- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- The XAU/USD retreated to $2,025 on Friday, registering losses of 0.40% on the day.

- Despite soft CPI revisions, the metal failed to gather traction.

- Daily chart indicators hint at a bearish bias, with RSI's negative slope and MACD's rising red bars suggesting selling momentum.

- In the four-hour chart, indicators appear flat hinting at a consolidation of losses.

In Friday's session, the XAU/USD was observed at a trading level of $2,025, marking a dip of 0.40%. Focus is set on next week’s Consumer Price Index (CPI) figures from January after the US downwardly revised the December figures, to continue placing their bets on the next Federal Reserve (Fed) decisions.

In that sense, investors are eyeing the Federal Reserve's moves, as soft CPI revisions seem to have provided a breather for officials considering rate cuts. However, strong Q1 growth predictions in the US market and rising wage pressures amidst a tight job market from the Fed indicate that rate cuts may be delayed. As for now, markets seem to have given up the odds of a cut in March and instead pushed them to May. Next week's inflation reading will be key for the timing of the easing cycle and in case, data justifies the delay of rate cuts, the yellow metal metal may see further downside

XAU/USD technical analysis

Technical indicators on the daily chart initially depict a dominance of selling pressure. The Relative Strength Index (RSI) is on a descending slope and is hovering in the negative domain, suggesting that bearish momentum is currently prevailing. Simultaneously, the Moving Average Convergence Divergence (MACD) displays growing red bars, reinforcing the strength of the selling momentum. However, the broader perspective reveals a different story. Despite the metal trading under the 20-day Simple Moving Average (SMA), it remains comfortably positioned above the 100 and 200-day SMAs. This inclination highlights the dominance of buying interest in the broader context but that the bears are steadily gaining ground in the short term.

XAU/USD daily chart

-638431107546926697.png)

Turning attention to the four-hour chart, the selling and buying forces appear to have temporarily reached a stalemate. The indicators have flatlined, illustrating a phase of consolidation following recent losses. The Relative Strength Index (RSI) is notably flat, entrenched within the negative zone, which might hint at a persisting bearish sentiment. The Moving Average Convergence Divergence (MACD) also insinuates a slight shift in momentum with flat red bars, proposing the possibility of a period of consolidation.

- GBP/JPY finds itself at the top end of near-term technical resistance.

- Next week sees a hefty economic calendar showing for the UK.

- Japan GDP growth slated for next Thursday.

GBP/JPY found itself back into familiar technical levels near 188.50 on Friday after an early-week bounce from the 186.20 region as the Pound Sterling (GBP) finds itself stepping over the Japanese Yen (JPY) that spent most of the week on the soft side.

It was a thin economic calendar for both currencies this week, leaving the Guppy pair hamstrung as investors grapple with interest rate cut outlooks from both the Bank of England (BoE) and the Bank of Japan (BoJ). Both central banks appear to be quite dovish for opposite reasons, with the BoE grappling with a lopsided UK economy that sees inflation threats around every corner, and the BoJ that fears a deflationary overhang in the future, with Japanese inflation forecast to decline below the Japanese central bank’s 2% target in the months to come.

BoE’s Bailey, Japan GDP in the pipe for next week

BoE policymaker Haskel noted early Friday that while signs of progress on inflation in the UK have been encouraging, but there’s still plenty of room to clear on the BoE’s to-do book, and money markets have once again trimmed bets on rate cuts from the UK’s central bank. Rate markets now see less than 75 basis points in rate trims from the BoE in 2024.

Next week kicks off with an appearance from BoE Governor Andrew Bailey who will be giving a speech at England’s Loughborough University. The midweek also sees UK labor figures, as well as Consumer Price Index (CPI) inflation and UK GDP growth, with next Friday wrapping up the UK’s data week with Retail Sales.

Japan sees GDP growth figures early Thursday, and markets are forecasting a fourth-quarter growth rebound in Japan to 0.3% QoQ, compared to the previous quarter’s -0.7% decline.

GBP/JPY Technical outlook

GBP/JPY continues to clatter along a near-term technical ceiling just south of the 189.00 handle, finding room near 188.80 before pulling back into the 188.50 region ahead of Friday’s closing bell. The pair rose cleanly through the 200-hour Simple Moving Average (SMA) near the 187.00 handle early in the week, and intraday momentum remains in the hands of bidders despite signs of congestion.

189.00 remains a key but tricky level for the GBP/JPY to overcome, with prices capped below the target level and keeping the Guppy constrained below the major 190.00 handle. The pair continues to trade into firmly bullish territory with the 200-day SMA near 182.11, far below current price action. Guppy bids have not touched the long-term SMA since a decline into 179.00 at the start of 2024.

GBP/JPY hourly chart

GBP/JPY daily chart

- Silver gains 0.15% to $22.60, buoyed by a softer USD despite higher Treasury yields.

- Indications of bottoming out between $22.15-$22.50, hinting at a potential move towards $23.00.

- Death cross' suggests bearish outlook; fall below support might aim for January low at $21.93, then $20.69.

Silver price prints minimal gains of 0.15% on Friday even though US Treasury bond yields climbed. Nevertheless, the Greenback remains down, a tailwind for Silver prices, which trade at $22.60 after jumping from a low of $22.37.

XAG/USD is downward biased but has bottomed out at around $22.15-$22.50, which has opened the door for an upward correction. If buyers could lift prices toward $23.00 per troy ounce, that could open the door to test the 100-day Moving Average (DMA) at $23.09, followed by the 50-DMA at $23.26.

On the other hand, a ‘death cross’ formed three days ago on the path of least resistance, a bearish signal that could clear the path for further downside. The next support surfaces at the January 22 low of $21.93, followed by the October 23 pivot low at $20.69.

