- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(raw materials / closing price /% change)

Oil 56.82 -0.66%

Gold 1,282.00 +0.49%

(index / closing price / change items /% change)

Nikkei -23.78 22913.82 -0.10%

TOPIX +4.31 1817.60 +0.24%

Hang Seng -86.74 28907.60 -0.30%

CSI 300 -6.24 4048.01 -0.15%

Euro Stoxx 50 -3.73 3655.04 -0.10%

FTSE 100 +16.61 7529.72 +0.22%

DAX +3.15 13382.42 +0.02%

CAC 40 -9.21 5471.43 -0.17%

DJIA +6.13 23563.36 +0.03%

S&P 500 +3.74 2594.38 +0.14%

NASDAQ +21.33 6789.12 +0.32%

S&P/TSX -26.44 16105.35 -0.16%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1594 +0,08%

GBP/USD $1,3114 -0,37%

USD/CHF Chf0,99999 +0,06%

USD/JPY Y113,86 -0,12%

EUR/JPY Y132,01 -0,04%

GBP/JPY Y149,327 -0,48%

AUD/USD $0,7677 +0,44%

NZD/USD $0,6960 +0,99%

USD/CAD C$1,27269 -0,38%

00:00 New Zealand RBNZ Press Conference

02:50 Japan Current Account, bln September 2380.4 2375.4

02:50 Japan Core Machinery Orders, y/y September 4.4% 1.9%

02:50 Japan Core Machinery Orders September 3.4% -1.8%

03:30 Australia Home Loans September 1.0% 3.0%

04:30 China PPI y/y October 6.9% 6.6%

04:30 China CPI y/y October 1.6% 1.8%

08:00 Japan Eco Watchers Survey: Current October 51.3 50.6

08:00 Japan Eco Watchers Survey: Outlook October 51

09:45 Switzerland Unemployment Rate (non s.a.) October 3.0% 3.0%

10:00 Germany Current Account September 17.8

10:00 Germany Trade Balance (non s.a.), bln September 20.0

12:00 Eurozone ECB Economic Bulletin

13:00 Eurozone EU Economic Forecasts

16:30 Canada New Housing Price Index, MoM September 0.1% 0.2%

16:30 Canada New Housing Price Index, YoY September 3.8%

16:30 U.S. Continuing Jobless Claims 1884 1890

16:30 U.S. Initial Jobless Claims 229 231

18:00 U.S. Wholesale Inventories September 0.8% 0.9%

Major US stock indexes finished trading above zero, but growth was limited by doubts about the decision of the Republican tax plan and controversial corporate reporting.

Edition of Washington Post, citing its sources reported that the leader of the Republican Party in the Senate considering delay possible entry into force in the US corporate tax rate reduction for one year. Recall, on Thursday posted a Republican tax reform plan, the key point of which is to reduce the tax rate on corporate profits to 20% from the current 35%. The S & P rose by about 21% since the election of Donald Trump's president in November last year, in part on the background of his promise to cut taxes for businesses.

Among the corporate nature of the message it is worth noting the disappointing quarterly results Snap (SNAP): Following the results of the third quarter, the company reported a loss of $ 12:14 per share (the average forecast of analysts anticipated - $ 12:15) on revenue of $ 207.9 million (analysts' forecasts $ 236.71 million.). as well as the rate of DAU (daily Active users) at the level of 178 million. (the average forecast of 183 million). SNAP shares have fallen by 22% in response to the quarterly report, but did rebound after the release of a report that Chinese technological giant Tencent (TCEHY) bought a 12% stake in the company. Total trading shares on the SNAP fell to 15: 54%.

Component DOW index completed trades mixed (plus 13, minus 17). leader of growth were the shares of Merck & Co., Inc. (MRK, + 1.74%). Outsider were shares of JPMorgan Chase & Co. (JPM, -1.28%).

Most sectors of the S & P Index recorded an increase. Most consumer goods sector grew (+ 0.6%). It showed the greatest decrease in raw materials sector (-0.4%).

