y-o-y terms,

building permits decreased 1.9 percent in May.

- Fed should look at price indicators not job indicators

- Price level stability and a steady dollar is what the Fed should aim for

- The management of the Fed has not been too far from what he expected over the last year

- There is no effort to remove Fed's Powell

The Canada

Mortgage and Housing Corp. (CMHC) reported on Tuesday the seasonally adjusted

annual rate of housing starts was at 245,657 units in June, up 24.8 percent

from a downwardly revised 196,809 units in May (originally 202,337 units).

Economists had

forecast an annual pace of 210,000 for June.

According to

the report, urban starts climbed by 25.7 percent m-o-m last month to 234,238 units,

as multiple urban starts jumped by 31.2 percent m-o-m to 185,804 units, while

single-detached urban starts rose by 8.2 percent m-o-m, to 48,434 units. At the

same time, rural starts were estimated at a seasonally adjusted annual rate of 11,419

units, up 9.9 percent m-o-m.

PepsiCo (PEP) reported Q2 FY 2019 earnings of $1.54 per share (versus $1.61 in Q2 FY 2018), beating analysts’ consensus of $1.51.

The company’s quarterly revenues amounted to $16.449 bln (+2.2% y/y), generally in line with analysts’ consensus estimate of $16.440 bln.

The company reaffirmed guidance for FY 2019, projecting EPS of $5.50 versus analysts’ consensus estimate of $5.53.

PEP rose to $134.00 (+1.09%) in pre-market trading.

Jane Foley, the senior FX strategist at Rabobank, notes that GBP/USD pair is trading close to its lowest levels for the year as the pound is clearly vulnerable against a backdrop of political uncertainty and a deteriorating UK economic environment.

“Towards the end of the month the results of the Tory Party leadership election should bring further clues as to the risks of a no deal Brexit. We see risk that GBP/USD will dip to the 1.23 area on a 3 month view on the back of fears of a no deal Brexit. Our assumption of a recovery to the 1.30 area in 6 months assumes that Brexit will be delayed into next year.

Politics is set to remain the main driver for the pound in the coming months. That said, the weakening UK economic backdrop is likely to increase GBP’s vulnerability. Last week’s releases of disappointing PMI data for June highlighted the downward pressures on the UK economy. Having been lifted by stockpiling in UK ahead of the original March Brexit date, there is growing evidence that economic activity is slowing as these are pared back. The results of a Bloomberg survey provides a consensus forecasts for a modest -0.1% q/q contraction in UK GDP in Q2 and a steady BoE policy rate until 2021.

Although the BoE’s official guidance suggests that rates could go either way dependent on Brexit, BoE Governor Carney has appeared to soften his policy stance recently against the backdrop of trade wars and slowing global growth. Tomorrow’s releases of May monthly GDP in addition to production and trade data should help clarify the relative strength of the UK economy.

On the charts a break through the December low close to GBP/USD1.2478 would target the 1.2351 area which is the April 2017 low.”

TD Securities analysts are expecting the Canadian housing starts to rebound to a 210k pace in June, in line with the market consensus, on a recovery in multi-unit construction following record permit issuance in April.

- “May building permits will be released shortly afterward at 8:30 ET, with the market looking for a 10% pullback following a +14.7% m/m print in April.”

- Says all EU member states are expected to grow this year, citing forecasts to be published on Wednesday

The National

Federation of Independent Business (NFIB) reported on Tuesday the Small

Business Optimism Index decreased by 1.7 points to 103.3 in June, reversing the

gain posted in May.

According to

the report, six index components fell, three improved, and one remained

unchanged. Both capital spending plans and reports of actual spending fell in

June, while the inventory component strengthened. Sales and earnings trends

softened, while expected credit conditions remained favorable. Uncertainty

levels rose to the highest level since March 2017.

- Says that Lagarde's IMF role makes her eminently qualified to be ECB president

- Says ECB could theoretically resume QE again if circumstances warrant such a move

Francesco Pesole, FX strategist at ING, points out that the Mexican currency is steady amongst top performers in the emerging market space across the last few days.

