- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 03:00 | China | Trade Balance, bln | July | 50.98 | 40 |

| 08:00 | Eurozone | ECB Economic Bulletin | |||

| 12:30 | U.S. | Continuing Jobless Claims | 1699 | 1690 | |

| 12:30 | Canada | New Housing Price Index, MoM | June | -0.1% | 0% |

| 12:30 | Canada | New Housing Price Index, YoY | June | 0% | |

| 12:30 | U.S. | Initial Jobless Claims | 215 | 215 | |

| 14:00 | U.S. | Wholesale Inventories | June | 0.4% | 0.2% |

| 22:45 | New Zealand | Visitor Arrivals | June | -1.2% | 3% |

| 23:30 | Australia | RBA's Governor Philip Lowe Speaks | |||

| 23:50 | Japan | GDP, y/y | Quarter II | 2.2% | 0.4% |

| 23:50 | Japan | GDP, q/q | Quarter II | 0.6% | 0.1% |

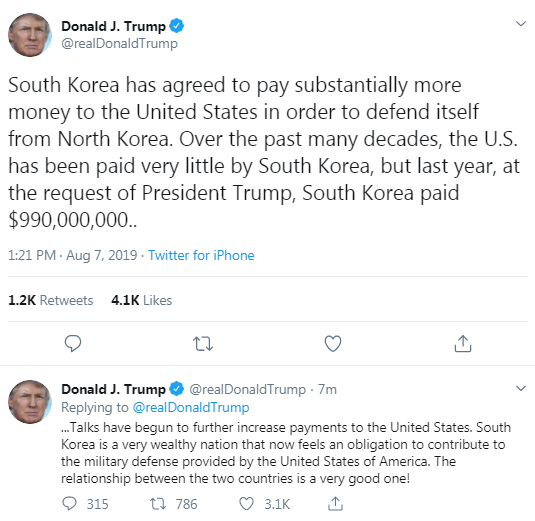

The main US stock indices mostly rose, but not significantly, as investors worried about the impact of increasing trade tensions between the US and China preferred safer assets.

The yield on 10-year US Treasury bonds earlier today reached its lowest level since 2016. This further smoothed the yield curve, a closely watched market recession indicator. The spread between the yield on 10-year government bonds and the yield on 2-year government bonds fell to the lowest level since 2007.

The fall in US government bond yields also reflected increased expectations that the Federal Reserve would cut interest rates three more times by the end of the year, with markets seeing a 100 percent chance of a decline in September.

Against this background, shares of banks, including J.P. Morgan Chase (JPM) and Bank of America (BAC) have come under pressure because they will lose the most as a result of lower interest rates.

Another factor that had a negative impact on the market was the fact that China set a lower-than-expected exchange rate for the yuan against the dollar. The People’s Bank of China (NBK) set the official average yuan rate on Wednesday at 6.9996 yuan for $ 1, which is 0.45% lower than the previous day, and only slightly below the psychologically important level of 7 yuan for $ 1.

The trade war between China and the United States has been going on for more than a year. Investors are concerned about its implications for the global economy and corporate results. Some central banks have even begun to cut interest rates under pressure from these fears. At night, New Zealand, India and Thailand all made decisions to lower interest rates.

Most DOW components recorded a decrease (17 out of 30). Outsider were the shares of The Walt Disney Co. (DIS; -4.96%). The biggest gainers were Walgreens Boots Alliance, Inc. (WBA; + 1.89%).

Most S&P sectors completed trading in positive territory. The consumer goods sector grew more than the rest (+ 0.9%). The conglomerate sector showed the largest decrease (-0.7%).

At the time of closing:

Dow 26,006.87 -22.65 -0.09%

S&P 500 2,884.01 +2.24 + 0.08%

Nasdaq 100 7,862.83 +29.56 + 0.38%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 03:00 | China | Trade Balance, bln | July | 50.98 | 40 |

| 08:00 | Eurozone | ECB Economic Bulletin | |||

| 12:30 | U.S. | Continuing Jobless Claims | 1699 | 1690 | |

| 12:30 | Canada | New Housing Price Index, MoM | June | -0.1% | 0% |

| 12:30 | Canada | New Housing Price Index, YoY | June | 0% | |

| 12:30 | U.S. | Initial Jobless Claims | 215 | 215 | |

| 14:00 | U.S. | Wholesale Inventories | June | 0.4% | 0.2% |

| 22:45 | New Zealand | Visitor Arrivals | June | -1.2% | 3% |

| 23:30 | Australia | RBA's Governor Philip Lowe Speaks | |||

| 23:50 | Japan | GDP, y/y | Quarter II | 2.2% | 0.4% |

| 23:50 | Japan | GDP, q/q | Quarter II | 0.6% | 0.1% |

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories rose

by 2.385 million barrels in the week ended August 2. Economists had forecast a

fall of 2.700 million barrels.

At the same

time, gasoline stocks surged by 4.437 million barrels, while analysts had

expected a drop of 1.250 million barrels. Distillate stocks climbed by 1.529

million barrels, while analysts had forecast an increase of 0.450 million

barrels.

Meanwhile, oil

production in the U.S. increased by 100,000 barrels a day to 12.300 million

barrels a day.

U.S. crude oil

imports averaged 7.1 million barrels per day last week, up by 485,000 barrels

per day from the previous week.

The Ivey

Business School Purchasing Managers Index (PMI), measuring Canada’s economic

activity, rose to 54.2 in July from an unrevised 52.4 in June. That was the highest

reading since May.

Economists had

expected the gauge to hit 53.0.

A figure above

50 shows an increase while below 50 shows a decrease.

Within

sub-indexes, the employment measure climbed to 56.6 in July from 52.7 in June and the

prices indicator surged to 59.2 from 55.0, while the inventories index dropped

to 46.9 last month from 50.9 in the prior month and the supplier deliveries

gauge fell to 46.0 from 48.9.

Analysts at TD Securities note that the U.S. Fed has increasingly put weight on global "crosscurrents" to explain its dovish pivot this year.

- “Prospects for a 2019H2 rebound in the global economy are remote, and expect further downgrades to the growth outlook in the coming months, in particular because of the recent escalation in trade tensions. We expect the FOMC to keep cutting interest rates at its next two meetings and again in 2020.”

U.S. stock-index futures declined on Wednesday as investors flocked to safe-haven assets amid increased concerns over the impact of the intensifying U.S.-China trade war on global economic growth.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,516.56 | -68.75 | -0.33% |

Hang Seng | 25,997.03 | +20.79 | +0.08% |

Shanghai | 2,768.68 | -8.88 | -0.32% |

S&P/ASX | 6,519.50 | +41.40 | +0.64% |

FTSE | 7,194.92 | +23.23 | +0.32% |

CAC | 5,265.08 | +30.43 | +0.58% |

DAX | 11,632.03 | +64.07 | +0.55% |

Crude oil | $52.39 | -2.29% | |

Gold | $1,506.60 | +1.51% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 162.77 | -0.94(-0.57%) | 5058 |

ALTRIA GROUP INC. | MO | 46.1 | -0.06(-0.13%) | 3672 |

Amazon.com Inc., NASDAQ | AMZN | 1,775.05 | -12.78(-0.71%) | 75314 |

American Express Co | AXP | 121.75 | -0.80(-0.65%) | 1060 |

AMERICAN INTERNATIONAL GROUP | AIG | 53.51 | -0.87(-1.60%) | 1256 |

Apple Inc. | AAPL | 195.6 | -1.40(-0.71%) | 305422 |

AT&T Inc | T | 33.79 | -0.17(-0.50%) | 232301 |

Boeing Co | BA | 330.1 | -2.35(-0.71%) | 18132 |

Caterpillar Inc | CAT | 120.59 | -1.49(-1.22%) | 5337 |

Chevron Corp | CVX | 119.45 | 0.07(0.06%) | 891 |

Cisco Systems Inc | CSCO | 52.06 | -0.54(-1.03%) | 37197 |

Citigroup Inc., NYSE | C | 65 | -1.25(-1.89%) | 15850 |

Deere & Company, NYSE | DE | 153 | 0.22(0.14%) | 201 |

Exxon Mobil Corp | XOM | 70.37 | -0.59(-0.83%) | 5875 |

Facebook, Inc. | FB | 182.58 | -1.93(-1.05%) | 101973 |

FedEx Corporation, NYSE | FDX | 161 | -0.19(-0.12%) | 11414 |

Ford Motor Co. | F | 9.45 | -0.03(-0.32%) | 56250 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.04 | -0.10(-0.99%) | 30982 |