XAG/USD Price Action – Daily Chart

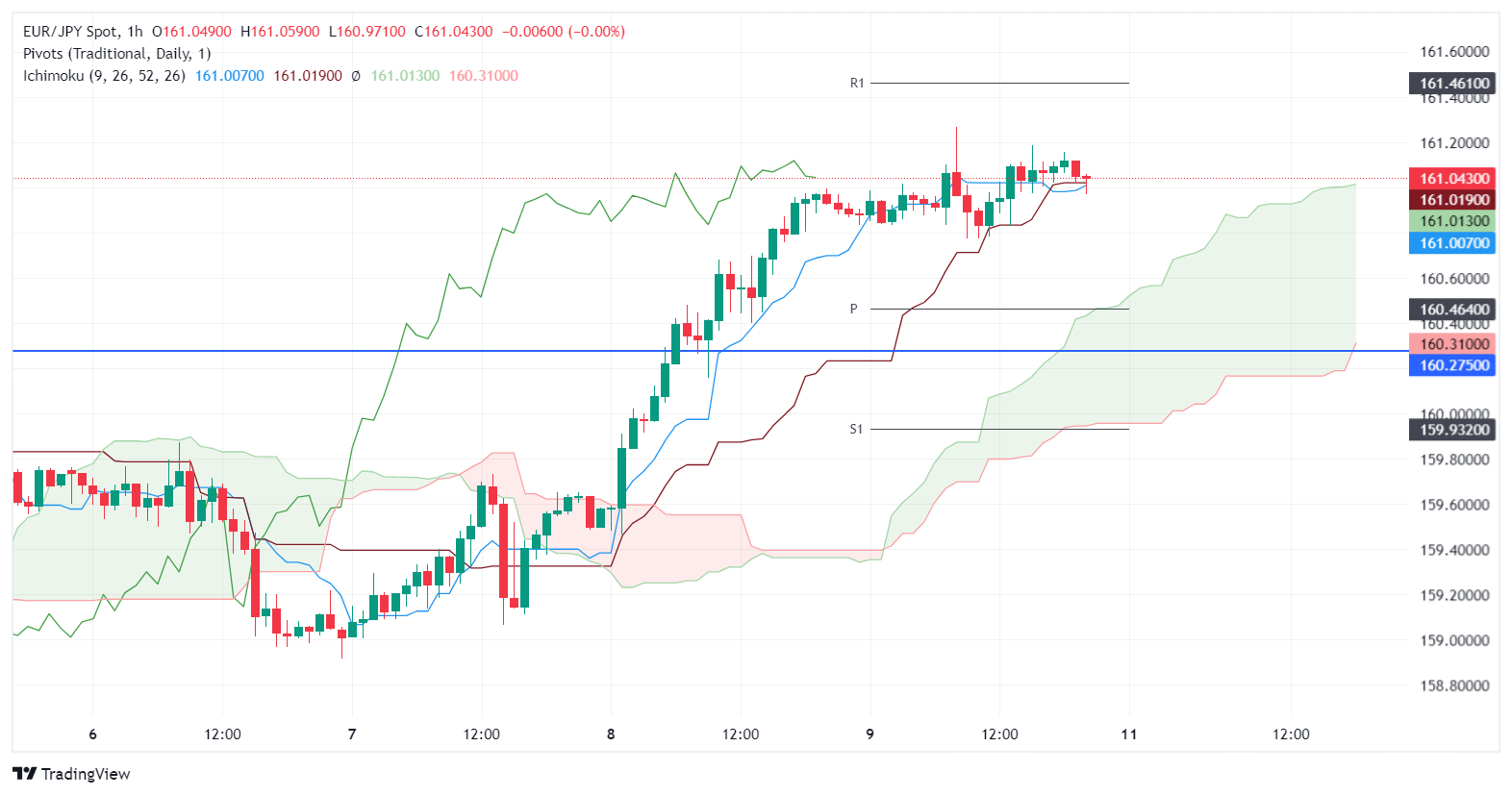

- EUR/JPY hits year-to-date high, buoyed by positive sentiment and BoJ dovish comments.

- Above 161.00, eyes on 162.00 resistance; below 160.27 swing low may test 160.00 support.

- Technical analysis hints at pullback, with critical supports at 160.00, today’s low 160.77, and pivot 160.46

The EUR/JPY pierces the 161.00 figure and hits a two-week high of 161.26, courtesy of a risk-on impulse and “dovish” comments by a Bank of Japan (BoJ) member. At the time of writing, the pair hovers around 161.00, clocking minimal 0.05% gains.

The daily chart portrays the EUR/JPY pair is upward biased. Still, Friday’s price action is shaping a doji, which indicates neither buyer's nor sellers' commitment to their positions. With that said, if buyers reclaim 161.00, look for an upside move to 162.00. On the flip side, if sellers step in and clear the February 5 swing low of 160.27, that could pave the way to challenge 160.00.

EUR/JPY Price Action – Daily Chart

In the short term, the divergence between EUR/JPY price action and Relative Strength Index (RSI) studies could open the door for a pullback. The first support is seen at 160.00 the confluence of the Tenkan and Kijun-Sen, followed by today’s low of 160.77, followed by the daily pivot at 160.46.

EUR/JPY Price Action – Hourly Chart

- WTI crude rises 0.25% above $76.50 amid Israel-Hamas conflict escalation and US production changes.

- Increased geopolitical tensions from Israeli military actions in Gaza and ceasefire rejections impact oil prices.

- US refining shutdowns due to various factors lead to higher gasoline and diesel prices, affecting crude market.

West Texas Intermediate (WTI), the US crude oil benchmark, rises 0.25% late in the North American session as the Israel-Hamas conflict escalates with Israel rejecting a ceasefire offer. That, along with diminished production in oil refined products, sponsored WTI's advance, as it trades at $76.54 per barrel.

Oil prices climb as Israel-Hamas conflict intensifies, US refining cuts impact supply

Israeli military continued their offensive on the Gaza Strip on Friday, sparking a jump in oil prices of around 3% in the previous day. Additionally, refining plants in the US were shut down, which boosted the prices of Gasoline and Diesel.

Ukraine’s attacks against two oil refineries in Southern Russia, and the latter exporting more crude oil in February than planned with the OPEC+, was a tailwind for WTI price.

In the meantime, the US Treasury Department sanctioned three companies based in the United Arab Emirates (UAE) and one ship registered by Liberia for violating a cap placed on the price of Russian oil by a coalition of Western nations.

WTI Price Analysis: Technical outlook

Oil prices are set to remain range-bound but tilted to the downside, as the 200-day moving average (DMA) at $77.29 remains the first resistance level for prices. A breach of the latter could pave the way for further gains toward the $80.00 pb. Nevertheless, despite being bullish, the Relative Strength Index (RSI), the slope shifted flat, and strong resistance would open the door to challenge the 20-DMA at $74.53. A breach of the latter will expose the latest swing low of $71.46.

- The AUD/JPY pair stands at 97.409 showing 0.50% gains in the last session of the week.

- The main reasons for the upward movements are the divergent RBA and BoJ monetary policy, which benefit the Aussie.

- Daily Chart indicators show strong buying momentum while four-hour indicators flash overbought conditions.

- Despite the looming correction, the overall trend is bullish.

In Friday's session, the AUD/JPY was observed rising to 97.40, registering a t gain of 0.50. This performance is primarily shaped by the contrasting economic stances of the Reserve Bank of Australia (RBA) and the Bank of Japan (BOJ). With the daily chart indicating a bullish momentum and the bulls asserting their dominance, the prevailing outlook seems positive. However, the four-hour chart shows indicators have entered the overbought zone, suggesting a potential for imminent correction.

In line with that, recent statements by the RBA Governor Bullock suggest a balanced perspective with the potential for future interest rate changes. The possibility remains open for both an increase or a standstill, subject to inflation and economic growth. The market expects the RBA's first rate cut in August, with a total easing of 50 bp anticipated for the year. In contrast, the Bank of Japan BoJ maintains a dovish stance, with Governor Ueda affirming that accommodative financial conditions may continue after the current negative rates era. As per the latest data, the likelihood of rate liftoff from the BoJ is forecasted for June, with only 25 bps of tightening for the rest of 2024, and as long as markets bet on a dovish BoJ, the pair may see further upside.

AUD/JPY technical analysis

On the daily chart, the Relative Strength Index (RSI) boasts a positive trajectory within positive territory, suggesting buyers maintain control in line with the Moving Average Convergence Divergence (MACD) histogram which reveals diminishing red bars, suggesting that the buyers are in command. On a broader perspective, the pair resides above the 20-day, 100-day, and 200-day Simple Moving Averages (SMAs). This emphasizes that bullish forces hold a firm grip on the larger time frames with the bears nowhere to be found.

AUD/JPY daily chart

-638431046503469120.png)

Moving to the four-hour chart, the momentum switches somewhat. Key performance indicators have approached overbought levels, suggesting an imminent correction. A closer look at the RSI confirms this forecast as it ventures into overbought territory. The MACD confirms this pattern as well, with its green bars gradually shrinking. In summary, whilst the bulls seem to be gaining ground currently, an impending correction looms as short-term momentum indicators align to suggest a pullback.

