- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- Tokyo headline CPI inflation cools YoY from 2.6% to 2.4%.

- Tokyo YoY Core CPI prints as-expected at 2.1% versus previous period's 2.3%.

Japan's Consumer Price Index (CPI) annualized inflation for the year ended December 2023 eased back further as inflation continues to cool within the major economic centers of Tokyo, printing at 2.4% compared to November's YoY 2.6%.

Tokyo's Core CPI (headline CPI less the volatility of fresh food prices) broadly met market expectations, printing at 2.1% for the year through December compared to November's annualized print of 2.3%.

Tokyo's 'Core-Core' CPI inflation (Core CPI minus energy prices) also slid, printing at 3.5% YoY compared to November's YoY print of 3.6%.

Market Reaction

The USD/JPY sees sedate trading conditions in early Tuesday market action, shifting within intraday levels above the 144.00 handle.

About Japan's Tokyo Consumer Price Index

The Tokyo Consumer Price Index (CPI), released by the Statistics Bureau of Japan on a monthly basis, measures the price fluctuation of goods and services purchased by households in the Tokyo region. The index is widely considered as a leading indicator of Japan’s overall CPI as it is published weeks before the nationwide reading. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Japanese Yen (JPY), while a low reading is seen as bearish.

A research note from Patrick Artus of Natixis Research is out on Monday, highlighting how the lack of productivity gains for the Eurozone could be a result of structural weakness, rather than the oft-touted cyclical factors.

Eurozone productivity struggles: lack of meaningful technology investment to blame, not hiring trends

There are two opposing interpretations of the lack of productivity gains in the euro zone since late 2017:

- A cyclical interpretation (the fall in the unskilled unemployment rate);

- A structural interpretation (the low level of investment in new technologies... and an ageing labour force).

By comparing OECD countries, we assess the contribution of structural problems to the slowdown in productivity gains in the euro zone.

When we simulate the productivity gap between the United States and the euro zone with recent data on investment in new technologies, R&D spending and the age structure of the working-age population, we find a productivity gains gap in favour of the United States of 2.5 percentage points per year. This shows that structural explanations can fully explain the stagnation of productivity since late 2017 in the euro zone.

- AUD/USD oscillates in a narrow trading band around 0.6719 on Tuesday.

- The markets have priced in a 50% possibility of a rate cut in the March meeting.

- Australian Retail Sales for November are projected to rise 1.2% versus -0.2% prior.

The AUD/USD pair consolidates above the 0.6700 mark during the early Asian session on Tuesday. The speculation that the Federal Reserve (Fed) may not cut their policy rate as quickly as previously expected lends some support to the US Dollar (USD) and weighs on the pair. Investors await the US Consumer Price Index (CPI) data later this week for the near-term catalysts. At press time, AUD/USD is trading at 0.6719, gaining 0.01% on the day.

The US core Consumer Price Index (CPI) is expected to rise 0.2% MoM in December, although energy price volatility poses downside risks. The headline CPI figures for December are estimated to show an increase of 0.2% MoM and 3.2%, respectively.

The Fed Chair Powell recently highlighted inflation progress throughout 2023, fueling speculation that the FOMC may shortly consider cutting interest rates. On Monday, Fed Governor Michelle Bowman said that she now sees US monetary policy as sufficiently restrictive and signaled her willingness to support eventual interest-rate cuts as inflation eases. Expectations for an early rate cut from the FOMC are high with the market pricing in a 50% odds of a March rate cut, according to the CME Group.

On the Aussie front, the Australian Retail Sales for November will be due later on Tuesday. The figure is projected to rise 1.2% from a 0.2% drop in the previous reading. The report could influence the Reserve Bank of Australia (RBA) to maintain interest rates high for longer.

- EUR/JPY slips amid a risk-on mood, as it remains below the Ichimoku Cloud

- Further downside is seen below the Tenkan and Kijun Sen levels as the pair aims toward 156.00.

- The EUR/JPY could shift bullish if buyers reclaim 159.00.

The EUR/JPY begins the week on a lower note, posting losses of 0.17% on Monday amid a risk-on impulse. The cross-currency pair's upward move was quickly rejected at a multi-month support trendline turned resistance, opening the door for a pullback. Therefore, the pair is trading at 157.92 as Tuesday’s Asian session begins, almost flat.

The cross-pair base shifted bearish after diving below the Ichimoku Cloud (Kumo). That along with the cross of the Tenkan-Sen below the Kijun-Sen, has kept the EUR/JPY capped below the 159.00 figure. If sellers would like to extend the downtrend, they must drag prices below the Tenkan-Sen at 157.03, followed by the Kijun-Sen at 156.48, as the pair extends its losses toward 156.00.

On the other hand, if the EUR/JPY reverses its course and achieves a daily close above 158.50, that could open the door for a test of 159.00. On further strength, the pair would aim towards the bottom of the Kumo at 159.30, ahead of challenging 160.00.

EUR/JPY Price Action – Daily Chart

EUR/JPY Technical Levels

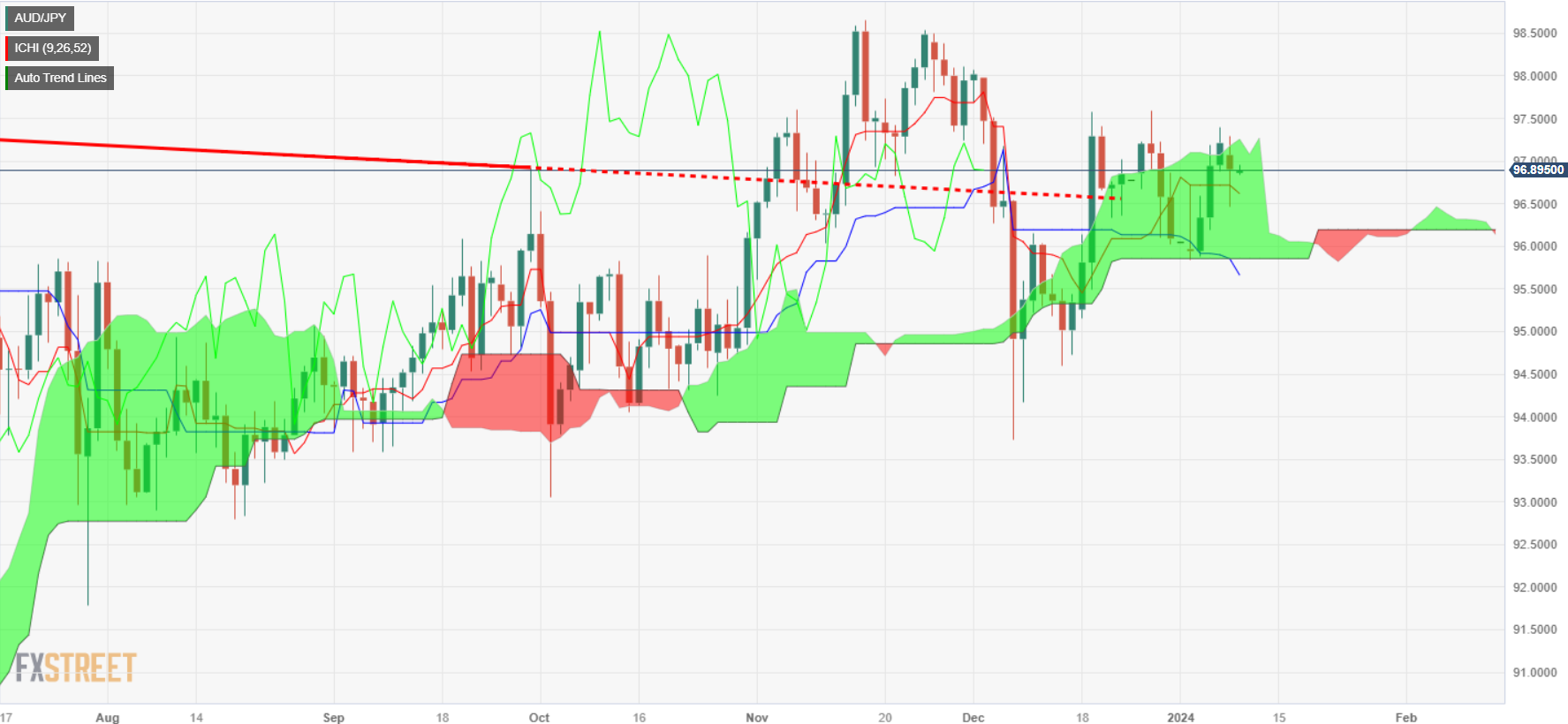

- AUD/JPY drops 0.20%, hovering near Ichimoku Cloud top, as improved market sentiment doesn't dent JPY's appeal.