General Electric Co | GE | 9.5 | -0.07(-0.73%) | 119203 |

Goldman Sachs | GS | 202.01 | -4.00(-1.94%) | 7405 |

Google Inc. | GOOG | 1,160.00 | -9.95(-0.85%) | 6554 |

Hewlett-Packard Co. | HPQ | 19.1 | -0.15(-0.78%) | 5394 |

Home Depot Inc | HD | 207 | -1.80(-0.86%) | 6324 |

HONEYWELL INTERNATIONAL INC. | HON | 162.92 | -1.60(-0.97%) | 624 |

Intel Corp | INTC | 46.55 | -0.41(-0.87%) | 23796 |

International Business Machines Co... | IBM | 139.75 | -0.98(-0.70%) | 12818 |

International Paper Company | IP | 39.85 | -0.12(-0.30%) | 980 |

Johnson & Johnson | JNJ | 130.61 | -0.16(-0.12%) | 3307 |

JPMorgan Chase and Co | JPM | 108.11 | -2.32(-2.10%) | 26378 |

McDonald's Corp | MCD | 214.19 | 0.11(0.05%) | 4863 |

Merck & Co Inc | MRK | 84.3 | -0.05(-0.06%) | 2991 |

Microsoft Corp | MSFT | 133.5 | -1.19(-0.88%) | 180789 |

Nike | NKE | 80.75 | -0.55(-0.68%) | 2946 |

Pfizer Inc | PFE | 36.88 | -0.07(-0.19%) | 6294 |

Procter & Gamble Co | PG | 114.29 | 0.01(0.01%) | 3271 |

Starbucks Corporation, NASDAQ | SBUX | 94.89 | -0.09(-0.09%) | 6676 |

Tesla Motors, Inc., NASDAQ | TSLA | 228.6 | -2.15(-0.93%) | 50052 |

The Coca-Cola Co | KO | 52.31 | 0.04(0.08%) | 5733 |

Twitter, Inc., NYSE | TWTR | 40.8 | -0.52(-1.26%) | 70147 |

Verizon Communications Inc | VZ | 55 | -0.05(-0.09%) | 1642 |

Visa | V | 171.46 | -1.02(-0.59%) | 17944 |

Wal-Mart Stores Inc | WMT | 106.8 | -0.47(-0.44%) | 4711 |

Walt Disney Co | DIS | 134.75 | -7.12(-5.02%) | 381731 |

Yandex N.V., NASDAQ | YNDX | 36.85 | -0.25(-0.67%) | 26036 |

Jane Foley, the senior FX strategist at Rabobank, thinks that while the UK’s PM Johnson’s special advisor Cummings made the claim at the weekend that a no deal Brexit could not be stopped by MPs, various UK political figures have suggested that this may not be the case.

- “There is little doubt that the prospect of a no deal Brexit has risen sharply since PM Johnson took office last month. The scenario presented by Cummings suggests that there is so little time left between the start of the next parliamentary term and October 31 that the PM needs only to run down the clock to allow the UK’s legal default position of a ‘no deal’ Brexit to take place. Insofar as the UK does not have a written constitution, there is no rule that would force a PM to resign even if he lost a vote of confidence. This would leave open the prospect of Johnson hanging on to office until after the UK left the EU even without the confidence of MPs.

- Betting odds currently suggest that the probability of the UK leaving the EU this year without a deal is roughly 60%. It is our long standing view that on a no deal Brexit uncertainty is likely to push EUR/GBP towards parity. So, if Cumming’s view remains untested, we expect that it is highly likely that EUR/GBP will continue to move higher. That said, the government has the chance to massage this outcome if it can reassure investors about the risks to the economy on a no deal scenario.

- Against the backdrop of a slowdown in world growth and Brexit concerns, the UK economy is stalling.

- UK Foreign Secretary Raab has promised that Brexit will bring a “huge series of upsides” for UK trade.

