- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Westpac Consumer Confidence | April | 98.8 | |

| 02:30 | Australia | RBA Assist Gov Debelle Speaks | |||

| 06:00 | Japan | Prelim Machine Tool Orders, y/y | March | -29.3% | |

| 06:45 | France | Industrial Production, m/m | February | 1.3% | -0.5% |

| 08:30 | United Kingdom | Manufacturing Production (MoM) | February | 0.8% | 0.2% |

| 08:30 | United Kingdom | Manufacturing Production (YoY) | February | -1.1% | -0.7% |

| 08:30 | United Kingdom | Industrial Production (MoM) | February | 0.6% | 0.1% |

| 08:30 | United Kingdom | Industrial Production (YoY) | February | -0.9% | -0.9% |

| 08:30 | United Kingdom | GDP m/m | February | 0.5% | 0% |

| 08:30 | United Kingdom | Total Trade Balance | February | -3.825 | |

| 11:45 | Eurozone | ECB Interest Rate Decision | 0% | 0% | |

| 12:30 | Eurozone | ECB Press Conference | |||

| 12:30 | U.S. | CPI, m/m | March | 0.2% | 0.3% |

| 12:30 | U.S. | CPI excluding food and energy, m/m | March | 0.1% | 0.2% |

| 12:30 | U.S. | CPI excluding food and energy, Y/Y | March | 2.1% | 2.1% |

| 12:30 | U.S. | CPI, Y/Y | March | 1.5% | 1.8% |

| 13:00 | United Kingdom | NIESR GDP Estimate | March | 0.1% | 0% |

| 14:30 | U.S. | Crude Oil Inventories | April | 7.238 | 2.513 |

| 15:50 | U.S. | FOMC Member Quarles Speaks | |||

| 18:00 | U.S. | Federal budget | March | -234 | -180 |

| 18:00 | Eurozone | ECB's Benoit Coeure Speaks | |||

| 18:00 | U.S. | FOMC meeting minutes | |||

| 22:45 | New Zealand | Food Prices Index, y/y | March | 1.7% |

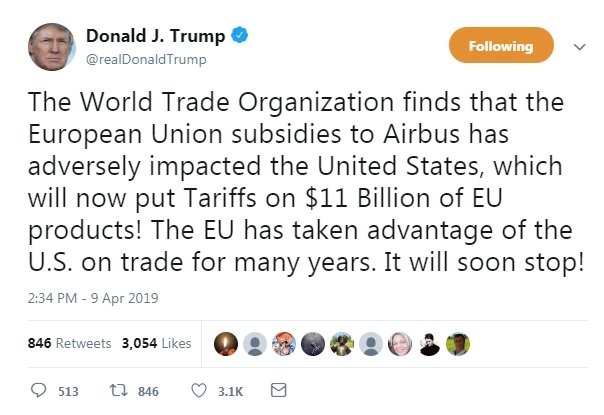

Major US stock indexes fell moderately after US President Donald Trump threatened to impose tariffs on European goods, while lowering the forecast for global economic growth from the IMF heightened concerns about a slowdown in global growth caused by trade disputes.

Trump wrote that the US wants to impose duties on European goods worth $ 11 billion in response to EU subsidies for the European aircraft manufacturer Airbus. "The World Trade Organization has established that Airbus subsidies to Airbus had a negative impact on the United States, and now we will introduce import duties of $ 11 billion," he wrote on Twitter. "The EU has benefited from trade advantages for many years at the expense of the United States. It will end soon!" - he added.

The European Commission said that the level of proposed US countermeasures is greatly exaggerated and that the scale of the response can only be determined by the WTO arbiter.

The International Monetary Fund (IMF) lowered the forecast for global economic growth in 2019 by 0.2%, to 3.3%, warning that growth may slow down even more due to trade tensions and a possible indiscriminate exit of the UK from the European Union.