- Technical setup shows a range-bound trend with immediate resistance at 97.00 and 97.39 swing high.

- Potential downside risks include breach of 96.71 (Tenkan-Sen), targeting Kijun-Sen at 95.82 and 96.00 level.

The AUD/JPY registered modest losses of around 0.20% on Monday despite market sentiment shifting positively, usually a headwind for the safe-haven status of the Japanese Yen (JPY). Consequently, the cross-pair is trading at 96.80, after hitting a daily high of 97.27.

From a technical perspective, the AUD/JPY is range-bound though slightly tilted to the upside, with the pair hovering near the top of the Ichimoku Cloud (Kumo), and above the Tenkan-Sen and the Kijun-Sen. Nevertheless, a breach of the former at around 96.71, could pave the way for challenging the latter just below the 96.00 figure, at 95.82.

Given the backdrop, the AUD/JPY first resistance level is the 97.00 figure. Followed by the January 5 swing high at around 97.39. if buyers step in and push the prices above that level, up next would be the December 27 high at 97.59, followed by the 98.00 mark.

AUD/JPY Price Action – Daily Chart

AUD/JPY Technical Levels

The Federal Reserve (Fed) Governor Bowman is speaking at the South Carolina Bankers Association 2024 Community Bankers Conference

Key quotes

“Inflation could fall further with policy rate held steady for some time

Current policy stance appears sufficiently restrictive.”

“It will eventually become appropriate to lower Fed’s policy rate, should inflation fall closer to 2%.”

“Labor market supply and demand coming into better balance.”

“Upside inflation risks remain, including geopolitical and easing financial conditions.”

“I will remain cautious in my approach to considering changes to Fed policy rate.”

“Remain willing to raise policy rate at a future Fed meeting, should inflation progress stall or reverse.”

“Climate guidance from banking regulators diverts resources from core financial risks.”

Market reaction

The US Dollar Index (DXY) is trading lower on the day at 102.28, as of writing.

- The Euro rose in early Monday trading on rising market sentiment.

- Eurozone economic data managed to mostly beat already-low expectations.

- EU unemployment on the docket for Tuesday.

The EUR/USD climbed on Monday, falling just short of 1.0980 before sliding back into 1.0950 in a consolidation pattern that is becoming familiar in the early stages of 2024.

Eurozone Retail Sales for the year through November declined less than expected, falling 1.1% versus the forecast 1.5% decline, compared to October’s YoY figure of -0.8% (revised upwards from -1.2%).

The Eurozone Sentix Investor Confidence index for January rebounded from -16.8 to -15.8, while the Eurozone Consumer Confidence survey index unexpectedly rose from -15.1 to -15.0, versus the market forecast for a steady hold at -15.1.

Eurozone Retail Sales for November also slid exactly as much as investors were expecting, printing at -0.3% compared to October’s print of 0.4% (revised upwards from 0.1%).

Tuesday will see an update on the Eurozone Unemployment Rate for November, which is forecast to hold steady at 6.5%, while broader markets will be focused on Thursday’s upcoming US Consumer Price Index (CPI) inflation print.

Thursday’s US Consumer Price Index (CPI) inflation print is expected to show slight declines in the near-term core figures, but annualized headline inflation continues to prove sticky, with the CPI for the year through December forecast to tick upwards slightly from 3.1% to 3.2%. Core YoY CPI, meanwhile, is forecast to slip from 4% to 3.8%, and December’s MoM Core CPI is expected to hold steady at 0.3%.

Markets will be looking for signs that inflation will continue to ease, with some investor hopefuls looking for an increasing pace in the reduction of price growth, in order to push the Federal Reserve (Fed) into the next rate cutting cycle sooner rather than later.

EUR/USD Technical Outlook

The EUR/USD rose into 1.0980 on Monday, falling just short of the near-term level and sliding back towards 1.0950 as the pair struggles in near-term consolidation. Intraday action continues to get capped under the 200-hour Simple Moving Average (SMA) near the 1.1000 major handle.

A bullish crossover of the 50-day and 200-day SMAs near 1.0850 is building out a technical floor beneath daily candlesticks, and the near-term ceiling is parked at December’s swing high just shy of 1.1150.

EUR/USD Hourly Chart

EUR/USD Daily Chart

EUR/USD Technical Levels

- EUR/GBP hovers at 0.8590, experiencing a 0.17% loss as bears gain ground.

- The bulls managed to push the cross to 0.8620 earlier in the session but failed to hold the momentum.

- Indicators from the daily chart project bearish sentiment.

- The four-hour chart reinforces bearish bias with RSI nearing oversold territory.

In Monday's session, the EUR/GBP trades at 0.8589, down by 0.17%. The daily chart conveys a bearish outlook, with bears progressively gaining ground. This downbeat vibe is more apparent in the four-hour chart, where indicators are deep in negative territory.

The negative slope and territory of the Relative Strength Index (RSI) reflect that sellers dominate the current chart. This bearish trend is further reinforced by the cross's position, which is lodged below the key Simple Moving Averages (SMAs) - 20, 100, and 200-day, a clear indication that there is a significant hurdle for potential buyers as the bears have taken the reins. Furthermore, the rising red bars of the Moving Average Convergence Divergence (MACD) insinuate an ongoing bearish momentum, symbolizing a negative outlook for the bulls.

Zooming into the four-hour chart, the bearish dominance is strikingly clear. The RSI is approaching oversold levels, which often indicates an overwhelming amount of selling activity but is often followed by an upward correction. Concurrently, the rising red bars of the four-hour Moving Average Convergence Divergence (MACD) reiterates the strength of the selling momentum.

EUR/GBP technical levels

EUR/GBP daily chart

-638403468523869806.png)

While the greenback survives just above the 102.00 region, the risk-associated complex appears to have regained its smile at the beginning of a week dominated by the upcoming release of US inflation figures measured by the CPI.

Here is what you need to know on Tuesday, January 9:

The US Dollar Index (DXY) started the week with modest losses just above the 102.00 barrier amidst investors’ preference for risk-linked assets and a corrective decline in US yields across the board.

US stocks accelerated the upside and appeared on track to challenge the record high seen earlier in the month amidst the weaker dollar and a firm appetite for the risk complex.

EUR/USD left behind Friday’s inconclusive price action and printed decent gains to the 1.0980 zone, where some initial resistance turned up. Bolstering the daily uptick in the pair emerged a tepid improvement in the Investor Confidence tracked by the Sentix Index as well as better-than-expected Retail Sales readings in the euro bloc.

GBP/USD maintained the bullish bias for the fourth session in a row, regaining the 1.2700 barrier and beyond, helped by the positive risk-on sentiment.

Declining US yields and the corrective knee-jerk in the greenback favoured the daily pullback in USD/JPY to the 143.60 region, although it reclaimed the 144.00 hurdle towards the end of the NA session.

AUD/USD added to Friday’s small recovery and navigated a volatile session, eventually regaining the 0.6700 level despite the generalized bearish performance in the commodity space.

USD/CAD could not sustain an early move just past 1.3400 the figure on Monday, eventually retreating to the mid-1.3300s against the backdrop of an incipient consolidative theme.

Gold retreated to three-week lows near $2015 per troy ounce amidst traders’ repricing of the likelihood that the Fed might extend its restrictive stance for longer, particularly in response to the December NFP prints. In the same line, Silver set aside two straight sessions of losses and revisited the area below the $23.00 mark.

