- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | China | PPI y/y | April | 0.4% | 0.6% |

| 01:30 | China | CPI y/y | April | 2.3% | 2.5% |

| 05:00 | Japan | Consumer Confidence | April | 40.5 | 40.3 |

| 12:30 | U.S. | Continuing Jobless Claims | 1671 | 1670 | |

| 12:30 | Canada | New Housing Price Index, MoM | March | 0% | 0% |

| 12:30 | Canada | New Housing Price Index, YoY | March | 0.1% | |

| 12:30 | U.S. | Initial Jobless Claims | 230 | 220 | |

| 12:30 | U.S. | PPI, y/y | April | 2.2% | 2.3% |

| 12:30 | U.S. | PPI, m/m | April | 0.6% | 0.2% |

| 12:30 | U.S. | PPI excluding food and energy, Y/Y | April | 2.4% | 2.5% |

| 12:30 | U.S. | PPI excluding food and energy, m/m | April | 0.3% | 0.2% |

| 12:30 | Canada | Trade balance, billions | March | -2.9 | -2.45 |

| 12:30 | U.S. | International Trade, bln | March | -49.4 | -50.2 |

| 12:30 | U.S. | Fed Chair Powell Speaks | |||

| 14:00 | U.S. | Wholesale Inventories | March | 0.2% | 0% |

| 14:45 | U.S. | FOMC Member Bostic Speaks | |||

| 17:15 | U.S. | FOMC Member Charles Evans Speaks | |||

| 23:30 | Japan | Labor Cash Earnings, YoY | March | -0.8% | |

| 23:30 | Japan | Household spending Y/Y | March | 1.7% | 1.7% |

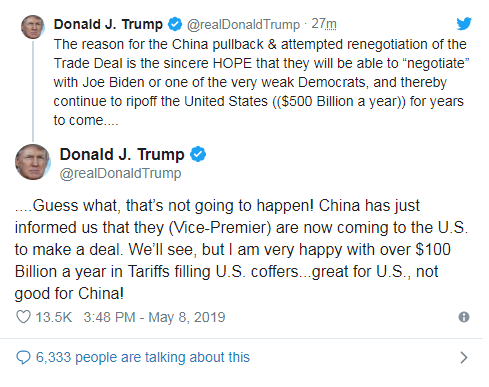

Major US stock indices predominantly declined as investors digested a mixed stream of reports on the US-China trade dispute ahead of a critical round of negotiations between the two countries.

US President Trump helped ease selling pressure on the market by writing Twitter this morning that Chinese Vice Premier Liu He is going to Washington to “make a deal.” However, his next statement “Let's See” made market participants temper expectations and contributed to maintaining market uncertainty.

Later, White House spokeswoman Sarah Sanders confirmed Trump's words that China intends to make a deal this week. She told reporters that the White House received "signs" that the Chinese delegation arriving in Washington wanted to conclude a trade agreement.

Earlier it was reported that Chinese Vice Premier Liu He should visit the United States on Thursday and Friday for trade talks. At the same time, Beijing said it would take the "necessary" countermeasures if Washington raises the tariffs on imports of Chinese goods by $ 200 billion from 10% to 25% on Friday.

Investors are concerned that the United States and China will not be able to resolve the trade agreement dispute before new tariffs are introduced on Friday that threaten Trump. According to Reuters, Chinese officials have abandoned key trade deal agreements previously reached, undermining hopes that the Chinese delegation, led by Deputy Prime Minister Liu He, will be able to save the deal this week.

Most of the components of DOW finished trading in positive territory (19 out of 30). The growth leader was The Walt Disney Company (DIS, + 1.42%). Intel Corporation (INTC; -1.84%) turned out to be an outsider.

Almost all sectors of the S & P recorded an increase. The exception is the utilities sector (-0.9%). The largest growth was shown by the conglomerate sector (+ 0.6%).