At the close:

DJIA + 0.03% 23,554.48 +6.06

Nasdaq -0.27% 6,767.78 -18.65

S & P -0.02% 2,590.58 -0.55

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.2 million barrels from the previous week. At 457.1 million barrels, U.S. crude oil inventories are in the upper half of the average range for this time of year.

Total motor gasoline inventories decreased 3.3 million barrels last week, and are in the lower half of the average range. Finished gasoline inventories increased, but blending components inventories decreased last week.

Distillate fuel inventories decreased by 3.4 million barrels last week and are in the lower half of the average range for this time of year. Propane/propylene inventories decreased by 1.1 million barrels last week, and are in the lower half of the average range. Total commercial petroleum inventories decreased by 9.1 million barrels last week.

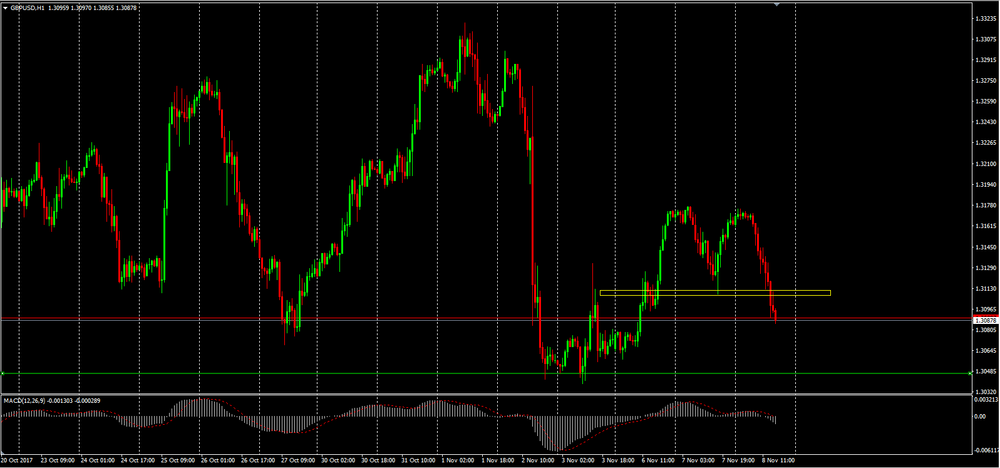

As we can see on 1h time frame chart, it is possible to see a chart pattern "Double Top" which the neckline has already been broken.

Therefore, it might be possible to see a depreciation of the British pound agaisnt the U.S dollar to values close to 1.305

U.S. stock-index futures were flat on Wednesday as earnings season winds down and investors closely watch Republican efforts to pass the tax bill.

Global Stocks:

Nikkei 22,913.82 -23.78 -0.10%

Hang Seng 28,907.60 -86.74 -0.30%

Shanghai 3,414.91 +1.33 +0.04%

S&P/ASX 6,016.27 +1.92 +0.03%

FTSE 7,516.25 +3.14 +0.04%

CAC 5,470.35 -10.29 -0.19%

DAX 13,387.62 +8.35 +0.06%

Crude $57.03 (-0.30%)

Gold $1,281.90 (+0.48%)

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 1,122.00 | -1.17(-0.10%) | 94238 |

| Apple Inc. | AAPL | 174.44 | -0.37(-0.21%) | 91553 |

| AT&T Inc | T | 33.3 | 0.23(0.70%) | 840278 |

| Barrick Gold Corporation, NYSE | ABX | 14.1 | 0.11(0.79%) | 10129 |

| Boeing Co | BA | 266 | -0.13(-0.05%) | 523 |

| Chevron Corp | CVX | 117.39 | 0.15(0.13%) | 244553 |

| Cisco Systems Inc | CSCO | 34.38 | -0.02(-0.06%) | 1805 |

| Citigroup Inc., NYSE | C | 72.62 | -0.09(-0.12%) | 691636 |

| Exxon Mobil Corp | XOM | 83.63 | 0.05(0.06%) | 482 |

| Facebook, Inc. | FB | 180 | -0.25(-0.14%) | 578263 |

| FedEx Corporation, NYSE | FDX | 222.11 | 0.95(0.43%) | 48700 |

| Ford Motor Co. | F | 12.17 | 0.01(0.08%) | 5623 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.52 | -0.03(-0.21%) | 62356 |