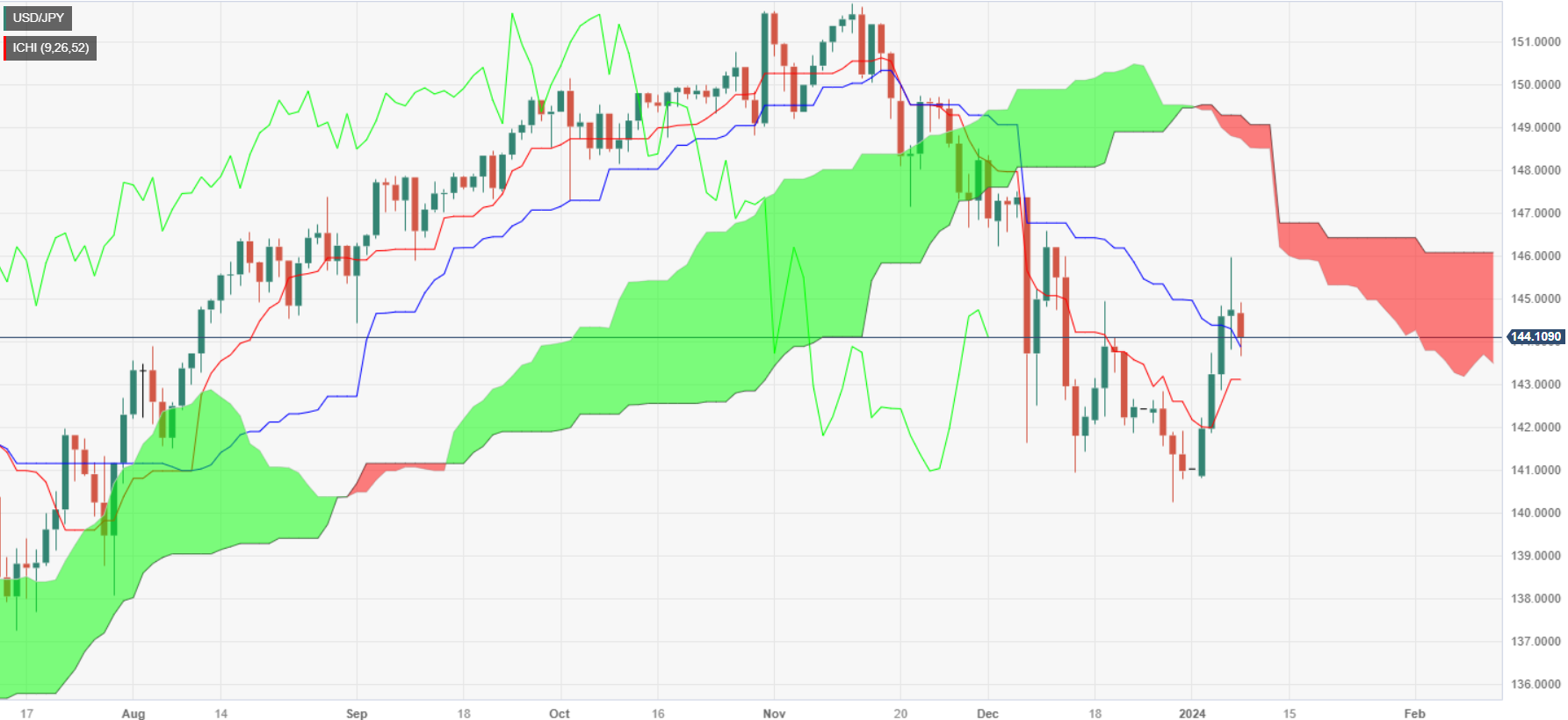

- USD/JPY's 0.33% decline influenced by falling US bond yields and a weaker USD, as market anticipates US inflation report.

- Technical analysis shows bearish trend under Kijun-Sen and Ichimoku Cloud, suggesting potential further declines.

- Immediate supports at 144.00 and 143.00, while a break above 145.00 could signal an upward shift in momentum.

The USD/JPY begins the week on the back foot with the major sliding 0.33%, weighed by falling US Treasury bond yields and a soft US Dollar (USD). The lack of a catalyst on Monday keeps traders focused on the main event of the week, which is the inflation report in the US. At the time of writing, the pair is exchanging hands at 144.11.

From a technical standpoint, the daily chart suggests the pair is bearishly biased, even though it briefly tested a September 11 swing low of 145.89, though buyers were quickly rejected at that level, achieving a daily close at around 144.59 last Friday.

The USD/JPY had remained downward pressured, below the Kijun-Sen and the Ichimoku Cloud (Kumo), suggesting that the downtrend remains in place. That, along with the Chikou Span remaining in bearish territory, would keep sellers hopeful of lowering prices.

The major’s first support is seen at 144.00, followed by the Tenkan-Sen level at 143.11, ahead of the 143.00 mark. Once cleared, up next would be the 142.00 mark, followed by the December 28 swing low of 140.25.

On the other hand, if buyers lift the USD/JPY above 145.00, that will pave the way for further upside.

USD/JPY Price Action – Daily Chart

USD/JPY Technical Levels

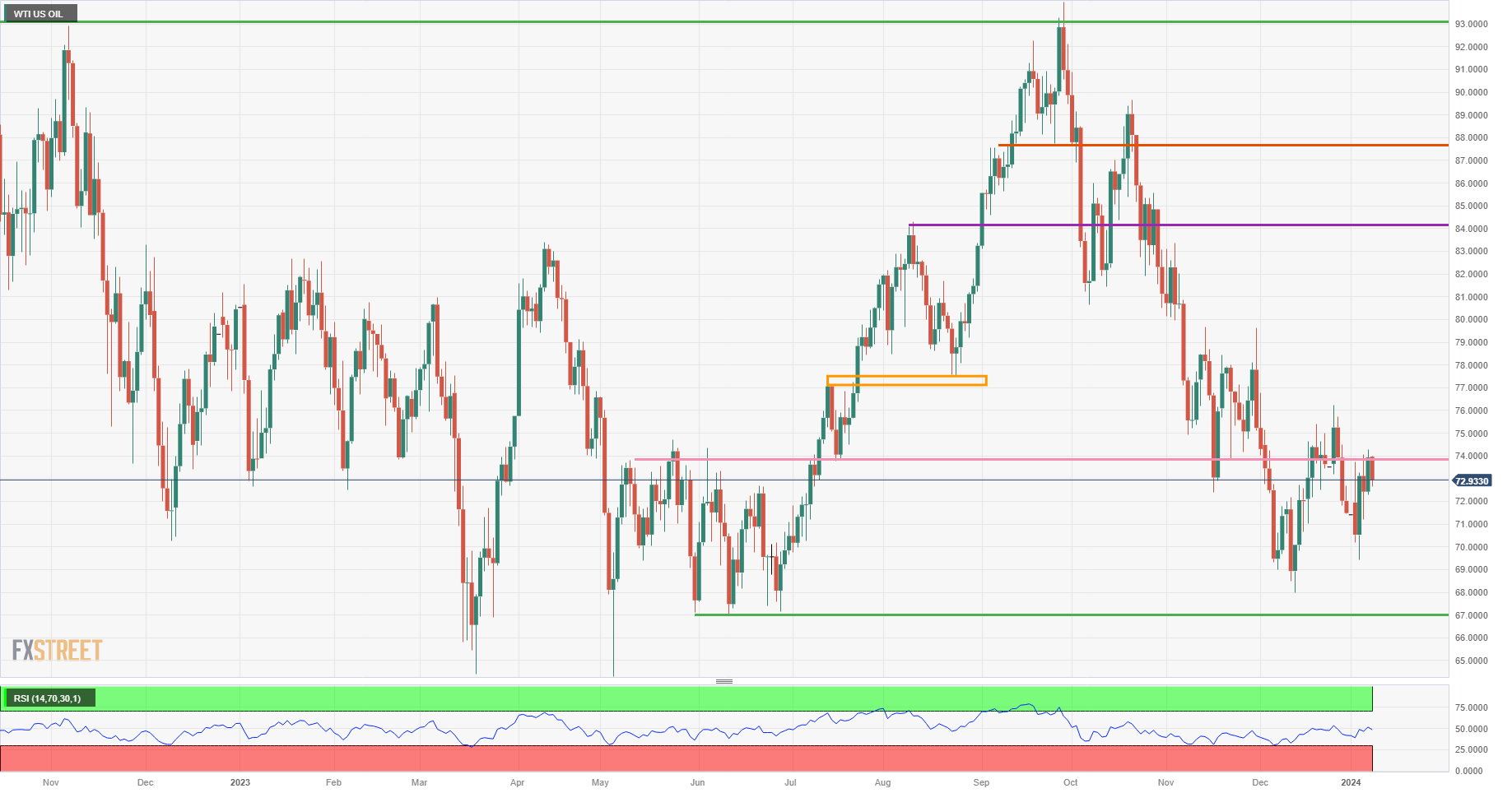

- WTI's sharp decline triggered by Saudi price cuts to Asian markets, amidst increased oil production by some OPEC members.

- Geopolitical tensions in the Middle East initially boosted oil prices, but escalating supply eases concerns.

- US diplomatic efforts intensify in the Middle East, as conflict impacts global shipping and oil market sentiments.

West Texas Intermediate (WTI) slid more than 4% on Monday as Saudi Arabia implemented price cuts, while the Organization of Petroleum Exporting Countries (OPEC) offset supply concerns amid geopolitical tension in the Middle East. At the time of writing, the US Crude Oil benchmark exchanges hands at $72.21 per barrel, a loss of 4.63%.