- If Raab’s plan to build the foundations for a trade agreement between the UK and the US receives a less favourable response than he had hoped, investors’ concern about a chaotic Brexit are likely to increase. This could hasten upside potential for EUR/GBP near-term. While we expect a no deal Brexit to bring parity for EUR/GBP, our 6 month view of EUR/GBP0.87 reflects our house view that Brexit will be delayed beyond October.”

Bart Melek, the head of commodity strategy at TD Securities, notes that oil prices extended their declines on Tuesday, as markets weighed the prospects of a prolonged U.S.-China trade dispute.

- “Brent crude dropped 1.5 percent to just under $58.94/bbl, which tilted the global oil benchmark into bear market territory. While there are worries that China is sitting on tens of millions of barrels of "illegally" exported Iranian crude, these oil price declines seem to be very much driven by the demand side of the equation, as the supply side still looks well-positioned for significantly firmer crude markets.

- OPEC+ continues to be committed to its 1.2 million b/d of reductions and delivered 130k b/d less supply in July, Iran is struggling to ship its product, while US shale producers are not punching above their weight as many had expected.

- US inventories started to erode sharply over the last several weeks. Plus, geopolitical tensions continue to be elevated in the Middle East in the aftermath of another oil tanker being seized by Iran amid claims it was smuggling fuel to Arab States and as Turkey readies to stage an incursion into Syria.

- We shouldn’t underestimate the potential impact of a full-blown trade war between the world’s two biggest economies, as this could very well mean the market significantly overestimated demand growth for oil and we could easily be in a surplus situation in 2020.

- Given the current global trade tensions and the risk of currency wars, demand growth could well drop some 400k b/d next year, which would negate OPEC+ hard work to rebalance the market. As such, a WTI move toward just above $50/bbl which is a technical and psychological support level is very much in the cards, should the US-China trade issues remain unsolved.”

Walt Disney (DIS) reported Q3 FY 2019 earnings of $1.35 per share (versus $1.87 in Q3 FY 2018), missing analysts’ consensus estimate of $1.74.

The company’s quarterly revenues amounted to $20.245 bln (+32.9% y/y), missing analysts’ consensus estimate of $21.404 bln.

DIS fell to $136.00 (-4.14%) in pre-market trading.

- U.S.' accusation of China being a currency manipulator is groundless and does not accord to facts

- Says China welcomes foreign investors, including those from the U.S.

- Promises it will keep forex management policies stable and consistent

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. surged 5.3 percent in the week ended August 2, following a 1.4

percent drop in the previous week.

According to

the report, refinance applications climbed 12 percent, while applications to

purchase a home fell 2 percent.

Meanwhile, the

average fixed 30-year mortgage rate decreased to 4.01 percent from 4.08

percent.

“The Federal

Reserve cut rates as expected last week, but the bigger influence on the

financial markets was the development that a trade war with China has started.

The result was a sharp drop in mortgage rates, which will likely draw many

refinance borrowers into the market in the coming weeks,” noted Mike

Fratantoni, MBA senior vice president and chief economist. “The 30-year fixed

rate mortgage fell to its lowest level since November 2016. We fully expect

that refinance volume will jump even higher this week given the further drop in

rates.”

Dominick Stephens, the chief economist at Westpac, notes that the Reserve Bank of New Zealand (RBNZ) has made an unprecedented decision to cut the official cash rate (OCR) 50 bps in a nonemergency situation today.

- “There was no signal of imminent further cuts, so we doubt the RBNZ will move again in September.

- But the new MPC has shown its willingness to react to adverse economic news, and the current downturn is likely to get worse before it gets better.

- Therefore, we now expect the RBNZ to cut the OCR to 0.75% in November.

- The consequence of this will be a housing market upturn.

- We were already forecasting 7% house price inflation next year, and the risk to that call is now to the upside.”

TD Securities analysts note that Germany's industrial production for June was much worse than expected, declining 1.5% m/m versus consensus of -0.5%.

- “It has now fallen almost 3.5% over the last three months as the out-performance of hard data vis-a-vis surveys is reversing. This will further embolden the ECB as they determine exactly how much stimulus to deliver in their September meeting where we expect at least a 10bps cut to the depo rate and €30bn/month of QE.”

Carsten Brzeski, the Chief Economist at ING Germany, notes that the industrial slump in Germany continues with industrial production dropping by 1.5% month-on-month in June, from 0.1% MoM in May.

