- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

(raw materials / closing price /% change)

Oil 57.73 -0.45%

Gold 1,295.00 +0.01%

(index / closing price / change items /% change)

Nikkei -445.34 22177.04 -1.97%

TOPIX -25.55 1765.42 -1.43%

Hang Seng -618.00 28224.80 -2.14%

CSI 300 -24.35 4015.82 -0.60%

Euro Stoxx 50 -9.00 3561.57 -0.25%

FTSE 100 +20.53 7348.03 +0.28%

DAX -49.69 12998.85 -0.38%

CAC 40 -1.18 5374.35 -0.02%

DJIA -39.73 24140.91 -0.16%

S&P 500 -0.30 2629.27 -0.01%

NASDAQ +14.16 6776.38 +0.21%

S&P/TSX -6.90 15908.78 -0.04%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1795 -0,26%

GBP/USD $1,3392 -0,37%

USD/CHF Chf0,98977 +0,25%

USD/JPY Y112,28 -0,26%

EUR/JPY Y132,44 -0,52%

GBP/JPY Y150,372 -0,63%

AUD/USD $0,7563 -0,58%

NZD/USD $0,6880 +0,07%

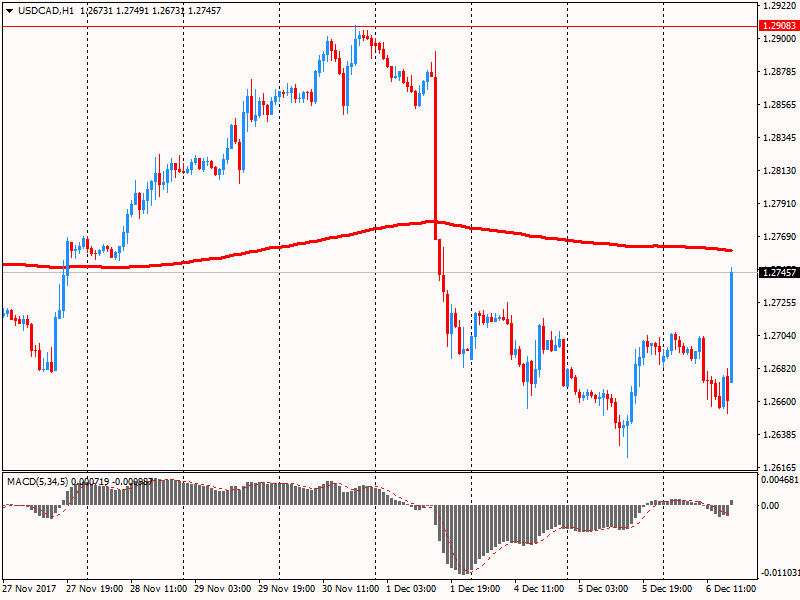

USD/CAD C$1,27864 +0,76%

00:30 Australia Trade Balance October 1745 1

05:00 Japan Leading Economic Index (Preliminary) October 106.4 106.1

05:00 Japan Coincident Index (Preliminary) October 116.2

06:45 Switzerland Unemployment Rate (non s.a.) November 3.0% 3.1%

07:00 Germany Industrial Production s.a. (MoM) October -1.6% 1%

07:45 France Trade Balance, bln October -4.7 -4.8

08:00 Switzerland Foreign Currency Reserves November 741.532

08:30 United Kingdom Halifax house price index November 0.3% 0.2%

08:30 United Kingdom Halifax house price index 3m Y/Y November 4.5% 3.9%

10:00 Eurozone GDP (QoQ) (Finally) Quarter III 0.7% 0.6%

10:00 Eurozone GDP (YoY) (Finally) Quarter III 2.3% 2.5%

13:30 Canada Building Permits (MoM) October 3.8% 1.5%

13:30 U.S. Continuing Jobless Claims November 1957 1

13:30 U.S. Initial Jobless Claims December 238 240

15:00 Canada Ivey Purchasing Managers Index November 63.8

16:00 Eurozone ECB President Mario Draghi Speaks

20:00 U.S. Consumer Credit October 20.83 17.50

23:50 Japan Current Account, bln October 2271.2 1721

23:50 Japan GDP, q/q (Finally) Quarter III 0.6% 0.3%

23:50 Japan GDP, y/y (Finally) Quarter III 2.5% 1.4%

Major US stock indexes finished trading mostly in the red, as the decline in quotations of the raw materials sector and shares of Merck & Co., Inc. (MRK) compensated for the growth of the technological sector.