At the time of closing:

Dow 25,967.60 +2.51 + 0.01%

S & P 500 2,879.43 -4.62 -0.16%

Nasdaq 100 7,943.32 --20.44 -0.26%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | China | PPI y/y | April | 0.4% | 0.6% |

| 01:30 | China | CPI y/y | April | 2.3% | 2.5% |

| 05:00 | Japan | Consumer Confidence | April | 40.5 | 40.3 |

| 12:30 | U.S. | Continuing Jobless Claims | 1671 | 1670 | |

| 12:30 | Canada | New Housing Price Index, MoM | March | 0% | 0% |

| 12:30 | Canada | New Housing Price Index, YoY | March | 0.1% | |

| 12:30 | U.S. | Initial Jobless Claims | 230 | 220 | |

| 12:30 | U.S. | PPI, y/y | April | 2.2% | 2.3% |

| 12:30 | U.S. | PPI, m/m | April | 0.6% | 0.2% |

| 12:30 | U.S. | PPI excluding food and energy, Y/Y | April | 2.4% | 2.5% |

| 12:30 | U.S. | PPI excluding food and energy, m/m | April | 0.3% | 0.2% |

| 12:30 | Canada | Trade balance, billions | March | -2.9 | -2.45 |

| 12:30 | U.S. | International Trade, bln | March | -49.4 | -50.2 |

| 12:30 | U.S. | Fed Chair Powell Speaks | |||

| 14:00 | U.S. | Wholesale Inventories | March | 0.2% | 0% |

| 14:45 | U.S. | FOMC Member Bostic Speaks | |||

| 17:15 | U.S. | FOMC Member Charles Evans Speaks | |||

| 23:30 | Japan | Labor Cash Earnings, YoY | March | -0.8% | |

| 23:30 | Japan | Household spending Y/Y | March | 1.7% | 1.7% |

The

U.S. Energy Information Administration (EIA) revealed that crude inventories fell

by 3.963 million barrels in the week ended May 3. Economists had forecast an

increase of 1.900 million barrels.

At

the same time, gasoline stocks declined by 0.596 million barrels, while

analysts had expected a drop of 1.000 million barrels. Distillate stocks reduced

by 0.159 million barrels, while analysts had forecast a decrease of 0.500 million

barrels.

Meanwhile,

oil production in the U.S. decreased by 100,000 barrels a day to 12.200 million

barrels a day.

U.S.

crude oil imports averaged 6.7 million barrels per day last week, down by

721,000 barrels per day from the previous week.

- Says it is hard to have a recession with unemployment and rates this low

- Feels good about financial stability

U.S. stock-index futures fell on Wednesday, as investors continued closely monitoring developments around U.S.-China trade talks.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,602.59 | -321.13 | -1.46% |

Hang Seng | 29,003.20 | -359.82 | -1.23% |

Shanghai | 2,893.76 | -32.63 | -1.12% |

S&P/ASX | 6,269.10 | -26.60 | -0.42% |

FTSE | 7,242.66 | -17.81 | -0.25% |

CAC | 5,397.75 | +2.00 | +0.04% |

DAX | 12,146.59 | +53.85 | +0.45% |

Crude oil | 61.50 | +0.16% | |

Gold | 1,288.40 | +0.22% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 178.77 | -0.35(-0.20%) | 3599 |