- “On the year, industrial production is down by more than 5%. Activity in all sectors dropped - only the construction sector grew by a meager 0.3% MoM, after two consecutive drops. The weak performance of the construction sector means that this sector – contrary to anecdotal evidence that it was still booming – has been a drag on growth in the second quarter.

- German industry continues to suffer from structural changes and ongoing trade conflicts.

- Looking ahead, despite yesterday’s encouraging industrial orders data, the combination of high inventories and few orders at hand does not bode well for industrial production in the months ahead. Add to this a further escalation of the current trade conflicts, Brexit and an ongoing structural transformation in the automotive sector and the outlook doesn’t look any better. Against this background, recent tentative signs that the domestic economy’s resilience is crumbling are concerning.

- All in all, we would characterize today’s industrial production report as devastating, with no silver lining. Today’s data also shows that we should prepare for contraction in the German economy in the second quarter, unless exports bring an unexpected surprise on Friday.

FX Strategists at UOB Group now believe EUR/USD could extend the sideline theme between 1.12 and 1.13 in the near term.

24-hour view: “Although EUR did not test July’s highs of 1.1281 yesterday as expected, the resulting pullback was relatively shallow and EUR turning well ahead of the stated support at 1.1140 (low: 1.1166). Overall, upside momentum has been reduced significantly and it would take some time for it to rebuild, if any. So, EUR is likely to consolidate recent gains at a higher range of 1.1175 to 1.1270 at least for today”.

Next 1-3 weeks: “As we reported in yesterday’s report, a NY close above 1.1130 would negate the ‘downside phase’. EUR closed up for a third day, by 0.85% to 1.1202. While upwards momentum appears strong, we are still not convinced to transit into a ‘positive phase’ as yet. As such, EUR is likely to consolidate recent gains and trades in a higher range between 1.1200 and 1.1300. A drop below 1.1160 indicates that the recent strength in EUR has ran its course and may be resuming its downtrend”.

Following the RBNZ rate cut earlier, NAB's senior FX strategist, Rodrigo Catril, says that the AUD is "certainly getting a bit of an unwelcome NZD infection". Adding that the "more aggressive, proactive RBNZ certainly ups the pressure on the RBA to do more".

However, the firm still sees the RBA only cutting rates by 25 bps again in November; arguing that "the RBA has its own approach based on its own outlook of domestic and global drivers, so the RBNZ cutting aggressively doesn't mean the RBA will follow".

That said, they still see a move downwards in AUD/USD as being "the path of least resistance" although the pair is unlikely to breach below 0.6550 "imminently".

China's foreign exchange reserves fell $15.54 billion in July to $3.104 trillion, central bank data showed. Economists had expected the country's reserves, the world's largest, would fall by $18 billion to $3.101 trillion, likely due to fluctuations in global exchange rates and the prices of foreign bonds that China holds.

China has been able to keep capital outflows under control over the past year despite a bruising trade war with the United States and weakening economic growth at home. But pressure could build after authorities let the yuan slide to 11-year lows this week, following U.S. threats of more tariffs from Sept. 1.

The value of China's gold reserves rose to $88.876 billion at the end of July from $87.27 billion at the end of June.

Fritz Louw, currency analyst at MUFG Bank, suggests that the prospect of a lull in Brexit-related GBP selling given parliament is in recess and hence nothing significant is likely to materialise in the coming weeks.

“The G7 Leaders’ summit between 24th -26th August being the possible exception. But reading through the details of the Fixed-Term Parliament Act, the timeframe for key decision making after the summer recess when parliament commences on 3rd September is tiny. If you assume the latest an election could be held is 29th October, the Fixed-Term Parliament Act stipulates that parliament would be dissolved at the beginning of the 25th working day before polling day. Working that back takes you to Wednesday 25th September. Then you have to incorporate the 14 calendar-day period for parliament needs to form another government after the passing of a government no-confidence motion, which takes you to Wednesday 11th September – just eight days after parliament returns from summer recess. It is increasingly unrealistic to view there being enough time for a general election to form a new government that would seek an extension to Article 50. This is especially so given there is some scope for the proroguing of parliament that the Fixed-Term Parliament Act does not restrict.”