US Oil benchmark dropped to $70.16 on Middle East conflict concerns

Since the beginning of the year, WTI’s rose by 2% amid risks of an escalation in the Middle East conflict between Israel and Hamas. Attacks by Yemen’s Houthis on ships in the Red Sea underpinned Oil prices.

Oil prices dived by rising supply as Crude output production increased in some countries led by Angola, offsetting continuing cuts by Saudi Arabia and other members of the OPEC. Therefore, that sparked Saudi Arabia’s price cut to Asian customers to its lowest level in 27 months, according to Reuters.

Meanwhile, the ongoing crisis in the Middle East gathered attention from the US Secretary of State Anthony Blinken, who held talks with Araba leaders on Monday to increase the efforts pushing for a diplomatic exit to the Gaza war from further spreading.

Nevertheless, the conflict is already weighing economically with rising shipping freight rates, as most ships avoid sailing through the Red Sea.

WTI Price Analysis: Technical outlook

Oil’s leg down on Monday pushed prices towards its daily low of $70.19, but sellers' failure to step in lifted Crude to the brisk of regaining $71.00, which could pave the way to test the 50-day moving averages (DMA) at $75.06. Once hurdled, the next stop would be the $76.00 figure, followed by the 200-DMA at $77.87.

- European equities saw gains to kick off the new trading week.

- Risk appetite recovering on the new week despite macro headwinds.

- German economy continues to lag in step with broader Eurozone economic conditions.

The German DAX led the charge in European equities on Monday, as investors bid up stocks and saw a healthy rebound in risk appetite after 2024 kicked things off with a retreat in market sentiment.

European economic figures on Monday were broadly better than expected as investor optimism carefully threads the needle on a positive outlook on data. Eurozone Retail Sales for the year through November declined less than expected, falling 1.1% versus the forecast 1.5% decline, compared to October’s YoY figure of -0.8% (revised upwards from -1.2%).

The Eurozone Sentix Investor Confidence index for January rebounded from -16.8 to -15.8, while the Eurozone Consumer Confidence survey index unexpectedly rose from -15.1 to -15.0, versus the market forecast for a steady hold at -15.1.

Eurozone Retail Sales for November also slid exactly as much as investors were expecting, printing at -0.3% compared to October’s print of 0.4% (revised upwards from 0.1%).

Structural economic issues continue to loom over the domestic German economy, with an aging population set to worsen an already-steep labor shortage, and the International Monetary Fund is projecting that Germany will be the only G7 country to see real economic decline in 2023.

Germany’s government budget for 2024 was rejected by Germany’s own top court last November, and Germany is scrambling to find a stopgap for a projected 17 billion Euro funding deficit for 2024.

Despite economic concerns swirling around the Eurozone’s single largest economy, European investors found reasons to buy on Monday, sending the German DAX higher by 122 points to close at €16,716.47, gaining nearly three-quarters of a percent. France’s CAC 40 index also closed up at €7,450, climbing 0.4% and gaining almost 30 points.

The Eurostoxx 600 major index also climbed around 0.4% to close up 1.8 points at €478.18. The London FTSE equity index climbed a little under five points to close at £7,694.20, a scant 0.06% higher.

DAX Technical Outlook

The German DAX etched in a third straight gain on Monday, keeping the equity index on the high end after hitting an all-time high of €16,984.44 in December.

The DAX’s current bull run kicked off from a six-month low of €14,618.09, climbing over 16% bottom-to-top.

The DAX is trading into lofty chart territory well above the 200-day Simple Moving Average (SMA) near €15,800, and a bullish crossover by the 50-day SMA is accelerating technical support at the €16,000 major handle.

DAX Daily Chart

DAX Technical Outlook

- GBP/JPY trades at 183.75 with slight losses, stopping bulls after a 2% uptick in the previous three days.

- The bulls presented battled and trimmed losses, which took the cross below the 100-day SMA.

- The daily chart uncovers flat RSI and MACD, representing a halt in the buying momentum.

- The four-hour chart shows little change in overbought conditions.

In Monday's session, the GBP/JPY softened modestly to 183.75. Despite pulling back slightly after a vigorous surge of more than 2% over recent days, the bulls seem to be catching their breath. Neutral to bullish on the daily chart, yet nearing overbought territory in the four-hour chart, the pair remains poised for additional corrections.

According to the technical indicators on the daily chart, the landscape appears somewhat idyllic for the bulls in the long term. The Moving Average Convergence Divergence (MACD) is fairly flat with green bars, indicating a neutral sentiment but with a slight bullish bias. Meanwhile, the Relative Strength Index (RSI) settles in the positive territory, preserving a tight line and suggesting a pause in recent buying momentum. Nonetheless, the pair remains well above the 20,100,200-day Simple Moving Averages (SMAs), implying that the bulls still maintain control in the wider perspective. This bullish dominance is further reinforced by the recent gains, with the pair having advanced more than 2% in the recent three days, thus indicating that buying momentum continues to hold sway over selling momentum.

Shifting to the shorter-term four-hour chart, the indicators paint a similar picture of bull's dominance, albeit with a hint of a possible slowdown. The Moving Average Convergence Divergence (MACD) portrays flat green bars, indicating a continuation of bullish sentiment, yet with a possible pause. The Relative Strength Index (RSI) remains flat within the positive territory, still near overbought conditions. Such positioning could suggest that the bulls are taking a breather, allowing for potential consolidation before the next leg upward. Thus, on a shorter time frame, the prevailing buying momentum appears to be taking a slight recess, providing a chance for sell-side action to develop, but the broader bullish bias remains intact.

GBP/JPY technical levels

GBP/JPY daily chart

-638403373220896204.png)

Atlanta Federal Reserve (Fed) President Raphael Bostic gave some talking points about the 2024 economic outlook while attending the Atlanta Rotary Club on Monday.

Atlanta Fed President Bostic will be taking a regular seat as a voting member on the Federal Open Market Committee (FOMC) in 2024 when seats change hands at the Fed's first meeting of 2024 on January 30-31.

An alternate voting member during the 2023 Fed year, Bostic will maintain a voting presence on the FOMC through 2024, and his perspective on market conditions will carry extra weight as a key policymaker as the Fed heads into the next rate cut cycle.

Highlights:

- Inflation has declined more than initially expected, sees two quarter-point cuts by year-end 2024.

- Short-term inflation measures, specifically three-month to six-month horizons, will matter significantly more in 2024.

- Goods inflation has returned to pre-pandemic levels, but services inflation remains stickier, falling more slowly.

- Is comfortable with the current rate level.

- The immediate goal now is to avoid a meaningful rebound in inflation, Fed will need to pay close attention.

- Fed still needs to give tight policy time to work on cooling off inflation.

- Bostic says the US is on the path to 2% inflation, goal is to remain on that path.

- Headline job number growth has been strong, but caution is needed as recent strength focuses on a relatively small section of the overall economy.

Market reaction

Fed President Bostic's remarks saw a minor uptick in the US Dollar Index (DXY), rising to 102.30 to pare back Monday's early losses, while the S&P 500 equity index is holding onto near-term gains near $4,730 to kick off the new trading week.

- The XAG/USD is rallying during the American session towards the $23.20 level with a current 0.90% increase after bottoming at $22.80.

- Still, the metal holds onto mild losses on the day.

- USD struggles to maintain the previous week's bullish momentum as risks on flows resume.

- Investors await key CPI data on Thursday to place their bets on the Fed.

In Monday's trading session, the silver prices, represented by the XAG/USD pair, took a bullish turn, trading at a higher level of around $23.15. The rally originates from a combination of a weakening Dollar and descending yields, giving silver an advantageous footing at the start of the week.

In its final meeting of 2023, the Federal Reserve recognized a dip in inflation rates and affirmed that 2024 will be free of rate hikes. The Fed even suggested a 75bps easing, leading market speculations to factor in rate cuts for March and May. In that sense, markets now await the next set of data after last week’s strong labor reports, which were offset by the disappointing ISM PMI figures, keeping afloat the dovish rhetoric.

Market attention will shift to the release of the US December Consumer Price Index (CPI) data on Thursday. Projected figures indicate an increase to 3.2% YoY, a subtle rise from prior 3.1% rates. Nevertheless, the anticipated annualized core CPI registers a slight relaxation to 3.8% from November's 4%.

Currently, US bond yields are declining. The 2-year rate stands at 4.32%, while the 5 and 10-year yields are at 3.93% and 3.97%, respectively. These lower yields bolster the appeal of non-yielding metals as the opportunity cost of holding them decreases.