The focus was also on the USA data. The report from Automatic Data Processing (ADP) showed that: growth rates of employment in the private sector of the US slowed in November, but were stronger than forecast. According to the report, in November, the number of employed increased by 190 thousand people compared to the figure for October at 235 thousand. Analysts had expected that the number of employed will increase by 185 thousand.

Meanwhile, the Labor Ministry said labor productivity in the US rose in the third quarter, while labor costs fell, another sign of lower inflationary pressures, despite a solid economy. Labor productivity grew by 3% year-on-year in the third quarter, this is the biggest increase in three years. This estimate, the second from the Ministry of Labor, confirmed the preliminary data on the productivity jump released last month. Costs decreased by 0.2% per annum in the third quarter; Previously, the Ministry estimated that costs increased by 0.5%. Economists had expected a jump in productivity of 3.3% per annum, and 0.2% of the annual increase in costs per unit of labor.

Most components of the DOW index recorded a decline (20 out of 30). Outsider were the shares of Merck & Co., Inc. (MRK, -2.60%). The leader of growth was shares of Microsoft Corporation (MSFT, + 1.33%).

Most sectors of the S & P index finished trading in the red. The greatest decrease was shown by the sector of raw materials (-1.2%). The technological sector grew most (+ 0.4%).

At closing:

DJIA-0.16% 24.140.98 -39.66

Nasdaq + 0.21% 6,776.38 +14.16

S & P -0.01% 2,629.27 -0.30

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.6 million barrels from the previous week. At 448.1 million barrels, U.S. crude oil inventories are in the upper half of the average range for this time of year.

Total motor gasoline inventories increased by 6.8 million barrels last week, and are in the middle of the average range. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories increased by 1.7 million barrels last week but are in the lower half of the average range for this time of year. Propane/propylene inventories increased by 1.3 million barrels last week, and are in the middle of the average range. Total commercial petroleum inventories decreased by 2.5 million barrels last week.

-

Exports declined more than expected in q3, but latest trade data support expectation export growth will resume

-

Despite rising employment and participation rates, other indicators show ongoing labor market slack, though it is diminishing

-

Global outlook subject to "considerable" uncertainty including geopolitical developments, trade policies

-

Housing has continued to moderate as expected

-

Revised higher level of past gdp unlikely to have significant implications for output gap because revisions imply higher level of potential output

-

Core inflation has edged up in recent months, reflecting continued absorption of economic slack

-

Inflation has been slightly higher than anticipated, will continue to be boosted by temporary factors in short term

The Bank of Canada today maintained its target for the overnight rate at 1 per cent. The Bank Rate is correspondingly 1 1/4 per cent and the deposit rate is 3/4 per cent.

"The global economy is evolving largely as expected in the Bank's October Monetary Policy Report (MPR). In the United States, growth in the third quarter was stronger than forecast but is still expected to moderate in the months ahead. Growth has firmed in other advanced economies. Meanwhile, oil prices have moved higher and financial conditions have eased. The global outlook remains subject to considerable uncertainty, notably about geopolitical developments and trade policies".

U.S. stock-index futures fell slightly on on Wednesday as high-flying technology stocks remained under pressure on worries over lofty valuations and the impact of a tax reform on corporate earnings.

Global Stocks:

Nikkei 22,177.04 -445.34 -1.97%

Hang Seng 28,224.80 -618.00 -2.14%

Shanghai 3,294.13 -9.55 -0.29%

S&P/ASX 5,945.71 -26.11 -0.44%

FTSE 7,340.57 +13.07 +0.18%

CAC 5,347.43 -28.10 -0.52%

DAX 12,931.94 -116.60 -0.89%

Crude $56.86 (-1.32%)

Gold $1,295.00 (+0.01%)

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 70.08 | -0.10(-0.14%) | 446 |

| Amazon.com Inc., NASDAQ | AMZN | 1,138.10 | -3.47(-0.30%) | 9145 |

| American Express Co | AXP | 98.56 | -0.15(-0.15%) | 529 |

| Apple Inc. | AAPL | 168.26 | -1.38(-0.81%) | 229504 |

| AT&T Inc | T | 36.41 | -0.14(-0.38%) | 15321 |

| Barrick Gold Corporation, NYSE | ABX | 13.75 | -0.02(-0.15%) | 13000 |

| Boeing Co | BA | 275.1 | -0.44(-0.16%) | 2573 |

| Caterpillar Inc | CAT | 139.02 | -1.12(-0.80%) | 1426 |

| Chevron Corp | CVX | 120.1 | -0.29(-0.24%) | 3660 |

| Cisco Systems Inc | CSCO | 37.28 | -0.03(-0.08%) | 5635 |

| Citigroup Inc., NYSE | C | 76.15 | -0.39(-0.51%) | 14647 |

| Exxon Mobil Corp | XOM | 82.5 | -0.39(-0.47%) | 4404 |

| Facebook, Inc. | FB | 171.75 | -1.08(-0.62%) | 108414 |

| FedEx Corporation, NYSE | FDX | 234.49 | -0.91(-0.39%) | 435 |

| Ford Motor Co. | F | 12.4 | -0.03(-0.24%) | 6565 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.15 | 0.04(0.28%) | 3805 |