ALCOA INC. | AA | 25.1 | -0.08(-0.32%) | 3949 |

ALTRIA GROUP INC. | MO | 52.71 | -0.23(-0.43%) | 2014 |

Amazon.com Inc., NASDAQ | AMZN | 1,917.35 | -3.65(-0.19%) | 60438 |

American Express Co | AXP | 118 | -0.22(-0.19%) | 1485 |

AMERICAN INTERNATIONAL GROUP | AIG | 49.8 | -0.50(-0.99%) | 3614 |

Apple Inc. | AAPL | 202.09 | -0.77(-0.38%) | 440454 |

AT&T Inc | T | 30.4 | -0.13(-0.43%) | 25139 |

Boeing Co | BA | 357.5 | 0.27(0.08%) | 48324 |

Caterpillar Inc | CAT | 133.2 | -0.47(-0.35%) | 13628 |

Chevron Corp | CVX | 118.19 | -0.08(-0.07%) | 1895 |

Cisco Systems Inc | CSCO | 53.33 | -0.12(-0.22%) | 19067 |

Citigroup Inc., NYSE | C | 67.75 | -0.41(-0.60%) | 36085 |

Deere & Company, NYSE | DE | 157.99 | 0.23(0.15%) | 909 |

Exxon Mobil Corp | XOM | 76.79 | 0.07(0.09%) | 2264 |

Facebook, Inc. | FB | 189.25 | -0.52(-0.27%) | 87843 |

FedEx Corporation, NYSE | FDX | 179.93 | -0.73(-0.40%) | 3788 |

Ford Motor Co. | F | 10.36 | -0.02(-0.19%) | 89544 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.45 | 0.01(0.09%) | 41998 |

General Electric Co | GE | 10.12 | 0.01(0.10%) | 130790 |

General Motors Company, NYSE | GM | 38.5 | -0.03(-0.08%) | 7285 |

Goldman Sachs | GS | 201.7 | -0.93(-0.46%) | 1994 |

Google Inc. | GOOG | 1,172.00 | -2.10(-0.18%) | 3607 |

Home Depot Inc | HD | 194.72 | -0.05(-0.03%) | 2356 |

Intel Corp | INTC | 50.35 | -0.13(-0.26%) | 35934 |

International Business Machines Co... | IBM | 137.97 | 0.33(0.24%) | 6710 |

Johnson & Johnson | JNJ | 139.95 | -0.02(-0.01%) | 3227 |

JPMorgan Chase and Co | JPM | 112.75 | -0.46(-0.41%) | 31117 |

McDonald's Corp | MCD | 198 | -0.04(-0.02%) | 2021 |

Merck & Co Inc | MRK | 77.99 | 0.09(0.12%) | 1123 |

Microsoft Corp | MSFT | 125.25 | -0.27(-0.22%) | 95042 |

Nike | NKE | 82.4 | -0.14(-0.17%) | 4003 |

Pfizer Inc | PFE | 40.85 | 0.02(0.05%) | 3665 |

Procter & Gamble Co | PG | 104.78 | 0.08(0.08%) | 3174 |

Starbucks Corporation, NASDAQ | SBUX | 77.5 | -0.10(-0.13%) | 9020 |

Tesla Motors, Inc., NASDAQ | TSLA | 246.6 | -0.46(-0.19%) | 62254 |

The Coca-Cola Co | KO | 48.1 | 0.10(0.21%) | 849 |

Travelers Companies Inc | TRV | 141.83 | 0.12(0.08%) | 208 |

Twitter, Inc., NYSE | TWTR | 38.54 | -0.08(-0.21%) | 74426 |

United Technologies Corp | UTX | 135.56 | 0.12(0.09%) | 727 |

UnitedHealth Group Inc | UNH | 238 | -0.05(-0.02%) | 1501 |

Verizon Communications Inc | VZ | 56.6 | -0.03(-0.05%) | 1987 |

Visa | V | 159.36 | -0.85(-0.53%) | 11483 |

Wal-Mart Stores Inc | WMT | 100.3 | -1.00(-0.99%) | 33302 |

Walt Disney Co | DIS | 134.06 | 0.62(0.46%) | 54149 |

Yandex N.V., NASDAQ | YNDX | 36.33 | 0.01(0.03%) | 6195 |

- Want to "hear more" about the idea of whether, if short-term rates again reach zero, Fed bond purchases could be used to set targeted levels for longer-term rates

- Fed may find best option is to enhance existing tools

- No comments on the outlook or monetary policy

The

Canada Mortgage and Housing Corp. (CMHC) reported on Wednesday the seasonally

adjusted annual rate of housing starts was at 235,460 units in April, up 22.6

percent from a downwardly revised 191,981 units in February (originally

192,527units).

Economists

had forecast an annual pace of 196,400 for April.