“Today, focus will be on June's CPI number, with the 4% level in the year-on-year headline print to prove crucial in directing speculation about possible Banxico monetary easing ahead. We suspect market easing expectations (54bp priced in for the next six months) may prove excessive should inflation fail to materially surprise to the downside. In turn, we see some scope for further MXN appreciation and expect USD/MXN to keep descending towards this year's low of 18.7544.”

Cristian Maggio, head of emerging markets strategy at TD Securities, suggests that the sacking of CBRT Governor Cetinkaya and appointment of Uysal suggest that the CBRT may go heavy on easing at the next MPC meeting on 25 July for the Turkish economy.

“Numerous risk factors still support our view that TRY may fall under new market pressure in the days or weeks ahead. This situation is likely to be exacerbated by politically-motivated CBRT easing and large scale fiscal expansion. We continue to see weaker TRY as the most likely scenario over the coming months. The main risk for Turkey's monetary policy is a forced reversal in the direction of rates, after one or more attempts to ease policy.”

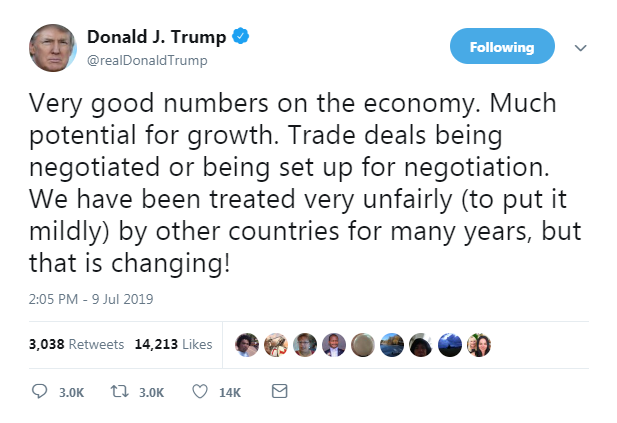

U.S. President can either be a “tariff president” or a “two-term president,” a public policy expert said.

It remains relatively undetermined to what extent U.S.-China trade tensions have weighed on the American economy, but any continued damage could tip the scales in the upcoming presidential election, according to David Firestein, executive director of the University of Texas at Austin’s China Public Policy Center.

That is, if Trump continues imposing tariffs, he may lose the slim electoral edge that won him the White House in the 2016 election, Firestein predicted.

“He doesn’t have the slack in his popular support to be able to damage the economic interests of many of his constituents in the heartland of the US and still expect that they will unanimously support him for president as they did four years ago,” said Firestein.

“President Trump has raised tariffs and that means he’s raised taxes on the American people pretty much across the board,” said Firestein.

Researchers from the International Monetary Fund found a “nearly complete pass through of tariffs” to Americans. That means American consumers and manufacturers are largely bearing the burden of Trump’s tariffs — not the Chinese exporters.

ING analysts suggest that it may turn out to be a key day for sterling after MP Dominic Grieve proposed an amendment to avert a no-deal Brexit.

“According to the proposal, parliament would be required to be in session every two weeks until 18 December. This would likely compromise any plan of Prime Minister-in-waiting Boris Johnson to suspend the legislature and bypass parliament in order to force a no-deal exit on 31 October. The House Speaker may or may not select the amendment for today’s debate, which may explain why GBP has still failed to move on the news. We expect, either way, to see some volatility today in the pound, where a vote in favour of the amendment may trigger a jump in GBP/USD towards the 1.26 level. EUR/GBP is close to a key 0.90 resistance, which may be tested should the amendment fail.”

In view of ING analysts, investors seem to have high expectations for Chair Powell’s testimony tomorrow as they attempt to assess the magnitude and timing of the upcoming FOMC moves.