| General Electric Co | GE | 17.72 | -0.04(-0.23%) | 55304 |

| Goldman Sachs | GS | 247 | -1.33(-0.54%) | 1194 |

| Google Inc. | GOOG | 1,001.01 | -4.14(-0.41%) | 2160 |

| Home Depot Inc | HD | 178.75 | -4.10(-2.24%) | 79716 |

| HONEYWELL INTERNATIONAL INC. | HON | 152.6 | -0.46(-0.30%) | 689 |

| Intel Corp | INTC | 43.2 | -0.24(-0.55%) | 34425 |

| International Business Machines Co... | IBM | 154.7 | -0.65(-0.42%) | 3292 |

| JPMorgan Chase and Co | JPM | 105.2 | -0.52(-0.49%) | 14071 |

| McDonald's Corp | MCD | 172.4 | -0.59(-0.34%) | 1524 |

| Merck & Co Inc | MRK | 55.6 | -0.17(-0.30%) | 3415113 |

| Microsoft Corp | MSFT | 81.4 | -0.19(-0.23%) | 26040 |

| Nike | NKE | 60.29 | -0.13(-0.22%) | 620 |

| Pfizer Inc | PFE | 35.59 | -0.04(-0.11%) | 4142 |

| Procter & Gamble Co | PG | 91.37 | -0.03(-0.03%) | 752 |

| Starbucks Corporation, NASDAQ | SBUX | 59.44 | 0.10(0.17%) | 2157 |

| Tesla Motors, Inc., NASDAQ | TSLA | 301.98 | -1.72(-0.57%) | 887124 |

| The Coca-Cola Co | KO | 46.24 | -0.02(-0.04%) | 728 |

| Twitter, Inc., NYSE | TWTR | 20.68 | -0.09(-0.43%) | 10559 |

| UnitedHealth Group Inc | UNH | 219.72 | -0.37(-0.17%) | 735 |

| Verizon Communications Inc | VZ | 50.75 | -0.17(-0.33%) | 2084 |

| Visa | V | 108.22 | -0.36(-0.33%) | 2571 |

| Wal-Mart Stores Inc | WMT | 97.61 | -0.22(-0.22%) | 3474 |

| Walt Disney Co | DIS | 107 | -0.22(-0.21%) | 4821 |

| Yandex N.V., NASDAQ | YNDX | 32.45 | 0.08(0.25%) | 1700 |

Labour productivity of Canadian businesses fell 0.6% in the third quarter, after edging down 0.2% in the second quarter and posting a 1.3% increase in the first quarter. This was the largest decrease since the second quarter of 2015 (-1.2%).

In the third quarter, business output and hours worked both increased at a slower pace than in the previous quarter, however, the increase in hours worked again surpassed the increase in output.

Real gross domestic product (GDP) of businesses edged up 0.3% in the third quarter. This was much lower than the 1.2% growth observed in the previous quarter and a deceleration was seen in both goods-producing and service-producing businesses. Mining, quarrying and oil and gas extraction, manufacturing, retail trade, and finance and insurance were the main industries that moderated the growth in output.

Twitter (TWTR) initiated with In-Line rating at Evercore ISI

Amazon (AMZN) initiated with Outperform rating at Evercore ISI

Facebook (FB) initiated with Outperform rating at Evercore ISI

Alphabet A (GOOGL) initiated with Outperform rating at Evercore ISI

Nonfarm business sector labor productivity increased 3.0 percent during the third quarter of 2017, the U.S. Bureau of Labor Statistics reported today, as

output increased 4.1 percent and hours worked increased 1.1 percent. The productivity increase was the largest since the third quarter of 2014, when

output per hour increased 4.4 percent.

From the third quarter of 2016 to the third quarter of 2017, productivity increased 1.5 percent, reflecting a 3.0-percent increase in output and a 1.5-percent increase in hours worked.

Private sector employment increased by 190,000 jobs from October to November according to the November ADP National Employment Report.