Two Federal Reserve (Fed) officials hit newswires on Friday, with Atlanta Fed President Raphael Bostic and Dallas Fed President Lorie Logan reiterating common themes about inflation and the Fed's rate outlook.

Both Fed policymakers highlighted that the Fed has made significant progress on reigning in US inflation, but reiterated that there's still plenty of work to be done, with key risk factors plaguing the Fed's ability to deliver rate cuts as fast or as deep as markets are pining for.

Key highlights:

- Bostic:

- Inflation has been too high for too long, and still a ways to go.

- The US is on a path to pre-pandemic economic activity, needs to avoid inflation resurgence.

- Data suggests firm real wage gains will be continuing for some time.

- Fed needs to be "resolute" and "stay the course".

- Logan:

- Fed balance sheet shrinking has been very smooth thus far.

- US federal debt is on an unsustainable path.

- US economy is in a good place right now.

- Inflation outlook appears to be sustained.

- Labor market remains tight, but there has been some loosening.

- Some industries still see supply chain issues.

- Sees no urgency for cutting rates.

- EUR/USD found some room higher but still lacks upside momentum.

- Final German HICP and CPI inflation brought no surprises.

- US CPI inflation, EU GDP figures slated for next week.

The EUR/USD found some room on the high side on Friday, continuing a near-term recovery. However, the pair remains firmly planted on the low side of technical barriers and remains pinned below the 1.0800 price handle.

German inflation figures brought nothing new to the table, confirming initial flash prints, and an adjustment by the US Bureau of Labor Statistics (BLS) made anticipated changes to how seasonal adjustment is calculated in US Consumer Price Index (CPI) figures. Markets jostled after the BLS adjustment, but US inflation figures saw little change, keeping markets on-balance for Friday.

Daily digest market movers: EUR/USD continues slow grind higher as technical ceiling weighs

- Germany’s final Harmonized Index of Consumer Price (HICP) showed no changes from preliminary prints, with the annualized German inflation rate through January holding at 3.1%.

- The US BLS made changes to how seasonal adjustment works for US CPI numbers, with a slight rise in annualized inflation getting offset by a near-term decline after calculations got adjusted.

- US December monthly CPI revised to 0.2% from 0.3%

- Next week brings a fresh print of US CPI inflation, with the YoY CPI through January expected to tick down from 3.4% to 3.0%.

- US CPI inflation slated for Tuesday, European Gross Domestic Product (GDP) figures due Wednesday.

- Pan-European GDP growth is expected to remain pinned in low territory.

- YoY quarterly EU GDP is forecast to print at 0.1%, in-line with the previous annualized quarterly print.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.09% | -0.14% | 0.01% | -0.36% | 0.07% | -0.63% | 0.12% | |

| EUR | 0.10% | -0.04% | 0.11% | -0.27% | 0.17% | -0.54% | 0.22% | |

| GBP | 0.14% | 0.04% | 0.15% | -0.23% | 0.20% | -0.49% | 0.26% | |

| CAD | -0.02% | -0.12% | -0.16% | -0.39% | 0.05% | -0.64% | 0.10% | |

| AUD | 0.37% | 0.27% | 0.22% | 0.38% | 0.43% | -0.26% | 0.48% | |

| JPY | -0.06% | -0.16% | -0.19% | -0.06% | -0.45% | -0.67% | 0.07% | |

| NZD | 0.63% | 0.53% | 0.48% | 0.64% | 0.26% | 0.70% | 0.74% | |

| CHF | -0.15% | -0.24% | -0.28% | -0.13% | -0.51% | -0.08% | -0.77% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: EUR/USD struggles to grow legs beneath technical recovery

The EUR/USD remains pinned on the south side of the 200-hour Simple Moving Average (SMA) just beneath 1.0800. Although the pair continues to recover into the upside from the early week’s bottom near 1.0725, topside momentum remains capped, with longer-term technical patterns remaining decidedly bearish.

Despite posting three straight days of gains and on pace for a fourth, the EUR/USD remains on the bearish side of the 200-day SMA at 1.0833. The pair is still down over 3% from late December’s peak of 1.1140, and Euro bidders are struggling to lift the Euro off the floor of a nearly 4% decline into January’s bottom bids of 1.0722.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- GBP/USD up 0.10% amid central bank caution, trading near the 50-DMA.

- Richmond Fed's Barkin calls for policy patience, mirroring Fed's focus on data-driven decisions.

- BoE's Haskel sees inflation improvement, supporting a data-dependent policy approach.

- Markets expect substantial Fed easing of 120 bps and a 75 bps rate cut by the BoE, potentially supporting GBP/USD.

The Pound Sterling (GBP) edges up moderately against the US Dollar (USD) in the mid-North American session but trades sideways unable to reclaim a key resistance level at the 50-day moving average (DMA). US and UK central bank speakers adopting a cautious stance and the lack of important economic data would likely keep the major within familiar levels. the GBP/USD trades at 1.2628, up 0.10%, but virtually flat in the week.

GBP/USD is set to finish the week almost flat

Even though the GBP/USD remains up in the day, it remains capped by comments made by Federal Reserve (Fed) officials. During the week, they said that the disinflation process continued and that they would eventually cut rates but pushed against the speed of easing, priced in by market players.

Data-wise, the latest unemployment claims report in the US showed the labor market remains tight. Meanwhile, the revisions for the US Consumer Price Index (CPI) confirmed the progress on inflation, as CPI stood at 3.3% YoY, while Core CPI at 3.7%. The report suggests the Fed is doing a good job, but it’s not done, as said by most policymakers.

Regarding that, the Richmond Fed President Thomas Barkin said, “he's cautious about the accuracy of recent data,” and added they (the Fed) could be patient before making any changes to monetary policy.

On the other side of the Atlantic, the Bank of England (BoE) member Jonathan Haskel commented that he sees progress on inflation despite voting for an interest rate increase in the last meeting. The BoE added they would be data-dependent, and next week’s economic calendar would provide an update on inflation and economic growth.

Meanwhile, monetary policy easing expectations for the Federal Reserve remain high, with traders seeking 120 basis points (bps) of cuts. Contrarily, the BoE is expected to slash rates by 75 bps, which would favor the Pound Sterling, opening the door for some upside in the GBP/USD pair.

GBP/USD Price Analysis: Technical outlook

The GBP/USD trades near weekly highs but buyers must reclaim the 50-DMA at 1.2672, which could open the door for further gains. The next resistance is 1.2700, followed by the February 2 high at 1.2772. On the flip side, if sellers step in and push prices below 1.2600, they could challenge the 200-DMA at 1.2562. Once cleared, an additional downside is seen at 1.2500. Therefore, the path of least resistance is downwards, as the Relative Strength Index (RSI) suggests that buyers are in charge.

- The DXY stands at 104.15 on Friday with mild losses.

- US December’s inflation figures were downwardly revised by the BLS.

- Next week January’s CPI is due.

The US Dollar (USD) stood flat on Friday, with mild losses, closing a winning week but trimming most of its gains. All eyes are on next week’s US inflation data.

The US Dollar gathered significant ground in the first days of February after Jerome Powell, the Chair of the US Federal Reserve (Fed), mentioned that a reduction in interest rates in March seemed improbable. He emphasized the necessity for further proof of declining inflation before the Fed could feel confident about lowering rates, so incoming data will be key. Next week, the US will release Consumer Price Index (CPI) figures from January, which will likely set the pace of the Greenback for the short term.