XAG/USD levels to watch

The daily chart indicates that the metal portrays a bearish sentiment, reflecting a dominant selling momentum. Based on the position of the Relative Strength Index (RSI), which is on a negative slope within the negative territory, a heightened selling pressure is evident. The negative bias is further amplified by the Moving Average Convergence Divergence (MACD), which presents flat red bars, indicating that sellers maintain the upper hand, although at a decreasing rate.

When observing the Simple Moving Averages (SMAs), the price's position below the 20, 100, and 200-day SMAs, further implies that bears retain control on a broader scale.

XAG/USD daily chart

-638403335748231586.png)

- AUD/USD remains flat after early dip, with improved market mood and speculations on Fed rate cuts impacting the USD.

- Dallas Fed President's remarks on potential rate hike contrast with declining US inflation expectations in NY Fed survey.

- Investors eye upcoming speeches by Fed officials and key Australian economic indicators, including Building Permits and Retail Sales.

The AUD/USD turned flat during the mid-North American session on Monday after hitting a daily low of 0.6677, but an improvement in traders' appetite weakened the Greenback (USD). Additionally, speculations that the US Federal Reserve (Fed) would cut rates in 2024 remain shy, a headwind for the USD. At the time of writing, the pair trades at 0.6713, almost flat.

AUD/USD hovers at around 0.6710s as market sentiment and expectations of a dovish Fed, weighs on the US Dollar

Wall Street began the week on a positive note, except for the Dow Jones, dragged lower by Boeing’s 737 Max 9 issues that grounded airplanes worldwide. Investors seem confident they would ease monetary policy during the year despite Dallas Fed President Lorie Logan's comments not to rule out another rate hike, as financial conditions had eased. She added that the US central bank should consider slowing its asset runoff.

Data-wise, the US economic docket was scarce, as the New York (NY) Fed revealed in its Survey of Consumer Expectations, which witnessed households downward, revising inflation expectations for one year, to 3%, its lowest level since January 2021. Estimates for three and five years were lowered to 2.6% from 3% and 2.5% from 2.7%, both readings lower than November’s.

Ahead of the week, the US economic docket will feature a speech by the Atlanta Fed President Raphael Bostic at around 17:30 GMT. On the Australian front, the docket will feature Building Permits and Retail Sales, both data for November on its preliminary readings.

AUD/USD Price Analysis: Technical outlook

From a daily chart perspective, the AUD/USD is neutral to upward biased, but buyers need to reclaim the 0.6800 figure so they can threaten to challenge the December 28 high of 0.6871. Once cleared, the next stop would be the 0.6900 figure. Nevertheless, if sellers’ step in and drag prices below 0.6700, look for a fall toward the confluence of the 50 and 200-day moving averages (DMAs) at around 0.6599/72, followed by the November 6 high at around 0.6523.

- Pound Sterling sees a Monday surge as investors try to recover some confidence.

- UK Retail Sales figures due on Tuesday.

- US CPI inflation print to be the pivotal datapoint of the week.

The GBP/USD is bounding higher in a risk-on market session to kick off the new week as broad-market risk appetite steps up in the US market session, pushing the US Dollar (USD) down and giving the rest of the major currencies some breathing room.

The Pound Sterling (GBP) climbed over the 1.2750 barrier against the Greenback, but a lack of meaningful UK economic data on the calendar this week leaves the Cable at the mercy of broad-market flows as markets gear up for another round of US inflation figures due on Thursday with the release of December’s US Consumer Price Index (CPI).

The UK’s BRC Like-For-Like Retail Sales for the year ended December will print early Tuesday, slated to release at exactly 00:01 GMT. BRC Retail Sales last came in at 2.6% YoY in November, and near-term figures are unlikely to recover much ground, down from 6.5% at the same time last year.

US CPI inflation to draw investor attention

Market focus will be squarely on US inflation figures this week as investors grapple with rate cut expectations from the Federal Reserve (Fed). The big question for 2024 is when, not if, the next rate cut cycle will begin, and traders will be looking for signs of deterioration in the US economic outlook with particular emphasis on hopes for continuing price growth declines.

Thursday’s US Consumer Price Index (CPI) inflation print is expected to show slight declines in the near-term core figures, but annualized headline inflation continues to prove sticky, with the CPI for the year through December forecast to tick upwards slightly from 3.1% to 3.2%. Core YoY CPI, meanwhile, is forecast to slip from 4% to 3.8%, and December’s MoM Core CPI is expected to hold steady at 0.3%.

GBP/USD Technical Outlook

The GBP/USD has been plagued by rough chop in recent weeks as the Pound Sterling struggles to develop momentum in either direction against the US Dollar. Monday’s US session rally sparked by a risk-on selloff in the USD sees the Cable knocking into near-term technical resistance as frequent intraday turnarounds etch in a barrier from 1.2760 to 1.2780.

Daily candlesticks emphasis the GBP/USD’s drift, but long-term bids remain supported by a bullish crossover of the 50-day and 200-day Simple Moving Averages (SMA) near 1.2550.

The immediate technical ceiling rests at December’s peak bids near 1.2830.

GBP/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Technical Levels

- The DXY Index declines toward 102.15, challenging 20-day SMA.

- Lower US Treasury yields weigh on the Greenback.

- Investors eye Wednesday’s CPI data from the last month of 2023.

The US Dollar (USD) is currently trading at the 102.15 area, seeing losses due to bulls struggling to sustain the momentum gained last week. Monday’s calendar has nothing relevant to offer, and the focus is set on the Consumer Price Index (CPI) figures from December, due on Wednesday.

In its last 2023 meeting, the Federal Reserve (Fed) mirrored a dovish stance, welcoming moderating inflation and projecting no rate hikes in 2024 alongside a forecasted 75 bps of easing. Current market expectations predict a March rate cut and another in May, hinging on December's CPI report. This dovish posture, coupled with anticipation of impending rate cuts, contributes to a weaker US dollar as lower interest rates decrease foreign investment appeal.

Daily digest market movers: US dollar hesitates ahead of CPI

- The US Dollar is struggling to hold last week's gains, which closed 1% up on Friday.

- Markets await key inflation data, which is expected to have picked up in the last month of 2023. The core measure is forecasted to be 3.8% YoY.

- US Treasury yields experienced a drop, with the 2-year yield at 4.32%, the 5-year yield at 3.94%, and the 10-year yield at 3.98%, adding pressure to the USD.

- According to the CME FedWatch Tool, the Federal Reserve's easing expectations also started to adjust last week. Five rate cuts are now priced in for 2024. Investors are pricing in a hold at the upcoming January meeting but anticipate higher chances of rate cuts in March and May.

Technical Analysis: DXY bears step in as bulls continue weak showing

The indicators on the daily chart reflect a bearish outlook for the USD. The Relative Strength Index (RSI) is currently demonstrating a negative slope in negative territory, which is backed by the bearish sentiment indicated by the Simple Moving Averages (SMAs) and the Moving Average Convergence Divergence (MACD) indicator’s rising red bars.

The index's position above the 20-day SMA while below the 100 and 200-day SMAs indicates that buying pressure is losing momentum to selling pressure in the medium and long-term time frames. This is a signal that the bears are maintaining some dominance.

Support levels: 102.10,102.00,101.80.

Resistance levels: 102.30,102.50, 102.70.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Canadian Dollar broadly turns lower amidst Crude Oil rout.

- Canada economic data docket is thin this week.

- Crude Oil tumbles once again in choppy trading as downside pressure mounts.

The Canadian Dollar (CAD) sees downside pressures across the major currencies board on Monday, getting pushed down the charts by a backsliding Crude Oil market to kick off the second week of 2024.

Canadian International Merchandise Trade Balance and Building Permits, both slated for release on Tuesday, represent the only data showings for the Canadian Dollar on this week’s economic calendar. Markets are still adjusting after last Friday’s US Nonfarm Payrolls (NFP) print saw heavy revisions to previous periods.

Weakening economic figures are the name of the game for data points from Canada, with Tuesday’s Canadian International Merchandise Trade Balance forecast to decline from 2.97 billion to 1.8 billion for November. Meanwhile, Canadian November Building Permits are likewise expected to slip from 2.3% to 2.0%.

Daily digest market movers: Canadian Dollar softens on despondent Crude Oil demand outlook

- Another slump in Crude Oil is dragging down the Canadian Dollar on waffling Middle East barrel prices.