According

to the report, urban starts surged by 24.0 percent m-o-m last month to 220,387

units, as multiple urban starts climbed by 29.6 percent m-o-m to 175,732 units,

while single-detached urban starts rose by 6.0 percent m-o-m, to 44,655 units.

At the same time, rural starts were estimated at a seasonally adjusted annual

rate of 15,073 units, up 5.5 percent m-o-m.

Barrick (GOLD) reported Q1 FY 2019 earnings of $0.11 per share (versus $0.15 in Q1 FY 2018), beating analysts’ consensus of $0.09.

The company’s quarterly revenues amounted to $2.093 bln (+16.9% y/y), missing analysts’ consensus estimate of $2.148 bln.

GOLD rose to $12.88 (+1.26%) in pre-market trading.

- Changing inflation target could damage credibility

- Pressure on nominal wages is increasing

- Rules out reshuffle of government following EU elections

According to Tom Newton Dunn, the political editor of The Sun newspaper, UK's Prime Minister Theresa May is now close to setting out a timetable for her departure from office.

"I understand Theresa May is now close to setting out a timetable for her departure from No10, with or without Brexit taking place," he tweeted, adding “Friends of Graham Brady say he had "a very productive conversation" with her in No10 yesterday, and is now awaiting firm thoughts from her - which may, or may not, come in time for the 1922 Committee meeting at 5pm today.”

ITV's political editor Robert Peston writes that Labour's negotiations on a Brexit pact with the Government may well be pronounced dead today - partly because the party is launching its EU elections manifesto tomorrow and would presumably need to say something about a possible pact other than "don't know".

- To be clear, there are more talks between the two sides this evening. But those involved tell me they have no expectation a breakthrough will be seized from the jaws of futility.

- Simultaneously Labour's leadership is consulting "all the elements" in and connected to the party, so there's no great backlash from MPs or union leaders as and when the hopes of a Brexit compromise are officially abandoned - which could happen tonight.

- One outstanding question is whether the party should now help the PM at least create the impression a process still exists to deliver Brexit, by providing assurances it won't be wilfully destructive, as and when she introduces the Withdrawal and Implementation Bill to the Commons.

The

Mortgage Bankers Association (MBA) reported on Wednesday the mortgage

application volume in the U.S. rose 2.7 percent in the week ended May 3,

following a 4.3 percent decrease in the previous week.

According to the report, the refinance

applications increased 0.8 percent and applications to purchase a home surged

4.2 percent.

Meanwhile, the average fixed 30-year mortgage

rate decreased to 4.41 percent from 4.42 percent.

“Even

with slower price appreciation in higher-priced markets, home prices are still

rising enough to push average loan sizes higher,” said Joel Kan, an MBA

economist. “With purchase activity increasing and mortgage rate movements

mostly unchanged, the refinance share of applications were at their lowest

level since last November.”

- Negative rate should be exceptional not the norm

Analysts at TD Securities say that the German IP rose 0.5% mom in March, confirming their expectations of a gain against the consensus of a 0.5% mom drop.

- March's gain marks the third increase for IP in the past four months, though it puts 19Q1 IP growth at just 0.5%, leaving a ways to go before a full recovery to its 2018H1 levels. Increases in March IP were fairly broadly-based, with mining/quarrying the only sector to see a decline.

Iris Pang, the economist for Greater China at ING, notes that China's exports contracted 2.7% yoy in April while its imports enjoyed a rise of 4.0% yoy. According to her, these numbers reflect the negative outlook for smart devices and automobile sales globally, and at the same show that China is importing more crude oil for domestic use. Pang also adds that she is not particularly optimistic on China's export and import data in coming months.

- First, the escalation of the trade war means it is likely there will be more tariffs imposed on China's exports, and China's retaliation means more expensive imported goods from the US. So both China's exports and imports will be hit.

- Second, the structural change in smart devices and automobiles will continue. Consumers have been delaying purchases of new smart devices because of a lack of new technology and as they await the rollout of 5G. For automobiles, ride-hailing apps globally, especially in China, have reduced demand for cars. Unless there are big improvements in the convenience of driving and charging a new energy car or even mass production of driverless cars, we believe this structural change in private cars will continue.