Investors are also continuing to prepare for the quarterly reporting season, which may be the first to show the annual reduction in corporate segment profits from 2016. The season of corporate reporting for the first quarter of 2019 starts on Friday with the publication of the results of the largest banks. According to Refinitiv, analysts predict that the profits of the S & P 500 companies in the first quarter will decline by 2.3% y / y. According to FactSet estimates, investors expect that the profits of the S & P 500 companies in the first quarter will fall by 4.3% y / y.

Most of the components of DOW finished trading in the red (25 out of 30). Caterpillar Inc. shares turned out to be an outsider. (CAT; -2.42%). The growth leader was The Walt Disney Co. (DIS; + 1.66%).

Almost all sectors of the S & P recorded a decline. Only the conglomerate sector grew (+ 0.2%). The largest decline was in the industrial goods sector (-1.4%).

At the time of closing:

Dow 26,153.90 -187.12 -0.71%

S & P 500 2,878.50 -17.27 -0.60%

Nasdaq 100 7,909.28 -44.61 -0.56%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Westpac Consumer Confidence | April | 98.8 | |

| 02:30 | Australia | RBA Assist Gov Debelle Speaks | |||

| 06:00 | Japan | Prelim Machine Tool Orders, y/y | March | -29.3% | |

| 06:45 | France | Industrial Production, m/m | February | 1.3% | -0.5% |

| 08:30 | United Kingdom | Manufacturing Production (MoM) | February | 0.8% | 0.2% |

| 08:30 | United Kingdom | Manufacturing Production (YoY) | February | -1.1% | -0.7% |

| 08:30 | United Kingdom | Industrial Production (MoM) | February | 0.6% | 0.1% |

| 08:30 | United Kingdom | Industrial Production (YoY) | February | -0.9% | -0.9% |

| 08:30 | United Kingdom | GDP m/m | February | 0.5% | 0% |

| 08:30 | United Kingdom | Total Trade Balance | February | -3.825 | |

| 11:45 | Eurozone | ECB Interest Rate Decision | 0% | 0% | |

| 12:30 | Eurozone | ECB Press Conference | |||

| 12:30 | U.S. | CPI, m/m | March | 0.2% | 0.3% |

| 12:30 | U.S. | CPI excluding food and energy, m/m | March | 0.1% | 0.2% |

| 12:30 | U.S. | CPI excluding food and energy, Y/Y | March | 2.1% | 2.1% |

| 12:30 | U.S. | CPI, Y/Y | March | 1.5% | 1.8% |

| 13:00 | United Kingdom | NIESR GDP Estimate | March | 0.1% | 0% |

| 14:30 | U.S. | Crude Oil Inventories | April | 7.238 | 2.513 |

| 15:50 | U.S. | FOMC Member Quarles Speaks | |||

| 18:00 | U.S. | Federal budget | March | -234 | -180 |

| 18:00 | Eurozone | ECB's Benoit Coeure Speaks | |||

| 18:00 | U.S. | FOMC meeting minutes | |||

| 22:45 | New Zealand | Food Prices Index, y/y | March | 1.7% |

The Job Openings and Labor Turnover Survey (JOLTS) published by the

Labor Department on Tuesday showed a decrease in the U.S. job openings in February.

According to the report, employers posted 7.087 million job openings in February,

compared to the January figure of 7.625 million (revised from 7.581 million in

original estimate) and economists’ expectations of 7.550 million. The job

openings rate was 4.5 percent in February, down from 4.8 percent in the prior

month. The report showed that the number of job openings fell for total private

(-523,000) and was little changed for government. Job openings decreased in a

number of industries, with the largest drops in accommodation and food services

(-103,000), real estate and rental and leasing (-72,000), and transportation,

warehousing, and utilities (-66,000).

Meanwhile, the number of hires edged down to 5.696 million in February

from 5.829 in January. The hiring rate was 3.8 percent, down from 3.9 percent in

January. The hires level was little changed for total private and fell for

government (-40,000). The number of hires declined in construction (-73,000),

nondurable goods manufacturing (-33,000), and state and local government

education (-22,000).