| General Electric Co | GE | 20.31 | 0.10(0.49%) | 171648 |

| General Motors Company, NYSE | GM | 41.75 | 0.05(0.12%) | 6810 |

| Goldman Sachs | GS | 239.49 | -0.32(-0.13%) | 1291 |

| Home Depot Inc | HD | 163.7 | 0.04(0.02%) | 1661 |

| Intel Corp | INTC | 46.68 | -0.10(-0.21%) | 5671 |

| International Business Machines Co... | IBM | 151.7 | 0.35(0.23%) | 2060 |

| JPMorgan Chase and Co | JPM | 98.6 | -0.15(-0.15%) | 9964 |

| Microsoft Corp | MSFT | 84.18 | -0.09(-0.11%) | 1111167 |

| Starbucks Corporation, NASDAQ | SBUX | 57.01 | -0.21(-0.37%) | 2719 |

| Tesla Motors, Inc., NASDAQ | TSLA | 304.63 | -1.42(-0.46%) | 20334 |

| The Coca-Cola Co | KO | 45.85 | -0.09(-0.20%) | 4528 |

| Travelers Companies Inc | TRV | 132.44 | -1.28(-0.96%) | 100 |

| Twitter, Inc., NYSE | TWTR | 19.88 | 0.22(1.12%) | 163311 |

| Verizon Communications Inc | VZ | 45.56 | -0.01(-0.02%) | 3994 |

| Wal-Mart Stores Inc | WMT | 89 | 0.05(0.06%) | 11818 |

| Walt Disney Co | DIS | 102 | 0.39(0.38%) | 1976 |

| Yandex N.V., NASDAQ | YNDX | 32.92 | 0.34(1.04%) | 2846 |

EURUSD: 1.1545-60 (EUR 1.33bln) 1.1600 (980m) 1.1640 (845m) 1.1700 (505 m)

USDJPY: 112.25-30 (USD 1.68bln) 113.50 (695m) 113.70-75 (1.05bln) 113.95-114.00(980m) 114.50 (1.34bln) 114.75 (605m) 115.00 (600m)

GBPUSD: 1.3050-55 (GBP 545m) 1.3090 (500m) 1.3248 (320m)

AUDUSD: 0.7640-50 (AUD 520m) 0.7675-80(460m) 0.7750-55 (340m) 0.7800-05(365m)

NZD/USD: 0.6920-25 (NZD 645m), 0.6950 (655m)

AUDNZD: 1.1200 (AUD 1.58bln)

The trend in housing starts was 216,770 units in October 2017, compared to 215,153 units in September 2017, according to Canada Mortgage and Housing Corporation (CMHC). This trend measure is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR) of housing starts.

"The trend in housing starts essentially held steady in October following a decrease in September," said Bob Dugan, CMHC's chief economist. "Nevertheless, new home construction remains very strong in 2017, as the seasonally adjusted number of starts has been above 200,000 units in nine of ten months so far this year."

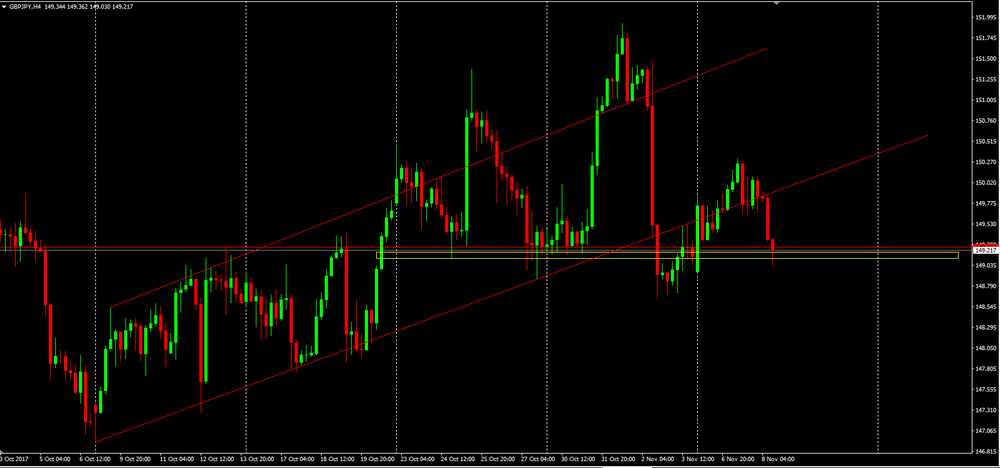

GBP/JPY on 4 hours time frame chart we can see that the price is in a critical zone.