- Third, if the trade dispute escalates further, we expect the US to push even harder on its Western allies not to use China-made 5G products and parts, which will dampen China's future exports.

The Bank of England has largely guarded against most of the risks to financial stability that could arise from a no-deal Brexit, but there are still some hazards, according to the institution’s Deputy Governor Dave Ramsden.

“In our view most risks to financial stability that could arise have been mitigated -- although, particularly in the absence of further actions by EU authorities, some potential risks to financial stability, primarily to EU households and businesses, remain,” Ramsden said.

“It’s important to note that financial stability is not the same as market stability. A disruptive Brexit could still be expected to bring significant market volatility,” he added.

The latest report by Reuters, citing sources with knowledge of the talks, says that China had deleted its commitments to resolve core complaints by the US last Friday i.e. theft of intellectual property and trade secrets, forced technology transfers, competition policy, access to financial services, and currency manipulation.

Adding that the document handed over by the Chinese camp was riddled with reversals on said key commitments and undermined core US demands.

The report adds that the stripping of binding legal language in the agreement was greeted with a cold response from Lighthizer as he views changes to Chinese laws as the highest priority for trade talks and is afraid of 'empty reform promises' from China.

Mitul Kotecha, senior emerging markets strategist at TD Securities, notes that the Chinese exports were weaker than expected in April (-2.7% y/y, market 3.0%) while imports were stronger (4.0% y/y, market -2.1%), yielding a much smaller trade surplus than expected ($13.84bn, market $34.56bn).

“The rebound in imports after 4 month of decline (in y/y terms) will likely be seen as further evidence of China’s economic stability. Weaker exports largely reflected a drop in demand from the US. China’s trade surplus with the US was $21.0bn, with exports dropping by -13.1% y/y and imports falling -25.7% y/y. The trade surplus with the US remained elevated at $327.5bn (12m sum), close to record highs, a fact that will likely not go unnoticed in trade talks tomorrow and Friday. Imports from Asia picked up over the month, but exports to every country in Asia dropped (m/m). Indeed, the data appears to add to evidence that China’s growth stability is not being echoed by demand from elsewhere in the region, with higher exports only to Malaysia, Philippines and Taiwan (y/y).”

According to Karen Jones, analyst at Commerzbank, EUR/USD is struggling to overcome resistance and remains capped by 55 day ma at 1.1267.

“For now, we are unable to rule out a retest of the 1.1110 support, but, if seen, we look for this to hold. Be advised that the pattern being traced out is a potential large reversal pattern, we have divergence of the weekly RSI and a 13 count on the weekly chart as well and there is a risk of reversal. Initial resistance is the 100 day ma at 1.1324 and the resistance line at 1.1348 ahead of the 200 day ma at 1.1406. Only above the 200 day ma would this imply reversal. Support at 1.1110 is regarded as the break down point to 2018-2019 support line (connects the lows) at 1.1052, the 1.0963 TD support and the 1.0814/78.6% retracement.”

Standard Chartered analysts note that the US has threatened to raise the tariff rate on $200bn of China’s imports to 25% from 10% on 10 May.

“Two rounds of US tariffs have been implemented so far. ‘Round one’ entailed 25% tariffs on $50bn of goods, split into two tranches of $34bn and $16bn; these were implemented on 6 July and 23 August 2018, respectively. Tariffs were originally due to be raised to 25% on 1 March 2019 (the end of the trade truce), but the US postponed this indefinitely in late February, citing progress on trade talks with China. Mexico, South Korea, Taiwan, the Philippines and Vietnam have emerged as the top five ‘winners’ from this round of tariffs. Raising tariff rates further could increase the benefits to these economies; meanwhile, a sudden trade deal rolling back tariffs could see the winners become losers, and vice versa.”