Daily digest market movers: US Dollar loses some ground on soft CPI revisions

- The US Bureau of Labor Statistics (BLS) updated the Consumer Price Index (CPI) figures with new seasonal adjustments, lowering December's inflation rate to 0.2% from the initial 0.3%.

- The Core CPI for December remained steady at 0.3%, with no revisions made.

- November's CPI was adjusted upwards to a 0.2% increase from the previously reported 0.1%, while October's 0.1% rise was unchanged.

- According to the CME FedWatch Tool, the odds of a cut in March are low at around 20% but may see some changes in case the US CPI from January comes in lower than expected.

Technical analysis: DXY bulls struggle, continue battling with 100-day SMA

On the daily chart, the Relative Strength Index (RSI) is flat, situated in positive territory, which generally suggests a stall in buying momentum but still maintains a generally bullish tilt. Coupled with the Moving Average Convergence Divergence (MACD), which shows flat green bars, it confirms the trend of bullish momentum yet hints at a possible consolidation or minor pullback.

On a wider horizon, Simple Moving Averages (SMAs) provide a mixed picture. The index is trading above the 20-day SMA, a clear signal of short-term bullish strength. However, it remains below the 100-day SMA, indicating that the medium-term selling pressure persists. Interestingly, it holds above the 200-day SMA, underscoring a strong bullish presence in the long run.

This confluence of factors paints a picture of bulls struggling to gain substantial ground, which leaves the index vulnerable for further downside if the bulls don't wake up.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- USD/MXN drops as revised US inflation data fuel expectations for Fed easing.

- US inflation adjustments show success in price control, leading to a weakened Dollar outlook.

- Banxico holds rates at 11.25% with changes in policy statements indicating a careful stance on future adjustments.

The Mexican Peso (MXN) advanced steadily in early trading on Friday against the US Dollar (USD) following the latest revision on inflation figures in the United States (US). The data confirms the Federal Reserve’s (Fed) attempt to curb elevated prices is working, opening the door to lower interest rates. Therefore, the Greenback (USD) is trading softer, and the USD/MXN exchanges hands at 17.10, down 0.25%.

Mexico’s economic docket during the last two days has been busy. Inflation is heading up, while the Bank of Mexico (Banxico) decided to hold rates at 11.25%, though it removed hawkish language from the monetary policy statement. Instead, they added, “In the next monetary policy meetings, it will assess, depending on available information, the possibility of adjusting the reference rate.”

Daily digest market movers: Mexican Peso appreciates despite Banxico dropping hawkish comments

- Banxico’s Governing Council stated that inflationary risks are tilted to the upside in the near term while adding that higher core inflation, foreign exchange depreciation, and a greater-than-expected economic resilience in the country would keep inflationary pressure up.

- On the downside, a global economic slowdown and lower exchange rate levels in relation to the first months of 2023 “contribute more than anticipated to reduce certain pressures on inflation.”

- Mexico’s central bank revised their inflation expectations to the upside for Q1 to Q3 of 2024, and they expected to converge toward 3.5% in Q4.

- Before Wall Street opened, the National Statistics Agency (INEGI) announced that Mexican Industrial Production fell 0.7% in December from November and was flat YoY.

- On Thursday, INEGI revealed that Mexico´s Consumer Price Index (CPI) in January, rose by 4.88% YoY, while underlying inflation moderated to 4.76%.

- The US Bureau of Labor Statistics (BLS) released an inflation data revision, indicating that US inflation rates at the end of 2023 were consistent with initial reports, even after annual revisions. The core CPI, which excludes food and energy, increased at a 3.3% annualized rate in Q4 2023, aligning with previous estimates. The headline inflation figure saw minimal adjustments with December's monthly rise slightly revised down to 0.2% from 0.3%.

- US Initial Jobless Claims of 218K for the last week were lower than estimates of 220K, down from 227K in the previous reading.

- US Federal Reserve officials remain cautious about guiding market participants about when they would begin easing policy. Yesterday, Richmond Fed President Thomas Barkin was asked about Powell’s comments: “Chairman Powell always speaks for the Committee.”

Technical analysis: Mexican Peso surges as USD/MXN tumbles below 17.10

The USD/MXN is neutral to downwardly biased after clashing with the 50-day Simple Moving Average (SMA) at 17.12 with buyers unable to decisively break that level. Since then, the exotic pair has resumed its downtrend, though it could remain at around the 17.05/17.17 range. Further downside lies ahead as the Relative Strength Index (RSI) shows bears are gathering momentum with the slope peaking two days ago before extending its downtrend. The next support levels lie at 17.05, the psychological 17.00 figure and last year’s low of 16.62.

On the other hand, if buyers reclaim the 50-day SMA, that can pave the way to test the 200-day SMA at 17.31. Upside risks emerge once that barrier is cleared. The next real resistance comes at 17.41, the 100-day SMA.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Canadian Dollar trends broadly lower after brief rally.

- Canada added more jobs than expected in January.

- Canadian wage growth in January continues to ease.

The Canadian Dollar (CAD) slipped back after testing higher on Friday. Markets readjusted exposure to the US Dollar (USD) after the US Bureau of Labor Statistics (BLS) introduced broad seasonal adjustment changes to how the Consumer Price Index (CPI) is calculated, causing slight changes to near-term inflation prints.

Canadian wage figures eased further in January, and net job additions showed a higher number of job gains than markets forecast, while December’s jobs number also saw an upside revision. The Canadian Unemployment Rate also ticked lower in January.

Daily digest market movers: Canadian Dollar falling back despite economic calendar beats

- Canada’s Unemployment Rate declined to 5.7% in January versus the forecast 5.9%, December’s 5.8%.

- Net Change in Employment added 37.3K new jobs in January, handily beating the forecast of 15K.

- December’s job additions also saw an upside revision to 12.3% from 0.1K.

- Canadian Average Hourly Wages declined to 5.3% in January from the previous month’s 5.7%.

- The US BLS brought far-reaching adjustments to how the CPI is seasonally-adjusted, causing an uptick in adjusted annualized US inflation, though recent inflation measures remain largely unchanged.

- With the adjustments out of the way, markets will focus on next week’s US CPI inflation print due on Tuesday.

- Next week sees a thin, low-impact economic calendar for Canada, exposing the Loonie to broad-market flows.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.04% | -0.05% | 0.15% | -0.27% | 0.08% | -0.52% | 0.18% | |

| EUR | 0.04% | -0.01% | 0.18% | -0.24% | 0.13% | -0.49% | 0.23% | |

| GBP | 0.05% | 0.01% | 0.19% | -0.24% | 0.12% | -0.48% | 0.22% | |

| CAD | -0.14% | -0.18% | -0.19% | -0.42% | -0.07% | -0.67% | 0.03% | |

| AUD | 0.28% | 0.24% | 0.23% | 0.43% | 0.35% | -0.25% | 0.45% | |

| JPY | -0.08% | -0.11% | -0.11% | 0.06% | -0.38% | -0.58% | 0.10% | |

| NZD | 0.52% | 0.48% | 0.47% | 0.66% | 0.24% | 0.60% | 0.70% | |

| CHF | -0.19% | -0.23% | -0.23% | -0.04% | -0.46% | -0.09% | -0.71% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: Canadian Dollar sheds weight against US Dollar after early rise

The Canadian Dollar is broadly lower on Friday, dipping into the red against the majority of its major currency peers with the New Zealand Dollar (NZD) leading the charge, gaining two-thirds of a percent against the CAD, while the Australian Dollar (AUD) approaches half a percent in gains against the Canadian Dollar.