The separation rate in February was at 5.556 million or 3.7 percent,

compared to 5.532 million or 3.7 percent in January. Within separations, the

quits rate was 2.3 percent (flat m-o-m), and the layoffs rate was 1.2 percent

(+0.1 pp m-o-m).

- Russia and OPEC+ are watching the oil market closely

- Are ready to sit down and talk in the second half of the year if needed

- Are ready for cooperation

- Not ready to say if Russia will reduce output or not

- That's the slowest global growth forecast in a decade

- 2020 unchanged at 3.6%

- Says risks to the downside based on Brexit and US-China talks

- Says growth will stabilize in the first half of 2019, sees gradual recovery afterward

- Sees global trade volume up 3.4% vs 4.0% in Jan

- Cuts eurozone growth to 1.3% from 1.6%

- Cuts US to 2.3% from 2.5%

- Raises 2020 US forecast to 1.9% from 1.8%

- Raises 2019 China growth forecast to 6.3% from 6.2%

- Lowers 2020 China forecast to 6.1% from 6.3%

- Cuts LatAm to 1.4% from 2.0%

- Canada 1.5% vs. 1.9% prior

- German 0.8% vs. 1.3% prior

- France 1.3% vs. 1.5% prior

- Italy +0.1% vs. +0.6% prior

- Advanced economies 1.8% vs. 2.0% prior

- Emerging markets 4.4% vs. 4.5% prior

U.S. stock-index traded fell moderately on Tuesday, as investors awaited the start of corporate earnings season later this week and digested intensifying trade tensions between the U.S. and the EU.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,802.59 | +40.94 | +0.19% |

Hang Seng | 30,157.49 | +80.34 | +0.27% |

Shanghai | 3,239.66 | -5.15 | -0.16% |

S&P/ASX | 6,221.80 | +0.40 | +0.01% |

FTSE | 7,434.75 | -17.14 | -0.23% |

CAC | 5,461.37 | -10.41 | -0.19% |

DAX | 11,895.62 | -67.78 | -0.57% |

Crude oil | $64.19 | -0.33% | |

Gold | $1,309.20 | +0.56% |

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 215.06 | 0.04(0.02%) | 107 |