The number of companies in the UK going into administration — which is when a licensed insolvency “administrator” is appointed to manage a company’s affairs, business, and property for the benefit of the creditors — jumped by 21.8% in Q1 2019 to 451, the highest quarterly level in five years (although the number of administrations is still much lower than during and after the Financial Crisis).

In Q1, the number of small businesses going into liquidation rose 5.1% compared to the same period a year ago, to 4,187. Liquidations also rose 6.3% from the fourth quarter of 2018, according to The UK Insolvency Service.

The number of companies classed as being in “critical distress,” often a precursor to insolvency, surged 17% in the first quarter from a year earlier, to 484,000 mostly small and medium-sized businesses, according to data compiled by financial adviser Begbies Traynor Group Plc. These businesses in “critical distress” now account for about 14% of all active businesses in the UK.

Goldman Sachs analysts now believes that the bounce in oil prices could be limited and the prices are likely to decline by end-2019.

“Beyond the next couple months, however, we continue to believe that all these supply and demand crosscurrents will dissipate to bring a balanced global oil market, once new Permian transport capacity is online and core-OPEC ramps up. … We also discuss in this report, we expect Russia's crude issues to be transient and soon allow for higher production. We, therefore, remain comfortable with our view that oil prices will sequentially decline later this year with our 3Q19 Brent forecast of $65.5/bbl.”

According to the report from Halifax Bank of Scotland, on a monthly basis UK house prices rose by 1.1%, versus a fall of 1.3% March. Economists had expected a 0.1% increase

House prices in the three months to April were 5.0% higher than in the same three months a year earlier

In the latest quarter (February to April) house prices were 4.2% higher than in the preceding three months (November to January).The average house price is now £236,619

In April 2009 average house prices were £154,663 - the low point following the 2008 financial crash. Since then we have seen an increase of £81,956, which reflects a 4.3% average annual increase.

Russell Galley, Managing Director, Halifax, said:

“The average UK house price now stands at £236,619 following a 1.1% monthly rise in April, as demand and supply of housing remained subdued for another month. The index has seen a weaker pace of growth over the last three years, which is consistent with the easing of transactions volumes and housing market activity reflected in RICS, Bank of England and HMRC figures”

The EU's industrial heartlands, its urban regions and Germany are the biggest beneficiaries of the bloc's single market, according to a study that highlights the economic and social inequalities plaguing the bloc. The single market seeks to guarantee free movement of goods, capital, services and labour across the 28-nation EU.

A report by the Bertelsmann Foundation found that Germany, Europe's largest economy, benefited most in absolute terms from the single market, earning an extra 86 billion euros a year because of it. It found that each German was on average 1,046 euros richer as a result of single market membership, while on average EU citizens were only 840 euros richer.

Wealthy, advanced economies near the EU's economic core such as Austria and the Netherlands are also far richer as a result of being members, the report showed, while poorer southern and eastern European countries benefit far less.

Rural regions also profit less from single market membership, the report showed, while highly developed regions such as the south of England were big winners.

The latest trade balance report from the Chinese General Administration of Customs showed that China imported record high oil. Surge in the Chinese oil imports is because the state-run refiners built up stocks of Iranian crude oil anticipating a sanctions clampdown.

Imports last month were 43.73 million tonnes, equal to 10.64 million barrels per day (bpd). That compared with 9.26 million bpd in March and was up 11 percent from the April 2018 level.

China’s Iran crude oil imports rose to 24 million barrels or about 800,000 bpd in April, the highest since August, as buyers rushed in shipments before the U.S. sanctions waiver deadline of early May.

Key highlights of the latest World Gold Council’s (WGC) Gold Demand Trends report for the first quarter of 2019:

Global gold demand grew to 1,053.3 tonnes in the first quarter of 2019. This constitutes a 7% rise year-on-year, largely driven by continued growth in central bank buying, as well as growth in gold-backed exchange-traded funds (ETFs).

Central banks bought 145.5 tonnes of gold – up 68% year-on-year and representing the strongest start to a year since 2013. The increased demand was largely due to diversification and a desire for safe, liquid assets.