A host of global factors mean gold’s price is set to maintain its strength at least for the next six to 12 months, according to an economist from a top Singapore bank.

“The world right now is in a precarious state and gold is due to benefit from this situation,” said Howie Lee, economist at Oversea-Chinese Banking Corporation.

Lee said that the metal is set to soon breach $1,500.

“We are seeing a perfect mix of ingredients in the melting pot: We have low rates, we have soft dollar, we have trade tensions, we have geopolitical tensions along the Persian Gulf,” Lee told.

He added that such a barrage of risks had propelled gold to its more-than-six-year highs, and is leading investors to take a “risk-off” approach to their portfolios. In other words, investors are uncertain about near-term global economic trends and are likelier to gravitate toward low-risk assets.

“They are piling their funds into gold,” Lee said.

In view of Karen Jones, analyst at Commerzbank, GBP/USD pair is consolidating/correcting higher very near term after last week the market sold off to the base of its short term channel at 1.2011 and the January 2017 low at 1.1988.

“Last weeks low was 1.2080, but given the 13 count on the daily chart we would allow for this to hold the initial test and prompt a near term rebound. Below here lies the 1.1491 3 rd October low (according to CQG). Rallies, if seen, should struggle circa 1.2320. It stays negative while contained by its 2 month downtrend at 1.2437 today. Above the downtrend this would introduce scope to the 55 day ma at 1.2536 and the June high at 1.2784. Only a rise above the June high at 1.2784 would indicate that a bottom is being formed (not favoured).”

The yuan may weaken beyond 7.5 against the U.S. dollar if President Donald Trump kicks tariffs up to 25% on the recently threatened $300 billion of Chinese goods, says Bank of America Merrill Lynch.

China’s currency has gotten greater attention in recent days after Beijing allowed the yuan to weaken past the important psychological level of 7 per dollar for the first time since the global financial crisis.

That depreciation came after Trump threatened to slap 10% tariff on $300 billion of Chinese goods starting Sept. 1. If that goes ahead, the U.S. dollar-Chinese yuan exchange rate may touch 7.3 by the end of 2019, weaker than an earlier forecast of 6.63, the BofAML predicted.

If that tariff rate increases to 25%, “you’ll be looking at CNY beyond 7.5 levels” assuming existing economic and financial conditions don’t change, Rohit Garg, a currency and rates strategist at the bank, said.

Many analysts have said they expect Trump to hike tariffs on all Chinese goods to 25% after the recent escalation in the U.S.-China fight. Such an elevated tariff rate would hurt sentiment further and the U.S. Fede would likely step in to stem some negativity, Garg told.

The Fed “would sound more dovish, it would actually go ahead and cut rates,” he said. That means it may be “difficult for the dollar to actually rally as much,” he added.

According to the report from Halifax Bank of Scotland, on a monthly basis, house prices fell by 0.2%, to £236,120. In the latest quarter (May to July) house prices were 0.4% higher than in the preceding three months (February to April). House prices in the three months to July were 4.1% higher than in the same three months a year earlier.

July’s annual change figure of 4.1% comes against the backdrop of relatively low growth in the corresponding period in 2018, which has had an impact on year-on-year comparisons.

Russell Galley, Managing Director, Halifax, said: “The average UK house price fell slightly for a second month, as the market continues to tread water with marginal increases or decreases in each monthly period. That said, it’s worth remembering that while economic uncertainty continues to weigh on the market, the overall trend actually remains one of comparative stability, with average prices down by less than £600 over the last three months. In the longer-term, we believe there is unlikely to be a step change in market activity until buyers and sellers see some form of resolution to the current economic uncertainty.”

Danske Bank analysts note that the US treasury curve 2-10y continued to flatten yesterday and is now just 11.5bp from inverting, which historically has been a reliable indicator of a forthcoming recession in the US.

“The flattening gained momentum after Fed's Bullard - normally one of the most dovish members of the Fed - said that the Fed has already reacted to trade uncertainty and that the Fed should not react to short-term stock moves and day-to-day trade negotiations. The latter should not surprise anyone, but it still underlines that if some investors thought that Powell would issue a 'Powell put' they might be wrong. That said, Bullard did underline that he would not rule out further policy changes ahead and that trade uncertainties would chill global investments and growth. However, all in all Bullard came across relatively 'hawkish' given his dovish reputation. Despite the 'hawkish' comments from Bullard and the flattening of the yield curve we did see a stabilisation in the US equity market with major indices rising up to 1%.”