ALTRIA GROUP INC. | MO | 55.3 | 0.02(0.04%) | 374 |

Amazon.com Inc., NASDAQ | AMZN | 1,845.90 | -3.96(-0.21%) | 37726 |

AMERICAN INTERNATIONAL GROUP | AIG | 44.79 | -0.08(-0.18%) | 175 |

Apple Inc. | AAPL | 200.88 | 0.78(0.39%) | 251079 |

AT&T Inc | T | 31.91 | 0.03(0.09%) | 122820 |

Boeing Co | BA | 371.82 | -2.70(-0.72%) | 70724 |

Caterpillar Inc | CAT | 139.35 | -0.47(-0.34%) | 151 |

Chevron Corp | CVX | 126.7 | 0.02(0.02%) | 125 |

Cisco Systems Inc | CSCO | 55.25 | -0.24(-0.43%) | 8357 |

Citigroup Inc., NYSE | C | 65.72 | -0.35(-0.53%) | 3529 |

Facebook, Inc. | FB | 175.76 | 0.83(0.47%) | 79128 |

Ford Motor Co. | F | 9.27 | -0.03(-0.32%) | 55352 |

General Electric Co | GE | 9.31 | -0.18(-1.90%) | 527470 |

General Motors Company, NYSE | GM | 38.85 | -0.21(-0.54%) | 3200 |

Home Depot Inc | HD | 202.3 | -1.25(-0.61%) | 5259 |

Intel Corp | INTC | 55.45 | -0.23(-0.41%) | 16779 |

International Business Machines Co... | IBM | 143.3 | -0.09(-0.06%) | 2750 |

International Paper Company | IP | 47.35 | -0.01(-0.02%) | 300 |

Johnson & Johnson | JNJ | 136.01 | -0.13(-0.10%) | 1789 |

JPMorgan Chase and Co | JPM | 105.38 | -0.27(-0.26%) | 11701 |

McDonald's Corp | MCD | 190.1 | 0.25(0.13%) | 3348 |

Microsoft Corp | MSFT | 119.11 | -0.82(-0.68%) | 57768 |

Nike | NKE | 84.5 | -0.23(-0.27%) | 581 |

Pfizer Inc | PFE | 43.11 | -0.03(-0.07%) | 966 |

Procter & Gamble Co | PG | 104.83 | -0.14(-0.13%) | 1368 |

Starbucks Corporation, NASDAQ | SBUX | 74.97 | -0.23(-0.31%) | 1729 |

Tesla Motors, Inc., NASDAQ | TSLA | 273.71 | 0.51(0.19%) | 40858 |

Twitter, Inc., NYSE | TWTR | 34.76 | -0.10(-0.29%) | 15530 |

Verizon Communications Inc | VZ | 58.5 | -0.03(-0.05%) | 18834 |

Visa | V | 157.61 | -0.14(-0.09%) | 2143 |

Walt Disney Co | DIS | 115.79 | 0.83(0.72%) | 84919 |

Boeing (BA) target lowered to $393 from $425 at Goldman Sachs

Walt Disney (DIS) upgraded to Outperform from Market Perform at Cowen

- Government hasn't moved on customs union

- There hasn't been sufficient discussion of alignment with single market in talks

- Government hasn't shown any changes in language yet on customs union

- Customs union will be the first item on today's agenda

- Second referendum is also on the agenda

Jane Foley, a senior FX strategist at Rabobank, notes that improved risk appetite has sapped the strength of the USD as EUR/USD has pushed higher towards the 1.1280 area to its highest levels for over a week.

“Although this has reawakened the risk of a recovery towards the 1.1300 area, we are not confident that the EUR’s fundamentals can justify a sustained move back to these levels and we continue to see risk of a break below the EUR/USD1.12 level in the coming weeks.”

“The Eurozone economy is currently being buffeted by a range of negative factor. Growth is weak, European parliamentary elections are looming, Brexit is on the doorstep and now trade tensions with the US have taken a turn for the worse. The Trump administration is reported to be proposing tariffs on $11 bln of EU products in response to EU subsidies to support Airbus. This is the culmination of an issue that has been simmering for 14 years.”

“Tomorrow, the ECB Council meeting will provide policymakers with a fresh opportunity to air their views on the economic risks currently facing the region. ECB President Draghi last month showed more of his hand than expected and the dovish policy outlook is set to be reinforced tomorrow.”

“Slowing growth is never good news for incumbent politicians. Opinions polls suggest that the far left and far right populists are set to perform well in May’s EU parliamentary elections. This outcome is likely to add to the concerns of investors. We see risk that EUR/USD can trade lower in the 1.10 area on a 3 to 6-month view.”

- Says that Macron wants quarterly checks to confirm extension

- Includes possibility of cutting extension short if UK isn't respecting its commitments

- Also wants the other 26 EU leaders to firmly commit to sticking to whatever position agreed at on Wednesday's summit and not dither further down the line

Macron is to meet with the UK PM May later today.

- Rationale for short extension is that May believes both UK and EU needs certainty

- May will tell EU leaders that she is holding cross-party talks

- May remains certain there is majority in parliament to leave with a deal

- It does remain the case that legal default is a no-deal on 12 April

National Federation of Independent Business (NFIB) reported on Tuesday its latest survey revealed that small business optimism improved modestly in March.

According to the report, the NFIB Small Business Optimism Index edged up 0.1 points to 101.8 in March, a historically strong level and an indication that small businesses continue to power the economy after being briefly shaken by January’s government shutdown.

Economists had forecast the index to come in at 101.3.

Five indicator's components improved, two were unchanged, and three declined. Labor market indicators showed improvement, the outlook for expansion, real sales and reports of rising earnings gained ground, and capital spending plans held steady. Meanwhile, the major soft spot was in inventories with stocks viewed as too large and plans to invest in inventories turning slightly negative - more firms planning reductions than additions.