ETFs and similar products added 40.3 tonnes in Q1, up 49% year-on-year. Bar and coin investment fell 1% to 257.8 tonnes.

Gold demand for jewellery grew 1% y/y to 530.3 tonnes and boosted by India. In India, jewelry demand grew 5% to 125.4 tonnes – the highest growth since the 1st of 2014.

If there is ultimately a trade agreement between the U.S. and China, it probably won’t be the one that is needed, Larry Summers, former economic advisor to President Barack Obama, told.

“I don’t think the deal is likely to be the right one,” he said.

“There’s a lot of focus on the cosmetics of the bilateral deficit,” added Summers.

“Instead of trying to mobilize the world together to work to address China’s many problems, we’re launching trade attacks on virtually every part of the world and therefore in a sense strengthening China’s position,” Summers said.

Trade tensions are once again escalating between the two nations and fears of an all-out trade war are hitting the stock market.

“We see this each time the president moves in ways that seem designed to disrupt the negotiations,” Summers said of the market’s moves.

What’s more, while the tariffs aren’t likely to cause a “sudden slowdown,” they are “gradually corrosive” to the economy, he said.

In the end, he expects the economy to start to slow down from here.

In March 2019, production in industry was up by 0.5% on the previous month on a price, seasonally and calendar adjusted basis according to provisional data of the Federal Statistical Office (Destatis). Economists had expected a 0.5% decrease. The revised figure shows an increase of 0.4% (provisional value: +0.7%) from February 2019.

In March 2019, production in industry excluding energy and construction was up by 0.4%. Within industry, the production of intermediate goods increased by 0.4% and the production of consumer goods by 1.1%. The production of capital goods remained at the level of the previous month. Outside industry, energy production was up by 0.3% in March 2019 and the production in construction increased by 1.0%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1338 (4243)

$1.1307 (2857)

$1.1294 (83)

Price at time of writing this review: $1.1203

Support levels (open interest**, contracts):

$1.1163 (3004)

$1.1137 (8029)

$1.1106 (5358)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date June, 7 is 115468 contracts (according to data from May, 7) with the maximum number of contracts with strike price $1,1500 (8084);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3236 (2524)

$1.3208 (1937)

$1.3165 (879)

Price at time of writing this review: $1.3069

Support levels (open interest**, contracts):

$1.3005 (427)

$1.2983 (1888)

$1.2926 (927)

Comments:

- Overall open interest on the CALL options with the expiration date June, 7 is 37343 contracts, with the maximum number of contracts with strike price $1,3450 (3269);

- Overall open interest on the PUT options with the expiration date June, 7 is 36739 contracts, with the maximum number of contracts with strike price $1,2700 (3677);

- The ratio of PUT/CALL was 0.98 versus 0.96 from the previous trading day according to data from May, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 69.43 | -2.2 |

| WTI | 61.42 | -1.67 |

| Silver | 14.88 | 0.07 |

| Gold | 1284.196 | 0.29 |

| Palladium | 1327.73 | -0.88 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| Hang Seng | 153.2 | 29363.02 | 0.52 |

| KOSPI | -19.33 | 2176.99 | -0.88 |

| ASX 200 | 12 | 6295.7 | 0.19 |

| FTSE 100 | -120.17 | 7260.47 | -1.63 |

| DAX | -194.14 | 12092.74 | -1.58 |

| Dow Jones | -473.39 | 25965.09 | -1.79 |

| S&P 500 | -48.42 | 2884.05 | -1.65 |

| NASDAQ Composite | -159.53 | 7963.76 | -1.96 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.70114 | 0.33 |

| EURJPY | 123.407 | -0.4 |

| EURUSD | 1.1193 | -0.01 |

| GBPJPY | 144.118 | -0.55 |

| GBPUSD | 1.30712 | -0.16 |

| NZDUSD | 0.66002 | -0.02 |

| USDCAD | 1.34693 | 0.11 |

| USDCHF | 1.01881 | 0.12 |

| USDJPY | 110.25 | -0.39 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.