The Canadian Dollar rallied early against the US Dollar, sending the USD/CAD into a near-term low of 1.3413 before a rally in the USD sent the pair back into the high end near 1.3480. The pair has rallied half a percent bottom-to-top on Friday, keeping the USD/CAD pinned into near-term congestion.

The USD/CAD continues to trade into the 200-day Simple Moving Average (SMA) near 1.3475, and bidders will be looking to drive the pair back into the last meaningful swing high at 1.3900 last November. On the low side, sellers will be looking for a return to December’s bottom bids near 1.3200.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Following Monday’s Powell-driven sharp rebound in the US Dollar, the risk-linked galaxy managed to regain some balance as the sessions passed by, sparking a decent recovery in the likes of the single currency and the British Pound in an environment broadly dominated by speculations surrounding the potential timing of interest rate cuts by the Federal Reserve.

On Monday, the only release in the US docket will be the January Monthly Budget Statement. Moving forward, the US Inflation Rate is due on February 13, while Retail Sales, Industrial Production, Business Inventories, the NAHB Housing Market Index and Net Long-term TIC Flows are expected on February 15. Finally, Producer Prices, Housing Starts, Building Permits, and the preliminary Michigan Consumer Sentiment all be published on February 16. The USD Index (DXY) entered a small consolidative range following Monday’s sharp rebound to fresh YTD peaks past 104.00.

In the domestic data space, the Economic Sentiment for both Germany and the euro area tracked by the ZEW institute comes on February 13. Additionally, another revision of the Q4 GDP Growth Rate along with Industrial Production readings is due on February 14. The Balance of Trade figures in the euro bloc for the month of December will close the docket on February 15. EUR/USD ended the week on a positive note, regaining some balance following Monday’s steep decline. The pair continues to target the 1.0800 hurdle in the very near term.

It will be an interesting week, data-wise, in the UK. The labour market report is due on February 13, followed by the Inflation Rate on February 14. On February 15, the GDP figures, Balance of Trade, Construction Output, and Industrial and Manufacturing Production are due, all ahead of the NIESR GDP Tracker, Finally, Retail Sales for the month of January will be released on February 16. The weekly recovery in GBP/USD appears to have stalled just ahead of the 1.2650 zone so far.

In the Japanese calendar, Producer Prices are due on February 13 ahead of Industrial Production and the flash Q4 GDP Growth Rate on February 15. Weekly Foreign Bond Investment and the Tertiary Industry Index are both due at the end of the week. USD/JPY approaches the key 150.00 barrier on the back of the intense pick-up in selling pressure around the Japanese currency.

In Australia, the Westpac Consumer Confidence Index kickstarts the week ahead of the publication of the labour market report and Consumer Inflation Expectations on February 15. It was a choppy week for AUD/USD, which extended the trade in the lower end of the range around the 0.6500 zone.

Anticipating Economic Perspectives: Voices on the Horizon

- RBA A. Kohler, BoE Governor A. Bailey and Minneapolis Fed N. Kashkari speak on February 12.

- FOMC Governor M. Barr speaks on February 14.

- RBNZ Governor A. Orr, ECB Board member J. Nagel are due to speak on February 15, along with BoE MPC members C. Mann and M. Greene.

- On February 16, San Francisco Fed M. Daly, Atlanta Fed R. Bostic and BoE MPC member H. Pill are also seen delivering speeches.

- The EUR/GBP currently trades at 0.8536, reflecting minor losses on Friday.

- The pair will tally a seven-week losing streak.

- Focus is set on next week's British economic data including inflation and labor market reports.

- A more hawkish stance of the BoE in relation to the ECB gives the Pound traction.

On Friday's session, the EUR/GBP traded at 0.8536, posting mild losses amid contrasting monetary policy expectations from the European Central Bank (ECB) and the Bank of England (BoE) ahead of key economic figures of the British economy to be released next week. Meanwhile, the technical scenario remains bearish on the weekly and daily chart with bears gaining ground and tallying a seven-week selling spree.

Adding to that, despite the ECB pushing back against market easing expectations, a 55% chance of an interest rate cut in April is still predicted. On the other hand, markets are expecting a potential uptick in inflation in the UK, with the Consumer Price Index (CPI) expected to have risen by 4.1% YoY in January, prompting a greater likelihood of the BoE delaying cuts. The inflation report is due on Wednesday and on Tuesday, the UK will release labor market figures which will also shape the expectations of the next decisions. As for now, markets are seeing 100 bps of easing by the British bank, and 125 bps of easing from its European peer, and as long as investors bet on more easing by the ECB, the pair could continue falling.

EUR/GBP technical analysis

From a technical viewpoint, the daily and weekly chart's negative direction of the Relative Strength Index (RSI) and the cross dwelling under its 20, 100, and 200-day Simple Moving Averages (SMAs) insinuate bearish dominance. This indicates that bearish momentum persists and selling pressure is primarily in control. The current seven-week losing streak of the pair also reinforces the negative outlook leaving the cross exposed for further downside.

EUR/GBP weekly chart

-638430929912432703.png)

The road to the White House currently looks like a rematch between President Joe Biden and former President Donald Trump. Economists at Citigroup explain why not wait to invest until after the US elections.

Markets are likely to go up no matter who wins in the US

The S&P 500 has posted a positive return in 13 of the last 15 Presidential Election years.

Only if there is a major geopolitical event or a radical change in policy after the US elections might there be a negative tilt in economic activity.

Meanwhile, this phase of normalization and growth, of resilience and reshoring will continue, driving future corporate profits and markets higher.

Economists at the Bank of America analyze the potential shift from the US Dollar's (USD) carry advantage to a significant headwind.

Challenging period ahead for the USD

The Fed is predicted to be one of the initial G10 central banks to reduce rates, challenging the USD's carry advantage.

Given the higher starting point of US rates, their potential reduction could significantly narrow the rate differentials with other currencies, diminishing the USD's attractiveness.

The USD stands as one of the most overvalued currencies in the G10, a factor that could amplify its vulnerability in a rate-cutting environment.

Lower interest rates in the US typically boost global risk appetite, a dynamic that historically benefits currencies other than the USD.

It has been a relatively quiet start to the year in FX markets. Economists at ING analyze the EUR/USD outlook.

EUR/USD seen ending the year at 1.1500

Doubts about the timing and speed of central banking easing cycles have contributed to lower levels of volatility and a search for yield.

Assuming the Fed is preparing to cut rates in May/June, the bullish steepening of the US curve should be positive for most activity currencies – including the Euro.

We still forecast EUR/USD ending the second quarter somewhere near 1.1000 and ending the year at 1.1500.

- EUR/USD rises to 1.0784 on mixed central bank remarks and economic data, extending gains for a third day.

- Fed's cautious stance on rate cuts highlighted, with Goolsbee's dovish view contrasting Powell's alignment.

- US Treasury yields hit 2024 peaks, bolstering USD amid varied reactions to CPI updates.

- German inflation continues to drop, sparking ECB's debate on rate adjustment timing.

The EUR/USD rose steadily for the third-straight day in early trading in the North American session, driven by the latest central bank comments from Federal Reserve (Fed) and European Central Bank (ECB) officials. At the time of writing, the pair trades at 1.0784 after hitting a daily low of 1.0762.