“Small business owners continue to create jobs, expand their operations, and are enjoying strong sales,” said NFIB President and CEO Juanita Duggan. “Since Congress resolved the shutdown, uncertainty has declined as small business owners add jobs, increase sales, and invest in their businesses and employees.”

- UK is heading for a long Brexit extension

- EU ambassadors will continue talks in Brussels tonight to nail down the extension date

According to analysts at TD Securities, in the US session, the NFIB small business optimism index is expected to have continued to gradually recover in March, recording a small gain to 102.0 from 101.7 before.

“The index suffered a sharp fall at the end of 2018 but appears to have stabilized at lower levels in February. Separately, job openings likely remained at current levels in February, following the strong 7.6 million openings recorded in the January JOLTS report. Note that the pace of job openings ticked up a tenth to 4.8% in January, the same as hirings, which increased to 3.9%.”

China's stimulus-boosted private sector is on track to lead the economy to a "self-sustained recovery" that could see growth hit 6.6% this year, according to HSBC.

And while that would only match last year's GDP result — the worst performance for the world's second-largest economy in 28 years — it is well above current consensus of about 6.2% for 2019. The Chinese government last month set its GDP growth target for this year at between 6.0% to 6.5%, below last year's of about 6.5%. China is set to announce first quarter economic growth on April 17.

HSBC said that recent economic data, including stronger manufacturing activity, show that "growth has bottomed and will gradually pick up in the coming quarters as the stimulus measures filter through." The British bank said that it sees GDP growth hitting 6.7% by the fourth quarter, which it predicted will push the figure for the full year to 6.6%.

According to the report from Istat, estimates of retail trade index for February 2019 stay relatively flat, as value increased by 0.1% from the previous month and volume was down 0.1%

In the three months to February 2019, the retail trade index slightly grew both in value and in volume terms, rising by 0.1% and 0.2% respectively.

When compared to February 2018, the value of retail trade in February 2019 rose by 0.9%, while the quantity sold increased by 0.3%.

Estimates for large scale distribution showed the first negative figure since September 2018, decreasing by 0.1%, while small scale distribution showed the strongest growth since September 2017, increasing by 1.6%. Online sales were up 17.5% when compared with February 2018.

declaration on future ties could be improved

According to Karen Jones, analyst at Commerzbank, EUR/GBP cross continues to show signs of recovery off the base of the recent range and has again tested the 55 day ma, currently at .8644.

“A close above here would allow for a test of the recent high at .8723 and .8829 (200 day ma). It continues to hold the .8471 recent low and we suspect might be trying to base near term. Currently though we remain unable to rule out the risk of a slide to the 200 week ma at .8411. The market is expected to struggle on rallies to the 200 day ma at .8830, and only above here allows for a move to the October .8941 high, which is expected to contain the topside.”

This is being reported by BBC's Nicholas Watt, citing a leading Brexiteer source on the matter. If proven to be true, it would be a significant change in stance from the European Union and could just help to push May's agenda to win over parliament.

Euro zone banks expect to ease credit standards for business loans and consumer credit in the second quarter but may tighten them for mortgages, the European Central Bank said in a quarterly lending survey.

"For the second quarter of 2019, banks expect an easing of credit standards for loans to enterprises and consumer credit, and a further tightening of credit standards for housing loans," the ECB added.

In the first quarter, credit standards -- banks' internal guidelines or loan approval criteria -- remained broadly unchanged for loans to enterprises while credit standards for mortgages and consumer credit tightened, the ECB added.

"Banks' cost of funds and balance sheet constraints and risk perceptions contributed to a tightening of credit standards on loans to enterprises, while competitive pressures continued to contribute to an easing of credit standards," the ECB said.

Nick Kounis, head of financial markets research at ABN AMRO, suggests that their base case is that the ECB will further push out its forward guidance on the period of unchanged policy rates and ongoing reinvestments.