The price at moment is close to a support line that might be relevent as soon as it is broken.

Besides the support level, we also have the possibilit to confirm a chart pattern (Head and Shoulders) which it reinforces the idea of a possible bearish movement against yen.

-

To grow by 2.2 pct in 2018 (previous forecast +1.6 pct)

-

Call for one-off extension of brexit negotiating timeframe to avoid worst case scenario of hard exit

-

German economy is gradually heading toward a boom phase

-

Expectations about UK's future trading relationships were dragging on spending by companies

-

Recruitment difficulties had intensified and were above normal in a range of activities

-

Employment intentions pointed to modest growth in staffing over the next six months

EUR/USD: 1.1545-55(1.1 b), 1.1600(911 m), 1.1640(753 m), 1.1700(503 m).

USD/JPY: 112.25-30(988 m), 113.50(691 m), 113.72-75(1.05 b),113.95-114.00(980 m), Y114.50(1.34 b), 114.75(605 m), 115.00(598 m).

GBP/USD: 1.3050-55(542 m), 1.3090(497 m), 1.3248(319 m).

AUD/USD: 0.7640-50(517 m), 0.7675-80(457 m), 0.7750-55(336 m),0.7800-05(365 m).

NZD/USD: 0.6920-25(642 m), 0.6950(652 m).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1710 (3801)

$1.1662 (958)

$1.1635 (758)

Price at time of writing this review: $1.1599

Support levels (open interest**, contracts):

$1.1552 (5757)

$1.1529 (8287)

$1.1500 (6035)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 8 is 150553 contracts (according to data from November, 7) with the maximum number of contracts with strike price $1,1600 (8287);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3271 (1890)

$1.3235 (634)

$1.3204 (1281)

Price at time of writing this review: $1.3155

Support levels (open interest**, contracts):

$1.3108 (1115)

$1.3060 (1306)

$1.3030 (2506)

Comments:

- Overall open interest on the CALL options with the expiration date December, 8 is 39262 contracts, with the maximum number of contracts with strike price $1,3200 (3183);

- Overall open interest on the PUT options with the expiration date December, 8 is 38105 contracts, with the maximum number of contracts with strike price $1,3000 (4620);

- The ratio of PUT/CALL was 0.97 versus 0.98 from the previous trading day according to data from November, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

To decide on whether to declare North Korea a state sponsor of terrorism at end of Asia trip

-

Believes any talks with North Korea would require reducing threats, ending provocations and movement toward denuclearization

China's exports grew at a slower-than-expected pace in October, while imports surged on domestic demand, official data cited by rttnews.

In dollar terms, exports climbed 6.9 percent year-over-year in October, data from the General Administration of Customs revealed.

Shipments were forecast to climb 7.1 percent after rising 8.1 percent in September.

Meanwhile, imports surged 17.2 percent in October from a year ago, faster than the expected growth of 17.0 percent.

Consequently, the trade surplus totaled $38.2 billion in October versus the expected level of $39.1 billion. At the same time, the trade surplus with the U.S. decreased to $26.6 billion.

After a strong start to the week, global stock markets were broadly lower in Asia on Wednesday, though Hong Kong equities outperformed as strong gains in one of the city's biggest share listings this year drove buying interest. Solid buying pushed several stock indexes, including those in Australia, Japan, and Hong Kong, to multiyear highs on Tuesday, but that was followed by a muted performance overnight on Wall Street.

Dow industrials eked out a small gain on Tuesday to end in record territory, but the broader market was weighed down by a selloff in financials, consumer discretionary and small-cap stocks amid concerns over the timing and ultimate shape of tax legislation working its way through Congress.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.