According to analysts at TD Securities, the RBNZ took the market by surprise and cut the OCR by 50 bps at its August MPC meeting.

“Ahead of the policy announcement, rates markets were fully priced for a 25bps move while all but a handful of analysts were looking for the same according to Bloomberg's poll. Those few in the minority were looking for an unchanged result. In its official statement, the MPC debated between a cut of 25 and 50bps this month. Members "noted both options were consistent with the forward path in the projections...[but] agreed that the larger initial monetary stimulus would best ensure the Committee continues to meet its inflation and employment objectives." In line with this, the accompanying Monetary Policy Statement for August indicated some chance of further rate cuts ahead. Their OCR forecasts trough at 91bps in Q4 2020 - i.e. an implied 36% chance of another 25 bps rate cut. The MPS continues to highlight a series of both domestic and global risks. The Committee expects growth to remain soft in the near term - although at 2.5% y/y in Q1, it is the envy of most other DM economies. Domestic demand remains under pressure from a slowing housing market and subdued business confidence. The RBNZ has revised its GDP forecasts lower accordingly by -0.3 to -0.5 ppts through the second quarter of next year.”

According to provisional data of the Federal Statistical Office (Destatis), in June 2019, production in industry was down by 1.5% on the previous month on a price, seasonally and calendar adjusted basis. Economists had expected a 0.4% decrease. In Mai 2019, the corrected figure shows an increase of 0.1% (primary +0.3%) from April 2019.

In June 2019, production in industry excluding energy and construction was down by 1.8%. Within industry, the production of intermediate goods decreased by 2.0% and the production of capital goods by 1.8%. The production of consumer goods showed a decrease by 1.4%. Outside industry, energy production was down by 1.6% in June 2019 and the production in construction increased by 0.3%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1268 (2318)

$1.1247 (1869)

$1.1237 (709)

Price at time of writing this review: $1.1208

Support levels (open interest**, contracts):

$1.1189 (2128)

$1.1146 (2959)

$1.1099 (5298)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 9 is 75758 contracts (according to data from August, 6) with the maximum number of contracts with strike price $1,1100 (5298);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2352 (207)

$1.2305 (247)

$1.2261 (564)

Price at time of writing this review: $1.2164

Support levels (open interest**, contracts):

$1.2087 (546)

$1.2044 (290)

$1.1997 (341)

Comments:

- Overall open interest on the CALL options with the expiration date August, 9 is 17070 contracts, with the maximum number of contracts with strike price $1,3000 (2051);

- Overall open interest on the PUT options with the expiration date August, 9 is 19987 contracts, with the maximum number of contracts with strike price $1,2450 (2362);

- The ratio of PUT/CALL was 1.17 versus 1.19 from the previous trading day according to data from August, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 58.5 | -1.96 |

| WTI | 53.35 | -2.38 |

| Silver | 16.42 | 0.31 |

| Gold | 1474.183 | 0.63 |

| Palladium | 1441.84 | 1.52 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -134.98 | 20585.31 | -0.65 |

| Hang Seng | -175.08 | 25976.24 | -0.67 |

| KOSPI | -29.48 | 1917.5 | -1.51 |

| ASX 200 | -162.2 | 6478.1 | -2.44 |

| FTSE 100 | -52.16 | 7171.69 | -0.72 |

| DAX | -90.55 | 11567.96 | -0.78 |

| Dow Jones | 311.78 | 26029.52 | 1.21 |

| S&P 500 | 37.03 | 2881.77 | 1.3 |

| NASDAQ Composite | 107.23 | 7833.27 | 1.39 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67598 | 0.11 |

| EURJPY | 119.224 | 0.66 |

| EURUSD | 1.12011 | -0.1 |

| GBPJPY | 129.489 | 0.96 |

| GBPUSD | 1.21648 | 0.18 |

| NZDUSD | 0.65263 | 0.24 |

| USDCAD | 1.32758 | 0.54 |

| USDCHF | 0.97567 | 0.41 |

| USDJPY | 106.427 | 0.75 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.