“The modest trajectory for economic growth will not be sufficient for underlying inflationary pressures to build. We think that ECB forecasts for growth and inflation remain too high despite recent downgrades. Our base case is that ECB policy interest rates will remain on hold through to the end of 2020 and that reinvestments will continue to the end of 2021. However, the risks are to the downside and the probability is rising that the ECB will need to step up stimulus and restart QE. Market pricing on the timing of the first ECB rate hike has converged towards our base case over recent weeks.”

China has cut a controversial tax on personal items bought overseas, ranging from iPads to books, in an effort to boost consumer confidence.

The government will trim the “tax on baggage and articles accompanying incoming passengers and personal postal articles”, a three-in-one tax consisting of value-added tax, consumption tax and import duties on Tuesday, according to an online notice posted by the Ministry of Finance.

The tax rate on products including computers, foodstuffs, gold and silverware, furniture and medicines will be lowered to 13% from 15%. The rate for commodities including textiles, electric appliances and bicycles will be cut to 20% from 25%, according to the statement. The tax rate for wine, cigarettes, jewellery, golf equipment, luxury watches and high-grade cosmetics will be kept at 50%.

This is the second round of tax cuts on consumer products bought overseas in six months, after Beijing initially lowered the rate on November 1, 2018.

2018 GDP growth stands at 0.9% for Italy, 2017 GDP growth revised up to 1.7% from 1.6%

Istat publishes a new version of the national economic accounts and the General Government (GG) account for 2017 and 2018, revised with respect to those released, respectively, on 1 March (for GDP) and 3 April (for the GG account).

The new estimate results in an upward revision of the nominal GDP of around 3.2 billion in 2017 and around 3.0 in 2018. The 2017 nominal GDP growth rate is now equal to 2.2% (previously 2.0%), but it is important to consider that since the 2016 level has not been revised, the rate of change is affected by a break in the accounts. This effect will be removed with the extraordinary revision of the national accounts scheduled for next September.

With regard to the General Government account, the changes in the perimeter of the sector give rise to a very slight reduction in the level of net borrowing which, in terms of the ratio to the GDP, remains unchanged compared to previous estimates (2.4% in 2017 and 2.1% in 2018).

Karen Jones, analyst at Commerzbank, notes that the GBP/USD pair has continued to consolidate above the 200 day ma at 1.2975 as the erosion of the 20 day ma last week was not sustained and the market is consolidating.

“Above 1.3217 (25th January high) suggests scope up to the 1.3351/82 resistance. Below the 200 day ma lies the 1.2942 55 week ma and the double Fibo retracement at 1.2900/1.2895, this is pretty solid support that is expected to hold the downside. This guards the recent low at 1.2772. The market recently reached 1.3382 before failing. Should the 55 week ma hold, our overall target remains the 1.3552 200 week ma. Below 1.2772 we would allow for losses to the 1.2669/62 15th January low and August low and possibly the 1.2609/78.6% retracement.”

British Prime Minister Theresa May will meet German Chancellor Angela Merkel and French President Emmanuel Macron on Tuesday to argue for a Brexit delay.

Britain’s departure from the EU has already been delayed once but May is asking for yet more time as she courts veteran socialist Jeremy Corbyn, whose opposition Labour Party wants to keep Britain more closely tied to the bloc after Brexit.

While May travels to Berlin and Paris ahead of an emergency EU summit in Brussels on Wednesday, British lawmakers will hold a 90-minute debate on her proposal to delay Britain’s EU departure date to June 30 from April 12.

Karen Jones, analyst at Commerzbank, points out that the EUR/USD pair has continued to hold over the 1.1176 recent low, and this week we should see it recover further.

“The market has recently not sustained breaks to new lows, and we favour near term recovery. We suspect that it is trying to base but needs to do more work. Once above the 200 day ma at 1.1455, the cross should target the 1.1570 January high, together with the 55 week ma at 1.1568. Initial resistance is the 20 day ma at 1.1281. Below 1.1185/75 (61.8% retracement) lies the 1.1110, the May 2017 low and the 1.0814/78.6% retracement.”