Mixed postures amongst Fed, ECB officials keep EUR/USD seesawing below 1.0800

During the last week, Fed policymakers had stressed that it’s too early to cut rates even though the disinflation process continued. On the most “aggressive” dovish side lies Chicago Fed Austan Goolsbee, who remains optimistic about the economy and inflation and has been the most active dove on the board. Other Regional Fed Bank Presidents like Susan Collins, Neil Kashkari, and Thomas Barkin adopted a stance aligned with Fed Chair Jerome Powell. Even when Barkin was asked about Powell’s comments, he said, “Chairman Powell always speaks for the Committee.”

That has driven US Treasury yields higher, with the 10-year note yielding 4.173% after touching 4.195%, the highest level in 2024, a tailwind for the Greenback, which is fluctuating between gains and losses as depicted by the US Dollar Index (DXY). The DXY is clinging to the 104.00 mark, down 0.05%.

Recently, the US Department of Labor revealed the revisions for the US Consumer Price Index (CPI) and confirmed the progress on inflation, as CPI stood at 3.3% YoY, while Core CPI at 3.7%.

Across the pond, Germany’s data revealed that inflation dipped from 3.8% to 3.1% YoY. That maintains the ECB’s progress in curbing inflation. In the meantime, ECB officials Holzmann and Chief Economist Lane remain cautious about opening the door for rate cuts, with the former saying, “There is a certain chance that there will be no interest-rate cut at all this year or only at the very end of the year.” On the dovish side, Kazaks and Villeroy remain optimistic about the disinflation process, maintaining their stance to ease policy.

EUR/USD Price Analysis: Technical outlook

The pair remains downward biased, unable to crack the 200-day moving average (DMA) at 1.0787, which could open the door to challenging 1.0800. Relative Strength Index (RSI) studies remain bearish, with a flattish slope, suggesting that bears remain in charge. Therefore, the path of least resistance is downwards, with the next support emerging at 1.0741, today’s low, followed by the weekly low of 1.0722. Further downside lies at 1.0700.

It has become increasingly likely that Donald Trump will be the Republican candidate in the presidential election in the fall and that there will be a repeat of the 2020 duel: Joe Biden against Donald Trump. Economists at Commerzbank analyze how a Trump victory could impact stock markets.

Another stock market rally?

In November 2016, the stock markets reacted positively to Donald Trump's election victory, as the new US president promised companies lower taxes and less regulation, among other things. However, a number of factors suggest that the stock markets would not welcome a Trump election winner with similar euphoria.

For example, share valuations in 2024 are significantly higher than in 2016, when investors paid a price/earnings ratio (P/E ratio) of 17 for the S&P 500 and 18 for the Nasdaq 100, while the current S&P 500 P/E ratio is 20 and the Nasdaq 100 P/E ratio is 25.

In addition, there was a high level of uncertainty and nervousness in the stock market in 2016 in the run-up to the presidential election, and the implied volatility VIX for the S&P 500 was regularly above 20. We see the current VIX level of 13 as a signal that many investors are quite carefree about Trump winning the election in 2024.

We expect that a possible Trump election victory in 2024 will not have as strong an impact on the stock markets as in 2016.

Gold has recorded a surprisingly strong performance despite interest rates reaching a two decade high in the US and Western world. Strategists at TD Securities analyze the yellow metal’s outlook.

Fed will cut starting around the middle of the year

While the yellow metal is well supported in the current trading range above $2,000, there are no compelling reasons why gold should surge in the relative near-term. With US unemployment materially under 4%, wage growth above 4+% YoY, jobs gains at 350K+, GDP growth at 3+% and inflation running materially above the implied 2% target, the Fed has little latitude to start to take policy rates down from the current 5.50%.

As such, there is consensus that a March rate cut is off the table and May is being priced. High interest rates, modest speculative appetite and slumping physical demand suggest that lease rates may move to levels high enough to attract a significant amount of metal into the market. Meanwhile, high carry costs are also likely to see metal being pushed onto the market or may significantly reduce interest in new long acquisitions.

However, we believe the US central bank will cut starting around the middle of the year. For a sustained rally to start, the market will need to see a material weakening in economic data and an inflation rate that is closer to 2%. We expect that rates will drop by some 250 bps during the upcoming easing cycle, bringing effective rates to just under 3%. Once this becomes baked into broader expectations, Gold should rally again.

Economists at Wells Fargo forecast US Dollar depreciation as 2024 progresses, and into 2025.

Further depreciation in the US Dollar through 2025

While we expect the US to avoid recession, Fed easing and slower economic growth should still weigh on the Greenback as the year progresses.

For the Fed's US Dollar Index against the advanced foreign economies, we see a depreciation of 2.8% over the rest of 2024.

A relatively benign global growth environment that supports broader financial market sentiment could also lessen safe-haven support for the Greenback, contributing to moderate US Dollar losses this year and next.

- USD/CAD falls to near 1.3430 as robust labor demand in Canada.

- US BLS revision shows that monthly CPI for January grew by 0.2% against the reading of 0.3%.

- Oil prices eye more upside as Israel rejects ceasefire proposal.

The USD/CAD pair has come under pressure as the Canadian Employment data for January has outperformed expectations in the early New York session of Friday. Statistics Canada has reported a strong labor growth of 37.5K against expectations of 15K and upwardly revised December’s reading of 12.3K.

The Unemployment Rate surprisingly fell to 5.7% while investors anticipated it rising to 5.9% from the former reading of 5.8%. An upbeat labor market data would strengthen the argument by the Bank of Canada (BOC) for holding interest rates at their current level.

On the oil front, oil price aims to extend its rally above $76.5 as Israeli Prime Minister Benjamin Netanyahu rejected the ceasefire proposal due to unacceptable truce terms proposed by Hamas. This is expected to deepen tensions in the Middle East, which could disrupt oil supply. Lower oil supply results in higher prices. It is worth noting that Canada is the leading oil exporter to the United States, and higher oil prices support the Canadian Dollar.

The US Dollar Index (DXY) comes under pressure as the US Bureau of Labor Statistics (BLS) has revised the monthly headline Consumer Price Index (CPI) to 0.2% from 0.3%. The inflation has been revised as the BLS has employed new seasonal adjustment factors. The new process accurately reflects how consumer prices behaved over the year.

Meanwhile, Federal Reserve (Fed) policymakers emphasize keeping key rates restricted until they get convinced that inflation will come down sustainably to the 2% target. Boston Federal Reserve Bank President Susan Collins said risks of inflation stalling have turned towards the upside due to strong economic growth.

Banxico announced its latest rate decision on Thursday, February 8 with no change to the current 11.25% policy rate. USD/MXN reaction was fairly muted. Economists at Rabobank analyze the pair’s outlook.

USD/MXN to trade up through the 18.00 handle in H2

Banxico decided to leave rates on hold at 11.25%. The accompanying material provided something for everyone, hawks and doves alike.

Our base case remains for a 25 bps cut at the June 27th meeting after the Fed announces its first cut on June 12th. We remain of the view that a cut from Banxico in March is highly unlikely, but we are cognisant that there is a significant risk of a cut at the May 9th meeting.

We still favor a retest of the 17.00 handle in the coming days with 17.00-17.20 likely to dominate in the coming weeks.

We still expect a total of 175 bps of cuts from Banxico this year and USD/MXN to trade up through the 18.00 handle in H2.

The US Dollar (USD) is narrowly mixed in quiet trading. Economists at Scotiabank analyze Greenback’s outlook.

USD needs more support from higher yields and/or stronger data to advance

The USD is trading firm on the day and week and underlying momentum signals are leaning bullish but beyond that, there are some softer technical signals creeping into longer-term price action in the DXY, suggesting markets may be turning a bit less constructive on the USD overall after its early year rally.