"The labor market continues to grow at a solid pace," said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. "Notably, manufacturing added the most jobs the industry has seen all year. As the labor market continues to tighten and wages increase it will become increasingly difficult for employers to attract and retain skilled talent." Mark Zandi, chief economist of Moody's Analytics, said, "The job market is red hot, with broad-based job gains across industries and company sizes. The only soft spots are in industries being disrupted by technology, brick-and-mortar retailing being the best example. There is a mounting threat that the job market will overheat next year."

On 4-hour time frame chart we can see that the price has broken the upside trend line and it has tested below the trend and after that test, the price started a new bearish movement.

If the bearish movement confirms, then we might expect a further depreciation on Crude Oil close to 61.8 fibonnaci levels (blue rectangle)

EUR/USD: 1.1624-25(544 m), 1.1740-45(510 m), 1.1795-1.1800(760 m), 1.1825(702 m), 1.1900(428 m), 1.1930(402 m)

GBP/USD: 1.3500(316 m)

USD/JPY: 111.00(452 m), 111.75-80(1.12 b), 112.00(598 m), 112.25-30(633 m), 112.75(916 m)

USD/CHF: 0.9805(218 m)

EUR/GBP: 0.9000(386 m)

AUD/NZD: 1.0950(65 m), 1.1050(400 m), 1.1085(517 млн)

The headline IHS Markit Eurozone Retail PMI - which tracks the month-on-month changes in retail sales in the bloc‟s biggest three economies combined - rose to 52.4 in November, from 51.1 in October.

Alex Gill, economist at IHS Markit which compiles the Eurozone Retail PMI, said: "The latest data paint a generally robust picture of the eurozone retail sector, with sales up on both a monthly and annual basis. Rises in purchasing activity and employment, combined with the strongest degree of business confidence since early-2016 bodes well for further growth over the coming festive period".

The consumer price index fell by 0.1% in November 2017 compared with the previous month, reaching 100.9 points (December 2015=100). Inflation was 0.8% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1954 (4215)

$1.1911 (5259)

$1.1874 (4246)

Price at time of writing this review: $1.1821

Support levels (open interest**, contracts):

$1.1776 (3647)

$1.1741 (3492)

$1.1696 (5373)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 8 is 164803 contracts (according to data from December, 5) with the maximum number of contracts with strike price $1,1500 (8828);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3533 (2819)

$1.3504 (2047)

$1.3482 (3806)

Price at time of writing this review: $1.3407

Support levels (open interest**, contracts):

$1.3364 (1256)

$1.3328 (1146)

$1.3287 (1926)

Comments:

- Overall open interest on the CALL options with the expiration date December, 8 is 53881 contracts, with the maximum number of contracts with strike price $1,3400 (3806);

- Overall open interest on the PUT options with the expiration date December, 8 is 46157 contracts, with the maximum number of contracts with strike price $1,3000 (3958);

- The ratio of PUT/CALL was 0.86 versus 0.87 from the previous trading day according to data from December, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

The Australian economy grew by 0.6% in seasonally adjusted chain volume terms in the September quarter.

-

Compensation of employees increased 1.2%.

-

17 of 20 industries recorded positive growth this quarter.

-

New engineering construction increased 6.3%.

-

Household final consumption expenditure increased 0.1% for the quarter.

Based on provisional data, the Federal Statistical Office (Destatis) reports that price-adjusted new orders in manufacturing had increased in October 2017 a seasonally and working-day adjusted 0.5% on the previous month. For the third time in a row, German companies have thus received more orders as they did before the economic and financial crisis end of 2007. For September 2017, revision of the preliminary outcome resulted in increase of 1.2% compared with August 2017 (primary +1.0%). Price-adjusted new orders without major orders in manufacturing had decreased in October 2017 a seasonally and working-day adjusted -1.0% on the previous month.

In October 2017, domestic orders increased by 0.4% and foreign orders increased by 0.5% on the previous month. New orders from the euro area were down 1.2%, new orders from other countries increased 1.6% compared to September 2017.

European stocks finished lower Tuesday, suffering their third loss in four sessions, with drops for Provident Financial PLC and tech shares weighing on the region's main benchmark.

U.S. stock-market indexes closed lower Tuesday, driven by losses in utilities, telecoms and industrials sectors. An earlier rebound in the technology sector fizzled out, sending the Nasdaq Composite into negative territory, reversing solid gains in the morning.

Asia-Pacific equities experienced fresh selling Wednesday following modest overnight declines in Europe and the U.S., as commodity prices added to ongoing softness. Tech stocks were key to Tuesday's weakness in Asia and the up-to-3% overnight slide in metals prices added to pressure on Wednesday.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.