British shoppers cut back spending for the first time in almost a year last month, reflecting a mix of seasonal pressures and Brexit worries, the British Retail Consortium (BRC) said.

The BRC said total sales at its members - mostly major high-street retailers and supermarkets - had dropped by 0.5% year-on-year in March, after a 0.5% rise the month before, the first fall since April 2018.

The fact that Easter holiday spending will fall in April this year could only account for part of the decline compared with last March, BRC chief executive Helen Dickinson said.

"Brexit continues to feed the uncertainty among consumers. While jewellery, beauty products and clothing purchases were all up to indulge on Mother's Day, shoppers were generally cautious not to overspend, particularly on larger items." she said.

According to State Secretariat for Economic Affairs (SECO) surveys, at the end of March 2019, 112'341 unemployed people were enrolled in the Regional Employment Centers (RAV), 7'132 less than in the previous month. The unemployment rate fell from 2.7% in February 2019 to 2.5% in the month under review. Compared with the same month of the previous year, unemployment fell by 18,072 persons (-13.9%).

Youth unemployment (15- to 24-year-olds) decreased by 1,206 (-9.4%) to 11,573. Compared to the same month last year, this represents a decrease of 1,978 persons (-14.6%).

The number of unemployed 50 and more fell by 1,505 people (-4.5%) to 31,872. Compared to the same month of the previous year, this represents a decrease of 4,767 persons (-13.0%).

A total of 189'467 job seekers were registered, 7'605 fewer than in the previous month. Compared to the same period of the previous year, this number fell by 11,652 persons (-5.8%).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1376 (2243)

$1.1358 (233)

$1.1339 (192)

Price at time of writing this review: $1.1262

Support levels (open interest**, contracts):

$1.1220 (3450)

$1.1182 (2677)

$1.1139 (2776)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date May, 3 is 64909 contracts (according to data from April, 8) with the maximum number of contracts with strike price $1,1500 (6225);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3365 (2433)

$1.3301 (1030)

$1.3251 (868)

Price at time of writing this review: $1.3081

Support levels (open interest**, contracts):

$1.2961 (1120)

$1.2901 (1311)

$1.2831 (2013)

Comments:

- Overall open interest on the CALL options with the expiration date May, 3 is 20703 contracts, with the maximum number of contracts with strike price $1,3500 (2578);

- Overall open interest on the PUT options with the expiration date May, 3 is 17445 contracts, with the maximum number of contracts with strike price $1,2600 (2560);

- The ratio of PUT/CALL was 0.84 versus 0.83 from the previous trading day according to data from April, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 70.84 | 0.58 |

| WTI | 64.31 | 1.45 |

| Silver | 15.22 | 0.79 |

| Gold | 1297.462 | 0.42 |

| Palladium | 1382.22 | 0.84 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -45.85 | 21761.65 | -0.21 |

| Hang Seng | 140.83 | 30077.15 | 0.47 |

| KOSPI | 0.99 | 2210.6 | 0.04 |

| ASX 200 | 40.1 | 6221.4 | 0.65 |

| FTSE 100 | 5.02 | 7451.89 | 0.07 |

| DAX | -46.35 | 11963.4 | -0.39 |

| Dow Jones | -83.97 | 26341.02 | -0.32 |

| S&P 500 | 3.03 | 2895.77 | 0.1 |

| NASDAQ Composite | 15.19 | 7953.88 | 0.19 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71232 | 0.26 |

| EURJPY | 125.535 | 0.21 |

| EURUSD | 1.12599 | 0.4 |

| GBPJPY | 145.638 | 0.08 |

| GBPUSD | 1.30628 | 0.26 |

| NZDUSD | 0.67426 | 0.2 |

| USDCAD | 1.33102 | -0.52 |

| USDCHF | 0.99913 | -0.07 |

| USDJPY | 111.482 | -0.18 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.