At the very least, the USD needs more support from higher yields and/or stronger data to advance from here – and solid US Treasury auctions this week suggest investors are happy to participate with the 10Y yield nearing recent highs around 4.20%.

The US Bureau of Labor Statistics (BLS) reported on Friday that it revised the monthly Consumer Price Index (CPI) increase for December lower to 0.2% from 0.3%. The Core CPI was unrevised at 0.3% for the same period.

November's CPI increase was revised higher to 0.2% from 0.1%, while the October's 0.1% increase was left unchanged.

The BLS noted that CPI revisions reflect the new seasonal adjustment factors.

Market reaction

The US Dollar Index edged slightly lower with the immediate reaction and was last seen losing 0.1% on the day at 104.07.

- USD/JPY marches toward 150.00 as Fed policymakers maintain a hawkish rhetoric.

- Fed Collins said the central bank should prioritize achieving the dual mandate.

- The BoJ is not expected to go aggressive for rate hikes after exiting from an expansionary policy stance.

The USD/JPY pair advances toward the psychological resistance of 150.00 in the late European session on Friday. The asset continues its two-day winning spell as investors turn cautious amid volatility ahead of January's United States Consumer Price Index (CPI) data.

The US Dollar Index (DXY) is slightly up from Thursday’s closing price as Federal Reserve (Fed) policymakers lean towards holding interest rates restrictive for longer. On Thursday, Boston Federal Reserve Bank President Susan Collins said the central bank needs to be sure about strength in the labor market and progress in inflation declining towards 2% before adopting an expansionary policy stance.

On the labor market front, the US economy is outperforming as weekly jobless claims, released on Thursday, were lower despite high lay-offs in the technology sector. For the week ending February 2, individuals claiming jobless benefits for the first time were at 218K, lower than expectations of 220K and the former release of 228K.

Going forward, the inflation will provide fresh guidance on interest rates. A stubborn inflation data would shift the hopes of a rate cut to June from May, which already shifted further from March. The CME Fedwatch tool shows trades see a 53% chance for a rate cut by 25 basis points (bps), declining in the range of 5.00%-5.25%.

On the Tokyo front, the Japanese Yen is under pressure as investors see the Bank of Japan (BoJ) not going aggressive on rate hikes after exiting from its ultra-dovish interest rate stance. On Thursday, BoJ Deputy Governor Uchida Shinichi said that monetary policy conditions in the Japanese economy are in a deep negative trajectory, which is not expected to get blown up aggressively.

Gold (XAU/USD) could trade well above the $2,300 level for a time next quarter, strategists at TD Securities say.

Positioning, Fed credibility angst are catalysts for Gold upside

Lower policy rates are set to send real rates, carry and opportunity costs sharply lower, which should bring speculative and ETF investors back in. This will very much work in tandem with physical markets and relative positioning, which is skewed to the short end, to bring Gold above $2,300 for a time later in the year.

The strong likelihood that the US monetary policy makers will start cutting before inflation reached the desired level suggests that long-term investors, who have an interest in wealth preservation, may boost portfolio weightings of Gold.

Cutting rates before the two percent inflation target is reached may well convince many in the Gold market to hedge their long-term purchasing power. They may question the credibility of the Fed's commitment to the current inflation target. The potential of a US election outcome, which elects politicians who want to cut taxes and grow spending at the same time, may also be a reason investors and central banks continue to buy physical Gold.

- S&P 500 is set to open at new all-time high above 5,000.

- Alibaba, PayPal and Disney were among noteworthy companies that reported earnings this week.

- Energy Sector was the best-performing S&P 500 major sector on Thursday.

S&P 500 futures rise 0.16%, Dow Jones futures are unchanged, and Nasdaq futures gain 0.33%.

S&P 500 (SPX), Dow Jones (DJIA), and Nasdaq (IXIC) indexes closed on Thursday with a 0.06% gain, a 0.13% increase, and a 0.24% rise, respectively.

What to know before stock market opens

- The Energy Sector was the best-performing S&P 500 major sector on Thursday, rising 1.09% on the day. The Utilities Sector settled in the opposite extreme, shedding 0.83%.

- Ralph Lauren Corp. (RL) and Monolithic Power Systems Inc. (MPWR) added over 10%, making it to the top gainers on Thursday. Snap-on Inc. (SNA) lost 9.7% and closed at its lowest level since early November at $266.03.

- The US Department of Labor reported that there were 218,000 Initial Jobless Claims in the week ending February 3, down from the previous week's revised 227,000.

- Federal Reserve (Fed) Bank of Richmond President Thomas Barkin told Bloomberg on Thursday that economic data has been remarkable across the board but noted that he is cautious about the accuracy of numbers at the turn of the year.

- The data from the US showed that the goods and services deficit was $62.2 billion in December, up $0.3 billion from $61.9 billion in November.

- The Federal Reserve (Fed) reported late Wednesday that consumers added $1.56 billion in additional borrowing, far below the $16 billion forecast and declining steeply from the previous month's $23.75 billion.

- In an interview with CNBC on Wednesday, Minneapolis Fed President Neel Kashkari argued they can dial back the policy rate quite slowly if the labor market continues to be strong. "At the moment, two to three rate cuts this year seems appropriate," he added.

- Federal Reserve Board of Governor member Adriana Kugler noted on Wednesday that she is pleased with the great progress on inflation and added that she is optimistic that the progress will continue. "Some measures of financial conditions have eased but remain relatively tight and are consistent with continued progress on inflation,” Kugler elaborated.

Alibaba, PayPal and Disney reported earnings this week

- Pinterest shares collapsed right after the close, as the company reported a $981 million revenue vs $991 million expected. Revenue rose 12% year-over-year from $877.2 million a year earlier, while net income was $201 million, or 29 cents a share, up from $17.49 million, or 3 cents a share, a year ago.

- Walt Disney Co. (DIS) reported a quarterly revenue of $23.5 billion, slightly below the market projection of $23.6 billion, per Reuters. Disney's board of directors authorized a $3 billion share repurchase program for the current fiscal year, and declared a dividend of 45 cents a share. “Our strong performance this past quarter demonstrates we have turned the corner and entered a new era of growth for our company,” Disney CEO Bob Iger said in a statement.

- PayPal Holdings Inc. (PYPL) said revenue rose 8.7% to $8.03 billion from a year ago, surpassing the market forecast of $7.87 billion. Quarterly adjusted earnings were $1.48 per share for the quarter ended in December, and quarterly net income was $1.4 billion. "We're doing a lot of things to drive change internally and externally,” CEO Alex Chriss said in a post-earnings conference call, according to Reuters. “However, nothing happens overnight. It will take time for some of our initiatives to scale and move the needle," Chriss added.

- Alibaba Group Holdings Ltd. (BABA) reported Q3 adjusted net income of RMB 47,951 million and Q3 revenue of RMB 260,348 million before the opening bell on Wednesday. In its earnings report, the company said that the board of directors approved an increase of $25 billion to the share repurchase program. “Our top priority is to reignite the growth of our core businesses, e-commerce and cloud computing,” Alibaba said, per Reuters.

- Uber Technologies Inc. (UBER) announced Q4 net income of $1.4 billion and Q4 gross bookings of $37.6 billion. Net revenue for that period was $9.94 billion. "Uber's platform advantages and disciplined investment in new growth opportunities resulted in record engagement and accelerating Gross Bookings in Q4," Chief Financial Officer Prashanth Mahendra-Rajah said, per Reuters.