- Saudi Arabia slashed the prices they charge to trading partners in Asia for Saudi crude as production cuts from the Organization of Petroleum Exporting Countries (OPEC) continue to get foiled by slumping barrel demand from key oil market drivers such as China.

- US Crude Oil production continues to pump at or near record levels near 13 million barrels per day.

- The legs continue to get kicked out from underneath broad market expectations of global undersupply that has yet to materialize despite months of production cuts.

- Last Friday’s US NFP goosed market expectations of Fed rate cuts after printing well above expectations, despite a steep downside revision to previous periods’ prints. A firm employment outlook in the US makes it less likely that the Federal Reserve (Fed) will get pushed into a rate cut cycle as soon as investors were initially hoping for.

- Key US data for this week lands on Thursday with another round of the US Consumer Price Index (CPI) inflation print.

- Headline annualized US CPI inflation is expected to tick up slightly from 3.1% to 3.2% for December.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.30% | -0.30% | 0.11% | 0.00% | -0.72% | 0.02% | -0.52% | |

| EUR | 0.30% | 0.00% | 0.42% | 0.31% | -0.40% | 0.32% | -0.22% | |

| GBP | 0.32% | 0.01% | 0.43% | 0.32% | -0.39% | 0.34% | -0.20% | |

| CAD | -0.11% | -0.40% | -0.42% | -0.11% | -0.80% | -0.09% | -0.62% | |

| AUD | 0.01% | -0.29% | -0.29% | 0.12% | -0.70% | 0.02% | -0.51% | |

| JPY | 0.69% | 0.42% | 0.39% | 0.84% | 0.70% | 0.72% | 0.19% | |

| NZD | -0.03% | -0.34% | -0.34% | 0.08% | -0.03% | -0.74% | -0.56% | |

| CHF | 0.52% | 0.22% | 0.23% | 0.64% | 0.53% | -0.18% | 0.54% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Canadian Dollar slides to 3-week low on soft barrel bids, USD/CAD tests 1.3400

The Canadian Dollar (CAD) saw further downside on Monday, sending the Loonie lower against all of its major currency peers. At the time of writing, the Canadian Dollar is down eight-tenths of a percent against the Japanese Yen (JPY), six-tenths of a percent against the Swiss Franc (CHF), and around four-tenths of one percent against both the Pound Sterling (GBP) and the Euro (EUR).

Canadian Dollar losses against the US Dollar (USD) remain limited on Monday, but they are still in the red as the USD/CAD pair extended to test the 1.3400 handle. The Loonie has shed 1.75% against the Greenback bottom-to-top from late December’s bottom bids near 1.3177.

The US Dollar has closed up or mostly flat against the Canadian Dollar for seven consecutive trading days, and Monday is set to chalk in an eighth consecutive loser for the CAD.

A continued upswing in the USD/CAD is set for a challenge from the near-term technical ceiling from the 200-day Simple Moving Average (SMA) just below the 1.3500 major handle, while a downside run into the 1.3200 region will see the pair testing into five-month lows below 1.3175.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- EUR/USD climbs 0.24%, buoyed by softer USD amid increasing speculation of an early Fed rate cut.

- Lower US inflation expectations revealed in New York Fed Survey, alongside Dallas Fed President's remarks, influence market sentiment.

- Eurozone retail sales show a decline, while German factory orders soften; Germany's trade surplus expands, supporting the Euro.

The Euro (EUR) advances against the US Dollar (USD) in early trading on Monday as the Greenback (USD) weakens, with no fundamental reason, except for traders increasing the odds for the first rate cut of the Federal Reserve by its March meeting. At the time of writing, the EUR/USD is trading at 1.0967, gaining 0.24% after hitting a daily low of 1.0922.

EUR/USD rises above 1.0960 boosted by upbeat German data

The US economic docket is light, though the New York Fed recently revealed its Survey of Consumer Expectations. According to Reuters, “Inflation one year from now is expected to be at 3%, the lowest reading since January 2021, versus a projection of 3.4% in November.” The same report showed estimates for three years are at 2.6%, from 3% in November, while price pressures for five years ahead stood at 2.5% lower than the previous reading of 2.7%.

Over the weekend, Dallas Fed President Lorie Logan said the Fed shouldn’t rule out another rate hike due to the recent easing in financial conditions. She added the US central bank should consider the slow the pace of its balance sheet reduction.

In the meantime, the US Dollar Index (DXY), a gauge of the buck’s value versus a basket of six other currencies, dropped 0.30% and is at 102.10, a tailwind for the EUR/USD pair, which is accelerating its uptrend toward 1.1000.

Aside from this, in the European session, the Eurozone (EU) revealed that November Retail Sales plunged -0.3% MoM as expected but trailed October’s 0.4% increase. Annually based dived sharply from -0.8% to -1.1%, less than the -1.5% projected but worse than the previous release.

In the meantime, in Germany, Factory Orders were softer, while November’s Trade Balance showed a €20.4 billion surplus vs €17.7 billion the previous month, propelled by Exports jumping by 3.7% MoM, while Imports rose by 1.9% MoM. Both figures exceeded projections.

Ahed of the week, the economic docket will feature German Industrial Production and the Unemployment Rate in the Eurozone. On the US front, the release of its Trade Balance and Federal Reserve’s officials speaking led by Michael Barr.

EUR/USD Price Analysis: Technical outlook

The major is bullishly biased, though it faces solid resistance at a multi-month support trendline turned resistance around the 1.0970/80 area. A decisive break is needed so buyers can challenge the 1.1000 figure on its way to testing last month’s high of 1.1139. On the other hand, if the EUR/USD drops below the first support level seen at 1.0950, that would exacerbate a drop towards the 1.0900 figure. Further downside is seen at the 50-day moving average (DMA) at 1.0870.

The Federal Reserve Bank of New York's latest Survey of Consumer Expectations showed on Monday that the US consumers' one-year inflation expectation dropped to its lowest level since January 2021 at 3% in December from 3.4% in November.

Key takeaways

"Expected inflation three years ahead at 2.6% in December vs 3% in November."

"Expected inflation five years ahead at 2.5% in December vs 2.7% in November."

"Median expected home price rise unchanged at 3% in December."

"Expected earnings, spending rises at lowest level since 2021."

"Households less pessimistic on credit access, financial situation."

Market reaction

The US Dollar (USD) stays under modest selling pressure following this report. At the time of press, the USD Index was down 0.3% on the day at 102.12.

EUR/USD rallied strongly into the end of last year. Economists at MUFG Bank analyze the world’s most popular currency pair outlook for 2024.

ECB to deliver 125 bps of rate cuts by the end of this year

We are now expecting the ECB to deliver 125 bps of rate cuts by the end of this year. It is one of the reasons why we expect the euro to strengthen only modestly against the US dollar in the year ahead as the Fed is also expected to be active in lowering rates to less restrictive levels in 2024.

Our latest forecasts for EUR/USD show a more neutral profile for the pair in the first half of this year before it adjusts higher in the second half of this year up to towards the 1.1400 level by year-end.

- Mexican Peso soars as mixed economic data from the United States, undermined the Greenback.

- Mexico’s Consumer Confidence deteriorates as households are concerned about the future economic outlook.

- USD/MXN tumbles toward 16.80 as sellers eye 2023’s low of 16.62.

The Mexican Peso (MXN) post decent daily gains of 0.31% against the US Dollar (USD) following last week’s US employment report and a light economic docket in Mexico. The USD/MXN continues to trade at around 16.82, at multi-month lows.

On Monday, data showed Mexico’s Consumer Confidence deteriorated in December, according to the National Statistics Agency known as INEGI. Across the border, last Friday’s Nonfarm Payrolls report for December depicted the labor market is in better shape than estimated. Nevertheless, in the near term, hiring could begin to slow down as business activity reported by the Institute for Supply Management (ISM) showed the Manufacturing PMI stood in recessionary territory, while the Services PMI clung to 50.7, at the brisk of turning contractionary.

Daily digest market movers: Mexican Peso remains firm, extending its gains against the US Dollar

- Mexico’s Consumer Confidence in December dropped slightly from 47.3 to 46.8 as consumers became more worried about the future economic outlook amongst households. In regard to the country’s outlook, consumers expect an economic slowdown, tough current conditions, sales of durable goods are expected to take a hit, as the poll showed.

- Last week’s economic data in the US was mixed. Although the economy added 216K jobs, exceeding forecasts, usually, it’s the latest piece of data that feels the pain of monetary policy tightening. Contrarily, the ISM Manufacturing and Services PMI usually lead the economy, and even though the Services PMI stood at expansionary territory, it is slowing faster than expected.