“Today, markets will look for clues from a crowded schedule of Fed speakers in an attempt to anticipate tomorrow’s testimony by Powell. What is likely to attract most attention will be comments from St. Louis Fed President James Bullard, arguably the most dovish member of the FOMC. He previously expressed the idea that the Fed will need to cut rates by 50 basis points by year end, but later acknowledged that a 50bp move in July was likely excessive. Should he reiterate this view, markets will likely further consolidate their current expectations for a 25bp cut on 31 July, keeping rates and the US dollar broadly unchanged. Comments by another dove, Atlanta Fed President Raphael Bostic, will likely have a less relevant impact given that Bostic is not a voter this year. All in all, we expect today’s speeches to provide only small hints about tomorrow’s testimony by Powell and expect the dollar to stay range-bound throughout the day.”

According to the report from Istat, in May 2019, estimates of retail trade saw a fall of 0.7% in value terms in the month-on-month series, that is the fourth consecutive month of no positive growth. Economists had expected a 0.2% increase. Likewise, the quantity sold decreased by 0.8%.

In the three months to May 2019, both value and volume of retail trade were down 0.4% and 0.5% respectively when compared to the previous three months (Dec 2018 – Feb 2019).

Value of sales contracted by 1.8% year-on-year in May 2019, while volume of sales fell by 1.5%.

After strong sales reported in April 2019, large scale distribution decreased by 0.4% year-on-year. Small scale distribution also saw a contraction, dropping by 3.6%.

Year-on-year online sales continued to grow, however value of internet sales fell slightly to 10.6% in May 2019 from the 17.1% reported in April 2019.

TD Research expects a dovish tone from this week's Fed Powell testimony and the FOMC minutes from the June meeting.

"Fed Chair Powell will use his two-day testimony before Congress to reiterate the view that the Fed stands ready to sustain the current economic expansion. We expect the minutes to offer more clarity on what would lead the Fed to lend this support after the notable dovish shift at the May meeting. Global uncertainty and subdued inflation should remain key concerns for the Fed," TD adds.

Gold prices can continue to climb even after they hit a multi-year high last week, a global investment strategist said.

In fact, prices are set to “reach $2,000 by the end of the year,” predicted David Roche, president and global strategist at London-based Independent Strategy.

Gold prices have been on an upward trend amid recent expectations of a Fed rate cut and heightened geopolitical concerns - conditions that might weigh on the stock market, according to Roche.

“I actually believe financial markets are now poised to crumble like a sand pile,” he told.

Roche projected gold prices would continue going up, partly because international trade tensions will add to the negative sentiment of stock market investors.

“I think the trade conflict with the US is a much far, wider-reaching, global conflict, which will undermine growth expectations in equity markets,” he said.

Analysts at the US investment banking giant, Goldman Sachs, believe that there is a scope for the European Central Bank (ECB) to restart its Quantitative Easing (QE) program, in the wake of deteriorating Euro area economic situation.

"A return to large-scale QE is complicated by the ECB's self-imposed limits on its asset purchases. But significant headroom remains to expand corporate sector purchases and we estimate that the ECB could buy up to €400 billion in sovereign debt under the current constraints. A limited QE program - for example, with monthly purchases of €30 billion for nine month - seems feasible within existing constraints."

Investors should be looking to buy emerging market currencies against the U.S. dollar, analyst told.

Those calls come as the U.S. Fed appears to be seriously considering cutting U.S. interest rates. As dollar-based investments begin to yield less interest, that may weaken the greenback against the currencies of higher-interest countries — including many in the developing world.

“What we see now is that the dollar is probably topped out against a number of the emerging market currencies, ” said Mike Ryan, chief investment officer for the Americas at UBS Global Wealth Management.

“We do think there is a basket of emerging market currencies that look appealing as the Fed is poised now to begin cutting rates as opposed to raising rates.” he told.

This does not signal broad-based U.S. dollar weakness, he added, noting that other developed-country central banks are also looking to pivot on rate policy.

In view of analysts at ING, Fed Chairman Powell’s first day of the two days long testimony in front of the US Congress could sound of imminent easing - or alternatively, the threat of rates on hold and will be keenly watched by the markets.