S&P 500 FAQs

What is the S&P 500?

The S&P 500 is a widely followed stock price index which measures the performance of 500 publicly owned companies, and is seen as a broad measure of the US stock market. Each company’s influence on the computation of the index is weighted based on market capitalization. This is calculated by multiplying the number of publicly traded shares of the company by the share price. The S&P 500 index has achieved impressive returns – $1.00 invested in 1970 would have yielded a return of almost $192.00 in 2022. The average annual return since its inception in 1957 has been 11.9%.

How are companies chosen to be included in the S&P 500?

Companies are selected by committee, unlike some other indexes where they are included based on set rules. Still, they must meet certain eligibility criteria, the most important of which is market capitalization, which must be greater than or equal to $12.7 billion. Other criteria include liquidity, domicile, public float, sector, financial viability, length of time publicly traded, and representation of the industries in the economy of the United States. The nine largest companies in the index account for 27.8% of the market capitalization of the index.

How can I trade the S&P 500?

There are a number of ways to trade the S&P 500. Most retail brokers and spread betting platforms allow traders to use Contracts for Difference (CFD) to place bets on the direction of the price. In addition, that can buy into Index, Mutual and Exchange Traded Funds (ETF) that track the price of the S&P 500. The most liquid of the ETFs is State Street Corporation’s SPY. The Chicago Mercantile Exchange (CME) offers futures contracts in the index and the Chicago Board of Options (CMOE) offers options as well as ETFs, inverse ETFs and leveraged ETFs.

What factors drive the S&P 500?

Many different factors drive the S&P 500 but mainly it is the aggregate performance of the component companies revealed in their quarterly and annual company earnings reports. US and global macroeconomic data also contributes as it impacts on investor sentiment, which if positive drives gains. The level of interest rates, set by the Federal Reserve (Fed), also influences the S&P 500 as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

EUR/USD remains well within this week’s range, with early gains capped again in the upper 1.0700s. Economists at Scotiabank analyze the pair’s outlook.

EUR is trying to base in a more sustainable way

Price signals look mixed across the intraday, daily and weekly charts.

The short-term pattern of trade suggests the EUR’s rebound from the early week low has stalled but there are some more positive signals on the daily and weekly charts that might indicate the EUR is trying to base in a more sustainable way – a high close on the week for the EUR would be a technical positive.

Intraday support is 1.0740. Resistance is 1.0790/1.0800.

- The US Dollar not breaking any pots this Friday with minor moves in either direction.

- Traders are taking some profit from the Greenback rally earlier this week with an empty calendar ahead.

- The US Dollar Index fails to close above the 100-day SMA and could slide back below 104.

The US Dollar (USD) is steady to lower this Friday with nothing really to report in markets. All eyes are rather on headlines in the papers with the landslide victory of former US President Donald Trump in both Nevada and the Virgin Islands, giving him a comfortable lead already early in the Primaries. The second big topic is the interview of former Fox news reporter Tucker Carlson with Russian President Vladimir Putin where the broad strokes are that Putin is not interested in invading the West, only Ukraine.

On the economic front, a blank sheet with no economic data to report. Though one US Federal Reserve Speaker is due to make an appearance after the European Closing Bell. Lorie Logan from the Dallas Fed is set to speak around 18:30 GMT.

Daily digest market movers: No news, no moves

- Germany's final inflation reading for January saw yearly Headline inflation closing off at 2.9%.

- Martin Kazaks from the European Central Bank Council said that rate cuts will be taking place this year for the ECB. It is just a matter of when the data is confirming the right time.

- The Senate is advancing with the aid for Ukraine and Israel, detaching the US Border Deal from the bill.

- Equity markets are dragging their feet towards the end of this week. Although several indices are residing near all-time highs, some fatigue is showing, and some profit taking might creep in towards this week’s closing bell.

- The CME Group’s FedWatch Tool is now looking at the March 20th meeting. Expectations for a pause are 84.5%, while 15.5% for a rate cut.

- The benchmark 10-year US Treasury Note trades near 4.17%, though the jump in the yield from the lower 4.06% earlier this week is not reflected in the US Dollar.

US Dollar Index Technical Analysis: Some fatigue

The US Dollar Index (DXY) is showing fatigue after the cost of finally moving away from the 200-day Simple Moving Average (SMA) near 103.61. Ideally a close above the 100-day SMA at 104.27 would have set forth the Greenback for more gains into next week, though US Dollar bulls are not supporting that plan. Instead, a week of false breaks took place and could mean that the DXY now falls back to the 200-day SMA for support.

Should the US Dollar Index move higher again, first look for a test at the peak of Monday, near 104.60. That level needs to be broken and is more important than the 100-day SImple Moving Average snap at 104.28. Once broken above that Monday high, the road is open for a jump to 105.00 with 105.12 as key levels to keep an eye on.

The 100-day SMA (104.28) is clearly the unreliable boyfriend in the rally at the moment. A false break on Monday and no support provided on Tuesday from the moving average opens the door for a bit of a squeeze lower. The first ideal candidate for support is the 200-day SMA near 103.61. Should that give way, look for support from the 55-day SMA near 103.02 itself.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

USD/CAD is trading flat on the session. Economists at Scotiabank analyze the pair’s outlook.

Resistance around 1.3540 firms

Short-term trend signals are weak, supporting the outlook for more range trading in the near term. But the weekly chart – at the moment – reflects another firm rejection of the 1.3540/1.3550 peaks seen in January and a weak close for funds on the day should see spot prices have a run at last week’s low around 1.3360 in the week ahead.

Minor, intraday support sits at 1.3440, with resistance at 1.3490/1.3500.

GBP/USD continues to pivot around 1.2600. Economists at Scotiabank analyze the pair’s outlook.

Medium-term support at 1.2500/1.2520 looks solid

Short-term price action looks a little soft but the weekly pattern of trade is shaping up a little more constructively for the Pound Sterling (GBP), with a solid rebound from the early week low putting a potential bull ‘hammer’ signal on the weekly chart (contingent on a high close for the GBP today).

Medium-term support at 1.2500/1.2520 looks solid now. Intraday support is 1.2575.

Resistance is 1.2640.

The battle for interest rate support in currency markets continues. Kit Juckes, Chief Global FX Strategist at Société Générale, analyzes EUR/USD outlook.

ECB talk of tightening is both very unlikely and a bad idea

The FX market’s strong focus on monetary policy, and the common refrain from major central banks that they think markets are pricing in rate cuts too soon, has helped EUR/USD meander around dispute a yawning growth divide.

If we were to see talk of a Fed rate hike (which is not in our forecasts at all) EUR/USD would fall.

The lack of growth in Europe means that ECB talk of tightening is both very unlikely and a bad idea.

Gold price is treading water while defending the $2,030 level. Economists at Commerbznka analyze the yellow metal’s outlook.

Optimism for rapid interest rate cuts only to return if inflation surprises to the downside

The direction of the Gold market has long been driven by expectations of US interest rate policy. At present, these are still very much determined by Fed Chairman Powell's indication that inflation must first fall sustainably before interest rates can be cut.

The next litmus test will be next Tuesday when the US inflation data for January is published. However, optimism for rapid interest rate cuts is only likely to return if the figures surprise to the downside. We do not expect this to happen: Gold is therefore unlikely to leave its trading range between a good $2,050 and $2,000.

- USD/CAD trades sideways near 1.3450 ahead of Canada’s labor market data.