- On Saturday, the President of the Dallas Federal Reserve Bank, Lorie Logan, said the Fed shouldn’t rule out another rate hike due to the recent easing in financial conditions. She added the US central bank should consider the slow the pace of its balance sheet reduction.

- The recent meeting minutes from Banxico (the Central Bank of Mexico) indicate that the institution might start considering the relaxation of its monetary policy, albeit cautiously. Four members of the Governing Council emphasized the importance of being prudent in both evaluating and communicating any decisions regarding rate reductions. Meanwhile, one member voiced the opinion that it might be time to start discussing potential rate cuts.

- Last Tuesday, Mexico’s S&P Global Manufacturing PMI for December came out at 52.0, below November’s 52.5, suggesting the economy is slowing down amid Banxico’s tightening cycle.

- On Wednesday, Business Confidence in Mexico improved to 54.6 from 54.0 in November, although it failed to underpin the Mexican Peso, which remained weak during the session.

Technical analysis: Mexican Peso buyers remain in charge as the USD/MXN drifts lower

The USD/MXN resumed its downtrend, and it’s accelerating its pace toward testing last year’s low of 16.62. A breach of the 16.80 area would expose the 16.69 August 28 swing low, followed by the 2023 low of 16.62.

On the flip side, if sentiment shifts bullish on the US Dollar, the exotic pair could reclaim the 17.00 figure, followed by the 17.05 mark. Once those two resistance levels are surpassed, up next would be 17.20, followed by the convergence of the 50, 100, and 200-day Simple Moving Averages (SMAs) at the 17.29/41 area.

Also read: Mexican Peso Price Annual Forecast: Which factor would impact most in 2024, economics or politics?

USD/MXN Price Action - Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

In the US, the December inflation figures will be released on Thursday. Economists at Commerzbank analyze how the CPI report could impact the Dollar.

Dollar will quickly be back in the penalty box on weak numbers

Those hoping for a clearer signal of an imminent rate cut from the Fed after the jobs report will likely be disappointed. Yes, inflation in the US continues to fall. But not very fast, according to our experts. An increase of around 0.25% MoM for both the headline and core rate does not indicate a rapid decline in inflation. According to our experts, the headline rate could even rise slightly to 3.2% YoY in December. The core rate is likely to remain uncomfortably high at 3.8%.

Perhaps the inflation figures will manage to slow the Dollar's downward trend. But I am afraid that the Dollar will quickly be back in the penalty box on weak numbers.

2023 marked the third consecutive year of outsized declines in the Japanese Yen (JPY). However, 2024 may be different for the currency, according to economists at HSBC.

A capitulation of short JPY speculative positions and lifers’ FX hedging could support the JPY

After three consecutive years of weakness, the JPY is set to recover this year, albeit modestly as markets have already built in expectations for interest rates to increase in Japan and fall in the US.

A capitulation of short JPY speculative positions and lifers’ FX hedging should be supportive for the JPY.

The USD is steady in broad terms to start the week. Economists at Scotiabank analyze Dollar’s outlook.

Jobs data dust settles

Choppy USD trade Friday around the release of better-than-expected NFP but softer than forecast ISM Services data (especially employment) leaves a bit of a question mark over the near-term direction of FX, at least.

The slide in the USD reflected weaker US yields and perhaps positioning running into the jobs report where expectations had favoured stronger data. Downward revisions to the prior months’ data also took the edge off the USD’s initial reaction to the NFP report. Still, with the dust settling after the data, the USD won back some of the ground lost and still managed to close out the week in relatively positive shape.

From a broader point of view, risks – reflecting seasonal trends and technical price action – remain tilted towards some extension of the broader USD rebound that developed over the turn of the year.

EUR/USD holds range around 1.0950. Economists at Scotiabank analyze the pair’s outlook.

Weekly techs lean bearish

Looking beyond the narrow, consolidation range evident on the intraday and daily chart, the weekly pattern of trade still leans EUR-bearish.

A net loss for the EUR on the week last week follows the bearish top/reversal signal that developed on the weekly chart over the turn of the year and completes a bearish ‘evening star’ pattern on the weekly. Look for resistance near 1.10 now.

Support is 1.0875.

Corrective losses may extend to 1.07/1.08 in the next few weeks.

GBP/USD holds flat range. Economists at Scotiabank analyze the pair’s outlook.

Cable retains some positive momentum above 1.26

Trading patterns in GBP/USD look a little more neutral than other USD pairs.

Weekly price action is soft but not obviously bearish for the GBP at this point.

Trend signals are leaning GBP-bullish on the short, medium and long-term DMI oscillators still at this point which gives the GBP some protection from the generally stronger USD tone that has developed over the turn of the year.

Key support is 1.2600/1.2605.

USD/CAD pressures support at 1.3390/1.3400. Economists at Scotiabank analyze the pair’s outlook.

Gains to extend above 1.3390/1.3400

Despite Friday’s hefty intraday swings, the longer-term chart still points to the risk of USD/CAD strengthening a little more in the near-term, at least.

The weekly chart shows a bullish ‘hammer’ candle developed through the turn of the year. A high close for the USD last week – despite the hefty intraday swings in the USD Friday – adds emphasis to the bullish pattern of trade and supports the outlook for some additional, corrective gains in the USD in the next few weeks towards 1.34/1.35.

Gains through high/low resistance at 1.3390/1.3400 will add to near-term bullish momentum.

Support should be firm on dips to the low/mid-1.33s now.

- The US Dollar trades flat after a whipsaw move on Friday.

- Traders will focus on US inflation numbers later this week.

- The US Dollar Index steadies around 102.00, though technical rejection on Friday points to more downturn ahead.

The US Dollar (USD) trades broadly steady on Monday after suffering a wild ride on Friday, likely hurting intraday and short-term traders. The US Dollar Index (DXY) jumped significantly higher after a strong headline number in the US Jobs report, only to fully unwind that move and sink lower on the back of very poor Employment numbers in the Institute for Supply Management (ISM) Services PMI report. Adding to the swings caused by economic data releases, traders need to revalue the US Dollar taking into account increasing geopolitical tensions and mounting expectations of interest-rate cuts by the Federal Reserve (Fed).

On the economic front, a calm Monday is ahead with only Consumer Credit data for November due. The focus on credit numbers, loans and defaults is likely to grow in the coming months as several banks signal they are seeing more payment delinquencies. For this week, the main event will be the US inflation numbers on Thursday.

Daily digest Market Movers: Firing at all cylinders

- German Factory Orders are nudging up a touch in November, heading from -3.7% to 0.3% against October. Estimate was for a jump of 1.1%. This made the US Dollar jump against the Euro to the session’s high (EUR/USD session’s low).

- Tensions are building up further in the Middle East after Israel claims it discovered Chinese weaponry in a Hamas depot.

- China's biggest construction firm Evergrande sinks 17% in Hong Kong after reports that its Vice Chairman has been detained.

- Tit-for-tat between China and the US, with China sanctioning five US defence industry companies after a US arms sale to Taiwan.

- Dallas Fed President Lorie Logan said that the Fed should begin discussing a slowdown in its balance sheet runoff.

- The US Treasury is taking a stab at the markets by placing a 3-month and a 6-month bill at 15:30 GMT.

- US Consumer Credit Change for November is due to come out at 20:00 GMT, with credit expected to jump from $5.13 billion to $9 billion.

- Equity markets are in the red across the board at the start of this week. Dow Jones futures are leading the decline, down near 0.50%.

- The CME Group’s FedWatch Tool shows that markets are pricing in a 95.3% chance that the Federal Reserve will keep interest rates unchanged at its January 31 meeting. Around 4.7% expect the first cut already to take place.

- The benchmark 10-year US Treasury Note trades has reclaimed back the area above 4% after the wild ride on Friday.

US Dollar Index Technical Analysis: Geopolitics counterweights rate cuts

Bets on the US Dollar look split. On the one hand, traders place bets favoring the US Dollar due to increasing geopolitical tensions in the Middle East, with ongoing headlines over the Red Sea and Chinese weaponry found in Hamas storages by Israel. On the other side, traders see reasons for quick rate cuts by the Fed after the implosion of the ISM numbers last Friday. Expect geopolitics to take over control for now, as long as new headlines point to further heightened tensions.

In the DXY US Dollar Index, the first level on the upside is 103.00, which falls nearly in line with the descending trend line from the top of October 3 and December 8. Once broken and closed above there, the 200-day Simple Moving Average (SMA) at 103.43 comes into play. The 104.00 level might be a bit too far off, with 103.93 (55-day SMA) coming in as the next resistance on the upside.