“There isn't a lot today that could impinge on the argument for or against easing. Powell need not think the economy is heading into recession to deliver 25bp or even eventually 50bp of insurance easing, but he believes that easing in this way will keep the US economy on its current growth path. Therefore, it makes no sense for Powell to wait until September to provide such insurance, as this is not a data dependent decision, but a risk-management one. By September, there may be other arguments for some easing. But as Powell says, an "...ounce of prevention is worth more than a pound of cure...", or something like that anyway. I might also add, "A stitch in time saves nine", though that may just be too esoteric.”

Axel Rudolph, analyst at Commerzbank, points out that EUR/USD remains below the 55 day moving average at 1.1231 and remains close to the March and mid-June lows at 1.1181/76 and while this area underpins on a daily chart closing basis, the 200 day moving average and early June high at 1.1328/48 will remain in sight.”

“Above the 1.1412 June high we look for a test of the 1.1570 2019 high. Slightly longer term we target 1.1815/54, the highs from June and September 2018. We regard the April and May lows at 1.1110/06 as a turning point and continue to view the market as based longer term and target 1.1990 (measurement higher from the wedge).”

According to surveys by the State Secretariat for Economic Affairs (SECO), at the end of June 2019, 97,222 unemployed were registered at the regional employment agencies (RAV), 4,148 less than in the previous month. The unemployment rate fell from 2.2% in May 2019 to 2.1% in the month under review. Compared to the same month last year, unemployment fell by 9,357 people (-8.8%).

Youth unemployment (15-24 year-olds) decreased by 287 (-2.9%) to 9,762. Compared to the same month of the previous year, this represents a decrease of 975 persons (-9.1%).

The number of unemployed aged 50-64 decreased by 978 people (-3.4%) to 28,101. Compared to the same month of the previous year, this corresponds to a decrease of 2,912 persons (-9.4%).

A total of 170,800 jobseekers were registered, 5,328 fewer than in the previous month. Compared with the same period of the previous year, this number fell by 8,977 persons (-5.0%).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1353 (1142)

$1.1328 (855)

$1.1296 (235)

Price at time of writing this review: $1.1217

Support levels (open interest**, contracts):

$1.1167 (2662)

$1.1130 (3355)

$1.1089 (2778)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 9 is 50307 contracts (according to data from July, 8) with the maximum number of contracts with strike price $1,1150 (3355);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2693 (1731)

$1.2661 (479)

$1.2634 (332)

Price at time of writing this review: $1.2509

Support levels (open interest**, contracts):

$1.2471 (1394)

$1.2442 (2263)

$1.2408 (2517)

Comments:

- Overall open interest on the CALL options with the expiration date August, 9 is 14012 contracts, with the maximum number of contracts with strike price $1,3000 (2052);

- Overall open interest on the PUT options with the expiration date August, 9 is 13824 contracts, with the maximum number of contracts with strike price $1,2450 (2517);

- The ratio of PUT/CALL was 0.99 versus 1.00 from the previous trading day according to data from July, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 63.75 | -0.73 |

| WTI | 57.55 | -0.28 |

| Silver | 15 | 0.2 |

| Gold | 1395.195 | -0.23 |

| Palladium | 1559.1 | -0.41 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -212.03 | 21534.35 | -0.98 |

| Hang Seng | -443.14 | 28331.69 | -1.54 |

| KOSPI | -46.42 | 2064.17 | -2.2 |

| ASX 200 | -79.1 | 6672.2 | -1.17 |

| FTSE 100 | -3.87 | 7549.27 | -0.05 |

| DAX | -25.02 | 12543.51 | -0.2 |

| Dow Jones | -115.98 | 26806.14 | -0.43 |

| S&P 500 | -14.46 | 2975.95 | -0.48 |

| NASDAQ Composite | -63.41 | 8098.38 | -0.78 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.69714 | -0.09 |

| EURJPY | 121.897 | 0.12 |

| EURUSD | 1.12149 | -0.09 |

| GBPJPY | 136.044 | 0.14 |

| GBPUSD | 1.2515 | -0.08 |

| NZDUSD | 0.66234 | 0.01 |

| USDCAD | 1.3095 | 0.16 |

| USDCHF | 0.99348 | 0.2 |

| USDJPY | 108.694 | 0.23 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.