To the downside, the rejection on the descending trendline is giving fuel to the Greenback bears for further downturn. The line in the sand here is 101.74, the floor which held halfway through December before breaking down in the last two weeks. In case the DXY snaps this level, expect to see a test at the low near 100.80.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

The Euro has given back some recent gains. Kit Juckes, Chief Global FX Strategist at Société Générale, analyzes EUR/USD outlook.

There is a lot of bad news priced in to the current level

Last year’s 7.9% EUR/USD range was the second smallest since 1999 and the fact that the only year with a tighter range, 2019, came just before the outbreak of Covid suggests this is a return to normal. Hardly encouraging for FX thrill-seekers!

I would be faintly surprised if this year’s range were wider than last year’s, and the high and low are unlikely to be threatened.

As 2024 starts, however, I’m struck that there is a lot of bad news priced in to the current level. It’s fair to argue that the most recent dollar bounce, while mostly about a positioning adjustment after the Nov/Dec moves, is driven by resilient US economic data, rather than any surprises in Europe. On that basis, whether the next move for EUR/USD is up to 1.12 or back down to 1.08 may depend on the US more than Eurozone data.

European Central Bank (ECB) Governing Council member Boris Vujcic said on Monday that he thinks the Eurozone will be able to avoid a recession, as reported by Bloomberg.

Vujcic noted that he also expects inflation to slow gradually, adding that they are not discussing rate cuts and they probably will not do so before summer.

Market reaction

These comments failed to help the Euro find demand during the European trading hours. At the time of press, the EUR/USD pair was virtually unchanged on the day at 1.0950.

Economists at Société Générale analyze USD/ZAR technical outlook.

Short-term bounce towards 19.14 and October high of 19.50/19.64 on the cards

USD/ZAR recently defended low of November near 18.10 and the trend line drawn since April 2022. A gradual rebound has taken shape, but crisscross moves around the flattish 200-DMA denote lack of clear direction.

Short-term bounce towards 19.14 and October high of 19.50/19.64 can’t be ruled out. This is a crucial resistance zone.

In case the pair dips below lower band of recent range at 18.10, there could be risk of a deeper down move.

- WTI Oil falls to around $71 on Monday morning.

- Saudi Arabia is offering discounts across the globe for its Crude.

- The DXY US Dollar Index holds above 102.00 as traders await US inflation figures later this week.

Oil declined to around $71 on Monday morning after prices tried and failed to pump back above $74 last week. Headlines this morning from Saudi Arabia are pushing down prices, with state-owned Oil company Aramco offering discounts on several regions, with biggest discounts for Asia for its Oil deliveries. Markets are pricing in these price cuts, though this could be positive for Oil prices in the longer run as cheaper supply could ramp up demand. India, for example, is already reporting another surge in demand for Oil as the country’s economy is outperforming.

Meanwhile, the US Dollar (USD) is paring back some losses it incurred in late December. The recovery comes on the back of the latest US jobs report, which points to a still buzzing job market, though the Institute for Supply Management numbers signalled a severe slowdown ahead. The Greenback is now getting torn between safe-haven flows on the back of rising tensions in the Middle East and the Red Sea, while the other camp is betting on swift rate cuts by the Fed to avoid a recession. With US Consumer Price Index (CPI) numbers this week, traders could possibly get reassurance whether rate cuts could be around the corner or not.

Crude Oil (WTI) trades at $71.76 per barrel, and Brent Oil trades at $76.67 per barrel at the time of writing.

Oil News and Market Movers: Aramco keeps firesale

- OPEC+ leader Saudi Arabia is offering substantial cuts in its official Oil prices to Asia and other regions. For Asia specifically, prices are lowered to the lowest level since 2021.

- In a spillover effect, Oil-related stocks are sliding lower, with the Oil stock Index down 2%, the most since December 4. Shell fell as much as 2.5%, becoming the biggest loser in the Stoxx 600 Index.

- India sees a sharp ramp-up in demand for Oil products with the economy booming at a record pace. Diesel consumption is swelling by 5% compared to last year.

- Rumours in OPEC+ are pointing to some more departures of a few countries from the bloc. Countries like Gabon, Equatorial Guinea and Congo are said to be reevaluating their participation.

Oil Technical Analysis: One step back, two steps forward

Oil prices are declining this Monday on the back of Saudi Arabia offering discounts across the board. Although the initial move in Oil prices, which is down, is granted, the medium term could result in quite the opposite. With nations like India and other emerging markets reconfirming a boom in economic activity, demand is set to expand, while frost in Europe could mean ample demand is also coming back online in the Oil market.

On the upside, $74 is still holding importance, although the level has become very chopped up. Once back above this, $80 comes into the picture. Still far off, $84 is next on the topside once Oil sees a few daily closes above the $80 level.

Below $74, the $67 level could still come into play as the next support to trade at as it aligns with a triple bottom from June. Should that triple bottom break, a new low for 2023 could be close at $64.35 – the low of May and March – as the last line of defence. Although still quite far off, $57.45 is worth mentioning as the next level to keep an eye on if prices fall sharply.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

What is WTI Oil?

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

What factors drive the price of WTI Oil?

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

How does inventory data impact the price of WTI Oil

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

How does OPEC influence the price of WTI Oil?

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

The Pound Sterling (GBP) was the second best performing G10 currency in 2023. EUR/GBP ended the year around 0.8670. Economists at Rabobank analyze the pair’s outlook.

Market consensus is expecting EUR/GBP to drift higher this year

The market consensus is expecting EUR/GBP to drift higher this year, but there is some evidence that forecasters’ pessimism over the outlook for GBP has become ingrained.

There has been plenty of justification for a lack of optimism with respect to both the Pound and the UK economy in the past few years, but Germany’s economy has fared worse since the pandemic.

While it is still difficult to paint a glaringly optimistic picture of the outlook for GBP, we see potential for EUR/GBP to tick lower to 0.84 on a 12-month view, in part due to the poor position of the German economy.

The Indian Rupee (INR) registered modest gains vs. the US Dollar (USD) last week. Economists at Société Générale analyze USD/INR outlook.

No reason to fret over INR depreciation

There is no reason for markets to fret over INR depreciation.

Confidence that the government will lower the budget deficit target for FY25 to 5.2-5.4% of GDP in February (from the FY24 target of 5.9%) is supportive of the currency and INRGBs.

The general election in April/May naturally poses tail risk, but favourable results for the BJP in state elections mean PM Modi can steer clear of a populist election agenda.

We are forecasting a 10-year yield of 6.20% and 81.00 for USD/INR at end-2024.

Antje Praefcke, FX Analyst at Commerzbank, analyzes USD reaction to US labour market data.

The US labor market is still relatively robust

The bottom line is that the US labor market is still relatively robust. In this respect, it tends to support our experts' expectation that the Fed's first rate cut will not come as soon as the market expects. Nevertheless, the market is not ready to make any significant adjustments to its Fed rate cut expectations. This leads me to believe that it will be all the more difficult for the Dollar to regain ground.

The market seems to be reacting more to data that supports their view that rates will be cut soon, while at the same time the data is getting worse. That doesn't bode well for the Dollar.

- Retail Sales in the Euro area decreased by 0.3% in November as forecast.

- EUR/USD trades modestly lower on the day below 1.0950.

Retail Sales in the Euro area declined by 0.3% on a monthly basis in November, Eurostat reported on Monday. This reading followed the 0.4% (revised from 0.1%) increase recorded in October and came in line with the market expectation.

Other data from the Euro area revealed that the Economic Sentiment Indicator improved to 96.4 in December from 93.8 in November, while the Business Climate Index worsened to -0.45 from -0.39.

Market reaction

These data don't seem to be having a noticeable impact on the Euro's valuation. At the time of press, EUR/USD was down 0.05% on the day at 1.0935.

- Investor sentiment in the Euro area improved modestly in January.

- EUR/USD trades in negative territory below 1.0950.

Sentix Investor Confidence Index for the Eurozone edged higher to -15.8 in January from -16.8 in December.

Commenting on the survey's findings, "this is unlikely to be a turnaround" for the Euro area, Sentix said in its publication. "This is partly due to Germany, whose economy is still in recession and therefore in crisis."

Market reaction

The Euro continues to weaken against its major rivals following this data. At the time of press, the EUR/USD pair was down 0.15% on a daily basis at 1.0925.

USD/JPY traded at the highest level since mid-December on Friday. Economists at Rabobank analyze the pair’s outlook.

The BoJ is unlikely to consider a rate hike before April